US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

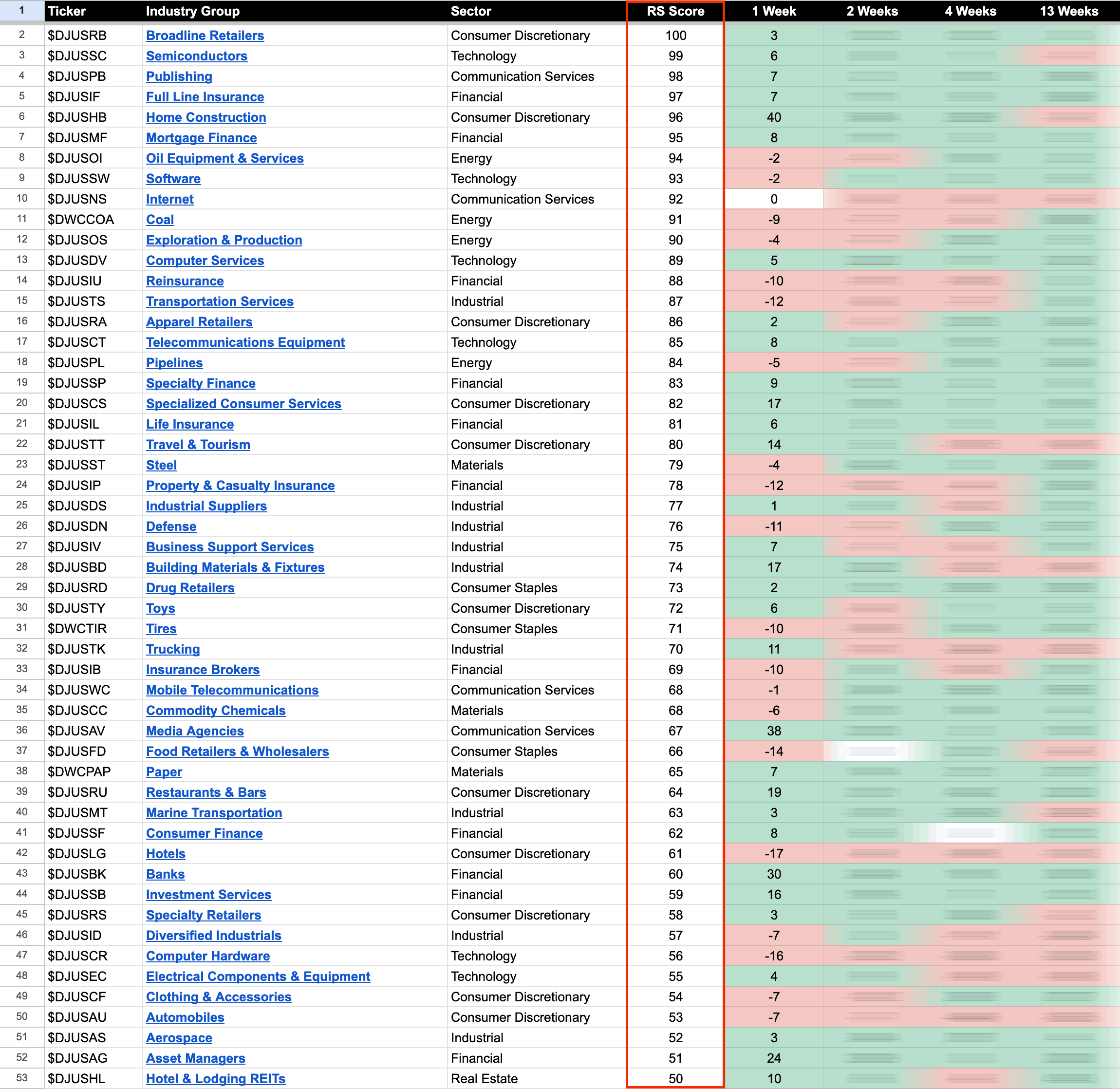

US Industry Groups by Highest RS Score

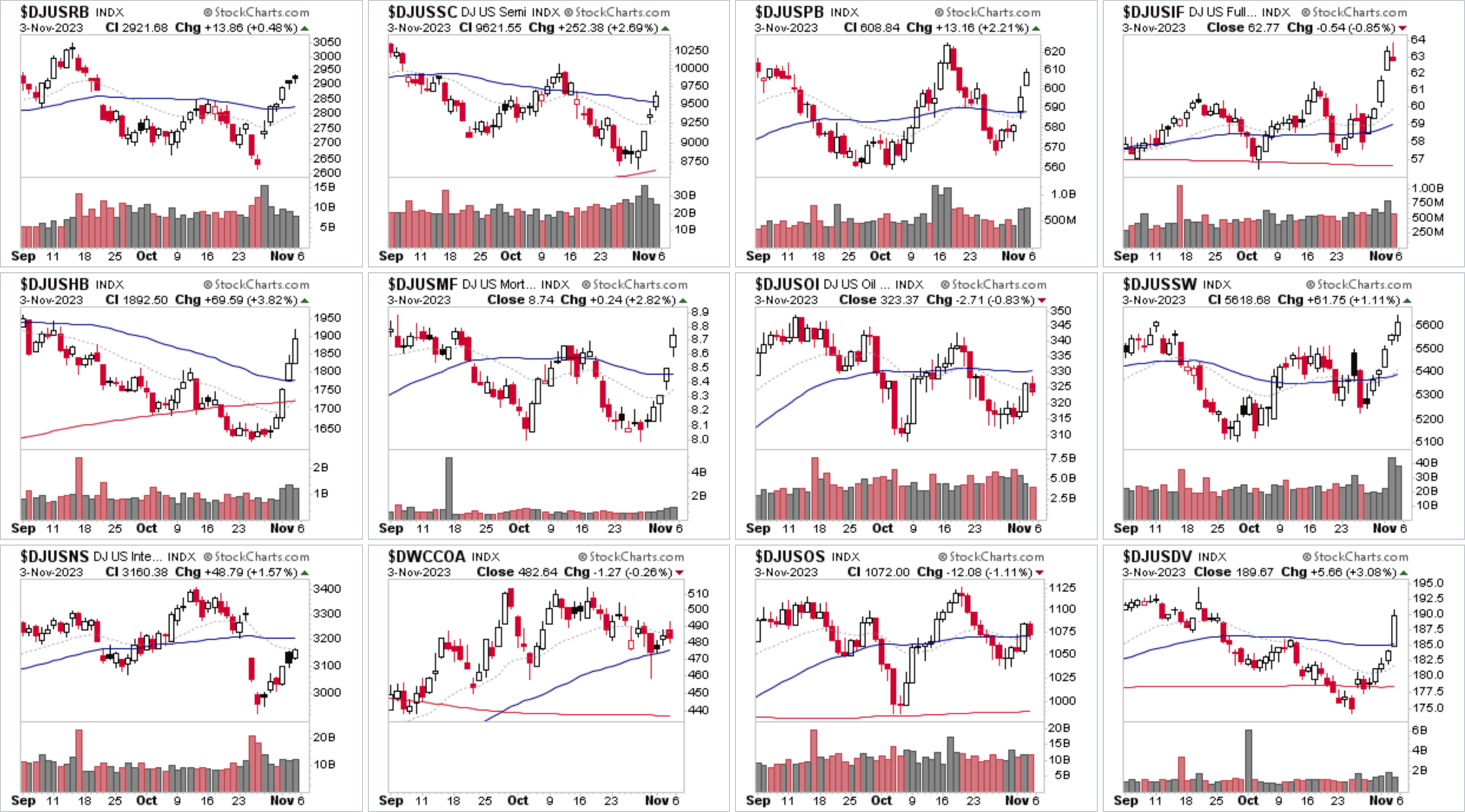

Big changes in the Industry Groups Relative Strength Rankings this week with Broadline Retailers ($DJUSRB) moving to the top of the RS rankings with AMZN a significant contributor to that. Semiconductors ($DJUSSC) recovered up to 2nd place overall, which was a gain of +8 RS points, but there where a few notable names in the group that gapped down this week following earnings. But the majority of the group ended the week strongly positive including large caps such as AMD, NVDA, QCOM and MU.

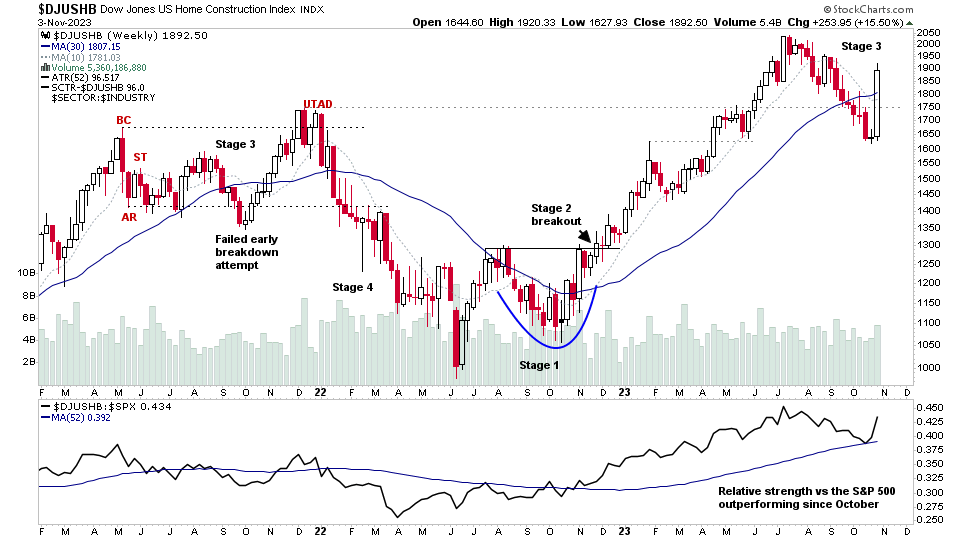

Home Construction ($DJUSHB) was the weeks largest mover though. Both in terms of percentage move and relative strength change. As it gained +15.50% and rose +40 RS points, to return to the top 10, into 5th place overall. It's a big reversal for the group, which just three week ago was making an early Stage 4 breakdown attempt, which failed, and has now returned above the 30 week MA and so would be considered in Stage 3 again.

This is a pattern seen across the market at the moment, as numerous stocks have rallied sharply from brief dips into early Stage 4, and so it looks like a significant shakeout of the weak hands has taken place. But the question is whether this change of behaviour is the end of the recent correction, or just a short covering rally in early Stage 3?

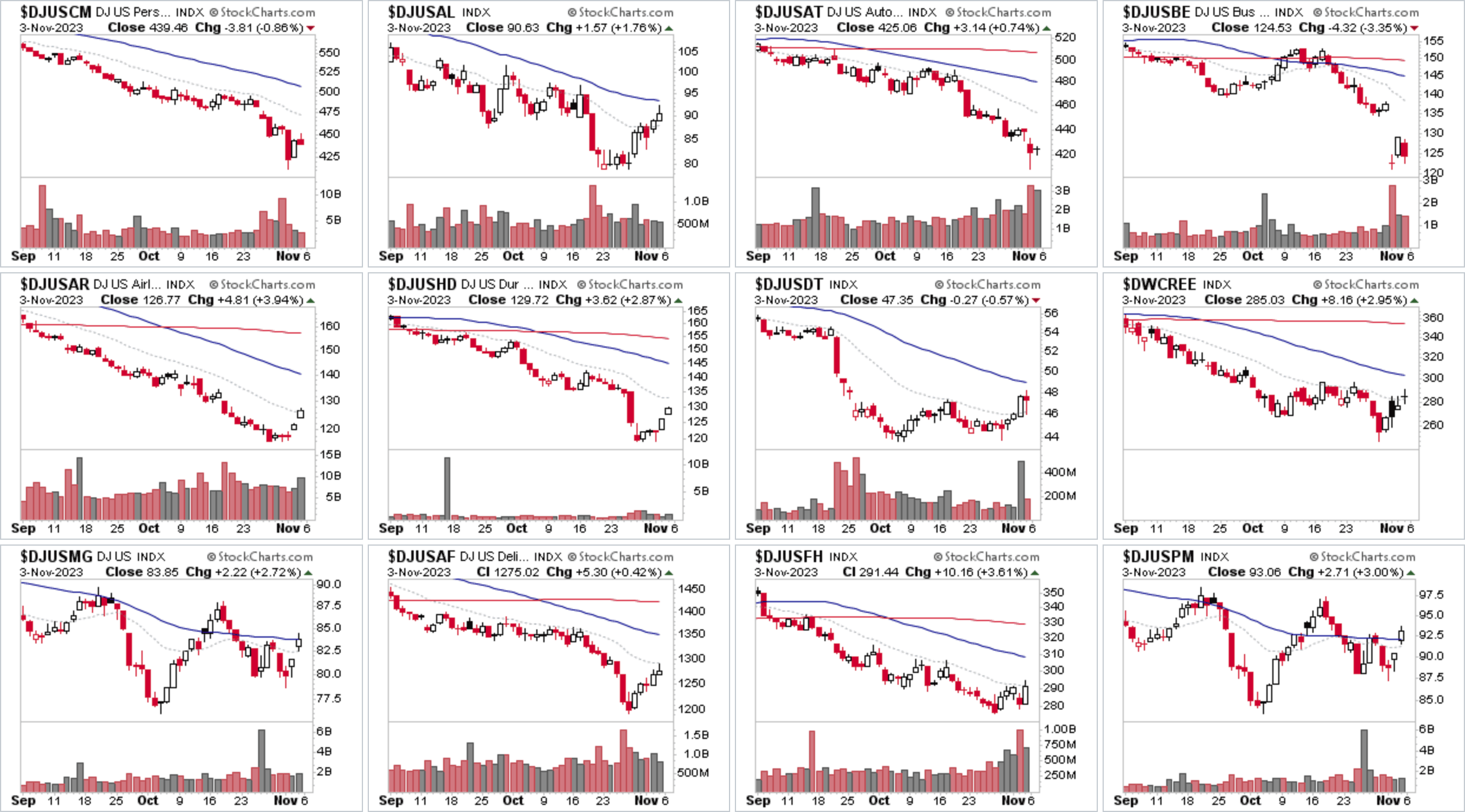

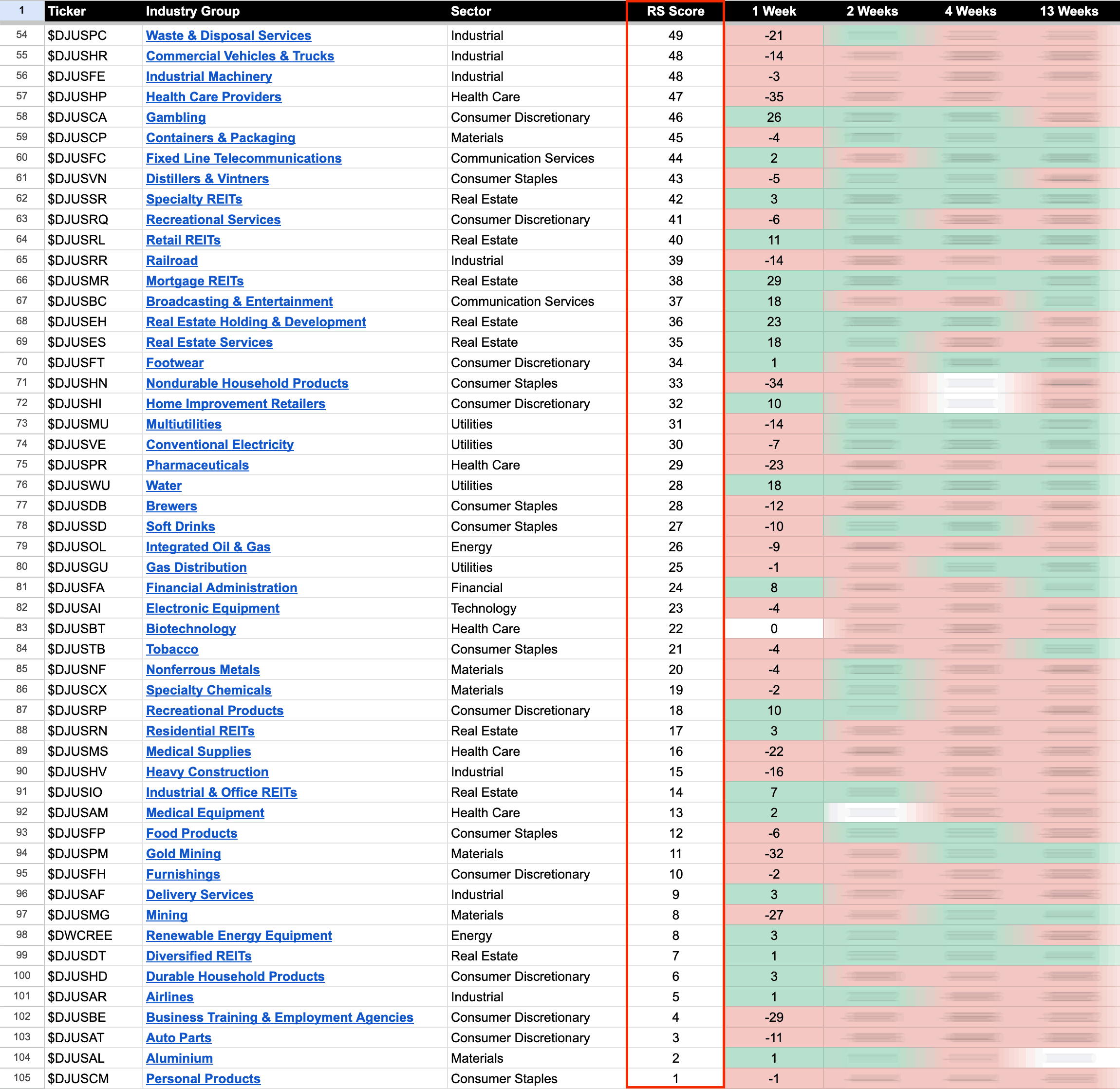

US Industry Groups by Weakest RS Score

US Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.