US Stock Market Continues to Digest the Recent Stage 4 Counter Trend Rally – 6 June 2022

The full post is available to view by members only. For immediate access:

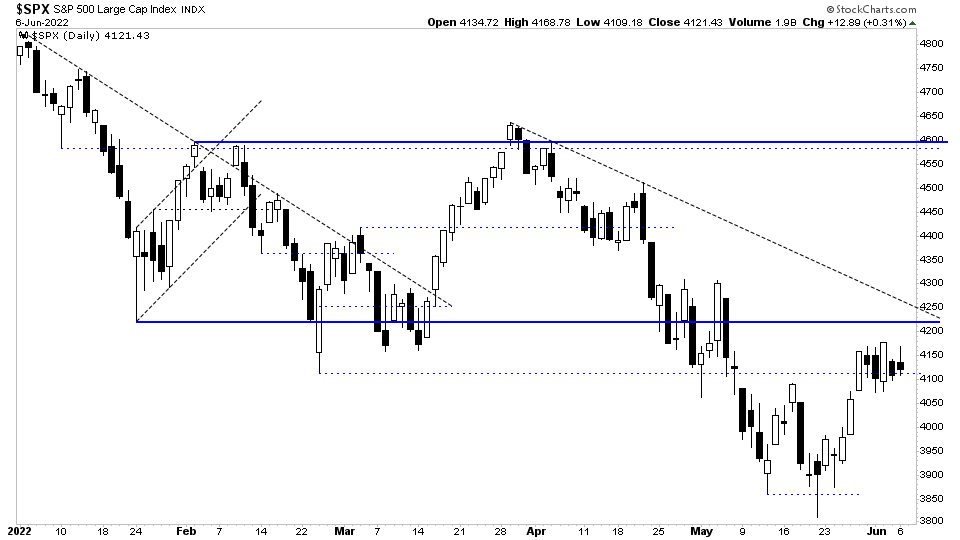

The S&P 500 continues to digest the recent run up from the lows in a tight consolidation pattern (flag) with a higher high and a higher low than yesterdays bar today, but with a close at the lower end of the range.

The year to date chart above shows how the downtrend has stair stepped its way lower into Stage 4, but it is at a pivotal point currently, as it tests the Stage 4 breakdown level in the S&P 500 and multiple other major indexes. So whether we see a continuation lower or a Change of Behaviour via a reversal back into the range seems likely to be decided very soon.

US Stocks Watchlist – 6 June 2022

There were 23 stocks for the US stocks watchlist today.

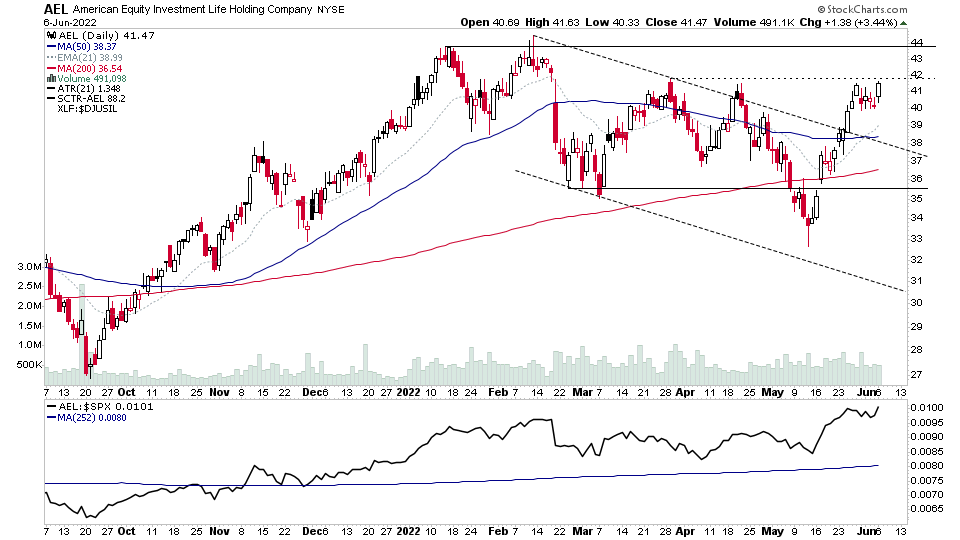

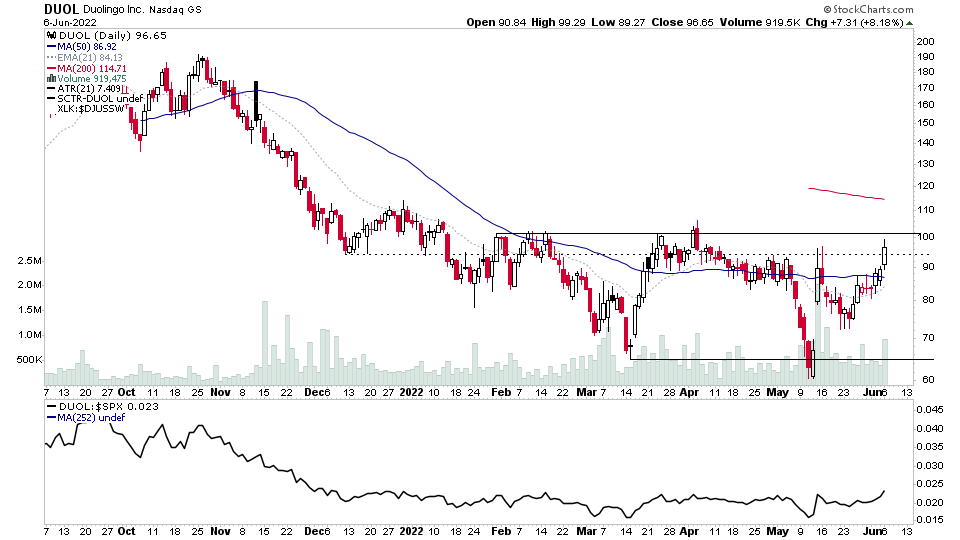

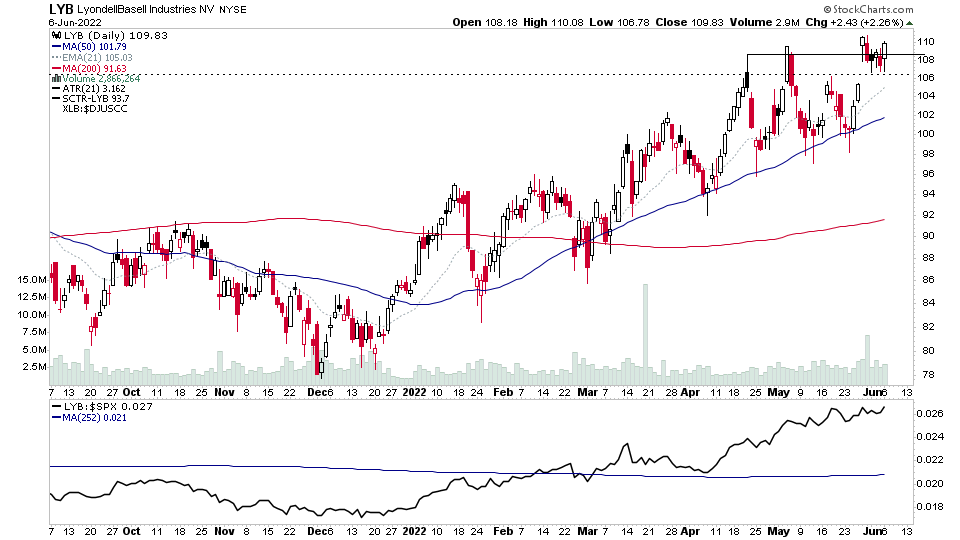

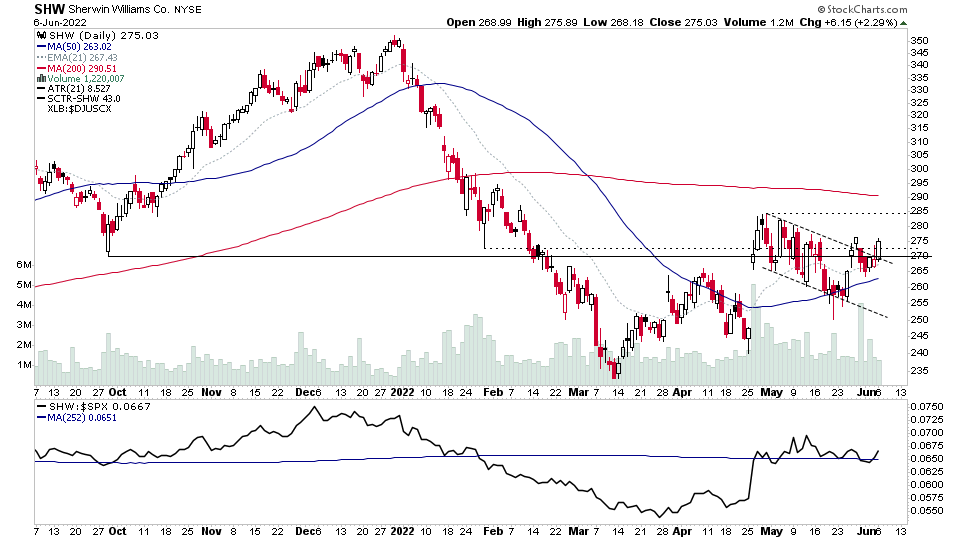

AEL, DUOL, LYB, SHW + 19 more...

Market Breadth: Percentage of Stocks Above Their 20 Day EMA

The short term breadth measure of the Percentage of Stocks Above Their 20 Day EMA in the Nasdaq Composite, NYSE, S&P 500 and Small Caps remains on a postive status currently with consolidation in all in the upper half of their ranges. But like the index charts, a break below the recent pivot could turn them negative again.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.