(2013-10-28, 06:01 AM)JimStudent Wrote: Footnotes on pg 76 of the book talks about calculating Stan Weinstein's survey of NYSE, he says an excellent Gallup Poll is to do this for the sectors.

I put the health of the Sectors at 75% (the percentage of stage 1 &2 sectors)

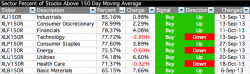

This is the purpose the previous post on the sector breadth, as the Percentage of Stocks above their 150 day (30 week) moving averages in each sector gives a very close approximation of what you'd get from a Stages survey like you did, as it covers around 4500 stocks in the whole US market. And as I've said previously it has a very good correlation with the stages survey.

So as you can see from the table if you average the sector percentages it came to 76.01% this week.

(2013-10-28, 06:01 AM)JimStudent Wrote: What I find most interesting is that the Utilities Sector is the most unhealthiest sector (1 in stage 2, 1 in stage 3, and 3 in stage 4). The health of the utilities sector is only 20%.

You seem to have a very small sample size of the Utilities sector. In my sector breadth data it covers 182 utilities stocks in the US, and although it was the weakest sector a month ago, it's been recovering strongly the last few weeks and has moved from below 35% in September to 74.18% now. See below:

(2013-10-28, 06:01 AM)JimStudent Wrote: In Stan Weinstein's 1997 interview (page 446) he says, "When your start to see things getting out of gear, that is a sign of a trend reversal. The sequence usually goes in this order - fist you have the utilities go. Then usually you start to usually see the Transportations go. The A/D line should come next. Then the speculative issues should top out. The last thing to top out are usually the blue chip averages."

I assume the sectors have changed since the book was written, it seems the transportation sector that Stan Weinstein referred to is now included in the Industrial Sector. Appreciate any thoughts.

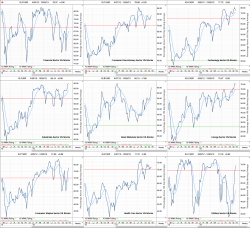

The Utilities and Transports charts he was referring to I believe were the Dow Jones Utility Average ($UTIL) and the Dow Jones Transportation Average ($TRAN)

The Utilities average is in Stage 3 and the Transports made a Stage 2 continuation move to new highs two weeks ago.

The A/D line also just broke out to fresh new highs after consolidating for most of the summer in a Stage 3 range, so has made a Stage 2 continuation move.

So keep an eye on these as Stan said, as when you start to see things breaking down in these measures you'll know to be a bit more defensive in your trading.

Hope that helps.