Watchlist stocks - Highlighted Weekly Charts - 1st to 5th February

Below is a selection of stocks from last weeks daily watchlists that finished the week with promising looking weekly charts.

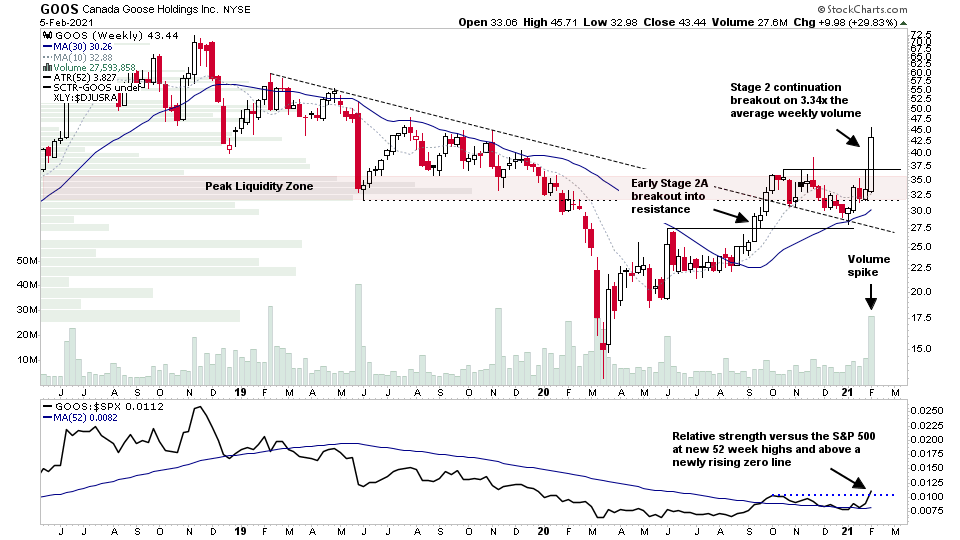

$GOOS initial Stage 2 continuation breakout on 3.34x the average weekly volume with RS versus the S&P 500 at new 52 week highs and a newly rising zero line

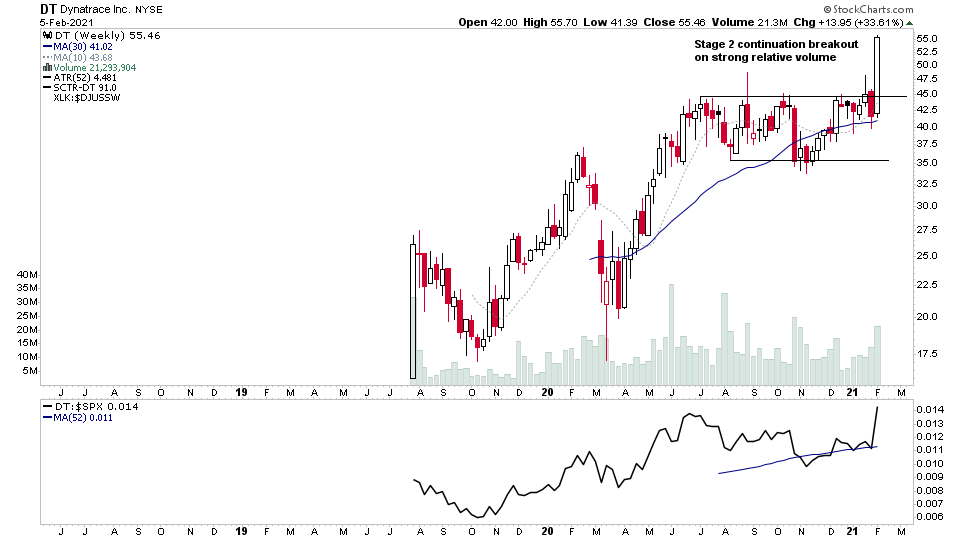

$DT another from this weeks daily watchlists. Weekly Stage 2 continuation breakout on strong relative volume

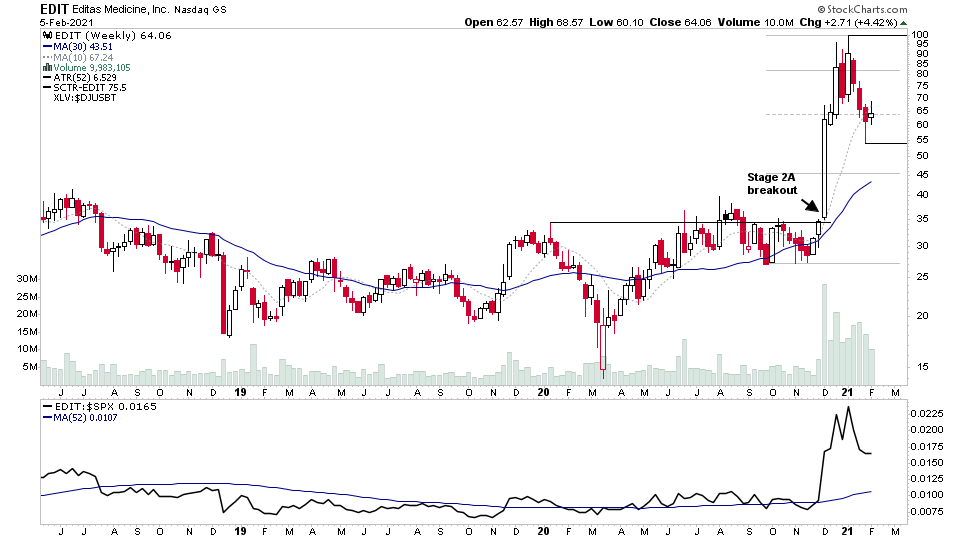

$EDIT starting to form it's first base since the weekly Stage 2A breakout back in early December

$MVIS Stage 2 continuation breakout to new highs this week in this monster with huge volume. Highlighted it at 7.62 on the 2nd. So already moved another 50%, but big potential still

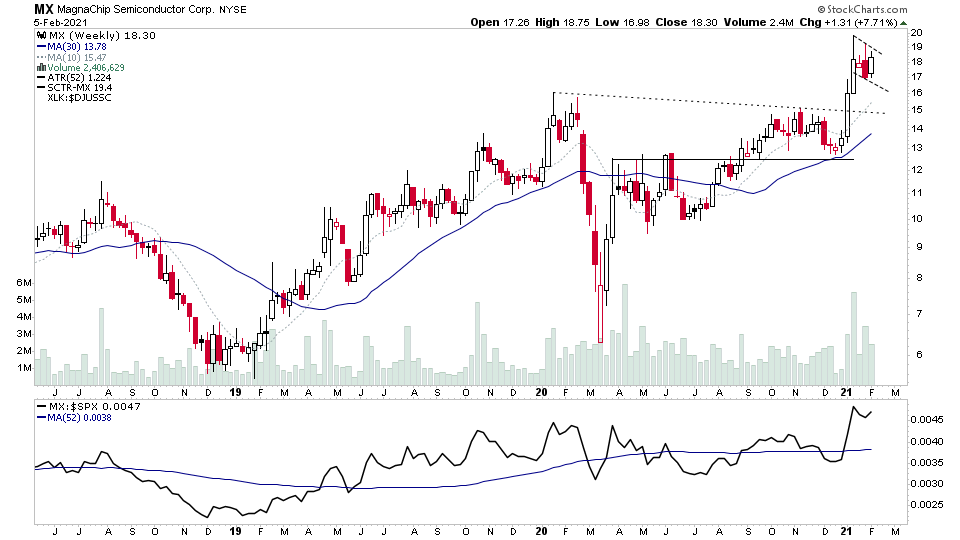

$MX came in the watchlist on the 2nd. Closed the week well with a developing flag pattern near the highs

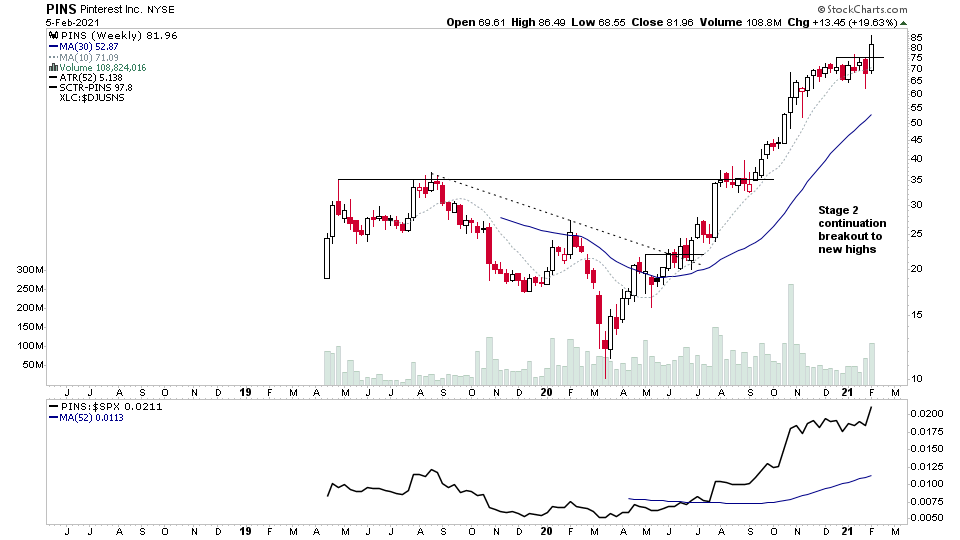

$PINS Another one from the 2nd Feb watchlist, made a Stage 2 continuation breakout to new highs this week.

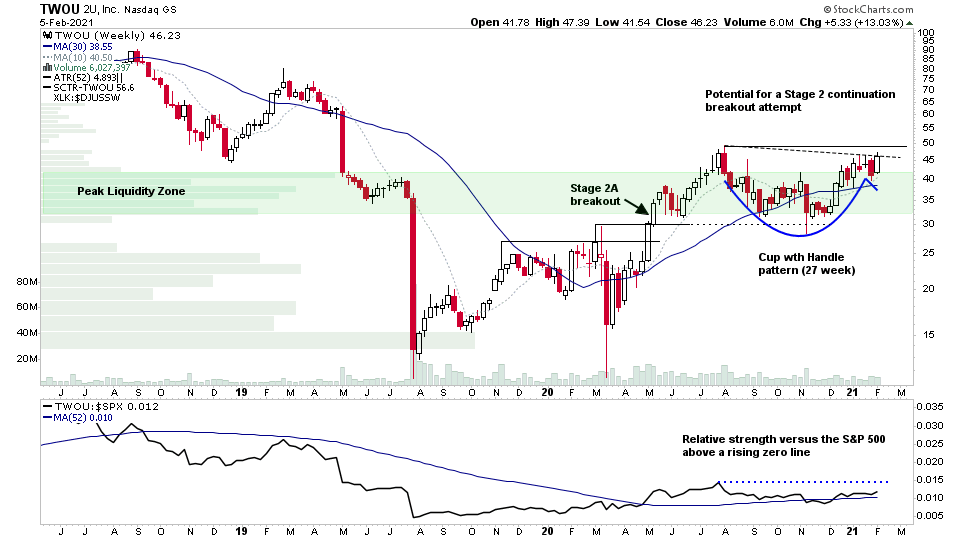

$TWOU Cup with Handle pattern (27 weeks) in early Stage 2 above the peak liquidity zone. Potential for a Stage 2 continuation breakout attempt

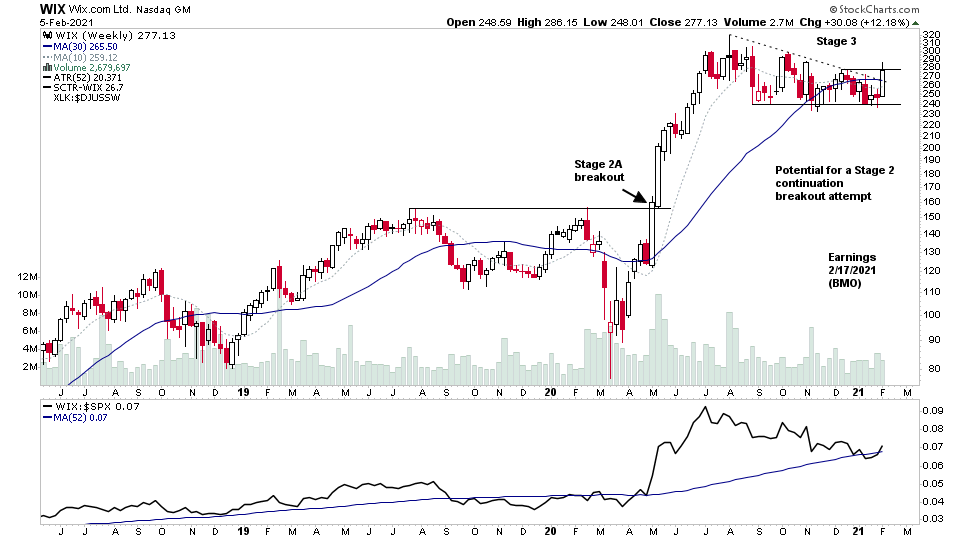

$WIX Potential for a Stage 2 continuation breakout attempt. Earnings 2/17/2021 (BMO)

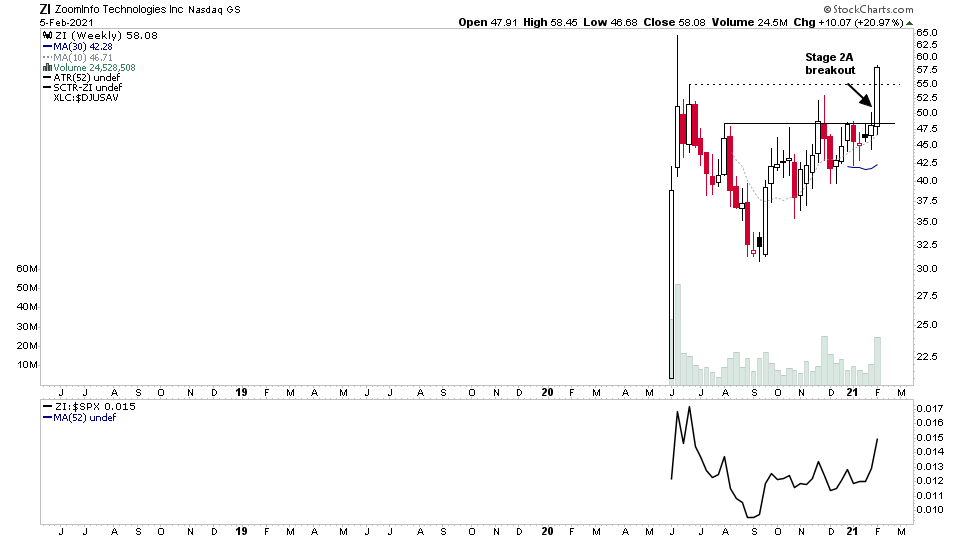

$ZI completes the Stage 2A breakout on more than 2x the 4 week average volume. Annoyed with myself on this one, as I sold it last week on the market weakness and didn't re-enter. Oh well. Will watch if the low risk backup entry point forms for another chance.

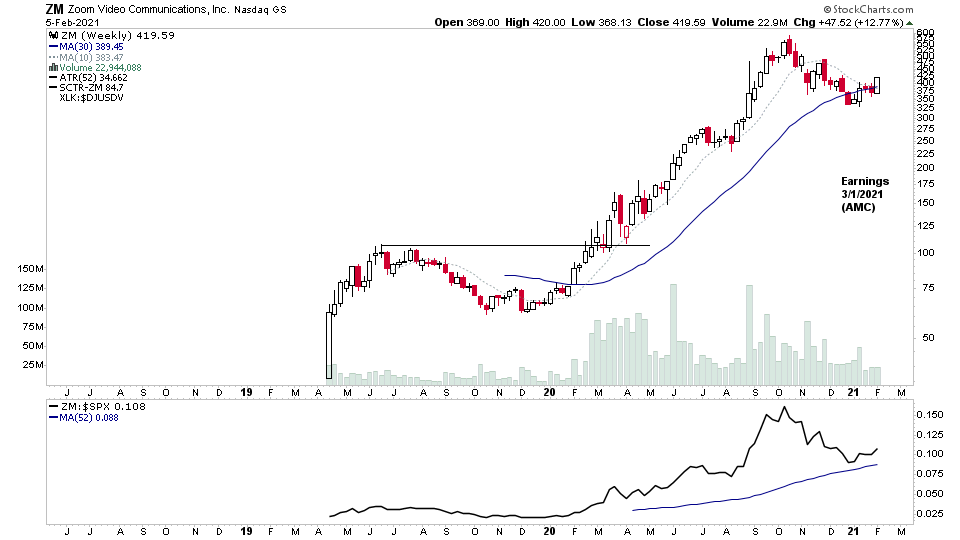

$ZM one of last years monster stocks at a potential pullback entry point this week

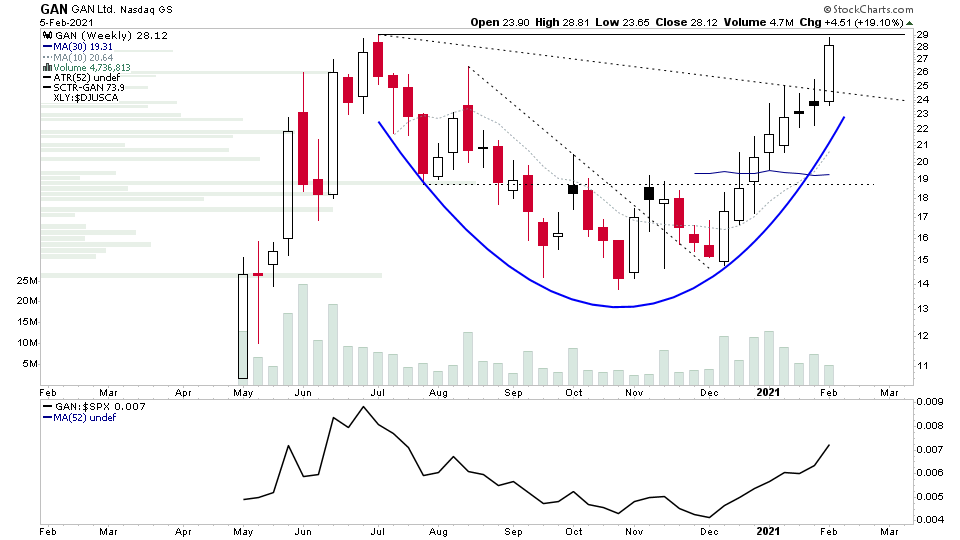

$GAN interesting one from the strong Gambling group this week. 31 week cup pattern forming its primary base since the IPO as it reaches the turbulence zone. Would be good to see some consolidation here imo

#stocks #trading #investing #money #swingtrading #stockmarket

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.