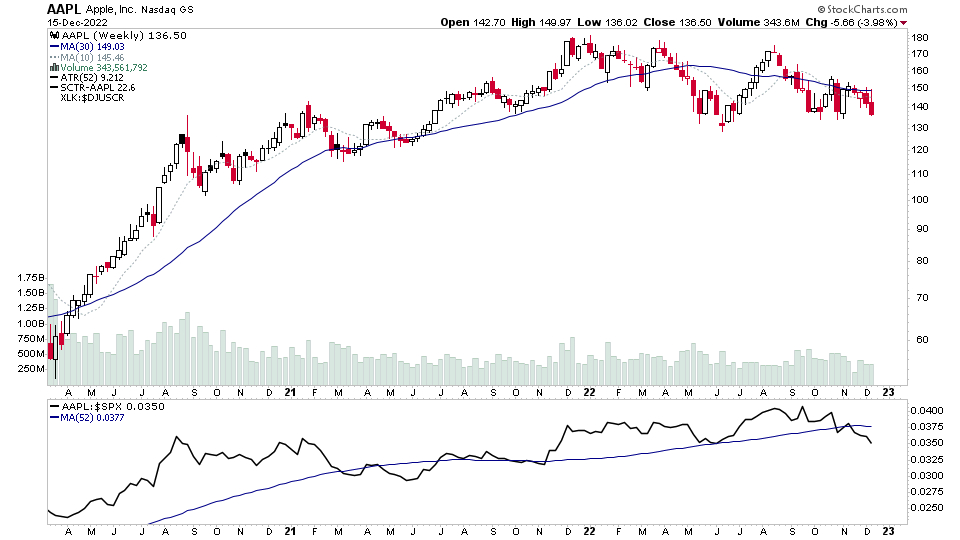

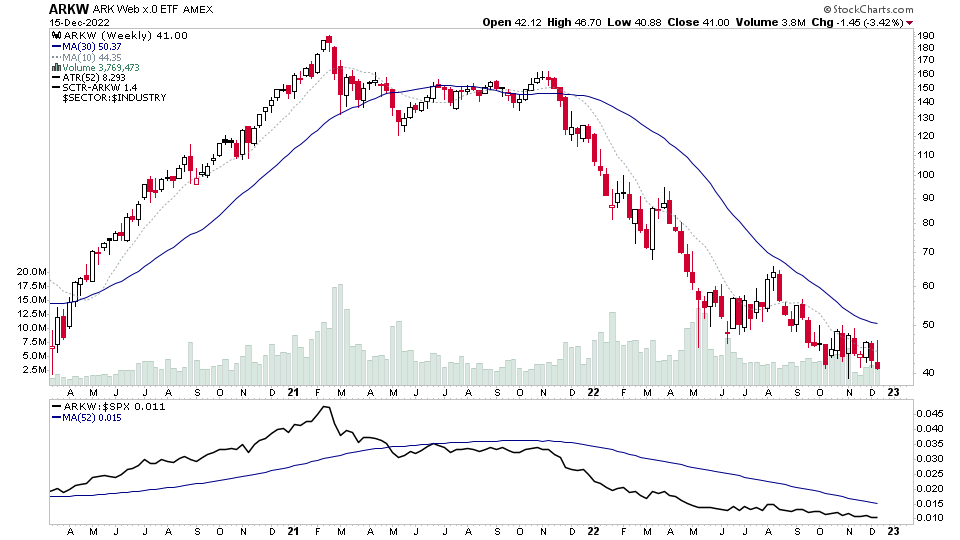

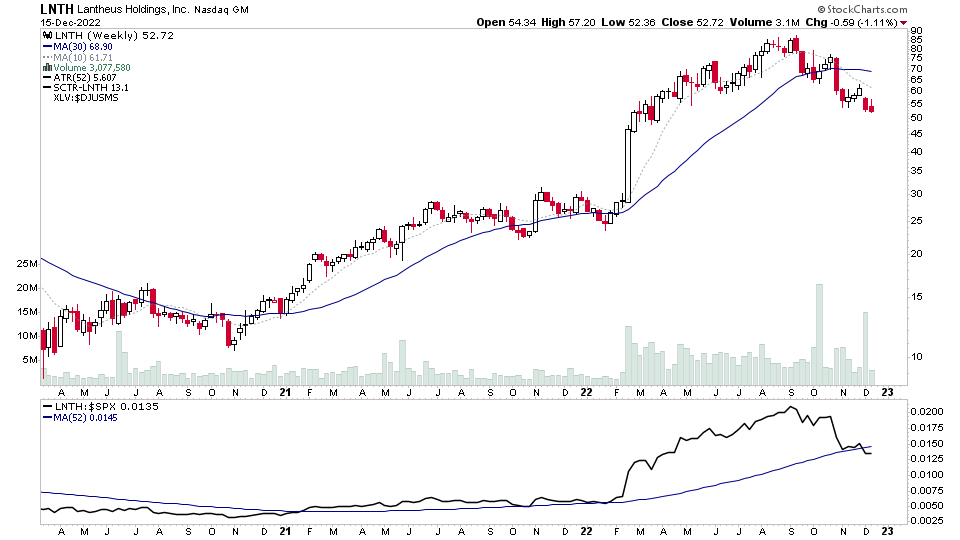

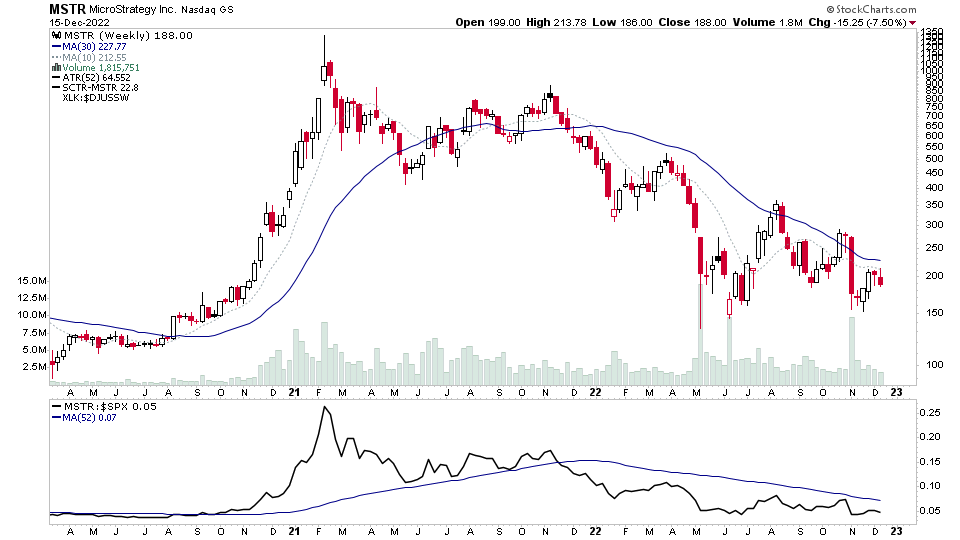

Most Vulnerable US Stocks & ETFs – 15 December 2022

The full post is available to view by members only. For immediate access:

This is the first post of a new weekly regular feature focusing on some of the most vulnerable issues in the US market, in order to get a broader picture of the overall market health and contribute valuable information to our Weight of Evidence – which is the key to successfully using Stan Weinstein's Stage Analysis method.

The posts will include stocks and etfs making breakdowns in Stage 4, or just technically weak stocks – i.e with a Stage Analysis Technical Attributes (SATA) score of 4 or less – in either Stage 4, Stage 1 or Stage 3 that are below short or medium term moving averages, or making short-term breakdowns within the base structure and many other alternate signs of weakness, such as weak rally attempts within the base that then fail at resistance, upthrusts, failed breakouts, weak spring attempts etc.

There were 45 technically weak/vulnerable stocks stocks/etfs highlighted today:

AAPL, ARKW, LNTH, MSTR + 41 more...

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.