US Stocks Watchlist – 19 June 2022

The full post is available to view by members only. For immediate access:

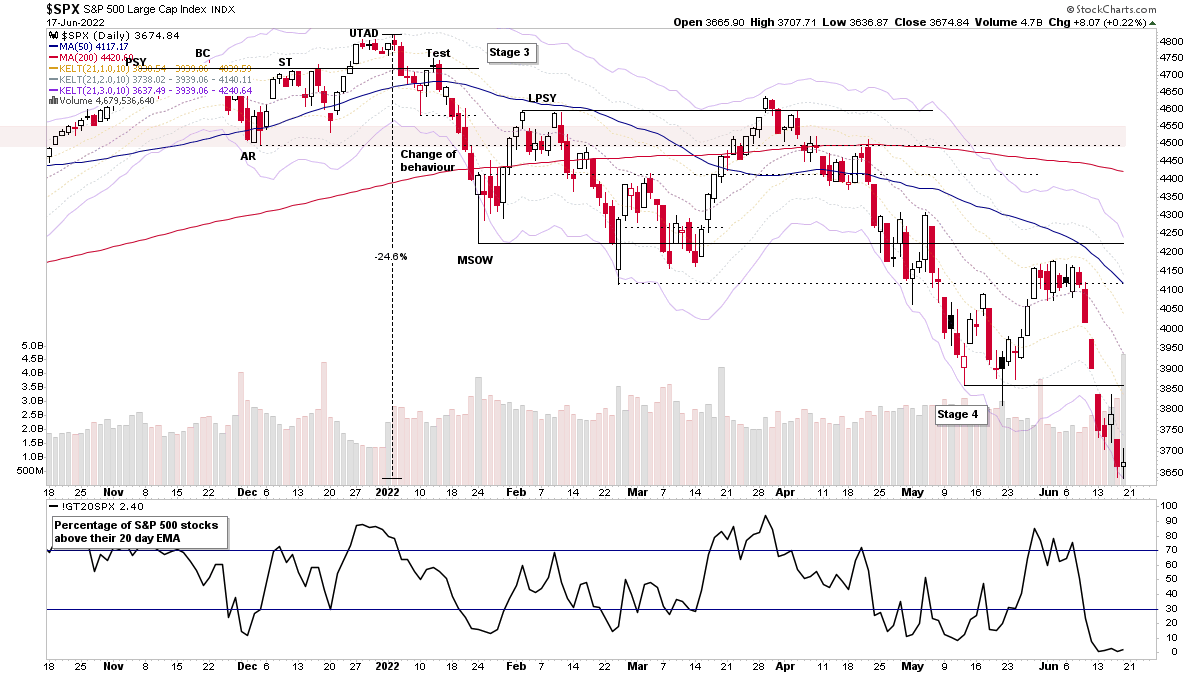

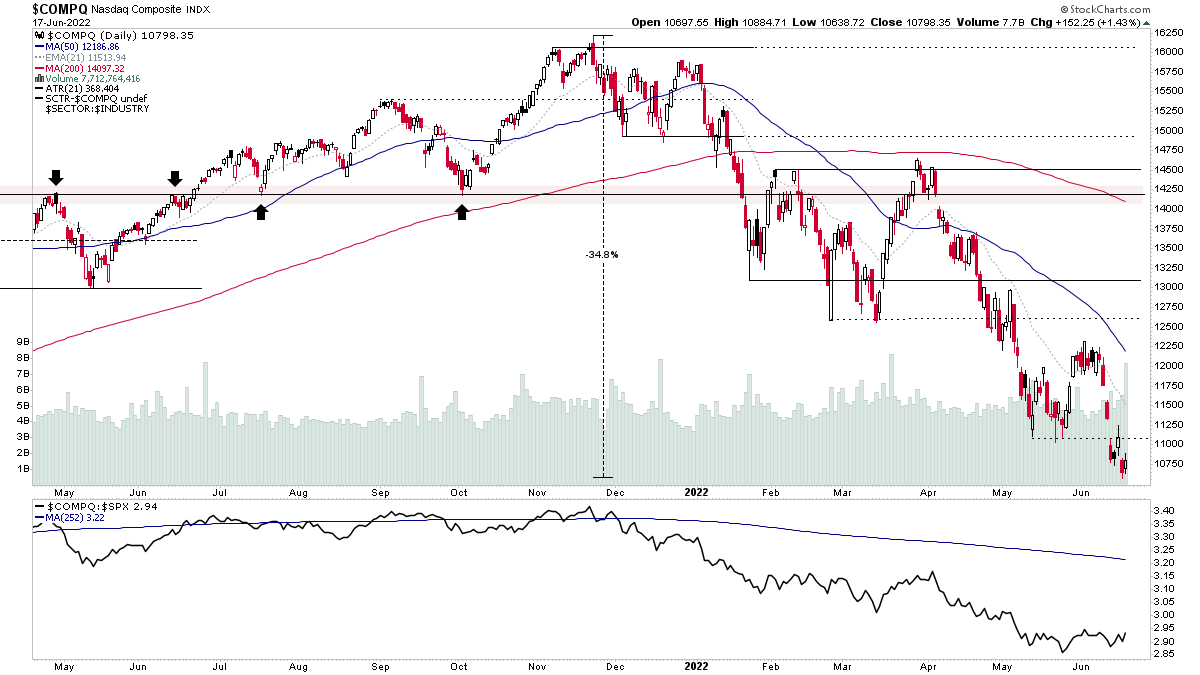

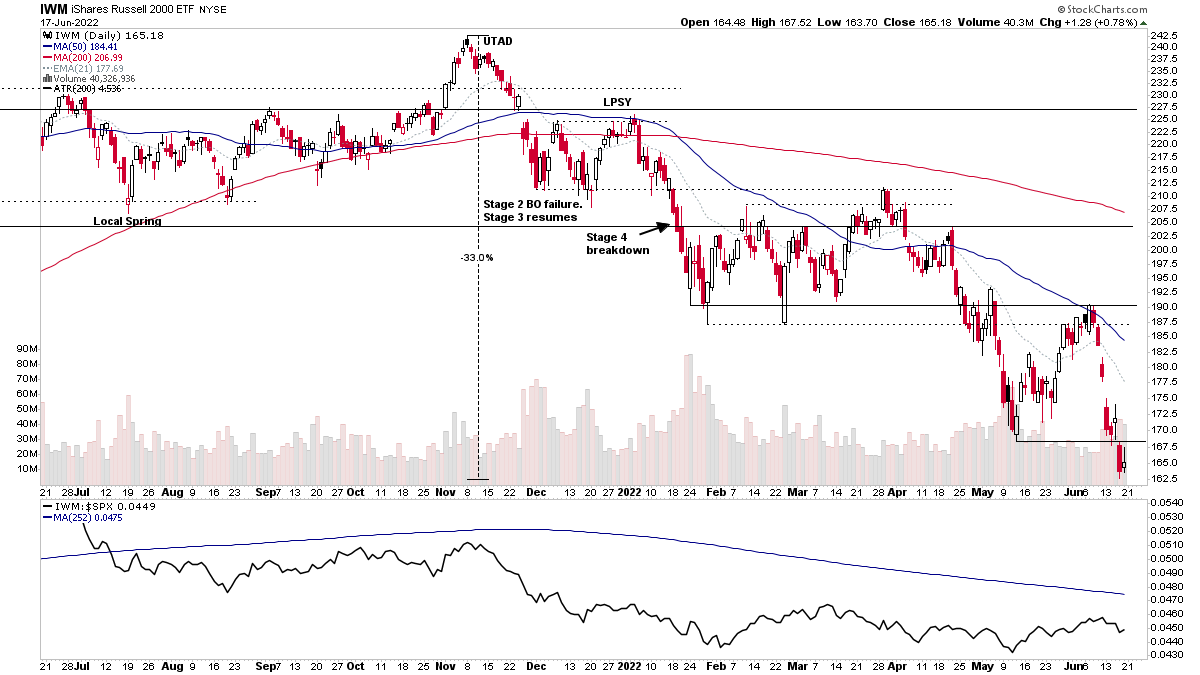

Strong selling continued this week causing a further leg lower in the stock market Stage 4 decline with the major indexes (i.e. S&P 500, Nasdaq Composite and Russell 2000 etc) all closing below their recent base structures and are now at percentage levels off the highs that rival major bear markets of the past.

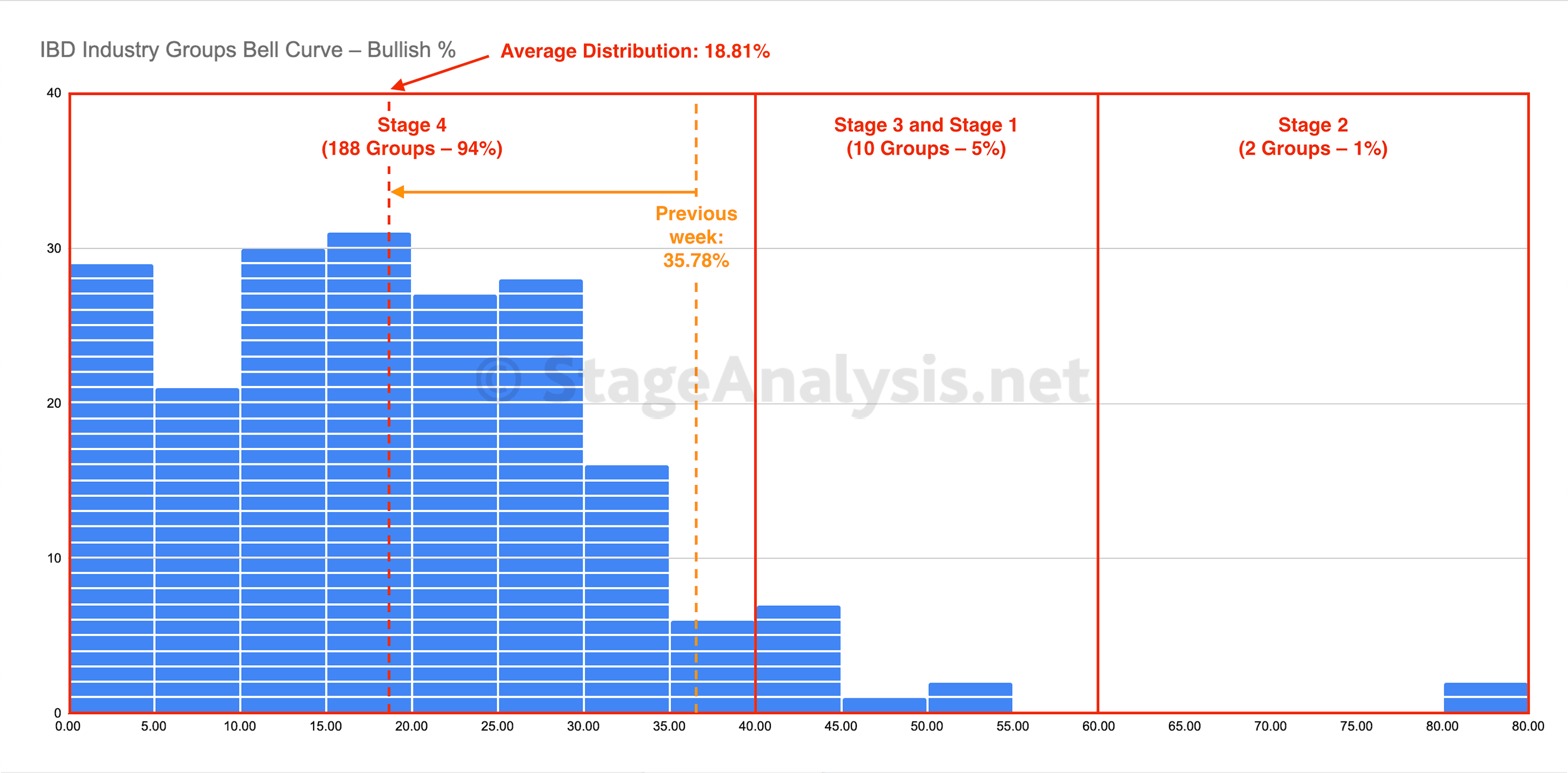

The amount of US Industry Groups in Stage 4 has hit extreme levels also, with 98% now in the Stage 4 with an average distribution of the Industry Groups Bell Curve at 18.81%. See the full post at: IBD Industry Groups Bell Curve – Bullish Percent

US Stocks Watchlist – 19 June 2022

There were 40 stocks for the US stocks watchlist from the weekend scans.

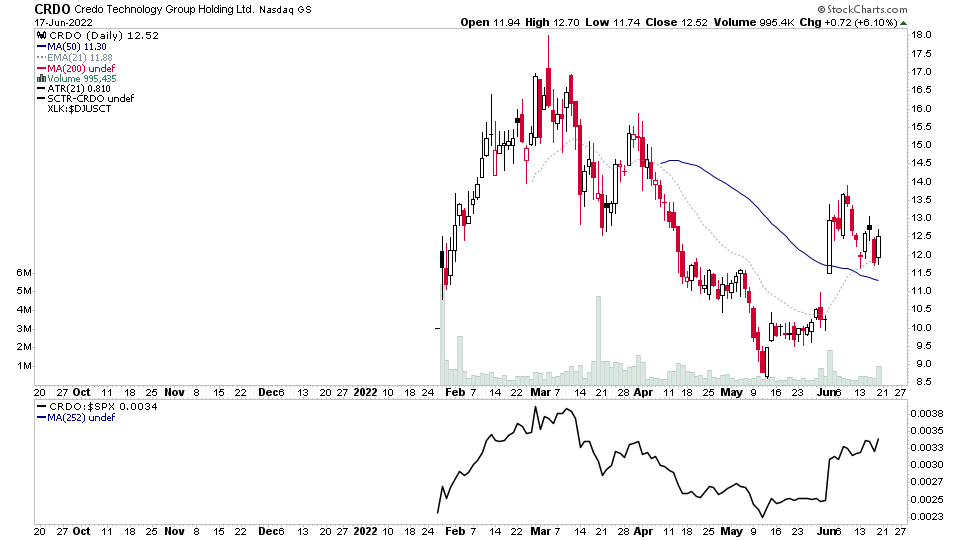

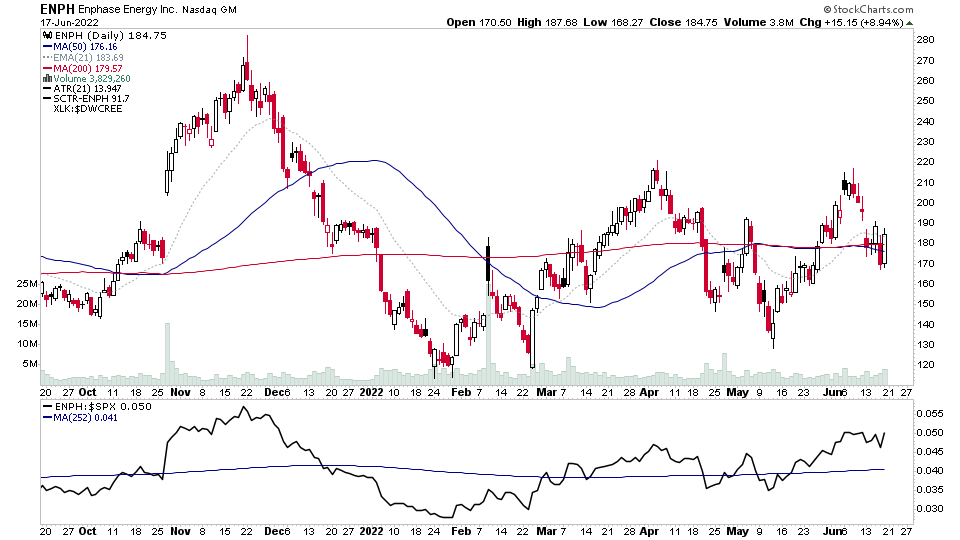

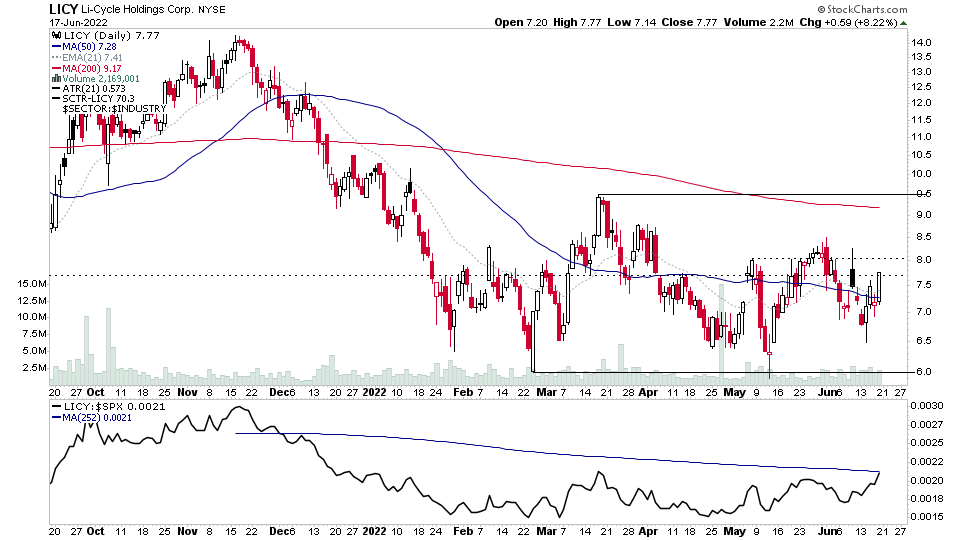

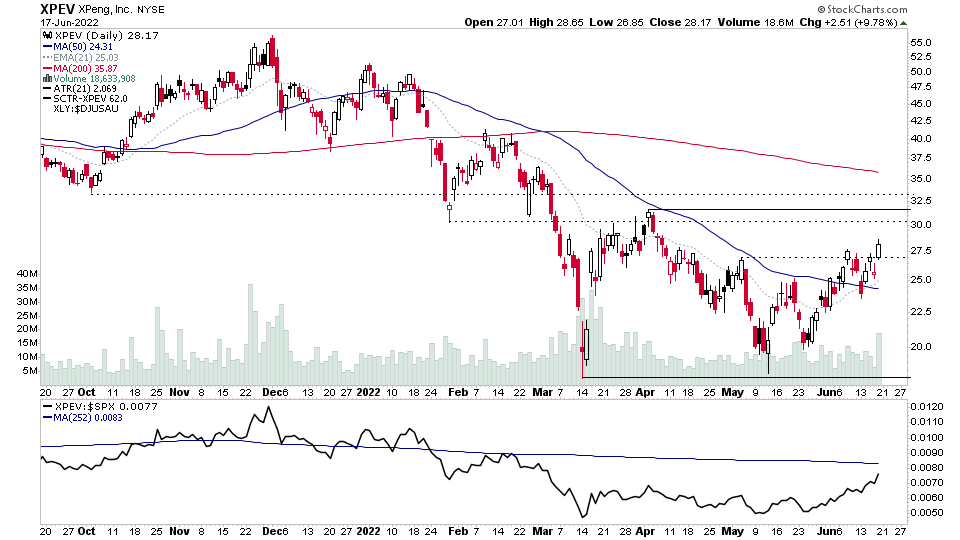

CRDO, ENPH, LICY, XPEV + 36 more...

I'll talk through the watchlist stocks, indexes, industry groups, market breadth and carnage in the crypto coins a bit later today (Sunday 19th) in the Members Weekend Video.

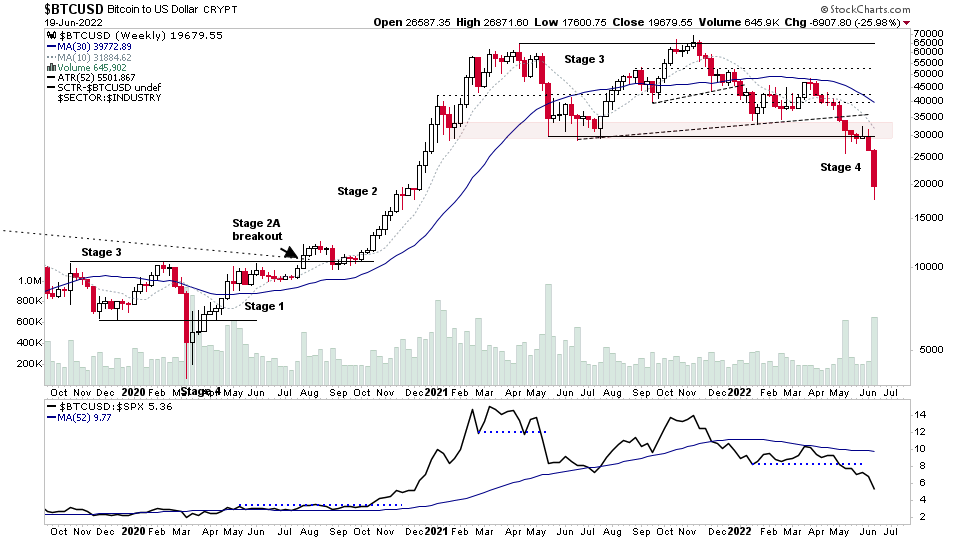

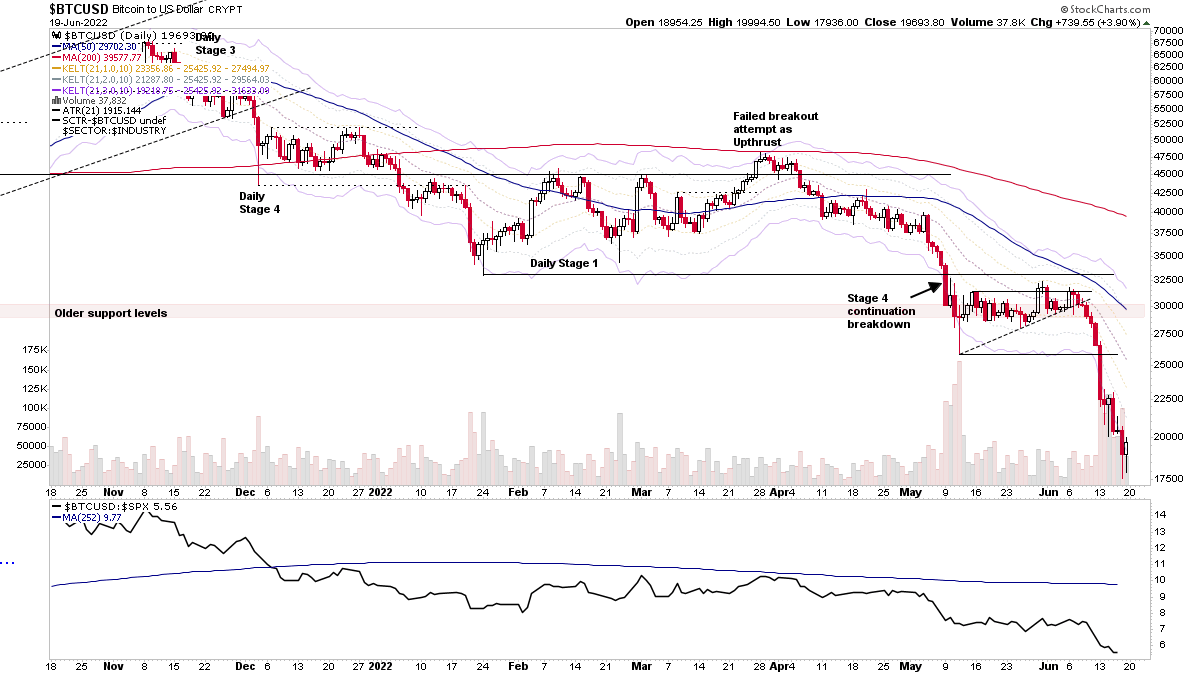

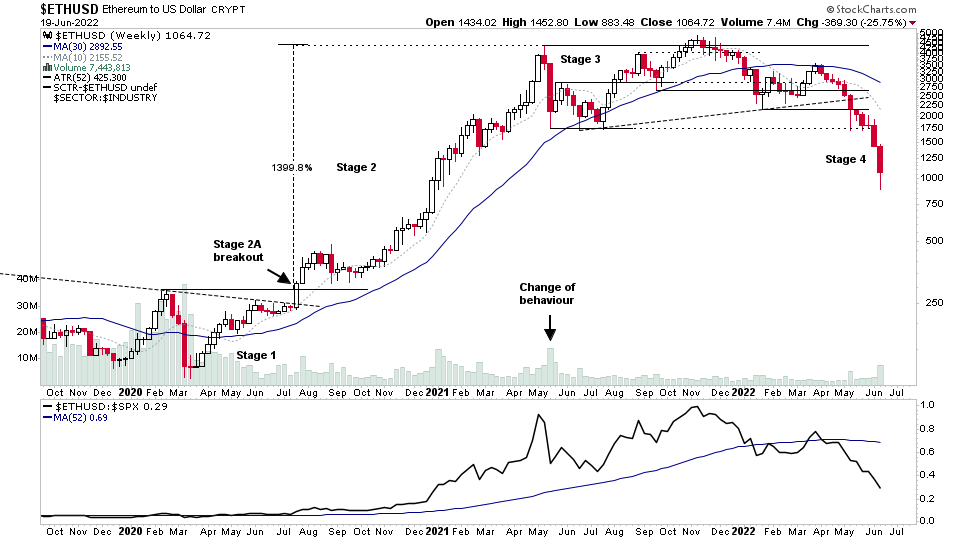

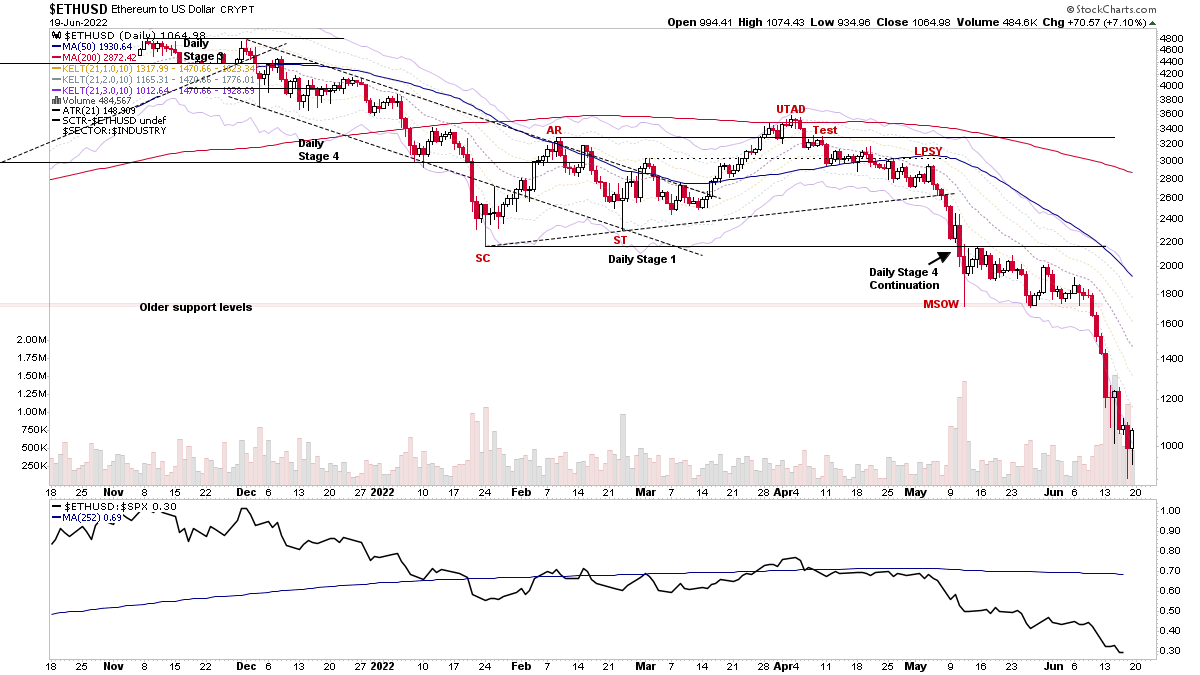

Crypto Carnage: Stage 4 in Bitcoin & Ethereum Deepens

Liquidation type selling in cryptoland as the Stage 4 decline in crypto coins generals Bitcoin and Ethereum picks up momentum, causing further carnage in the altcoins. With the number of negative crypto related stories exploding online, with the likes of Ponzi scheme trending on twitter for example in relation the coins and staking.

Many people are asking where will the selling end, which is always an unknown until after the fact, and as you've seen from the multitude of growth stocks this year, it can fall a lot further than you might think, and even if it's fallen 90% already. It doesn't mean it couldn't still fall another 90% from here. However, there are technical analysis methods for creating targets from simple swing targets to more complex horizontal point and figure base counts and projections. But there is a fair amount of debate on their effectiveness.

All you need to know from a Stage Analysis perspective is that they virtually all in a deep Stage 4 decline, with only a few feeble attempts to stop the decline so far. Hence, even if it bottoms immediately, then it would still be a very long way from the Stage Analysis or Wyckoff method entry zones, as the overhead resistance will be massive and take a long time to deal with. So unless you are short from higher levels, then it remains an avoid in terms of the method/s until at least we start to see signs of basing, a change of behaviour with a strong counter trend rally and relative strength once more.

"Don't try to catch a falling knife"

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.