Change of Behaviour? Multiple Major Indexes Reject Key MAs

The full post is available to view by members only. For immediate access:

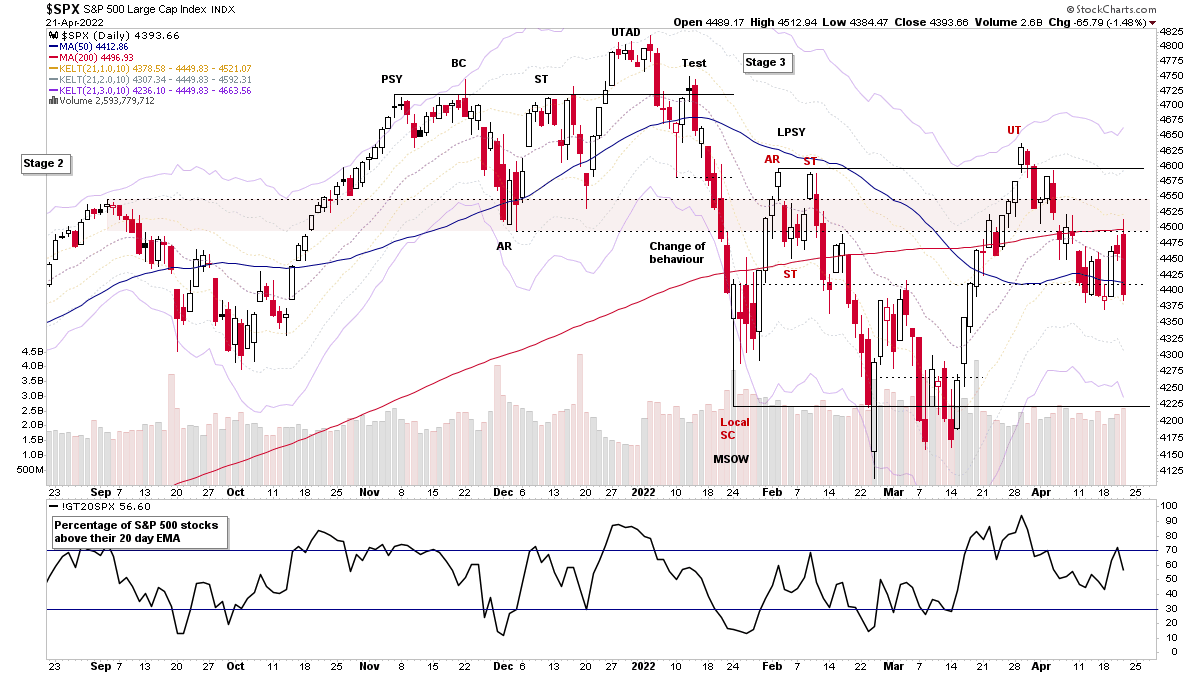

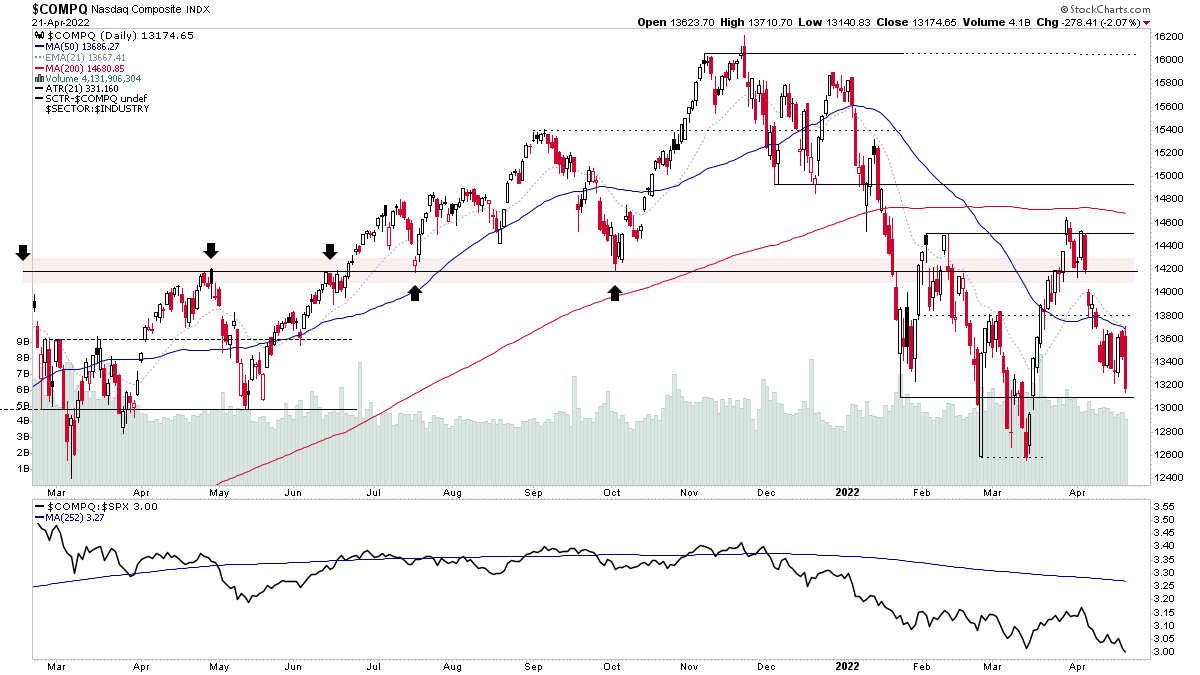

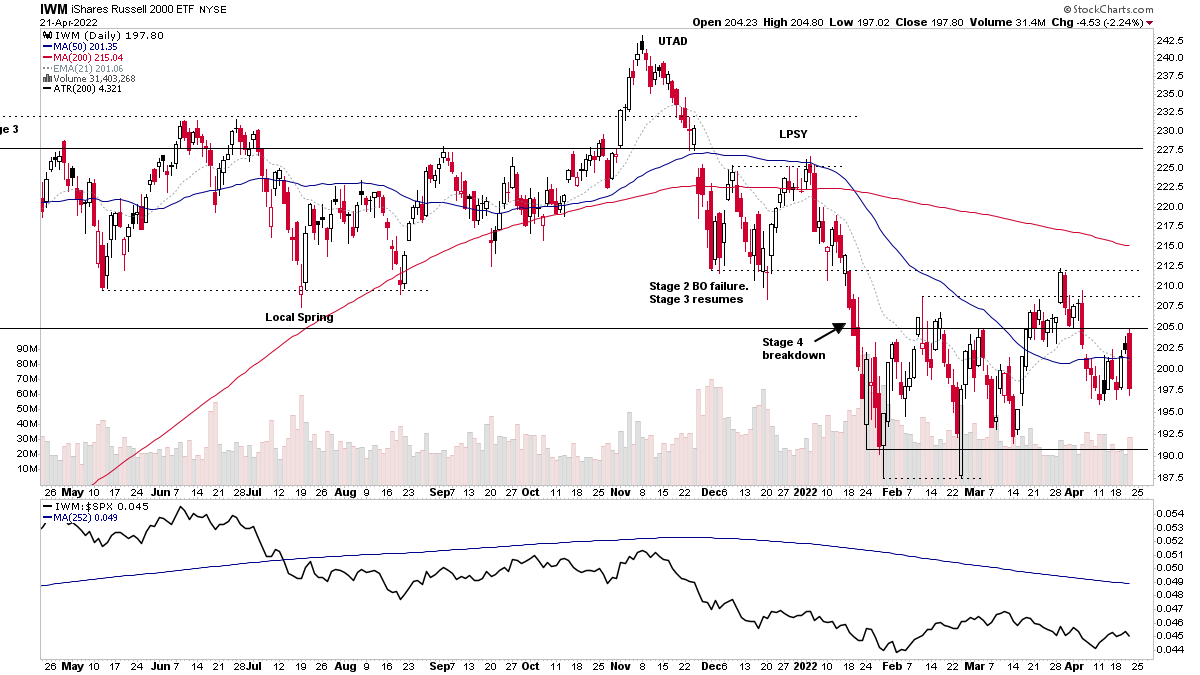

The S&P 500 strongly rejected the 200 day MA today following statements by Fed Chairman Jerome Powell of potential upcoming rate hikes to help tackle rampant inflation. Which gave the market the excuse it needed for a selloff at the key level of the 200 day MA in the S&P 500 and the Dow Industrials, while the Nasdaq Composite and Russell 2000 Small Caps rejected their 50 day MAs.

No Watchlist Additions

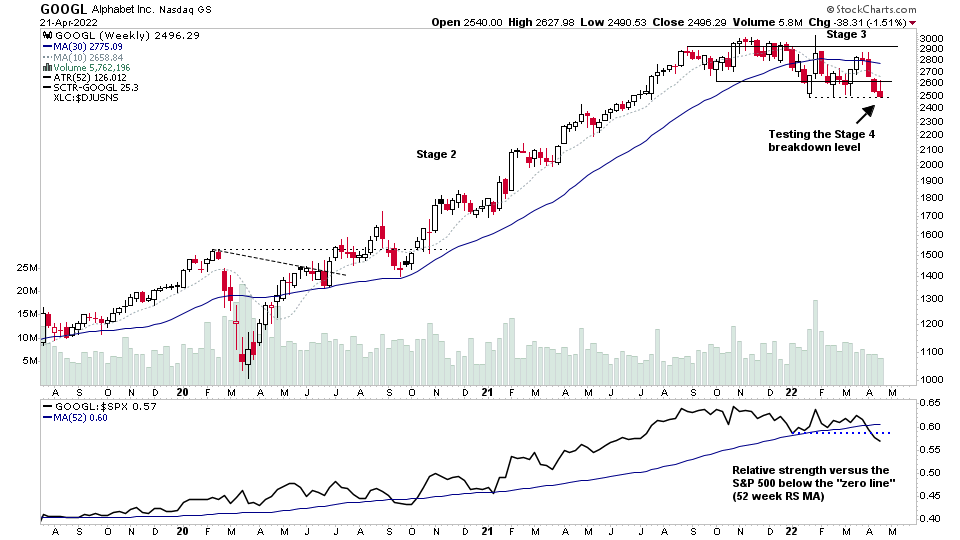

I went through over 500 charts tonight and there wasn't anything new for the watchlist on the long side. But the main observation was the large amount of stronger stocks failing at the top of ranges or reversing at their +3x ATR levels. As well as other already weak areas of the market testing their Stage 4 breakdown levels. GOOGL is one example that I mentioned last week that's in Stage 3 and testing the Stage 4 breakdown level (see below).

So caution remains key in this difficult Stage 3/4 environment, and remember that cash is a position.

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.