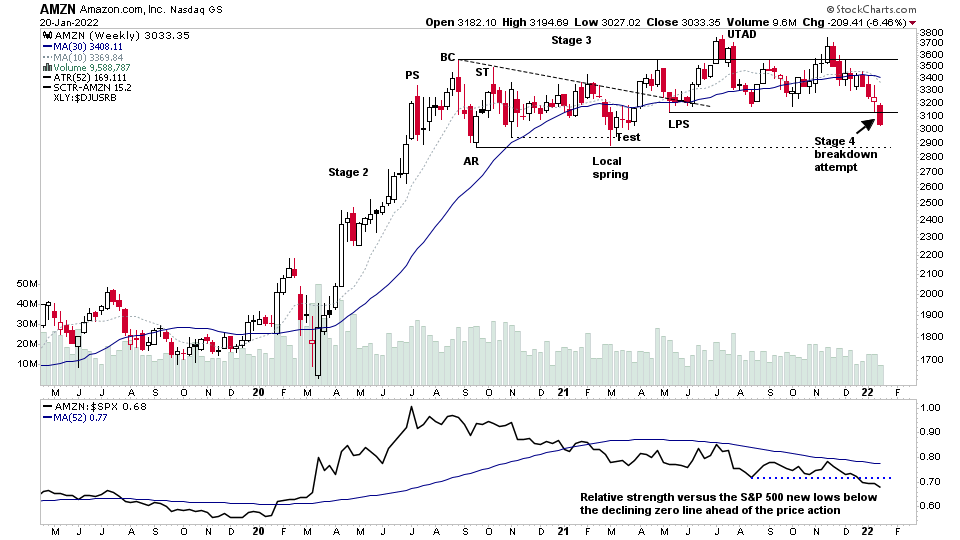

Stage 4 declines proliferate... mega caps enter the fray

$AMZN - the Nasdaq 100 no. 3 holding by weight, cracking and making a Stage 4 breakdown today.

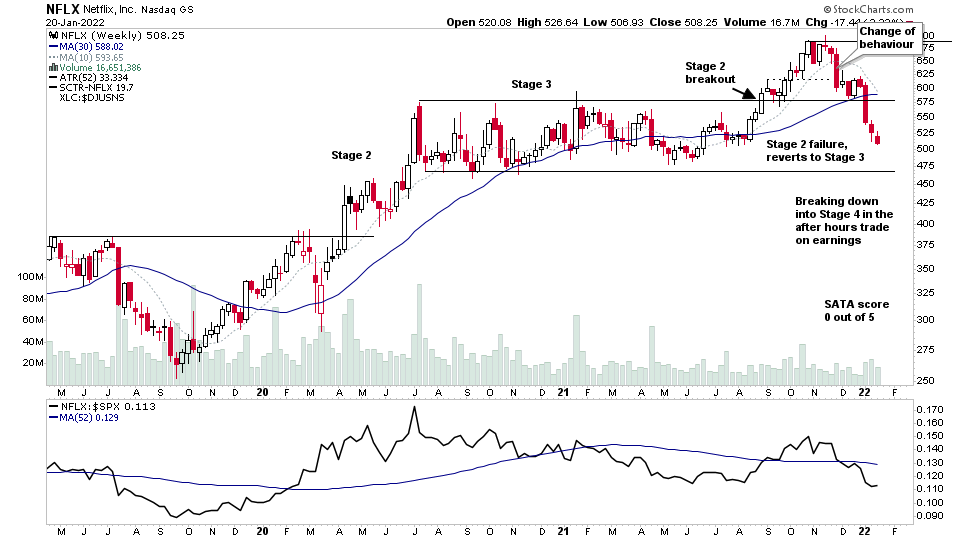

$NFLX another mega cap breaking down into Stage 4, with a negative reaction to earnings in the after hours trade.

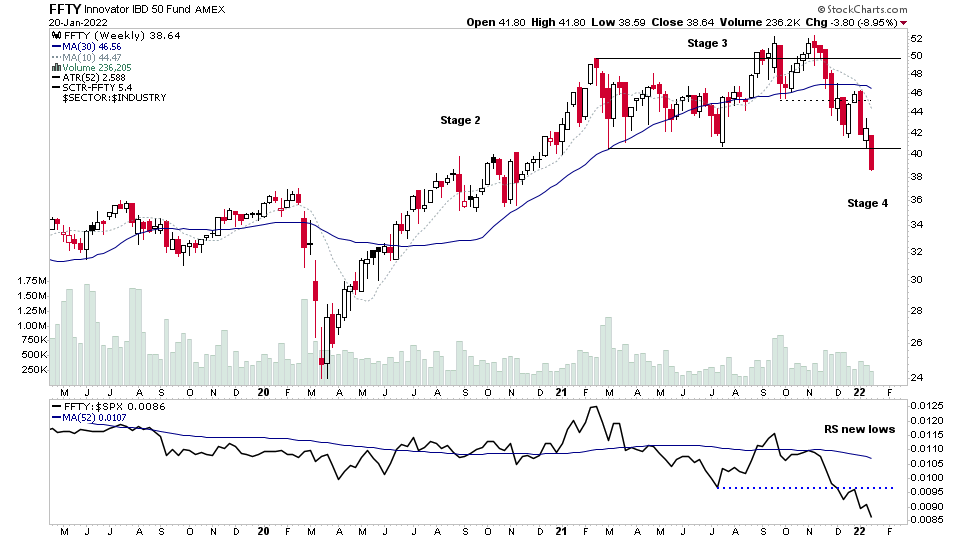

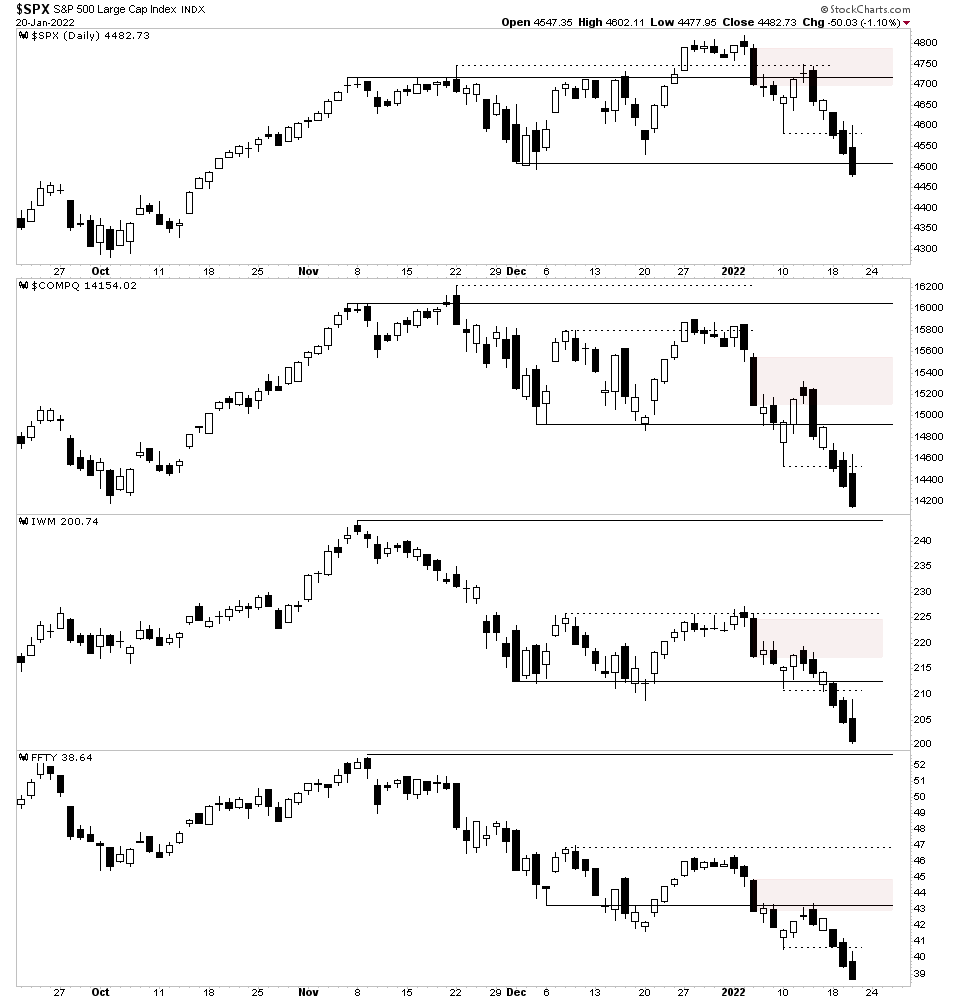

IBD 50 - CAN SLIM Growth ETF

$FFTY IBD 50 CAN SLIM stocks etf joining the Stage 4 party in the secondary indexes

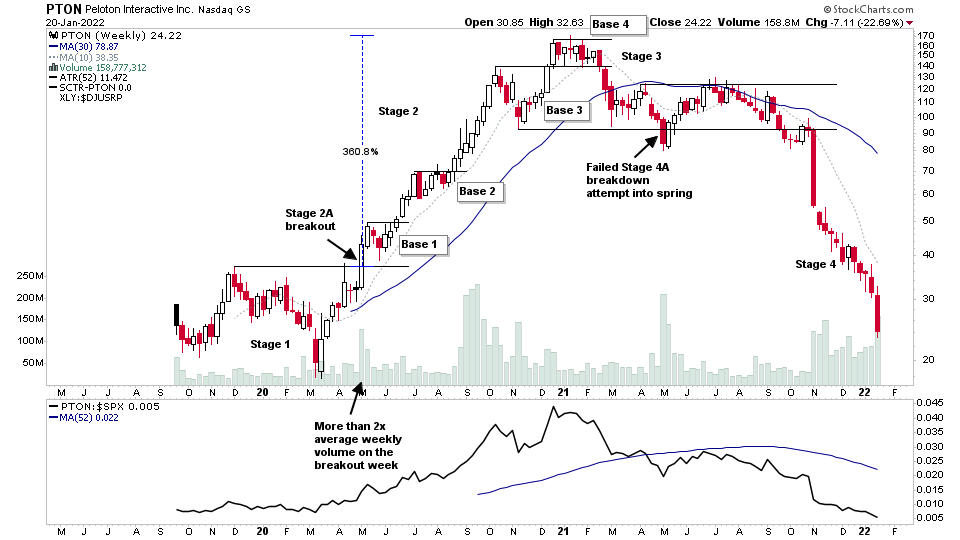

PTON - The Best Modern Example of Stan Weinstein's Four Stages

$PTON - I think this might become my go to chart for explaining Stan Weinstein's Four Stages. Has got it all.

S&P 500 , Nasdaq Composite, Russell 2000 and IBD 50

Lower highs again today in the indexes as the bounce fades into the end of the day and the major indexes continue to make lower lows with the S&P 500 breaking the December pivot low.

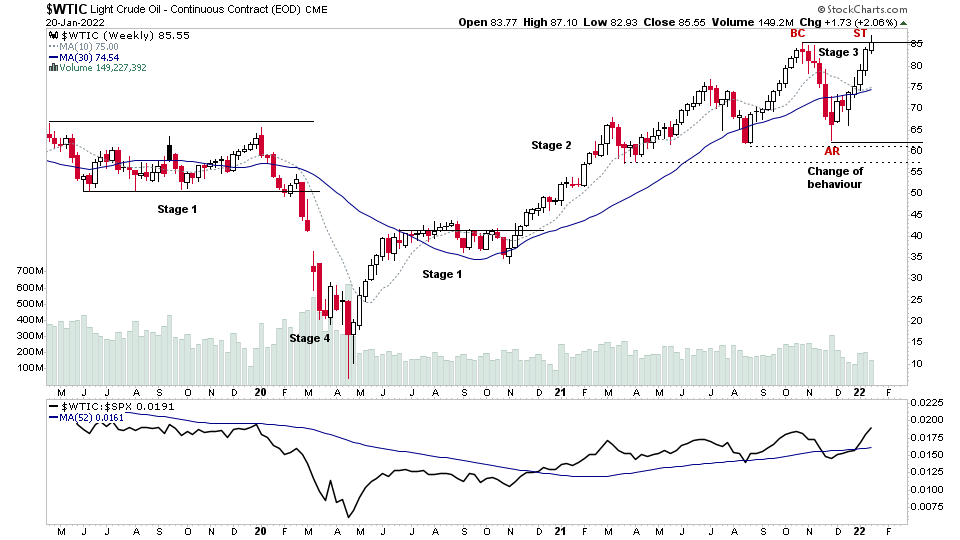

Crude Oil - Double Top in Stage 3?

Light Crude Oil in potential Stage 3 and testing the top of the range with a small upthrust currently. So on watch for a double top, as it has had a sharp move back to the highs of the range on light volume after the distributional behaviour in Nov.

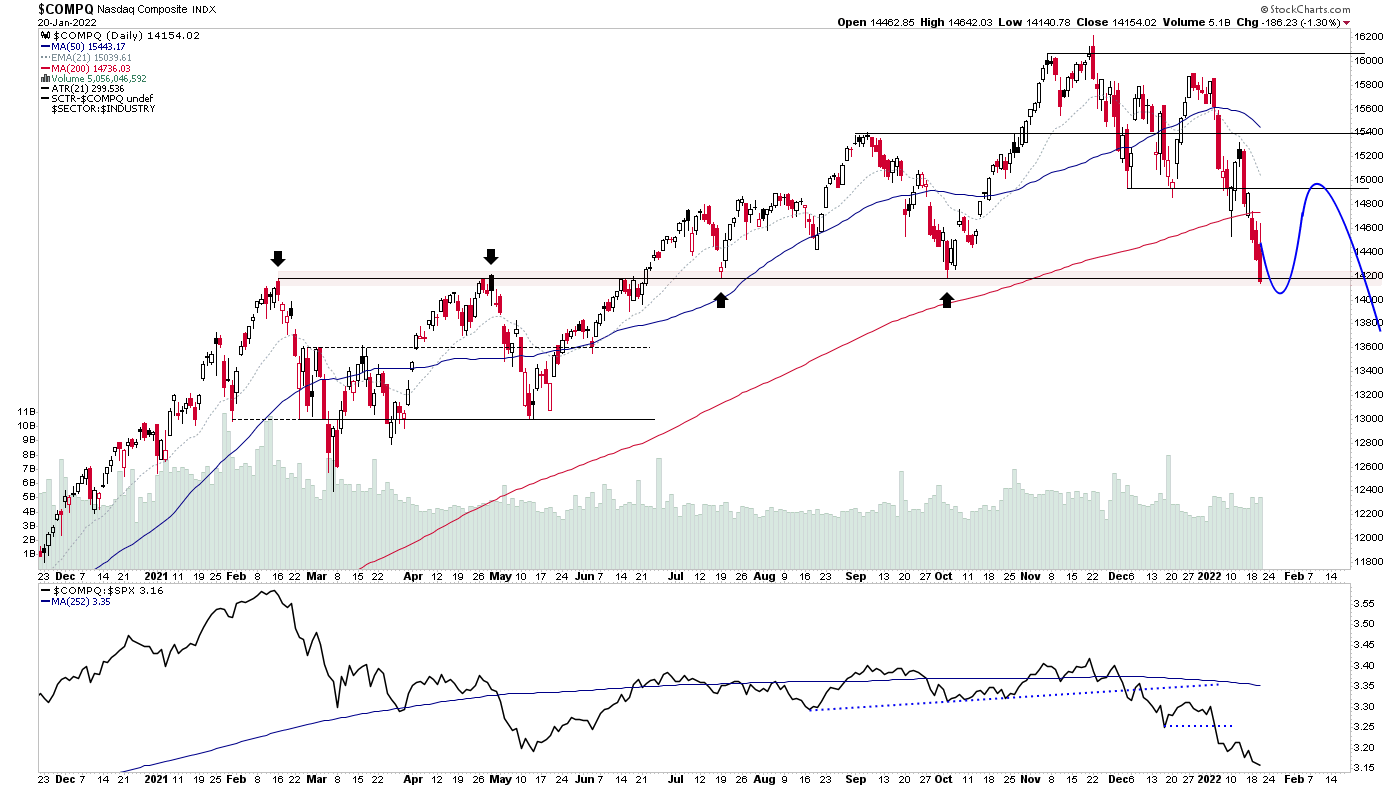

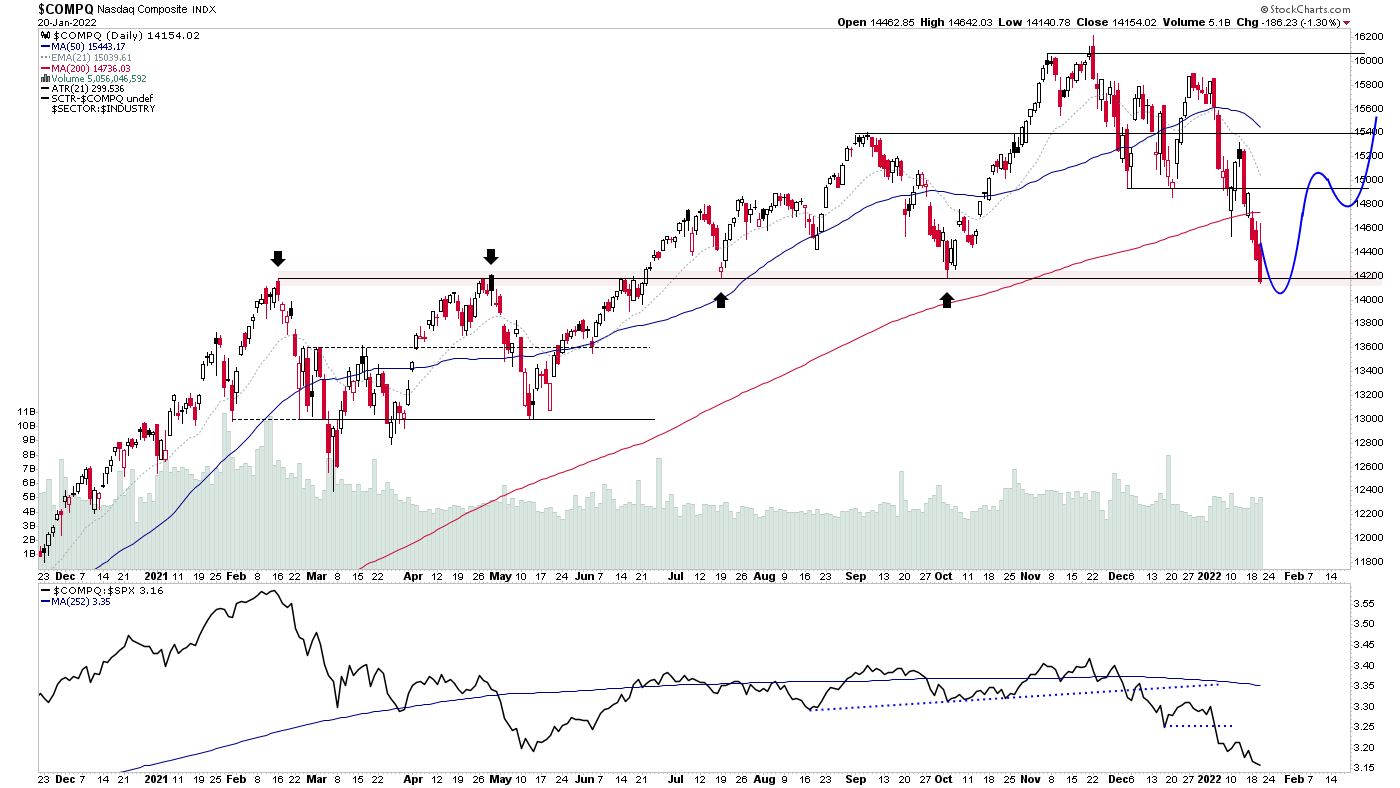

Nasdaq Composite - Bullish and Bearish Scenarios

Bearish Scenario

It's currently approaching a major level of support / resistance, as the 14,200 area & has had 2 swing highs and two swing lows over the last 12 months. So potential for a short term swing low & then retest the 200 day MA.

Bullish Scenario

Same initial bounce at the major support level of 14200, but with the bullish scenario, it instead overcomes the 200 day MA and finds support on the backtest to it again & continues higher once more.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.