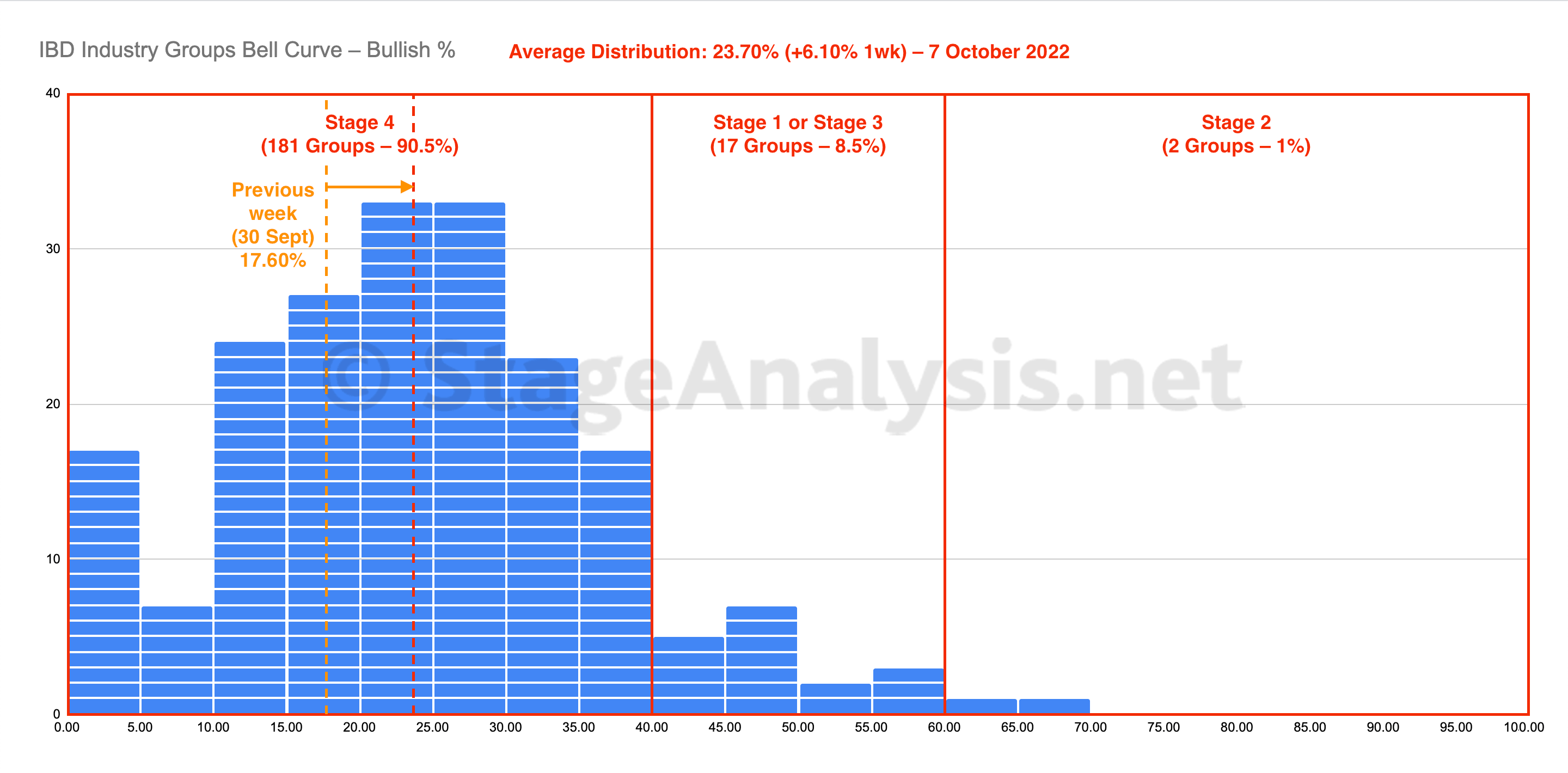

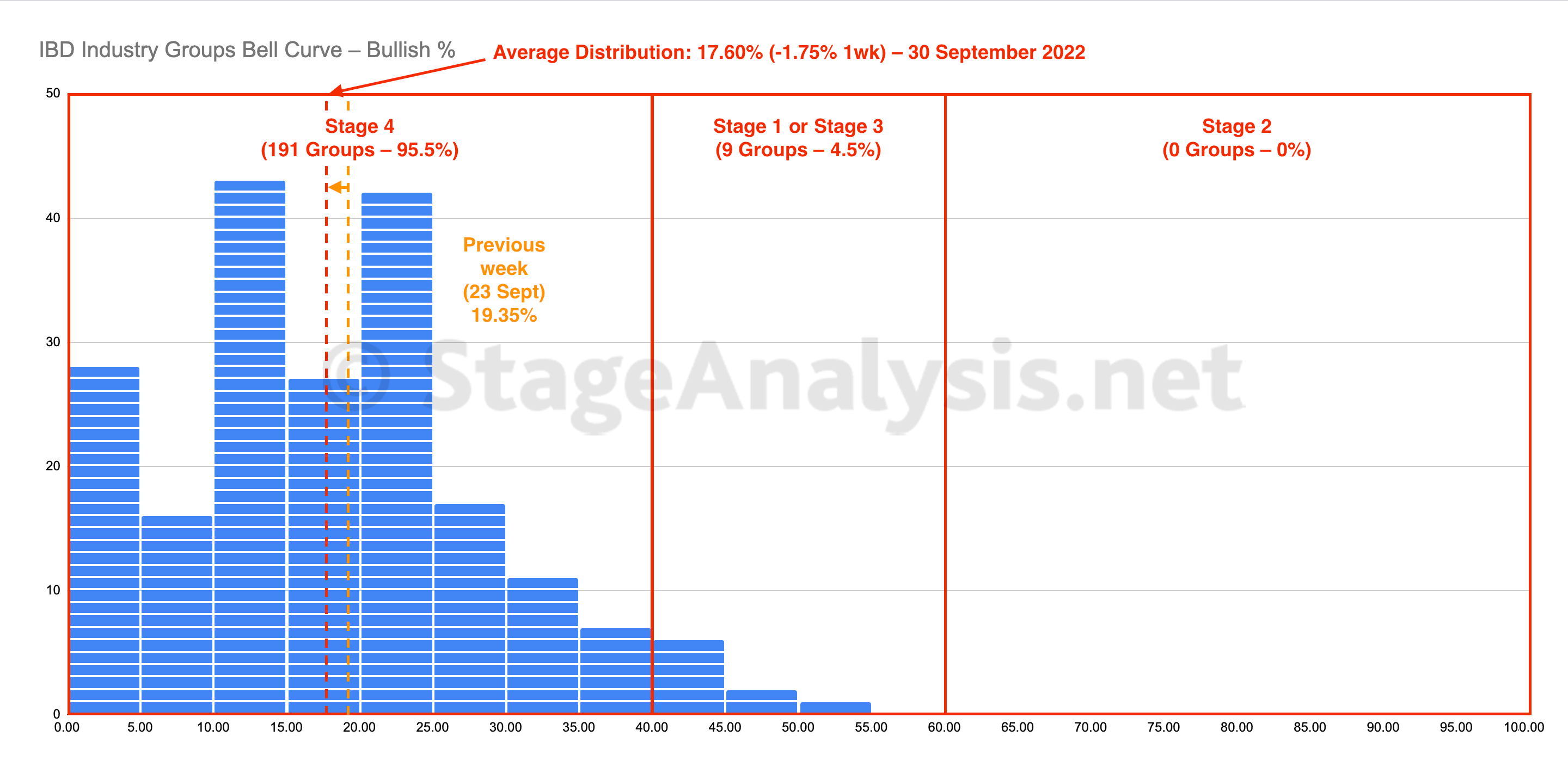

The IBD Industry Groups Bell Curve – Bullish Percent recovered from the previous weeks, year to date low and gained +6.10%, to close the week at 23.70%. The vast majority of groups (90.5%) are still in the Stage 4 zone (below the 40% level), but the amount in Stage 4 decreased by 5%...

Read More

08 October, 2022