US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

US Industry Groups by Highest RS Score

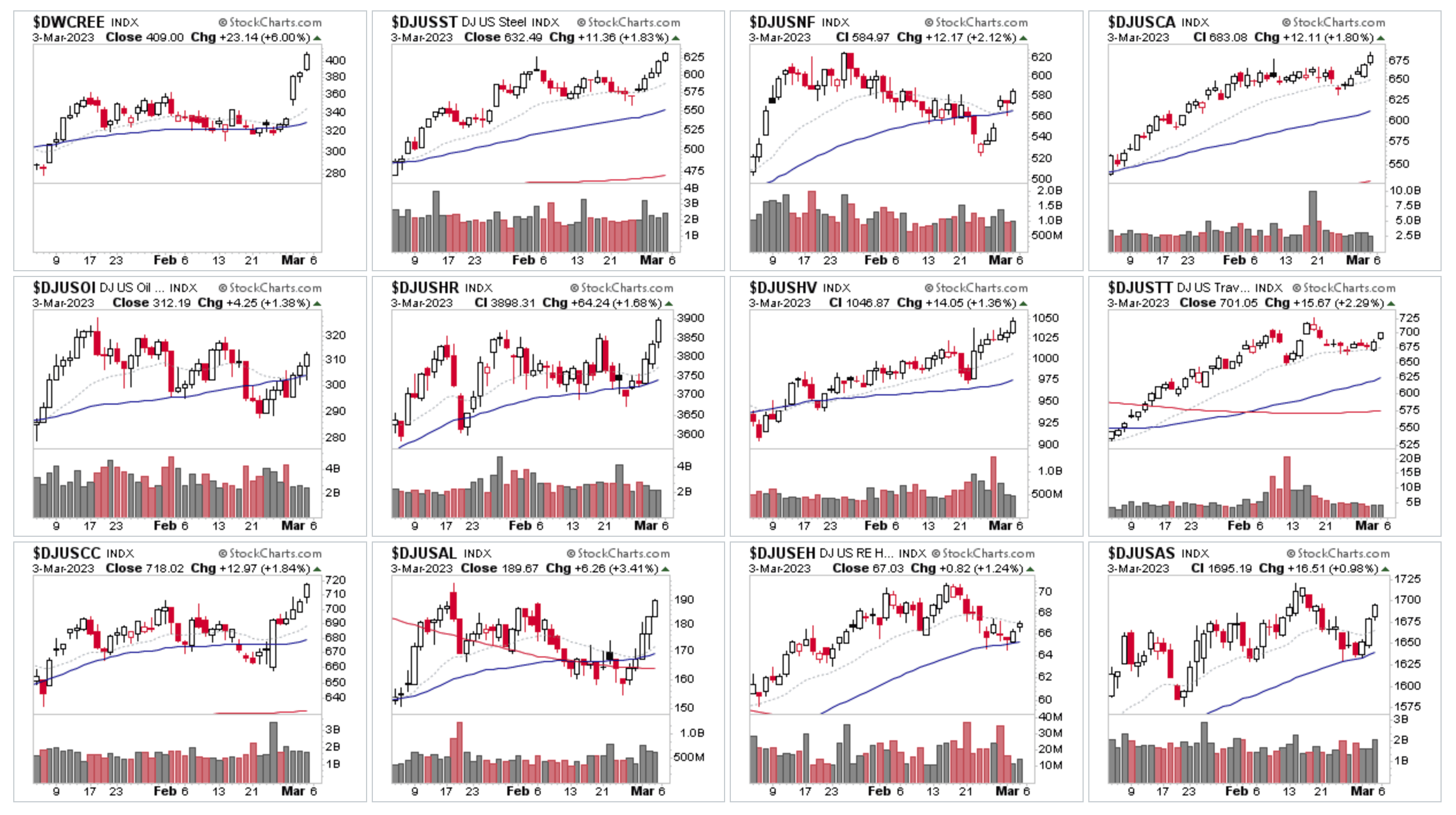

Steel ($DJUSST) was replaced this week at the top of the Industry Group RS Rankings by a strong move in the Renewable Energy Equipment ($DWCREE) group, which is mostly due to the Stage 2 continuation breakout in FSLR following its earnings. But numerous Steel stocks still had a very strong week and continue to move higher in their Stage 2 advances.

Aluminum ($DJUSAL) was the weeks largest RS riser, gaining +89 RS points to move into 10th place overall, but it's a relatively small group, with only 8 stocks and so has bigger swings within the RS rankings. AA and CENX were two of the main drivers of the move, as they attempt to move higher in potenial early Stage 2 advances.

Nonferrous Metals ($DJUSNF) was another group of note, as it rose +13 RS points to 3rd overall, with multiple 10%+ moves in Copper and Silver miners as they rebounded along with the physical metals futures attempting to themselves.

Commercial Vehicles & Trucks ($DJUSHR) made a new all time high and rose +8 RS points to 6th place overall, rejoining the top 10, which it's been mainly been in since October, with only a few dips out of it, as its consolidated over the last 3 months. CAT and DE are two of the large caps from the group that have been in the watchlist again recently.

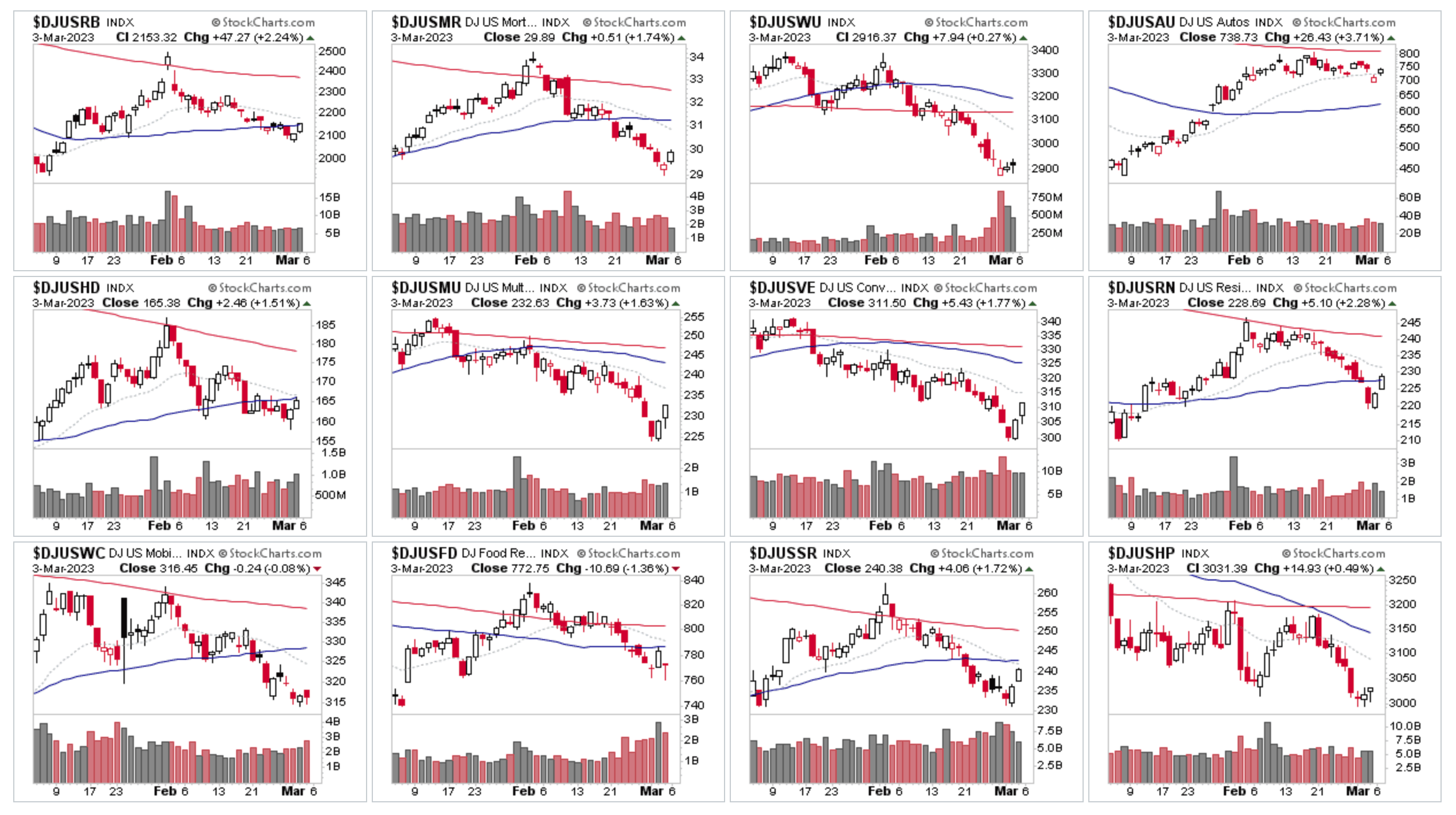

US Industry Groups by Weakest RS Score

Broadline Retailers ($DJUSRB) holding on to the bottom spot for another week, and Automobiles ($DJUSAU) dipping back after a strong start to the year for the group.

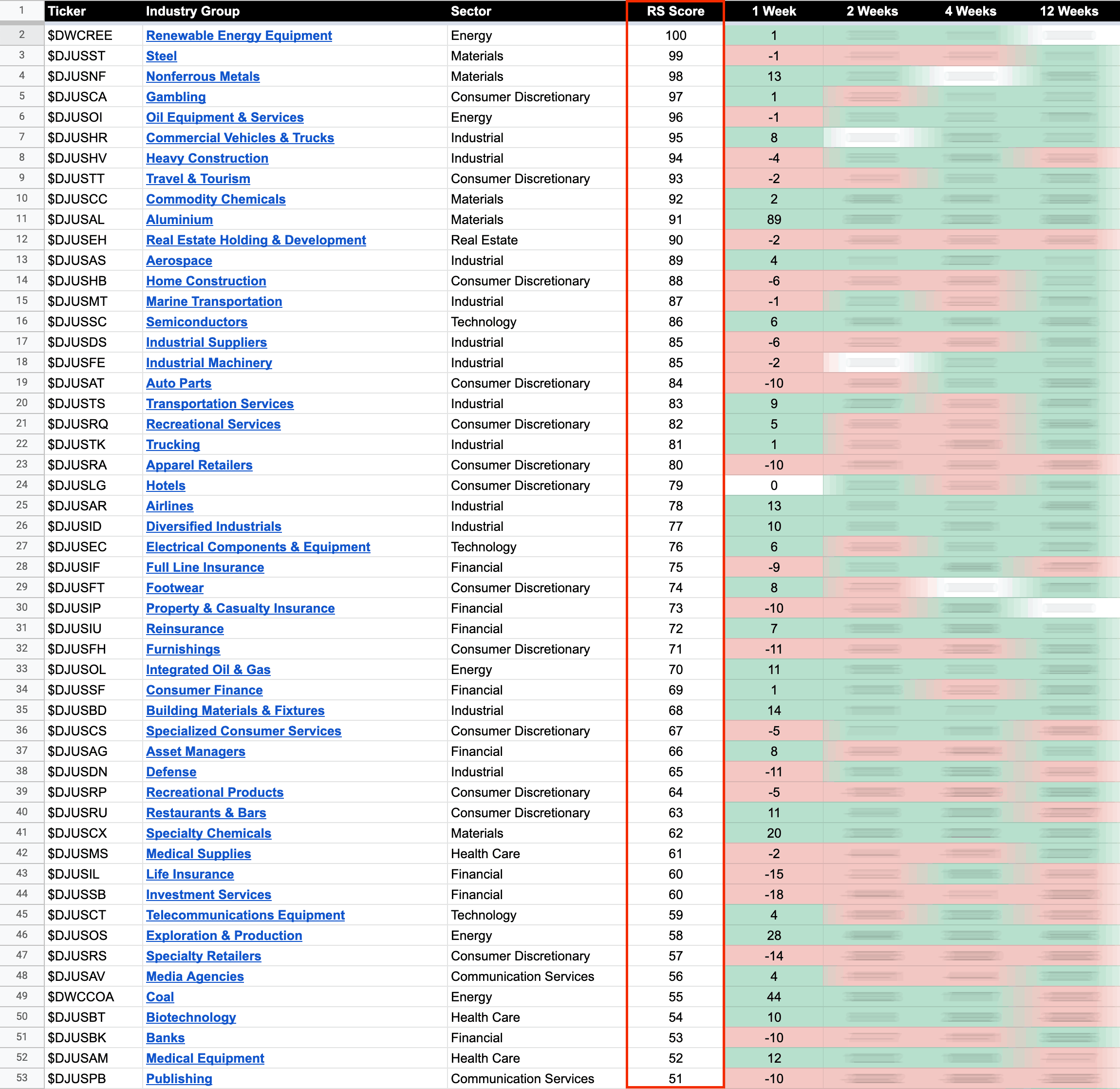

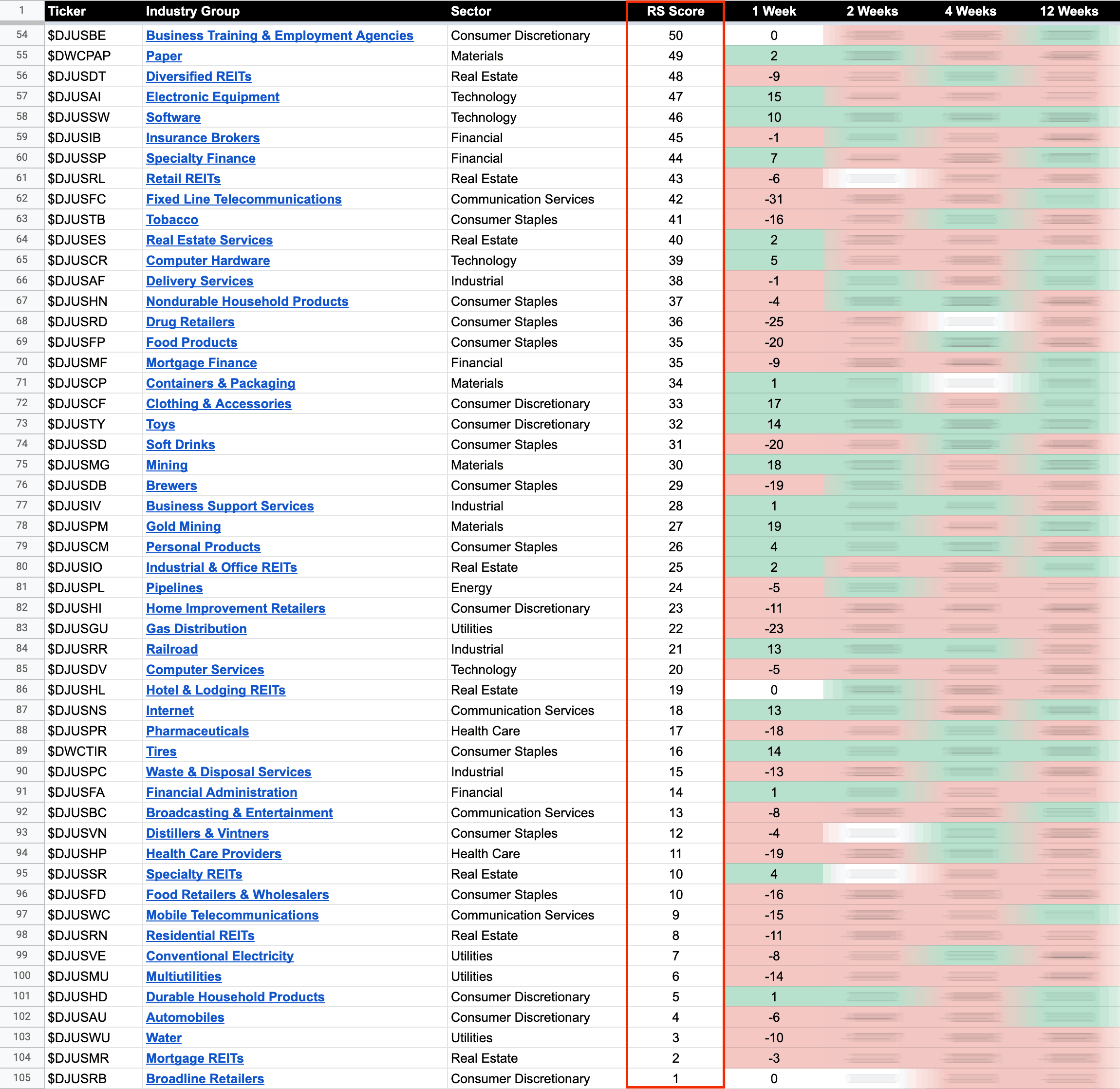

104 Dow Jones Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.