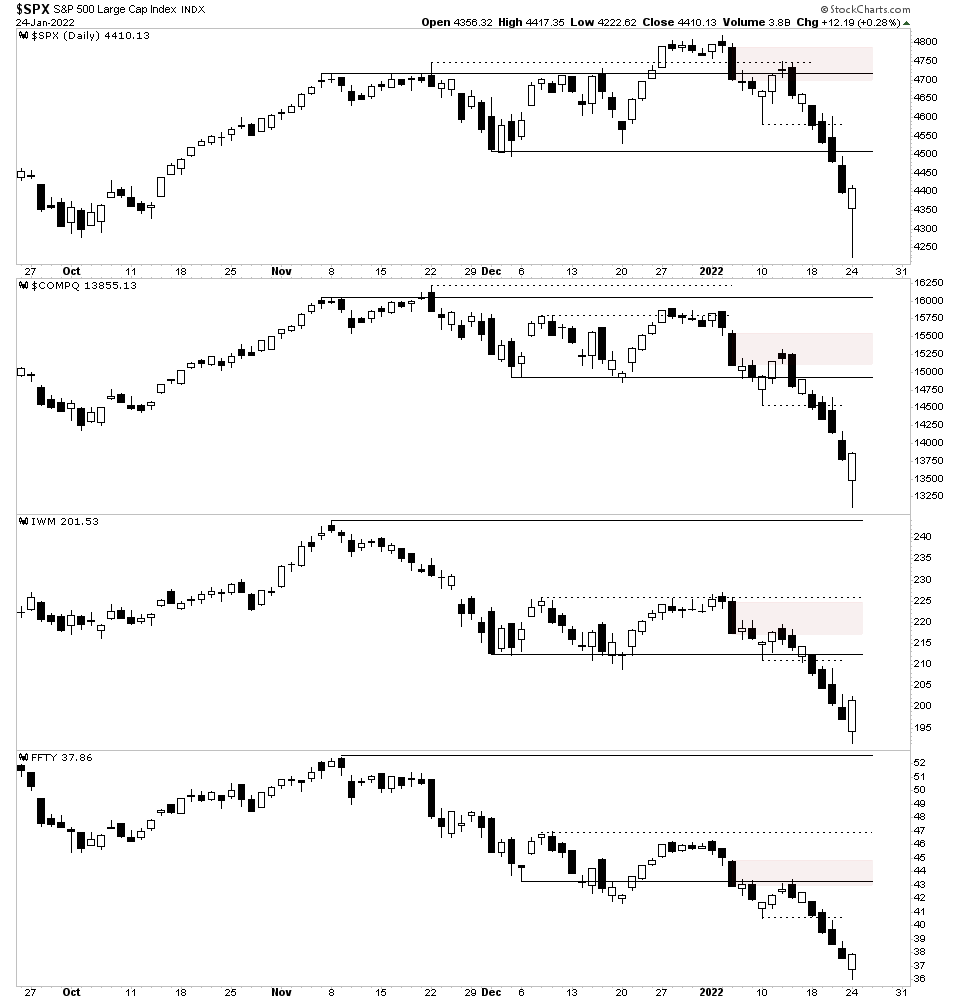

Major US indexes attempt to put in a swing low

A wide swing today in the US stock market with a strong move down intraday of over -4% in multiple indexes in the first half of the day, and then a strong recovery move to send the indexes all back to green territory again.

Numerous stocks made Undercut and Rally (U&R) / Spring Type Action type moves today with the U&R scan that I run each day closing at 240 stocks. Which is roughly 10x the average daily amount. So a clear attempt to stop the decline today with some signs of a Selling Climax (SC), which is the first point of a potential new base structure (Study the Wyckoff method schematics to learn the five phases of a base structure - from A to E).

It will of course need further confirmation. But a potenial Day 1 of a near term swing low, within the broader Stage 3 and in some cases Stage 4 behaviour that we are in. So potential for a reaction rally back to the mean ( i.e. the short term moving averages).

US Stocks Watchlist - 24 January 2022

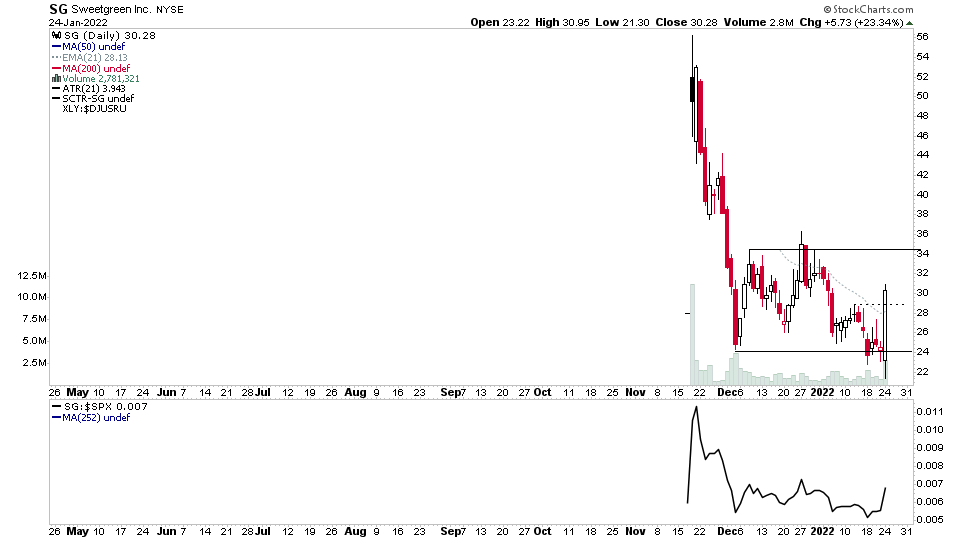

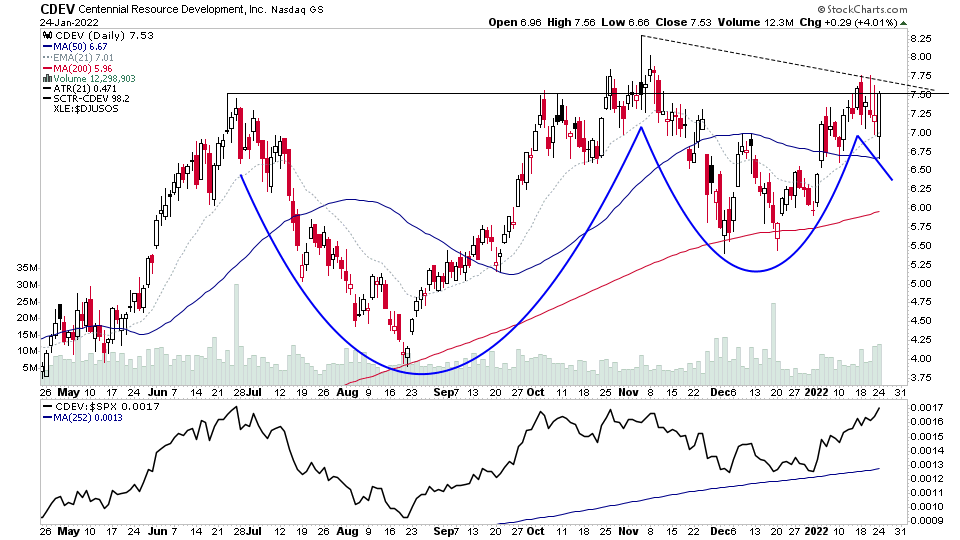

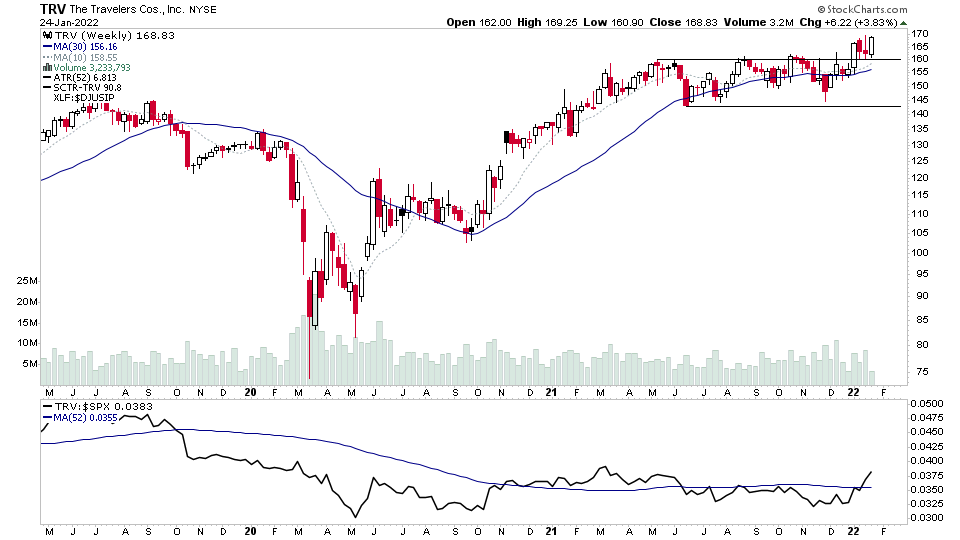

There were 36 stocks for the US stocks watchlist today. Here's a small sample from the list:

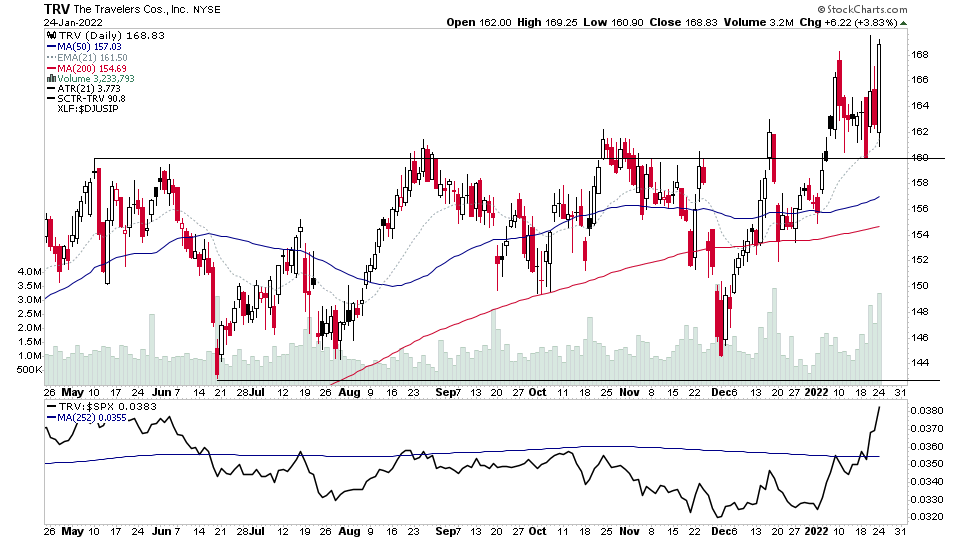

AEHR, CDEV, SG, TRV, + 32 more...

Non-members

To see all the watchlist posts and other premium content, such as regular detailed videos and exclusive Stage Analysis tools, become a member

Join Today

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.