US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

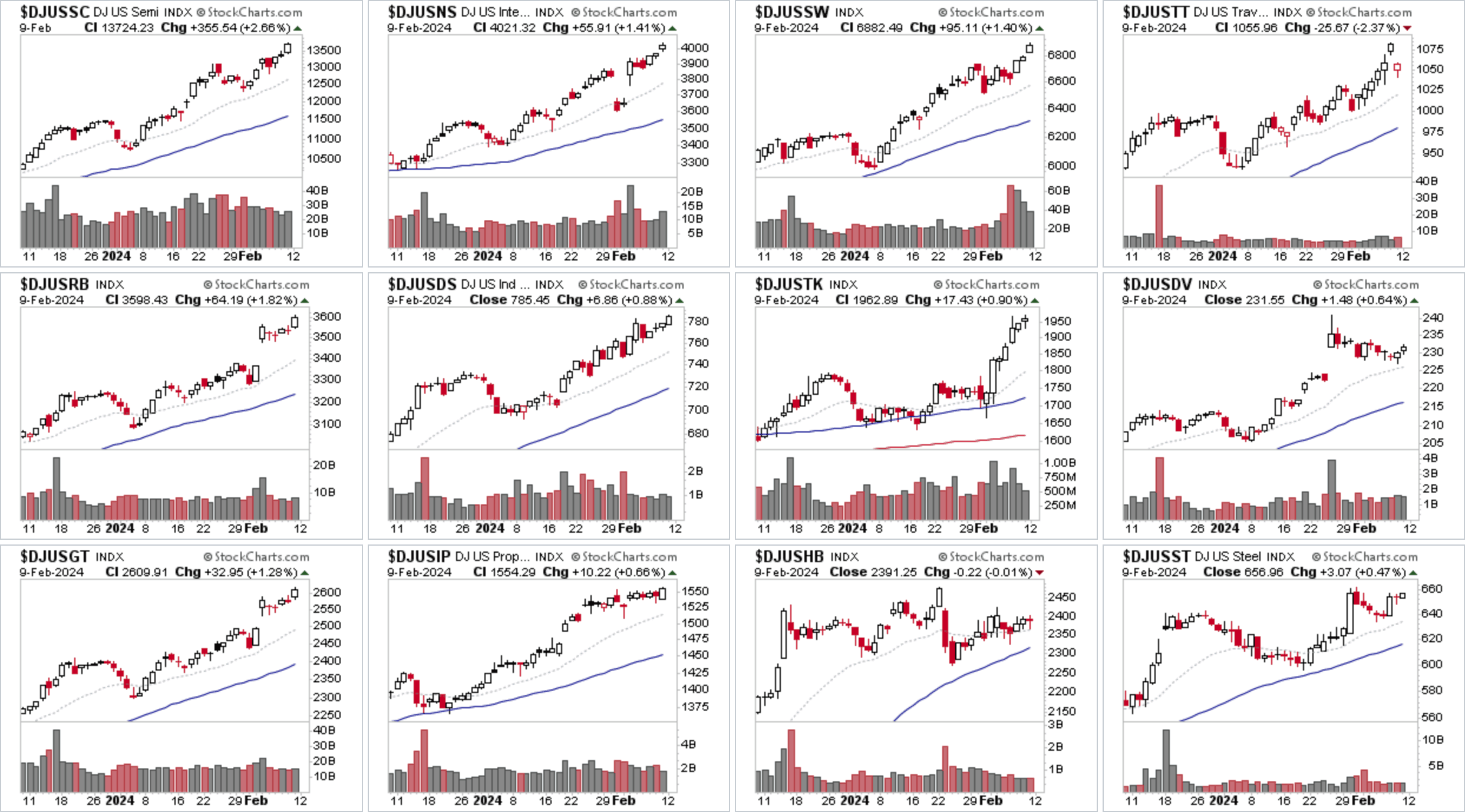

US Industry Groups by Highest RS Score

Semiconductors ($DJUSSC) continues to lead the Industry Groups Relative Strength (RS) Rankings with a further strong week of +6.26%, which was the third strongest move of all the industry groups. While Internet ($DJUSNS) holds in 2nd place overall with stocks such as DASH and SPOT pushing to new 52 week highs.

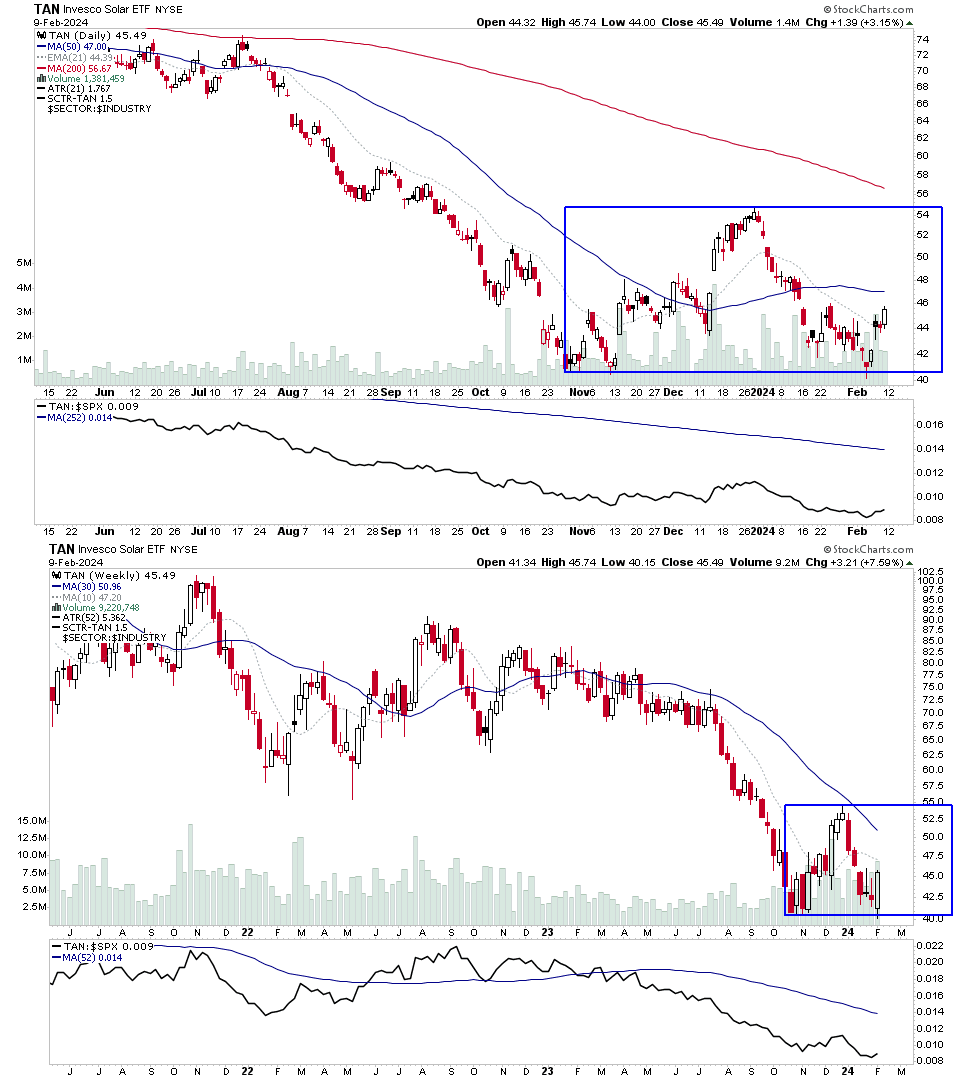

But another big mover this week (which is off of the majority's radar) was laggard Renewable Energy Equipment ($DWCREE), which is in 100th position overall. So near the bottom of the rankings and includes the solar, wind and fuel cell stocks. However, multiple stocks in the group had a strong week and are starting to show signs of potential bases developing in Stage 1 and Stage 4B- (i.e. basing but too early to be called Stage 1 yet). So the group is attempting to bottom, with the vast majority reporting earnings in the coming four weeks. Hence per the Stage Analysis methods Forest to the Trees approach, it could be time to take a closer look at the group, to try to identify the potential leaders and start tracking the stocks for if they reach the methods various entry points. Which start for the swing traders at the Stage 4B- move over the 50 day MA with the aim of getting to the 200 day MA, and investors later on in more developed Stage 1 bases and on the Stage 2 breakout and first backup in Stage 2.

The group etf is TAN, which shows the potential base that's developing with the Wyckoff Phase A characteristics now having been defined. i.e The Selling Climax (SC), Automatic Rally (AR) and Secondary Test (ST). Hence, we can draw an initial structure (Blue box).

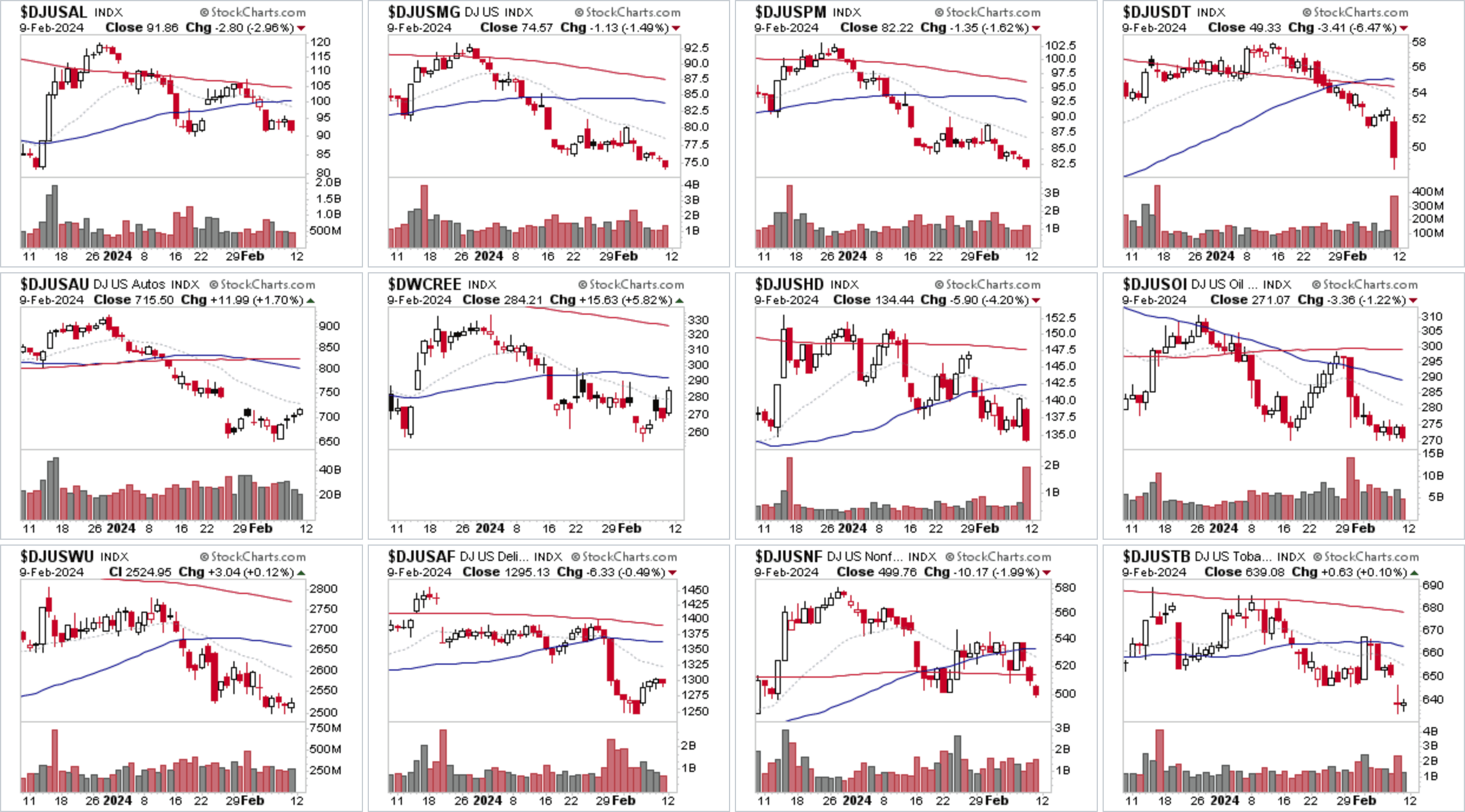

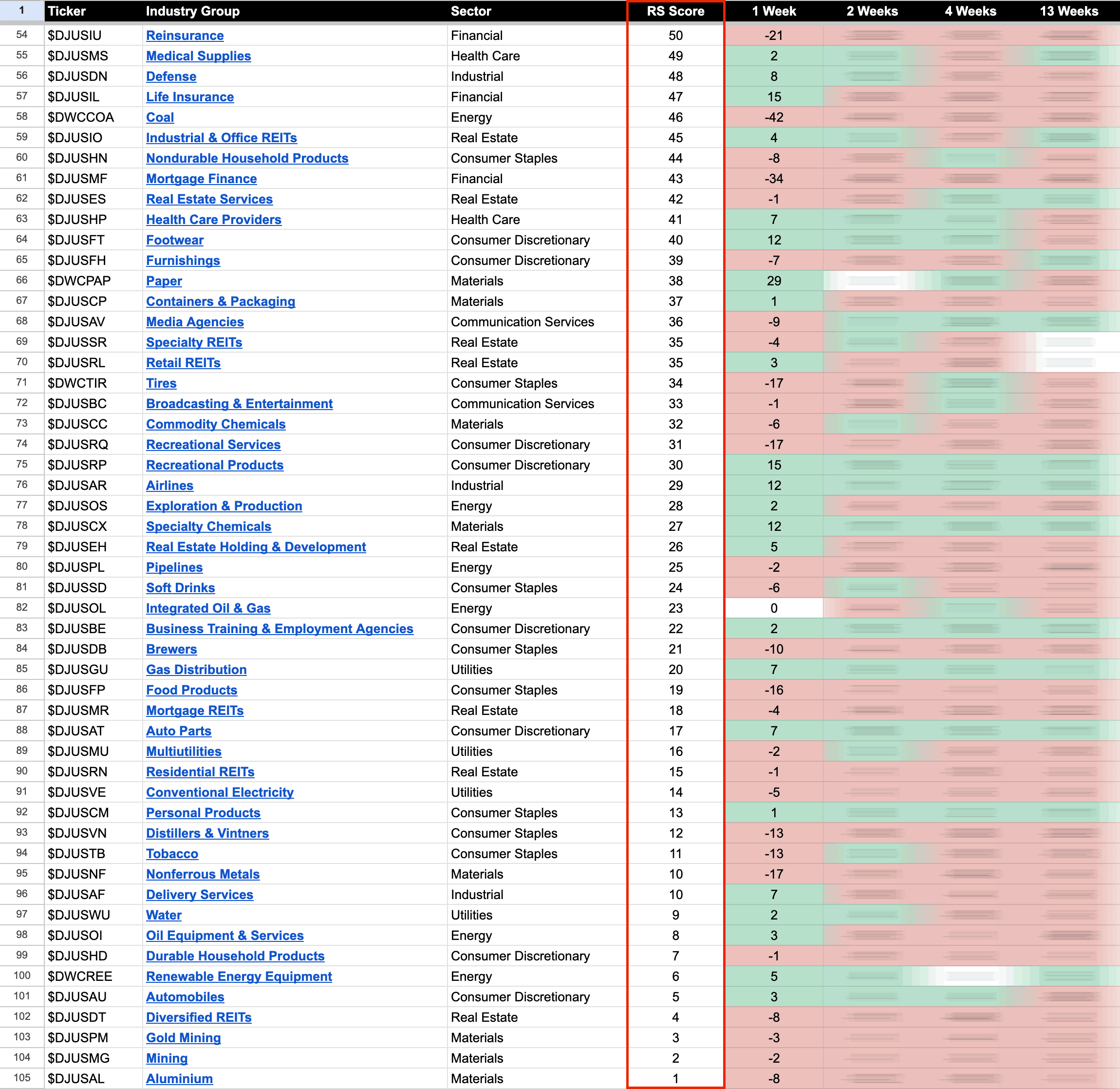

US Industry Groups by Weakest RS Score

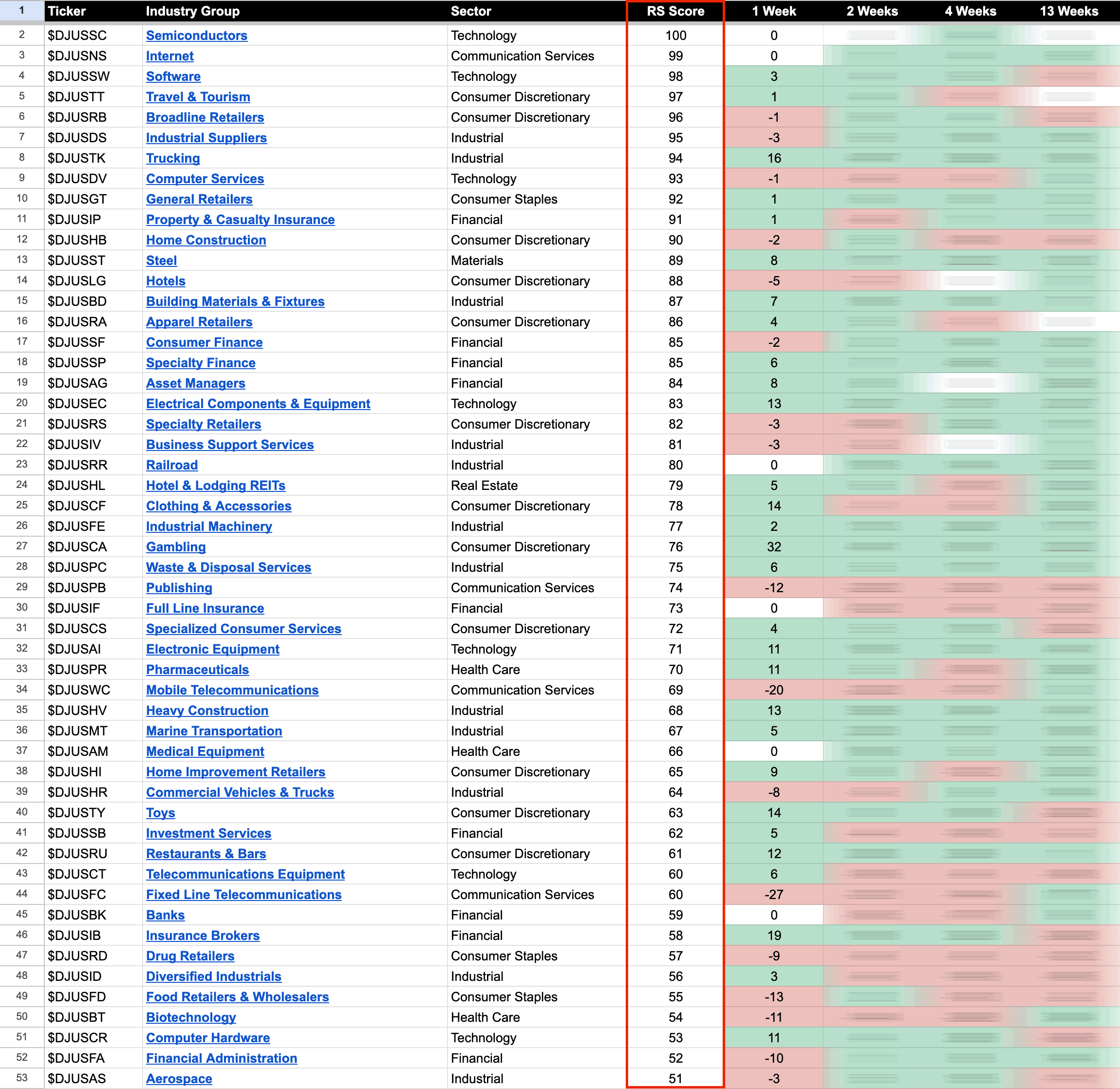

US Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.