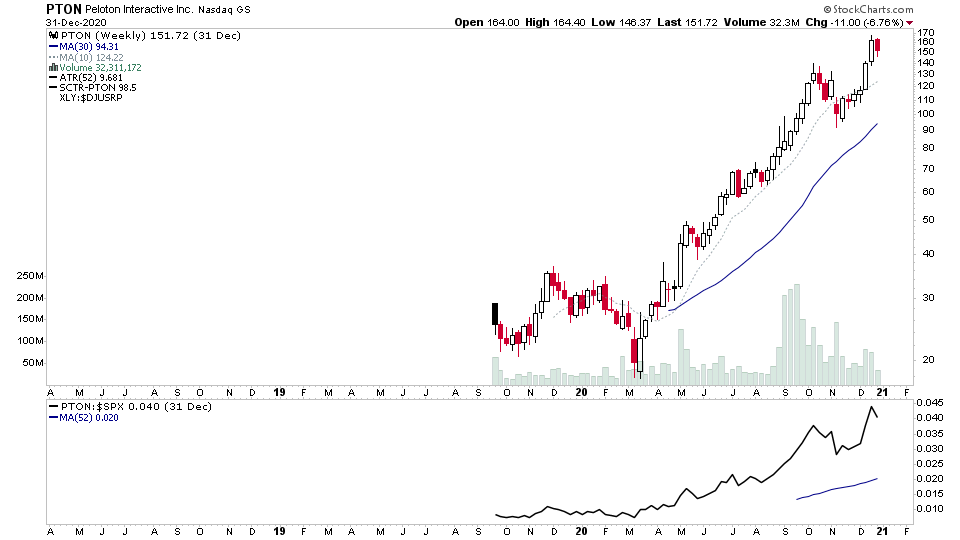

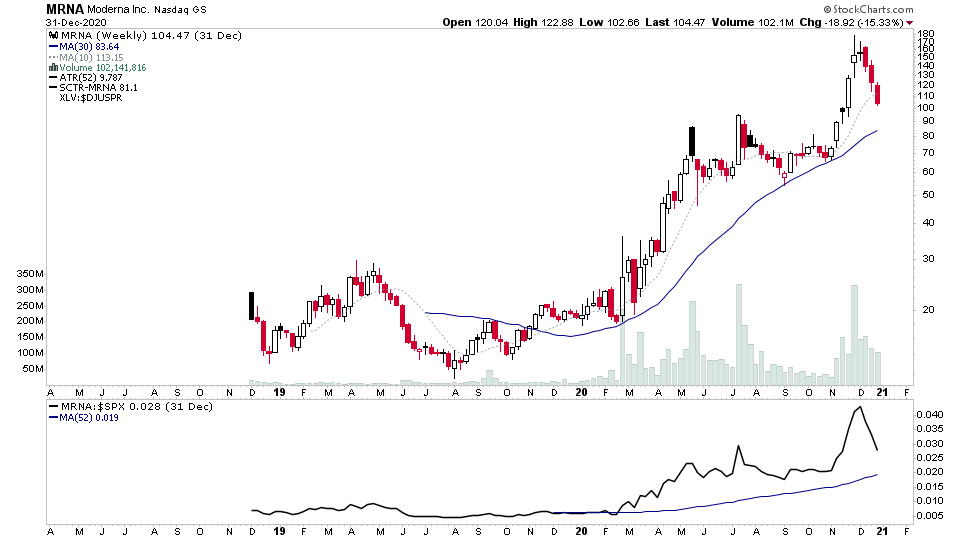

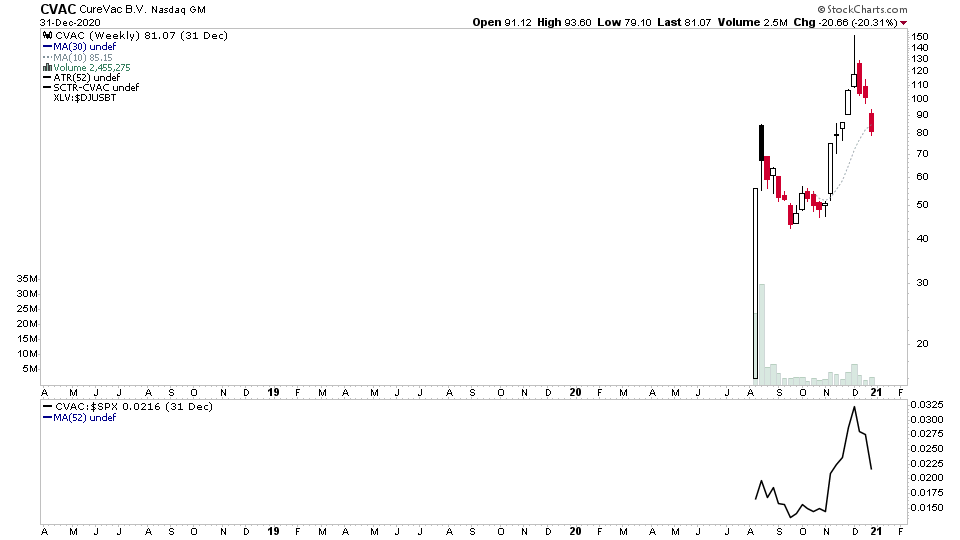

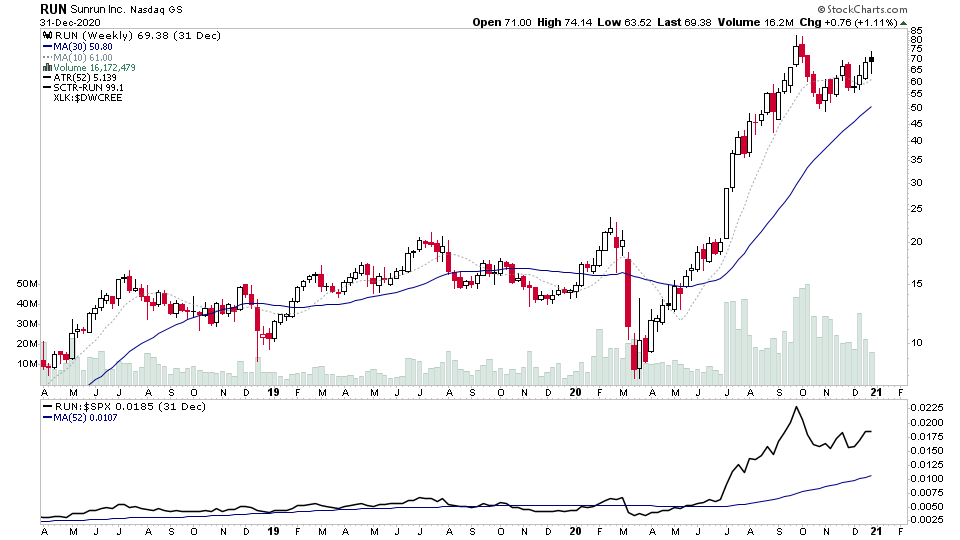

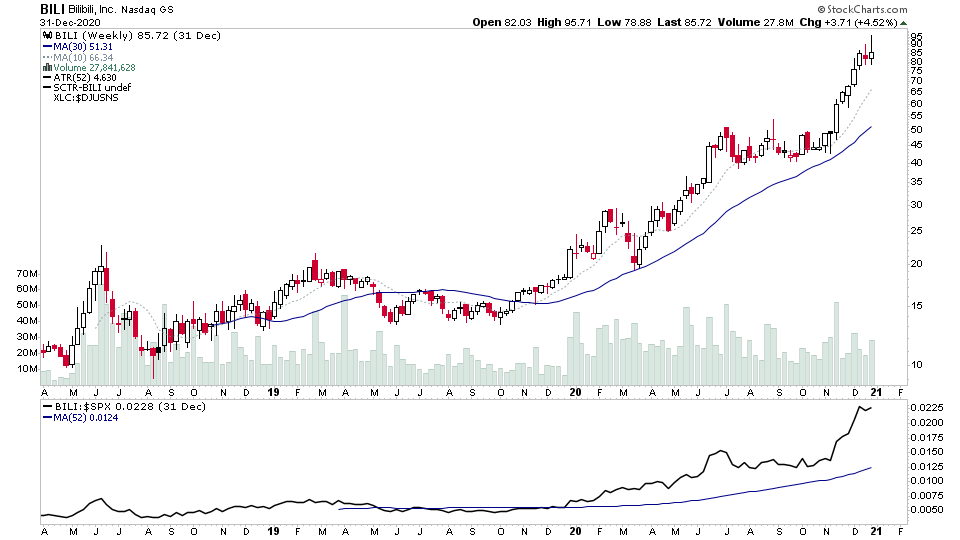

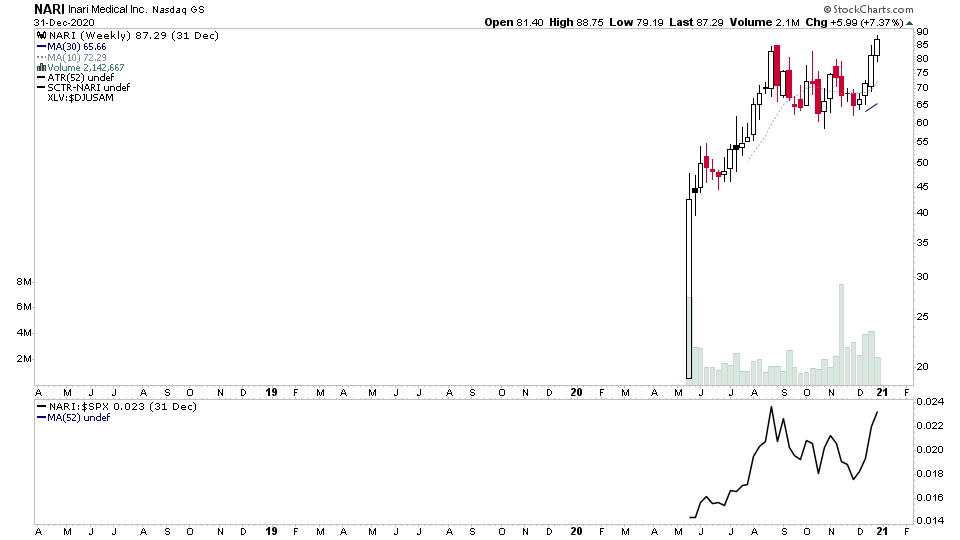

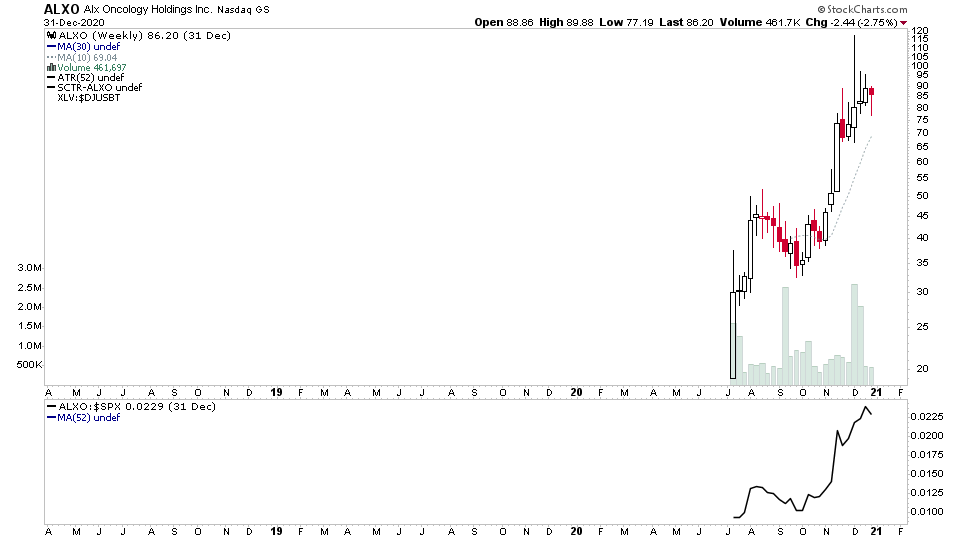

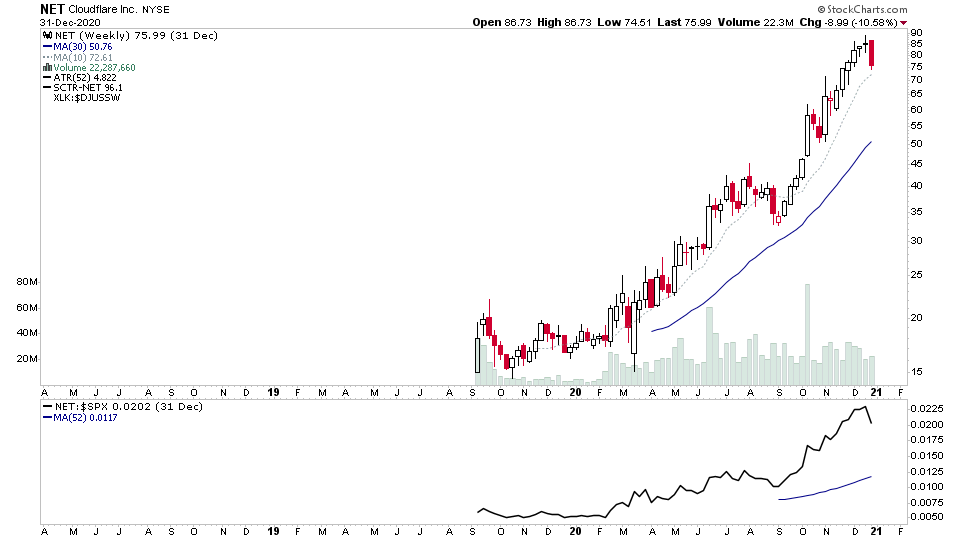

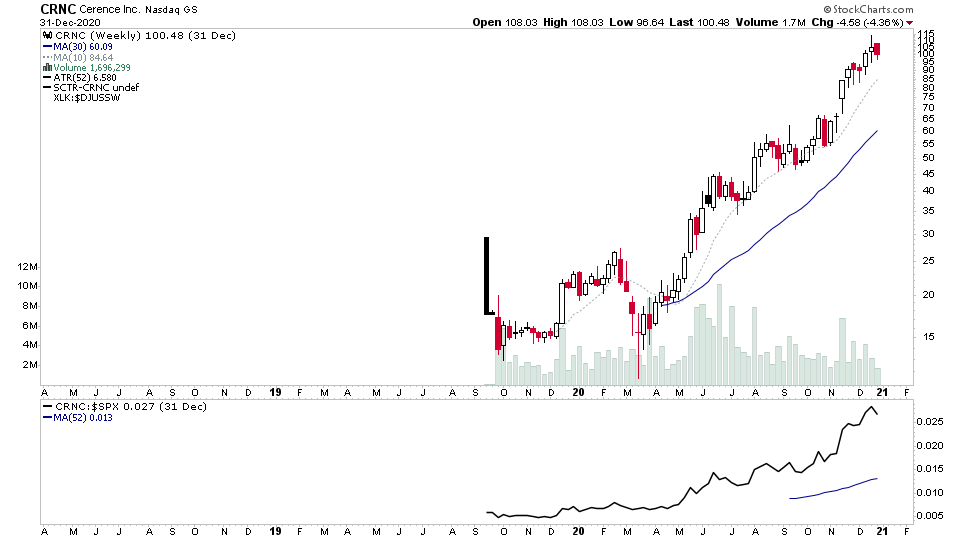

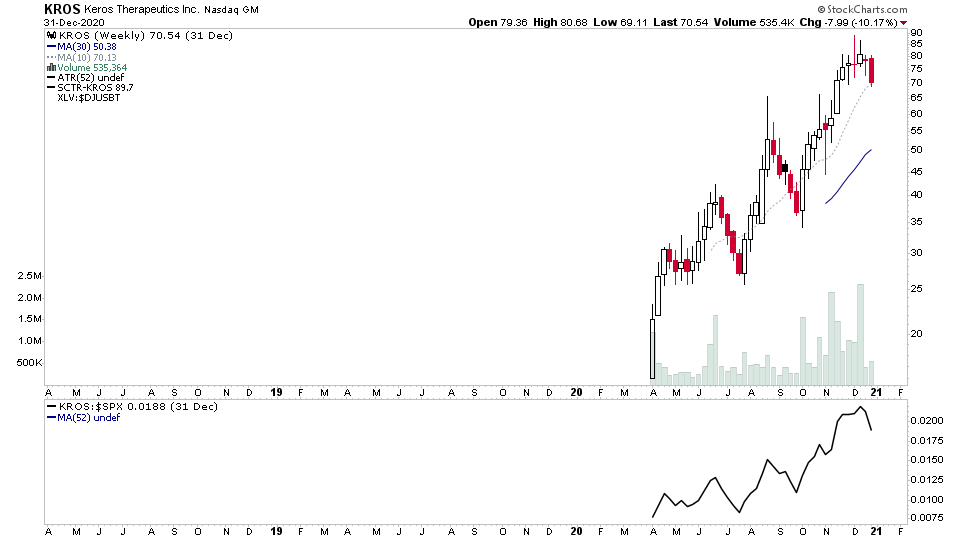

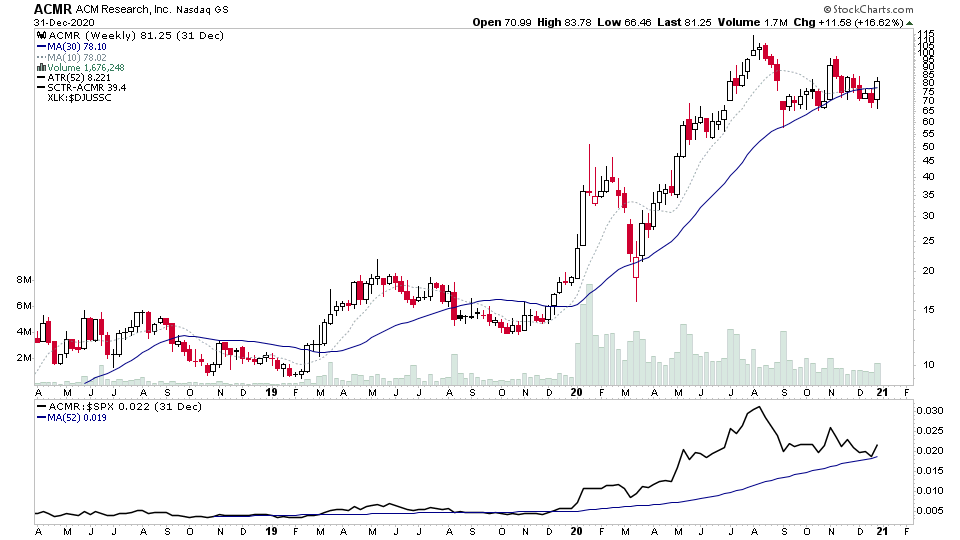

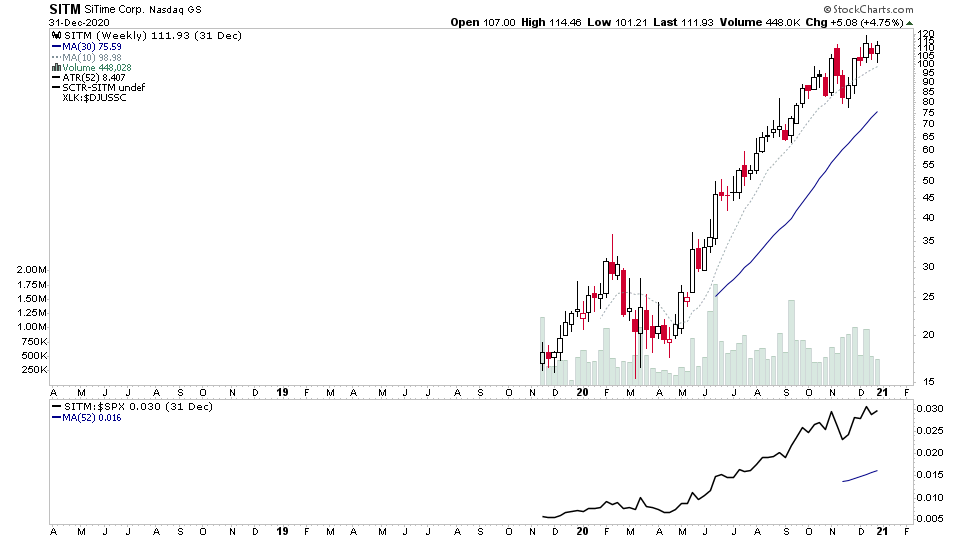

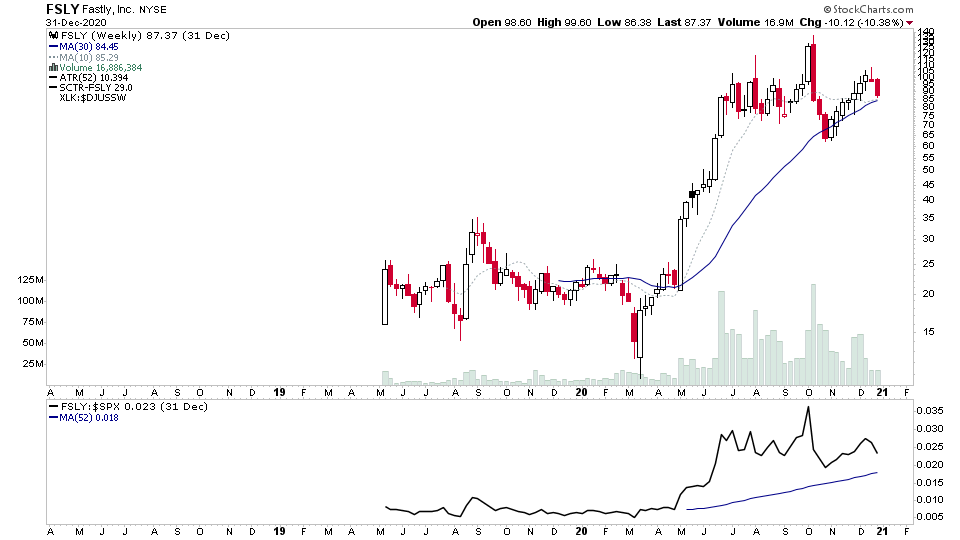

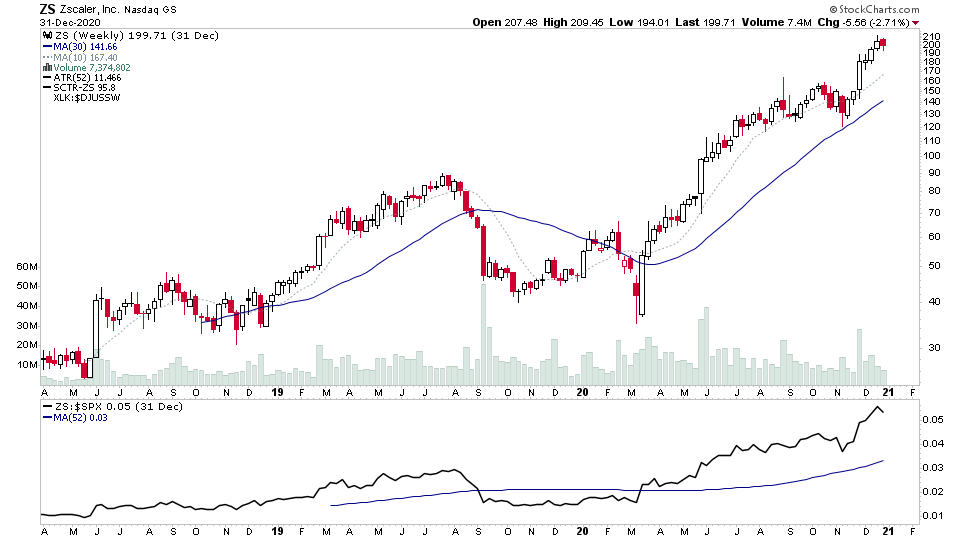

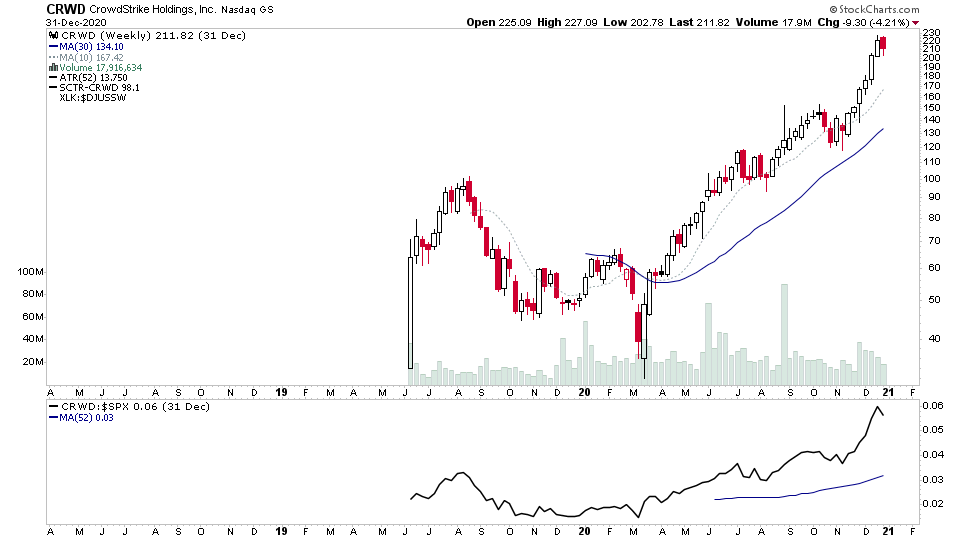

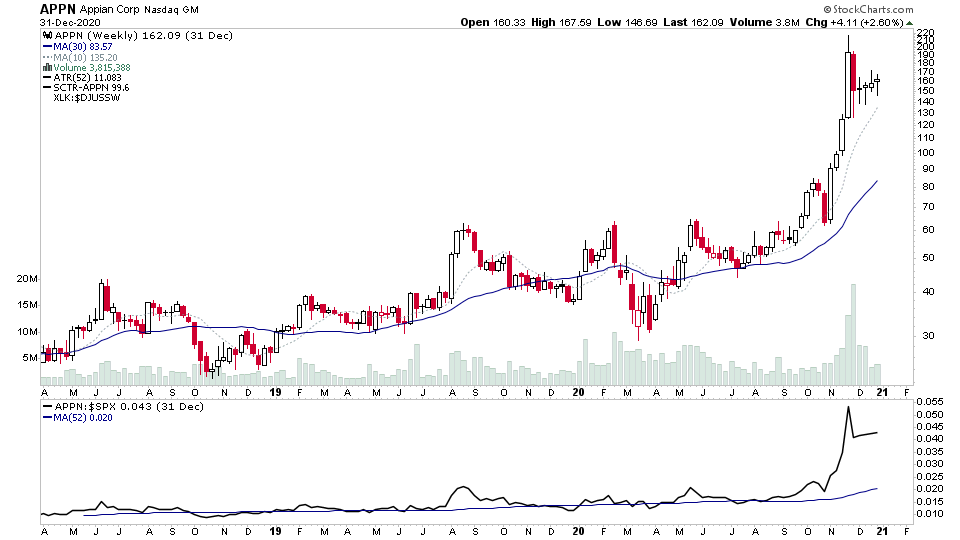

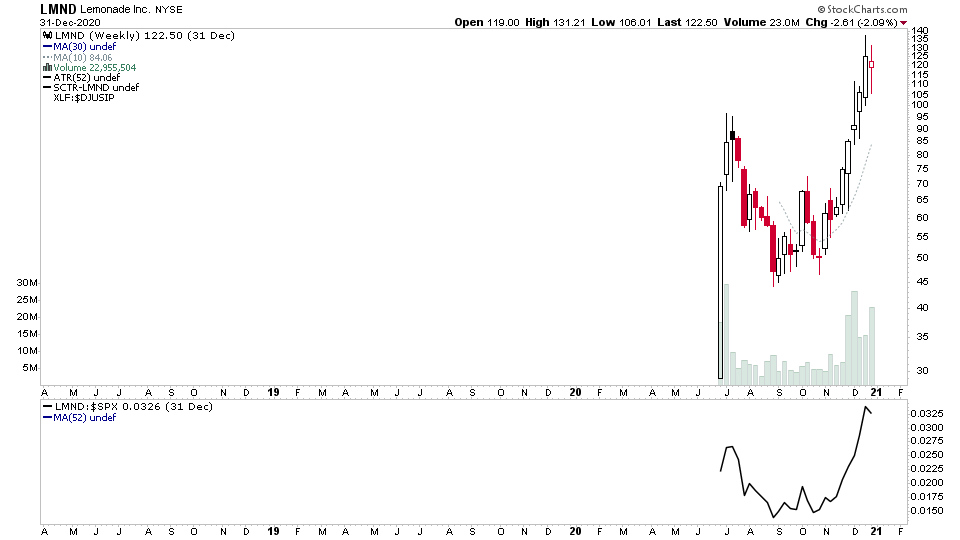

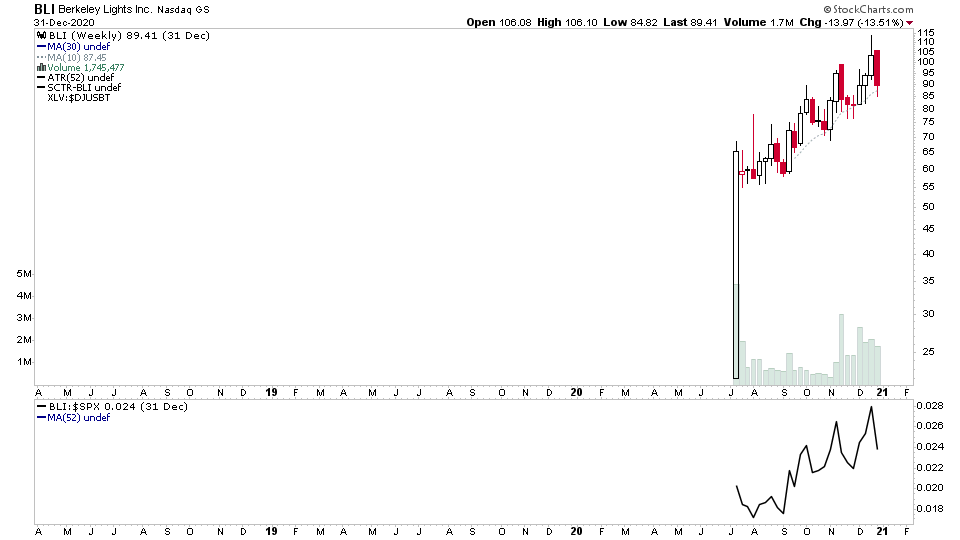

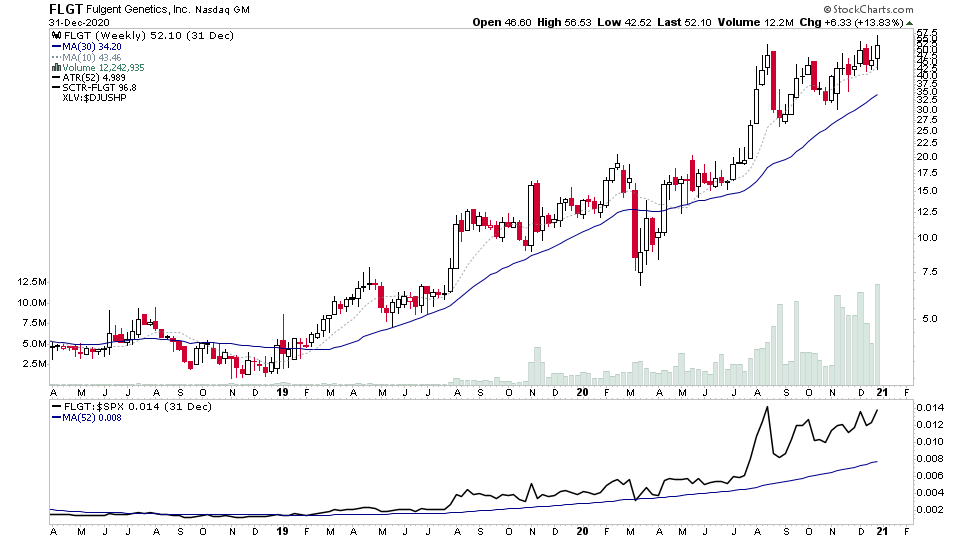

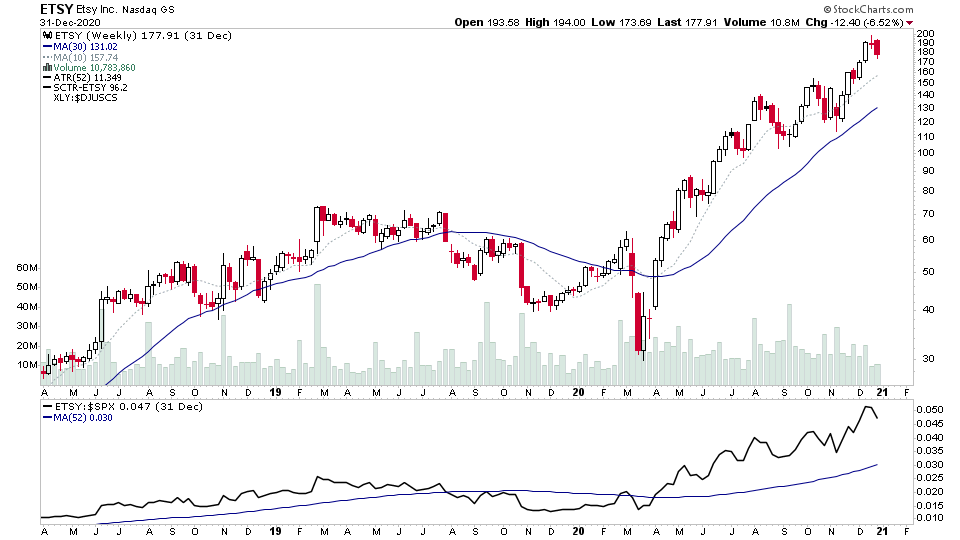

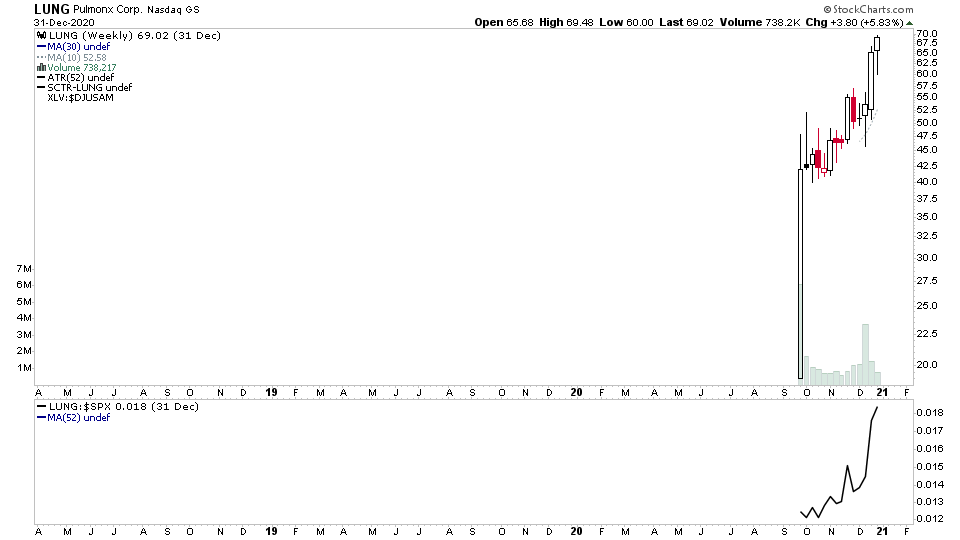

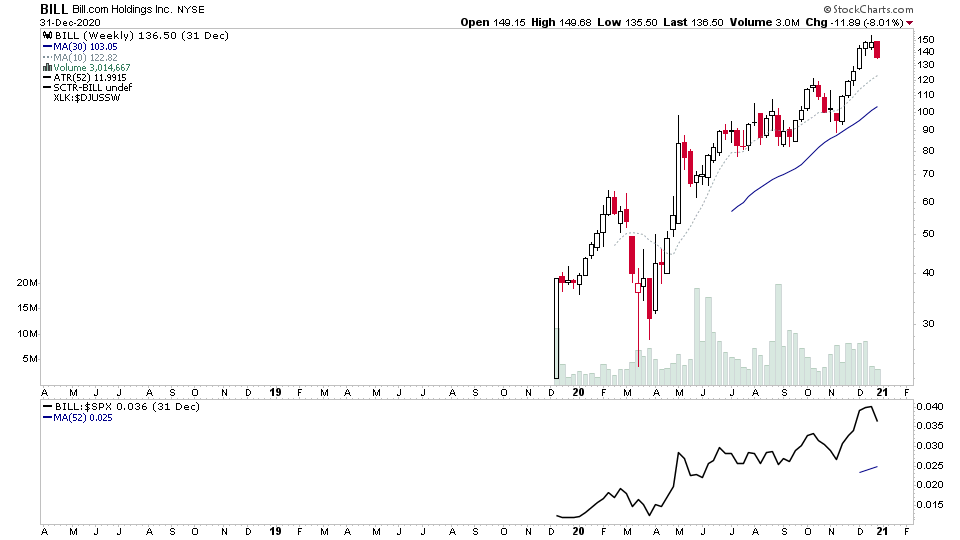

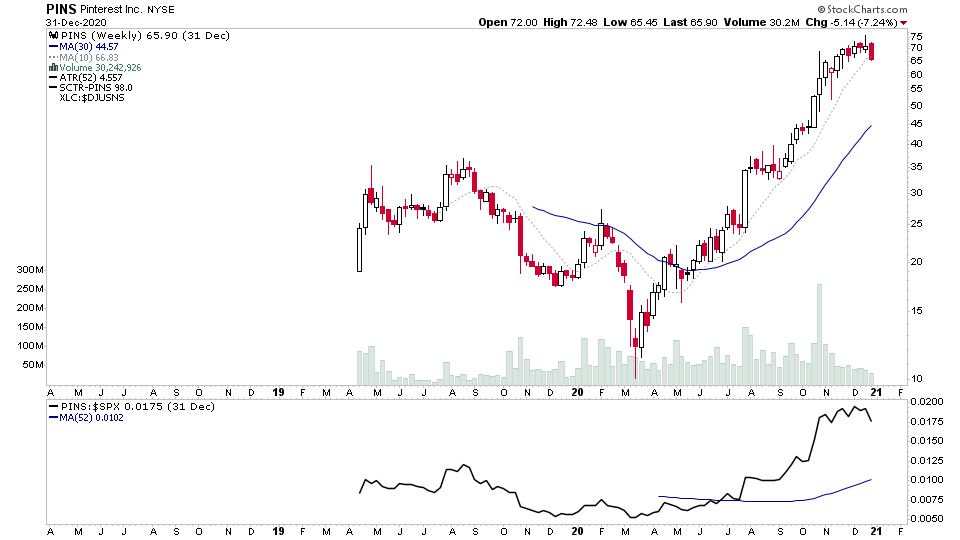

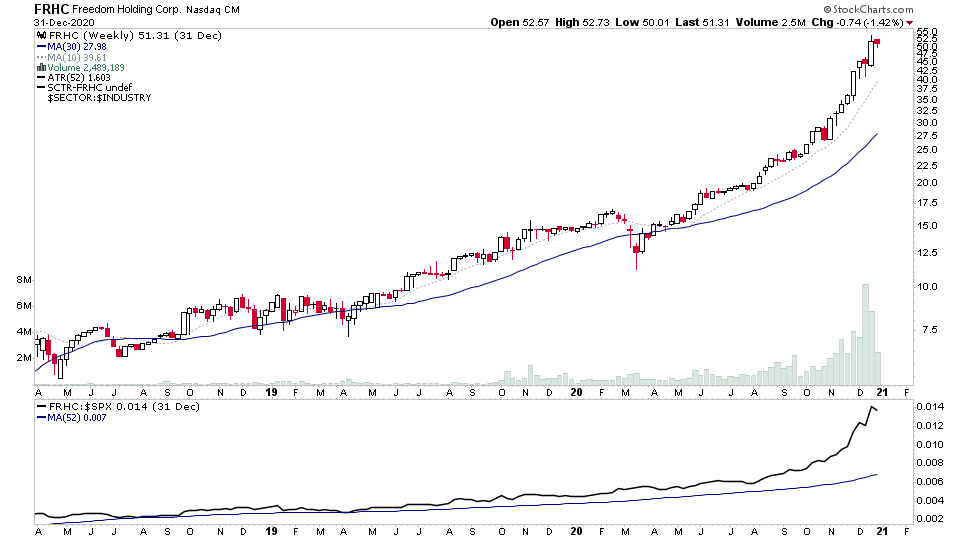

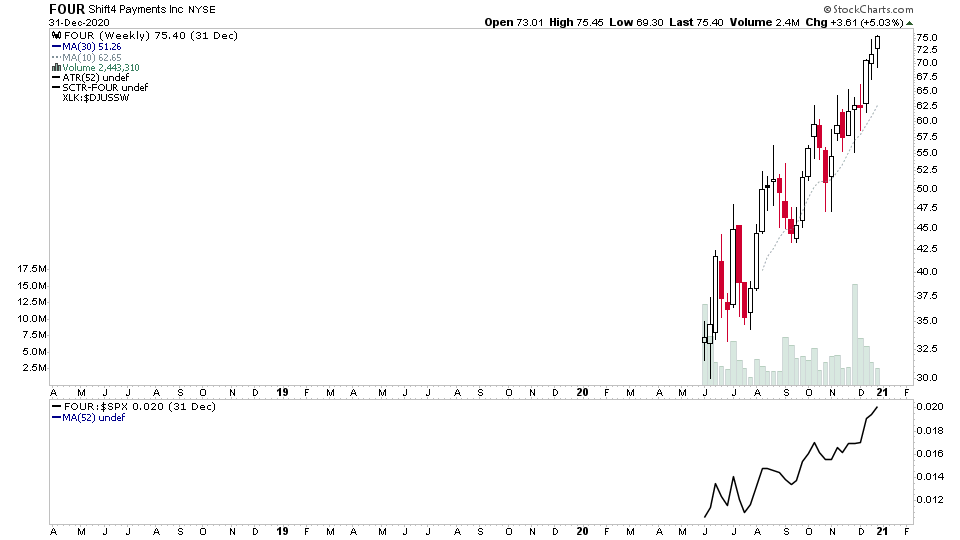

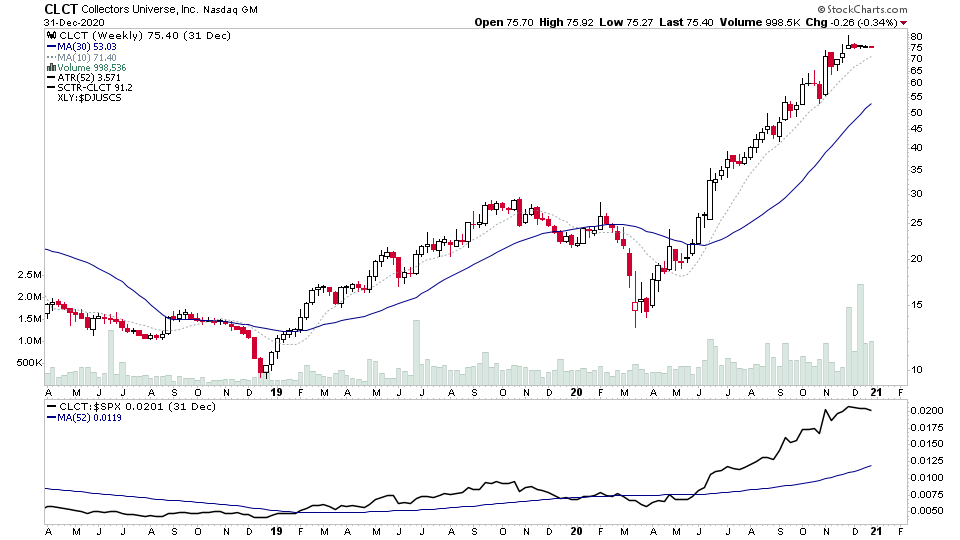

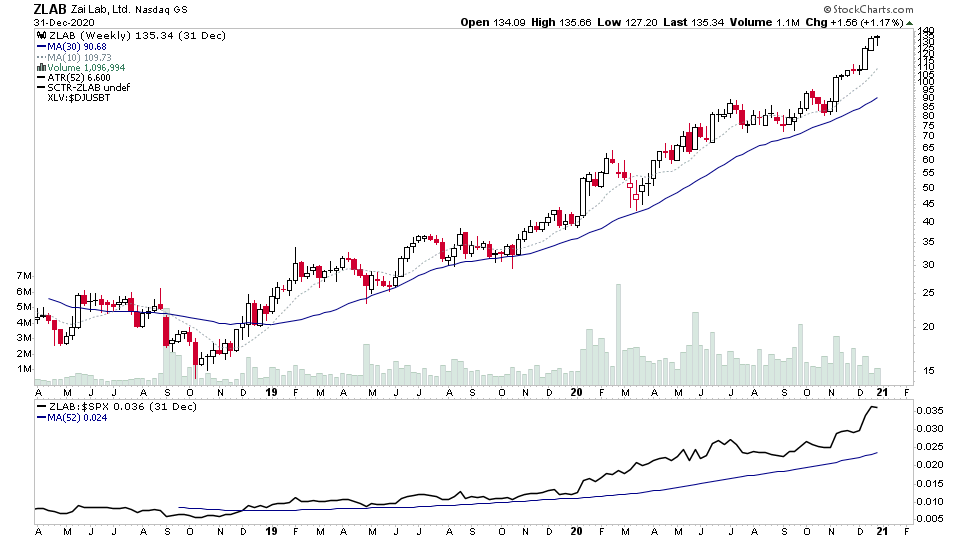

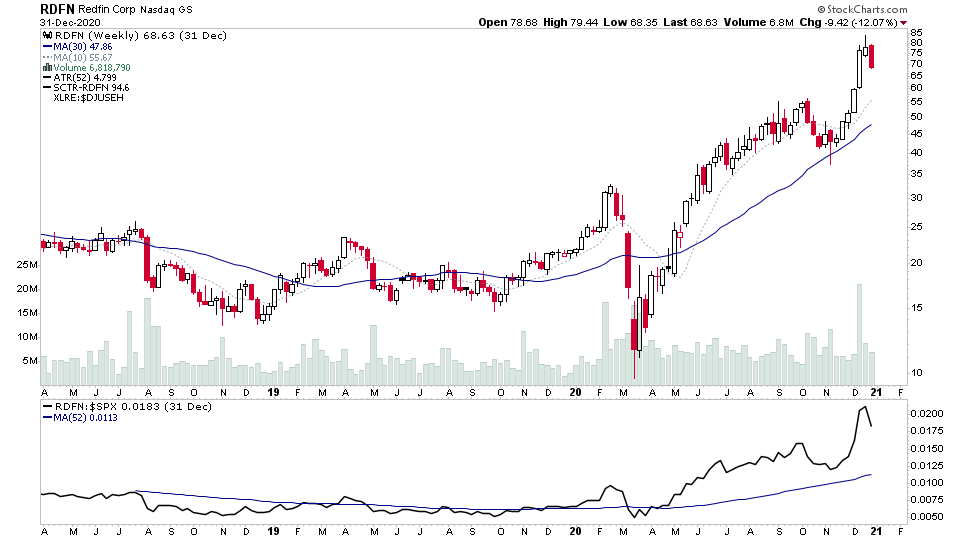

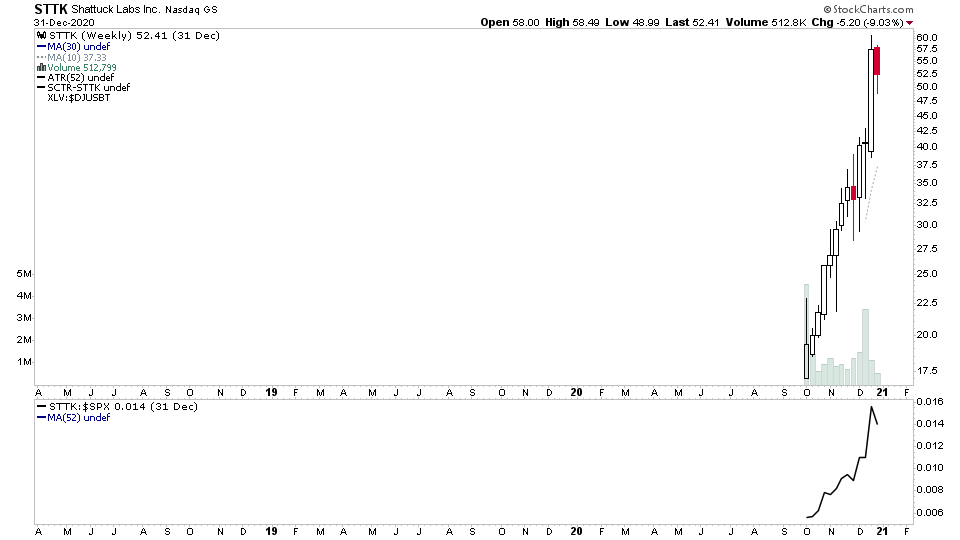

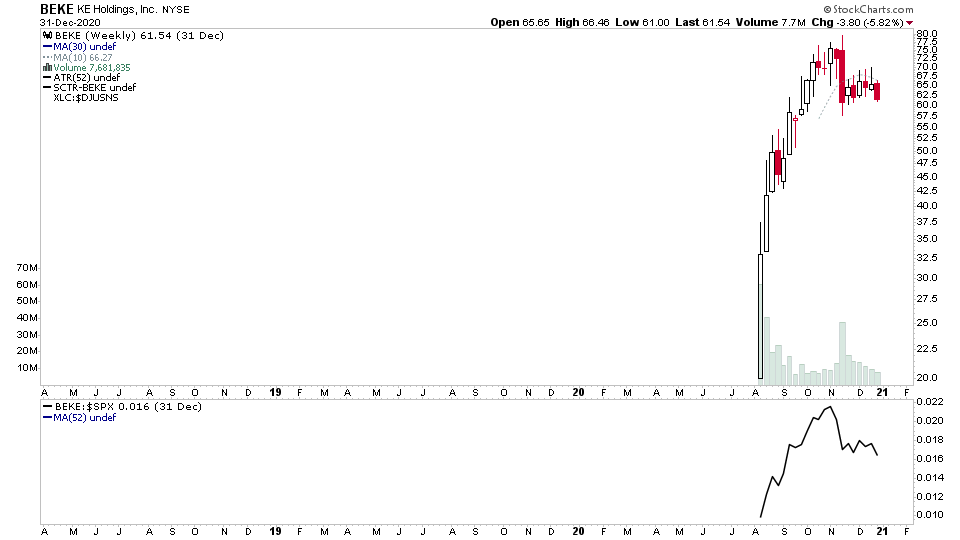

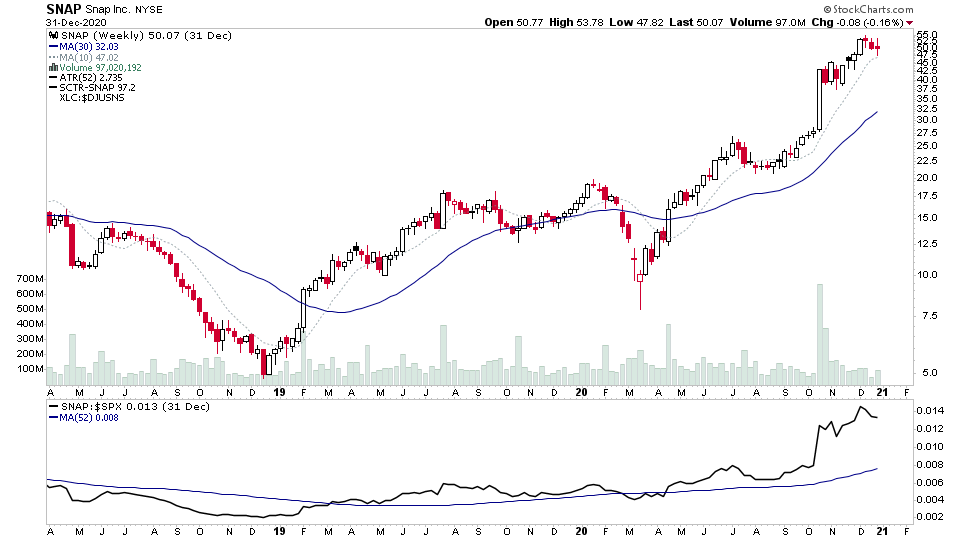

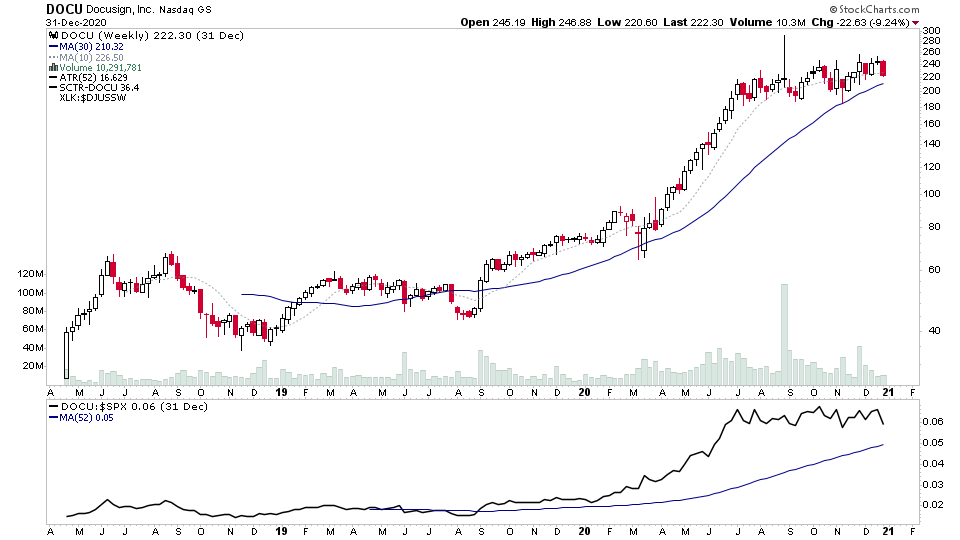

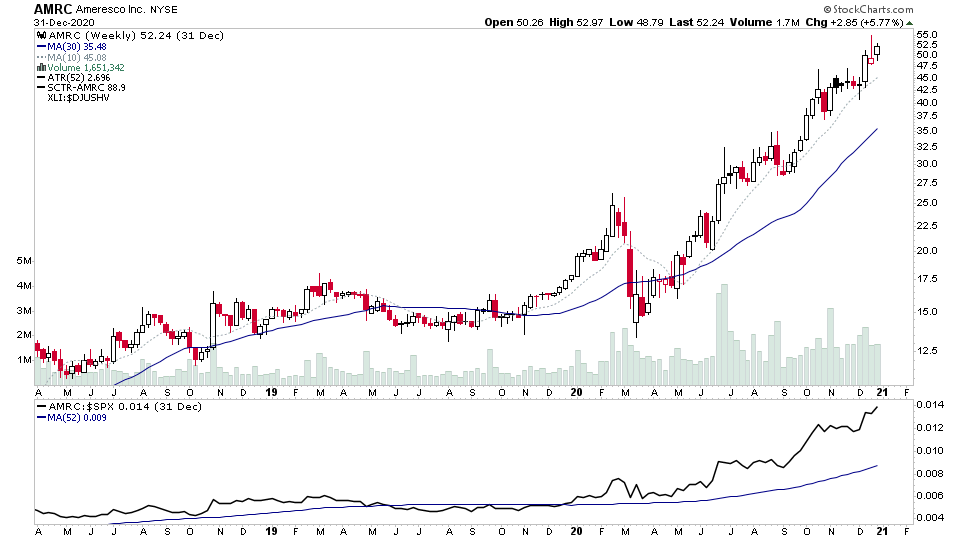

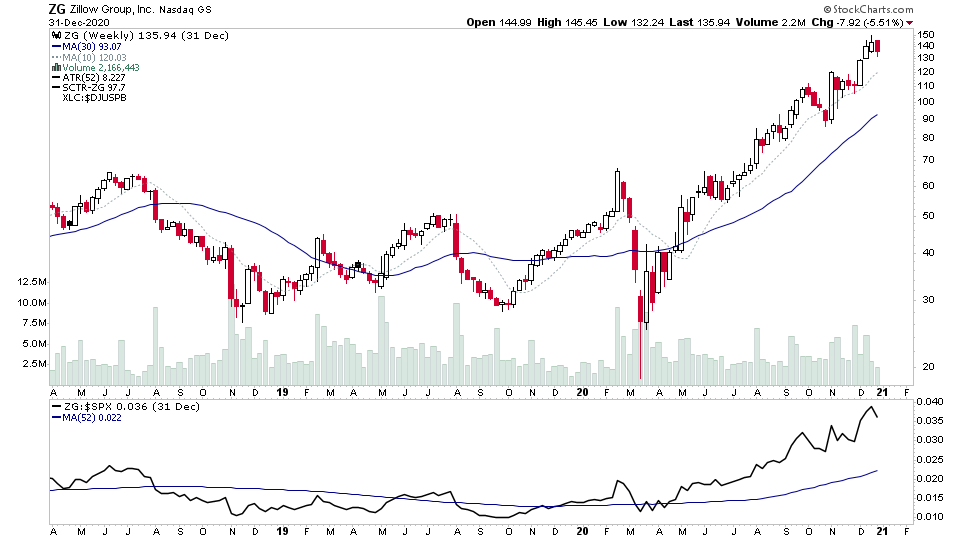

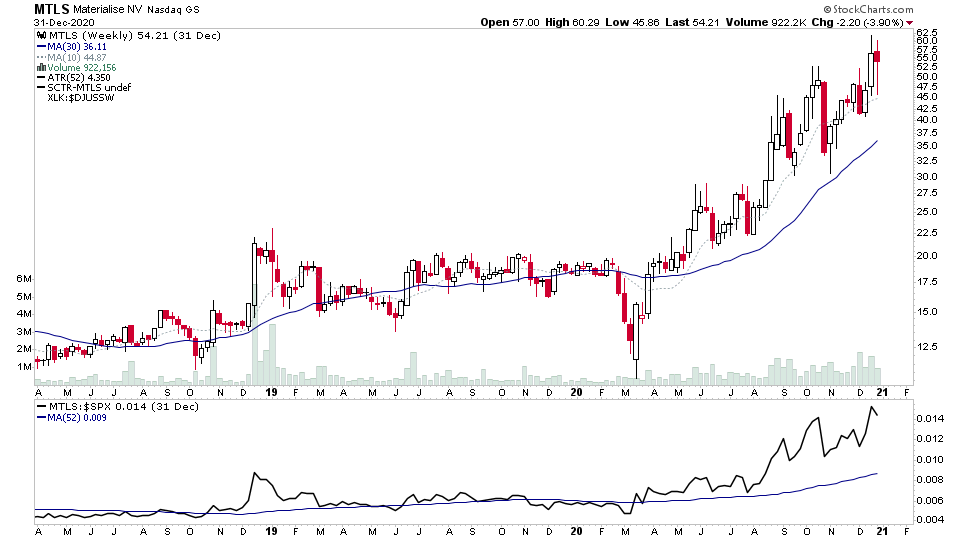

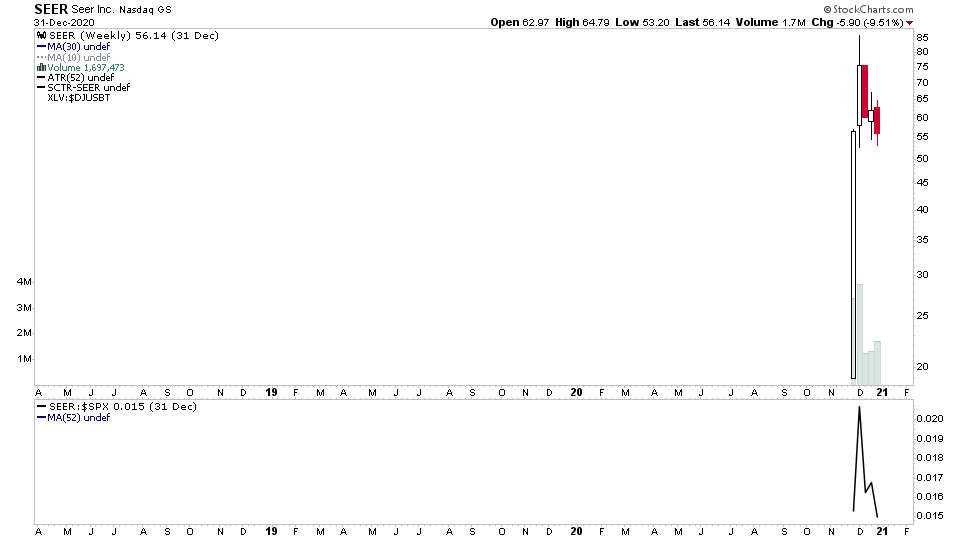

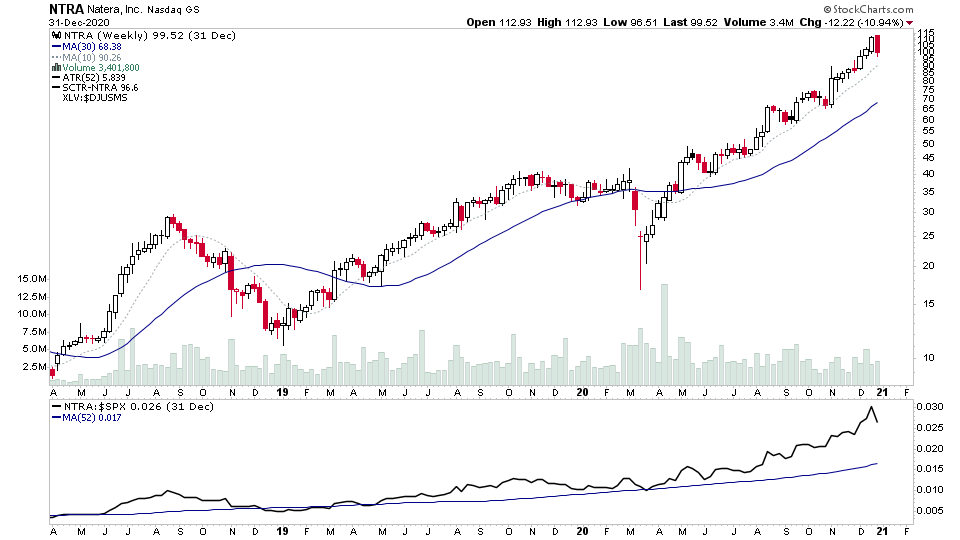

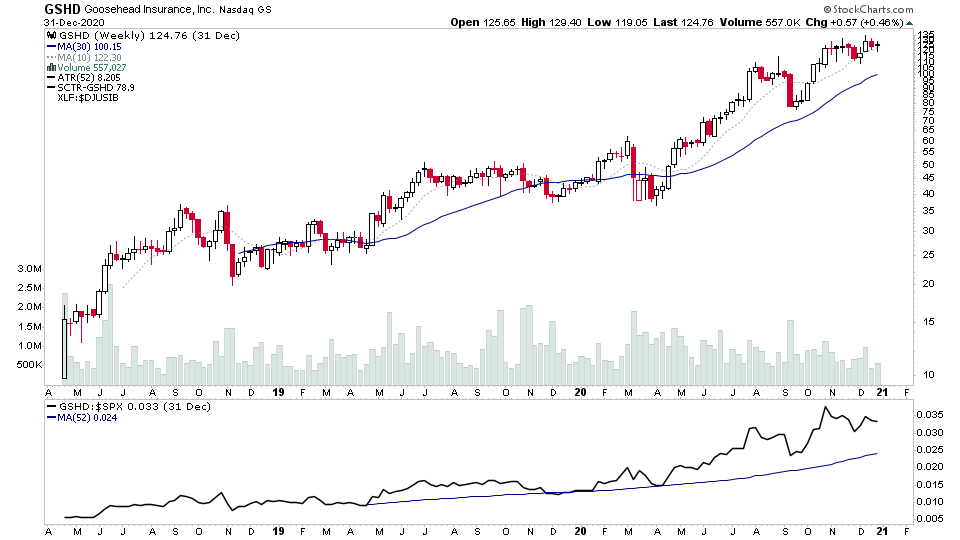

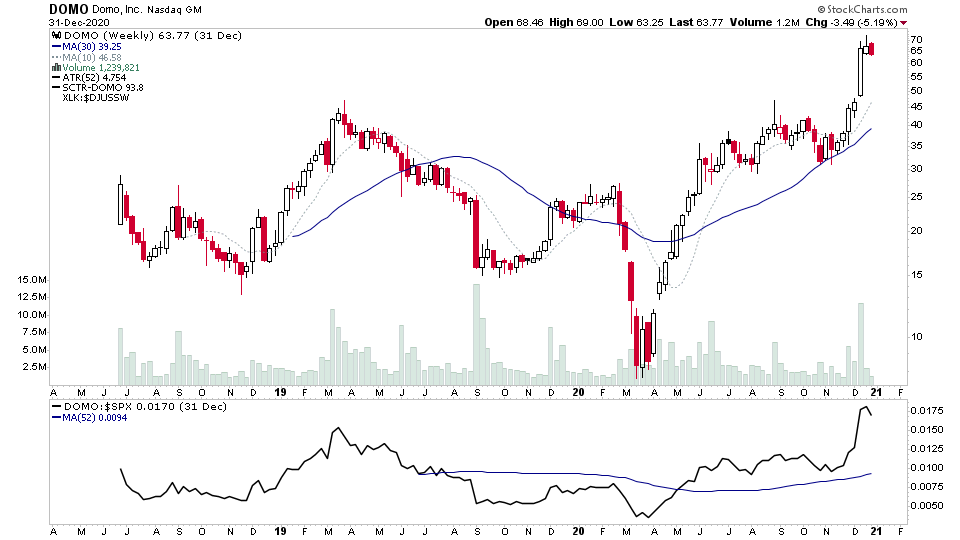

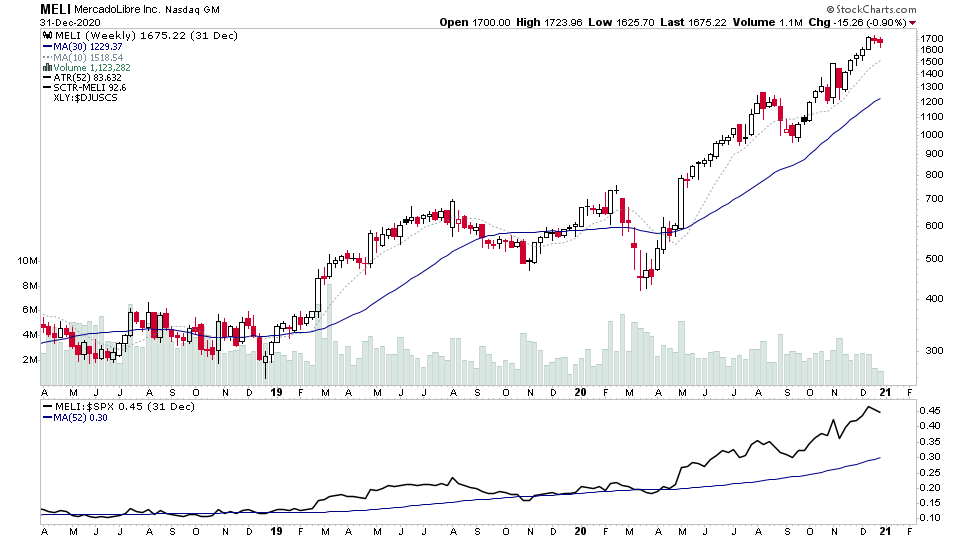

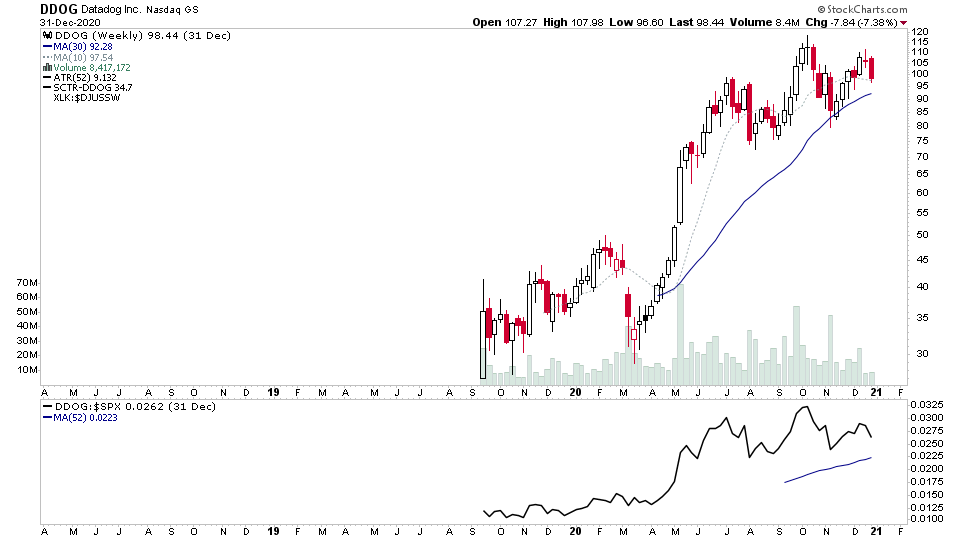

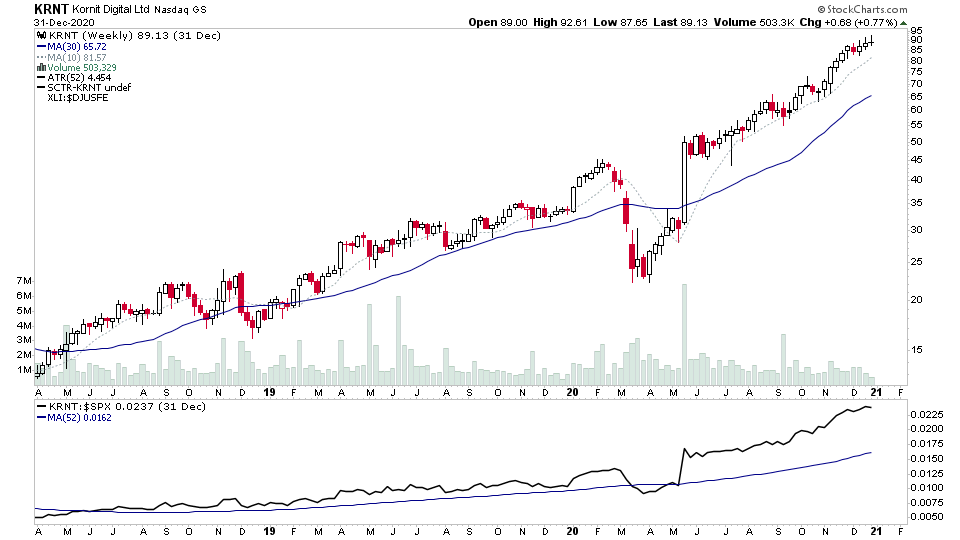

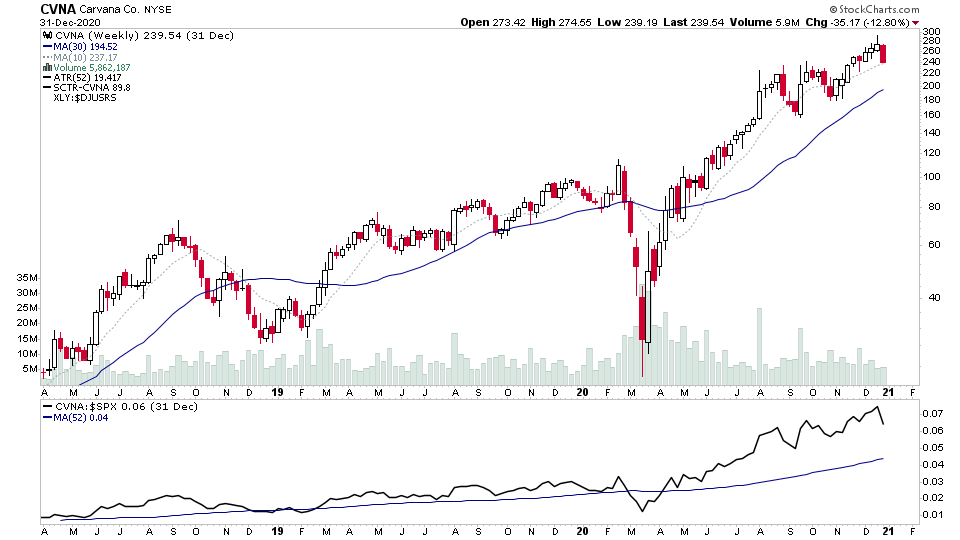

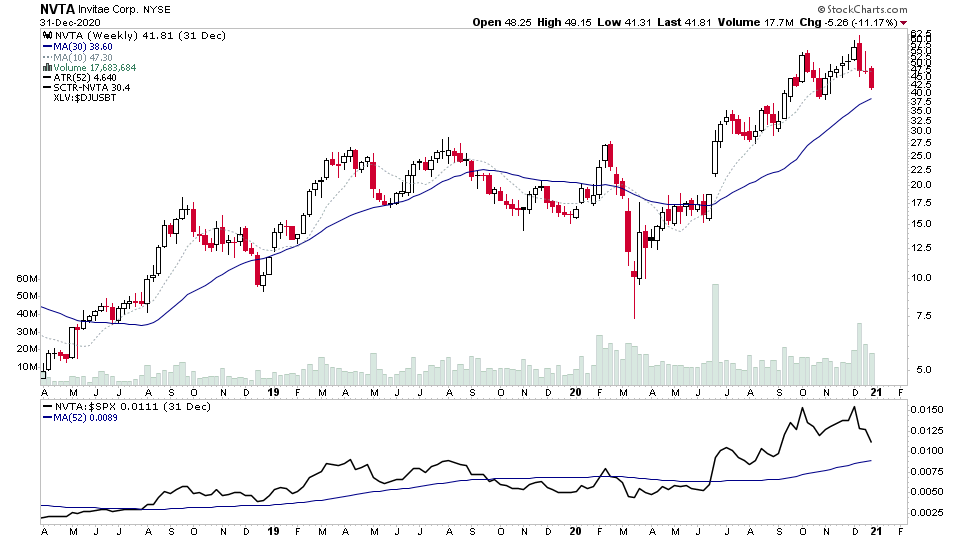

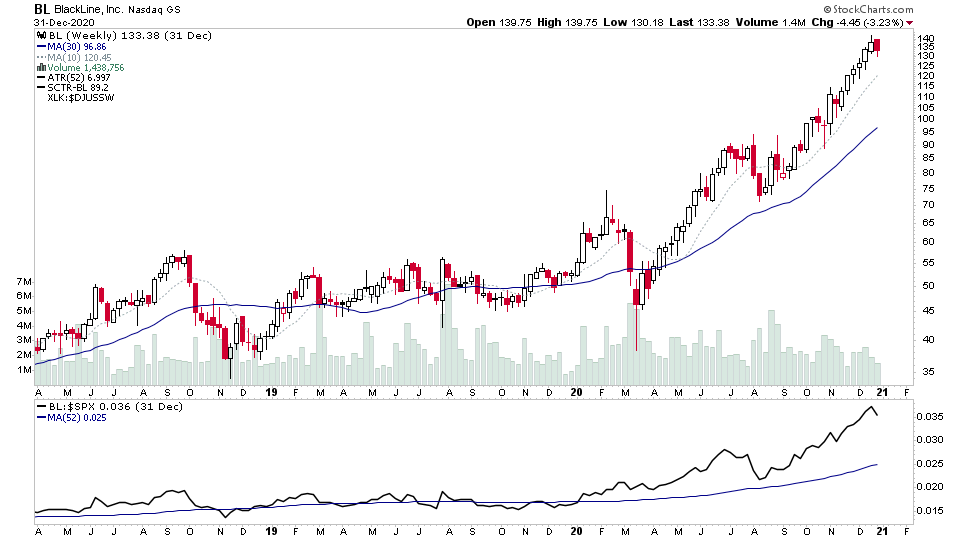

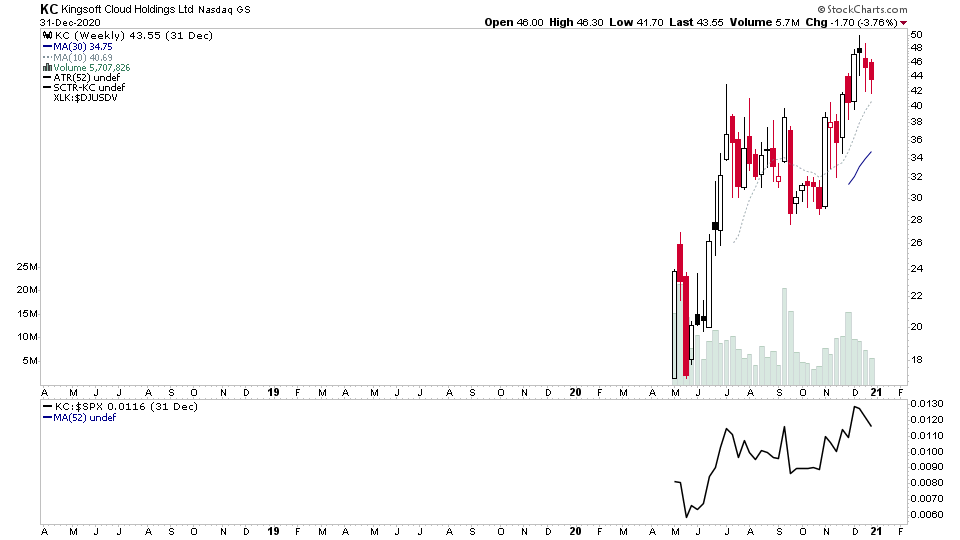

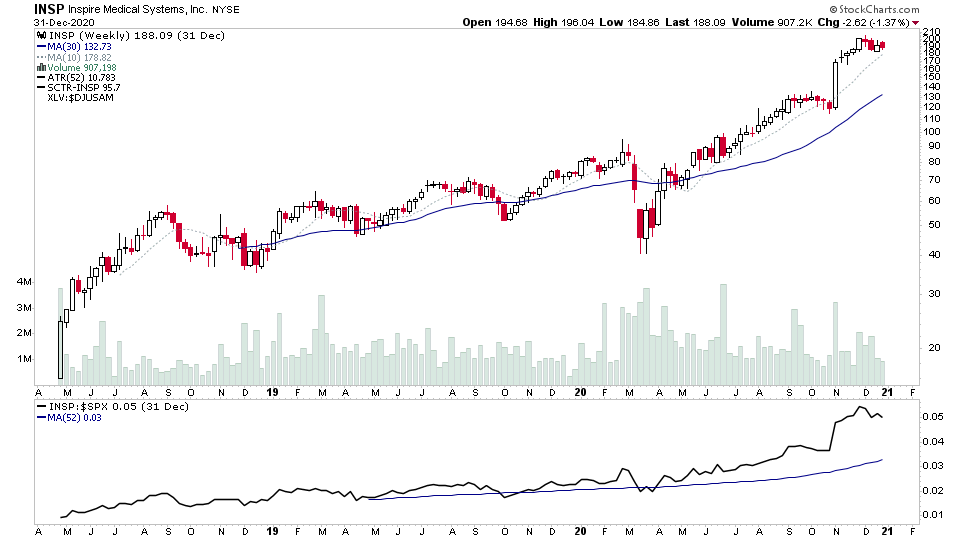

IBDs Best CAN SLIM stocks of 2020

Weekly charts of the Top 100 CAN SLIM stocks of 2020 per the IBD article on the Investors Business Daily website. For the full article go to: https://www.investors.com/research/best-companies-2020/

To view the full list in table format with the CAN SLIM ratings. Go to: Best Companies of 2020 List with Ratings

Note: All stocks on the list have an average daily trading volume of 100,000 shares or more and were priced at $12 or higher at the start of the year. Closed-end funds were excluded.

2020 was an amazing year for stock returns with Growth stocks investors and traders producing triple digit returns, while Value stocks investors struggled to make a profit.

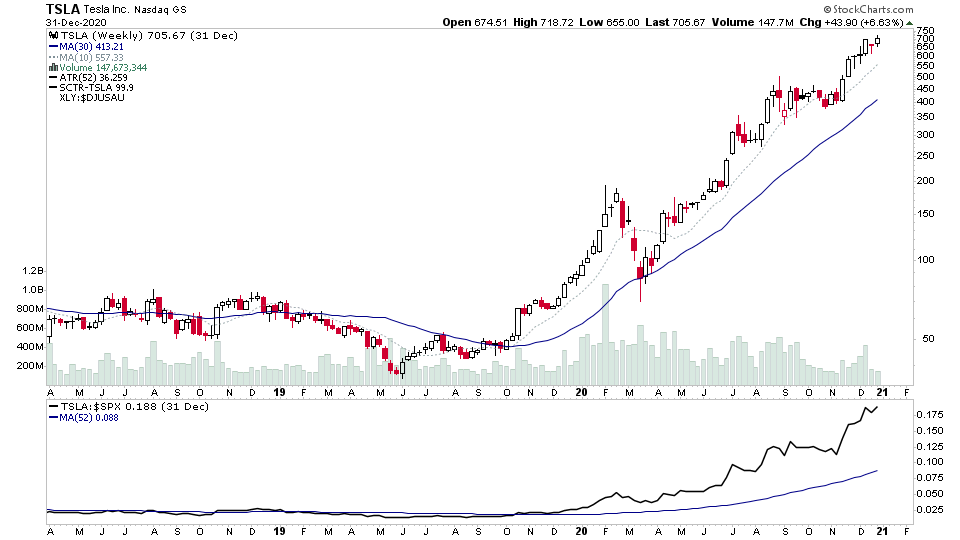

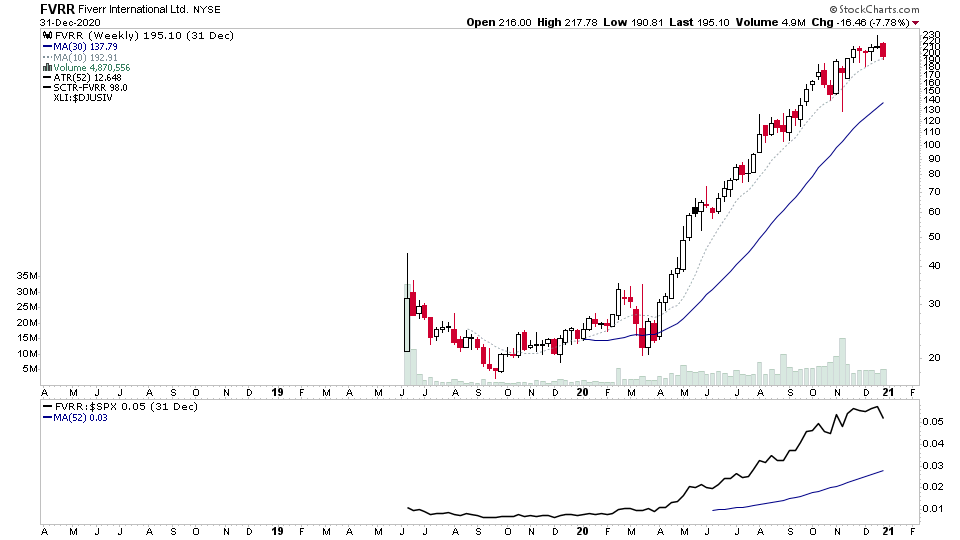

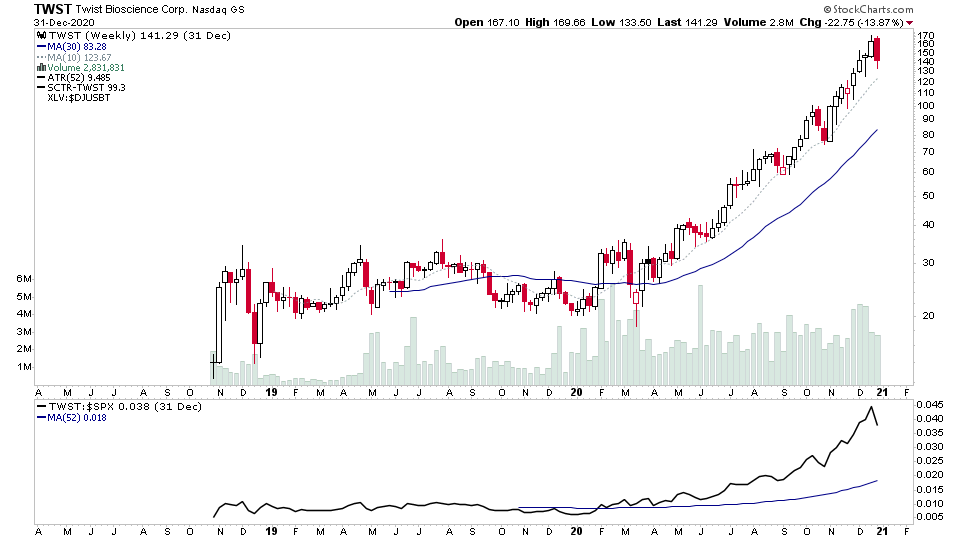

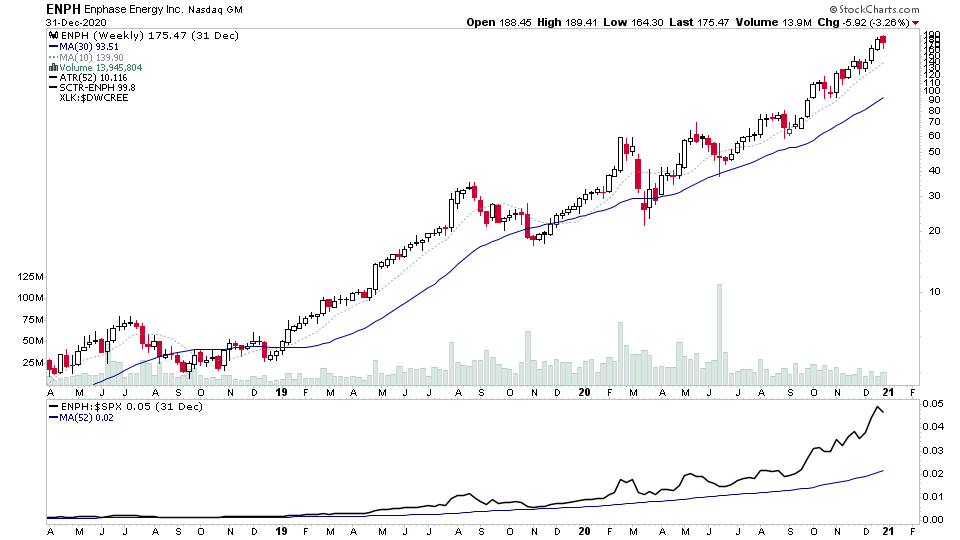

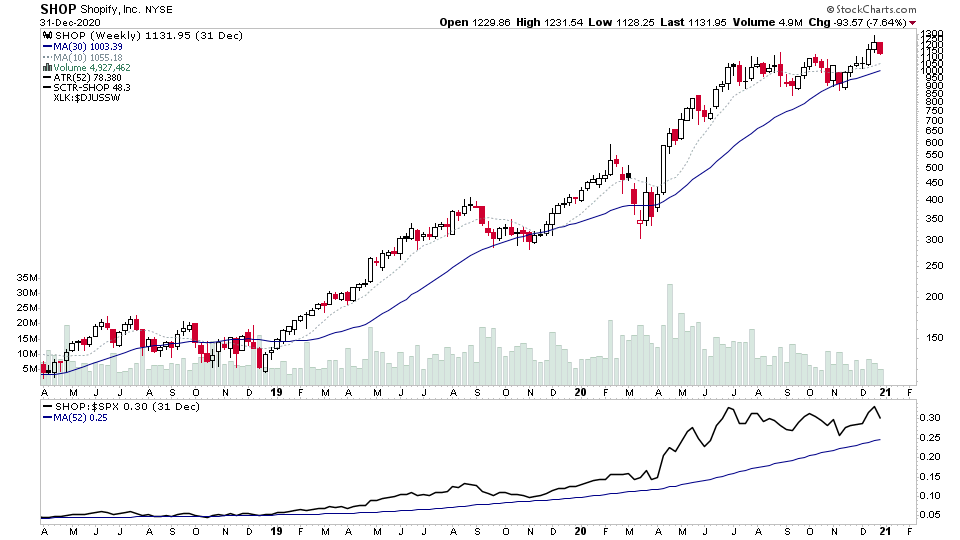

Growth stocks and IPOs dominated 2020, which as you can see from the top 100. All in the list more than doubled with the biggest winner TSLA finishing the year up +743%.

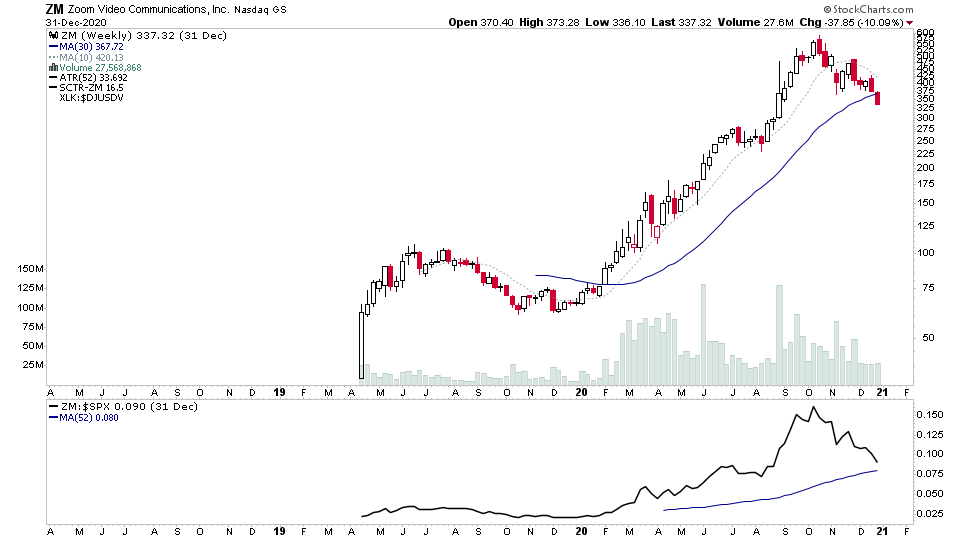

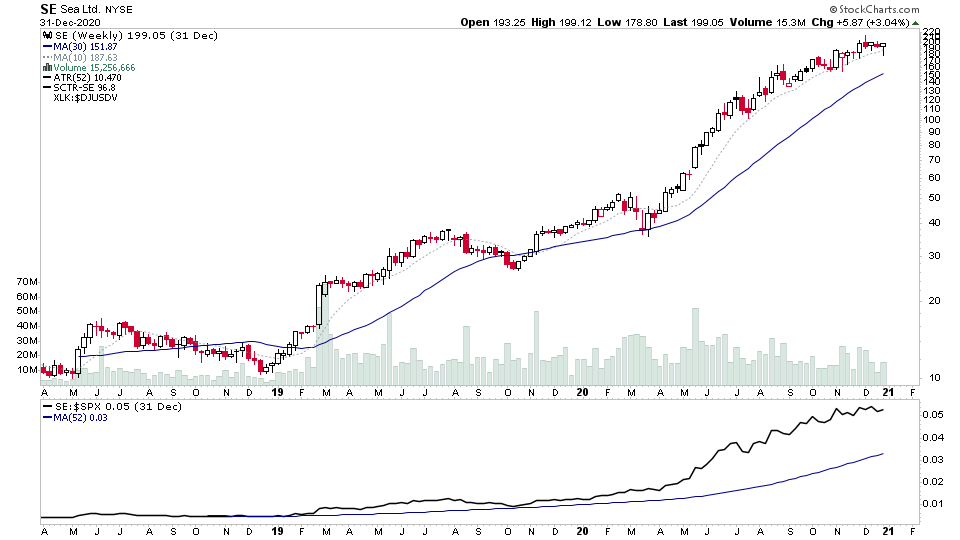

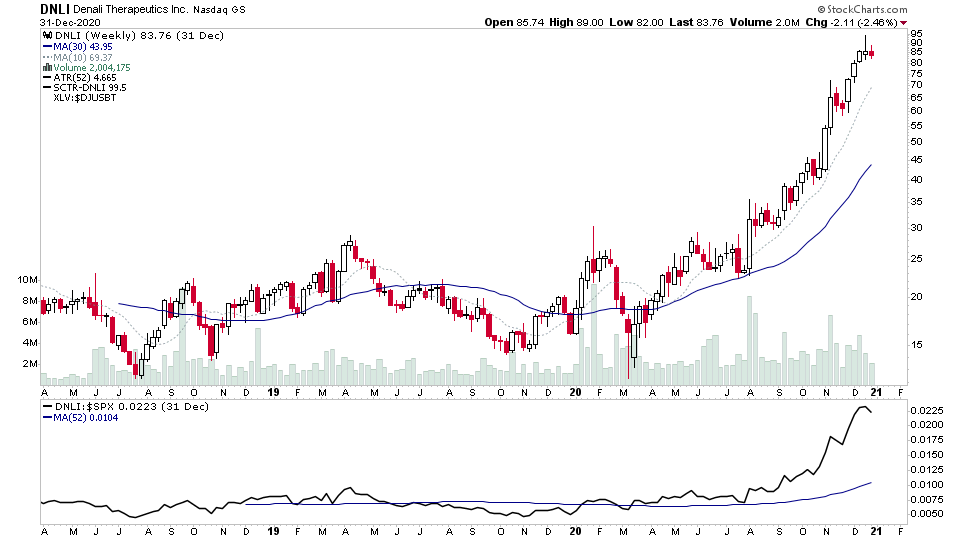

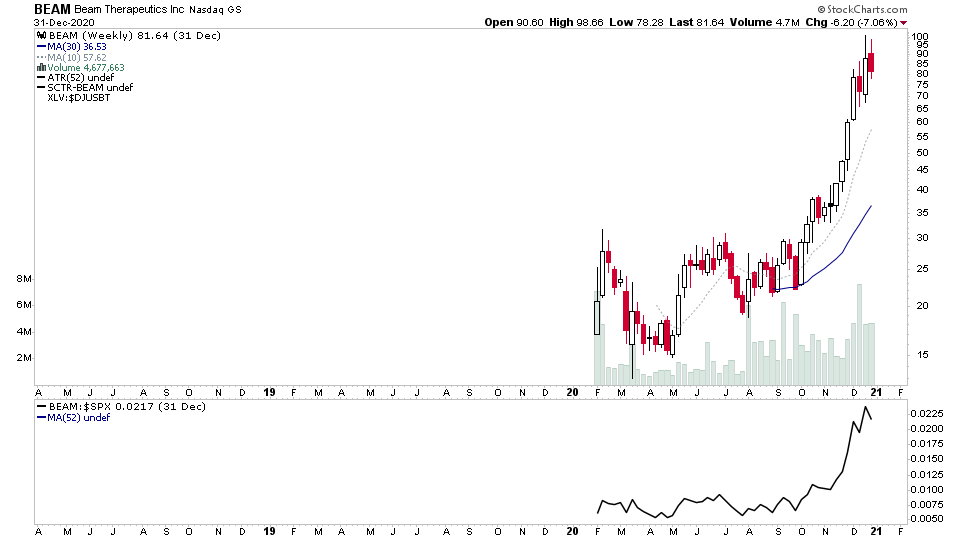

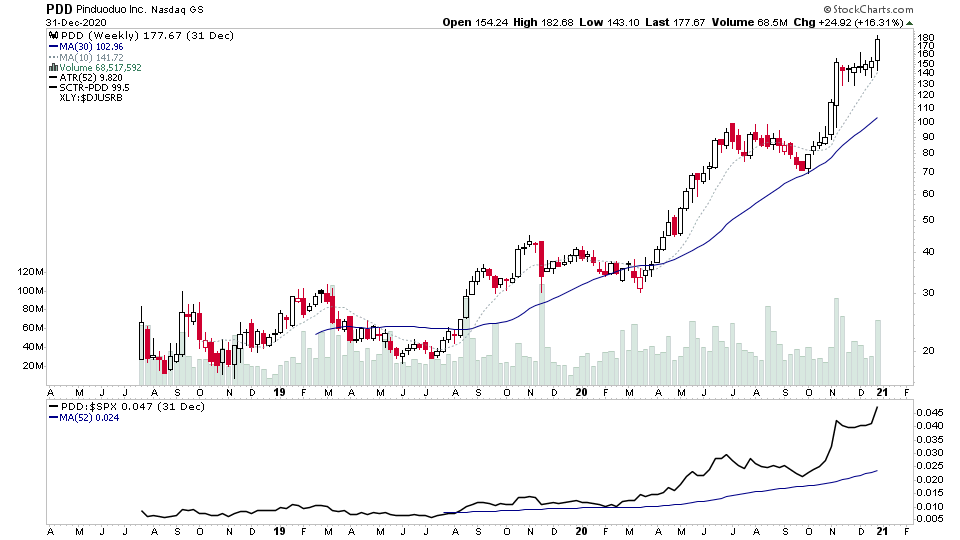

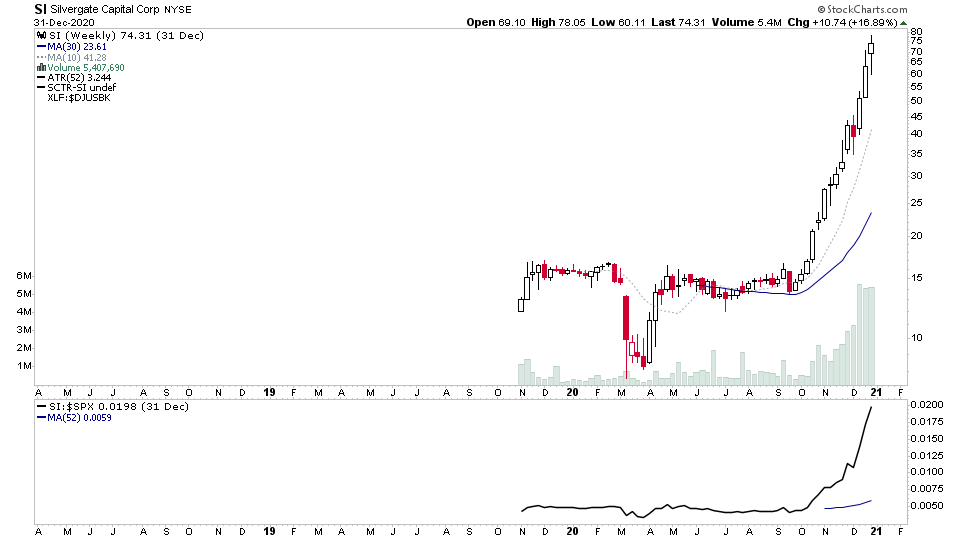

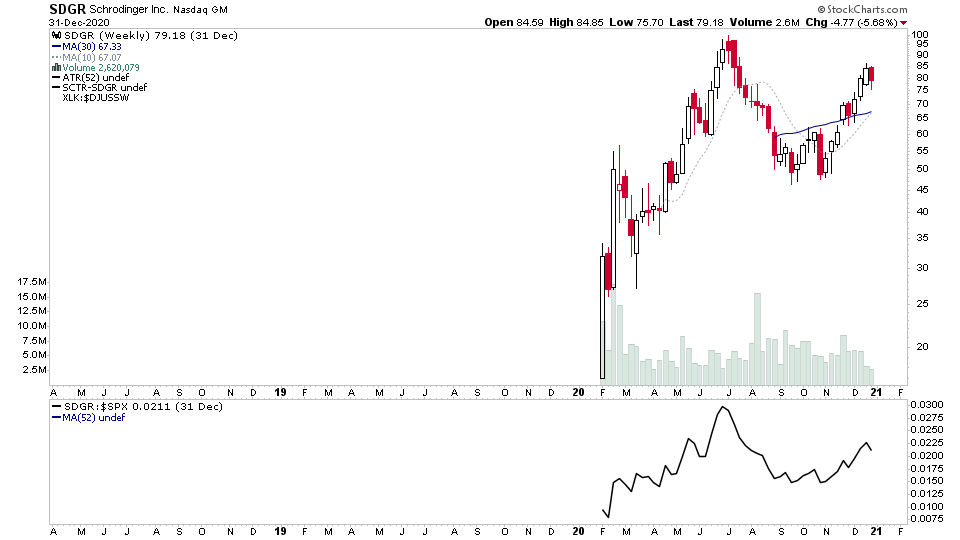

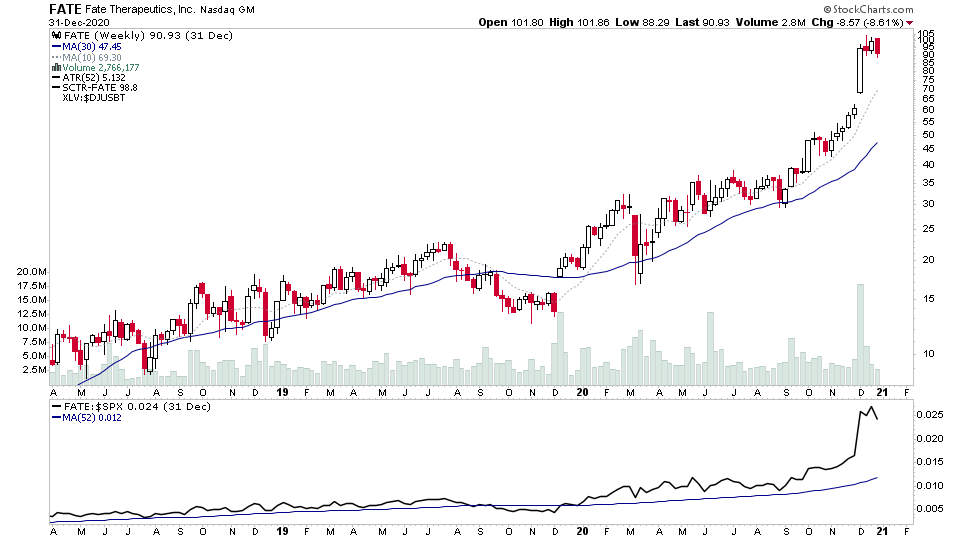

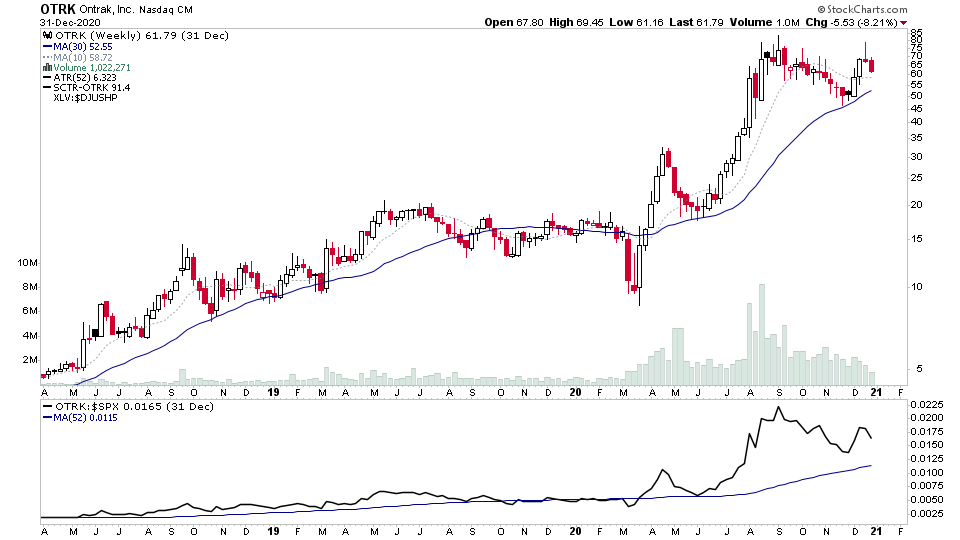

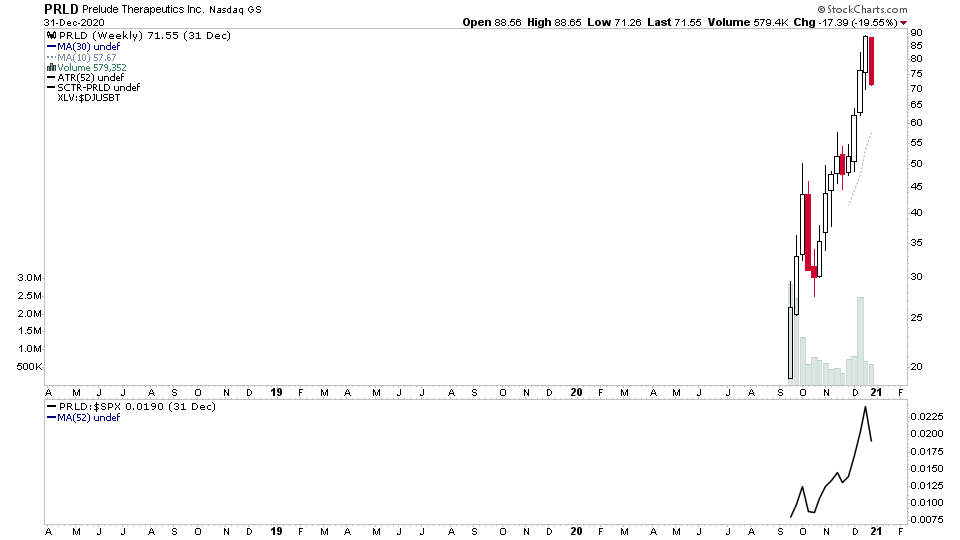

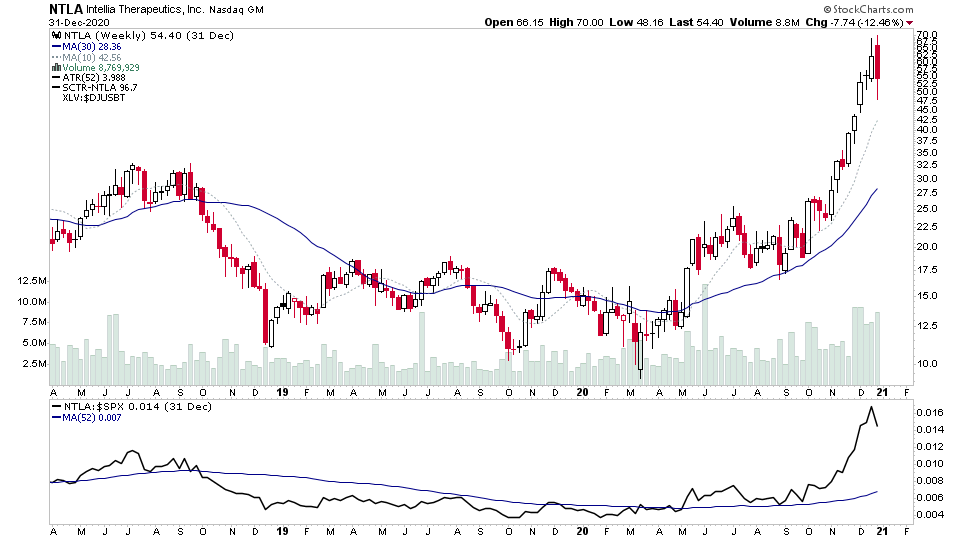

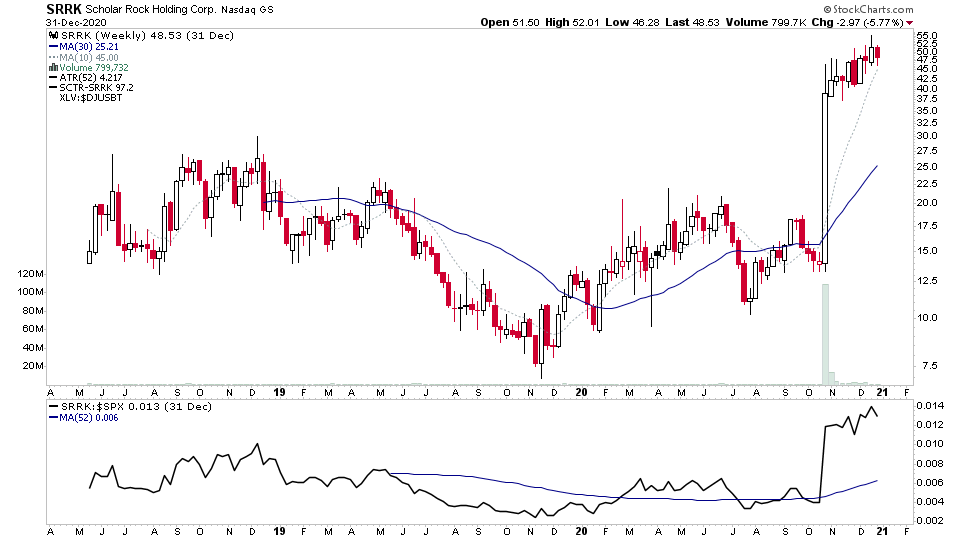

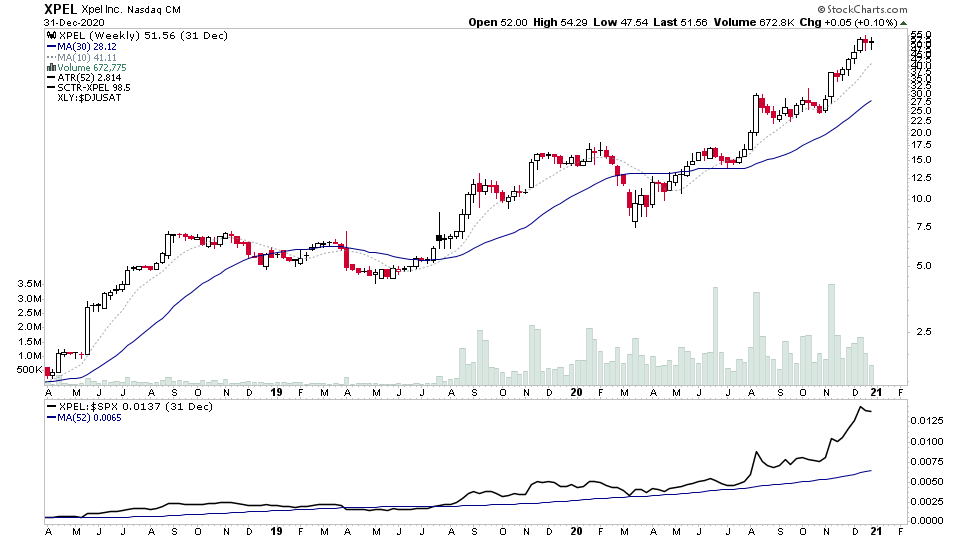

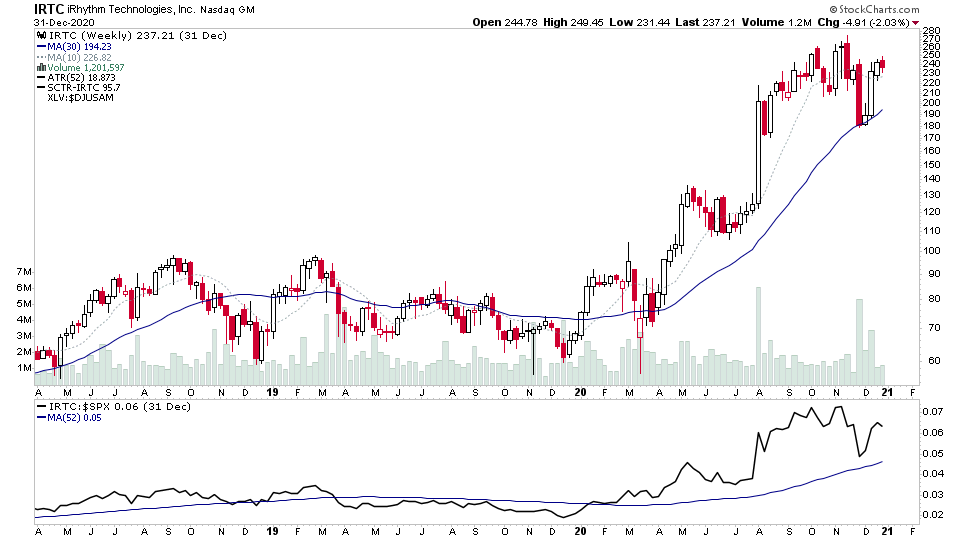

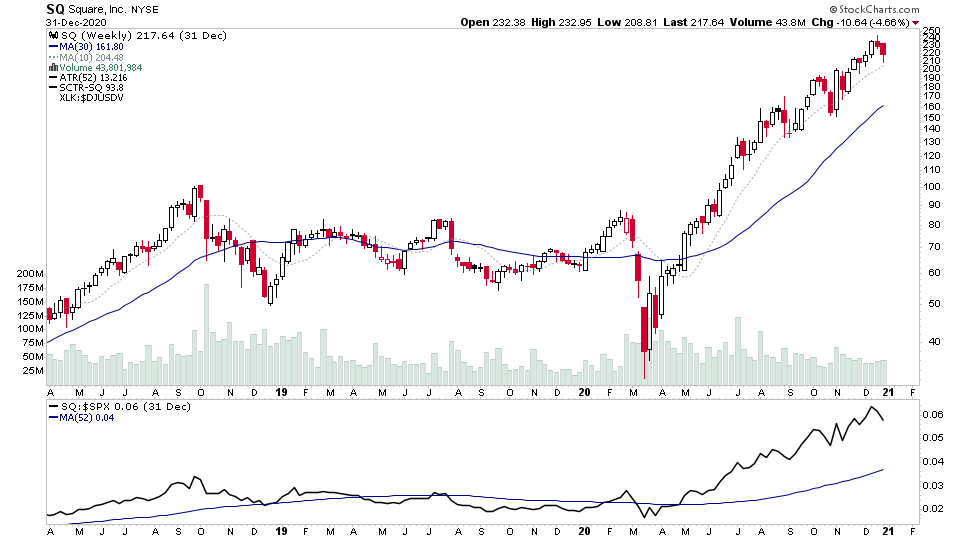

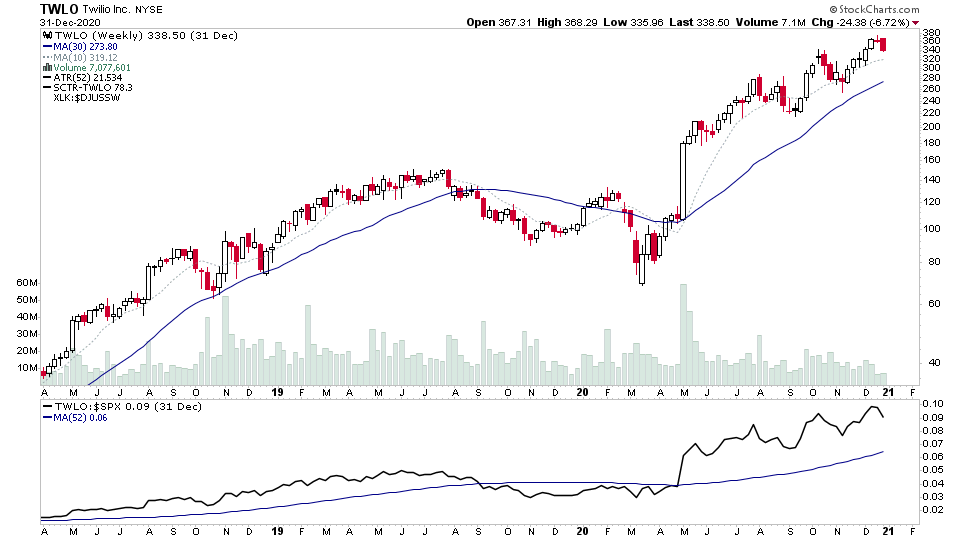

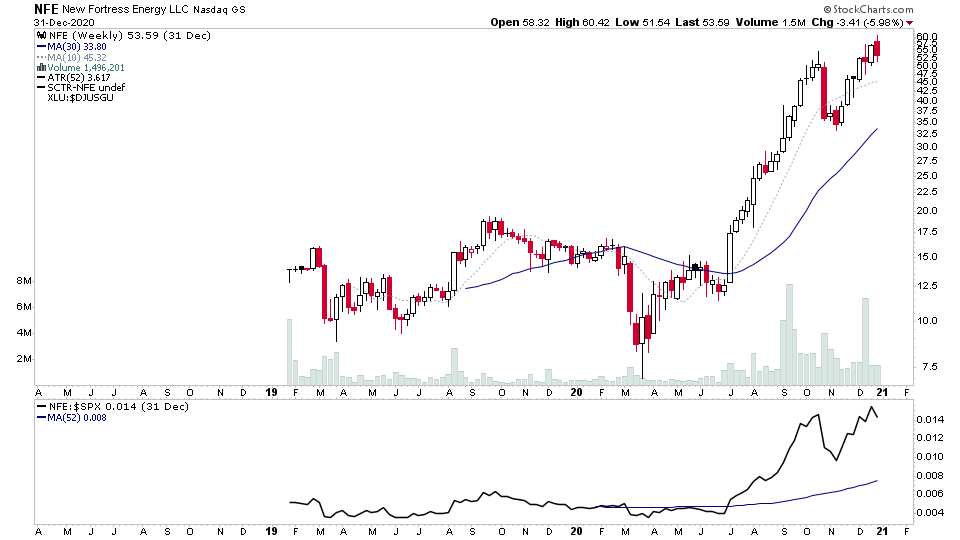

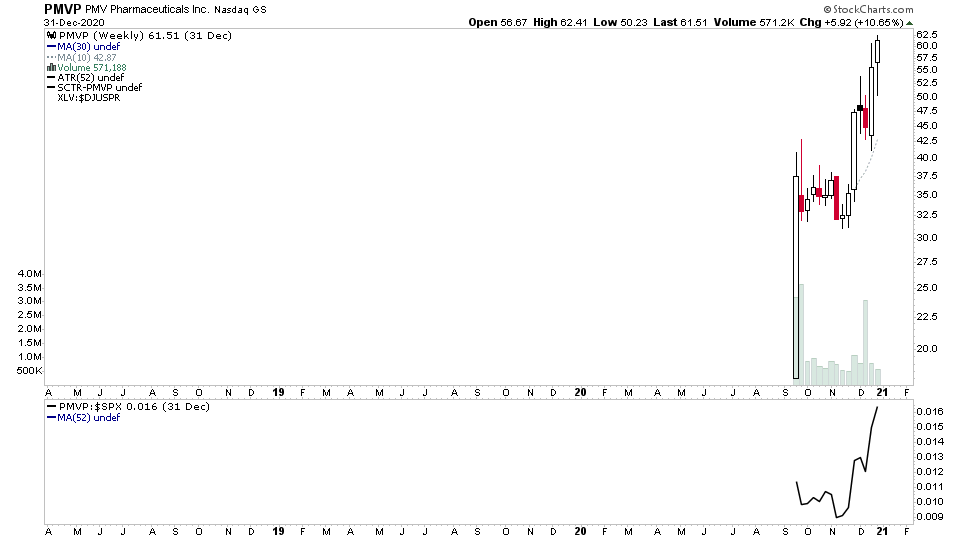

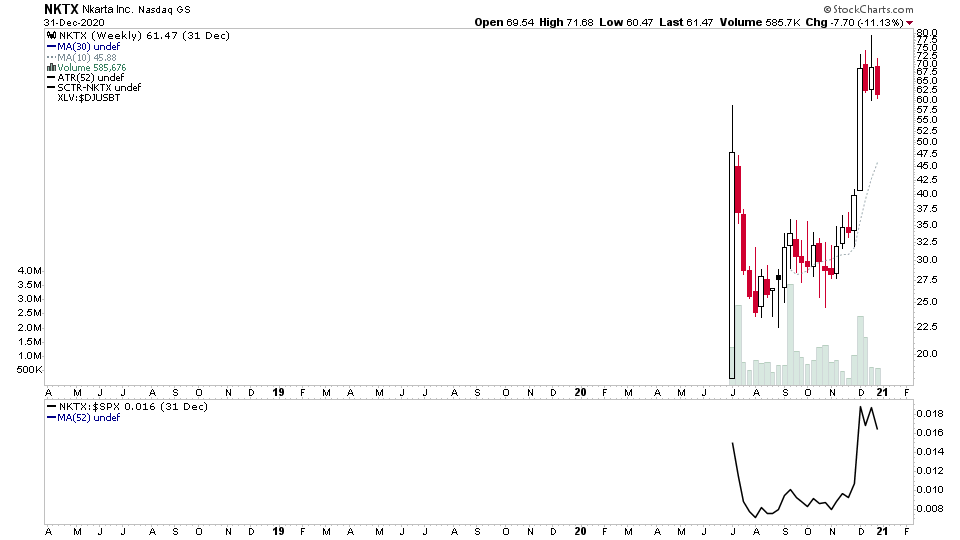

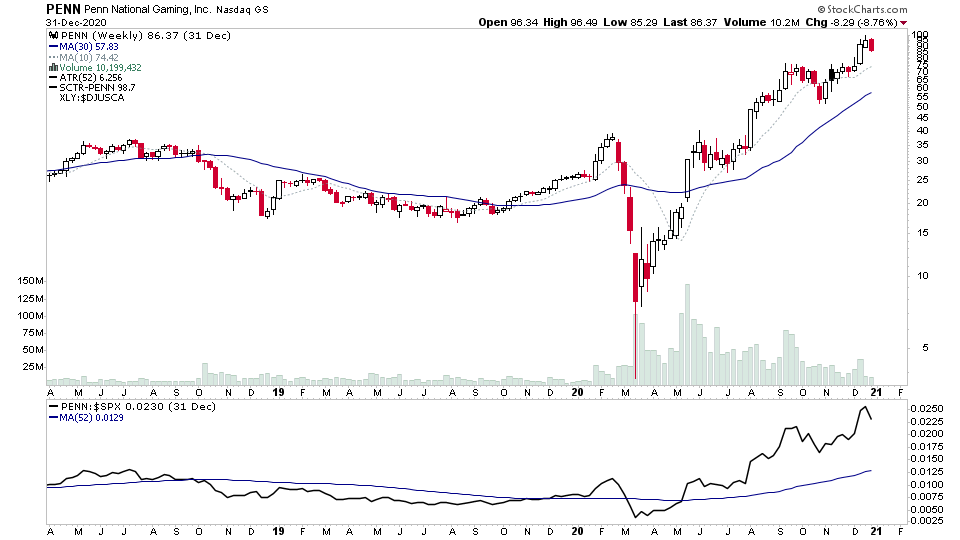

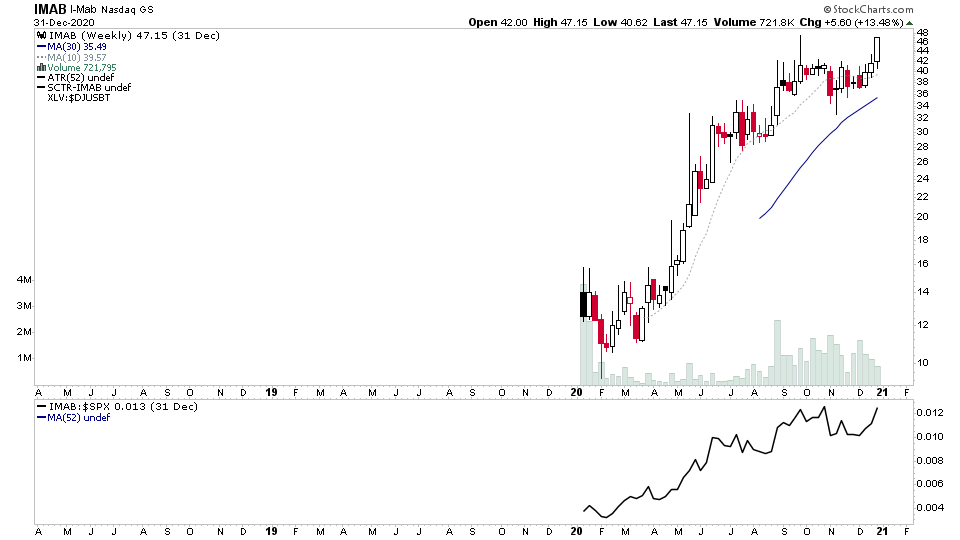

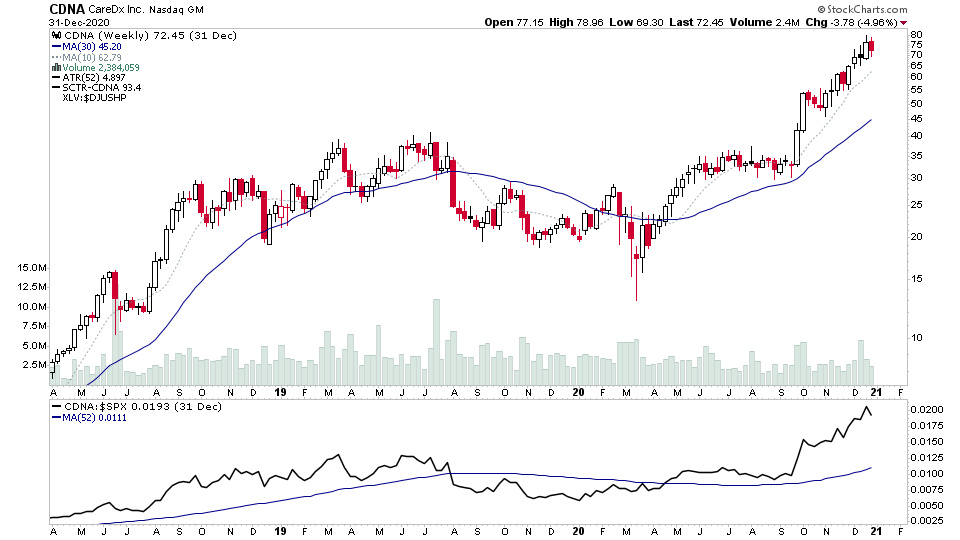

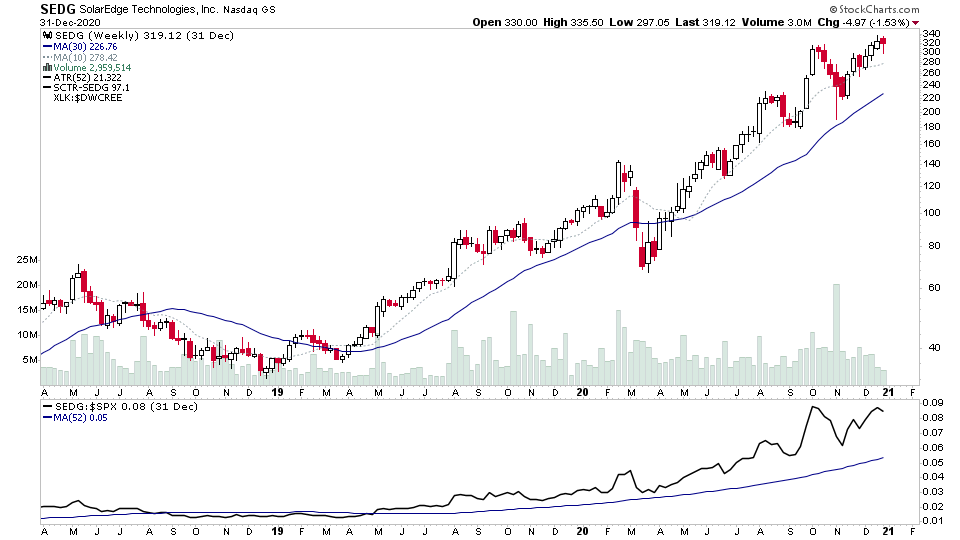

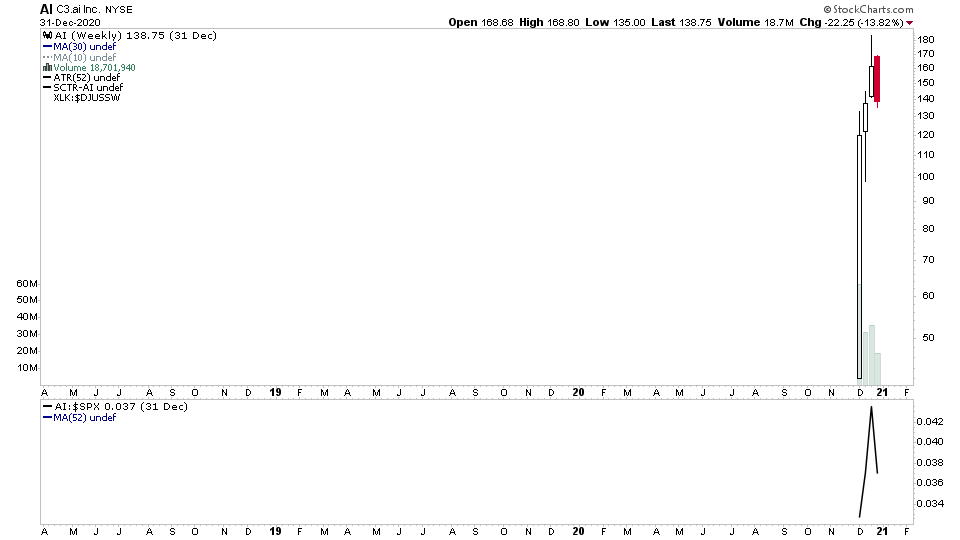

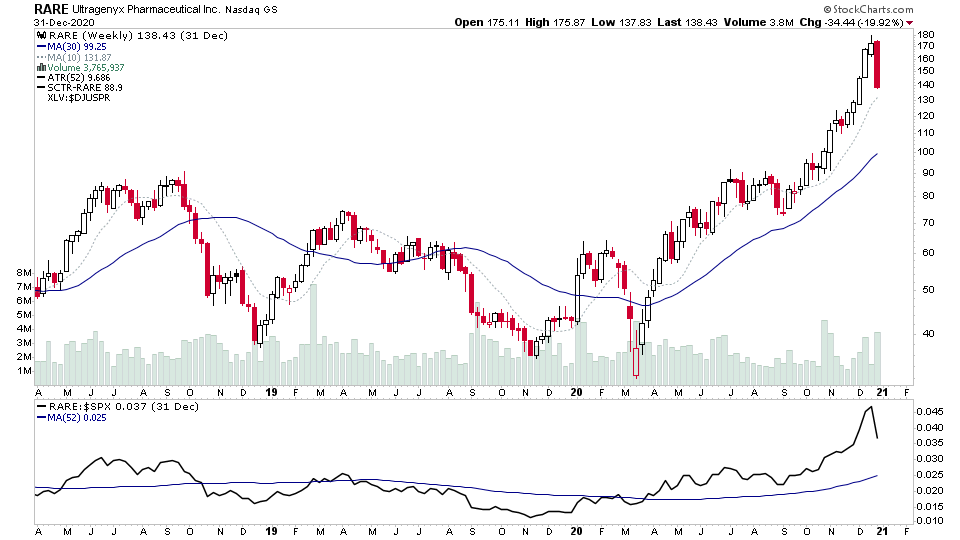

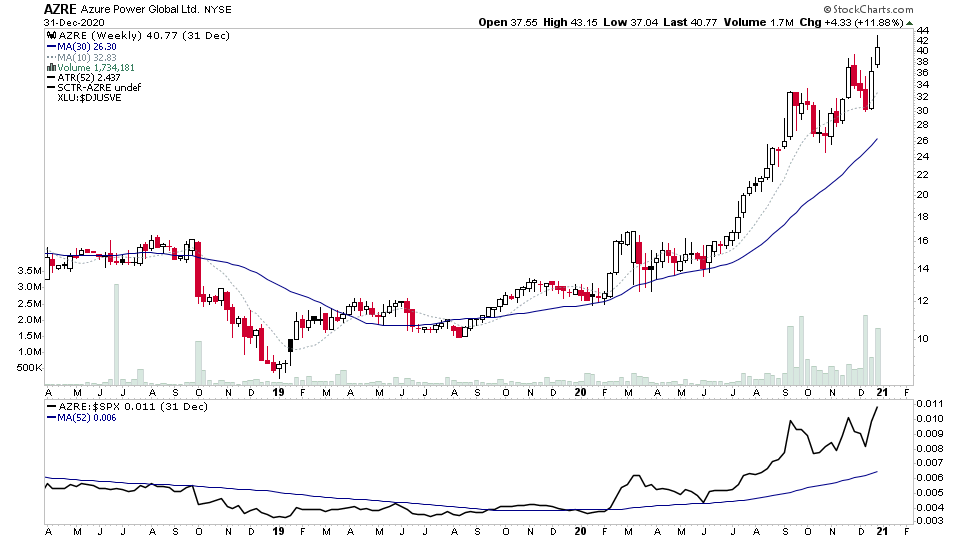

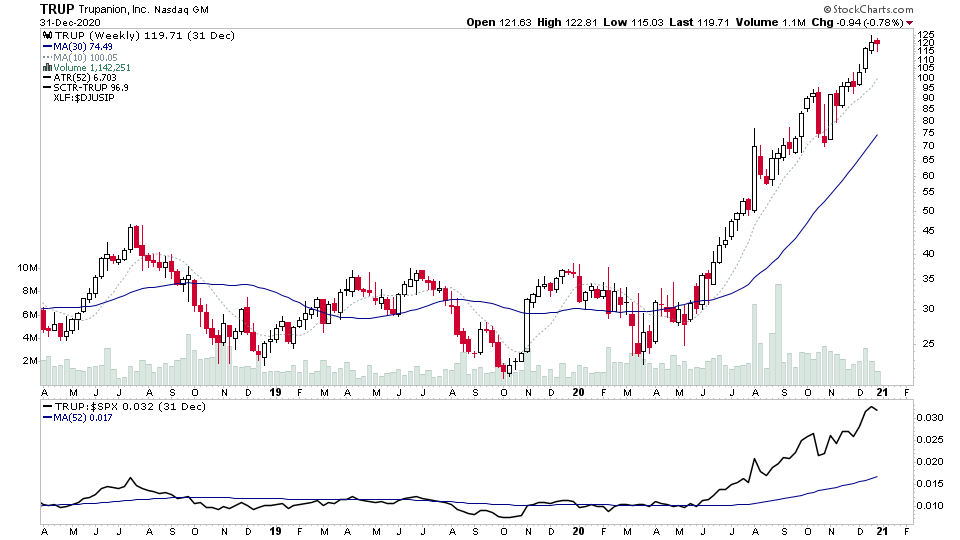

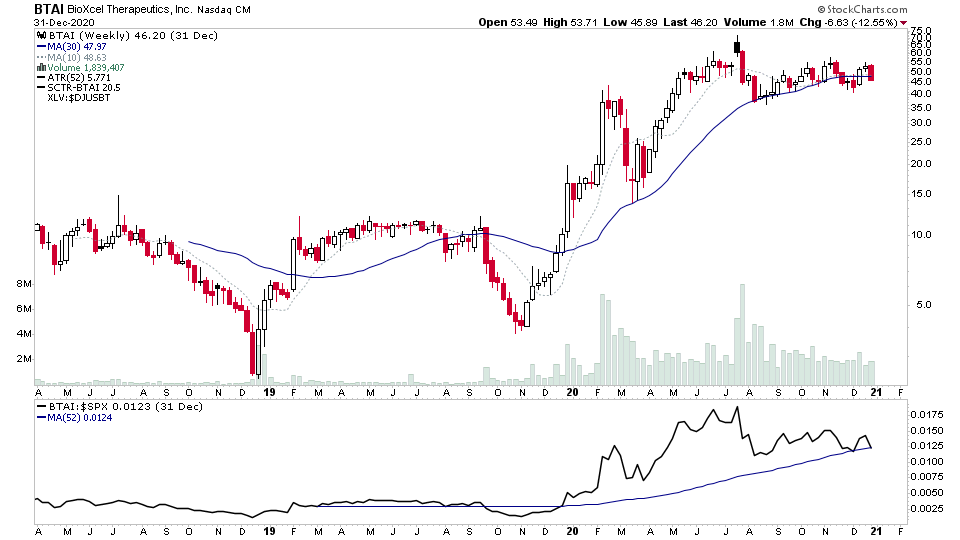

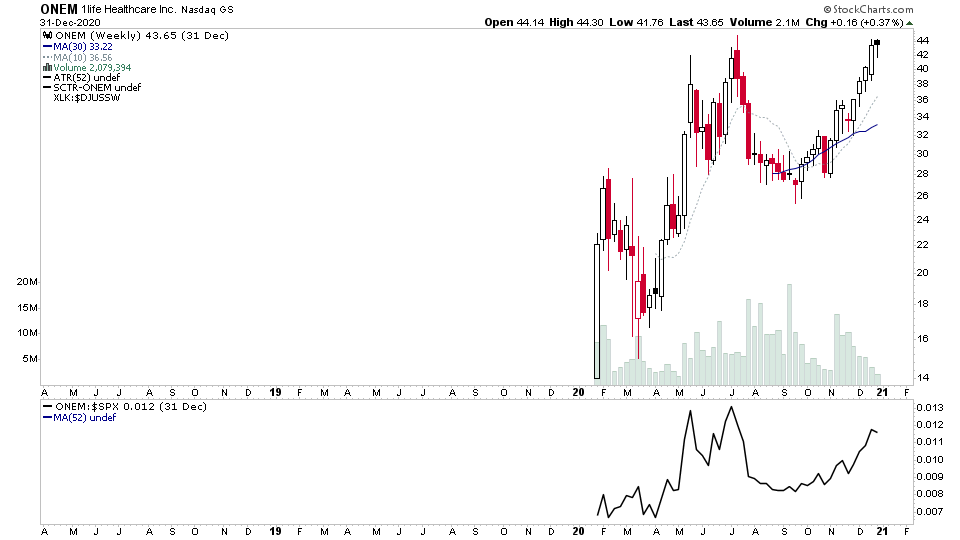

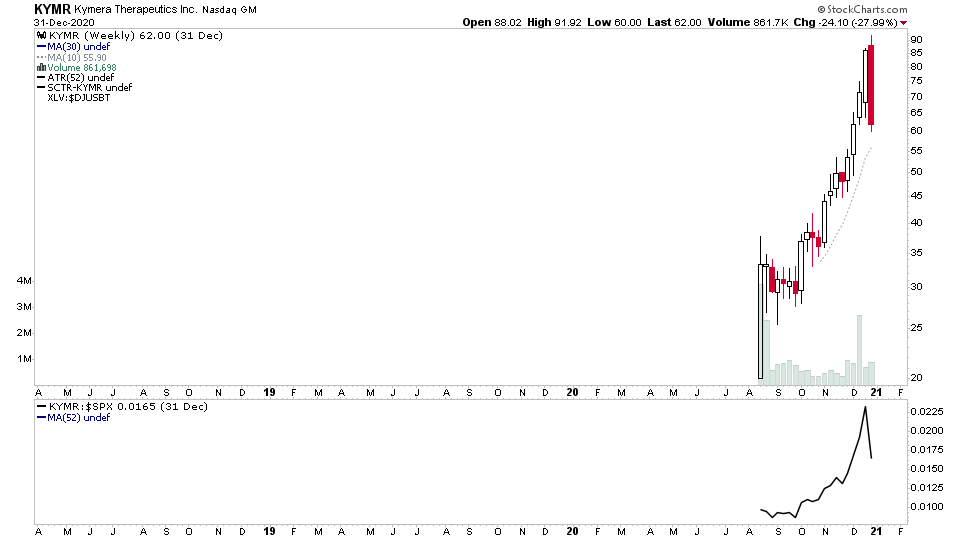

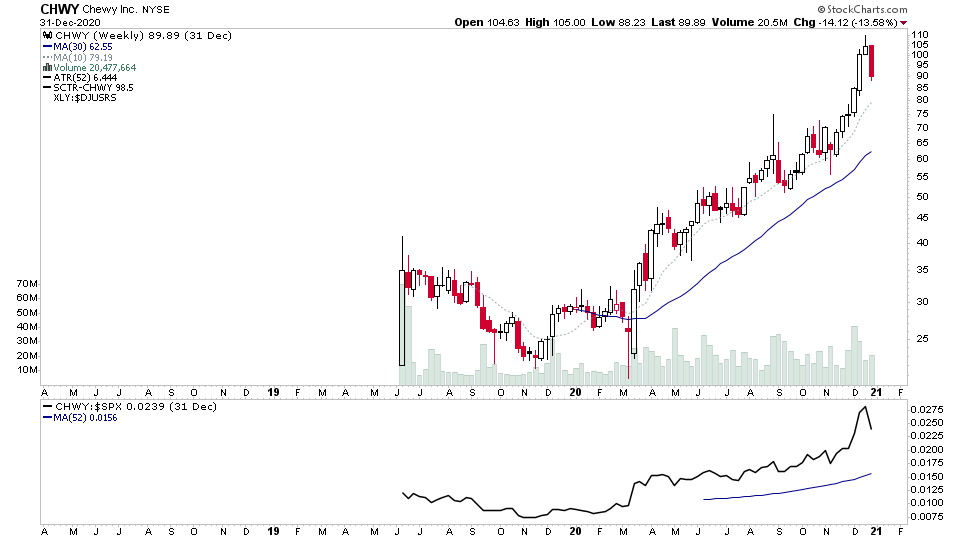

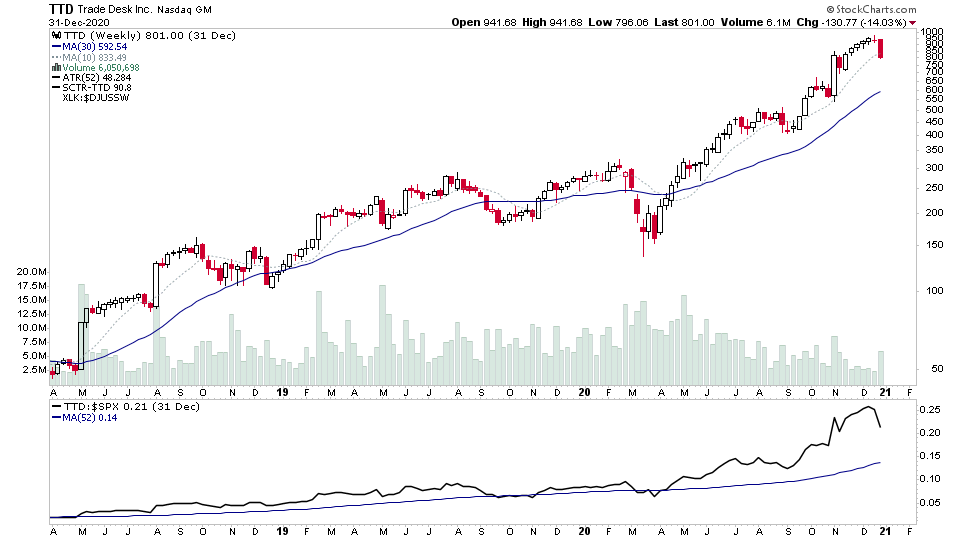

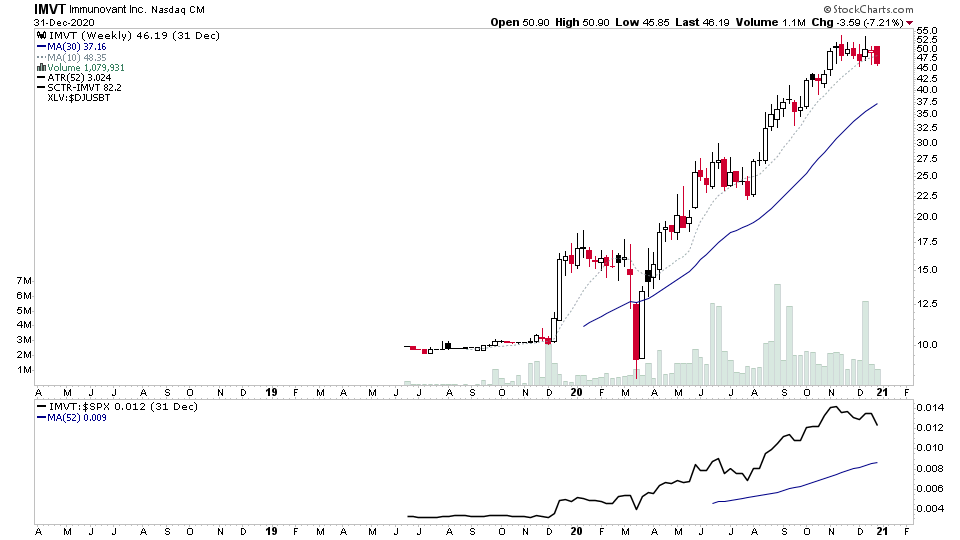

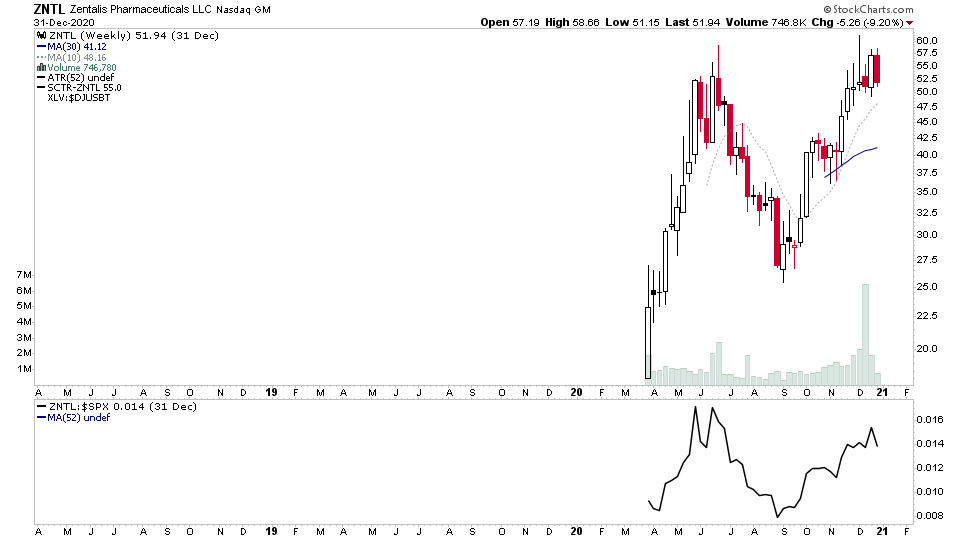

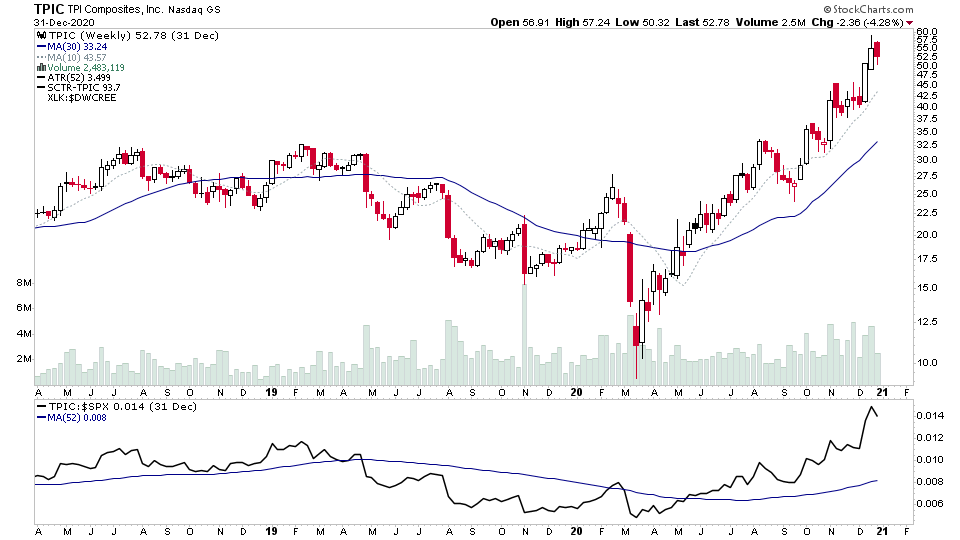

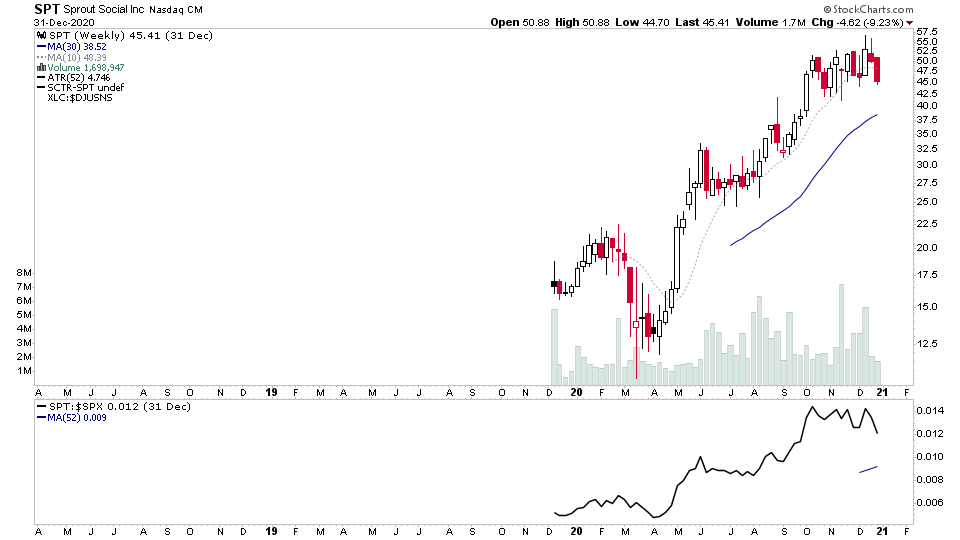

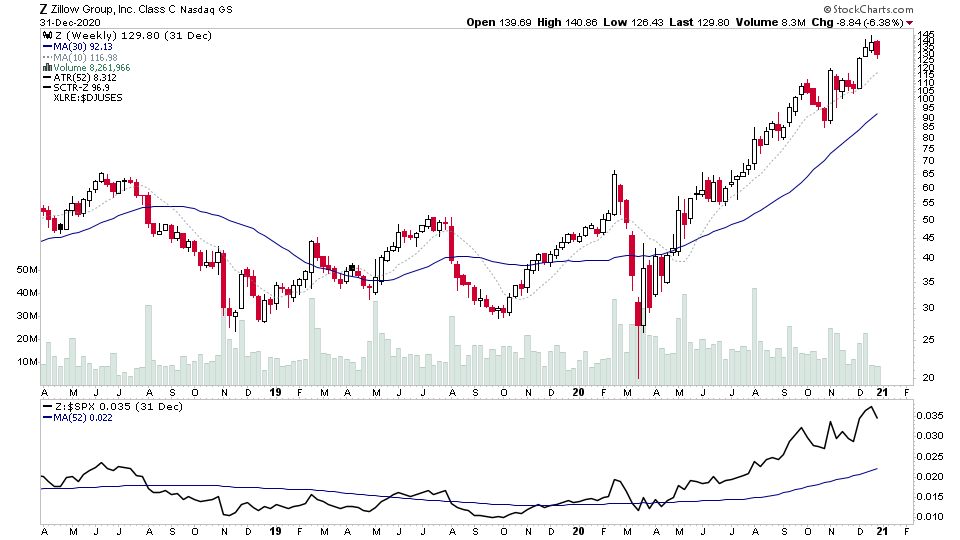

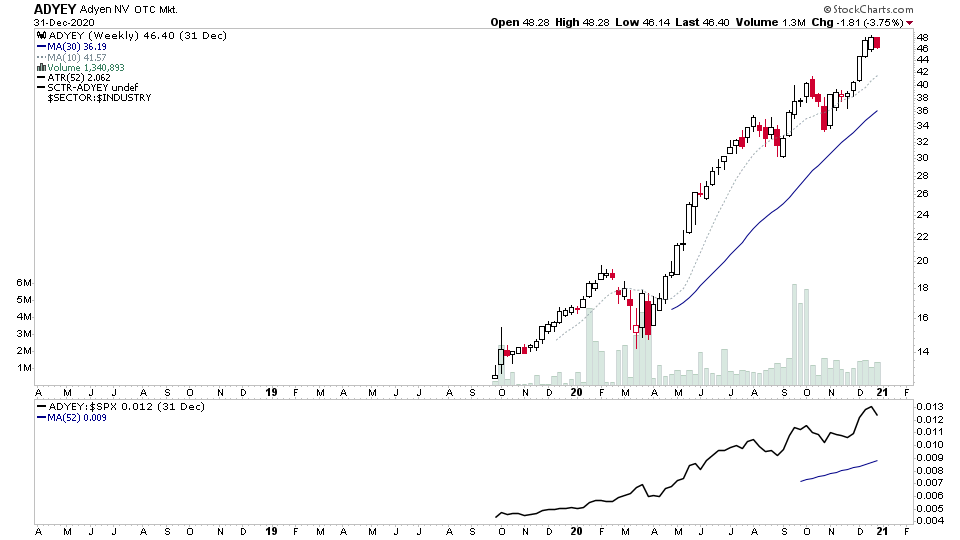

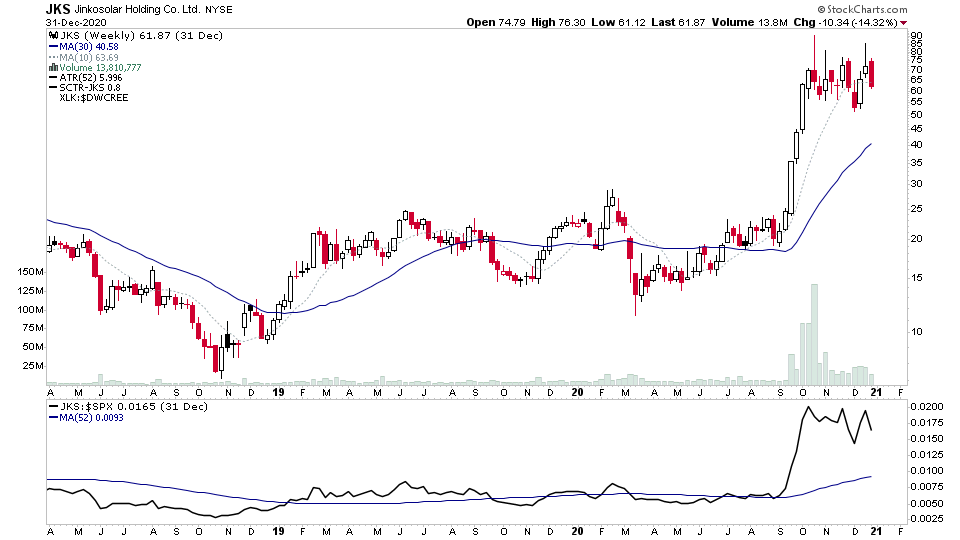

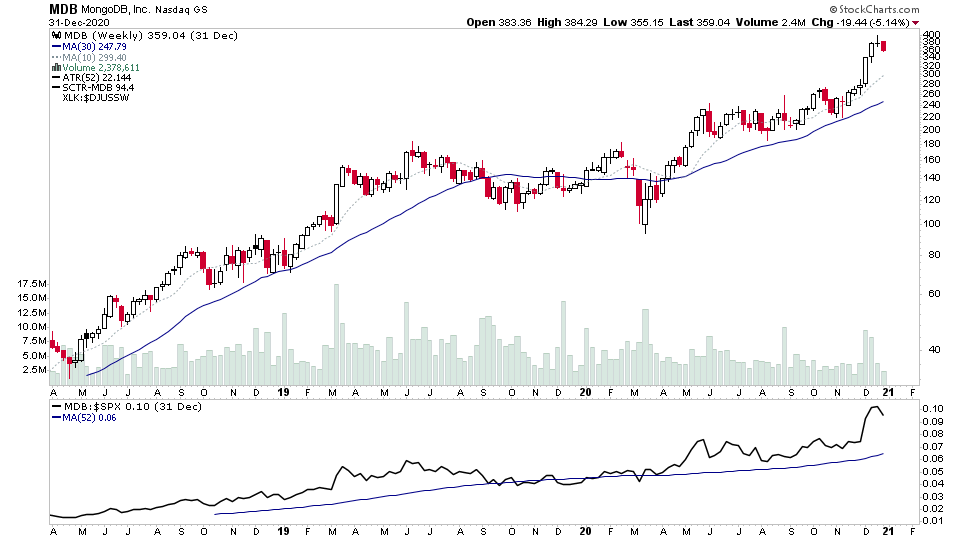

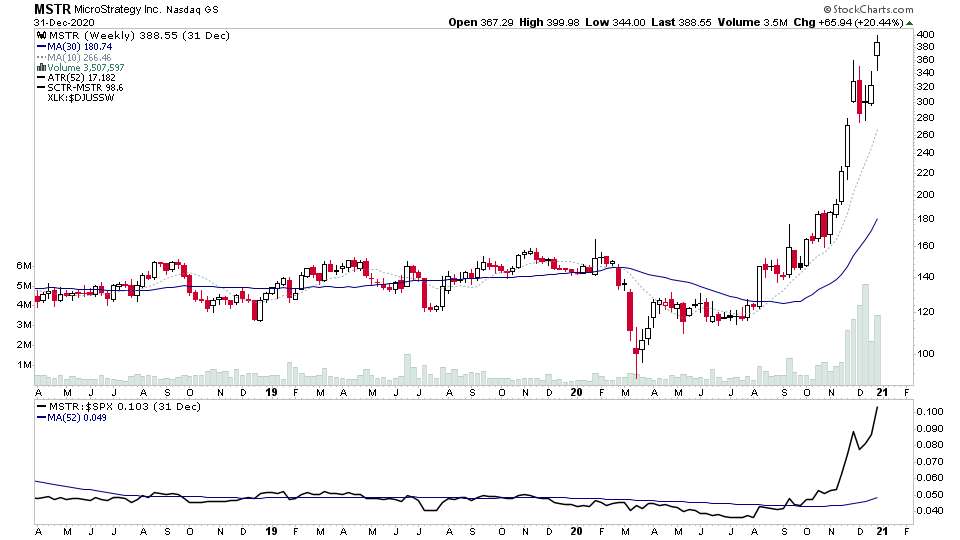

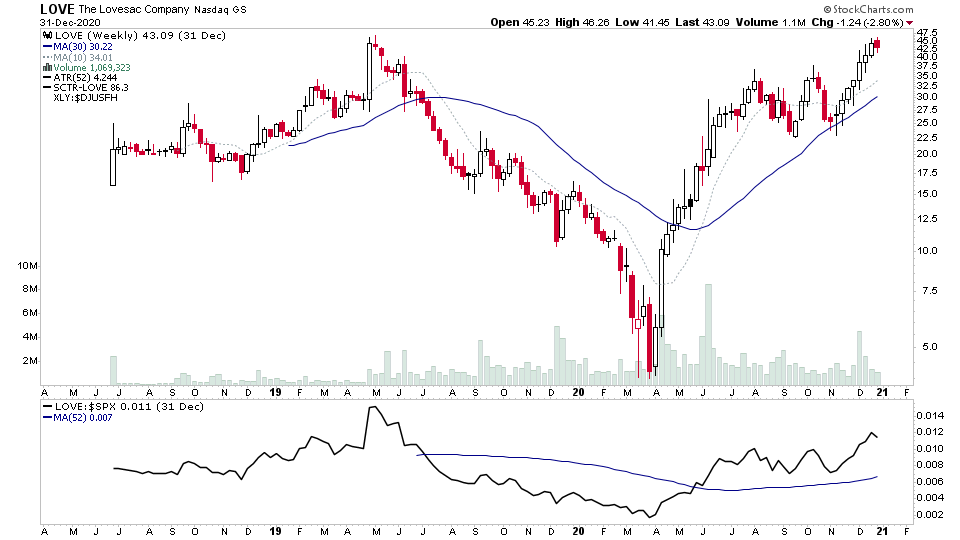

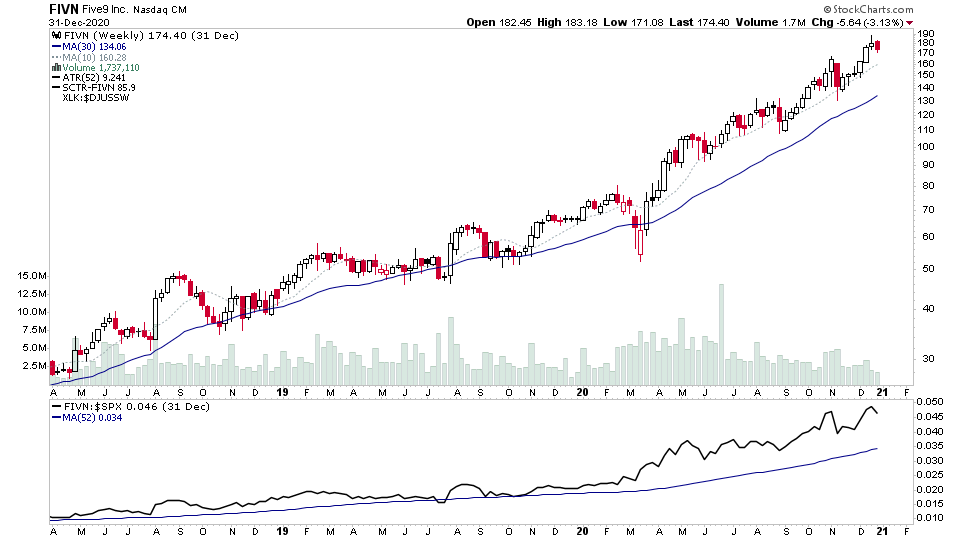

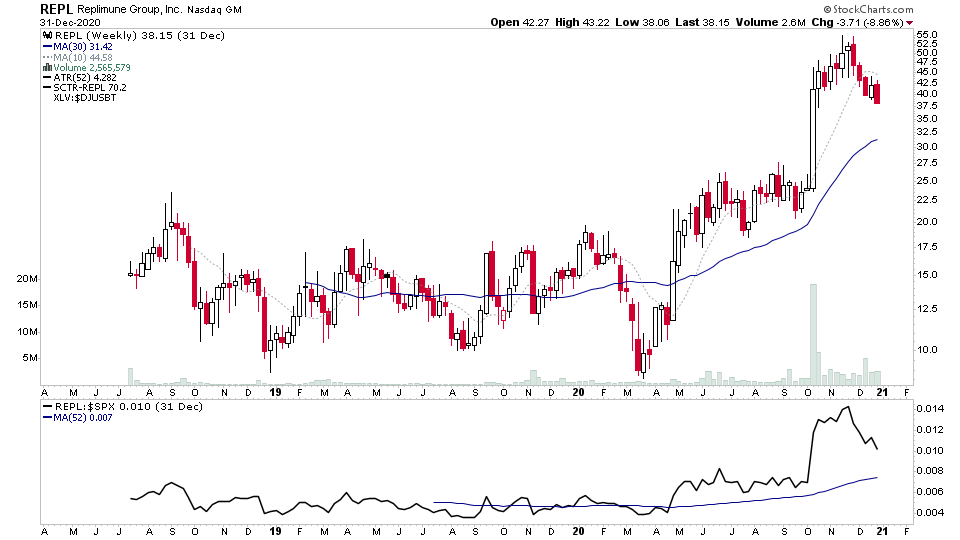

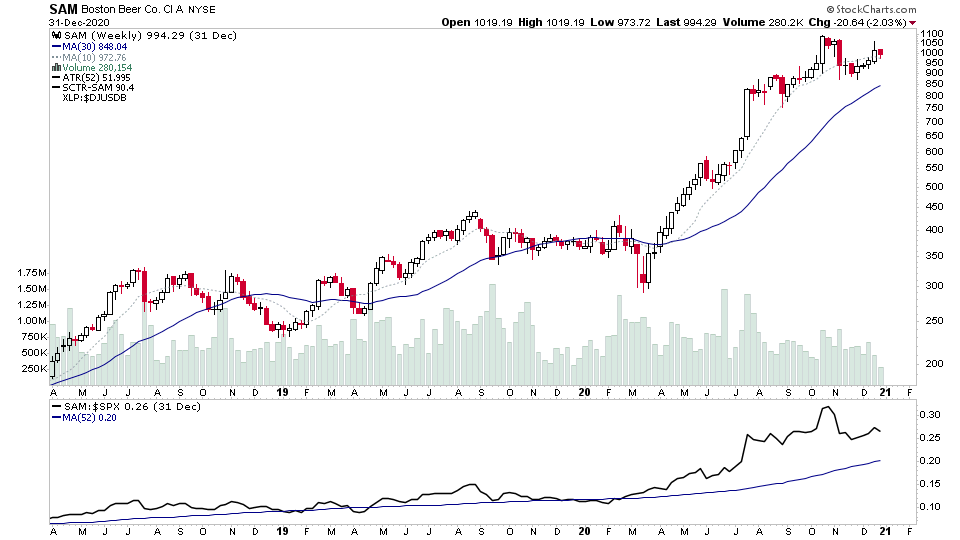

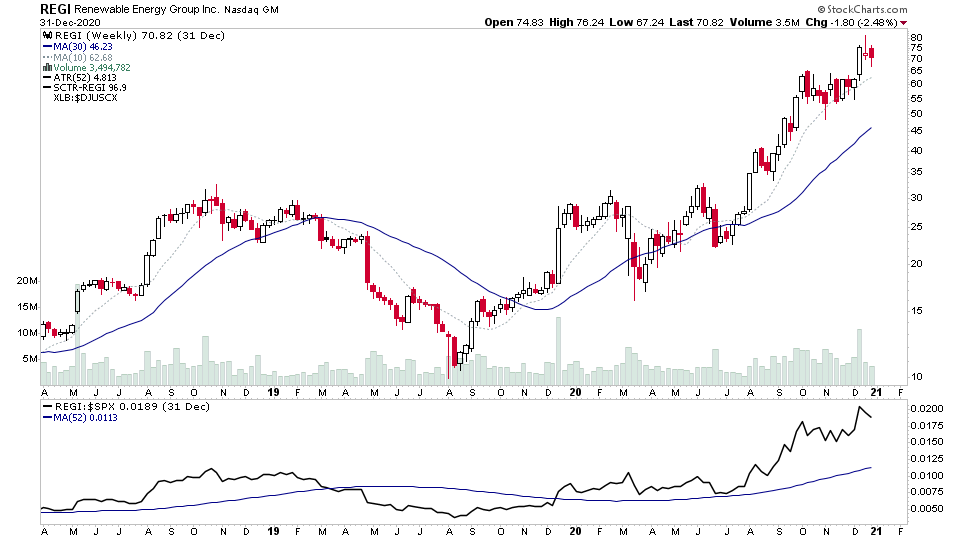

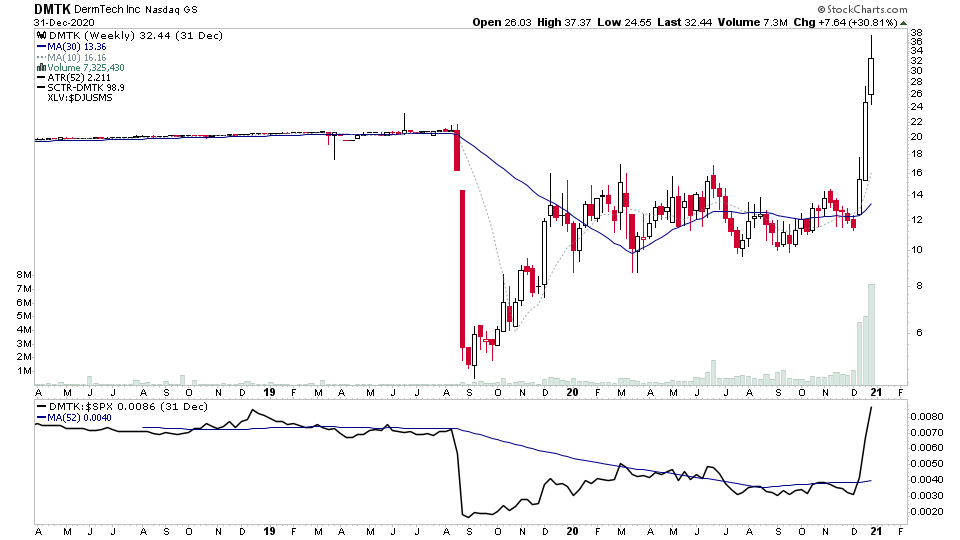

A good exercise would be to study the charts of the top 100 stocks and identify the key characteristics that we look for in Stage Analysis:

- Where was the Stage 2A breakout level?

- What was the Volume like at the breakout point?

- Did the volume contract on the pullback entry point?

- What was the Relative Strength compared to the S&P 500 at the Stage 2A breakout?

- What was the depth of the pullbacks towards the 30 week MA?

- How many bases did the stock have following the Stage 2A breakout?

- What was the group price action like at the breakout. i.e. did multiple stocks in the group have equally strong Stage 2 advances?

- Is the stock still in Stage 2, or has it topped and is forming Stage 3, or even broken down into Stage 4?

- Where were the Trader method entry points etc?

There are many other questions that you could ask, but the key to improving is to find out for yourself and study the patterns.

To learn more about how to use the Stage Analysis method. I have a 3.5 hour foundation Video course on Udemy, which has a 30 minute FREE preview, so you can try before you buy. But its very reasonably priced anyway. Go to: https://www.udemy.com/course/learn-stock-trading-investing-techniques-stage-analysis/?referralCode=9D25591C34FF56918379

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.