Gold Futures Testing Stage 2 Level and the US Stocks Watchlist – 28 February 2023

The full post is available to view by members only. For immediate access:

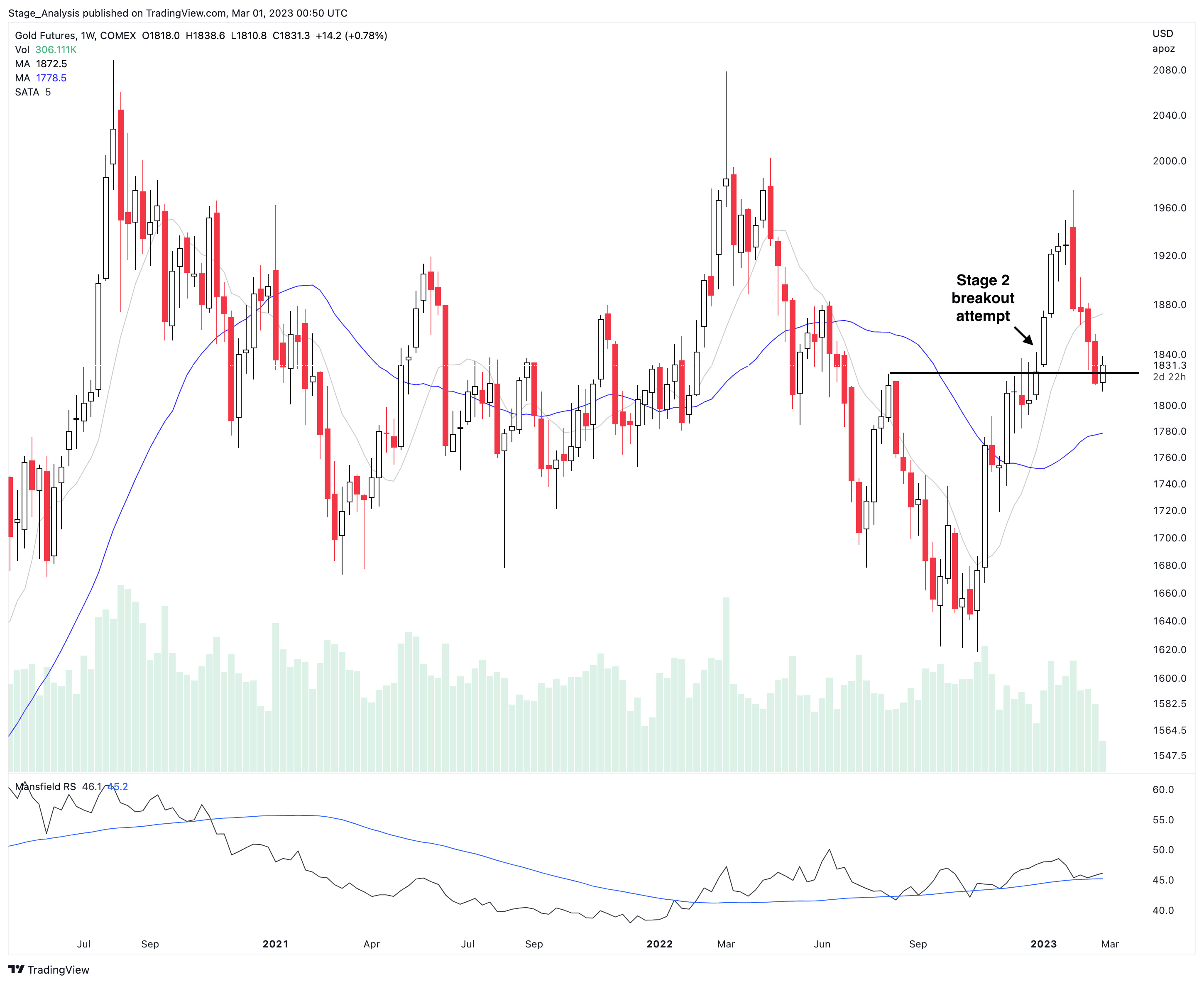

Gold is at an interesting point, as the Gold Futures (GC) has pulled back to its Stage 2 breakout level recently, while the US Dollar Index (DX) has also rebounded to its Stage 4 breakdown level, and hence both are now at potential pivotal points where support/resistance comes into play and hence potential for reversals.

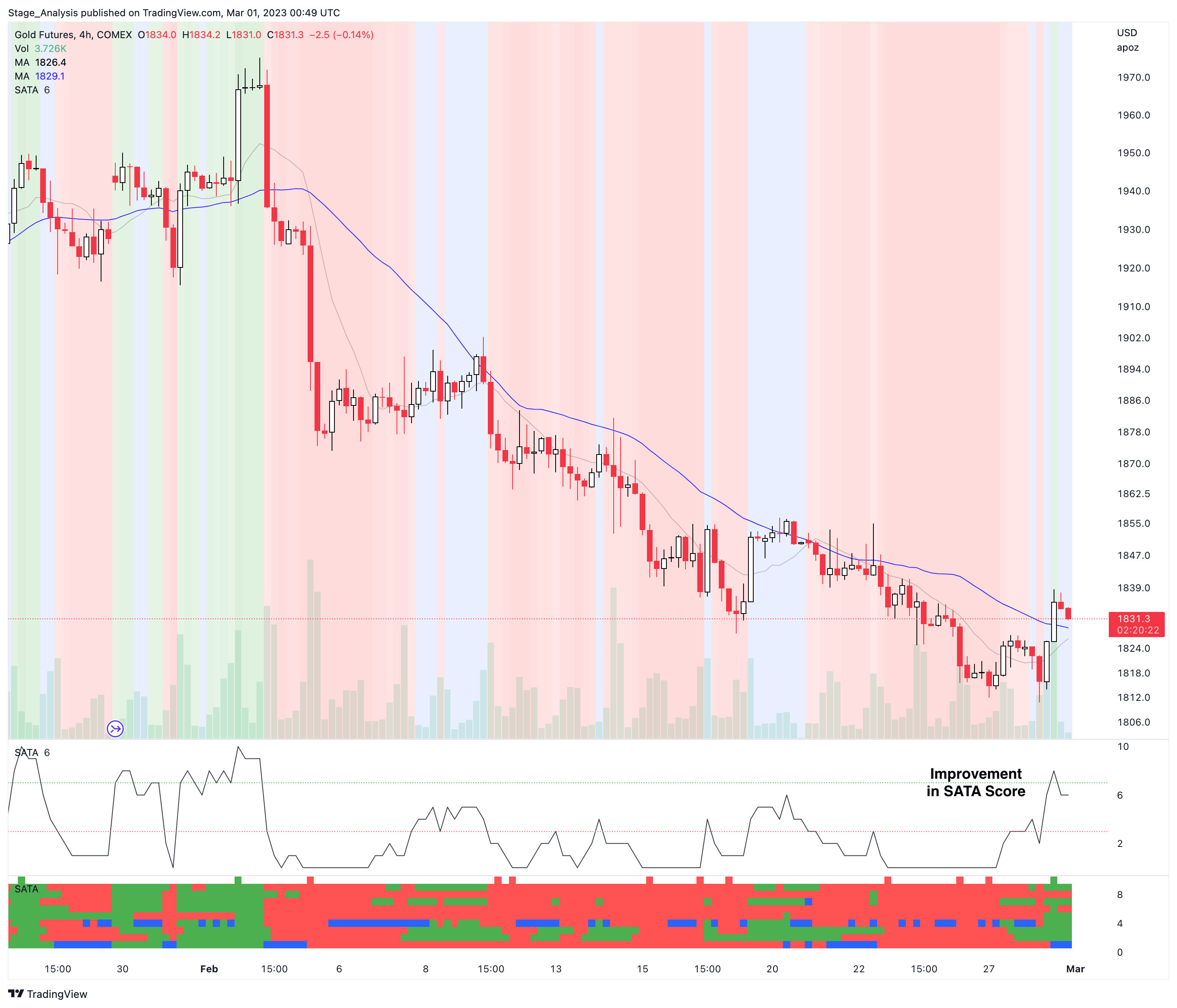

Gold Futures has started to show some technical signs of improvement on an an intraday basis with the intraday SATA (Stage Analysis Technical Attributes) scores reaching their highest levels in a month on Tuesday. For example the 4 hour chart reached a SATA Score of 8 and is potentially showing very fledgling signs of Stage 1 Phase A on that timeframe, but that's not confirmed yet. So it is on watch for a further change of behaviour and the typical Wyckoff Events that we look for that make up Phase A. i.e. Selling Climax, Automatic Rally and Secondary Test.

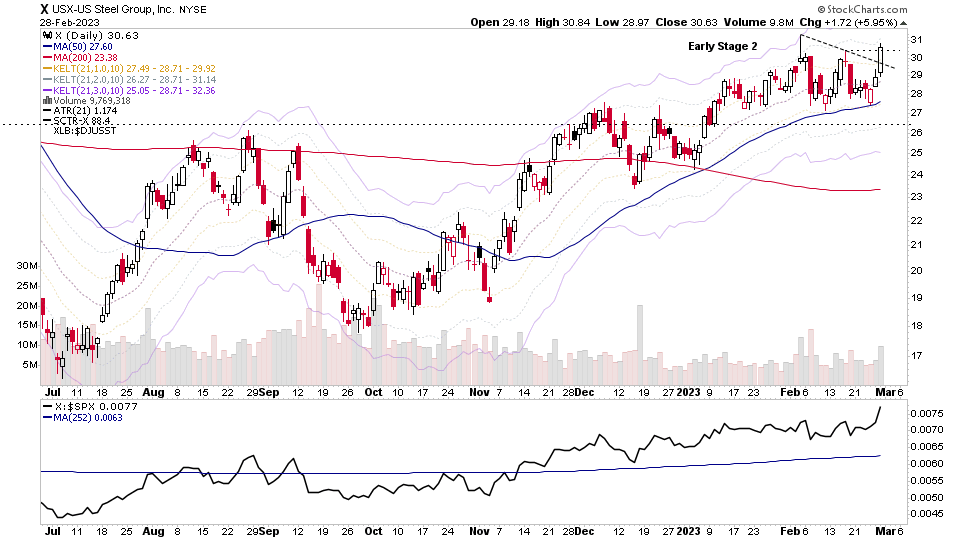

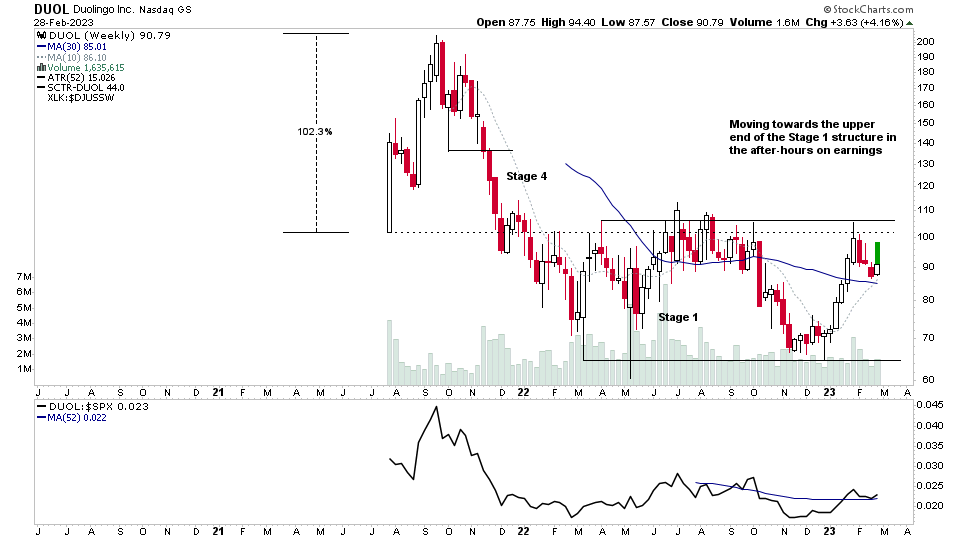

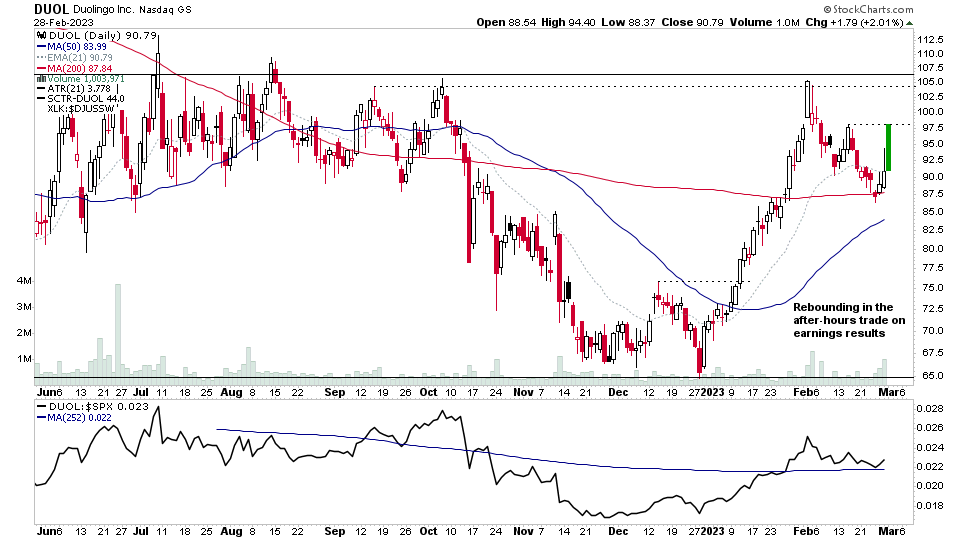

Stocks Watchlist

There were 21 stocks highlighted from the US stocks watchlist scans today

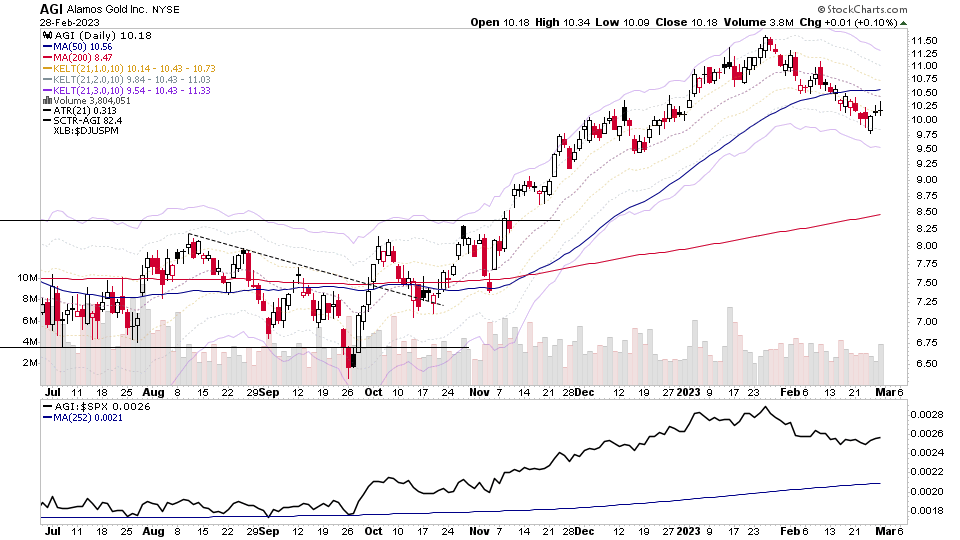

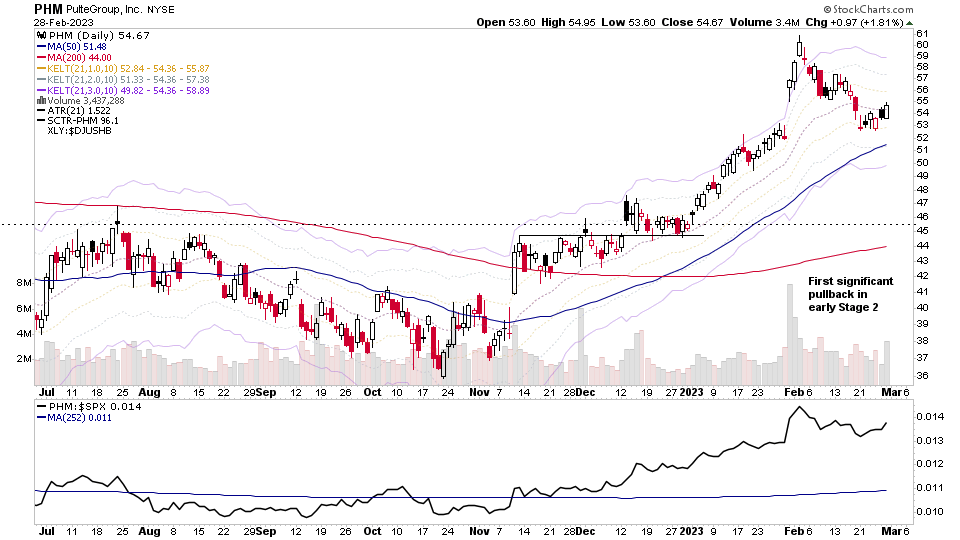

AGI, PHM, X, DUOL + 17 more...

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.