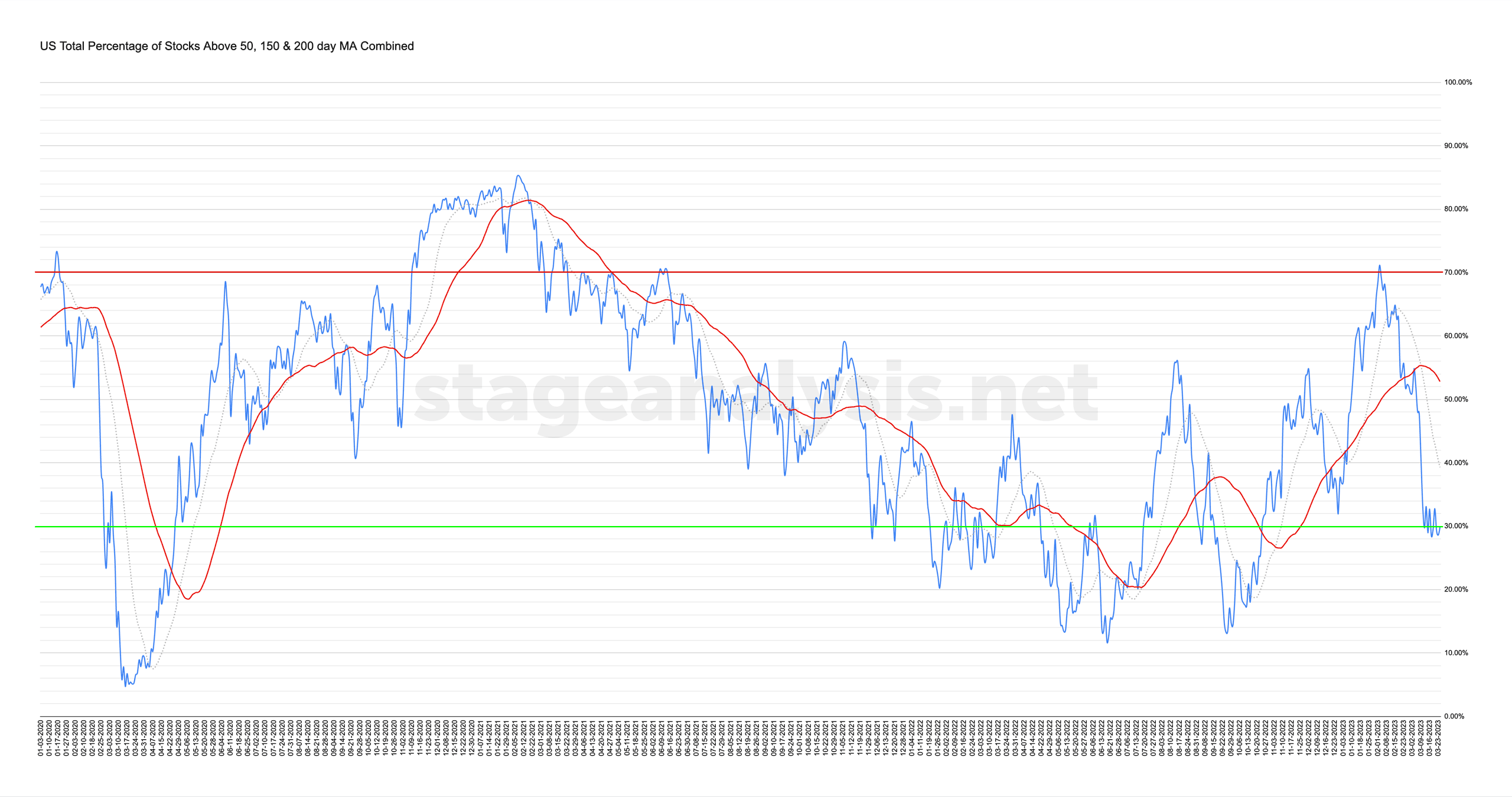

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

29.81% (+1.33% 1wk)

Status: Difficult Environment – Stage 4 zone

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) mostly consolidated this week, closing the week with a modest +1.33% gain on the prior week, although it did close -2.96% below Tuesdays high point.

The overall combined average now stands at 29.81% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages, and remains just on the edge of the lower zone (below 30%).

The distance below its own 50 day MA signal line is -22.99%, which remains at an extreme by historical standards of this measure, and the distance below its shorter-term 20 day MA improved to -9.47%, which is more within the normal range after recovering from an extreme reading of -22.55% on the 13th March.

So the status remains unchanged on a Difficult Environment status, and is in the Stage 4 zone (Below 40% level).

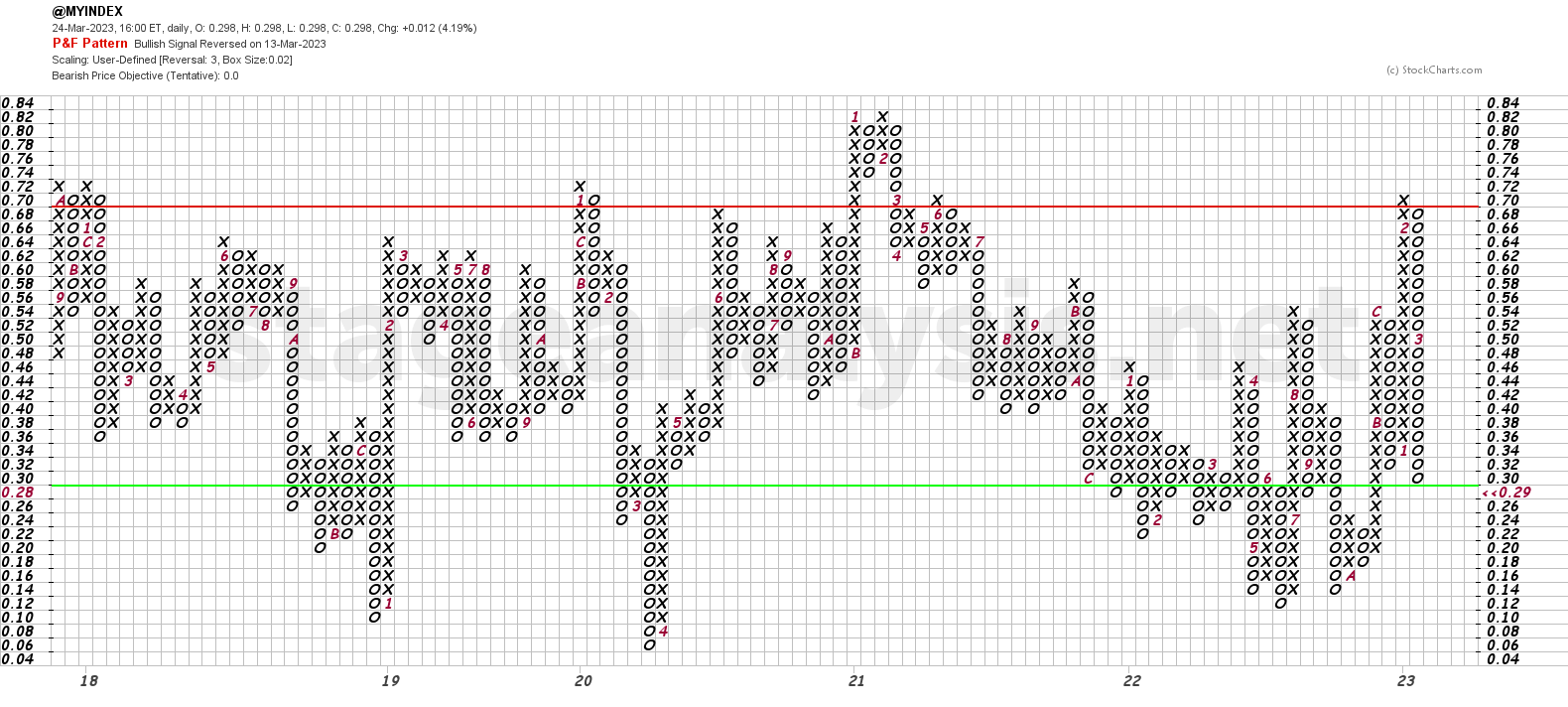

The Point and Figure (P&F) chart (shown above) was unchanged this week, and so the strategy based on the P&F chart remains on Defense for a seventh week (since the reversal to the column of Os on the 9th February), and the P&F status remains on Bear Confirmed status. So the defensive team remains on the field until a reversal to a column Xs triggers a shift to Offense, which currently it would need a daily close above the 36% level to achieve that.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.