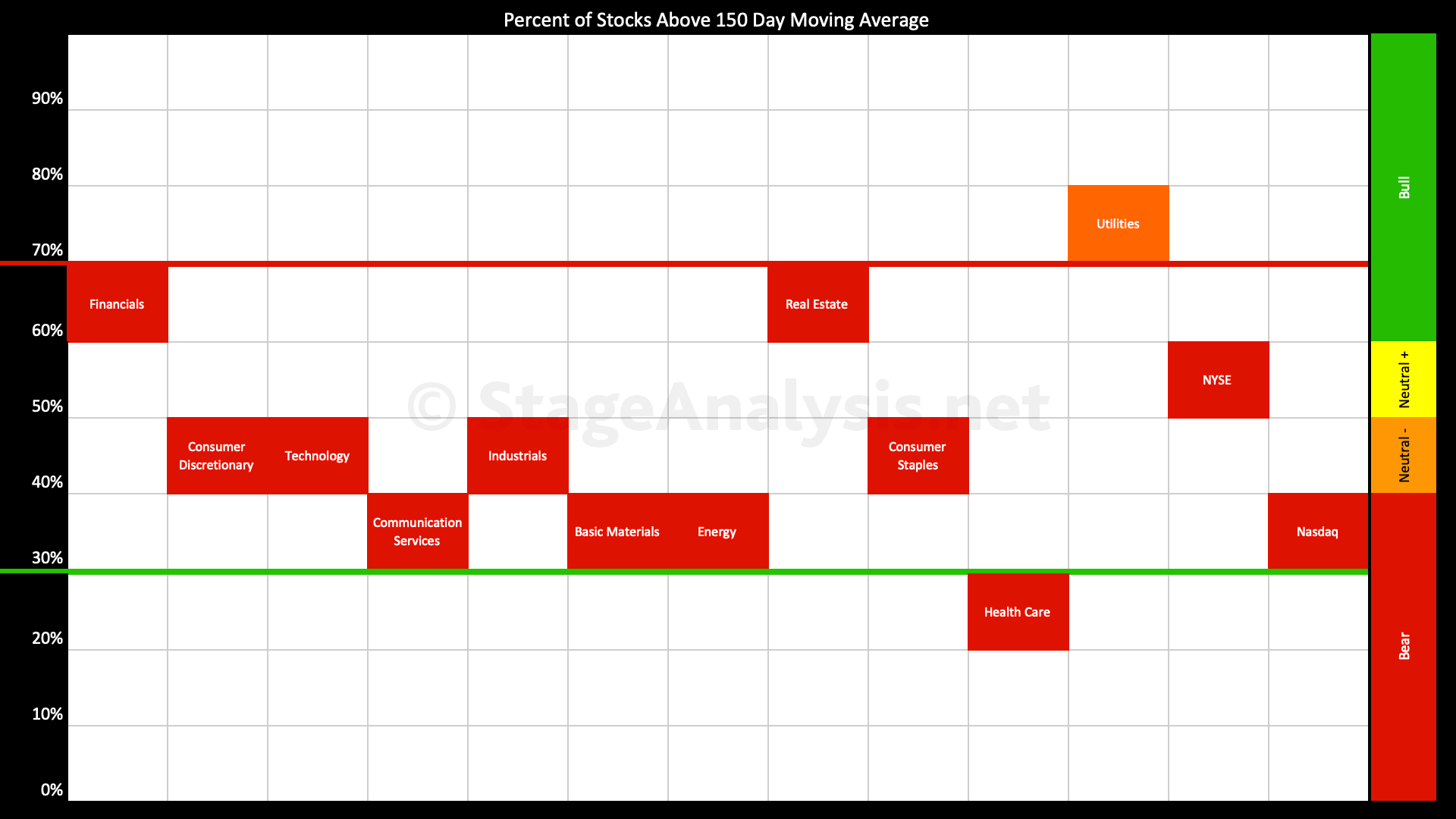

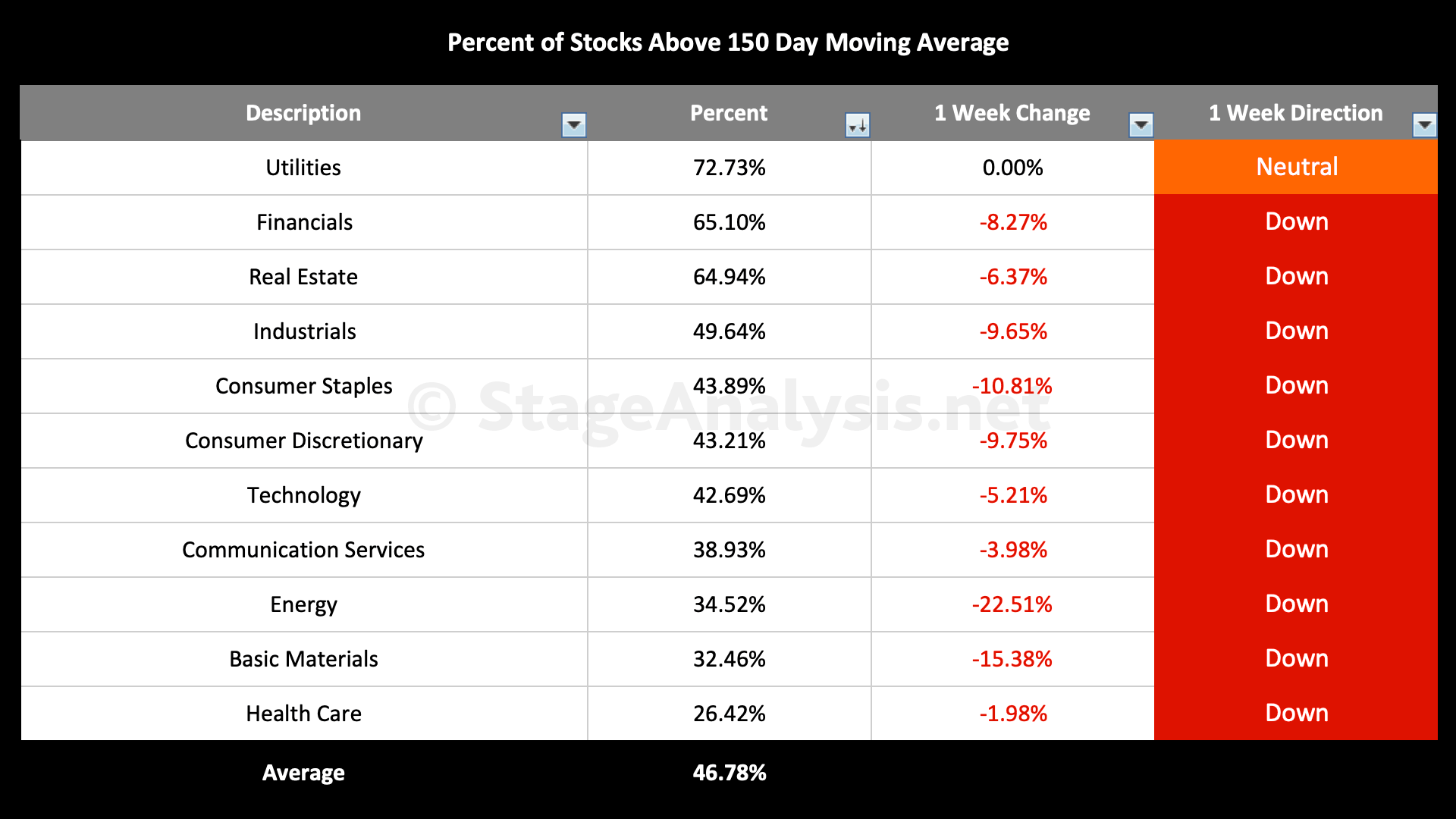

US Sectors - Percentage of Stocks Above their 150 Day (30 Week) Moving Average

Average: 46.78% (-8.54% 1 week)

Heavy declines across the majority of sectors with only the leading sector Utilities escaping with a flat week. Energy took the hardest hit with over 22% of stocks in the sector closing the week below their 150 day (30 week) MAs, and Basic Materials was also hard hit with a 15% drop.

3 sectors are in the Stage 2 zone ( Utilities, Financials, Real Estate)

4 sectors are in Stage 1 / 3 zone ( Industrials, Consumer Staples, Consumer Discretionary, Technology)

4 sectors are in Stage 4 zone ( Communication Services, Energy, Basic Materials, Health Care)

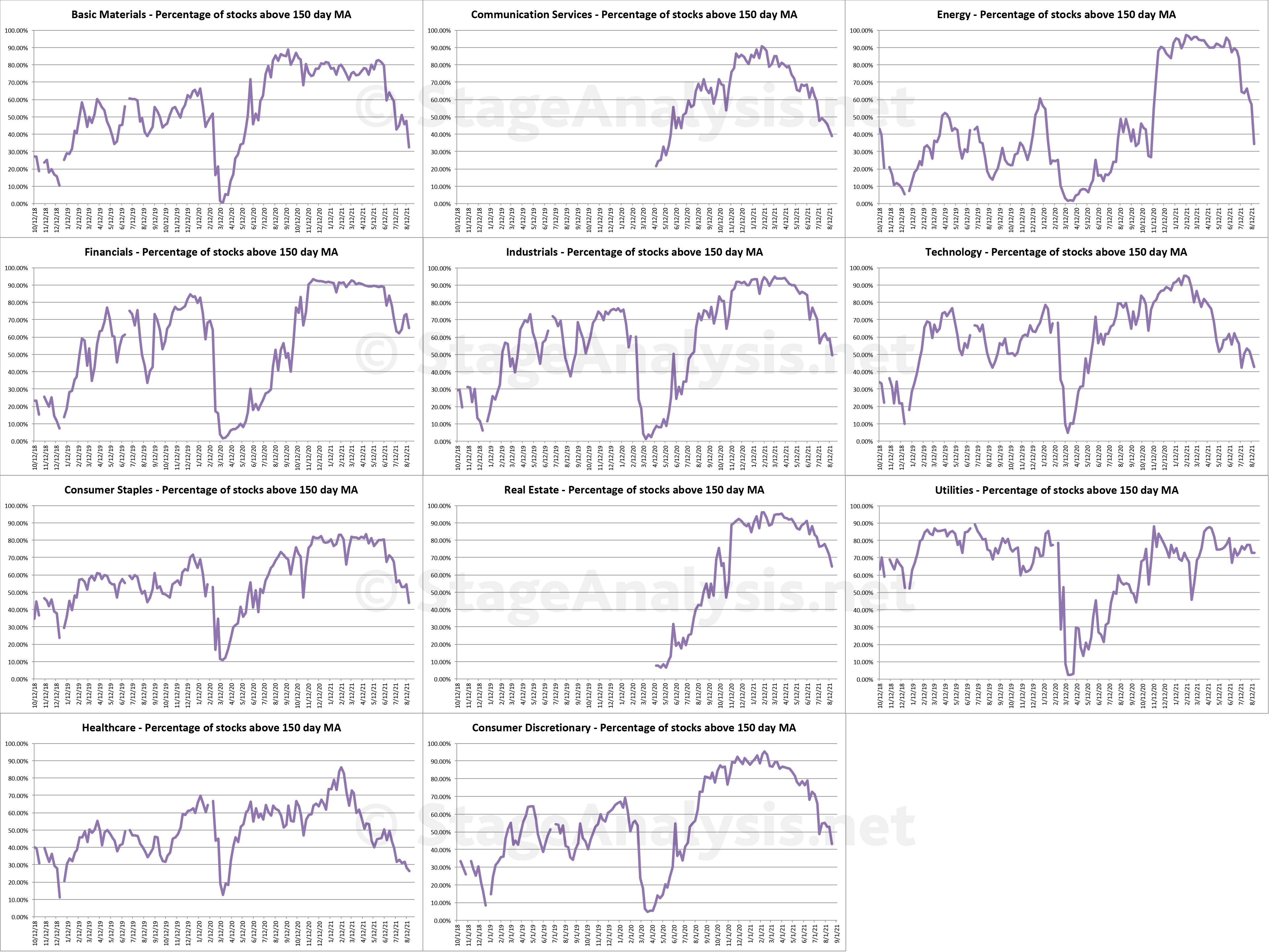

Overall as you can in the individual sector charts below. The market continues to weaken with four sectors now in the Stage 4 zone. So increased chance that we could get a flush to the lower zone across the board in the coming month or two, as we move into the seasonally weak time of year. So this deterioration is suggesting caution imo.

Want to learn more? Join Today.

Become a member of Stage Analysis to learn more about the Stage Analysis method and to see our regular posts and videos on US stocks and crypto.

Join today at https://www.getrevue.co/profile/stageanalysis/members

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.