Stock Market Update and US Stocks Watchlist – 2 August 2022

The full post is available to view by members only. For immediate access:

It was a negative day for all the major US stock market indexes today with the S&P 500 closing down -0.67%, while the Nasdaq showed the best relative strength closing down -0.16%.

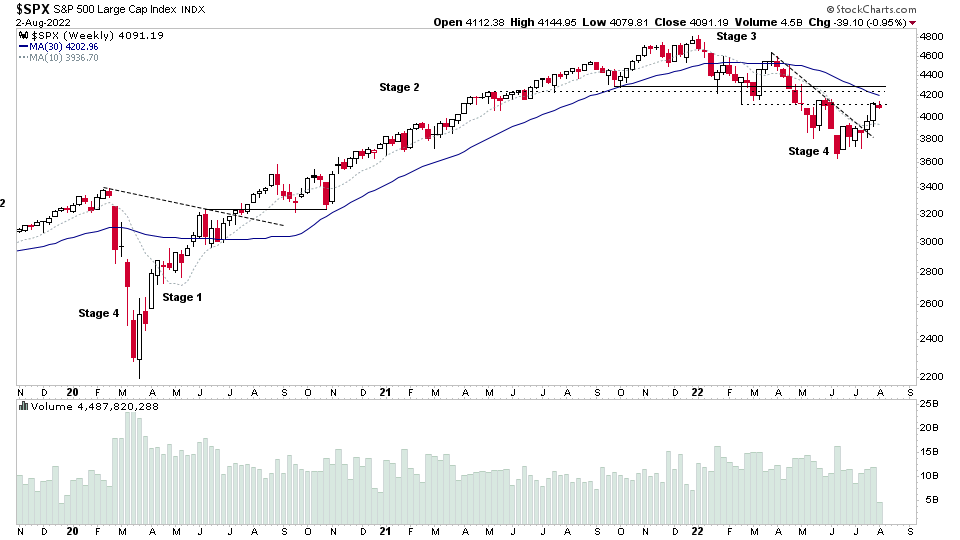

The S&P 500 weekly chart is still in Stage 4 (shown above), although the recent counter-trend rally has shown a change of character, and so although the chart is not technically in early Stage 1 yet, we have seen some positive improvements in the Market Breadth via the Weight of Evidence from all the various breadth charts that we follow. So under the surface metrics are suggesting a potential transition to Stage 1, although the weekly chart isn't quite there yet, and could easily revert to Stage 4 behaviour again.

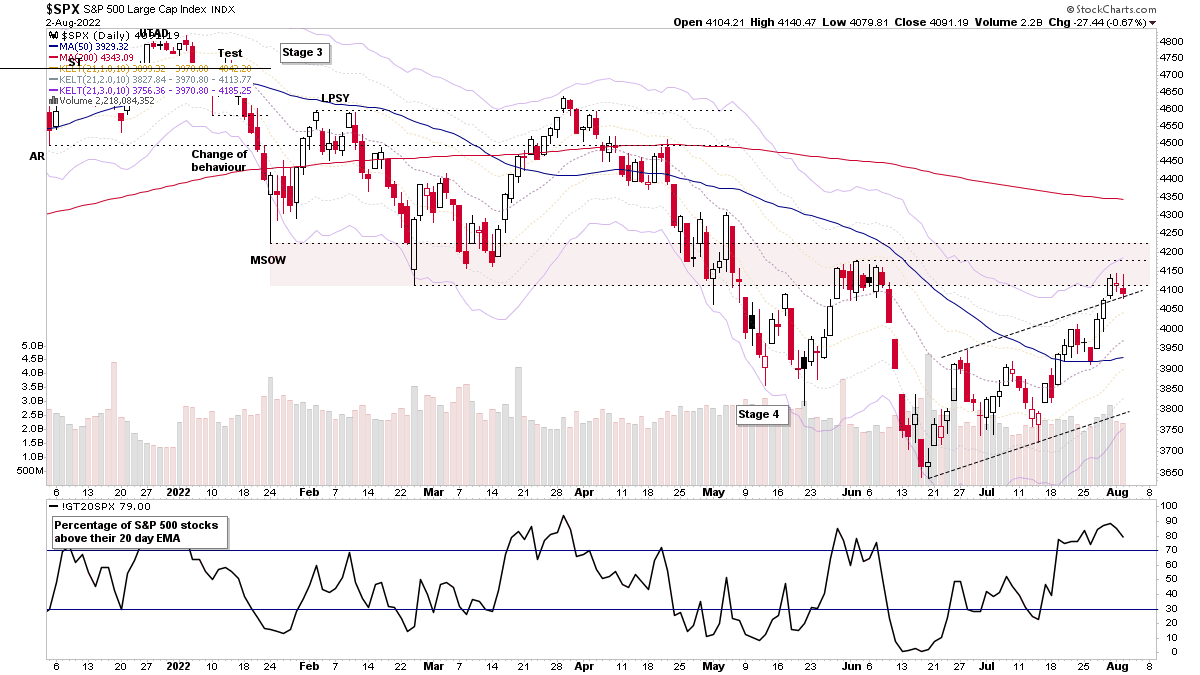

Moving down the timescales to the daily chart, I've highlighted a rough zone of resistance that the S&P 500 is currently reversing from, and it is sitting just atop of the recent short-term channel, but is still above the +1x ATR level. So if it does pullback into the channel and form a local Upthrust / Throwover, then I'd want to see it hold the short-term MAs and for the volatility to diminish to maintain confidence in the short-term counter-trend rally that has taken it back above the 50 day MA for multiple weeks.

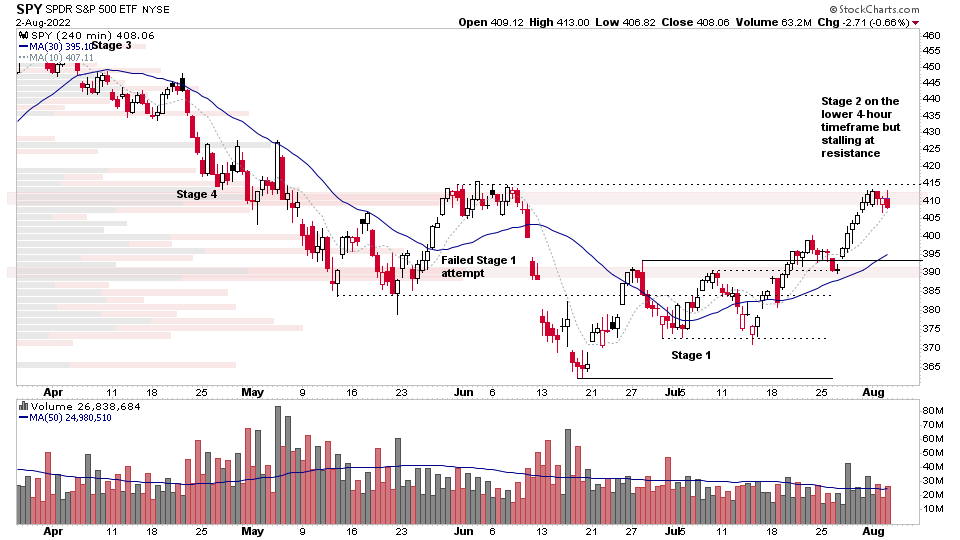

Going down the timeframes further, the 4-hour chart of the S&P 500 zooms in on the last 4 months, with the current Stage on the 4-hour timeframe in Stage 2, after two attempts to form Stage 1 base. However, the price is stalling at the prior resistance with the high volume nodes. So if it continues to pullback, then from a Stage Analysis perspective, we'd want to see it hold above the prior Stage 1 base range on diminishing price spread and volume to form the Backup entry point. Or to consolidate with contracting volatility on each swing, which is known as a Volatility Contraction Pattern (VCP), which would then produce a potential lower risk entry point on a breakout. But if the pullback characteristics are poor, with expanding price spread and volume, then that would signal caution once more.

US Stocks Watchlist – 2 August 2022

There were 28 stocks for the US stocks watchlist today

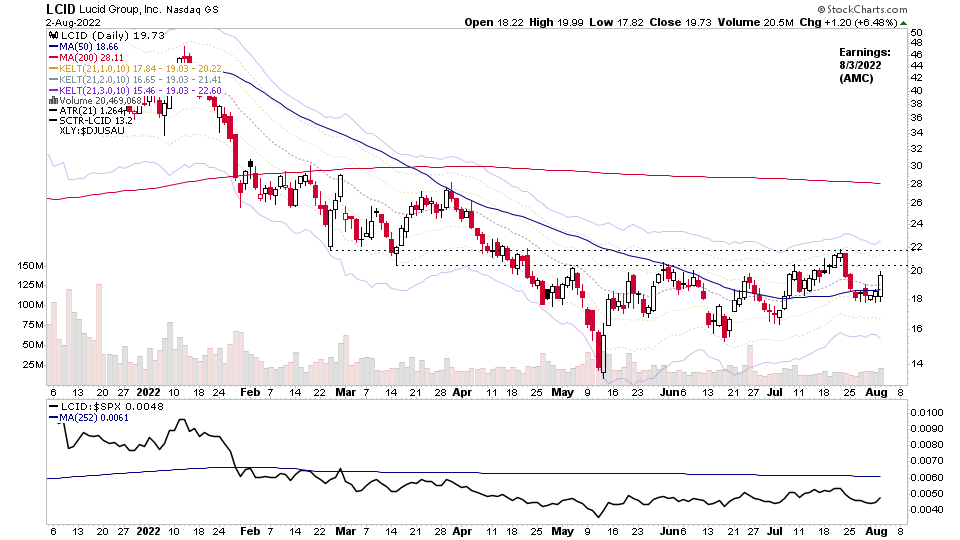

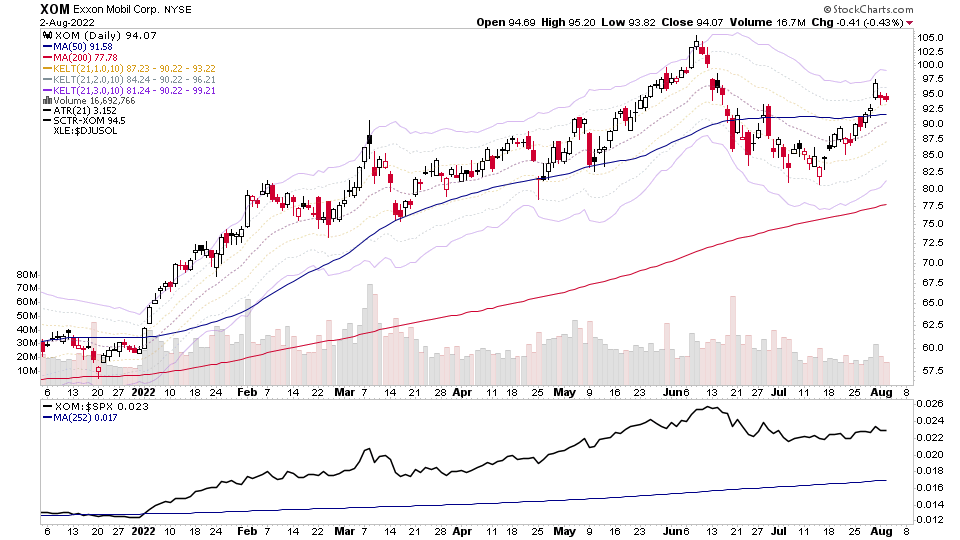

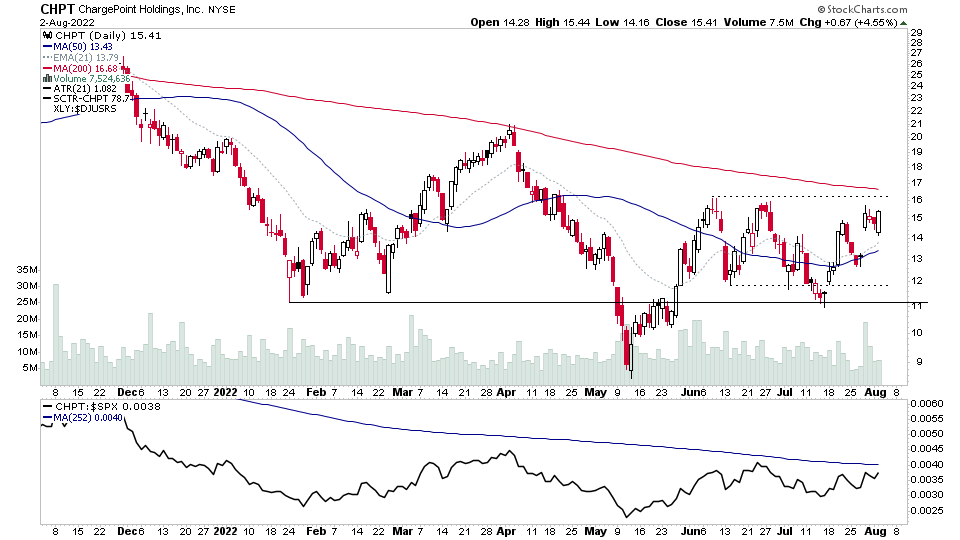

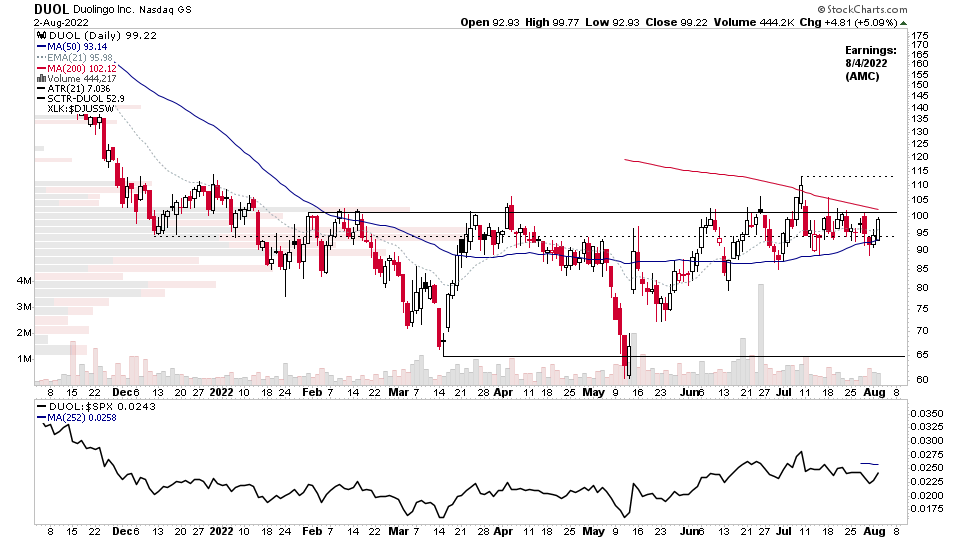

LCID, XOM, CHPT, DUOL + 24 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.