US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

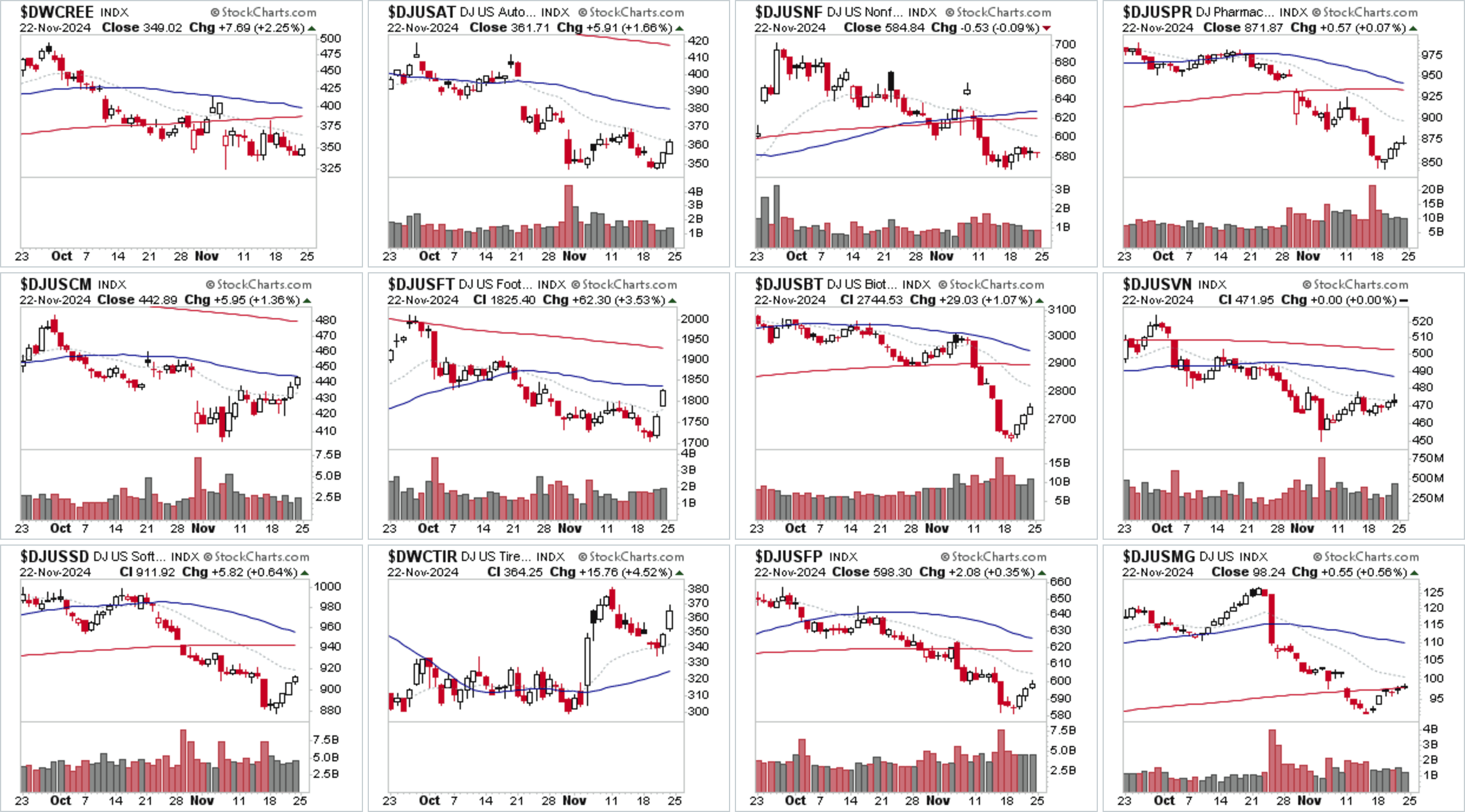

US Industry Groups by Highest RS Score

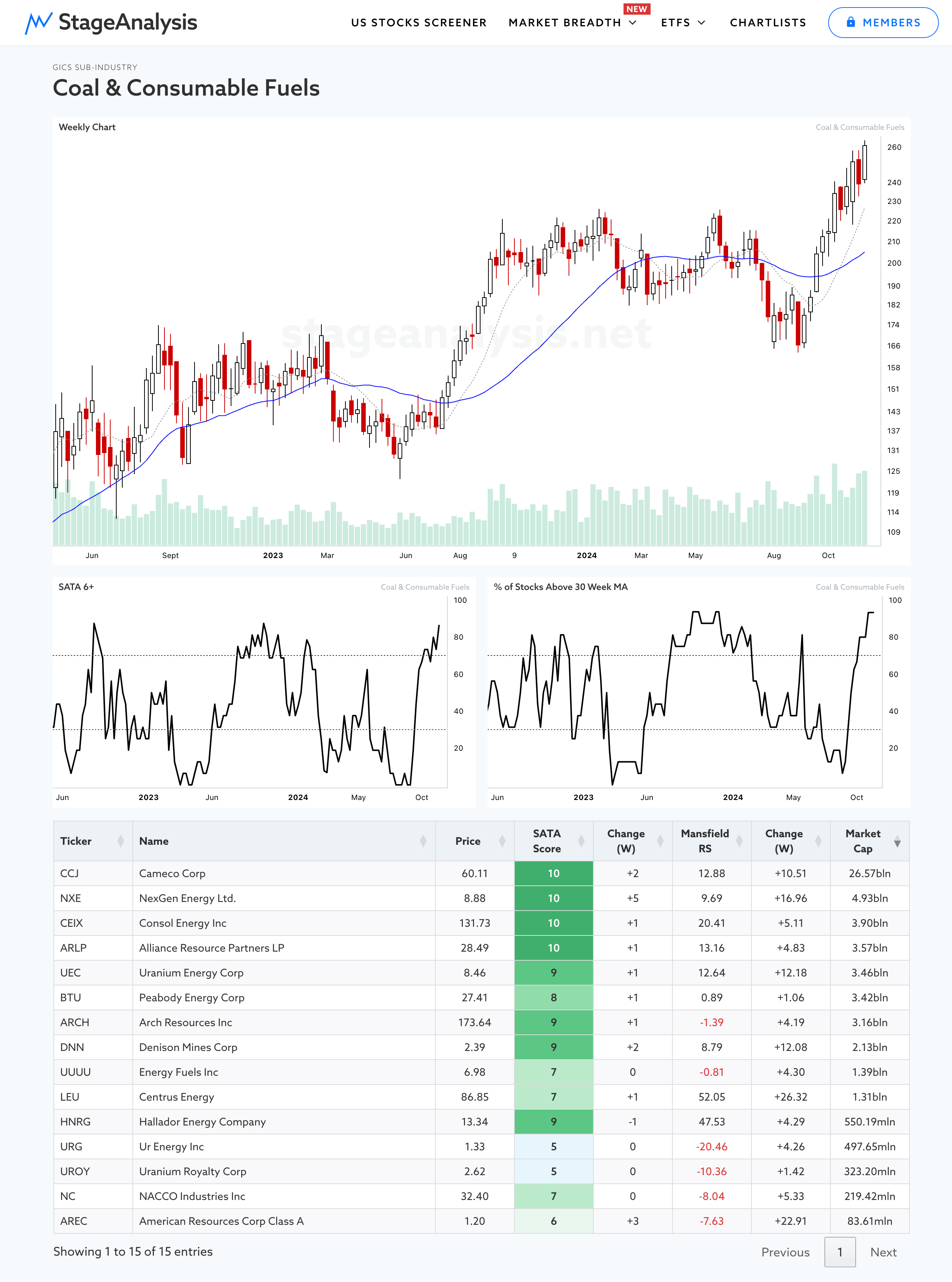

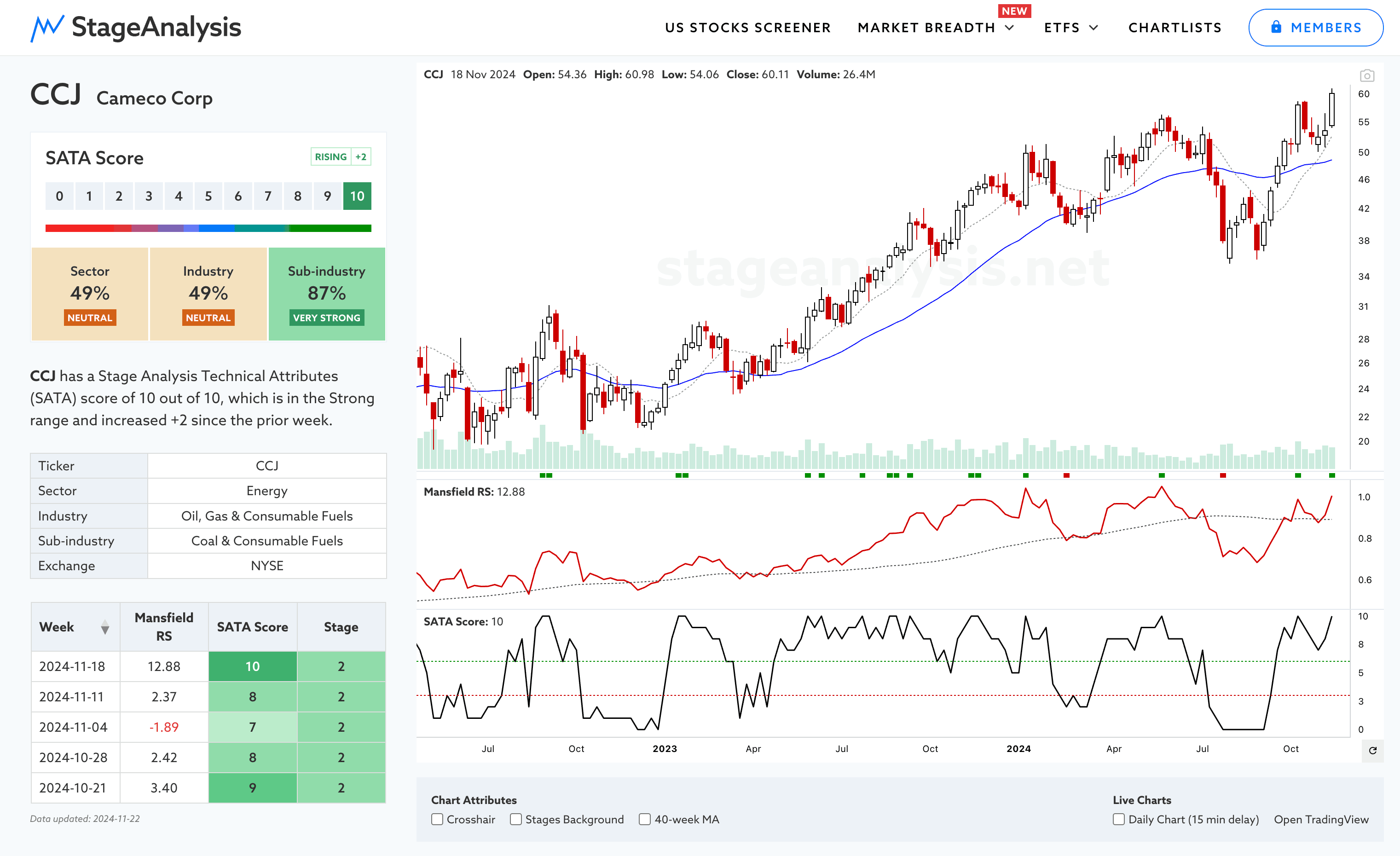

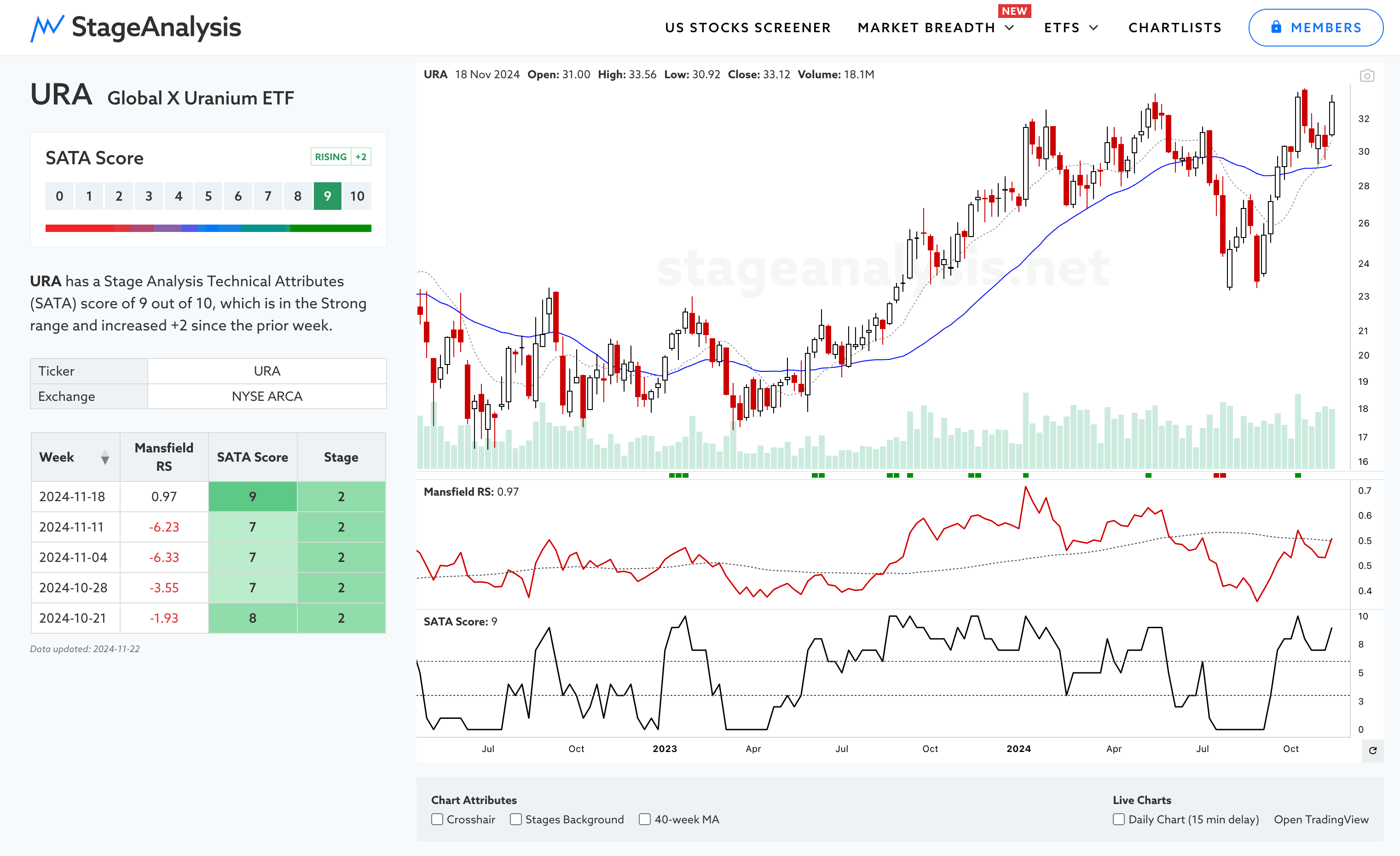

Coal & Consumable Fuels continues to be one of the major group themes since early September, and has been highlighted a number of times since then, as the percentage of technically healthy stocks has been improving in the group. For example the week beginning 9th September there were 0% of technically healthy stocks. But that has now risen to 86.67% at the close this week, and over a similar period, the percentage of stocks above their 30 week moving averages has risen from 6.25% to 93.33% currently.

So a major improvement over the last few months with the overall group recovering strongly from Stage 4 back to Stage 2 currently, with individual stocks like CCJ, NXE, UEC and more back at their highs in Stage 2, as well as group ETF URA

US Industry Groups by Weakest RS Score

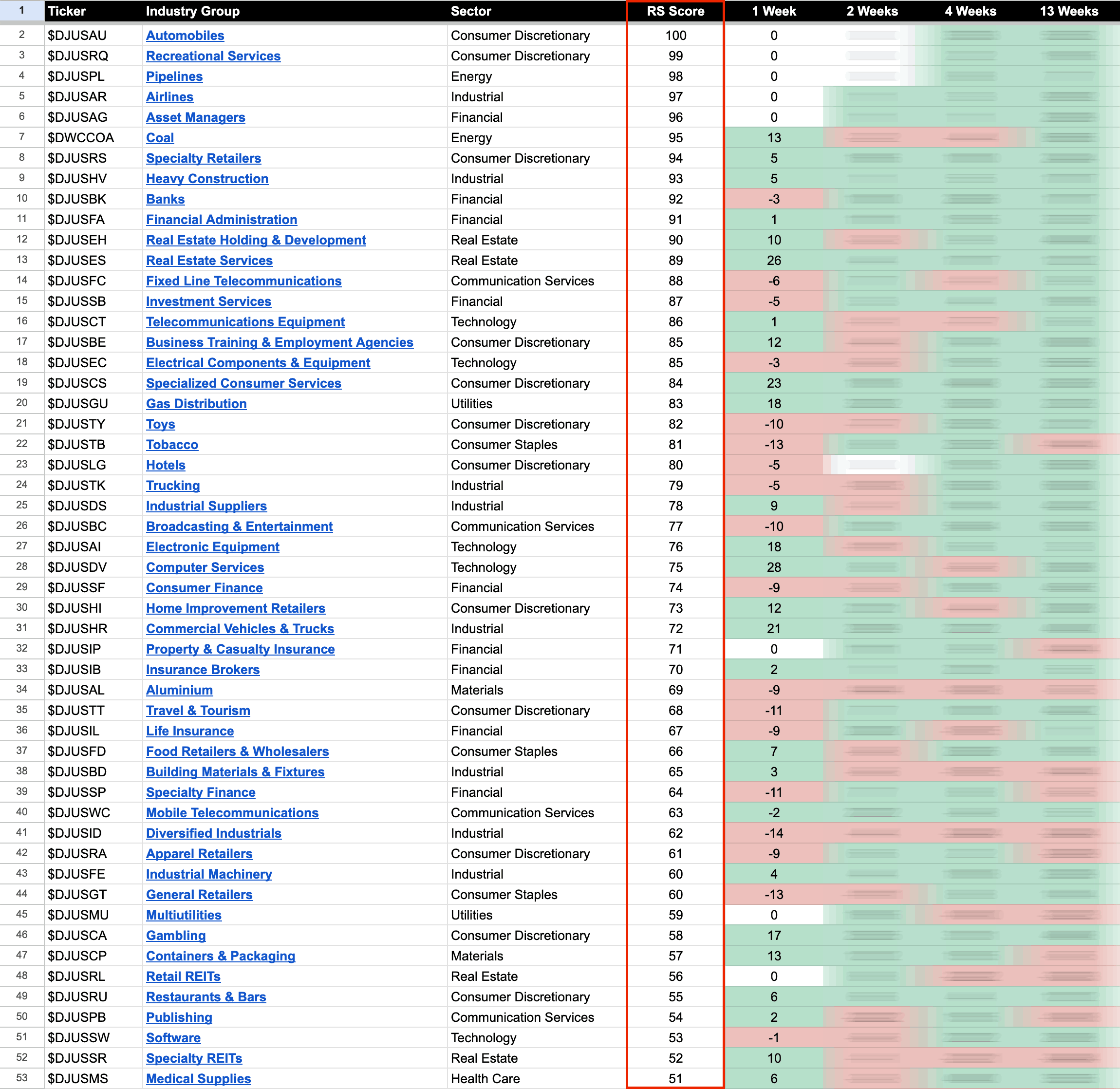

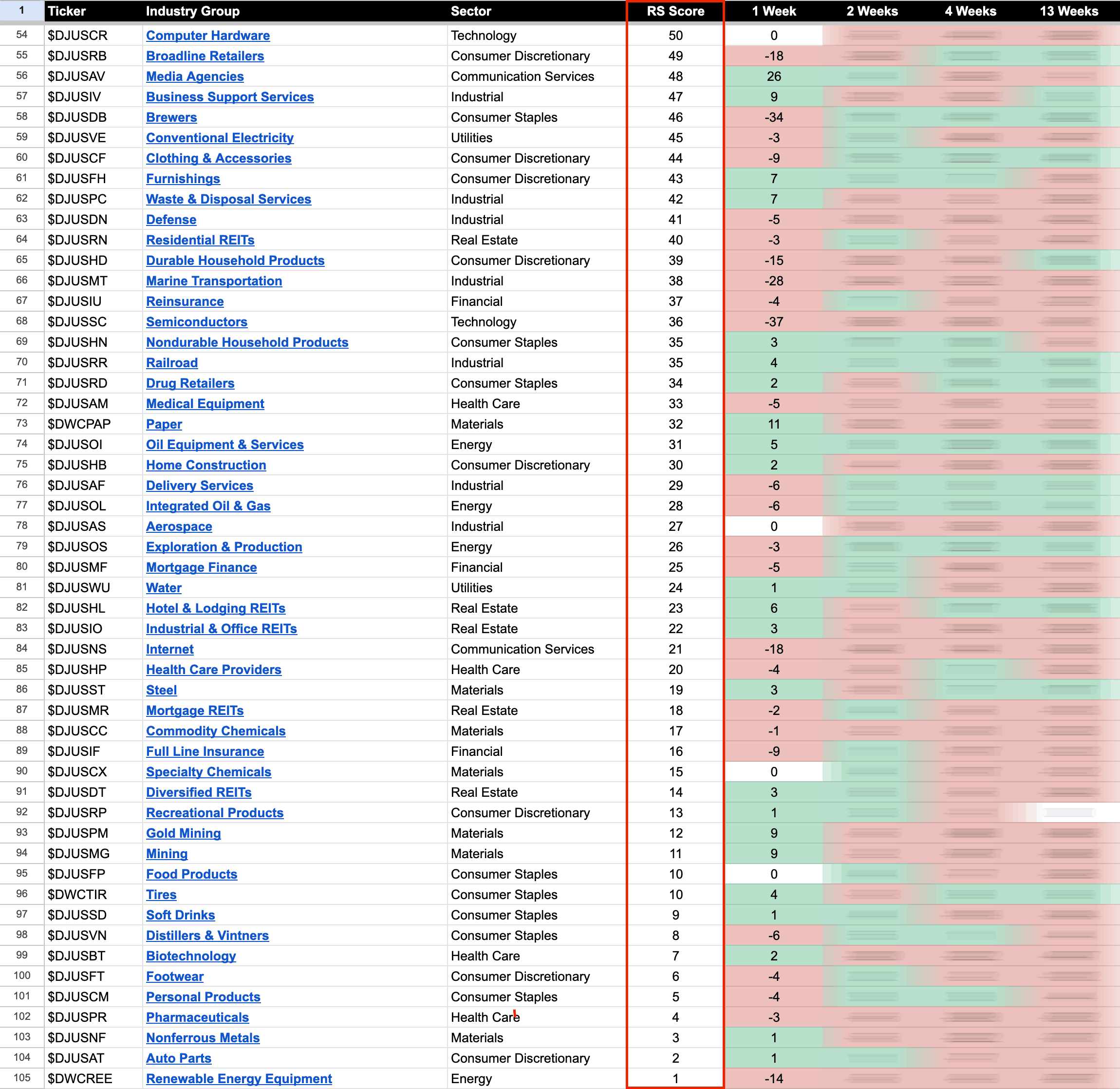

US Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.