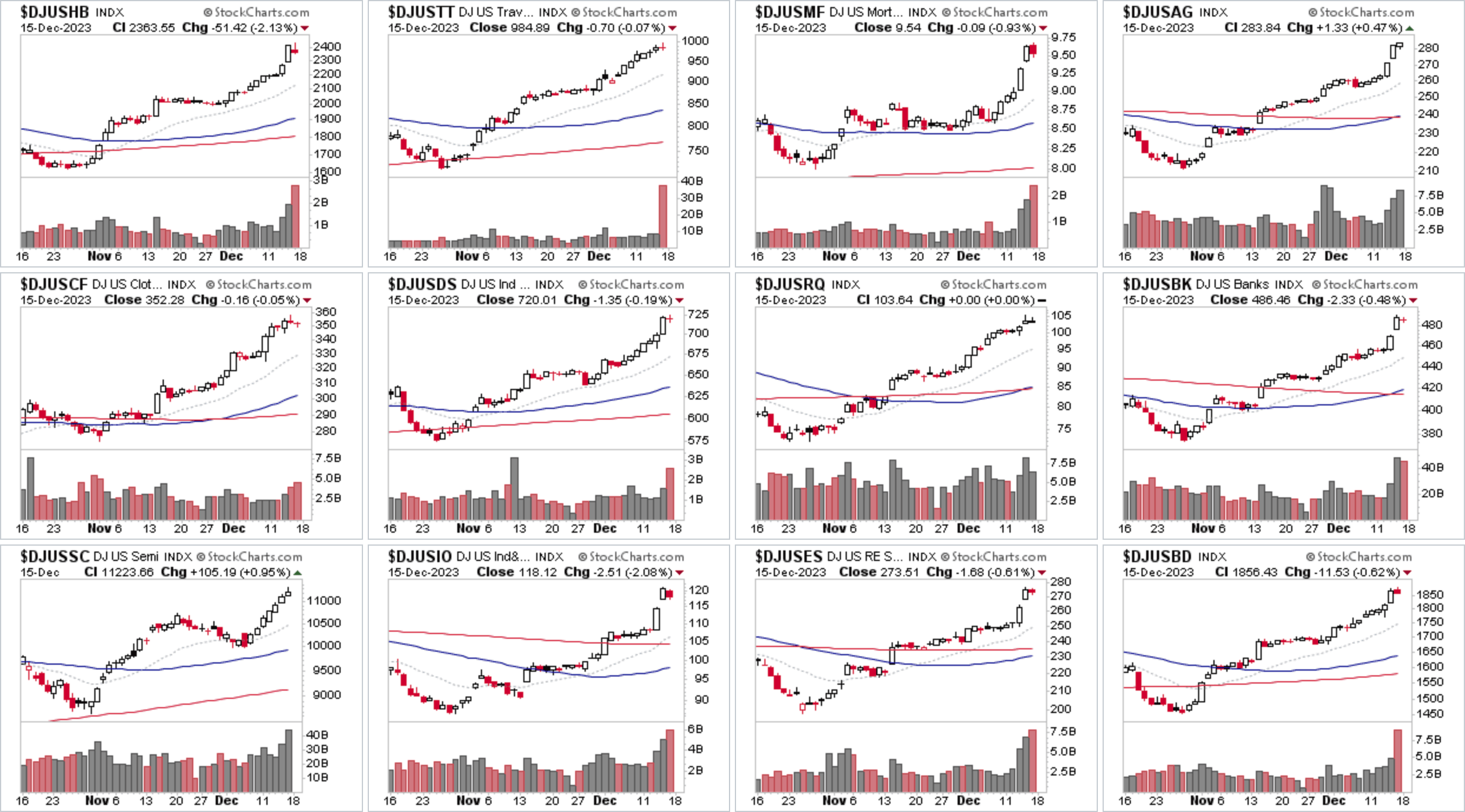

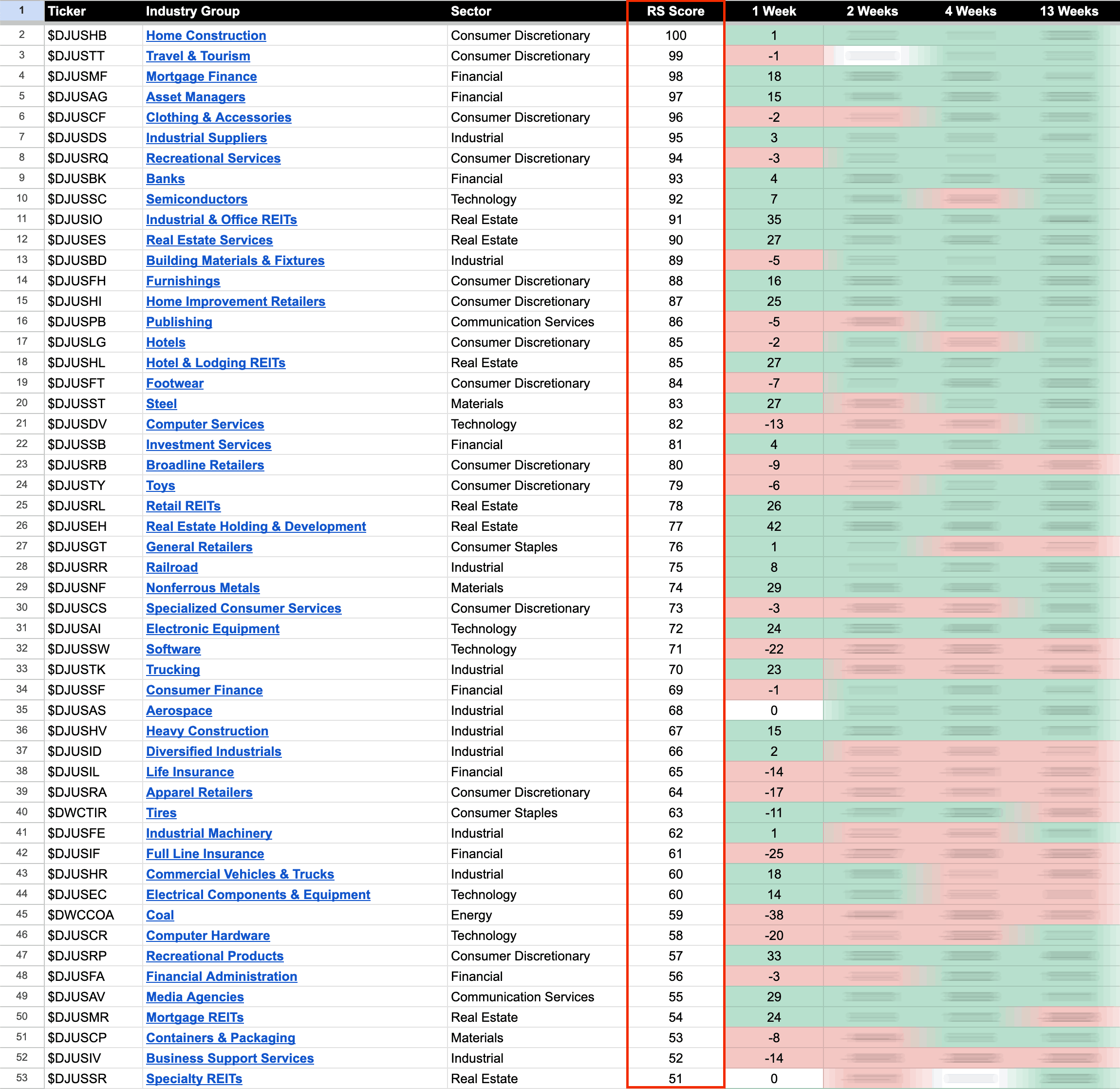

US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

US Industry Groups by Highest RS Score

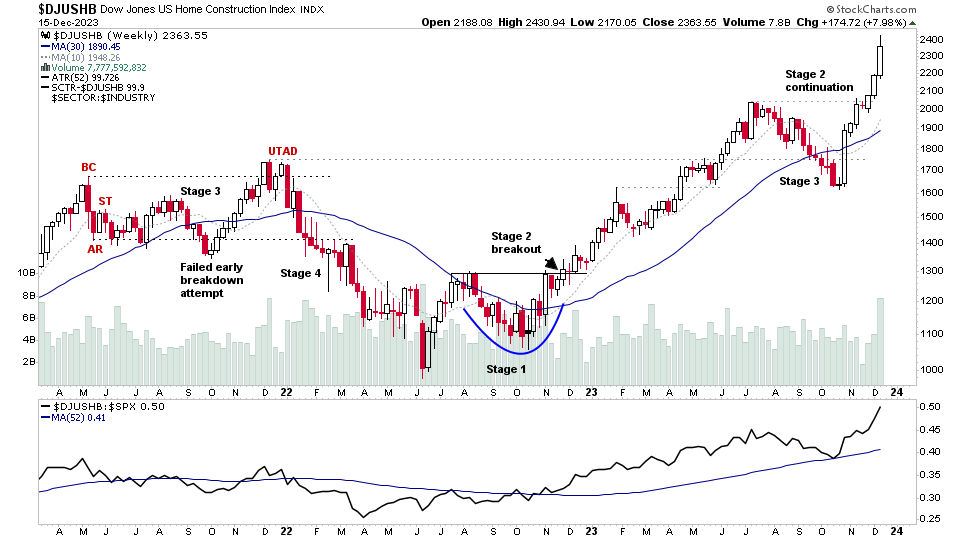

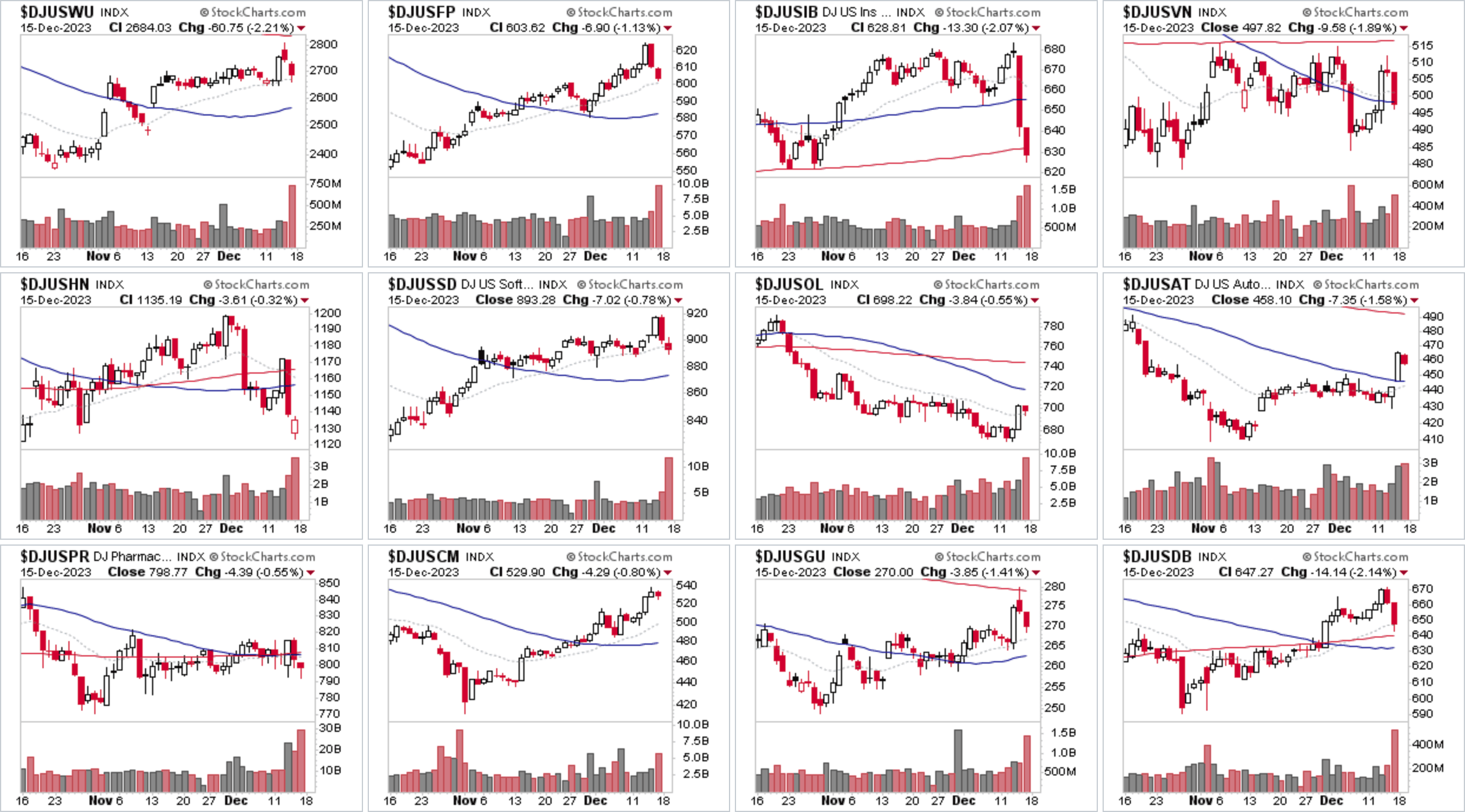

Home Construction ($DJUSHB) returns to the top of the Industry Groups Relative Strength (RS) Rankings with a blow off move on Thursday, surging outside of its normal ATR range. But it wasn't alone, with numerous groups making similar moves, following the Fed meeting midweek. So there was an expansion of breadth into the small and midcaps, which have been laggards year to date. Boosting the overall health of the market, with all the major US indexes now in Stage 2.

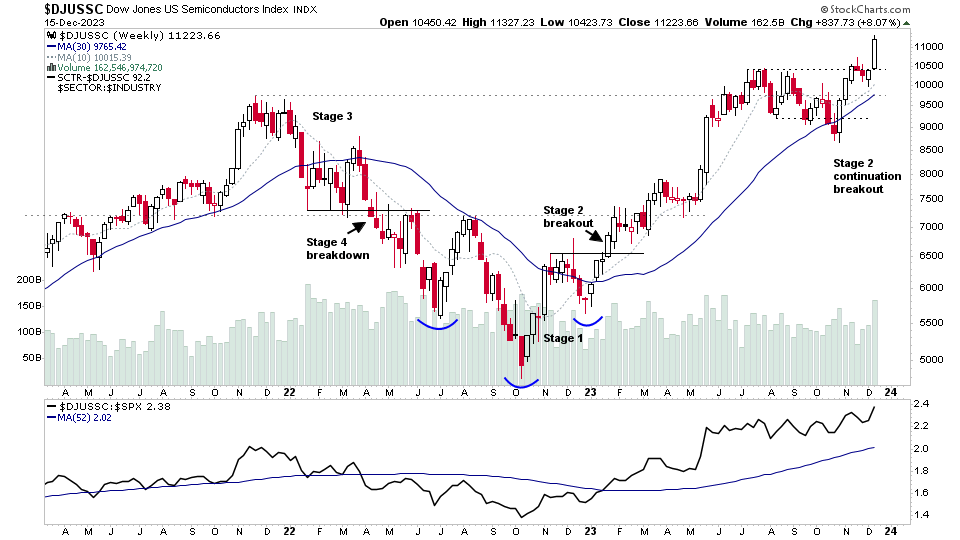

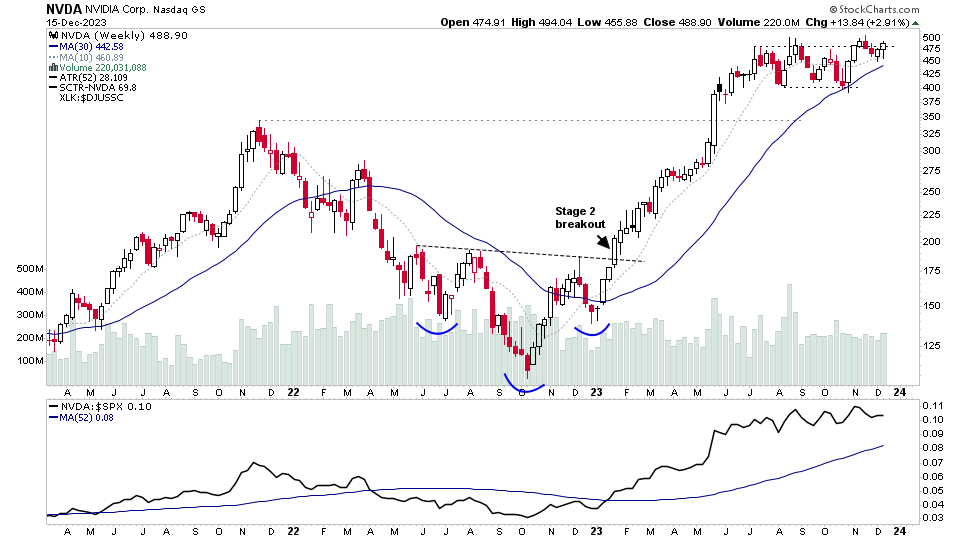

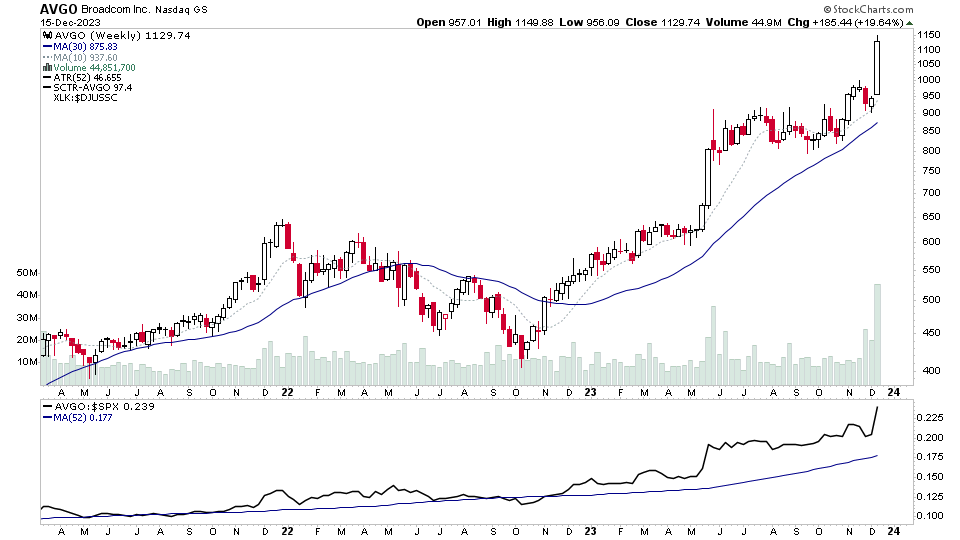

Semiconductors ($DJUSSC) continues to improve, and was a major group theme in the watchlist posts over the last few weeks, and has returned into the top 10 RS groups, with a +7 RS points move this week and an 8.07% gain, as multiple stocks in the group made Stage 2 continuation breakouts and surged higher. So if NVDA joins in and and makes a continuation move to new highs, then there's a chance that it could rise back to the top of the RS rankings in the coming weeks.

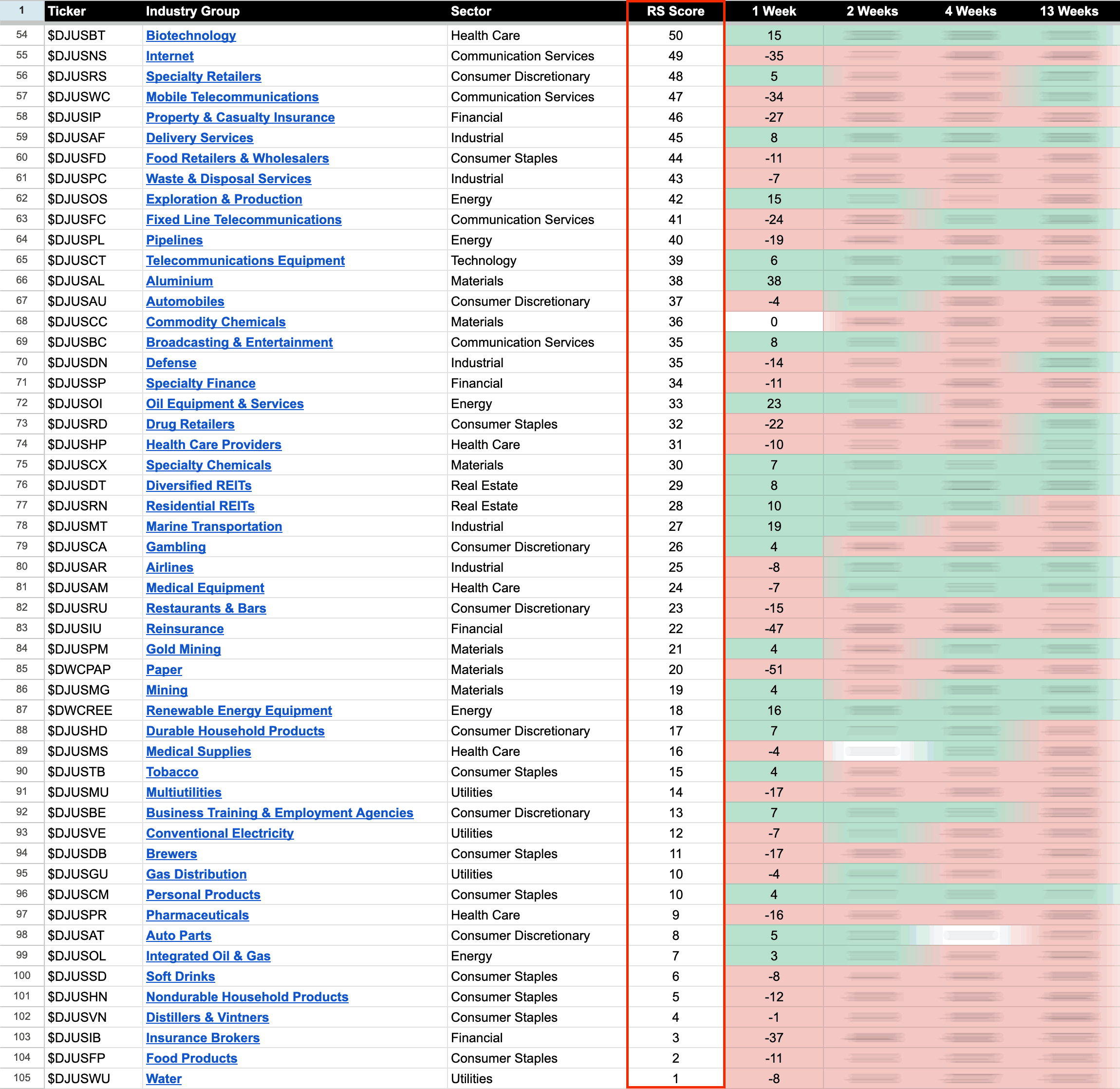

US Industry Groups by Weakest RS Score

While there were lots of powerful moves this week, however, the major percentage moves came in the laggards at the bottom of the RS rankings as multiple stocks had short-covering rallies in Stage 4B- positions.

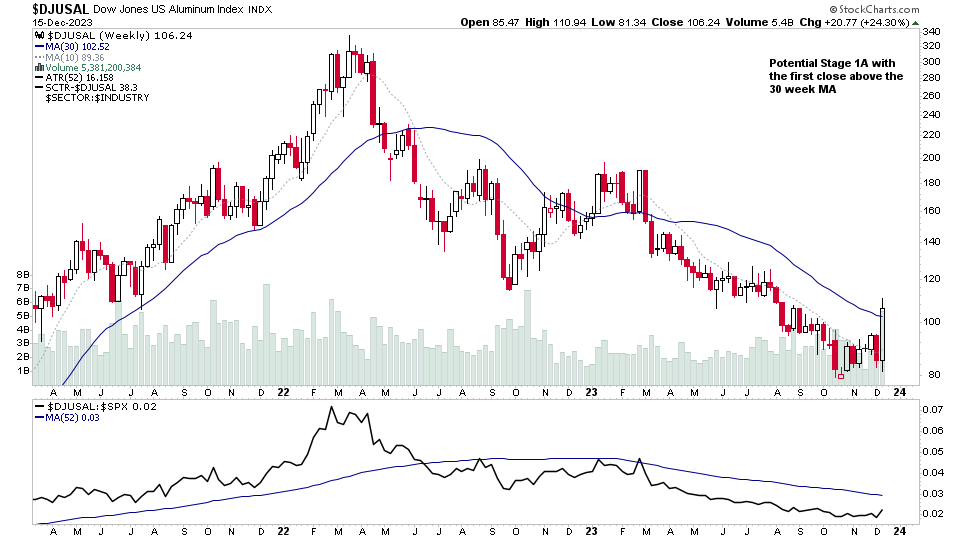

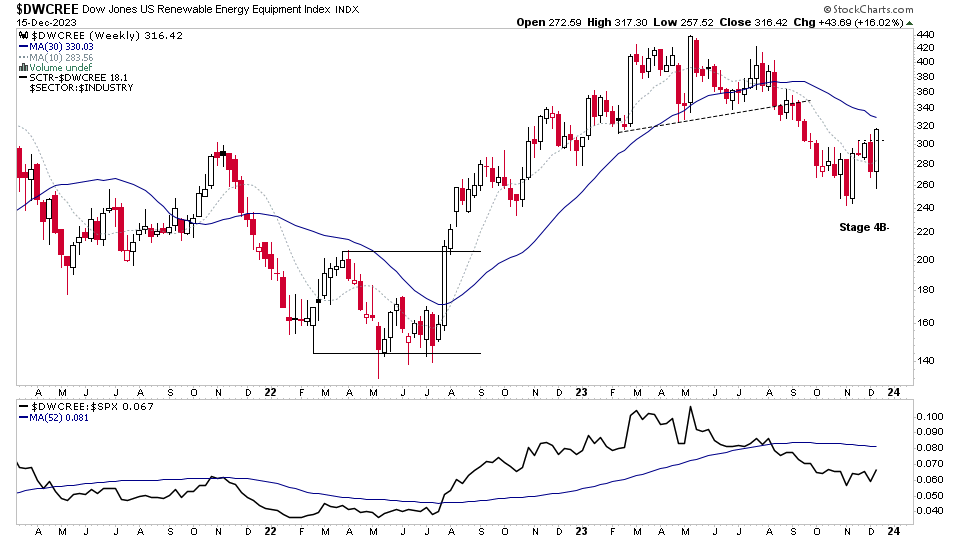

Aluminium ($DJUSAL) and Renewable Energy Equipment ($DWCREE) were the two strongest movers of these types of moves, which propelled them out of the bottom of the rankings. With Aluminium gaining +38 RS points and a +24.30% gain, and Renewable Energy Equipment (Solar, Hydrogen etc) gaining +16 RS points and a +16.02% gain.

US Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this and other premium content, such as the regular US Stocks watchlist, detailed videos and intraday posts, become a Stage Analysis member.

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.