Precious Metals Stocks Showing Strong Relative Strength and the US Stocks Watchlist – 8 November 2022

The full post is available to view by members only. For immediate access:

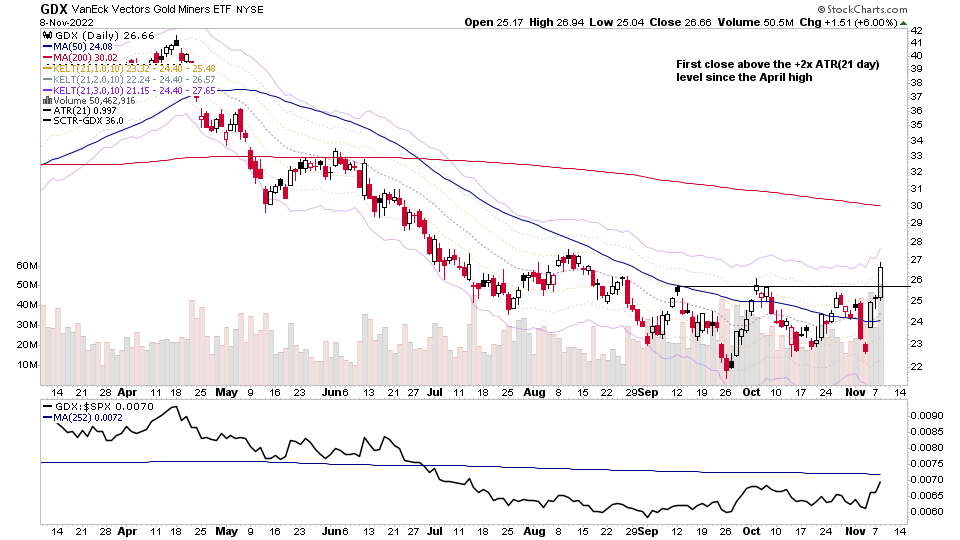

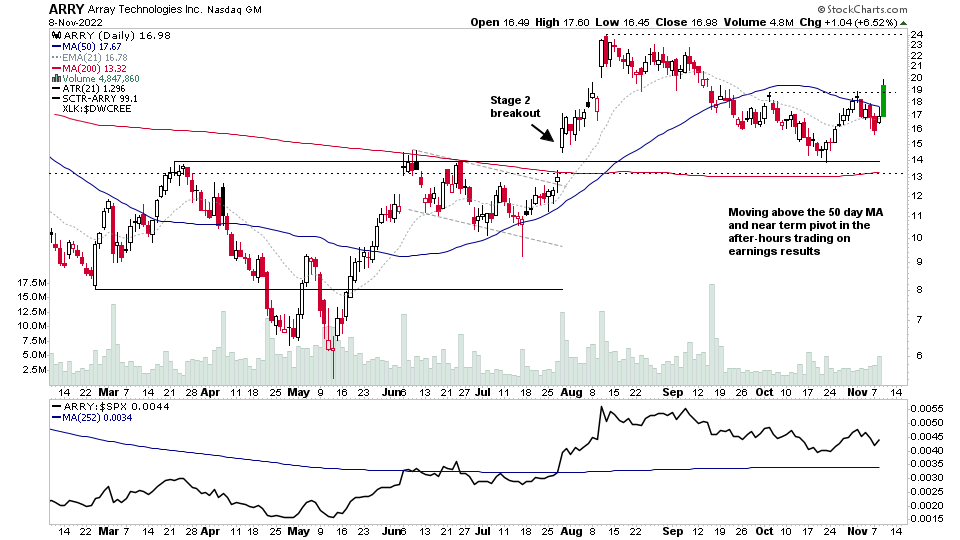

The precious metals stocks – which I did a feature on in the weekend video – showed some the strongest relative strength today with multiple gold and silver stocks breaking out on volume from their recent base structures, and a couple are even attempting early Stage 2 breakouts (CDE & OR), but which still have declining 30 week MAs, and so would be considered still very early attempts before the weekly technicals have fully formed, which increases the risk of failure. However, there has been a notable uptick in volume in stocks in the group on the two strong up days since Friday, which is a positive.

The weekly move in the GDX etf is showing a potential change of behaviour, and so the gold miners etf could be moving towards early Stage 1 behaviour. But for now remains as Stage 4B-. i.e. a potential bottom, that's not technically developed enough yet to be considered as Stage 1. So using the Stage Analysis Investor method. Now is the time to be doing more research on the Gold and Silver miners to be ready if any start moving to actionable entry zones in late Stage 1 or early Stage 2. And from the Trader method perspective Stage 4B- stocks can give opportunities for short-term swing trades, as they start to develop the broader base structures.

US Stocks Watchlist – 8 November 2022

There were 23 stocks highlighted from the US stocks watchlist scans today

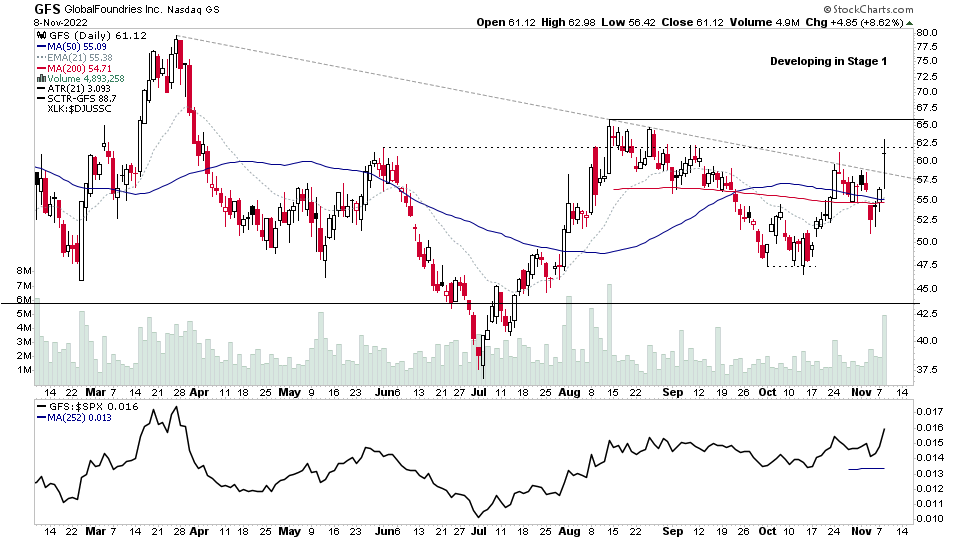

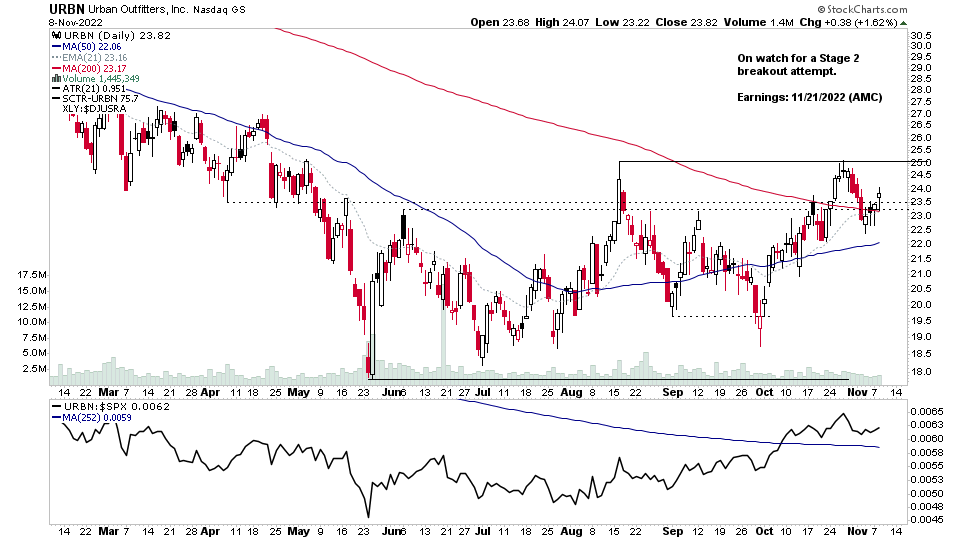

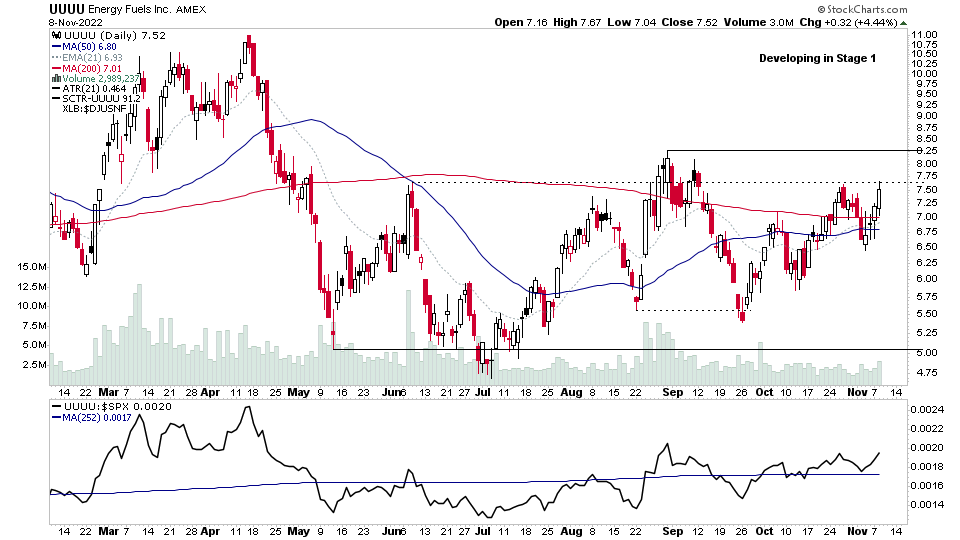

ARRY, GFS, URBN, UUUU + 19 more...

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.