S&P 500 Rebounds from Short Term Moving Average Test and the US Stocks Watchlist – 7 June 2022

The full post is available to view by members only. For immediate access:

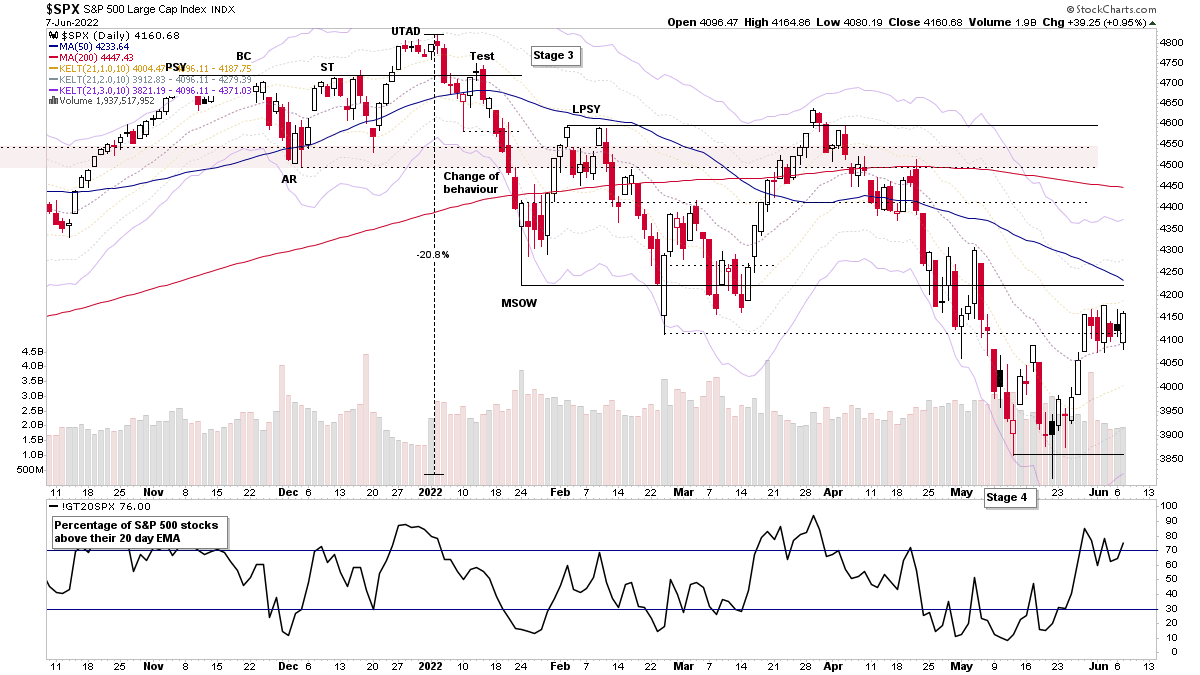

The S&P 500 gapped lower at the open, but rebounded from around its short term 21 day EMA early in the session and progressed steadily higher through the day to close near its highs at +0.95%. Which created an engulfing candle on the daily chart, and sets it up for a potential breakout attempt from the consolidation range that's formed over the last 7 days.

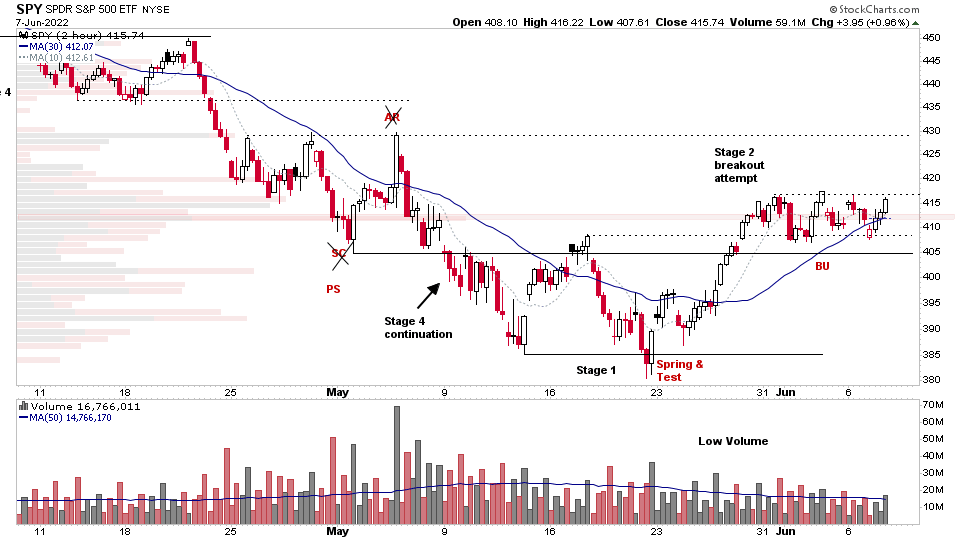

Dropping down to the intraday 2 hour chart, the S&P 500 remains in early Stage 2 on that timeframe in the Backup (BU) range which has developed above the Stage 1 base structure with diminishing volume, and closed the day above the peak volume node. So it's in position for a possible Stage 2 continuation breakout attempt – which if it does, we'd want to see expanding volume ideally, as the next area of resistance is not far away. So it will need strength to overcome it and the declining 50 day MA, which is another closer level of interest that shorts will likely want to test if it reaches it.

US Stocks Watchlist – 7 June 2022

There were 40 stocks for the US stocks watchlist today.

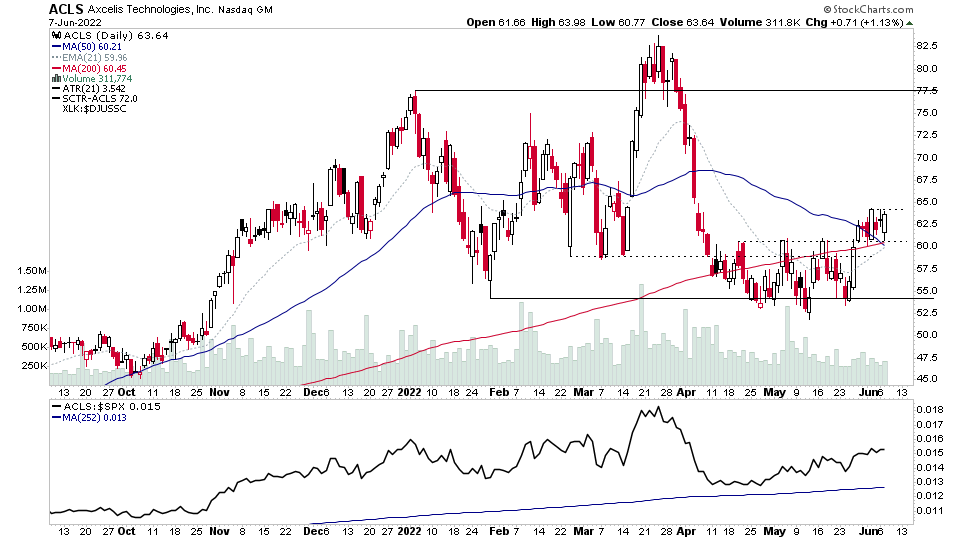

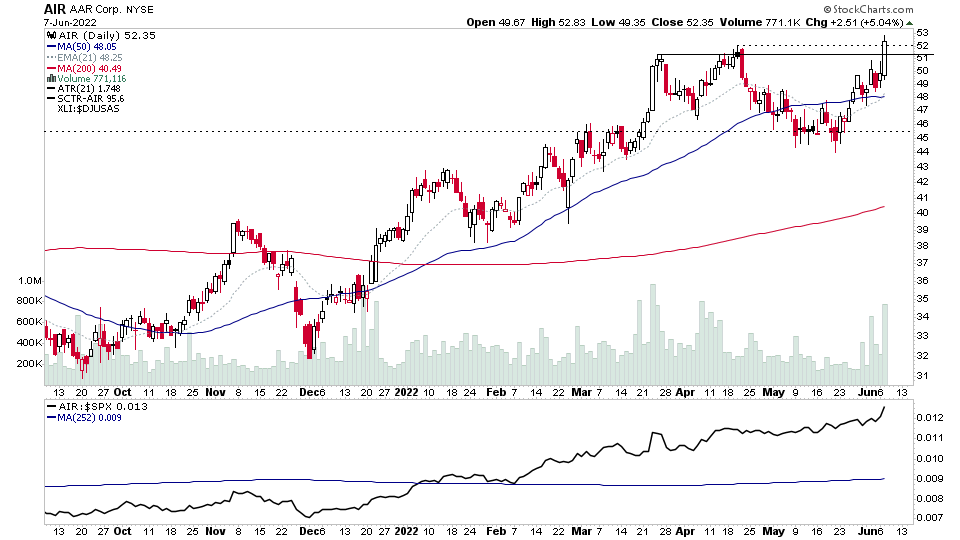

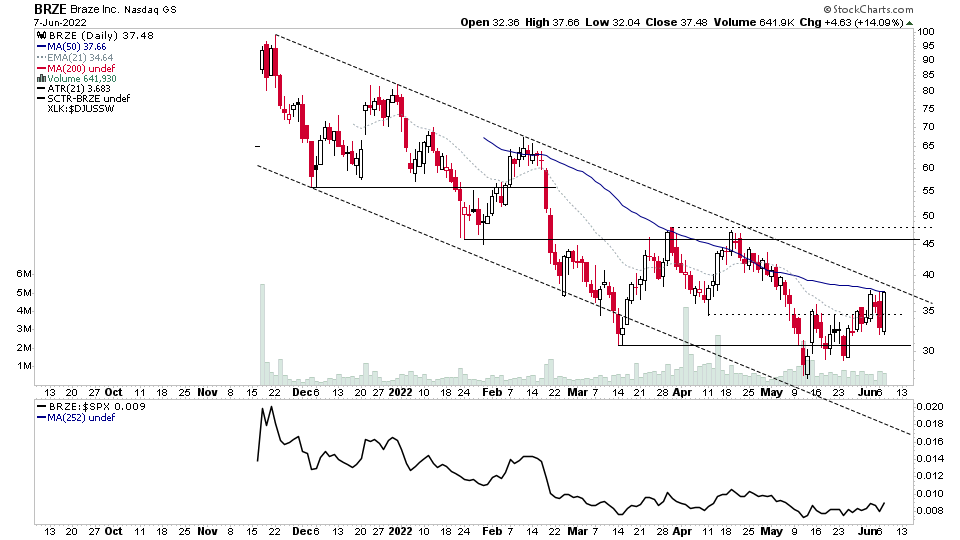

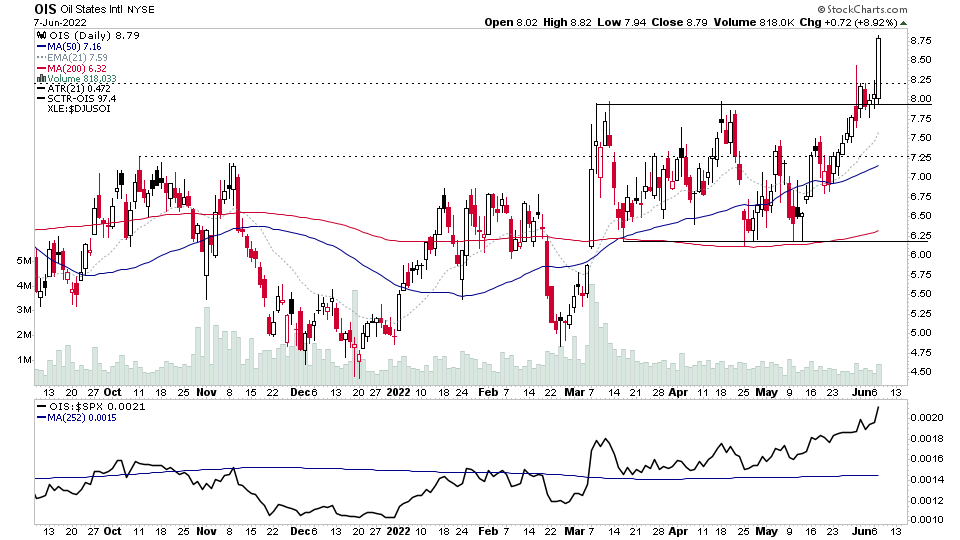

ACLS, AIR, BRZE, OIS + 36 more...

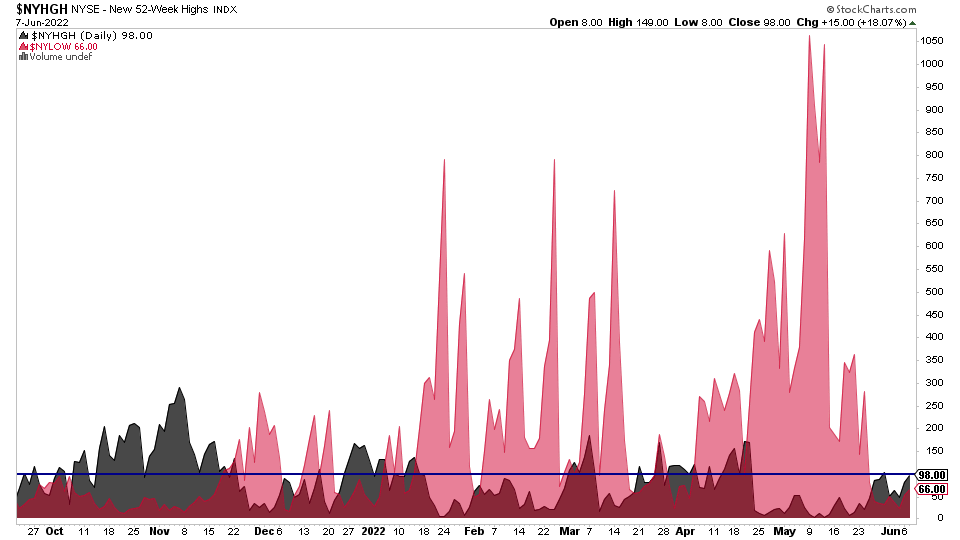

Market Breadth: New Highs - New Lows

The NYSE New Highs continued to slightly outpace the New Lows. However, it's still a very low reading and need to improve significantly before it can move to a positive status.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.