US Stocks Watchlist – 2 February 2024

I thought I'd do something a little bit different today from the usual watchlist post, as I've added multiple new features in the last few weeks to the Stage Analysis Screener, Stage 2 and Stage 4 levels on the weekly stock charts, and other areas of the website too, like the new Relative Strength pages – where you can see sub-industries and sectors etc ranked by strongest to weakest, and also their percentage changes for the current week and multiple other periods over the last year.

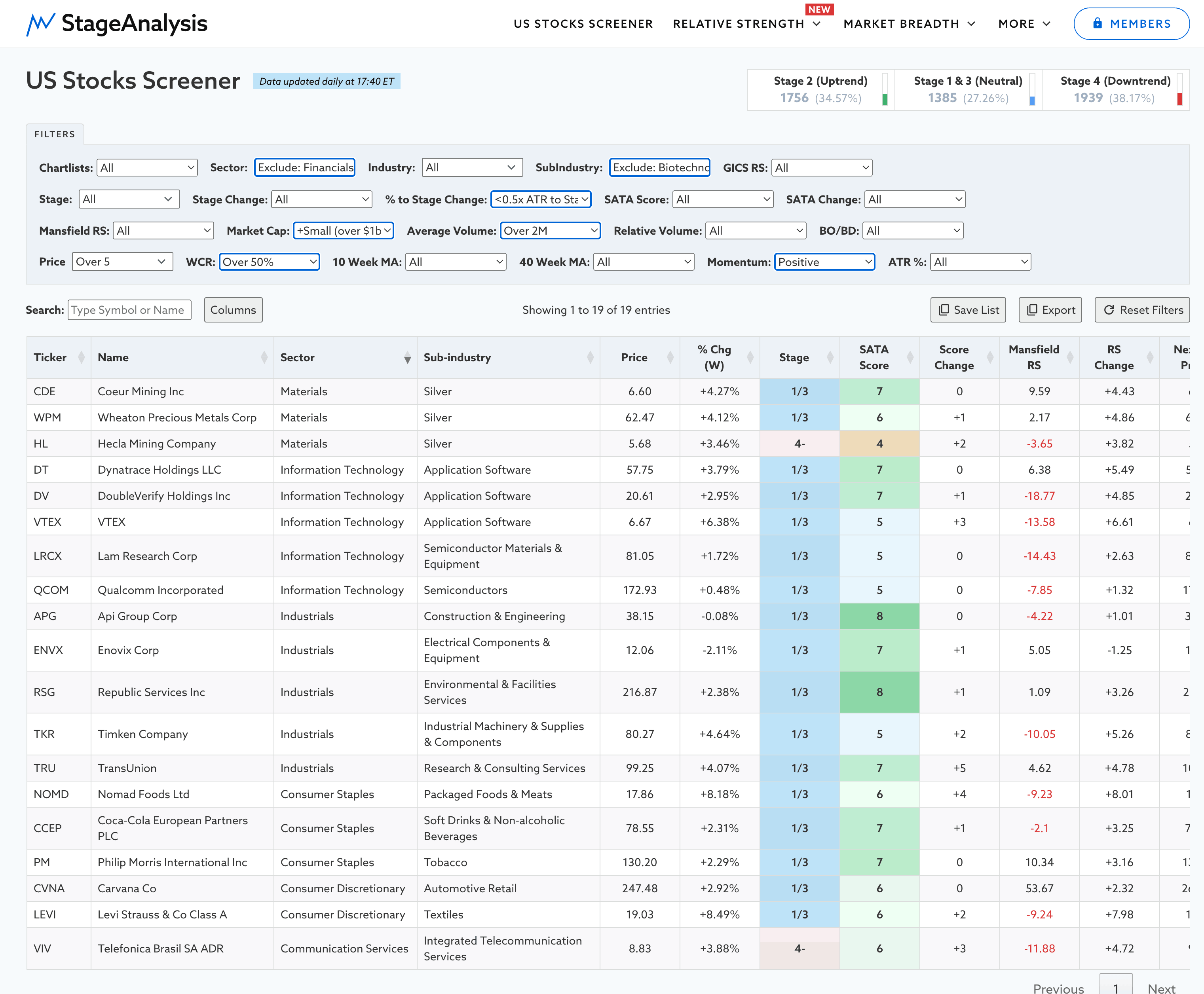

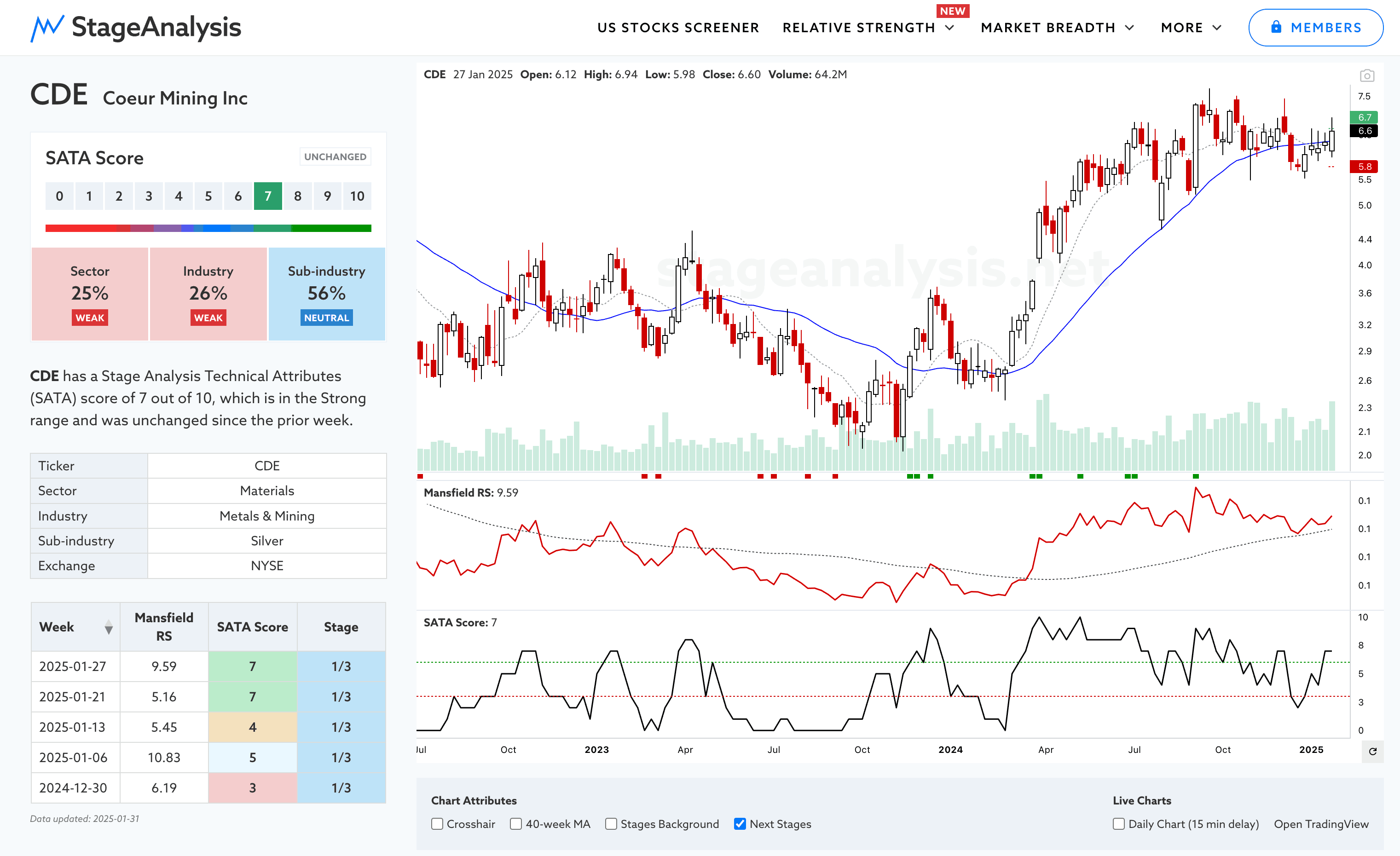

So, I wanted to give you an example of how you can use the new Screener filters to find the stocks in the positions that I typically show in the watchlist posts. Of which the main position is, stocks in Stage 1 or Stage 3 ranges/structures that are close to the top of their ranges, and hence, are in position to make a potential Stage change to Stage 2 (i.e. they are on Stage 2 breakout watch)

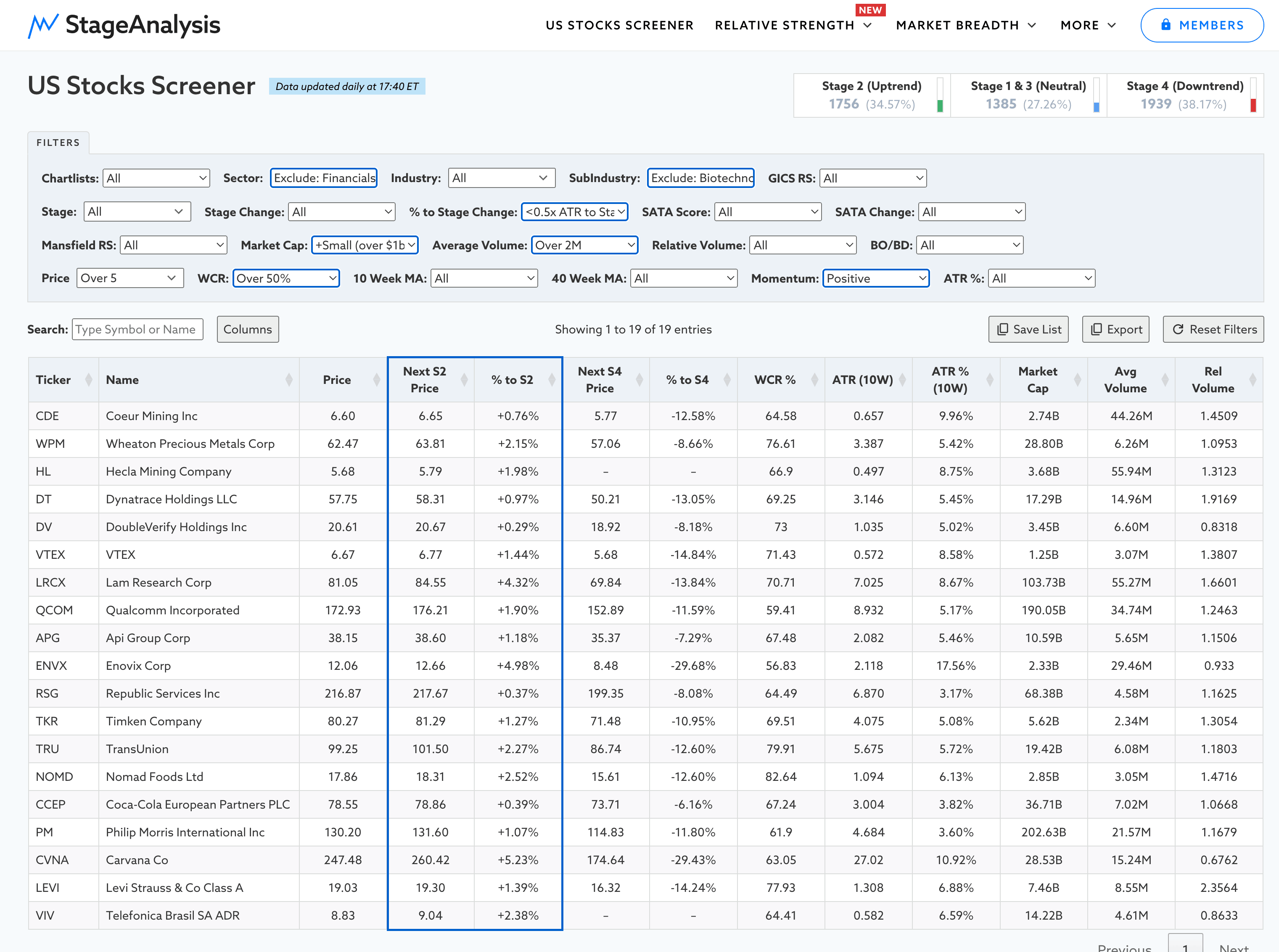

Once you've filtered down the stocks with your desired settings (I give a potential example in the screen shots below), you can then use the table columns to see the exact level at which the stock would need to close above in order to change to Stage 2 (Next S2 Price), and the percentage distance it is from that level currently (% to S2). Enabling you to potentially set alerts in your live trading platform, such Tradingview, Stockcharts, Marketsmith etc.

Filter settings used for this scan to find stocks in a base near to the Stage 2 breakout level:

- Sector: Exclude: Financials, Real Estate

- SubIndustry: Exclude: Biotechnology

- % to Stage Change: <0.5x ATR to Stage 2

- Market Cap: +Small (over $1bln)

- Average Volume: Over 2M

- Price: Over 5

- WCR: Over 50%

- Momentum: Positive

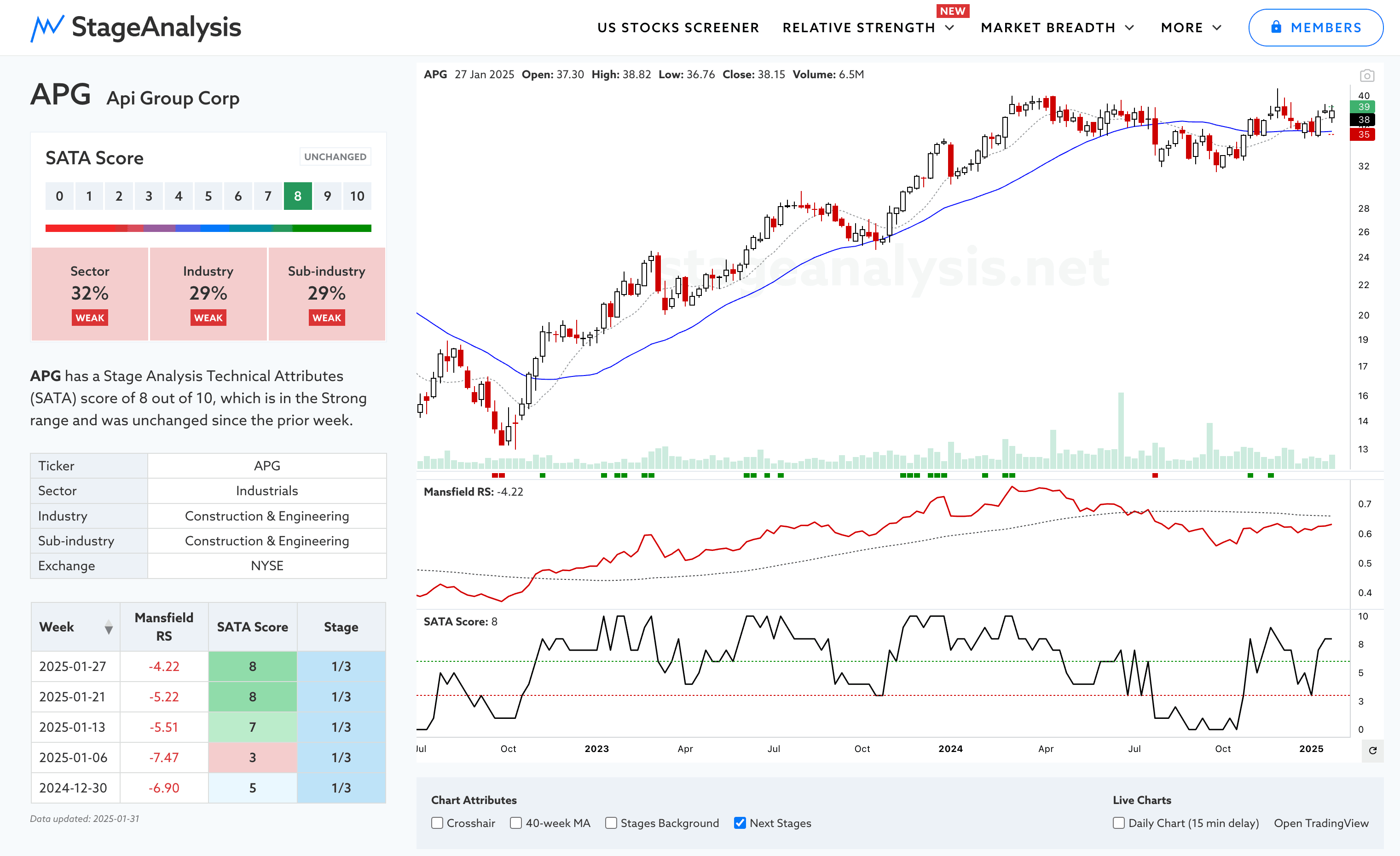

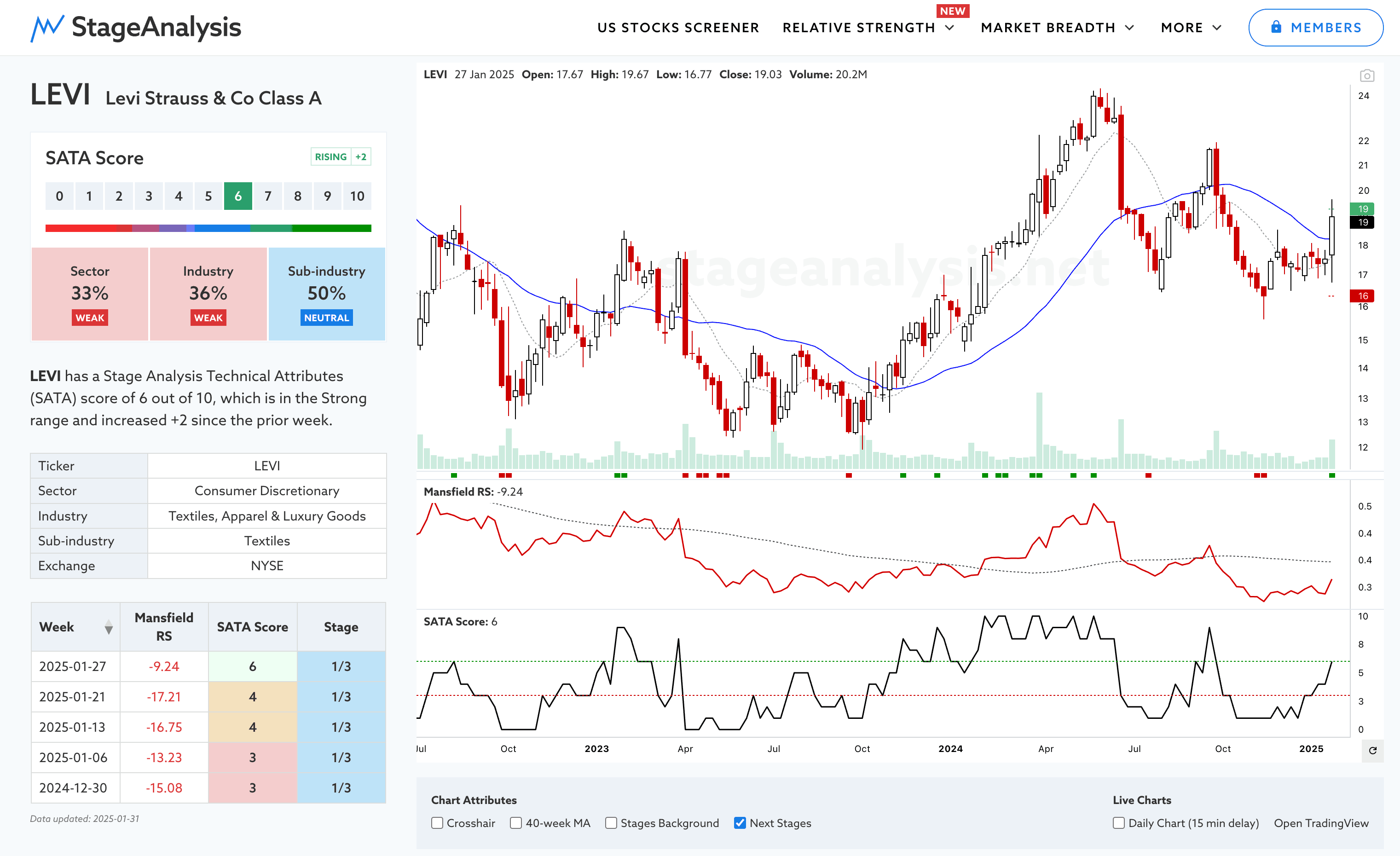

Results from the scan: CDE, WPM, HL, DT, DV, VTEX, LRCX, QCOM, APG, ENVX, RSG, TKR, TRU, NOMD, CCEP, PM, CVNA, LEVI, VIV

This is is just one potential way that you can use the screener. As you can look for Stage 2 breakouts, Continuation breakouts, Stage changes, Sub-Stage changes, those attempting to bottom (i.e change to Stage 4B-). Or stocks approaching their Stage 4 breakdown level, or breaking down into early Stage 4 etc. As it can be used for both long and shorts, with a huge amount of potential options, that are growing each week, as we continue to build out the Stage Analysis tools and features.

So as you can see, it's a powerful tool for those who trade with Stage Analysis, Wyckoff, CAN SLIM and other related methods.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.