US Stockmarket Weekend Update - 30 January 2022

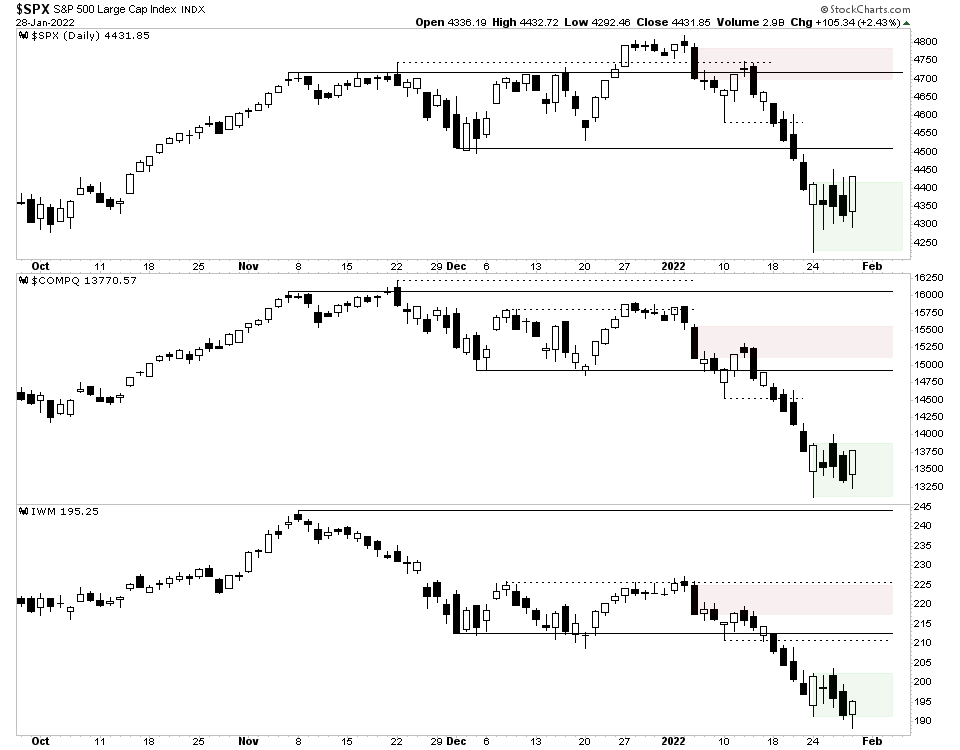

The major indexes attempted to stop the recent decline with a potential swing low forming on Monday with a local Selling Climax (SC) developing, which was followed by a higher low and follow through move into the end of the week. The S&P 500 is lingering just under its 200 day MA, but the Nasdaq Composite is lagging and is still around 7% below its own 200 day MA.

US Stocks Watchlist - 30 January 2022

There were 34 stocks for the US stocks watchlist today. Here's a small sample from the list:

DAC, VSCO, BROS, SG, + 30 more...

Non-members

To see all the watchlist posts and other premium content, such as regular detailed videos and exclusive Stage Analysis tools, become a member

Join Today

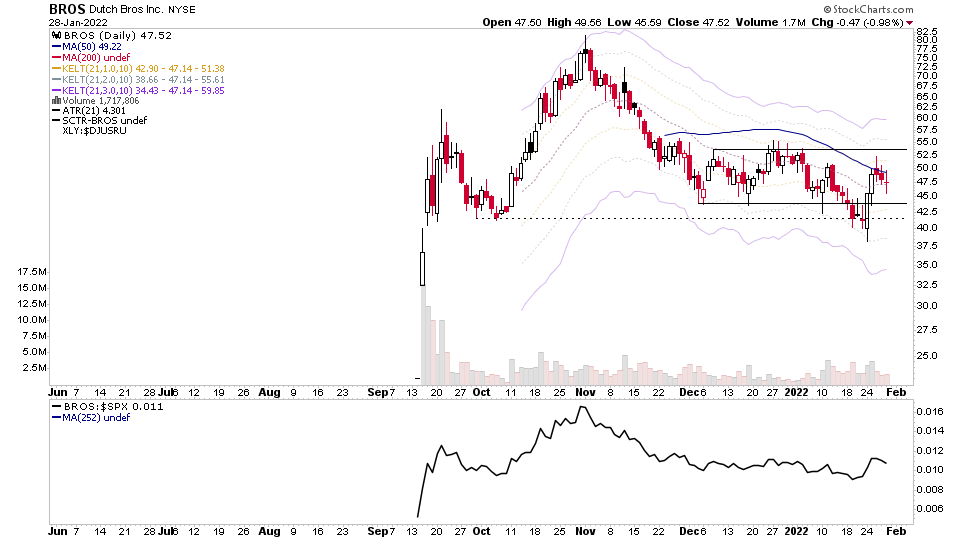

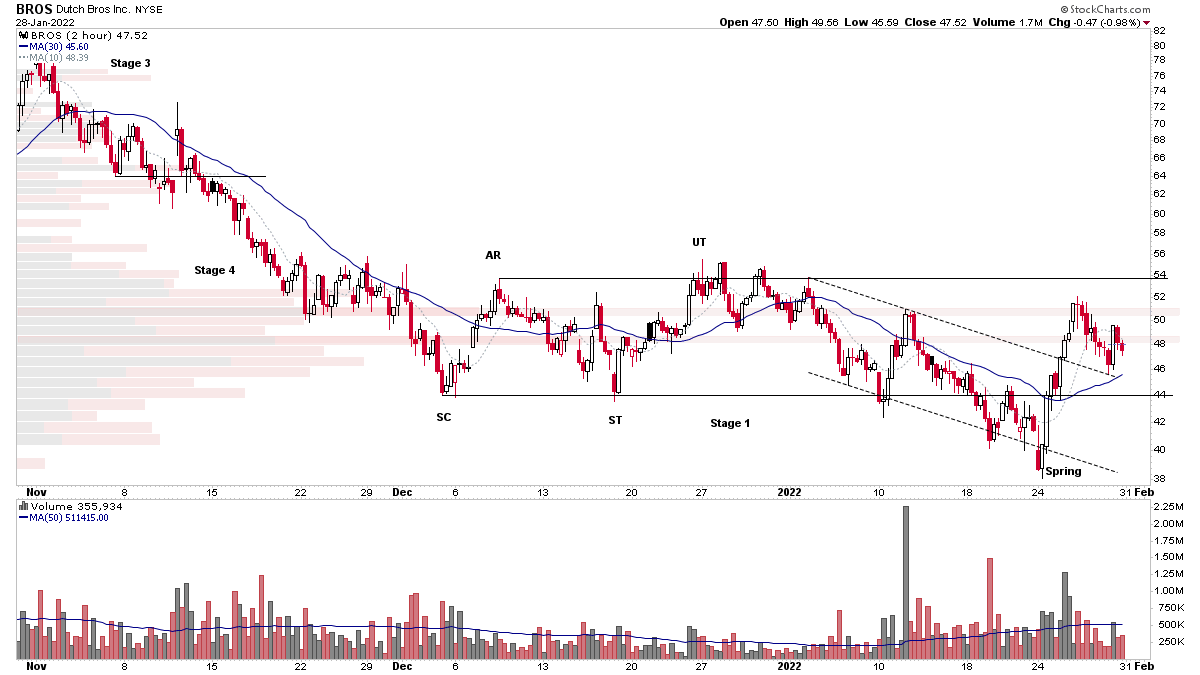

BROS made a spring attempt on 24th and followed through strongly to the 50 day MA. It then pulled back on lower volume into the end of the week, and sits just its Volume Point of Control (VPOC) level in Phase D of the two month base structure (see 2 hour chart below). Watching for a strong volume move through the 50 level and Sign of Strength (SOS) rally out of the base structure.

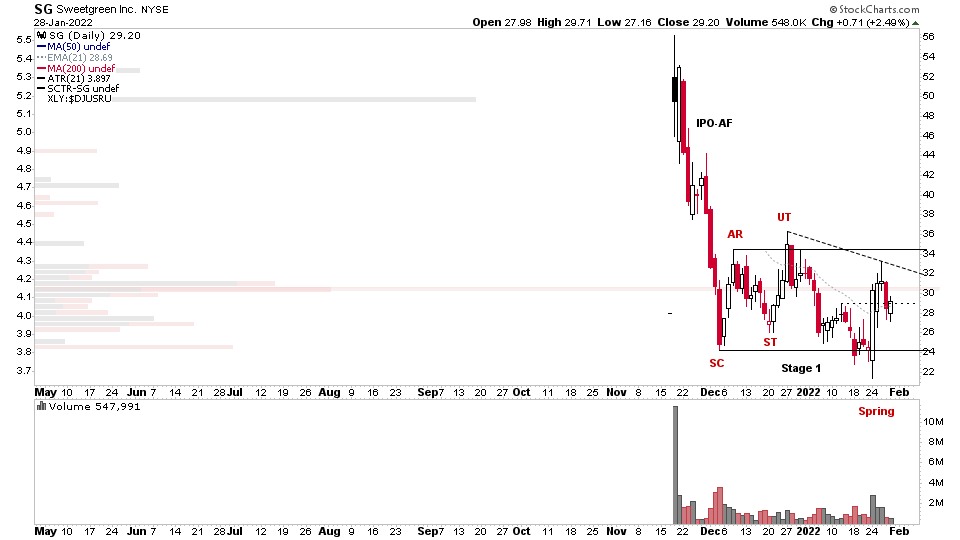

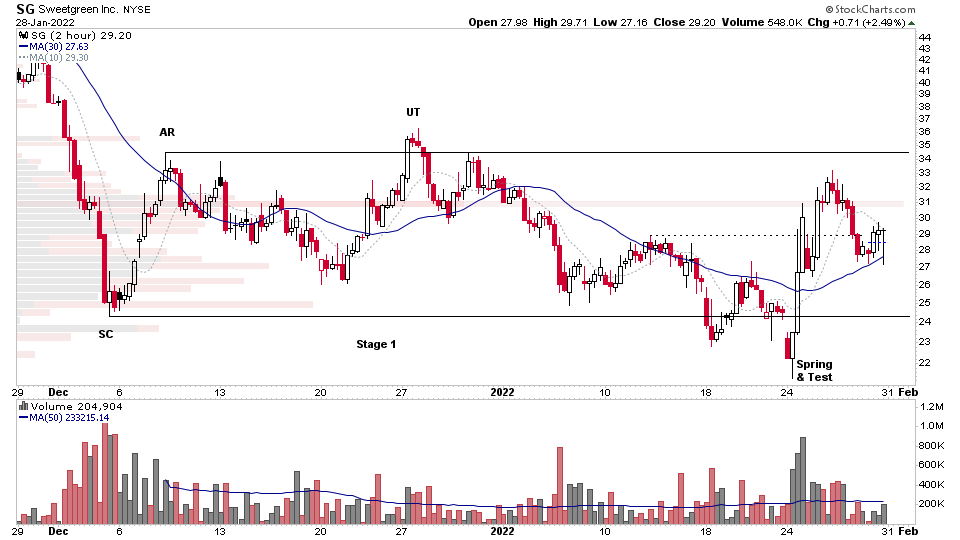

SG is developing its primary Stage 1 base structure since the recent IPO. The near term VPOC level is in the 30-31 range. Structurally it's making a Spring and test pattern in Phse D of the current Stage 1 structure.

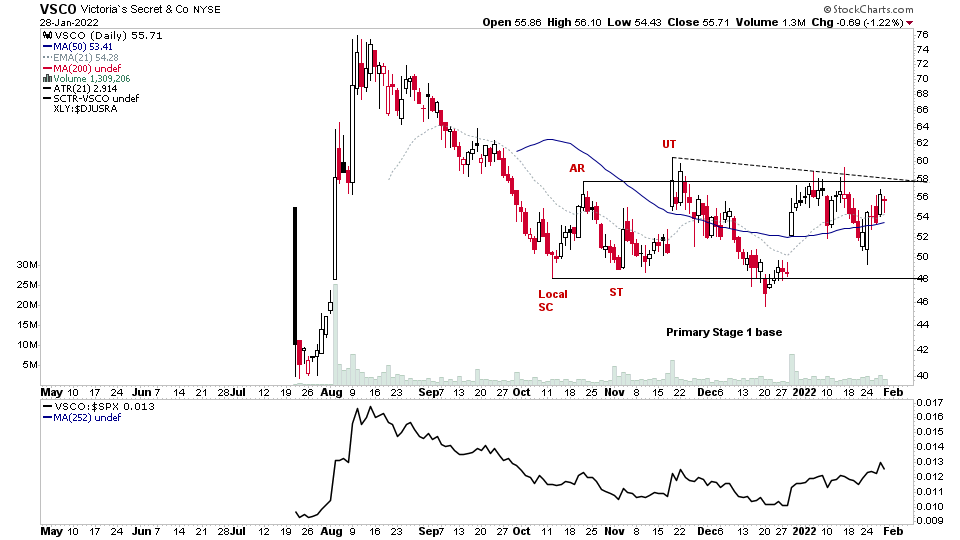

VSCO is also making a primary Stage 1 base structure since its recent IPO and is potentially forming a Last Point of Supply (LPS) in Phase C of the structure. The Anchored VWAP from the IPO is at 57.65, so I am watching for a strong volume move through that level and potential Stage 2A breakout attempt.

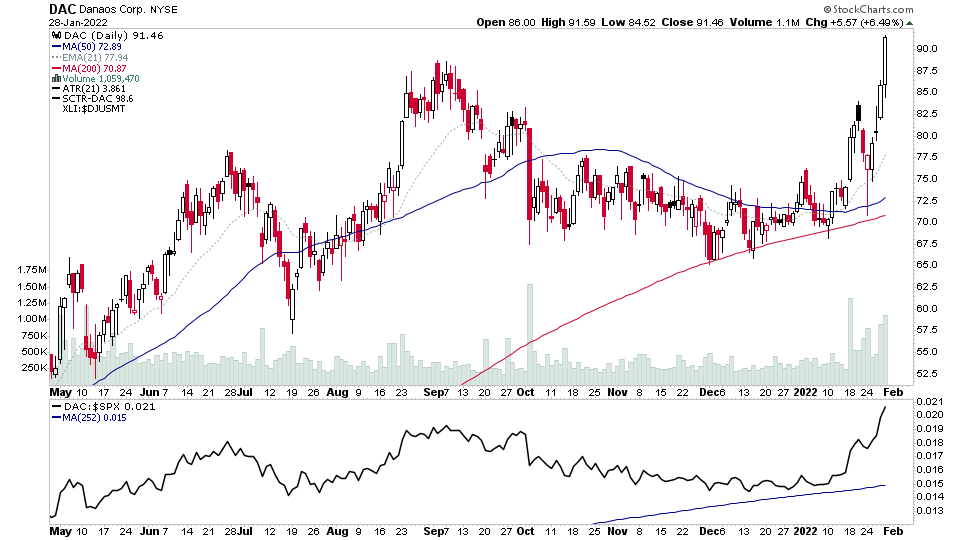

Marine Transportation group moved up to 5th in the overall RS table this week, with multiple stocks in the group have strong weekly bullish engulfing candles. DAC is one of the strongest currently and made a new 52 week high. Short term its extended at the +3x ATR level, so might need to back and fill a bit and tighten up in order to form a new entry zone. So would want to see any pullback respect the $80 level.

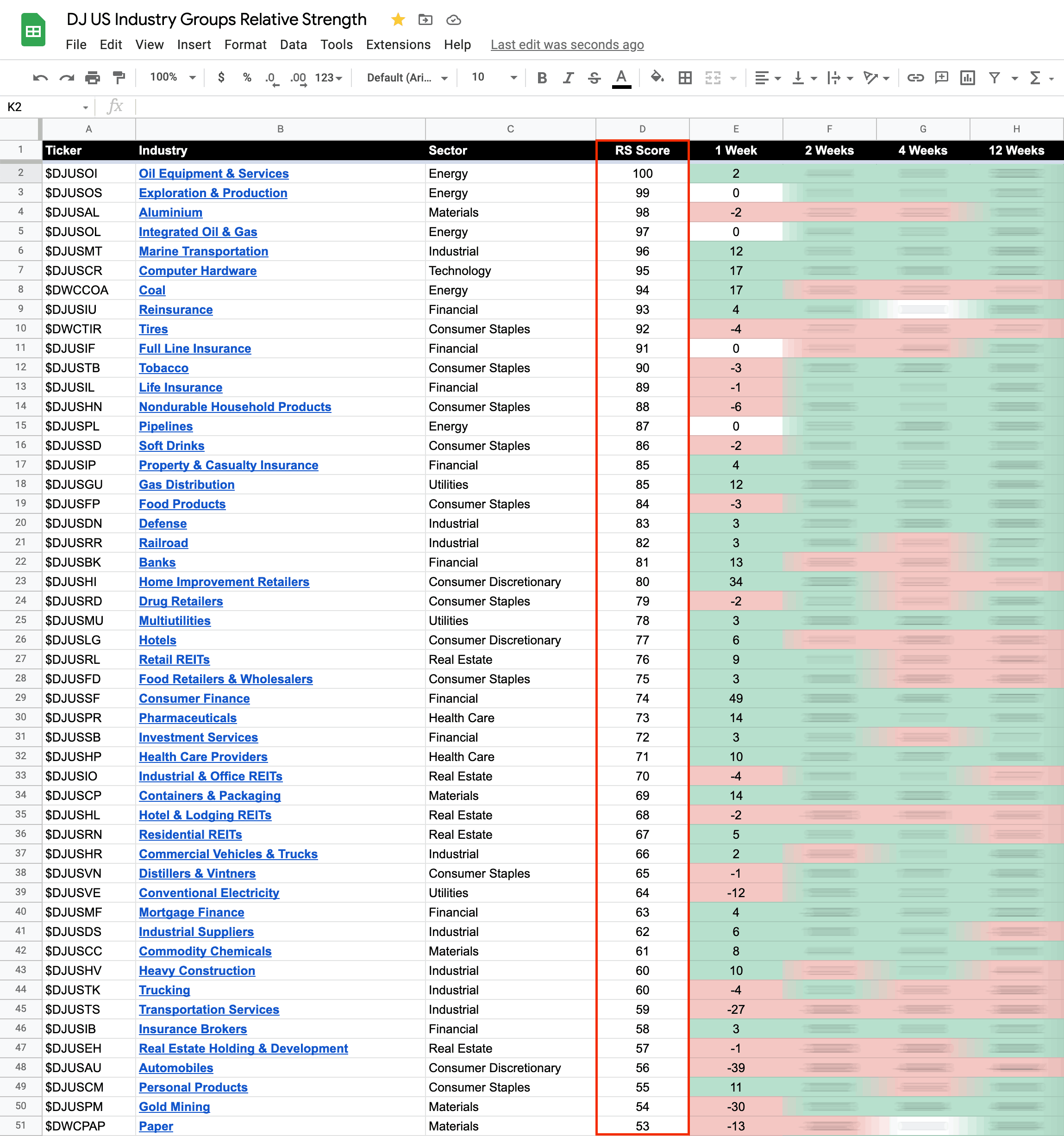

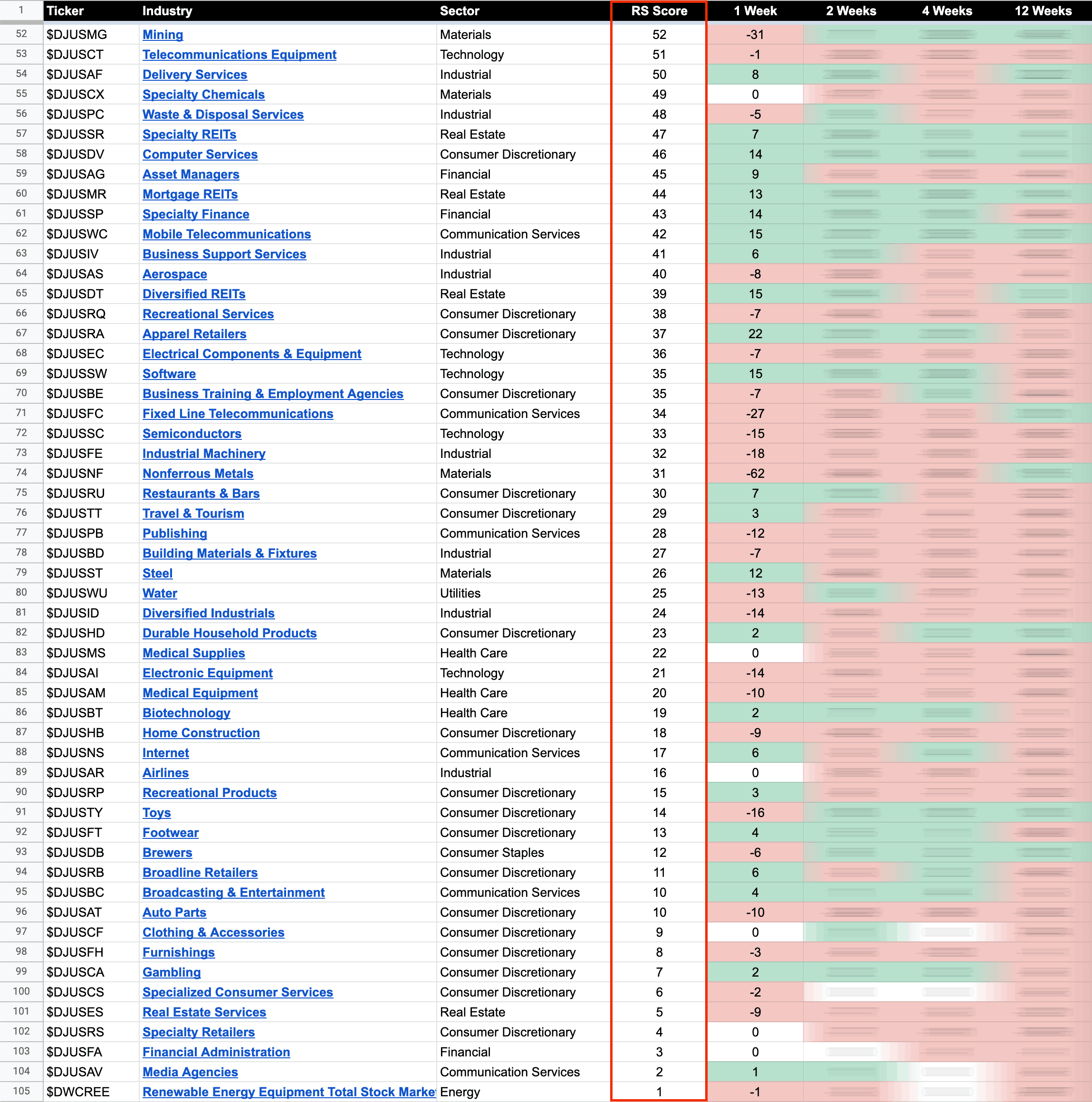

104 Dow Jones Industry Groups sorted by Relative Strength

The purpose of the RS tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd.

100 is strongest, 0 is weakest

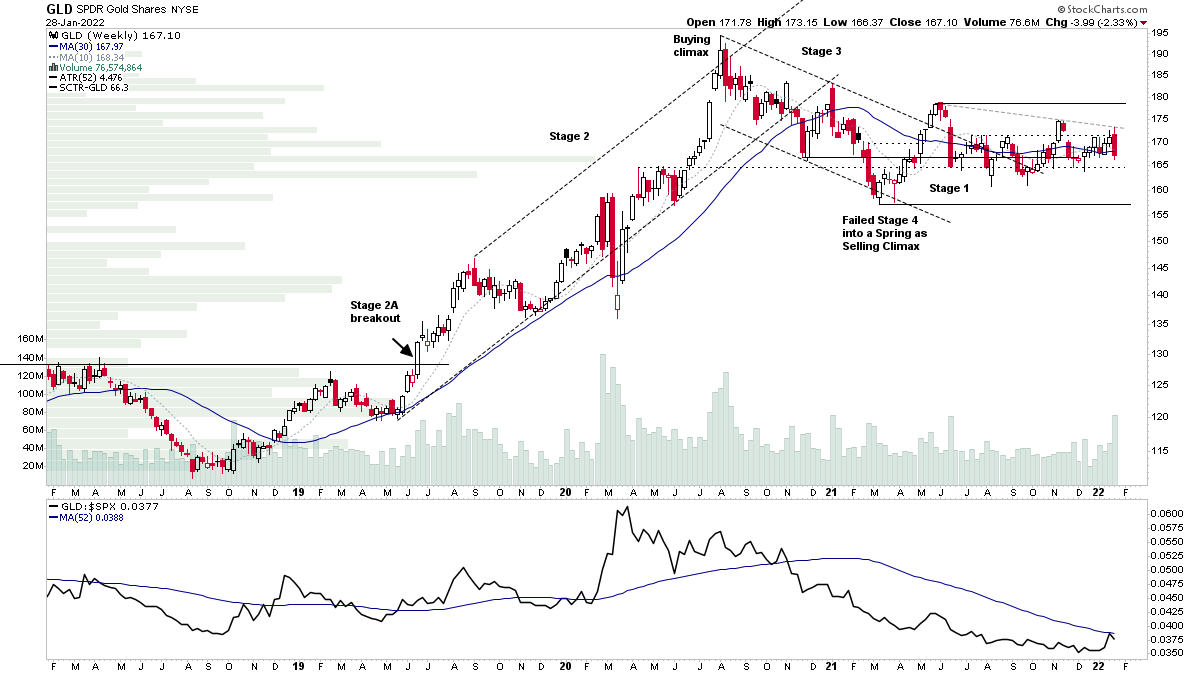

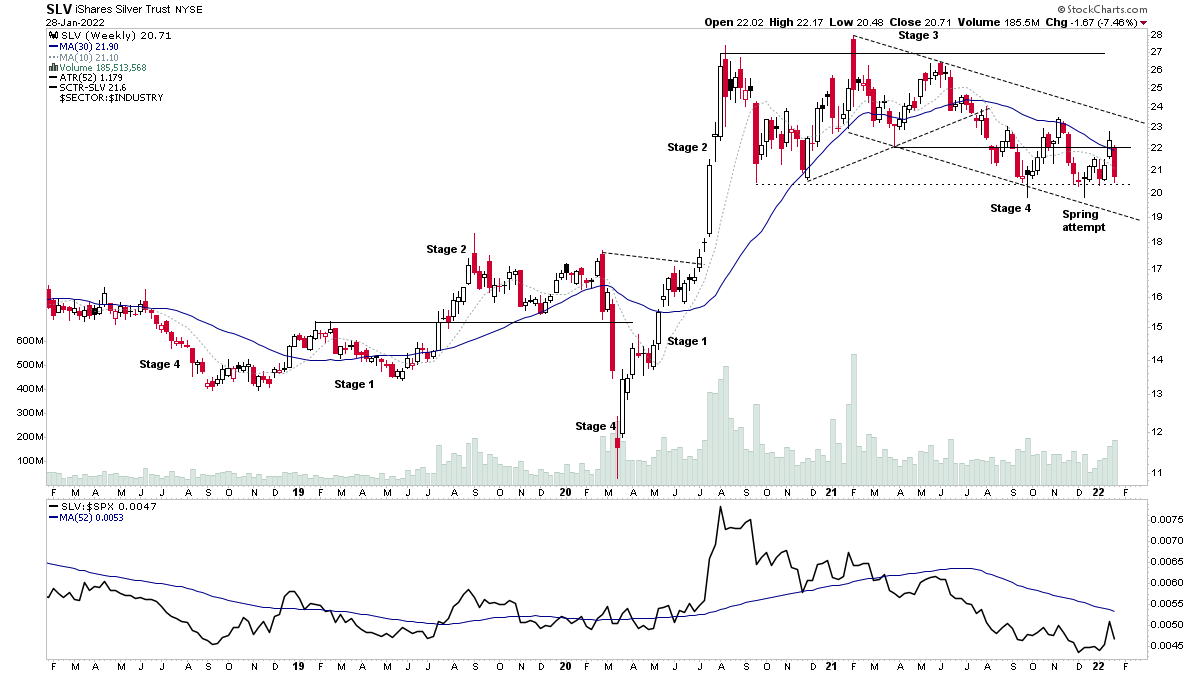

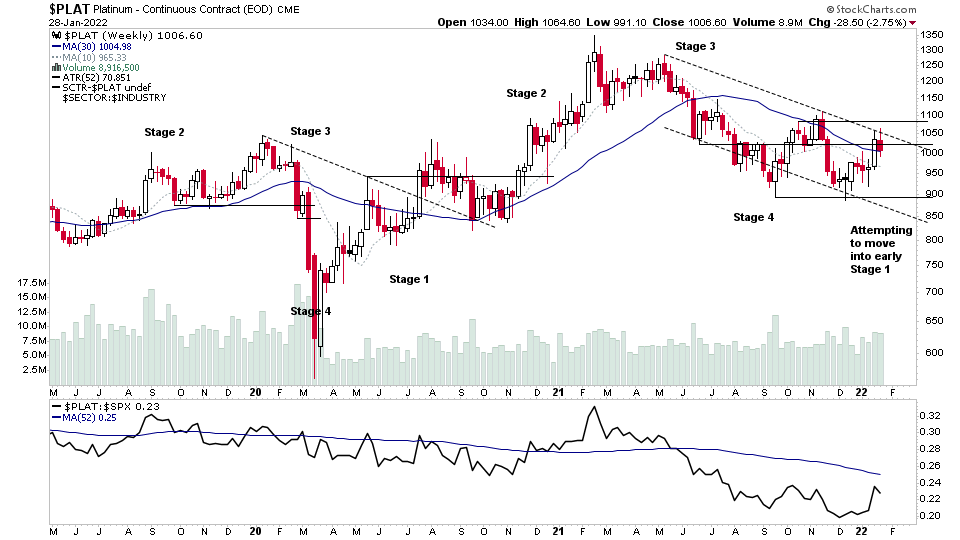

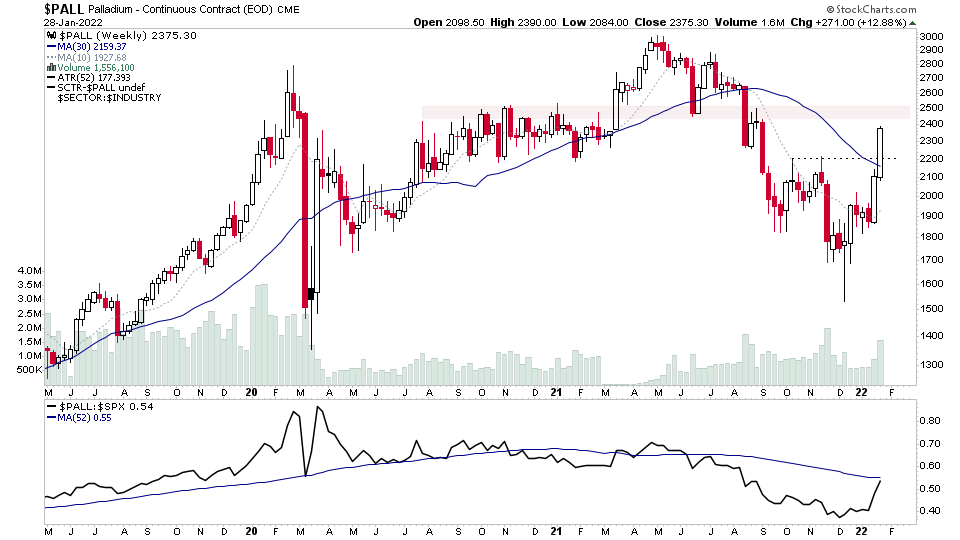

Precious Metals - Gold, Silver, Platinum & Palladium

Stage Analysis Weekend Video - 30 January 2022 (Partial video for non-members)

➜ Members can view the full length video (1 hr 20mins) including the individual stocks in focus in the premium board or on the private twitter channel.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.