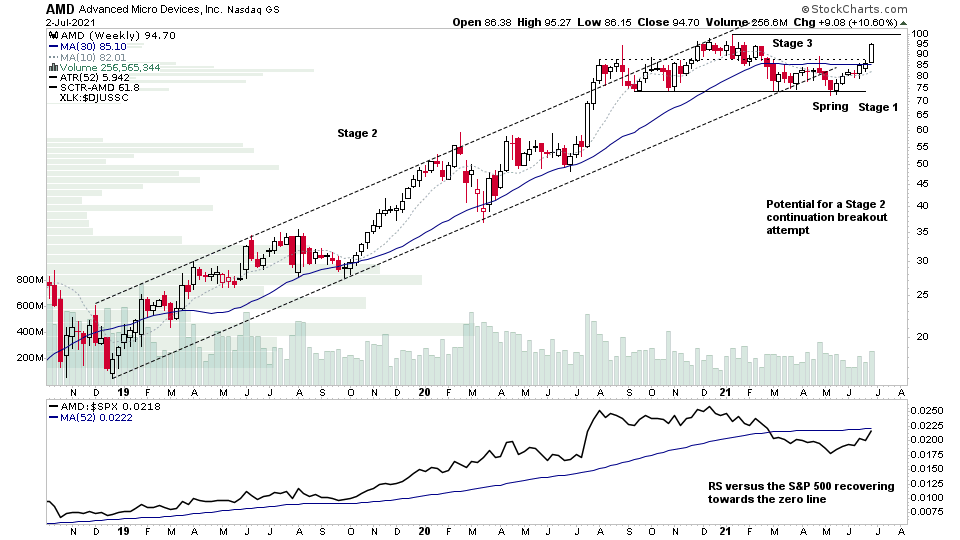

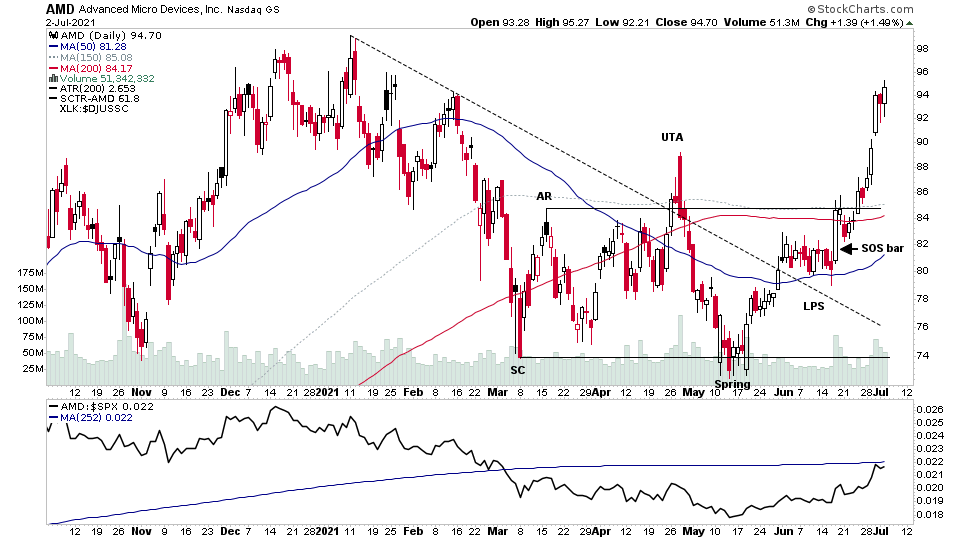

$AMD - sign of strength?

$AMD has been basing for almost a year. However, the Stage 3 top failed to breakdown into the Stage 4 declining phase, and it has instead formed a spring and test, and last week followed through strongly to the upside within the trading range with a sign of strength bar. So, it still needs to make progress in order to move into Stage 2 once more. So I would put it back in Stage 1 currently. As once the base moves into Phase C and D following a spring, it begins to lean towards re-accumulation over distribution in Stage 3. So becomes Stage 1 once more.

The Livermore 100 level will likely provide resistance, and it stopped there previously also. Hence, there could be a chance for some consolidation / backing up action near the top of the range prior to a breakout attempt, unless big volume comes in with a major Sign of Strength rally which would be a Stage 2 continuation breakout attempt.

The sector also continues to strengthen, and has moved up the RS tables, with strength in leading stock $NVDA the main driver - which I consider to be one of the True Market Leaders (TML) of 2021 and have a position in $NVDA in my pension account.

Want to learn more? Join Today.

Become a member of Stage Analysis to learn more about the Stage Analysis method and to see our regular posts and videos on US stocks and crypto.

Join today at https://www.getrevue.co/profile/stageanalysis/members

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.