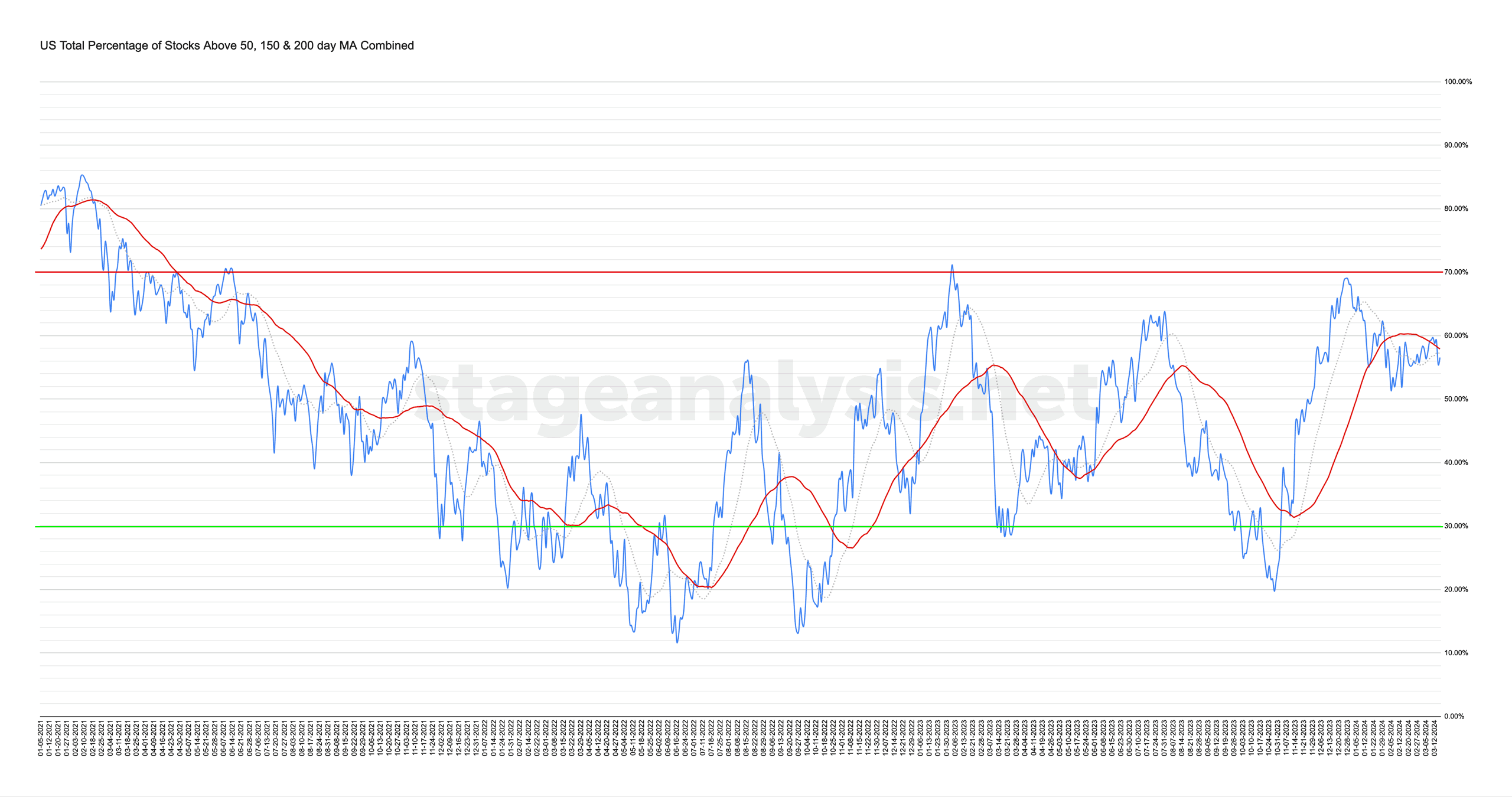

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -2.74% this week. Therefore, the overall combined average is at 56.57% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

Blog – All Posts

The blog shows all articles in date order – including the US Stocks Watchlist, Videos, Indexes, Market Breadth and featured articles on Industry Groups, Sectors or individual Stocks. But if you want see the watchlist posts only, then use the Watchlist tab in the menu, or the category link in the sidebar area.

15 March, 2024

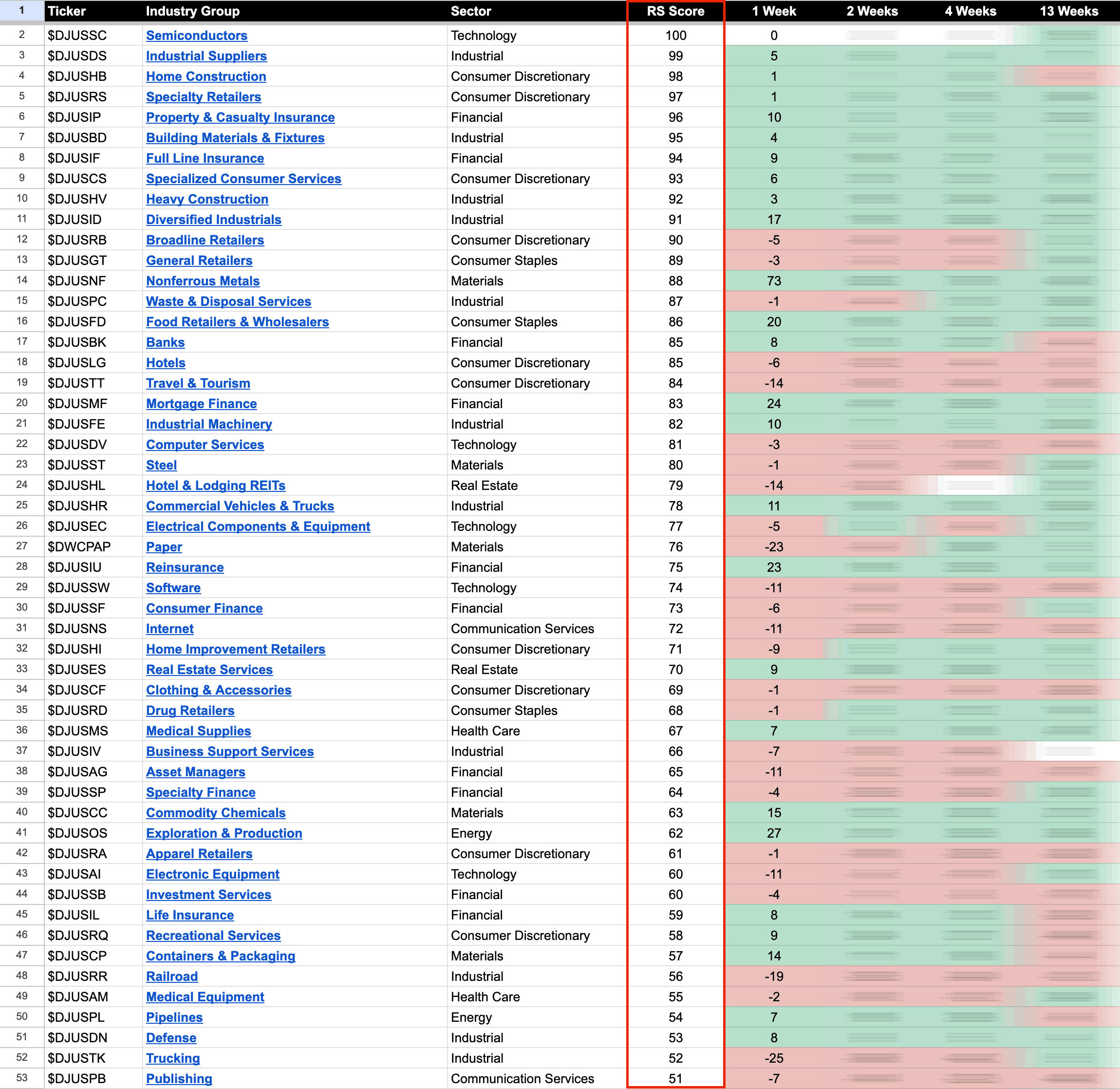

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

14 March, 2024

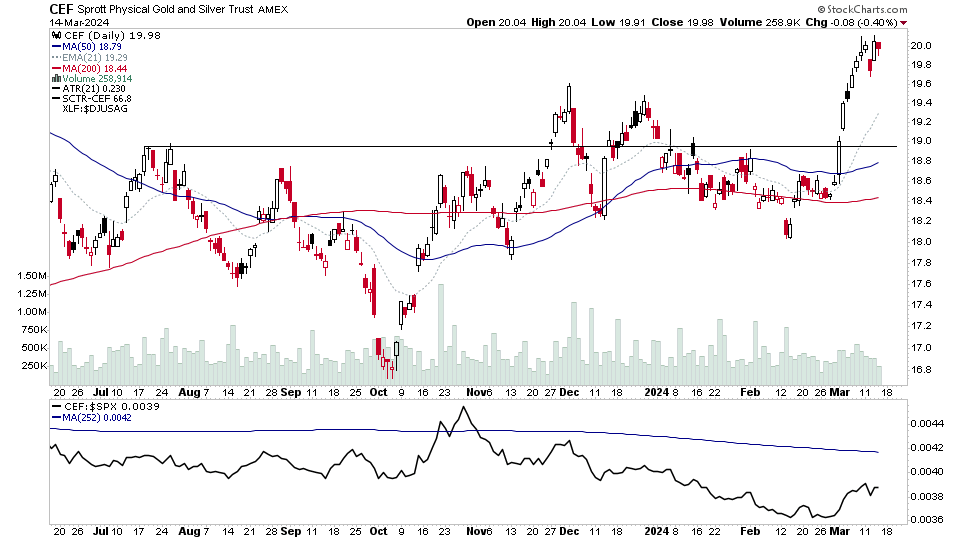

US Stocks Watchlist – 14 March 2024

There were 25 stocks highlighted from the US stocks watchlist scans today...

Read More

13 March, 2024

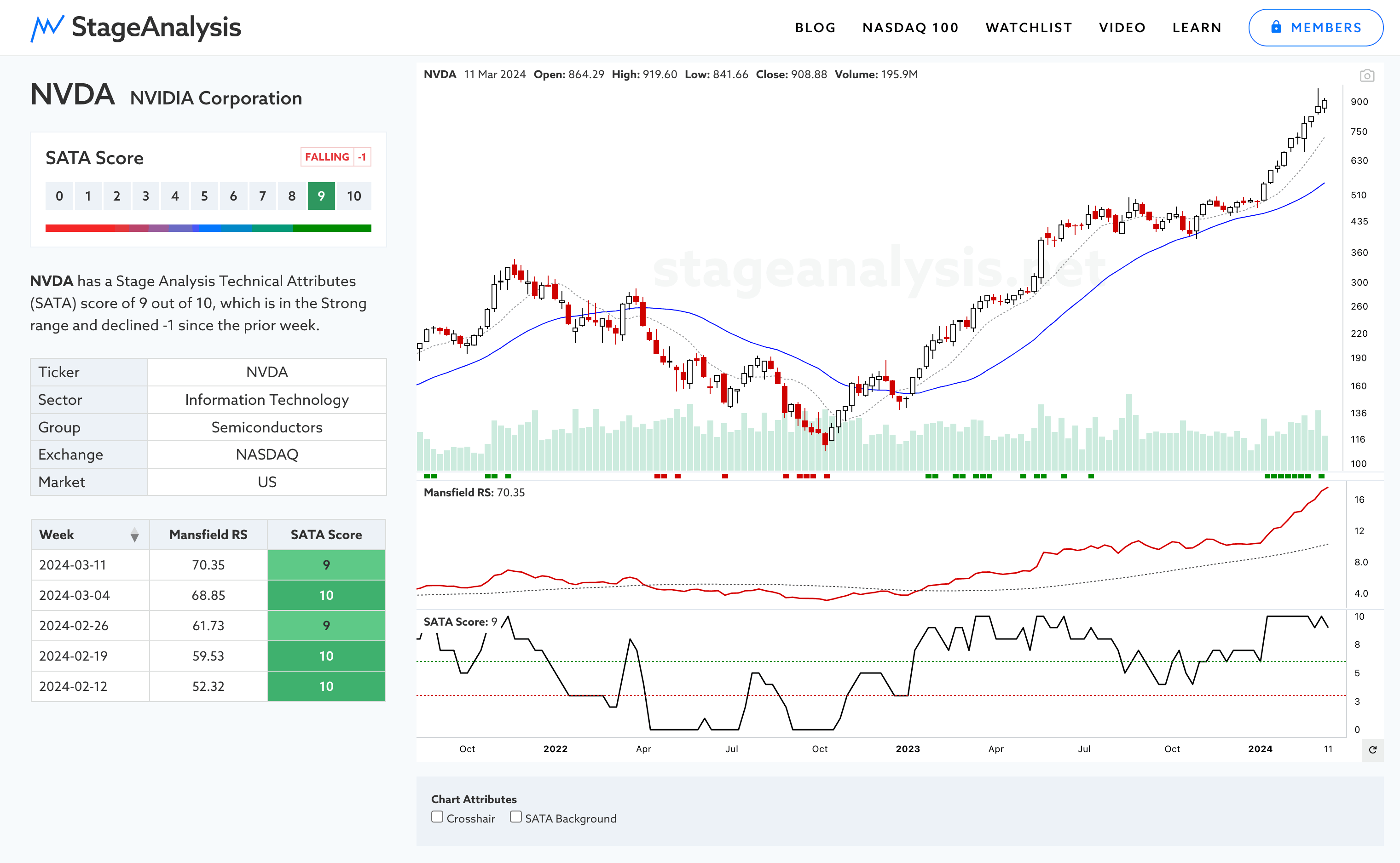

New Features Video: Overview of New Group & Sector Additions to the SATA Tool – 13 March 2024

A brief overview of some of the additional features that have been added to the Stage Analysis Technical Attributes (SATA) stock pages this week...

Read More

12 March, 2024

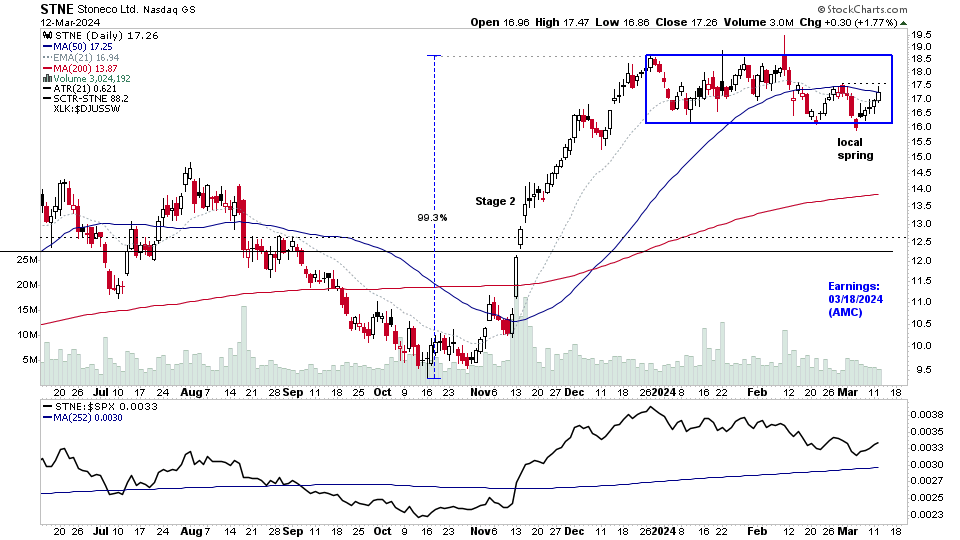

US Stocks Watchlist – 12 March 2024

There were 26 stocks highlighted from the US stocks watchlist scans today...

Read More

11 March, 2024

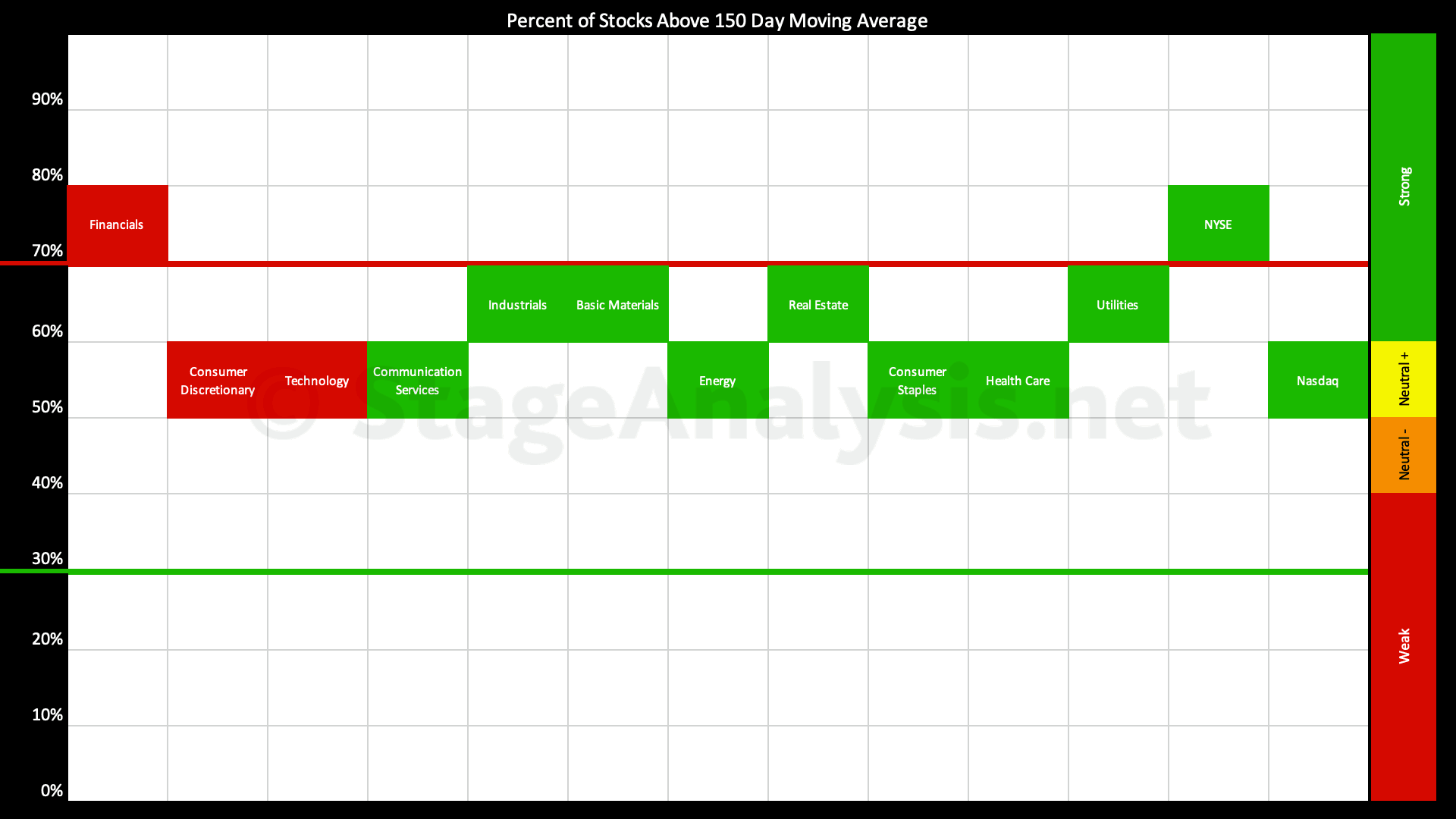

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day moving averages in the 11 major sectors increased by +5.57% since the previous post on the 19th February 2024, moving the overall average to 60.26%, which is on the borderline of the Strong zone (60%+ range).

Read More

10 March, 2024

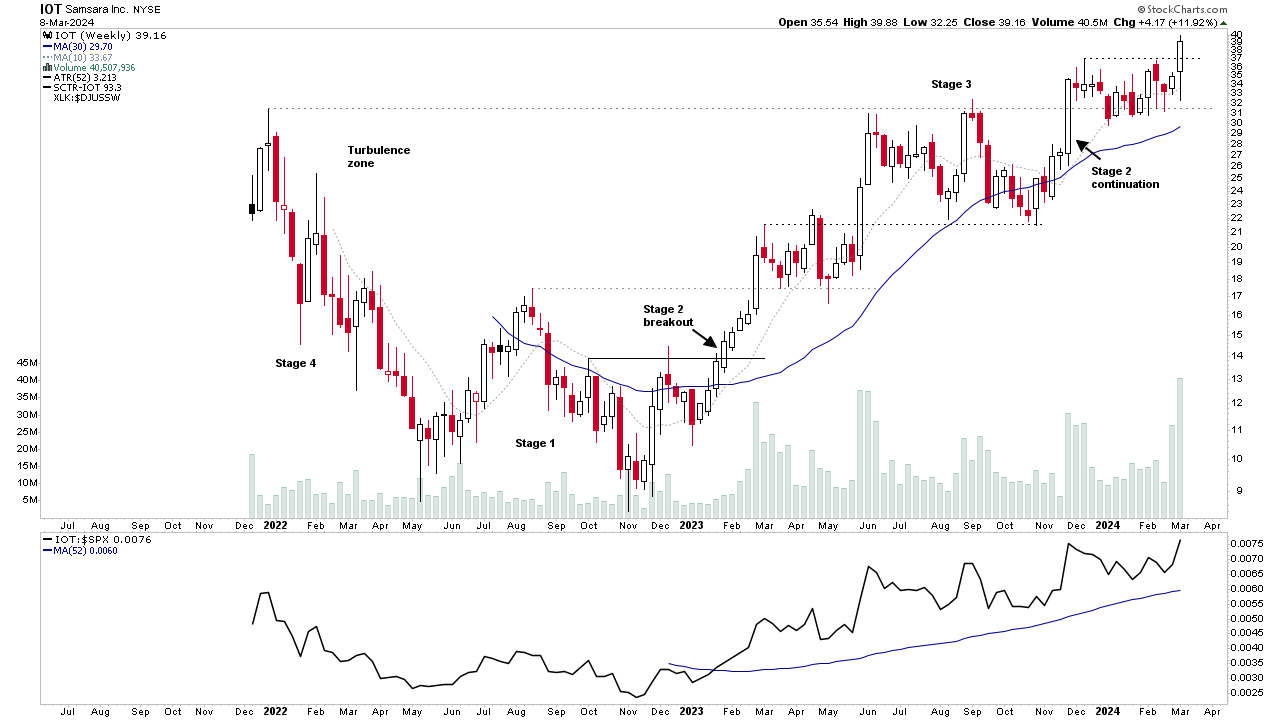

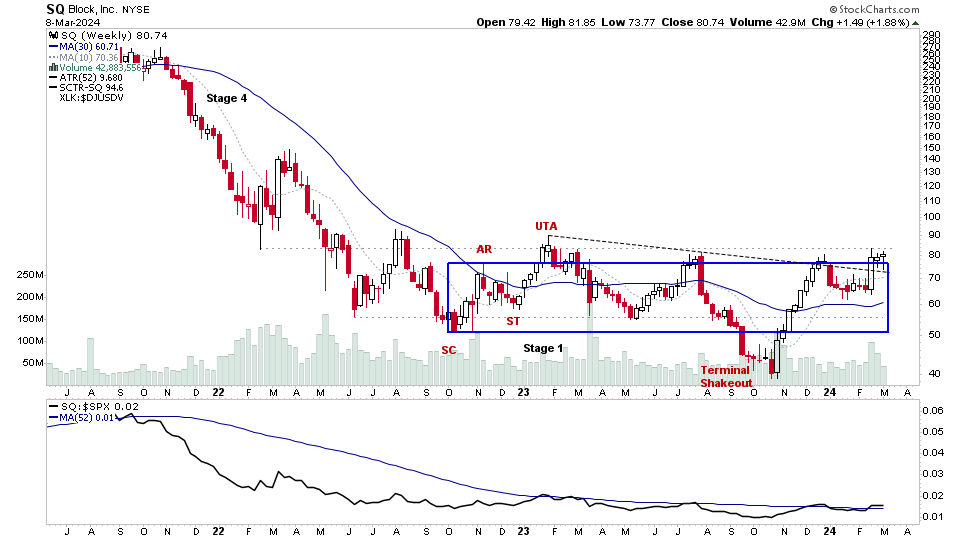

Stage Analysis Members Video – 10 March 2024 (1hr 3mins)

Stage Analysis members weekend video discussing the Significant Weekly Bars moving on volume, the US watchlist stocks in detail on multiple timeframes, the new Stage Analysis Technical Attributes (SATA) tool and how to use it, the Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, the Crypto Coins and the Major US Stock Market Indexes.

Read More

10 March, 2024

US Stocks Watchlist – 10 March 2024

There were 14 stocks highlighted from the US stocks watchlist scans today...

Read More

10 March, 2024

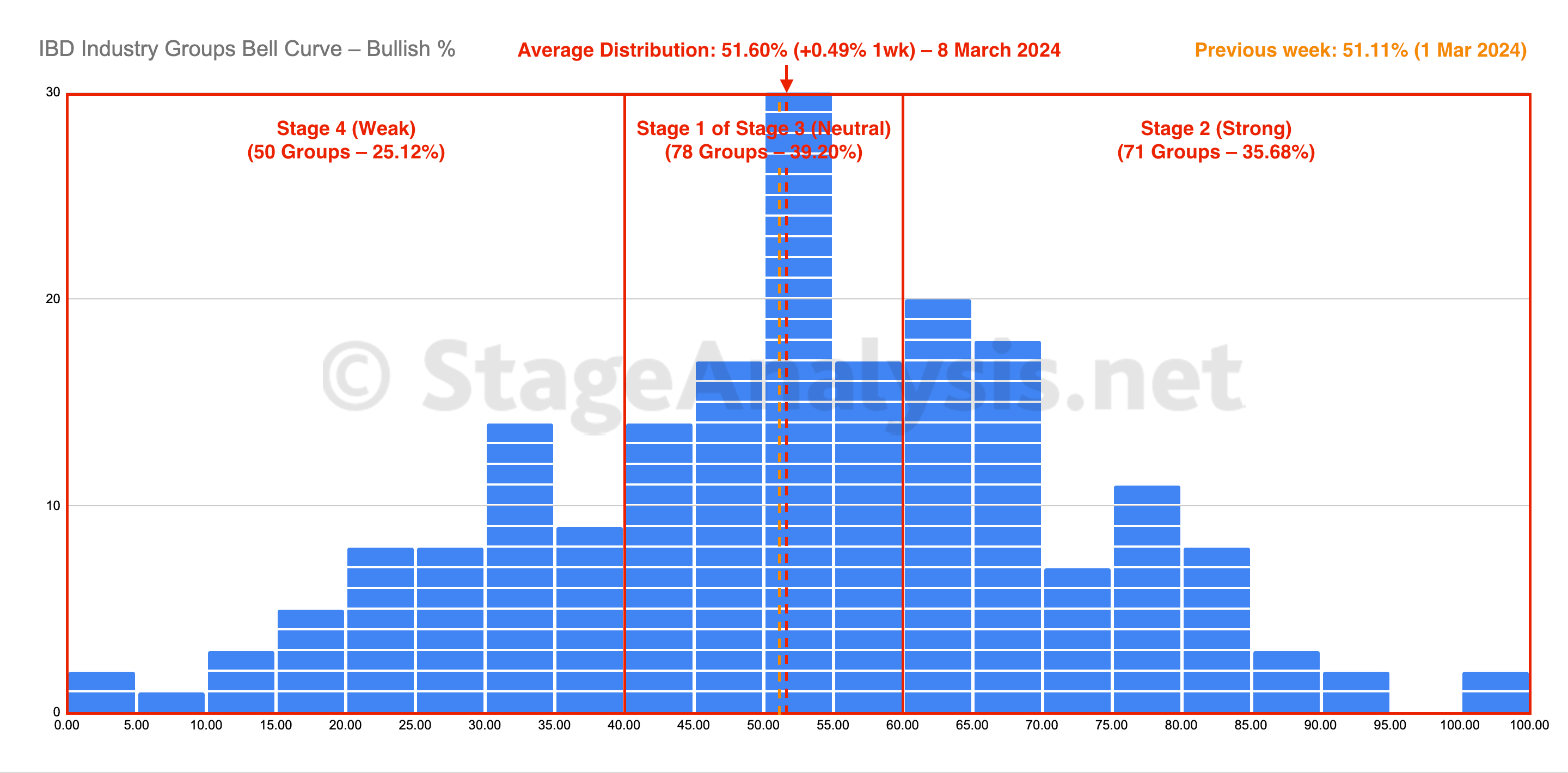

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve increased by +0.49% this week to finish at 51.60% overall. The amount of groups in Stage 4 (Weak) decreased by 4 (-2%), and the amount of groups in Stage 2 (Strong) decreased by 4 (-2%), while the amount groups in Stage 1 or Stage 3 (Neutral) increased by 8 (+4%).

Read More

09 March, 2024

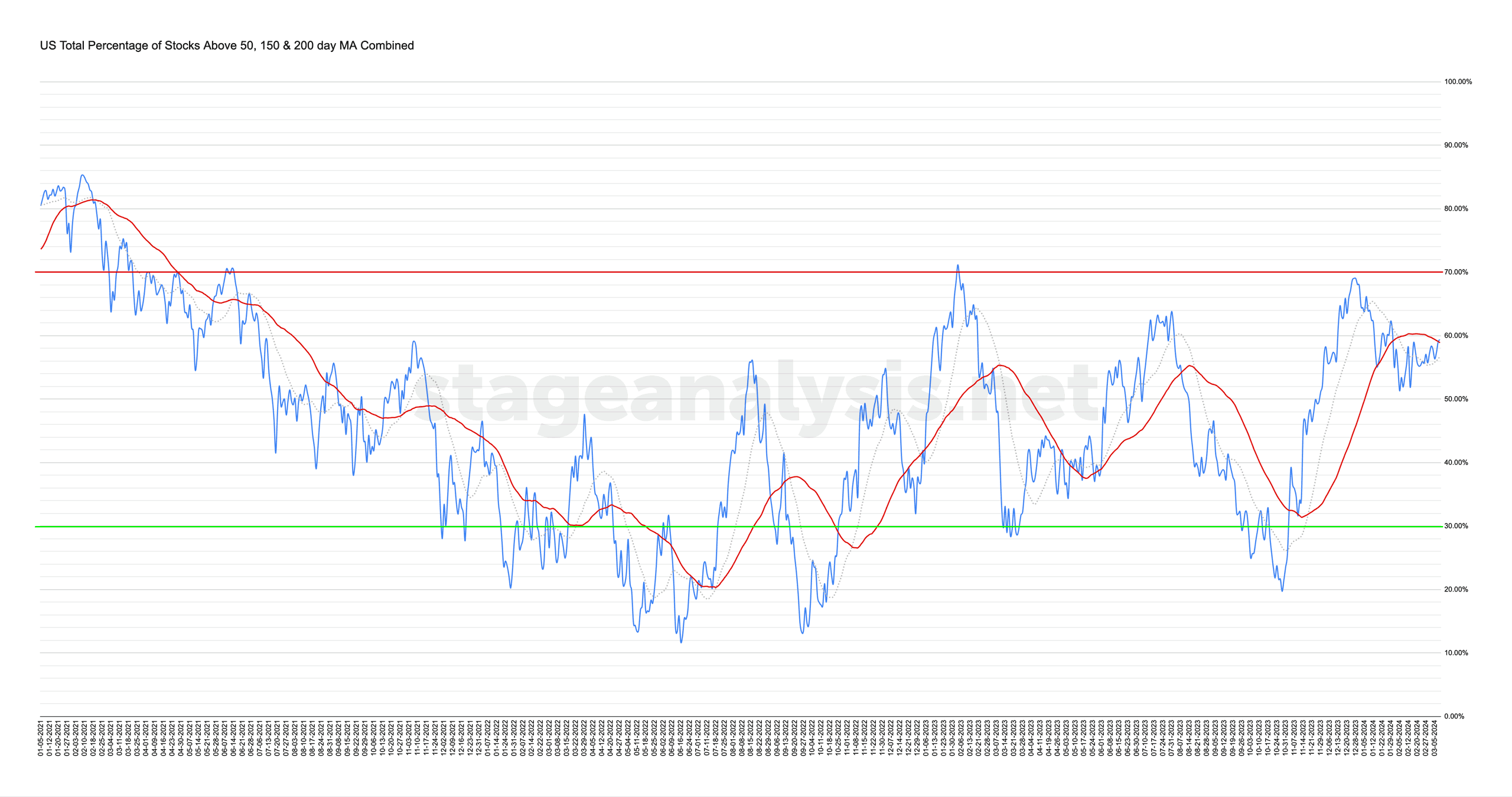

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +0.98% this week. Therefore, the overall combined average is at 59.30% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages...

Read More