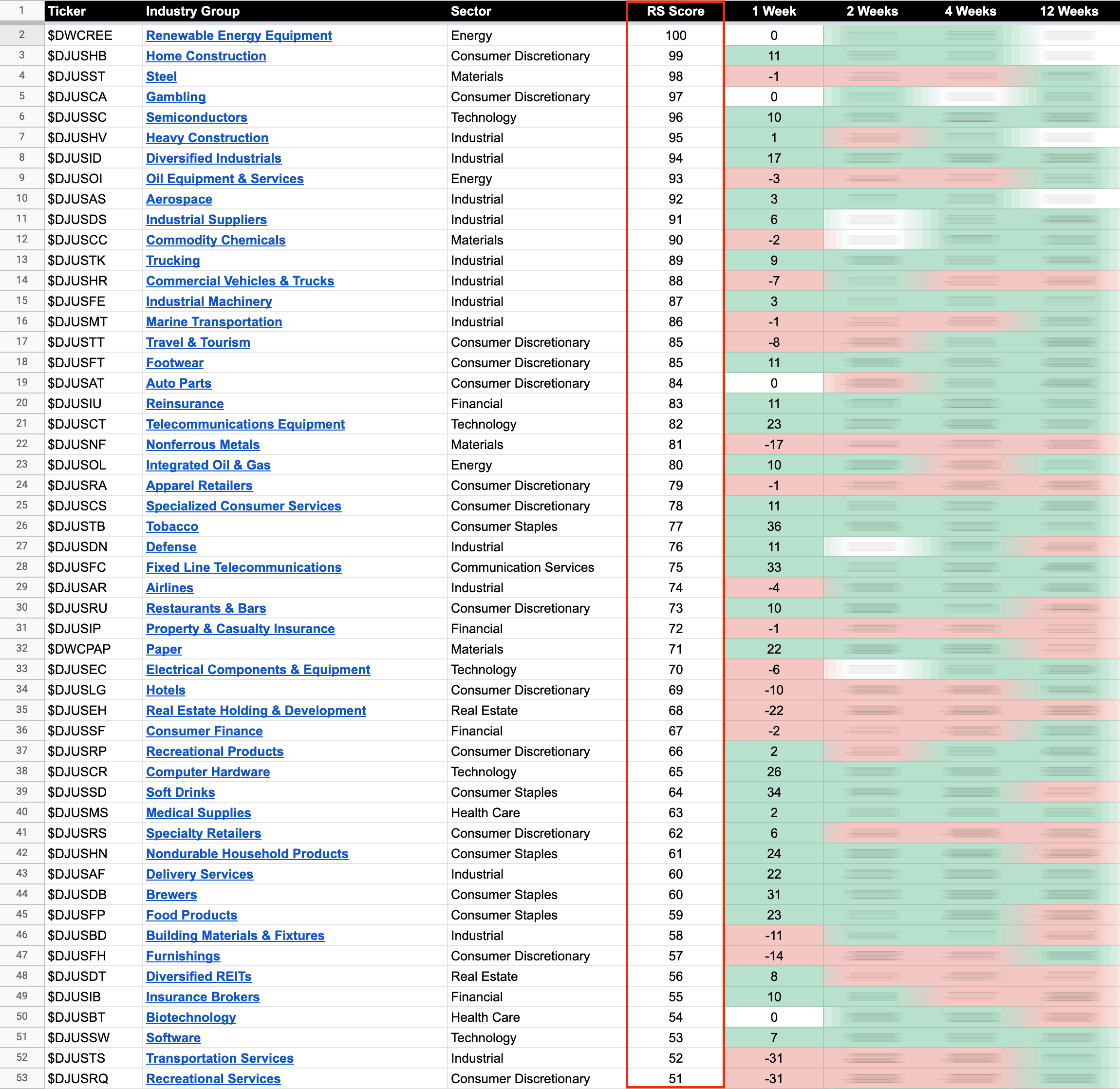

US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

US Industry Groups by Highest RS Score

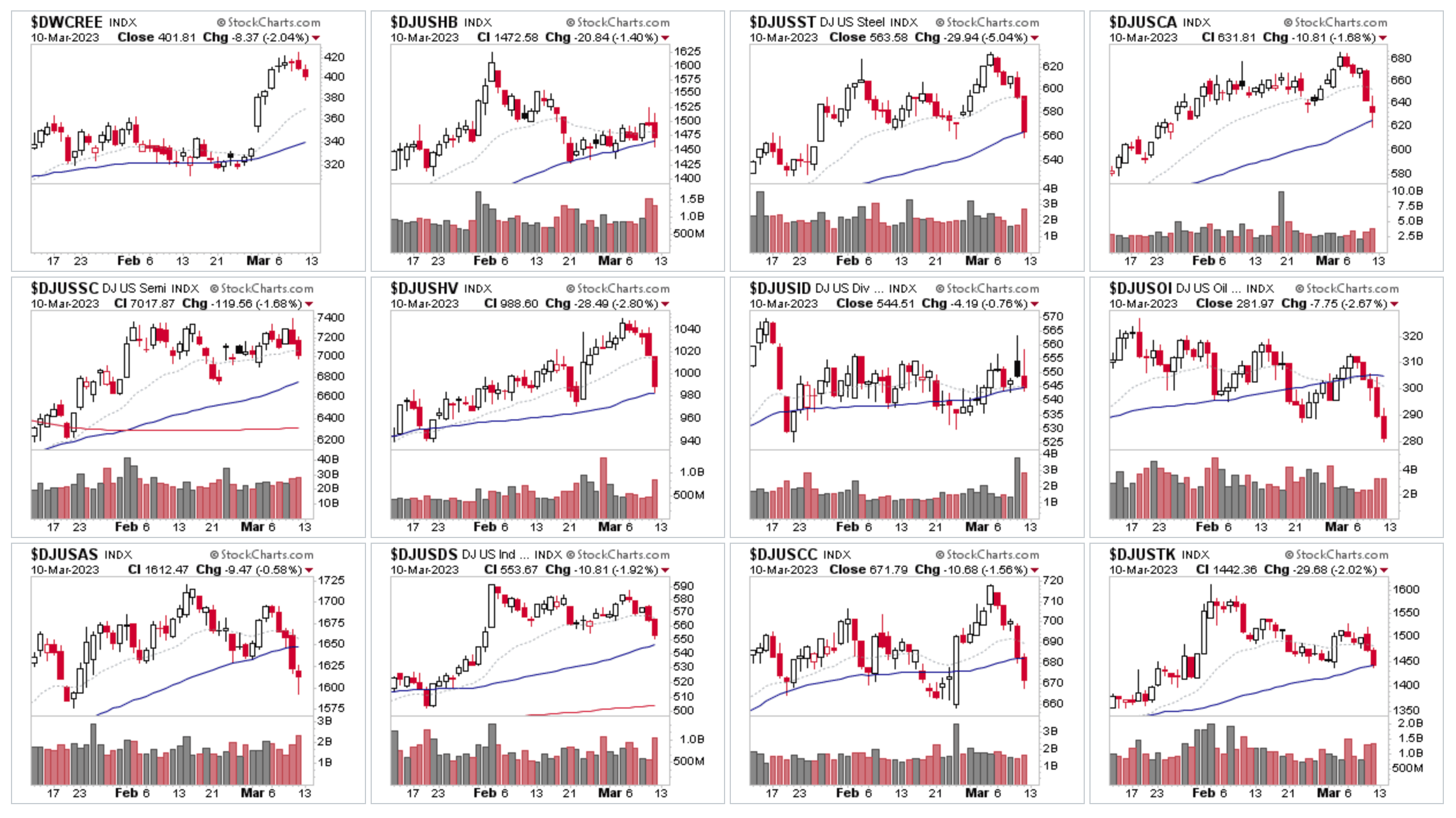

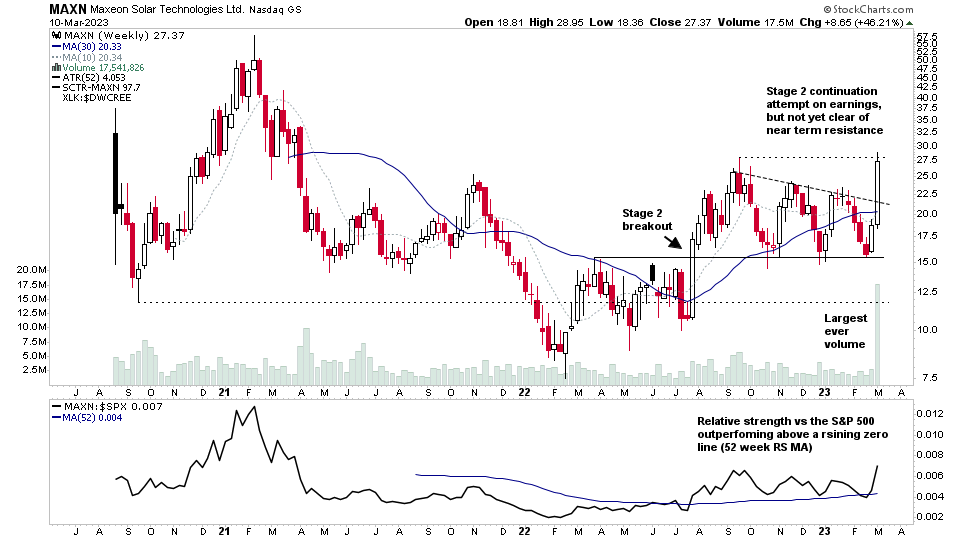

All of the Industry Groups had a negative week. But the Renewable Energy Equipment ($DWCREE) group held onto the top spot in the Industry Group RS rankings for a second week helped by the strong Stage 2 continuation breakout attempt in MAXN following earnings results on the 7th March and its largest ever volume week, which was more than double the previous largest dollar volume week. But this was very much an outlier.

Home Construction ($DJUSHB) group gained +11 RS points to move up to second in the RS rankings, with a smaller decline (-0.96%) than the majority of other groups and major indexes, and multiple Home Construction stocks were highlighted in the watchlist mid-week.

Steel ($DJUSST) dropped to third place overall, but of note is potential failed continuation breakout, which has the possibility of becoming an Upthrust After Distribution (UTAD) if the broad market weakness persists.

Overall there were a number of engulfing candles on the weekly charts of many of the leading groups, which is a potential change of behaviour over what we've seen year to date in those groups. So a warning sign to be alert to.

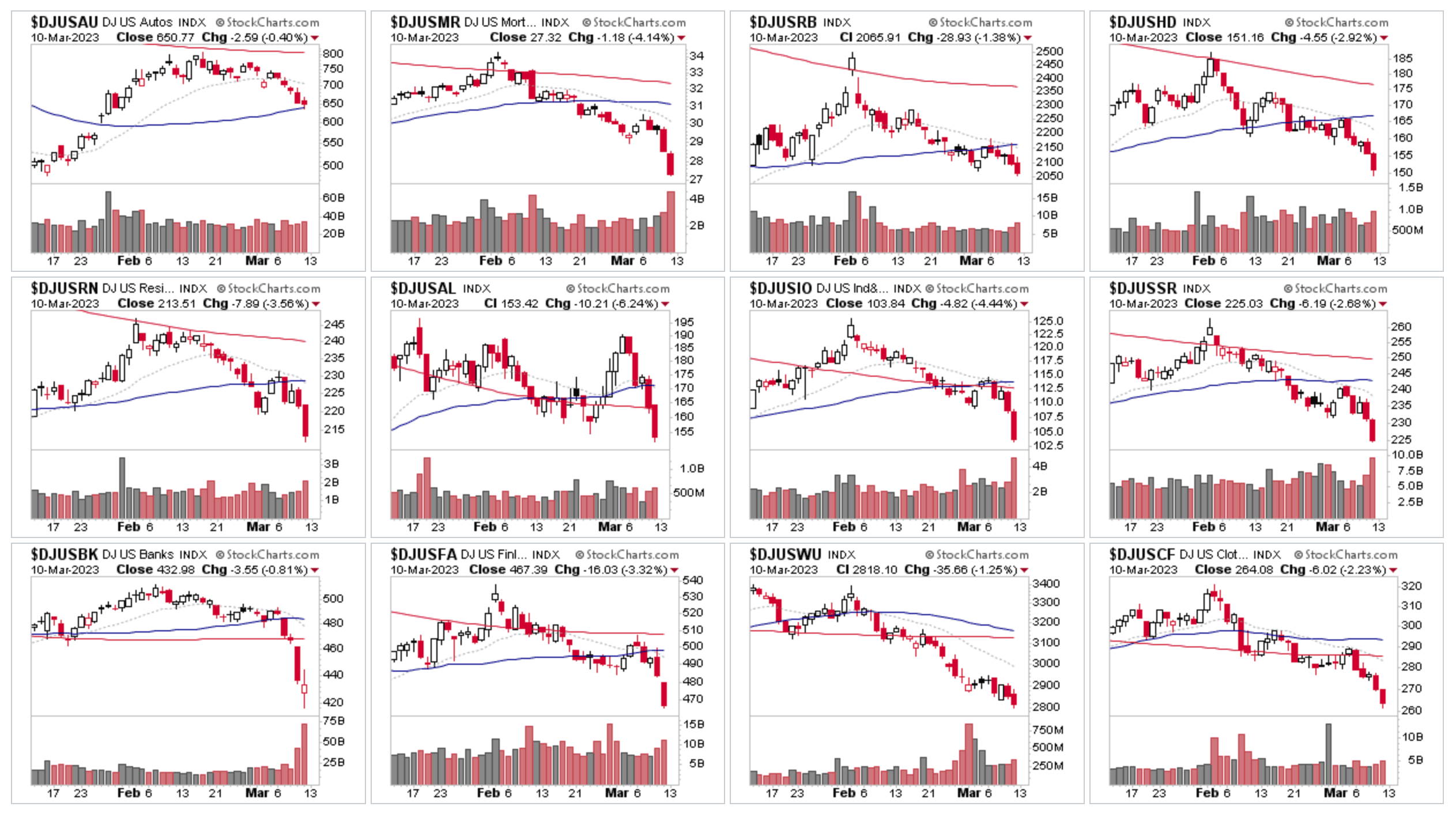

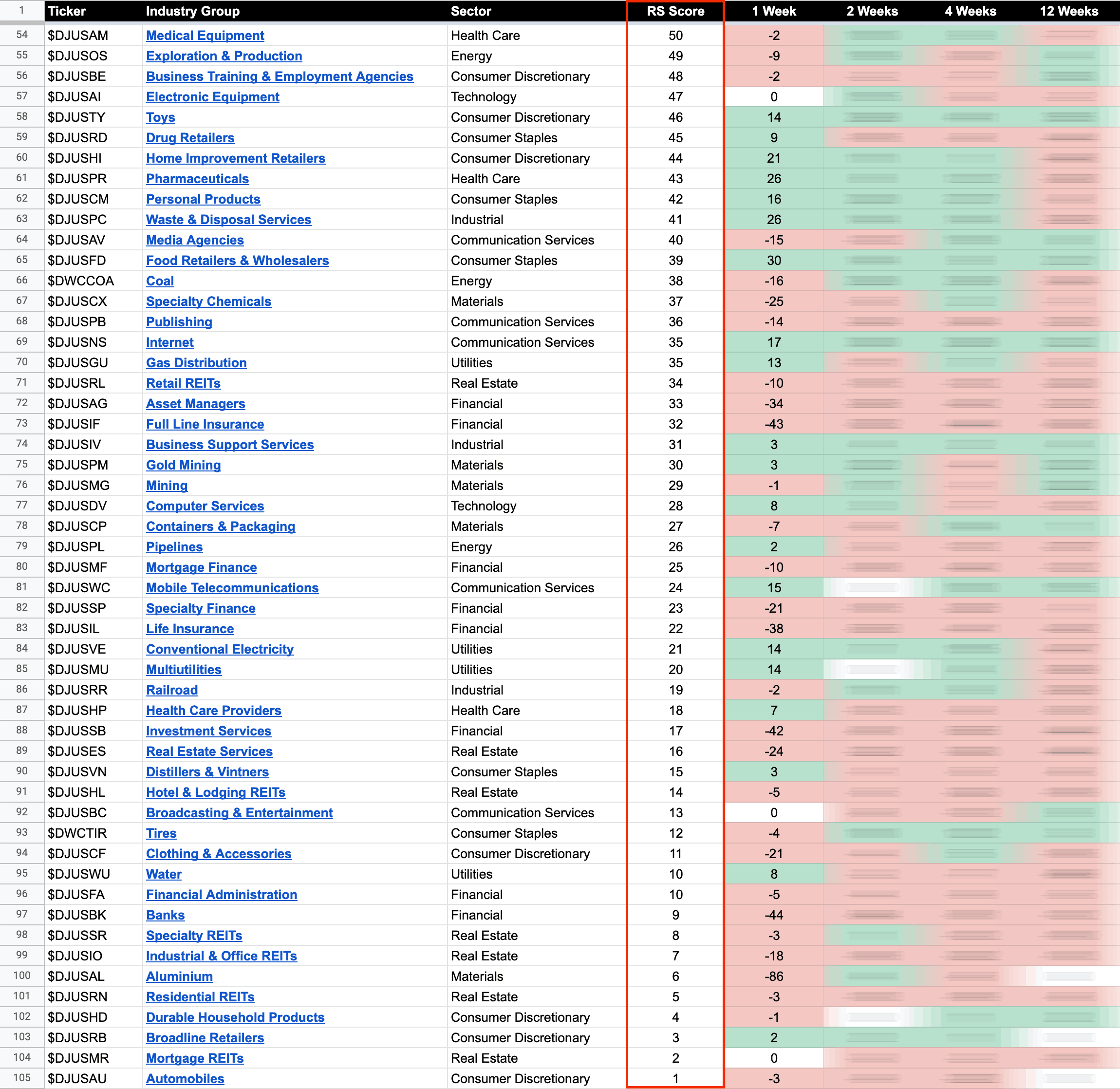

US Industry Groups by Weakest RS Score

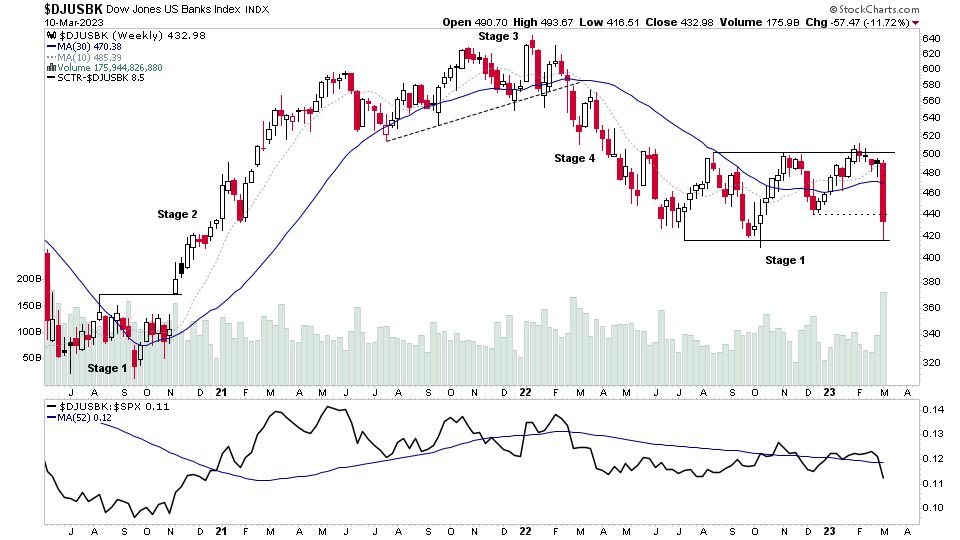

At the bottom end of the Industry Group RS rankings, Banks (DJUSBK) group was significant RS decliner, dropping -44 RS points to 95th position of the 104 groups, caused by the collapse of SVB Financial (SIVB), the parent company of Silicon Valley Bank. Which had a knock on effect across the market.

104 Dow Jones Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.