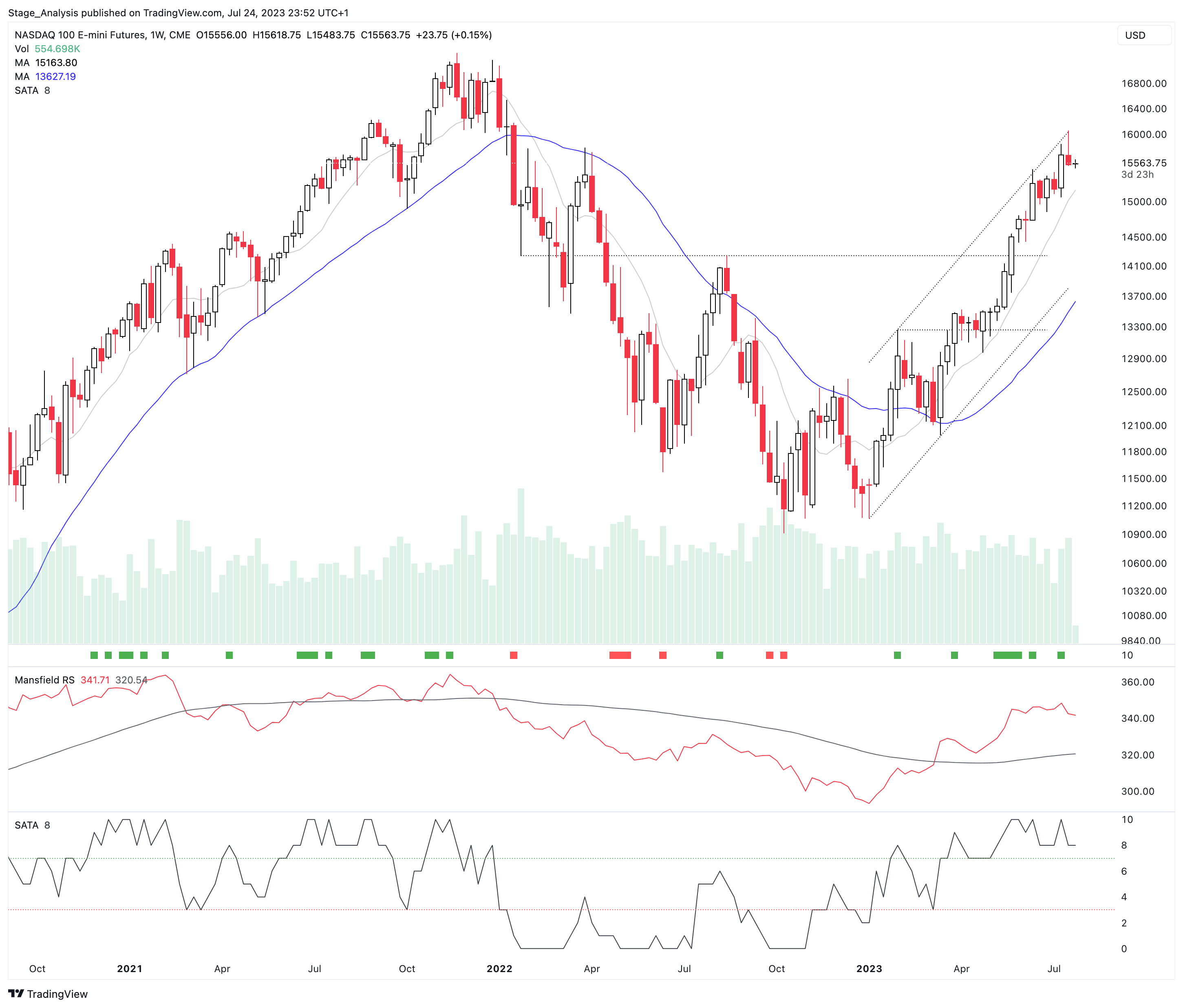

Stage Analysis Technical Attributes Scores – Nasdaq 100

The full post is available to view by members only. For immediate access:

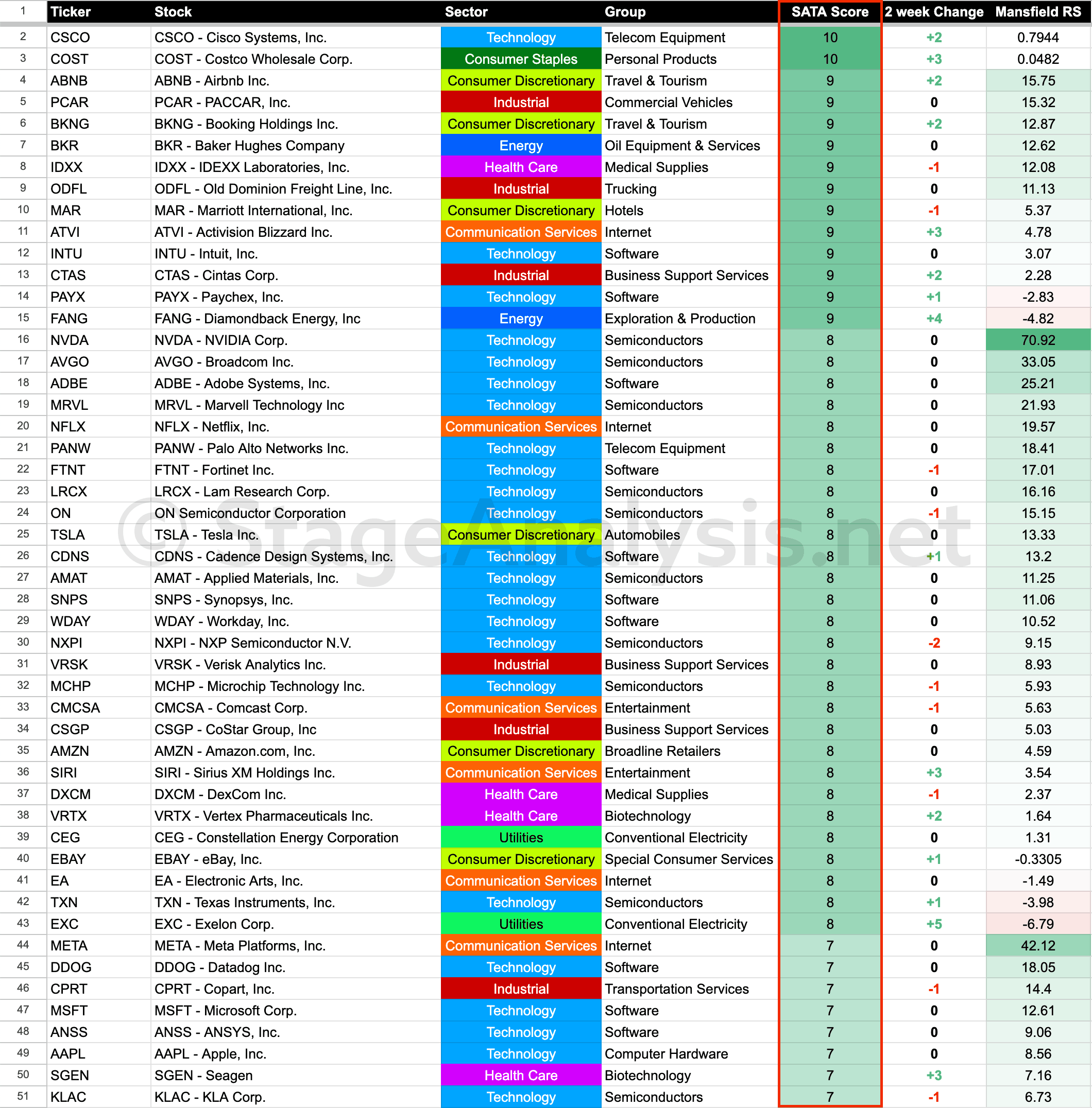

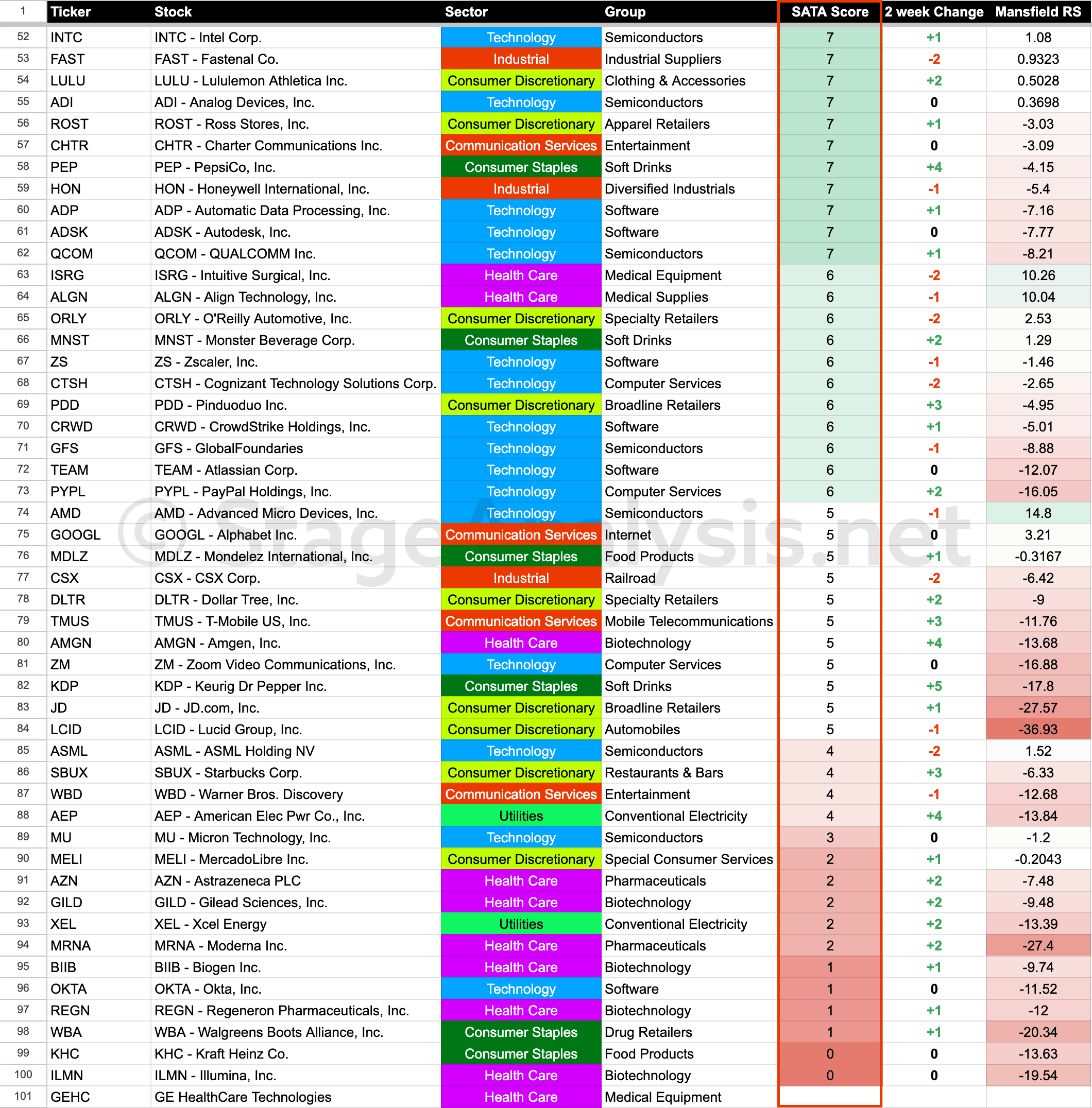

The Stage Analysis Technical Attributes (SATA) score is our proprietary indicator that helps to identify the four stages from Stan Weinstein's Stage Analysis method, using a scoring system from 0 to 10 that rates ten of the key technical characteristics that we look for when analysing the weekly charts.

We last covered the weekly SATA scores for the Nasdaq 100 back on 10th July, which gives a rough guide of the Stages of the individual stocks within the Nasdaq 100. i.e. everything above a 7 would be considered in the Stage 2 zone (Strong), 4-6 in the Stage 1 or Stage 3 zone (Neutral), and 3 or below is the Stage 4 zone (Weak).

Currently the Nasdaq 100 consists of:

- 61% Stage 2 zone (Strong)

- 26% Stage 1 or Stage 3 zone (Neutral)

- 12% Stage 4 zone (Weak)

- 1% has no SATA score yet

Nasdaq 100 weekly SATA Score: 8 (Strong), daily SATA Score: 4 (Neutral-)

Percentage of stocks with a technically healthy SATA Score (6+): 72%

Compared to the 10th July post there are +5% more stocks in the Stage 2 zone, +4% more stocks in the Stage 1 or Stage 3 zone, and -10% less stocks in the Stage 4 zone, and so the weighting continues to shift to the positive side of the bell curve, with 72% of the Nasdaq 100 stocks in a technically healthy position (based on their SATA score data) and 5 times as many stocks in the Stage 2 zone compared to the Stage 4 zone.

Nasdaq 100 Stocks – Ordered by Highest SATA Score + Mansfield Relative Strength

Coming Soon – SATA Scores on the Website

We have been continuing to work hard since the start of the year developing a new tool for the website, so that we can hopefully make the SATA scores available for the whole US market on the Stage Analysis website, and in time potentially other markets too. Which will give Stage Analysis members the ability to see the SATA scores and changes on a daily basis and then make use of that information.

There's multiple ways that this data could be useful on both the long and short side of the market and also as market breadth data and charts. So we are excited to get it up and running on the website. So stay tuned for more info about it the coming months.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.