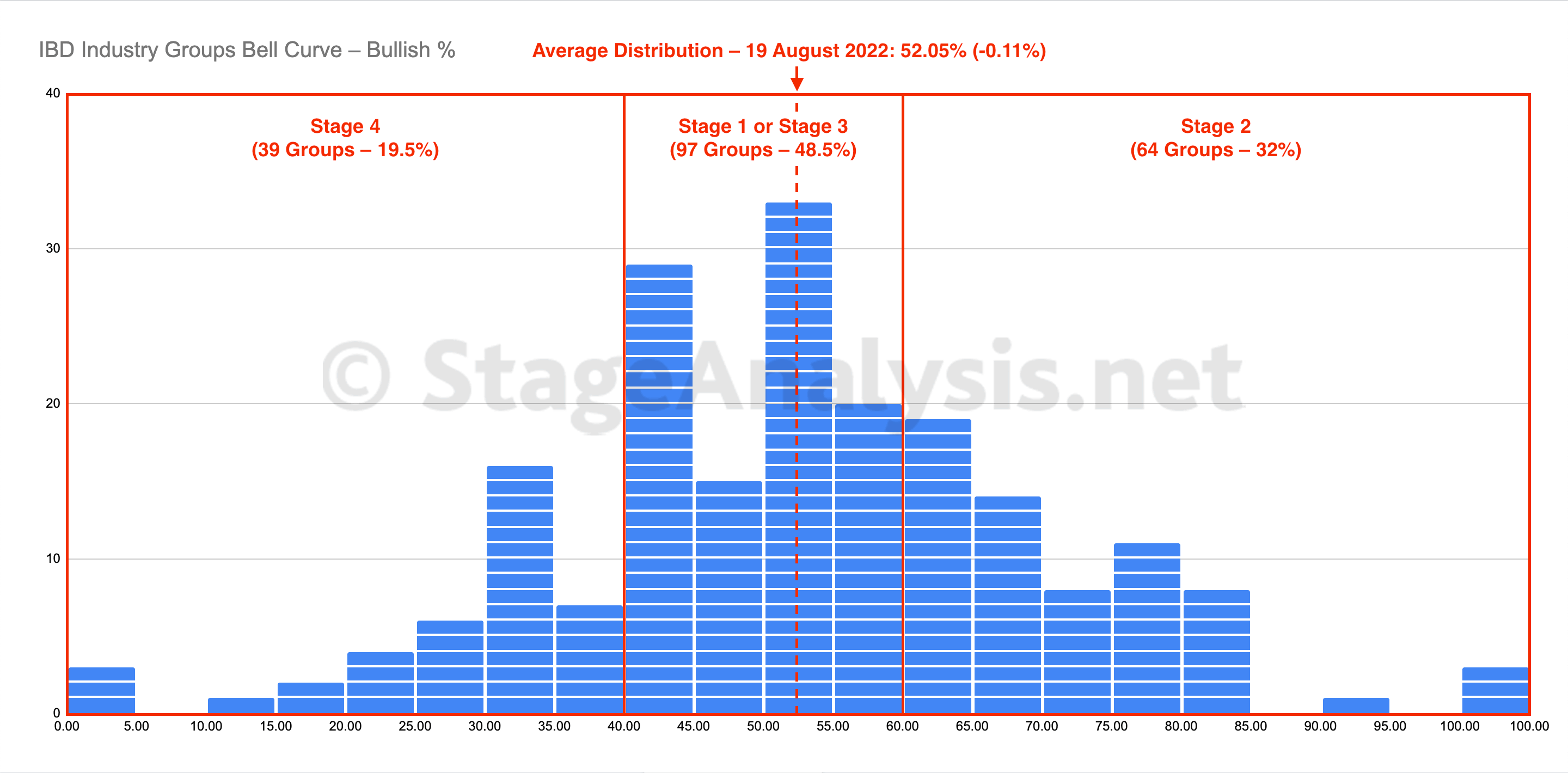

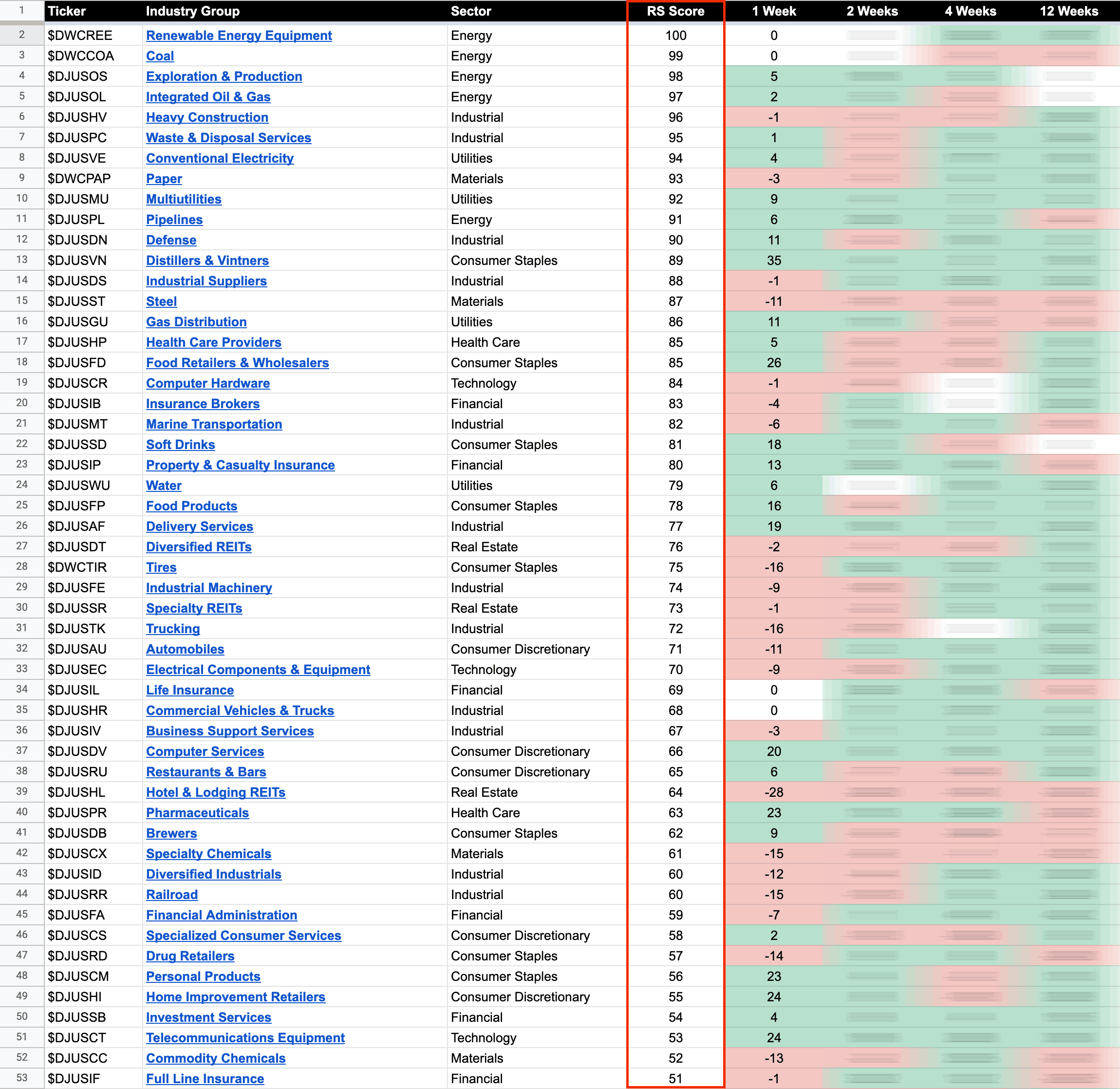

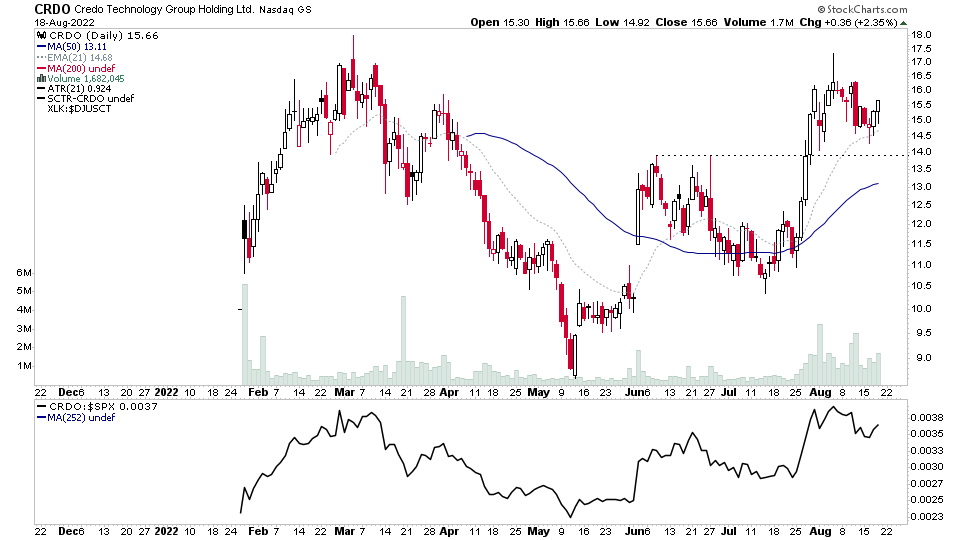

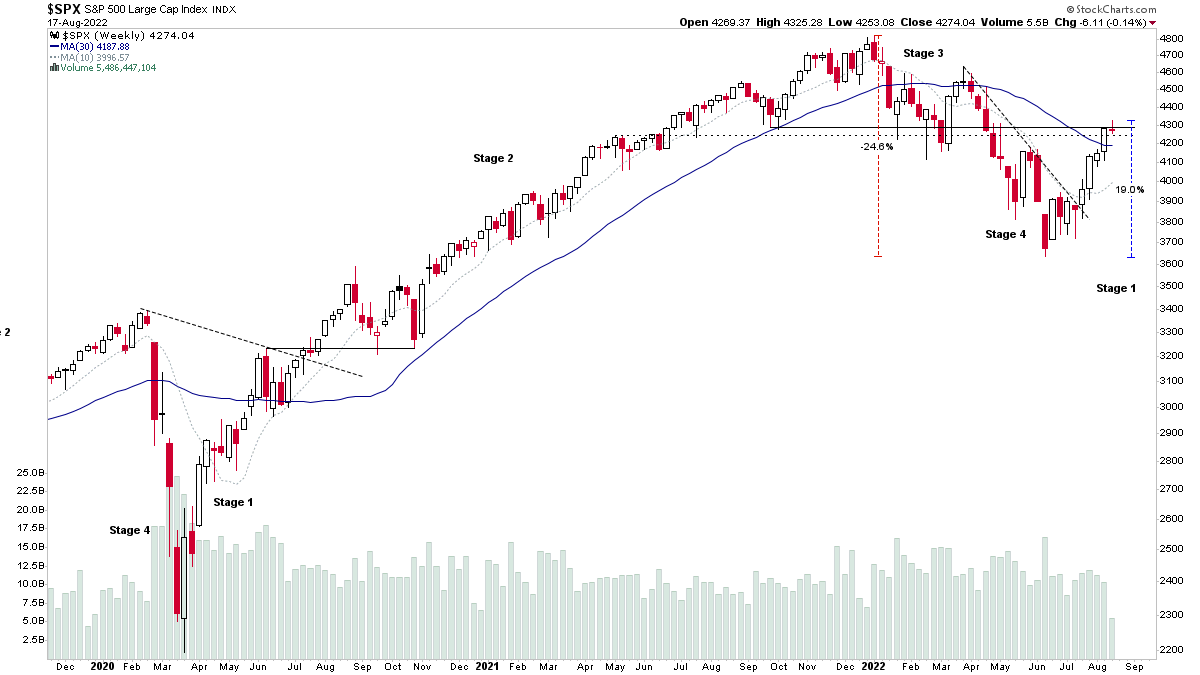

Renewable Energy Equipment was big feature in tonights watchlist, as multiple stocks in this leading group are pulling back towards short-term MAs, and so could be near to actionable areas if the market doesn't fall apart that is...

Read More

23 August, 2022