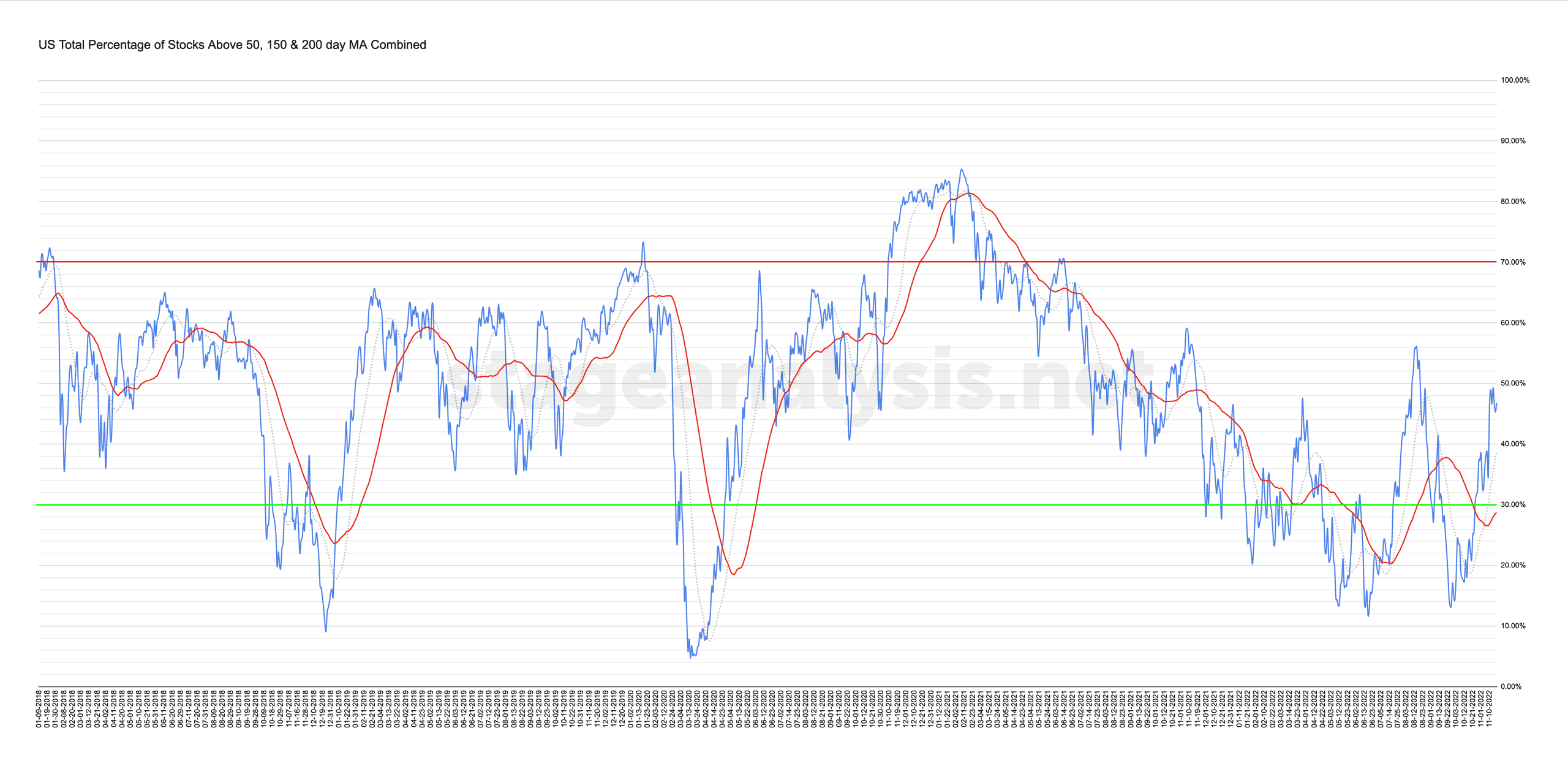

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

46.80% (-2.17% 1wk)

Status: Positive Environment in the Stage 1 zone

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) declined by -2.17% this week, closing at 46.80%. However, it remains +33.55% above the September swing low in the data.

The status remains as a Positive Environment in the Stage 1 zone, as the combined average is in the lower middle range, and is 18.09% above its own 50 day MA (which is used as the signal line) and 7.97% above its 20 day MA.

For the rating to improve to the Stage 2 zone, we'd need to see the total percentage of stocks continue to expand and move above the 60% level. But if it starts to fall back below the 40% level once more, which has happened three times already this year. Then it would return to the Stage 4 zone. But for the moment, remains neutral, with consolidation in the Stage 1 zone.

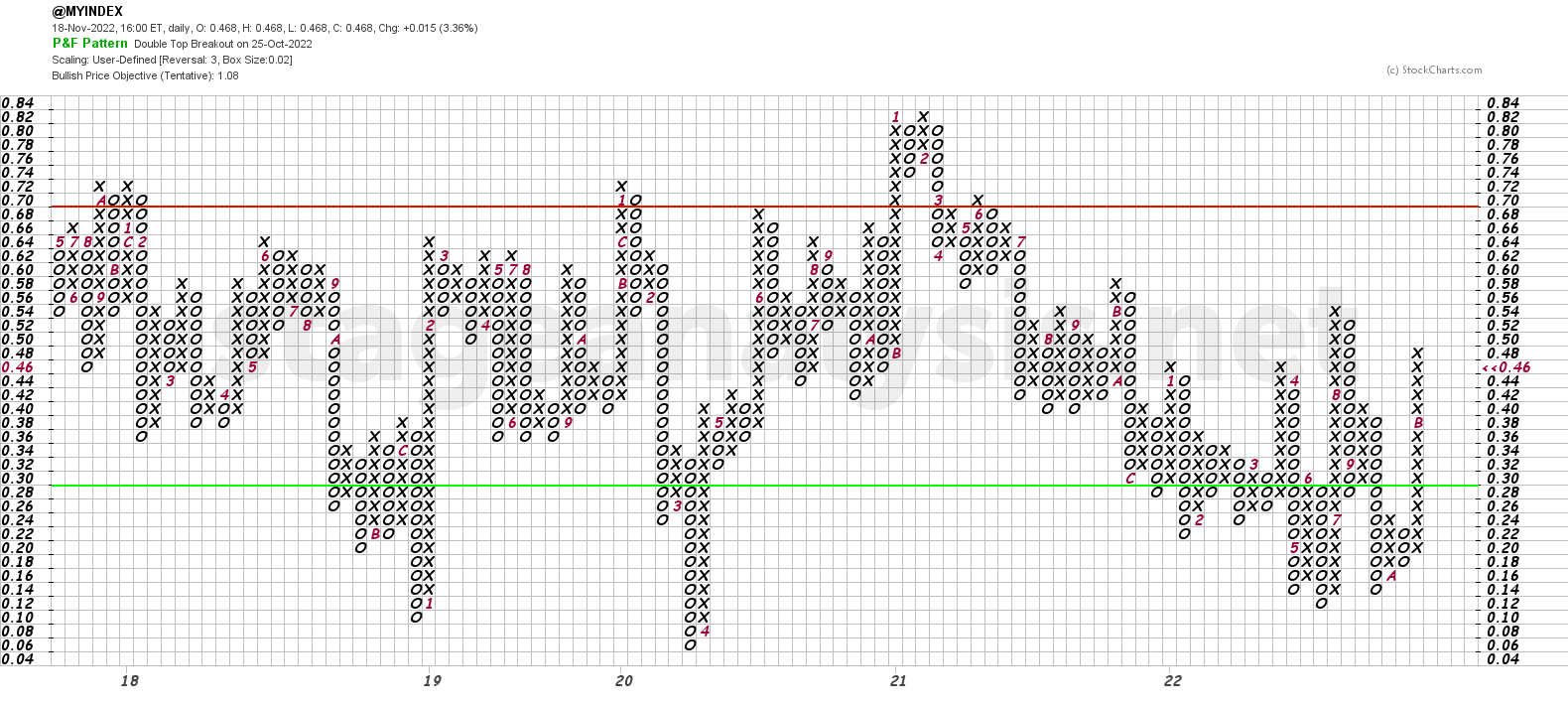

The Point and Figure chart (shown above) was unchanged this week and so the P&F strategy remains on Offense (as it's in a column of Xs) and on Bull Confirmed status, and has been on a bullish status since the 18th October when reversed up to Bull Alert status.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.