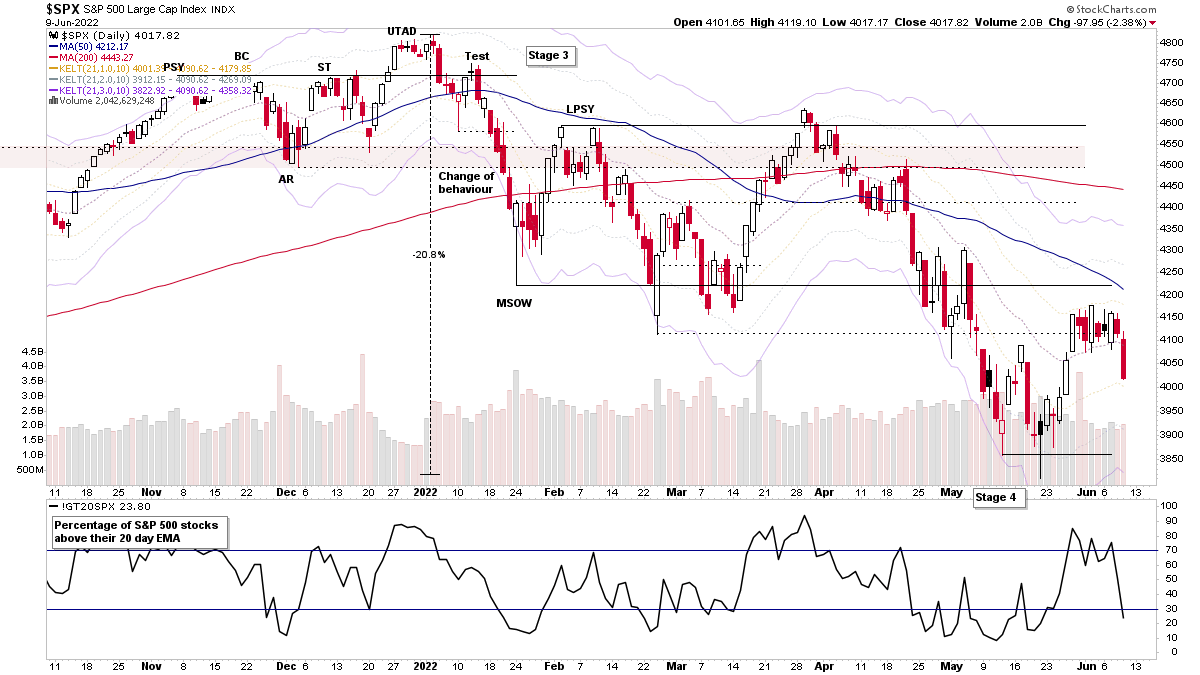

Stage 4 Trend Reasserts Itself – 10 June 2022

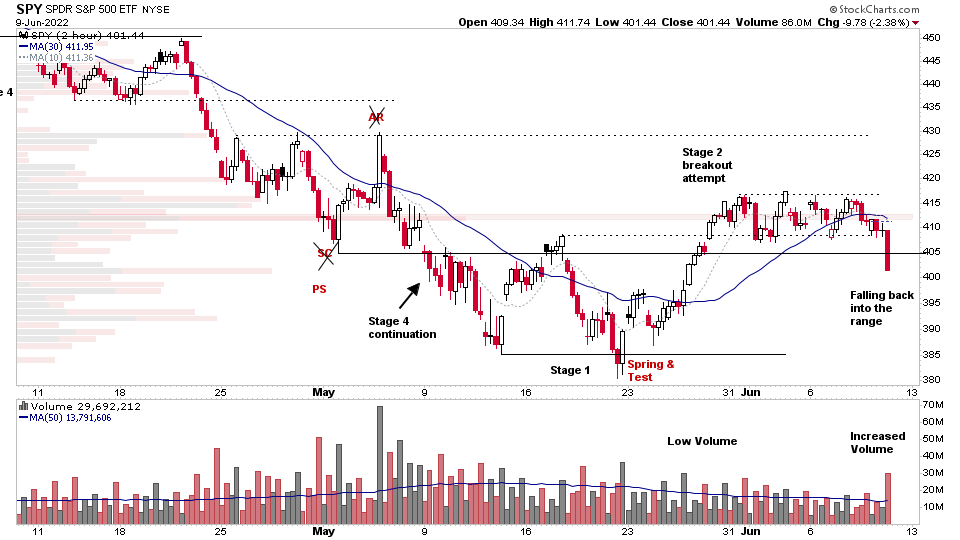

Broad based selling today with stocks accelerating to the downside in the afternoon session after initially attempting to hold up during the morning, and if you zoom into the intraday 2 hour chart (see below), you can see that there was increased volume in the final two hours, as the S&P 500 broke back down into the intraday Stage 1 range.

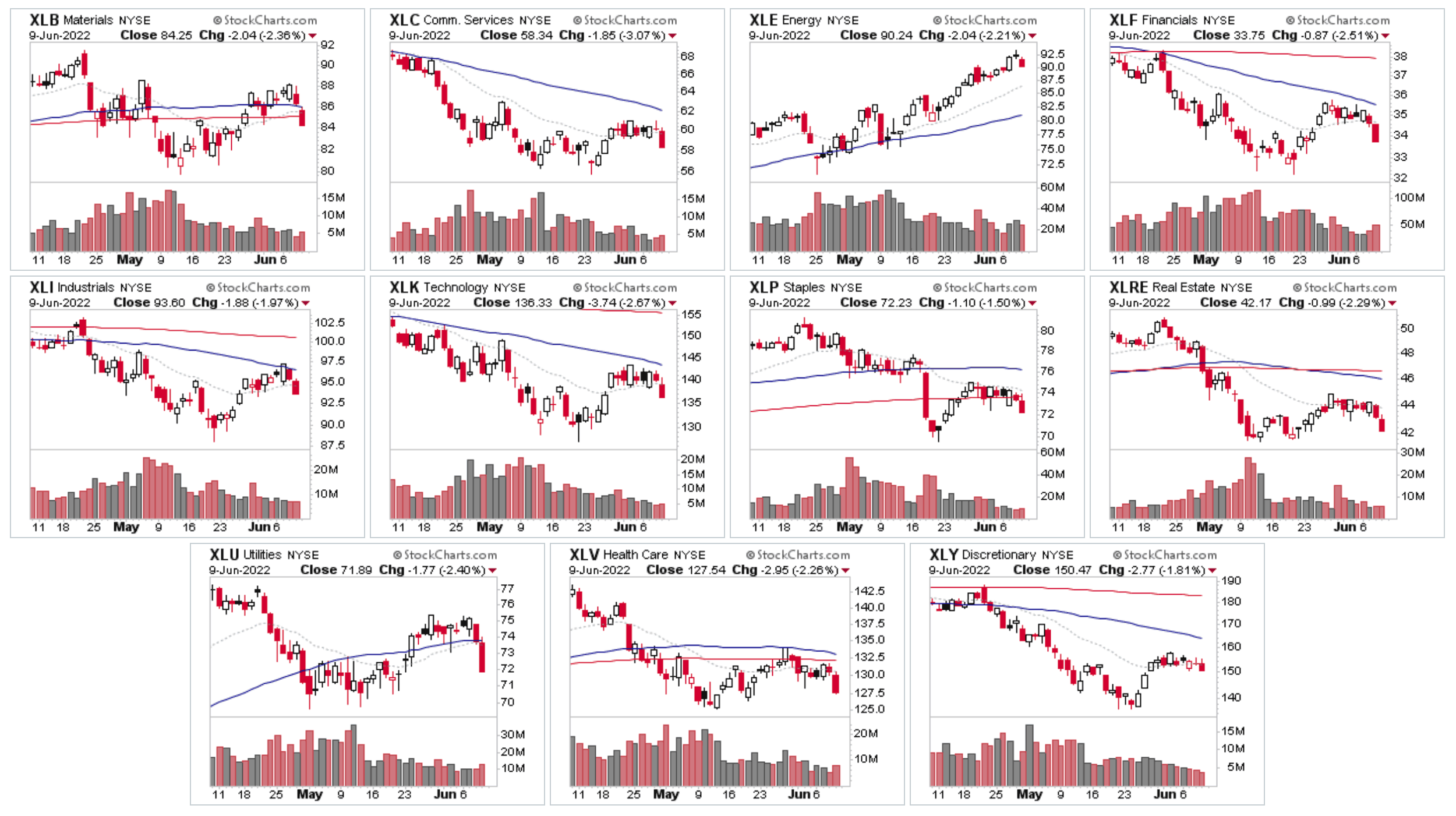

US Sectors

The sector charts (see below) show that there was strong declines in all sectors of the market with even the Energy sector not escaping the selling, and of note was a strong move below the 50 day MA in the Utilities sector, which continues to look like it is developing in Stage 3. Which leaves Energy (XLE) as the only remaining Stage 2 sector.

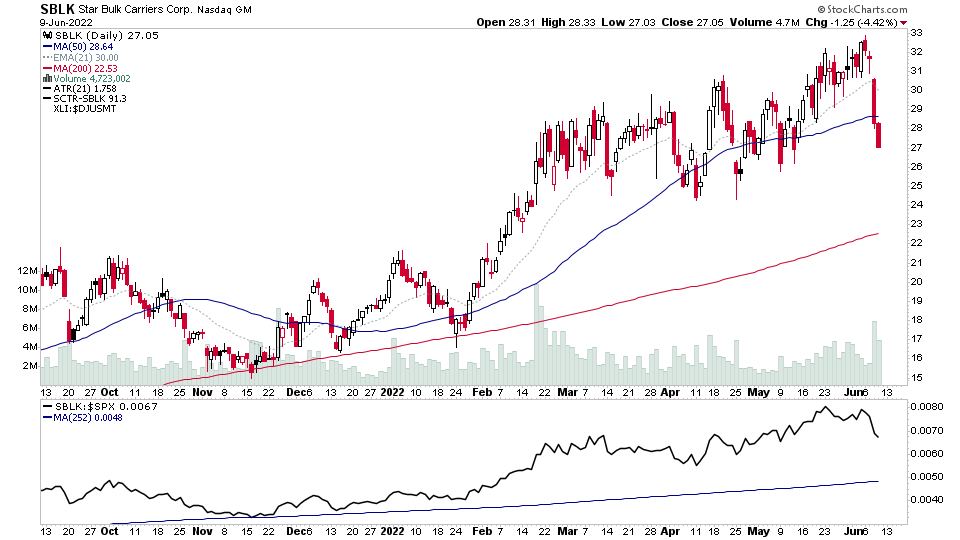

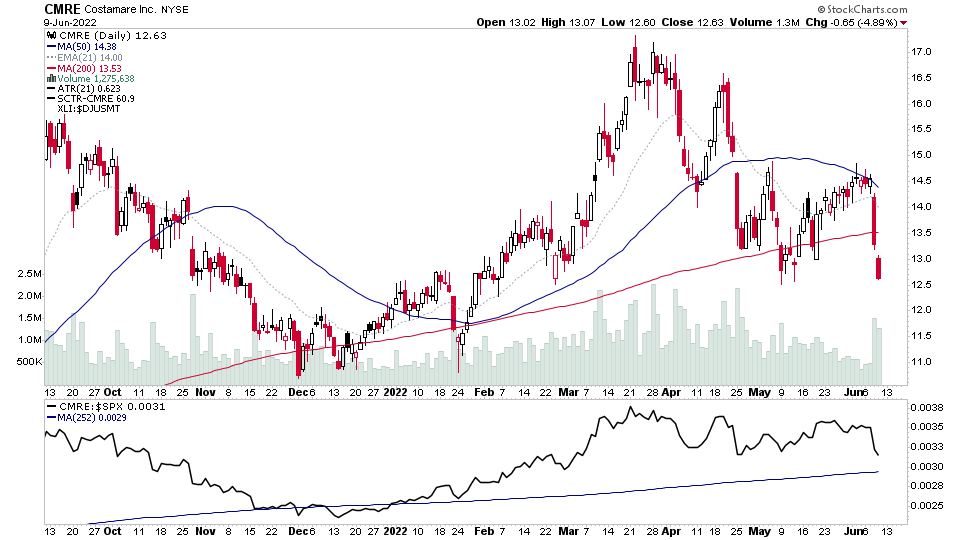

Group Focus: Marine Transportation

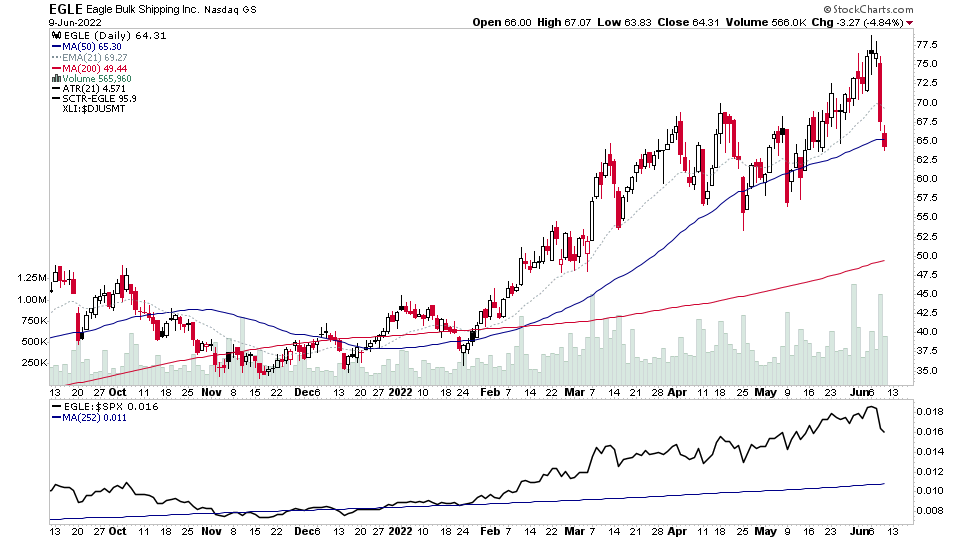

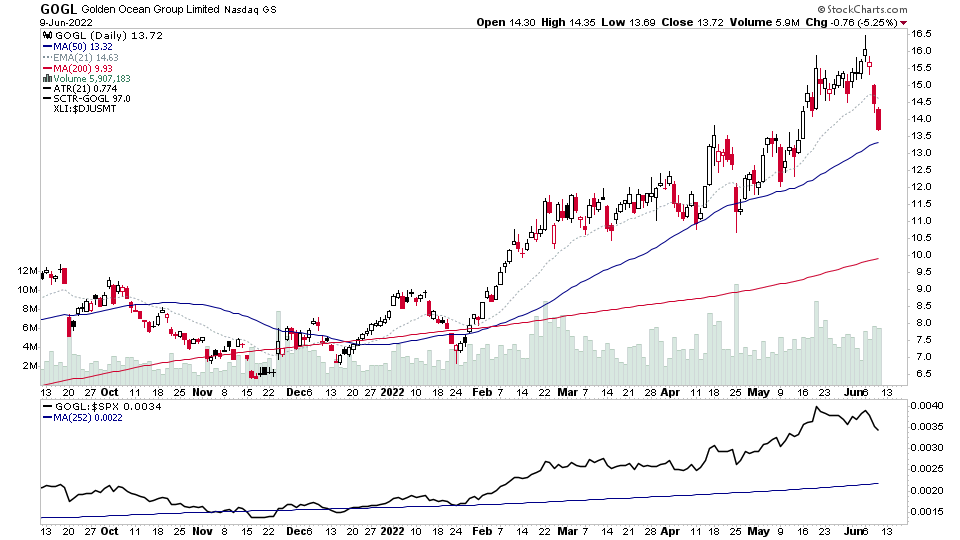

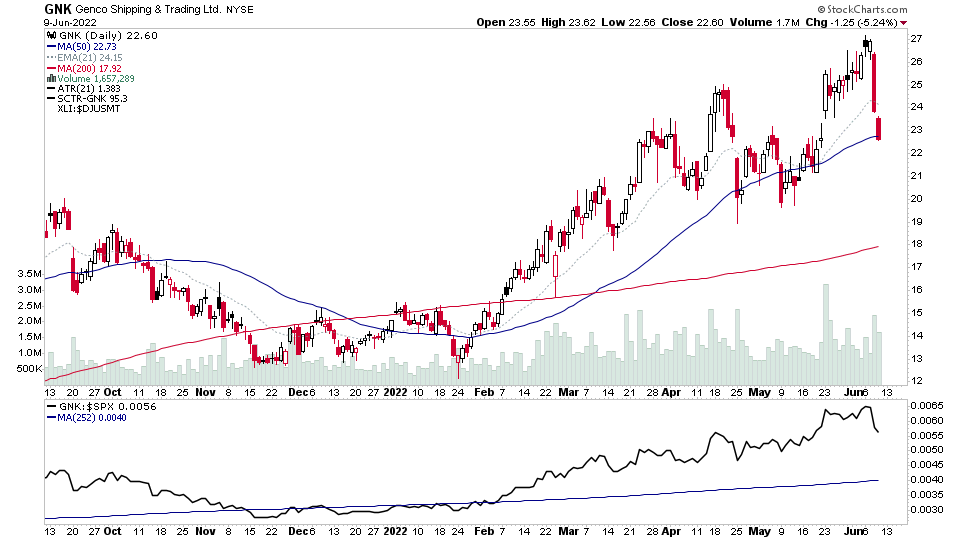

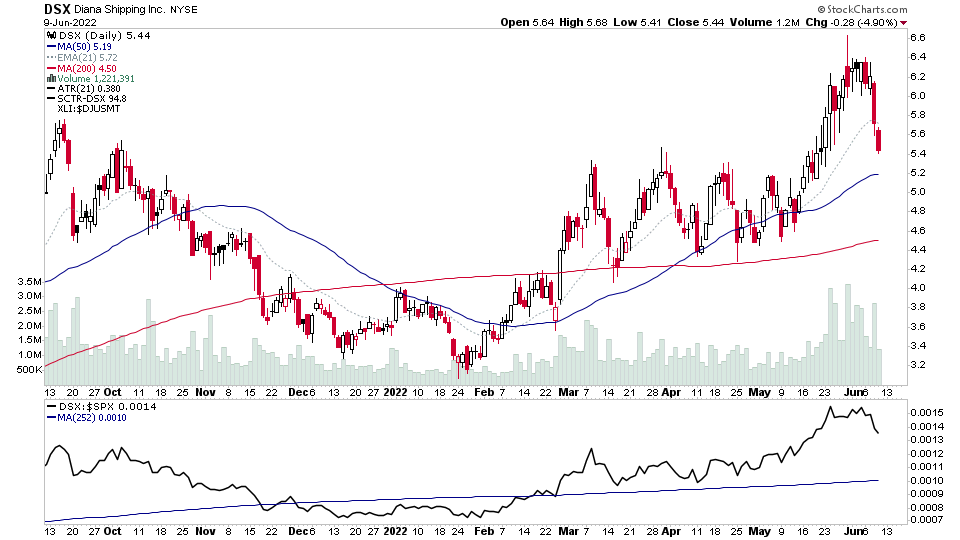

I highlighted yesterday in the private twitter feed the change of behaviour in multiple Marine Transportation stocks. Which has been one of the leading areas of the market this year, with numerous stocks in the group making Stage 2 advances higher while the broad market has been declining in Stage 4.

The group is showing bearish engulfing candles on multiple stocks on the weekly charts in Stage 2. So, are we seeing another of the few remaining strong areas of the market being taken out by the termites as Stan Weinstein called it in the recent interview in early April. That have been gradually eating away at the strong areas one by one, with only a very few still remaining now.

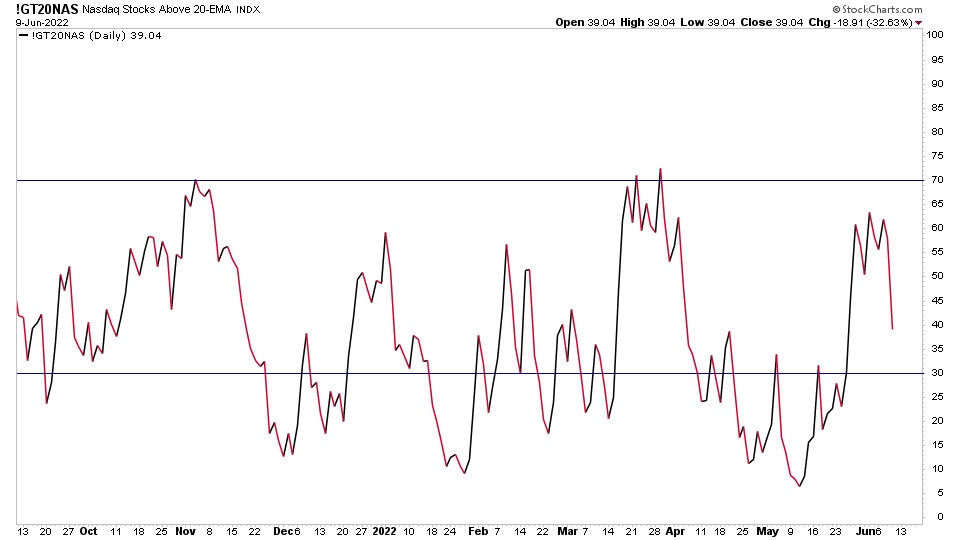

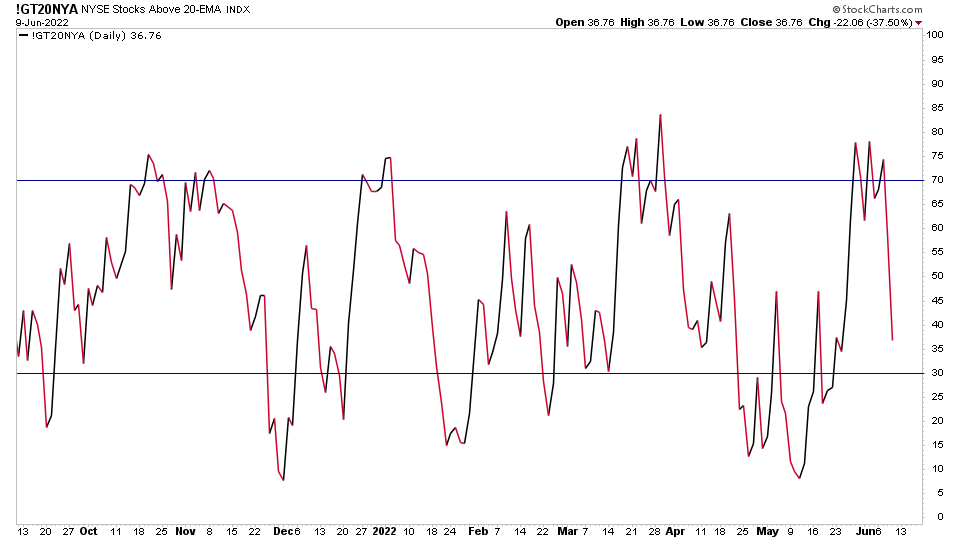

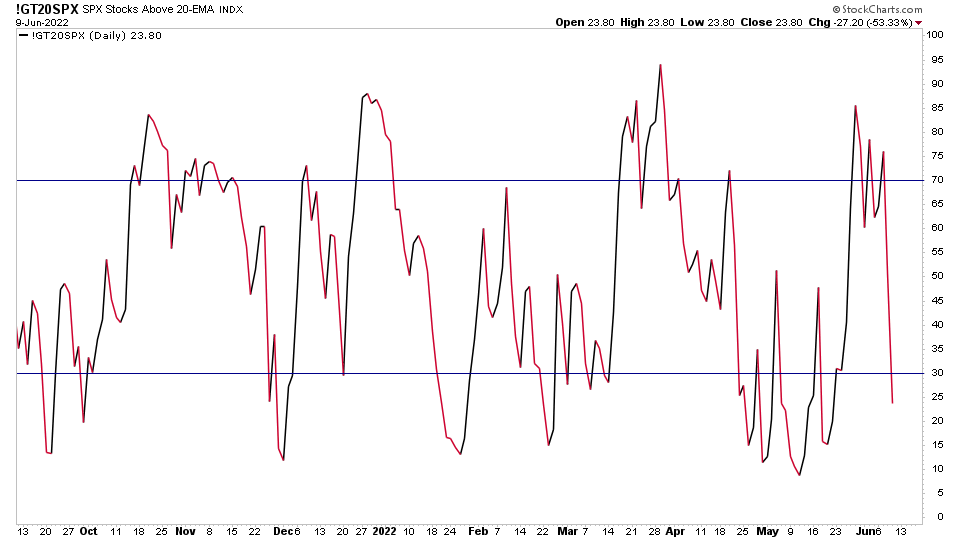

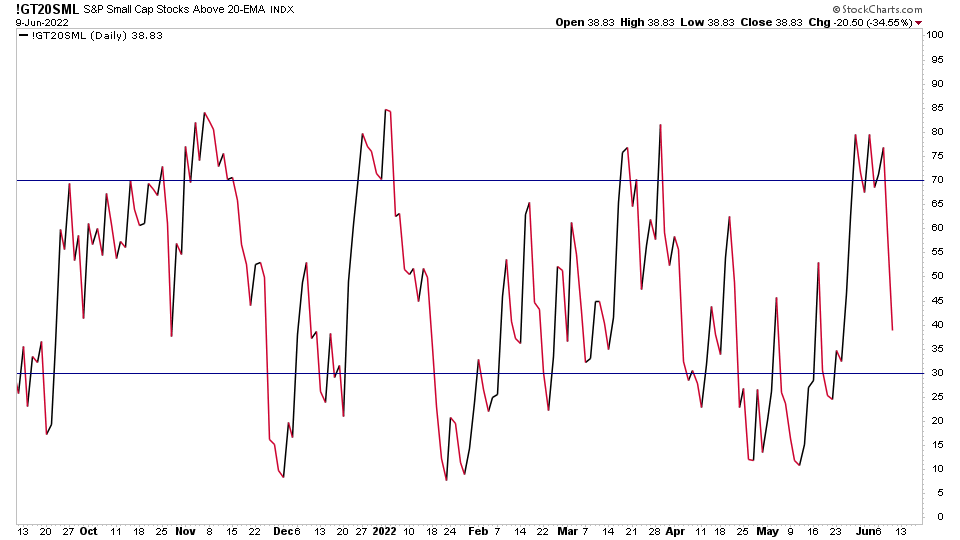

Market Breadth: Percentage of Stocks Above Their 20 Day EMAs

I talked about the breakdown from the upper ranges below their pivots in a few of the Percentage of Stocks Above Their 20 Day EMAs charts yesterday, which changed them to a negative status.

We saw follow through to the downside today and the broader Nasdaq Composite % chart also broke down with almost 19% of stocks in the Nasdaq closing back below their 20 day EMAs today – which takes the total down to 39%, and all the short term MA breadth charts are now back on a negative status.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.