Small Caps Rotation and the US Stocks Watchlist – 6 June 2023

The full post is available to view by members only. For immediate access:

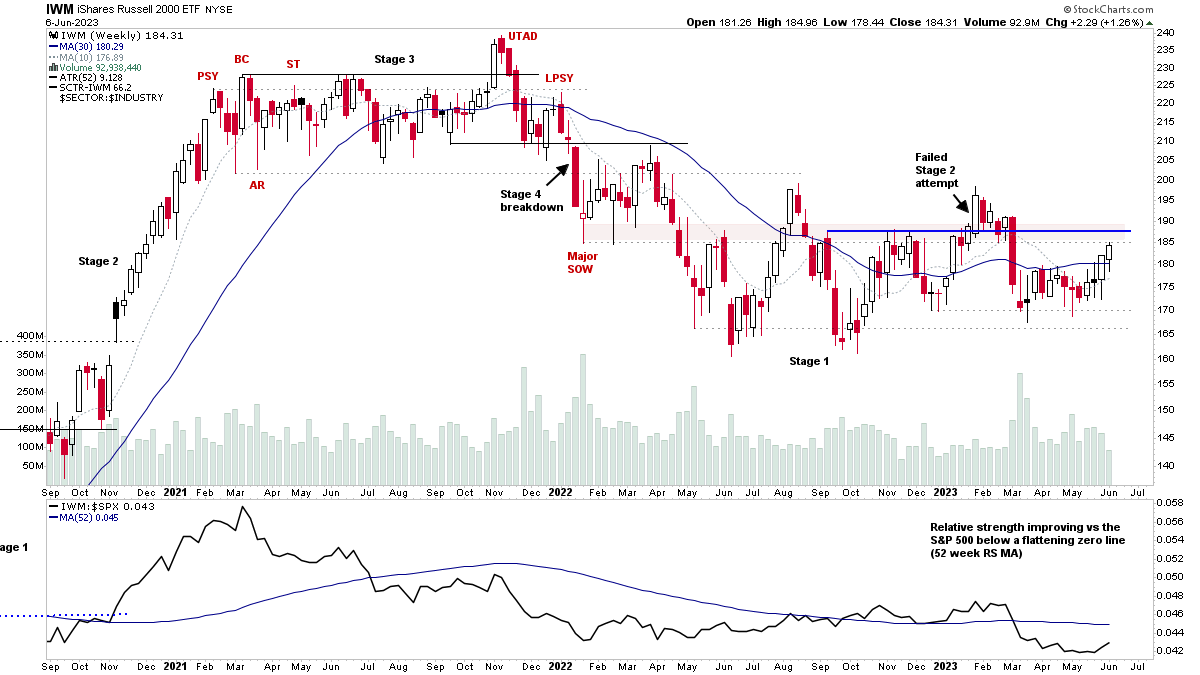

The Russell 2000 Small Caps (IWM, RTY) Index has seen some improvement over the last three days with an expansion in the market breadth, as numerous small cap stocks have caught a bid, after months of choppy sideways price action since the regional banking crisis erupted and took the Russell 2000 below it's 30 week MA and 200 day MA, where it had remained for almost 3 months.

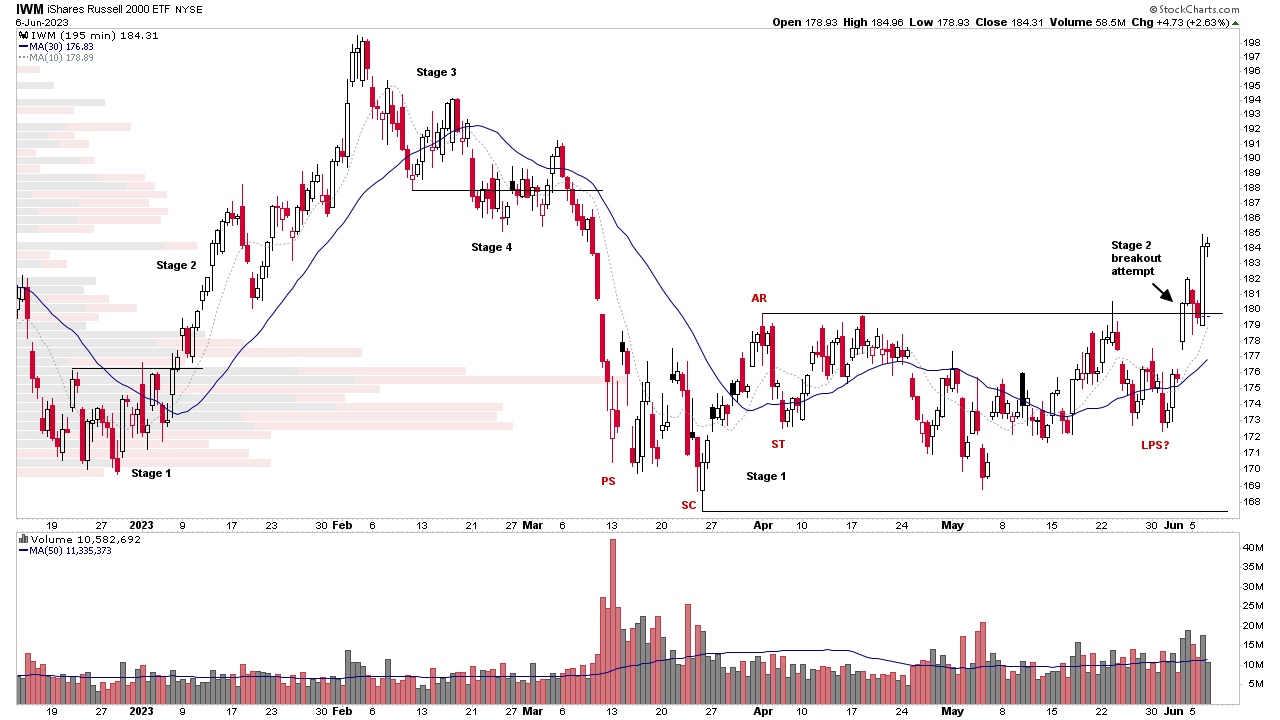

It's now trading back above those longer-term moving averages after a strong 3 day move since Friday, which has moved it back towards the upper part of its very long Stage 1 base structure on the weekly chart. But Stage Analysis can be used on multiple timeframes which can be helpful for fine-tuning entry points for example on pullbacks when a stock etc is already in a Stage 2 advance, and also more advanced earlier entry points for swing traders when the stock/etf is still in late Stage 1 or in Stage 2.

So Friday's rally is a great example of using Stage Analysis on lower timeframes and was highlighted on the Stage Analysis Twitter feed on the day. The updated intraday chart (195 minutes - 2bars/day) can be seen below.

It's still a way off the Stage 2 breakout level on the weekly chart though, but as the watchlist stocks have shown over the last few posts. There's definitely increased interest in multiple areas that have been lagging year to date, so we will be watching to see if this rotation into the small caps is more than just a short-term move or not. As for the broad market to move into Stage 2, and not just the large cap indexes, the small caps and the NYSE stocks will need to participate.

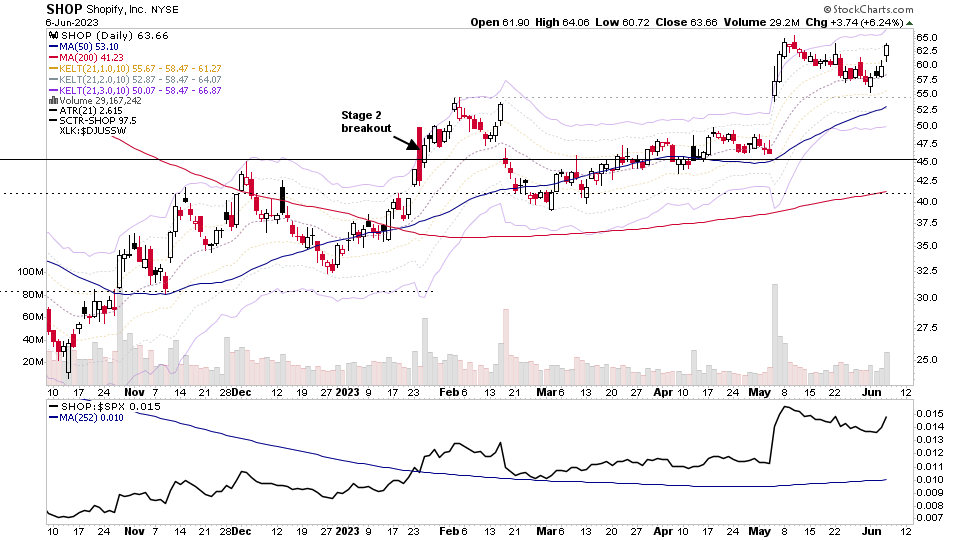

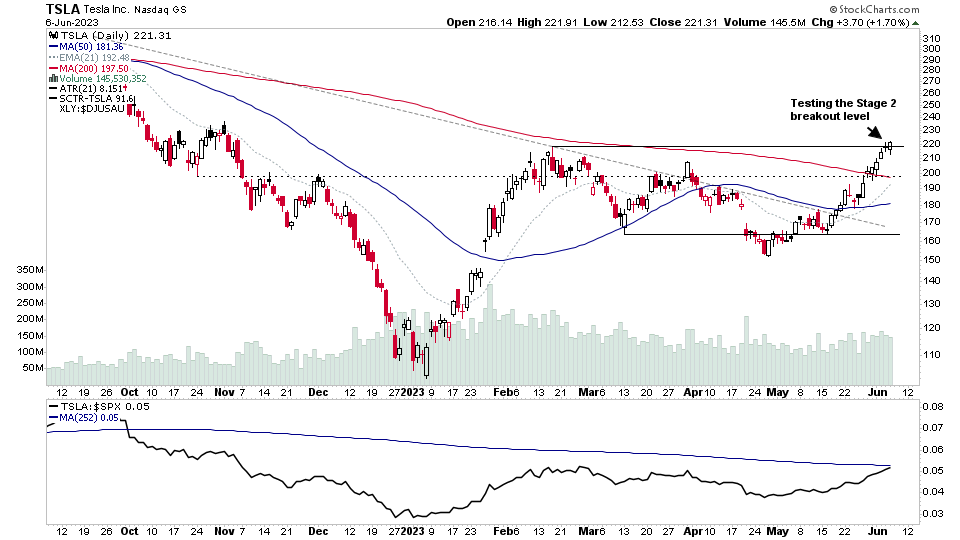

There were 31 stocks highlighted from the US stocks watchlist scans today

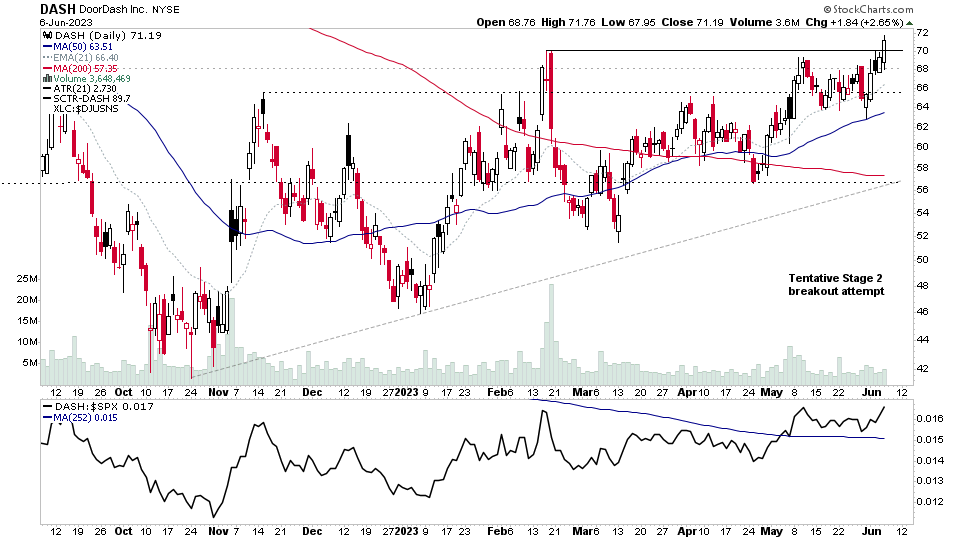

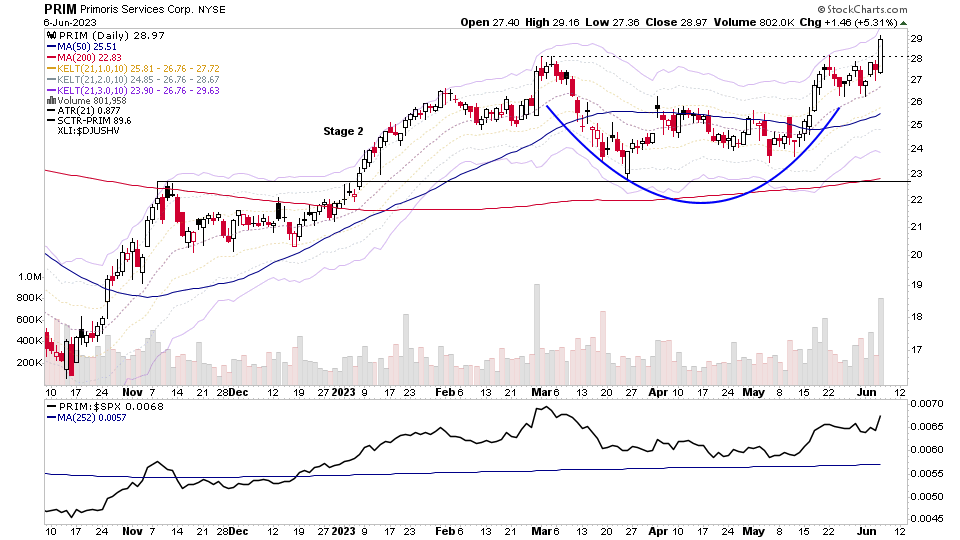

SHOP, TSLA, DASH, PRIM + 27 more...

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.