Short-term Market Breadth Improvement and the US Stocks Watchlist – 29 August 2023

The full post is available to view by members only. For immediate access:

There were 28 stocks highlighted from the US stocks watchlist scans today

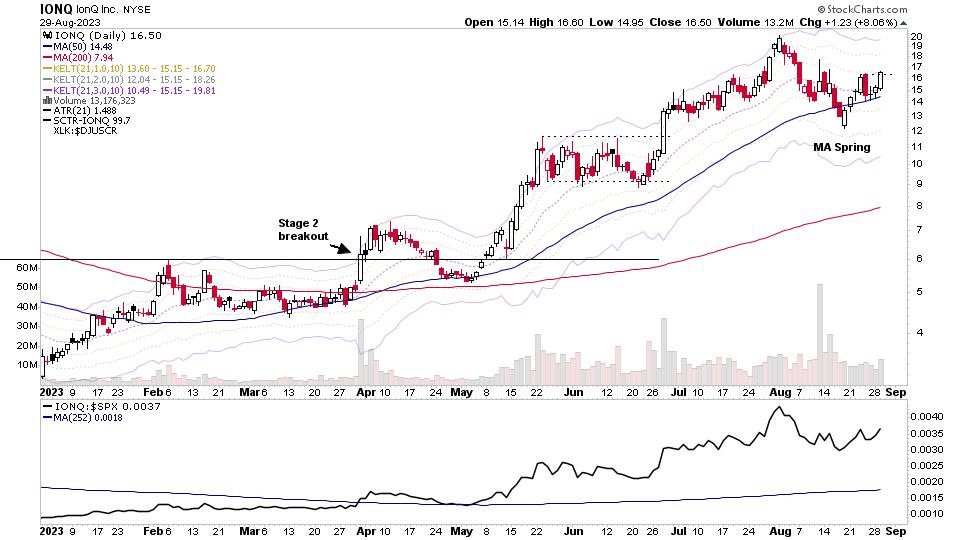

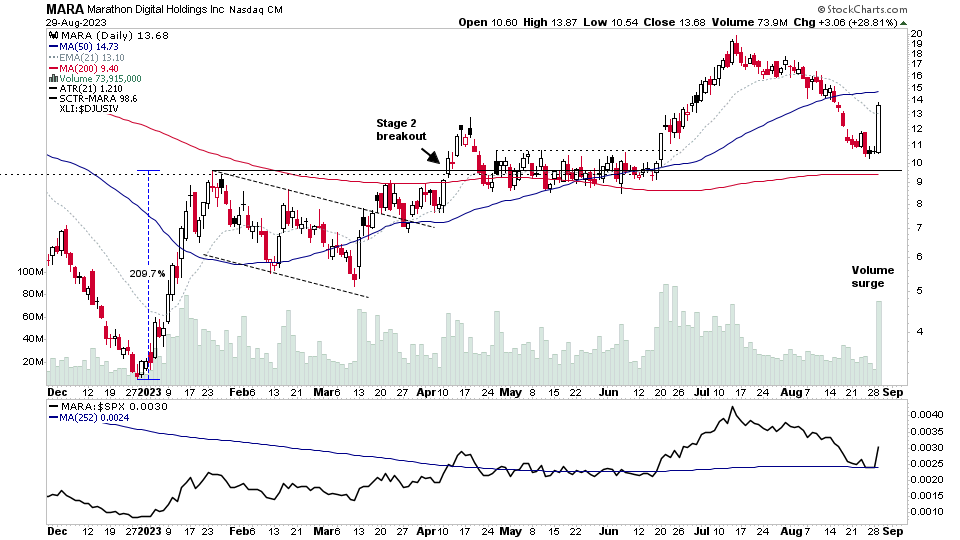

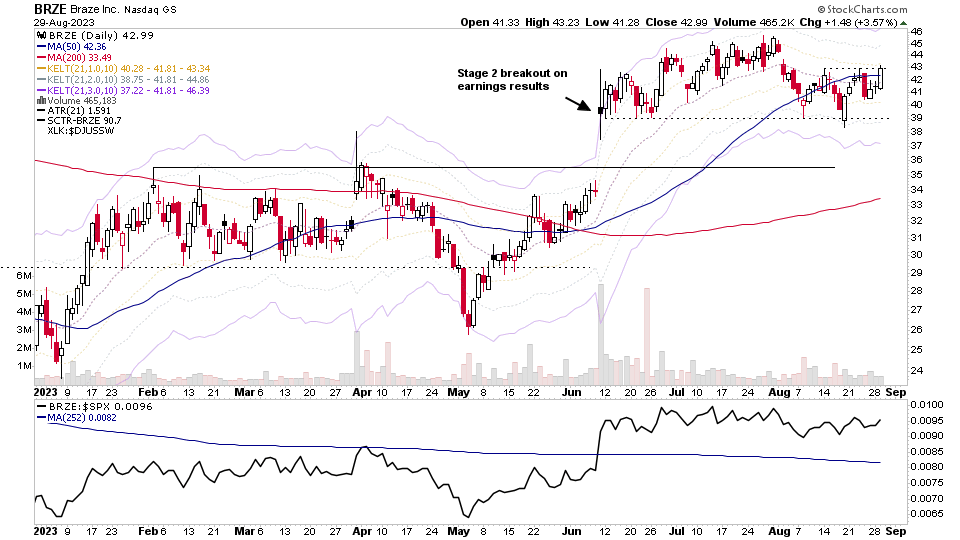

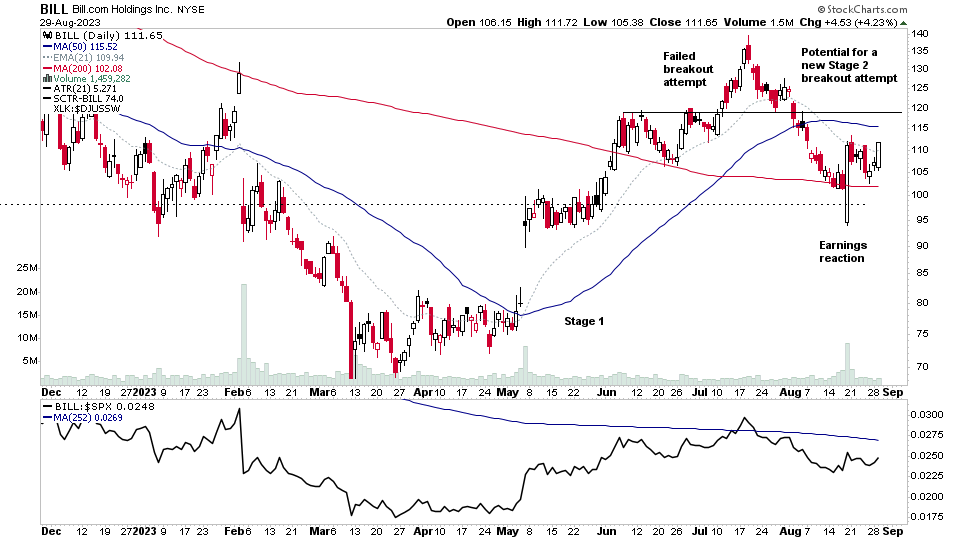

IONQ, MARA, BRZE, BILL + 24 more...

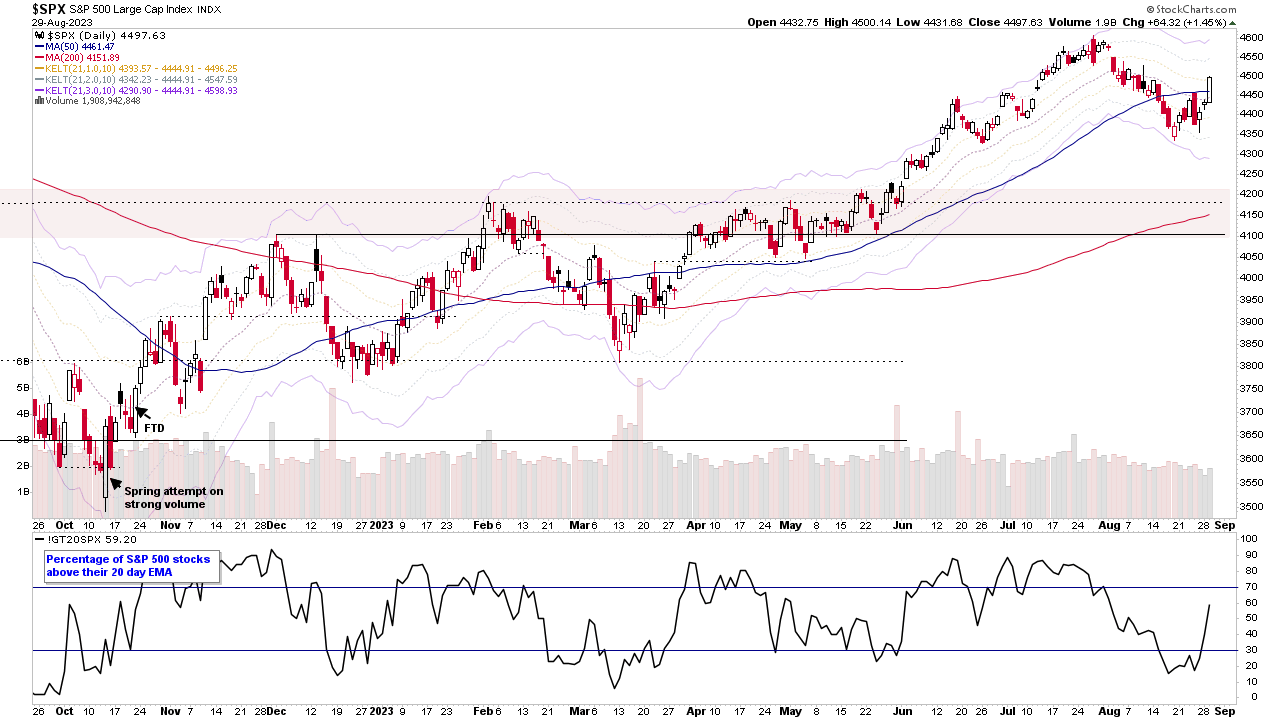

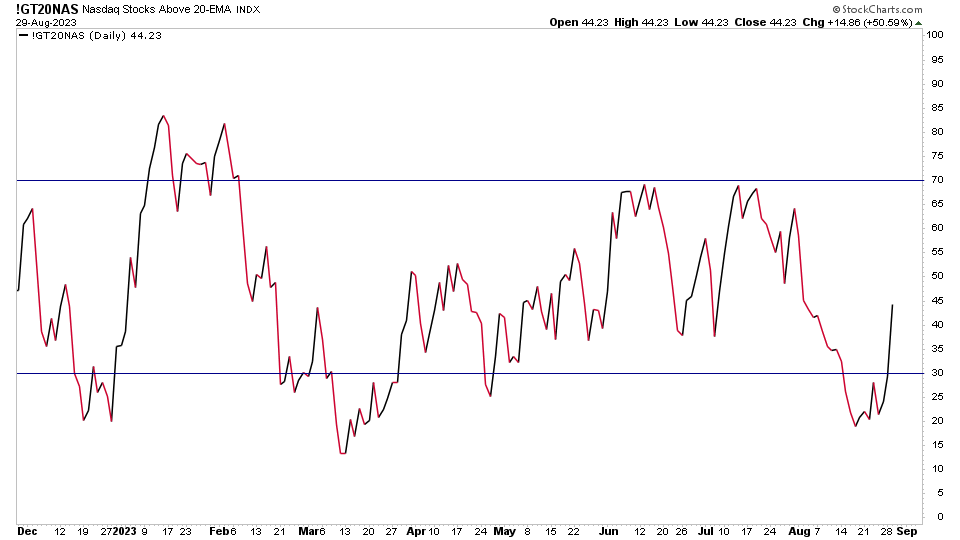

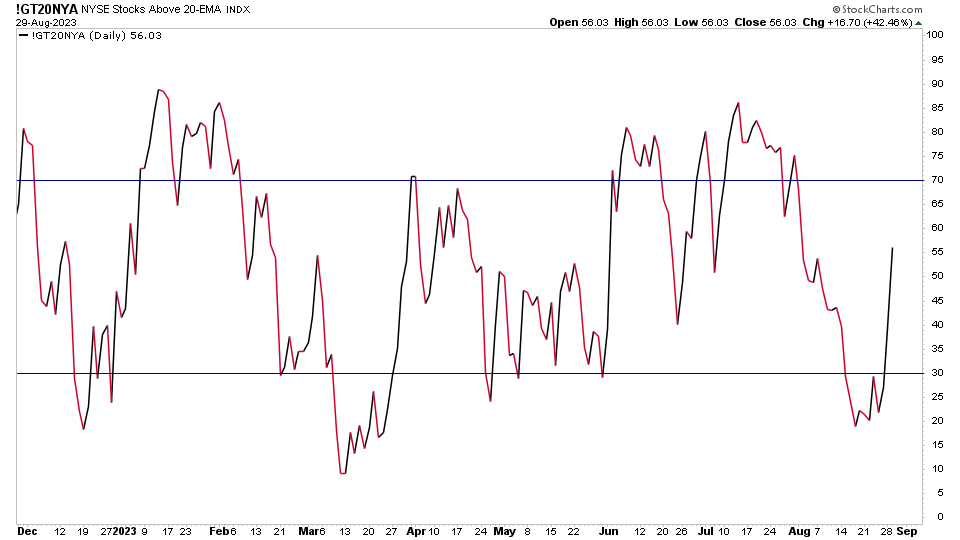

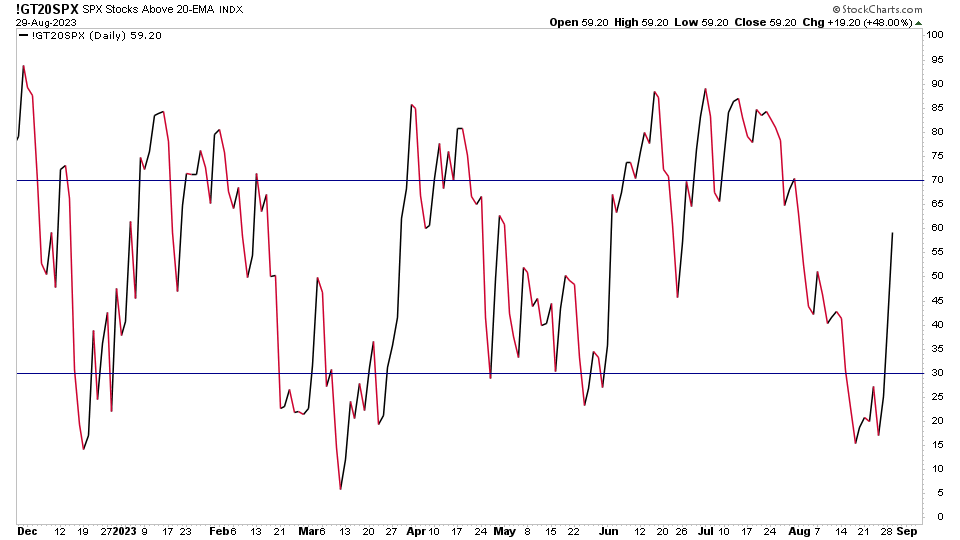

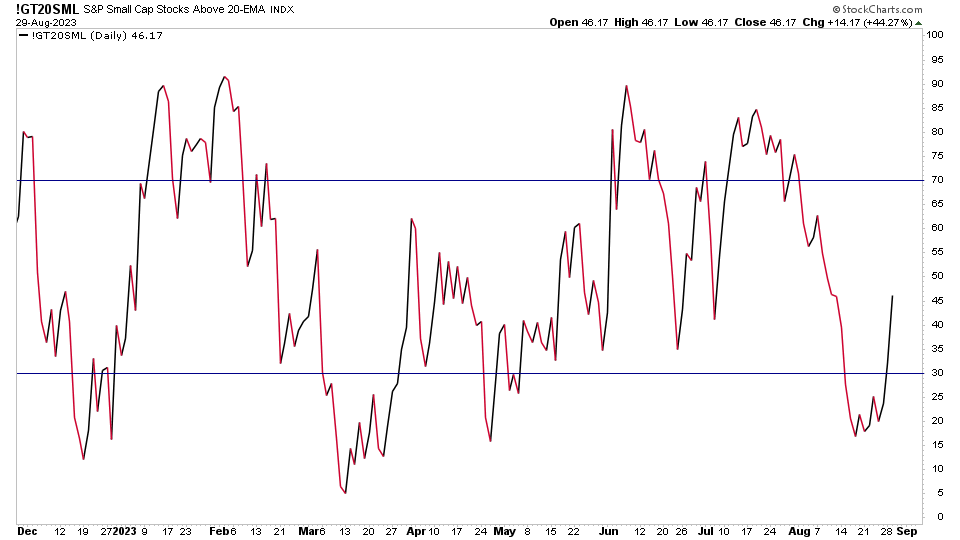

Market Breadth: Percentage of Stocks Above 20 Day EMA

There was improvements in multiple short-term market breadth measures. For example the Percentage of Stocks Above 20 Day EMA in the Nasdaq, NYSE, S&P 500 and Small Caps all moved strongly out of their lower zones, which is considered a positive signal.

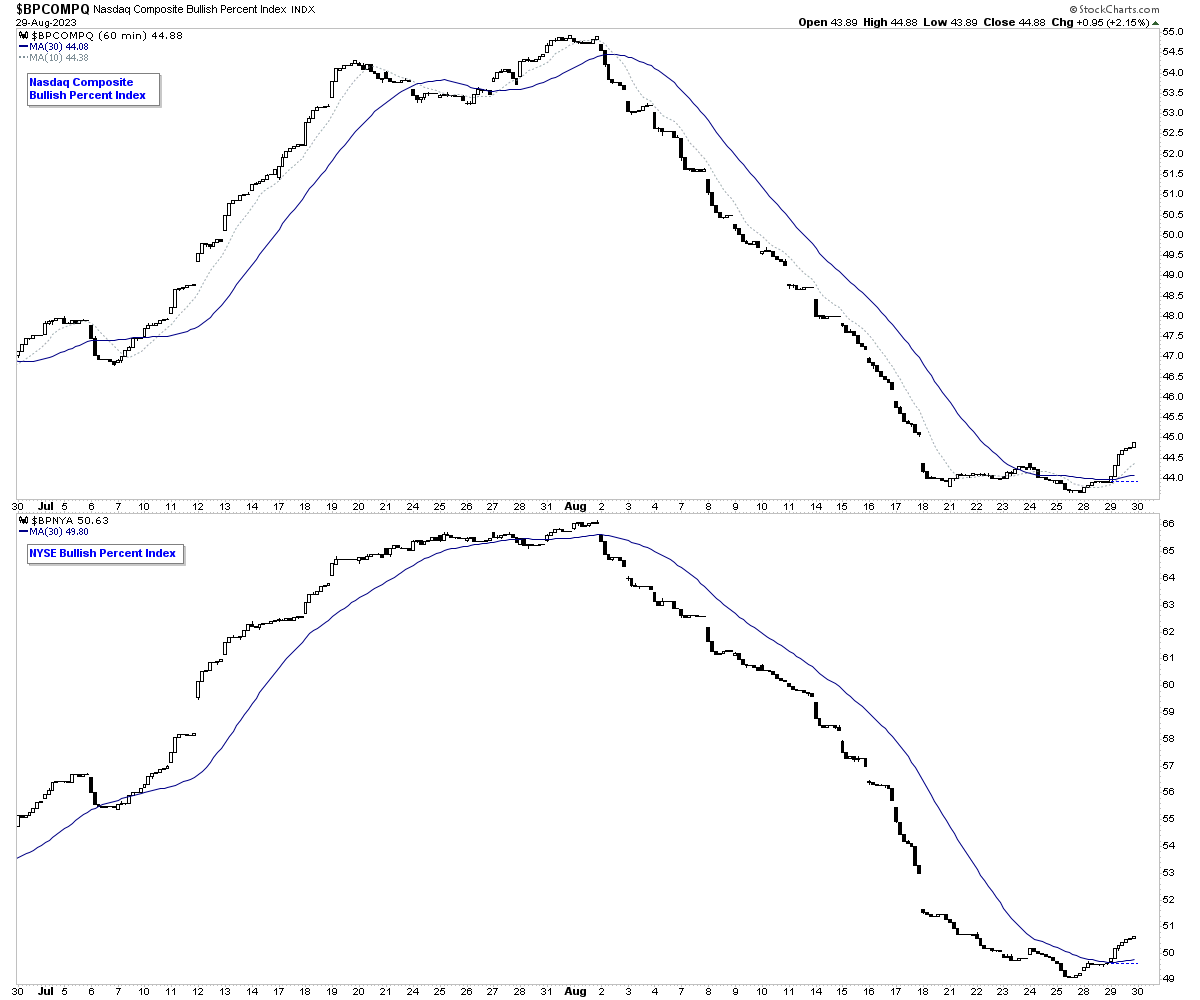

Market Breadth: Bullish Percent Index

The short-term versions of the Nasdaq and NYSE Bullish Percent Index also improved and moved to a positive status with a breakout on both charts above the 24th August level and their 30 bar MAs.

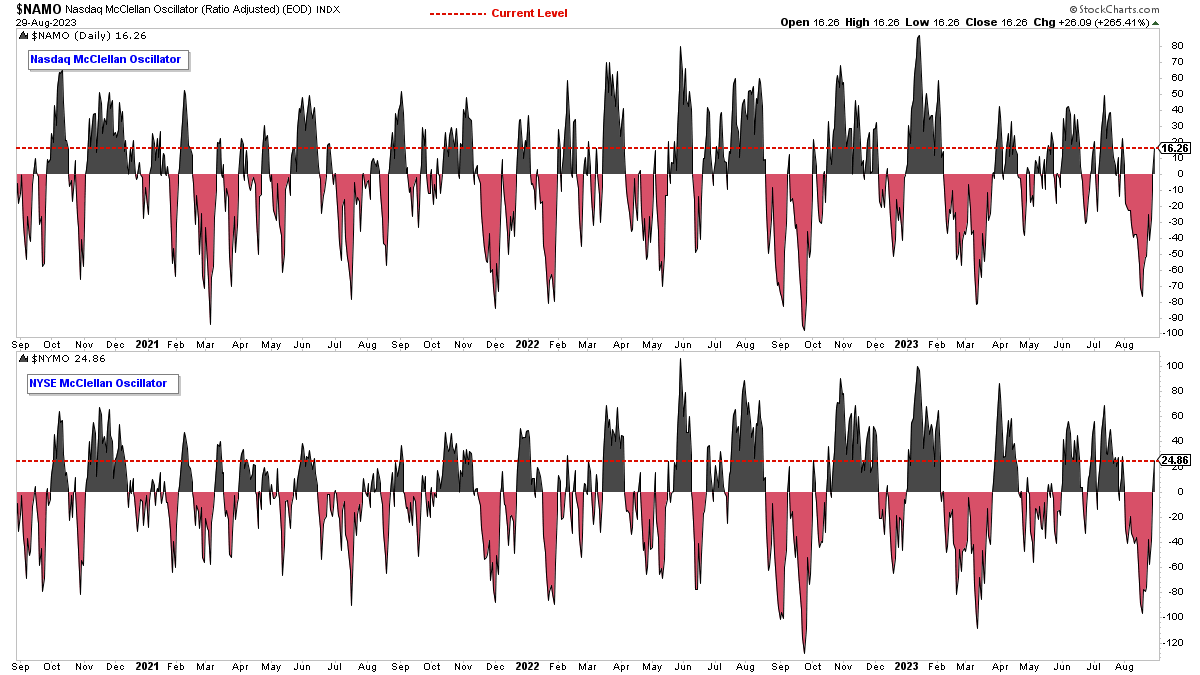

Market Breadth: McClellan Oscillator

The McClellan Oscillator has continued to improve since reaching an extreme on the 18th August, and today moved back above the zero line in both the Nasdaq and NYSE charts, and so has moved back to positive territory also. Hence, it will be interesting to see what affect these short-term improvements in breadth have on the longer-term breadth measures in the weekend market breadth review.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.