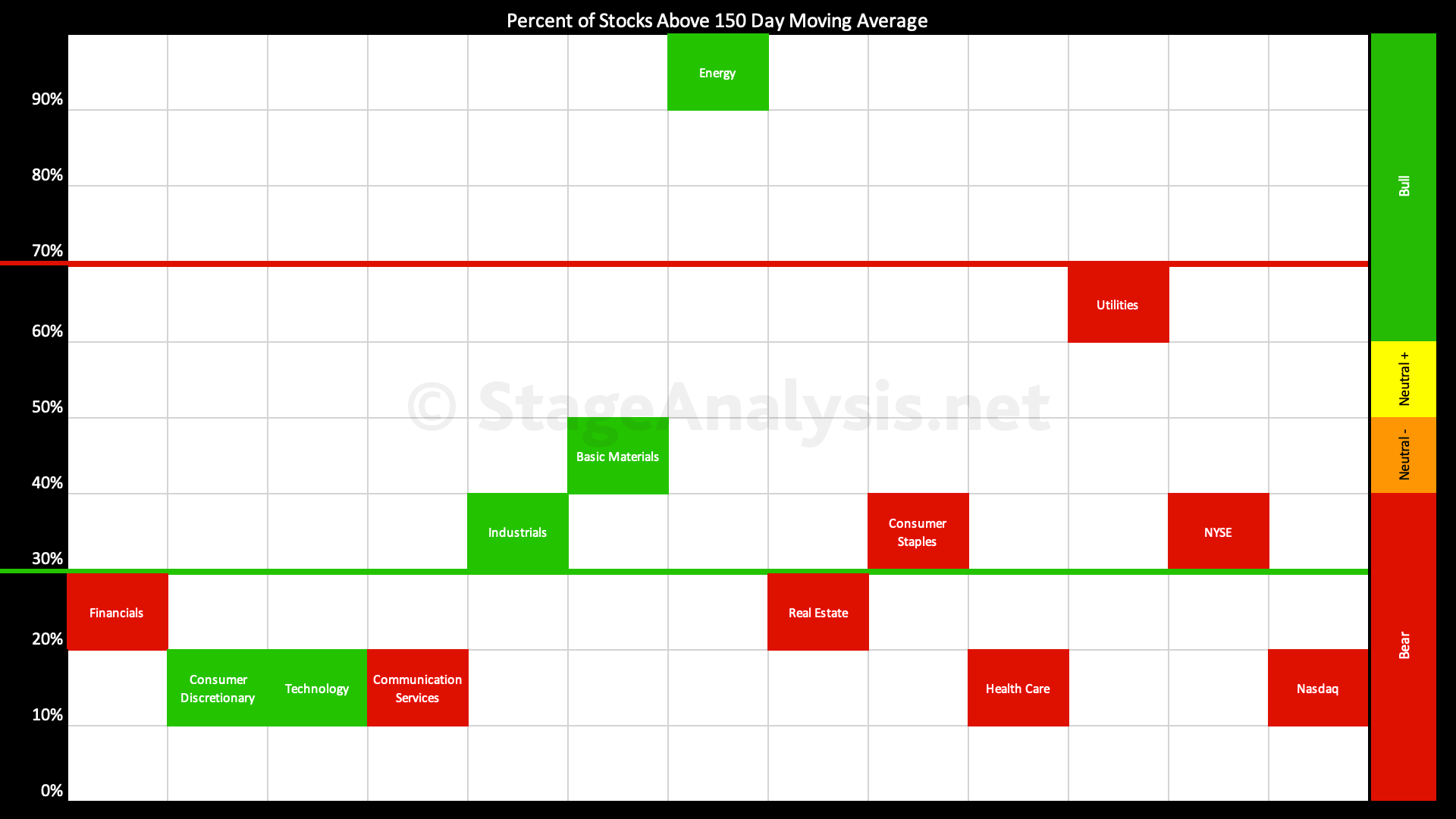

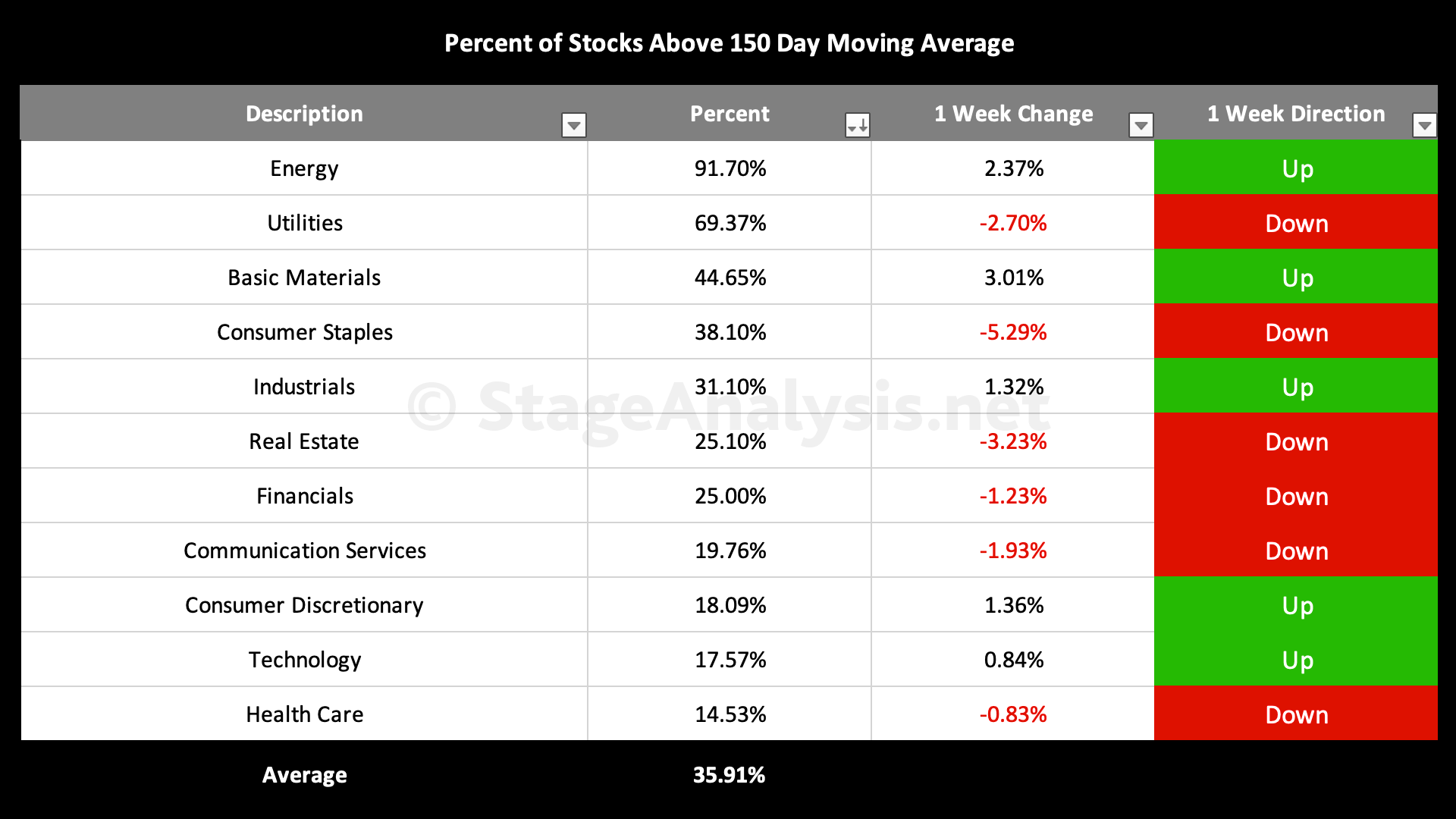

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

Average: 35.91% (-0.57% 1wk)

- 2 sectors are in the Stage 2 zone (Energy, Utilities)

- 1 sector is in Stage 1 / 3 zone (Basic Materials)

- 8 sectors are in Stage 4 zone (Consumer Staples, Industrials, Real Estate, Financials, Communication Services, Consumer Discretionary, Technology, Health Care)

I last updated the Sector breadth table three weeks ago when the sector breadth had reached the lower zone for the first time since March 2020. See the previous post from the 14th May: Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages for a direct comparison of what's changed – I find it's best to open as a new tab in your browser, and then flick between the two tabs with both tabs scrolled to the top so that you can see the position moves.

Energy remains the leading group in the Stage 2 zone, and has pushed back above the 90% level once more.

I talked in the previous post about looking for new leadership in sectors that reverse strongly back out of the lower zone, of which Basic Materials and Industrials have been the first movers in the last few weeks. So they are a potential areas to focus on initially, but if the market continues to improve, then watch for other sectors coming out of the lower zone also.

Overall we seen improvement in the average over the last month with it closing this week at 35.91%, after it dipped down into the lower zone during May with a reading of 28.32% on the 14th May post. So an improvement of +7.59%, but with the average still below 40%, the sector breadth still remains in the Stage 4 zone. So caution remains prudent.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.