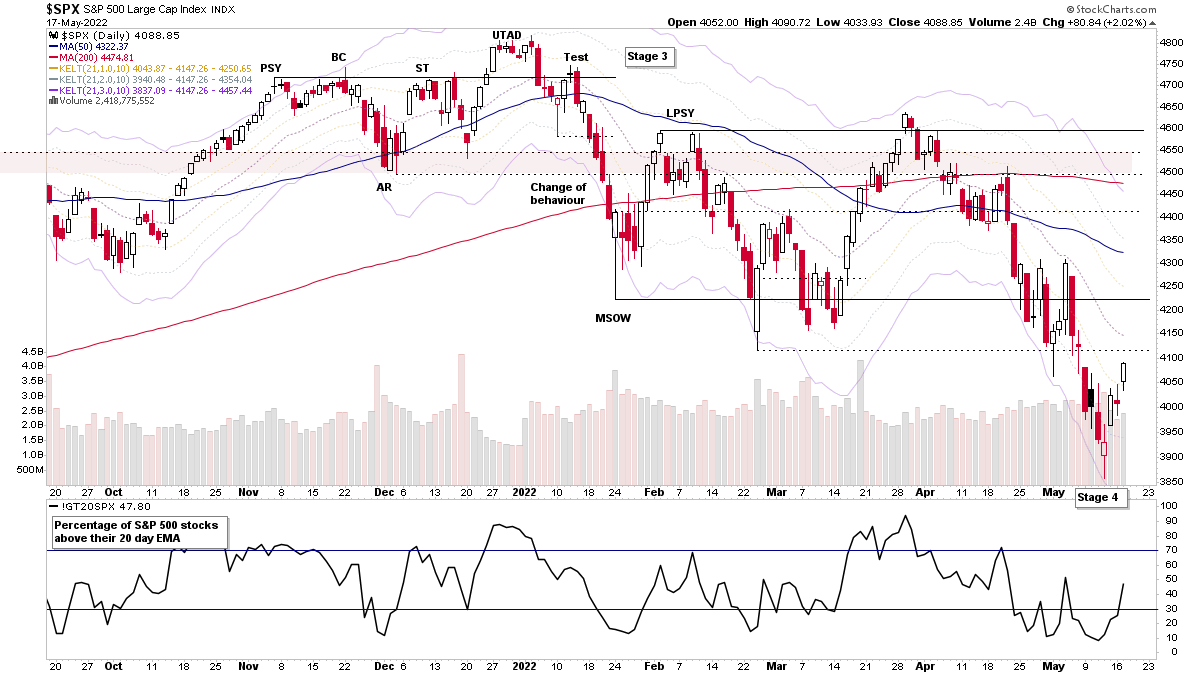

Friday produced a potential shakeout move in the major US stock markets (i.e. the S&P 500, Nasdaq Composite and Russell 2000) with a failed breakdown attempt and monthly options expiry potentially playing a role, with the price action closing between the maximum pain levels for both puts and calls...

Read More

Blog

20 May, 2022

Gold Attempting To Move Back Above the 200 Day MA and the US Stocks Watchlist – 19 May 2022

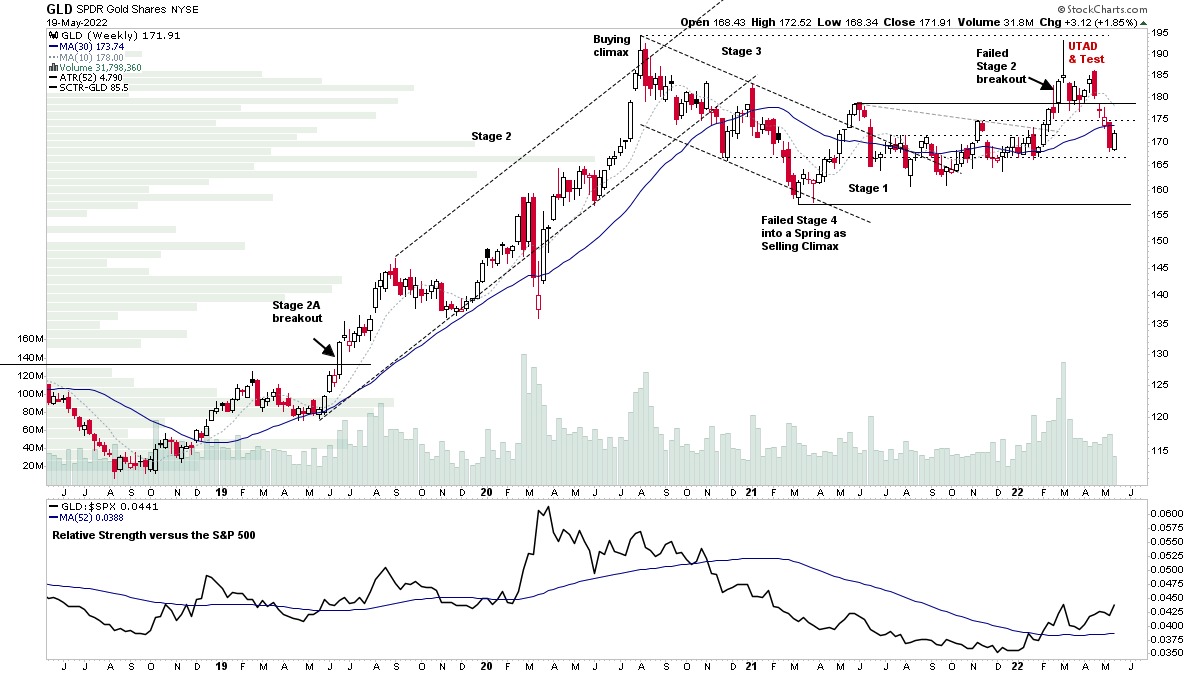

Gold and Miners are coming back into focus today, with a move by the Gold continuous futures back through the 200 day MA on increased volume, and so a potential spring type event at the moving average – which has also been showing up in the individual gold miners and some of the silver miners too over the last week or so...

Read More

19 May, 2022

Stage Analysis Members Midweek Video – 18 May 2022 (1hr 17mins)

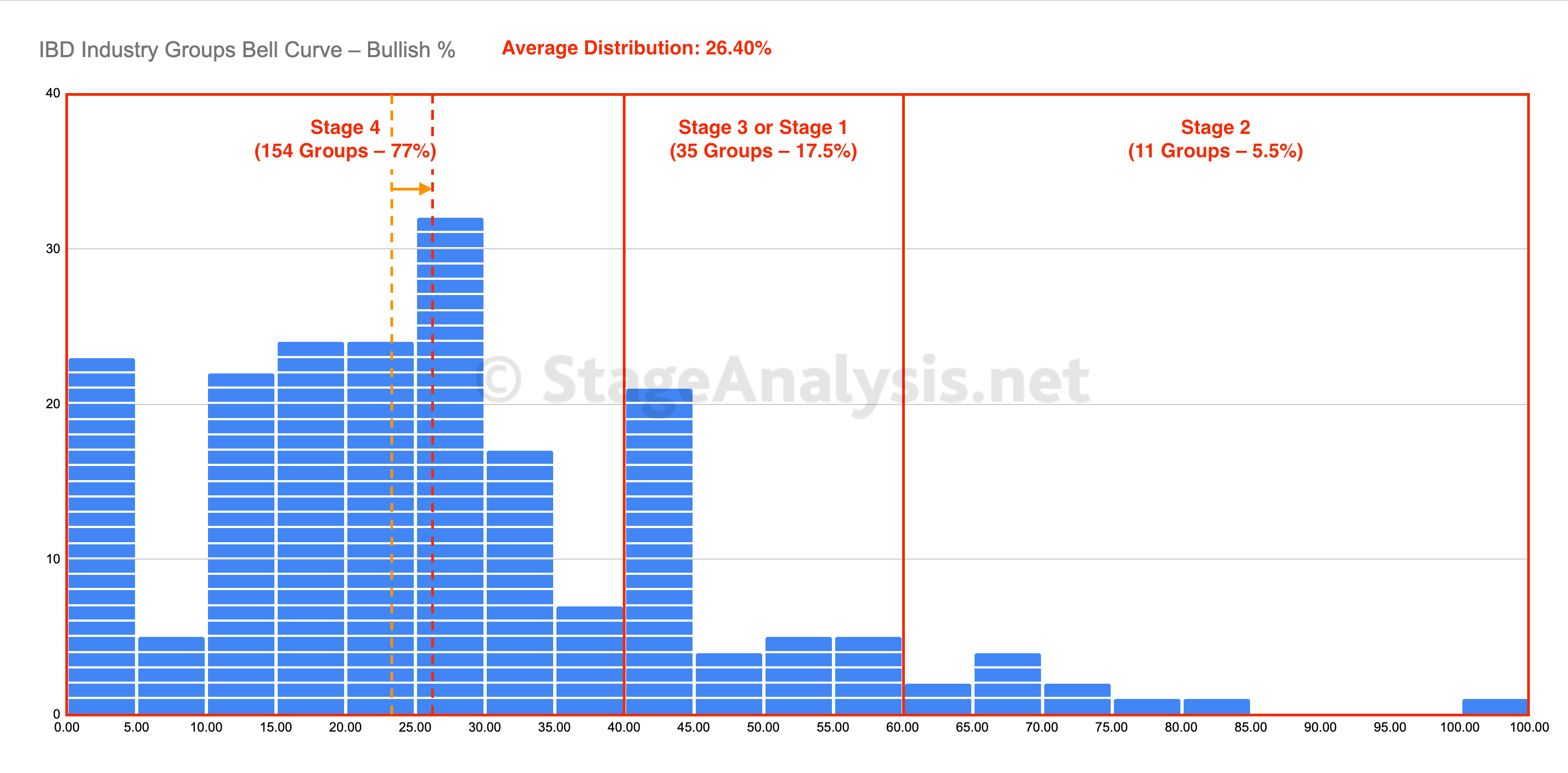

The Stage Analysis Members Midweek Video features Analysis of the Stages of the major US sectors, as well as a look at the sector breadth visual the custom IBD Industry Groups Bell Curve – Bullish % chart that I do for the members that shows the distribution of the 200 IBD Industry Groups as a bell curve chart...

Read More

18 May, 2022

NYSE Bullish Percent Status Change to Bull Alert and New CAN SLIM Follow Through Day Triggered

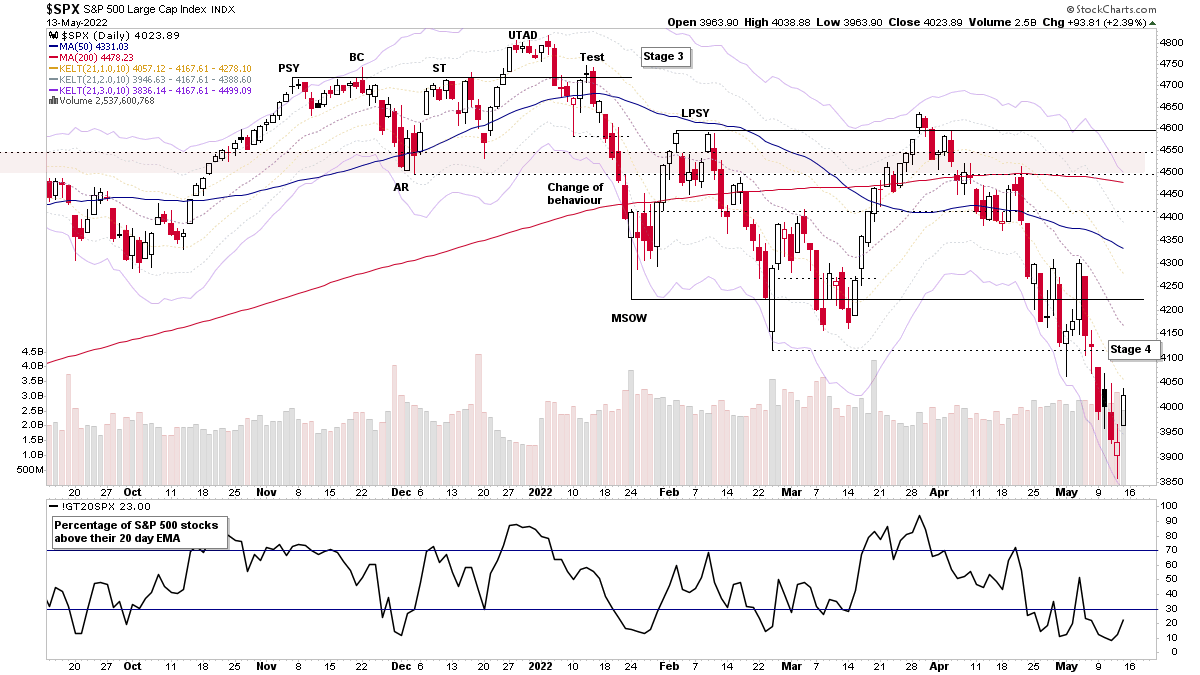

The major indexes managed to put in a Follow Through Day (FTD) which is defined in the excellent book about the CAN SLIM method called – How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition by William O'Neil. Which changes the Investors Business Daily (IBD) outlook to Confirmed Uptrend.

Read More

16 May, 2022

Inside Day on the Nasdaq Composite and the US Stocks Watchlist – 16 May 2022

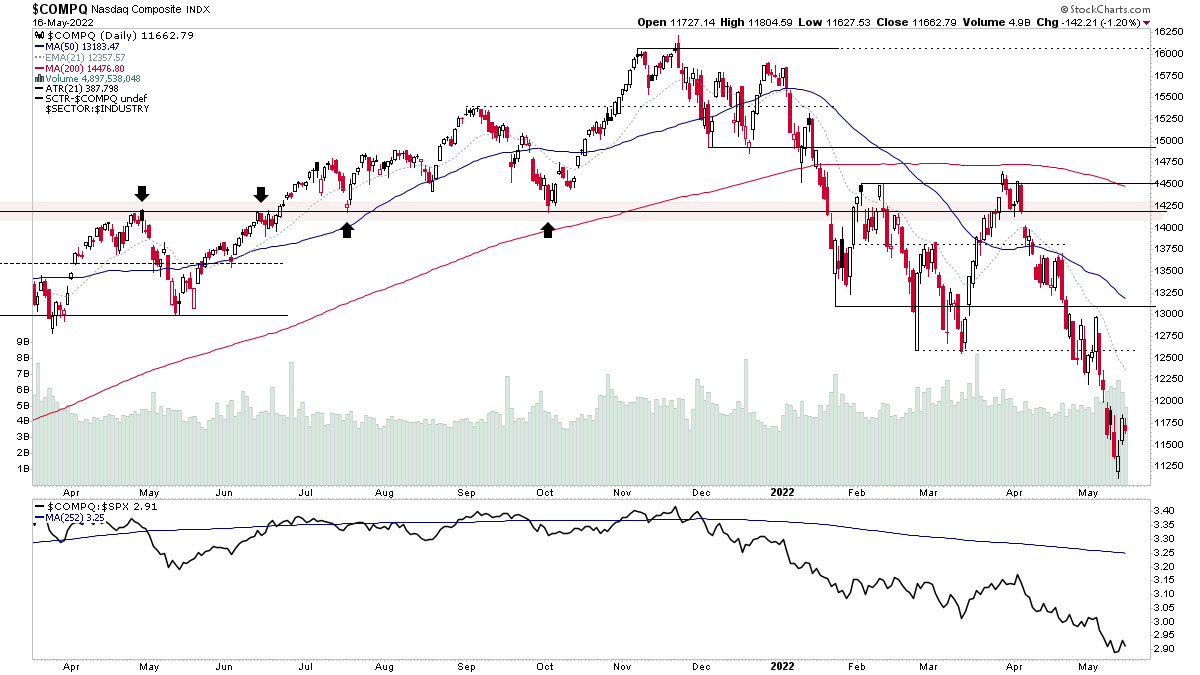

There wasn't much in the way of follow through today except in the stronger RS areas of the market, with progress in all of the top ten groups, which is still dominated by the Energy groups. But in the broader market indexes such as the Nasdaq Composite (see above) there was mix of inside days and small stalling dojo candles...

Read More

15 May, 2022

Stage Analysis Members Weekend Video – 15 May 2022 (1hr 40mins)

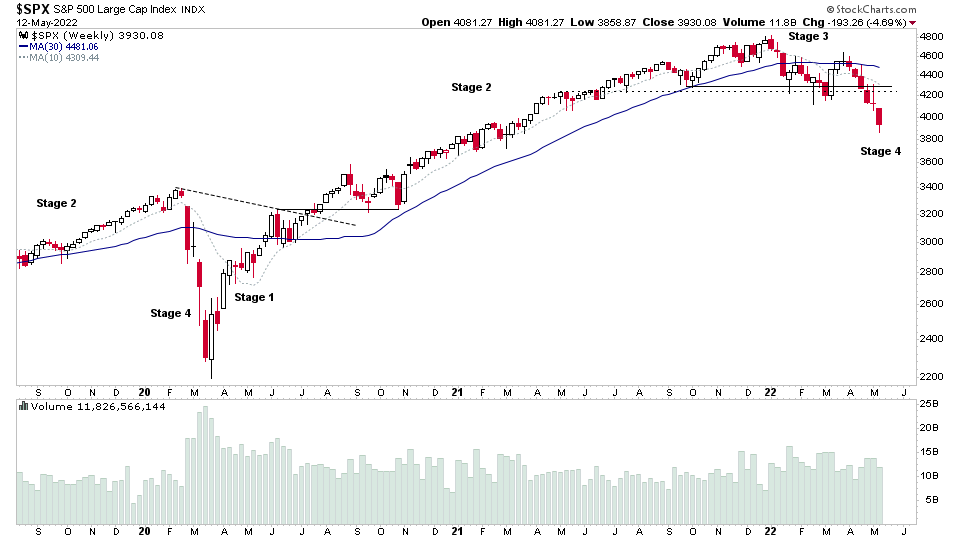

This weekends Stage Analysis Members Video features the Major Indexes Review and analysis of the Sector Breadth charts. Plus the US Stocks Industry Groups Relative Strength tables and groups of interest. The Market Breadth Charts to determine The Weight of Evidence and the US Stocks Watchlist in Detail, with marked up charts of what I'm watching for on the long and short side.

Read More

15 May, 2022

US Stocks Watchlist – 15 May 2022

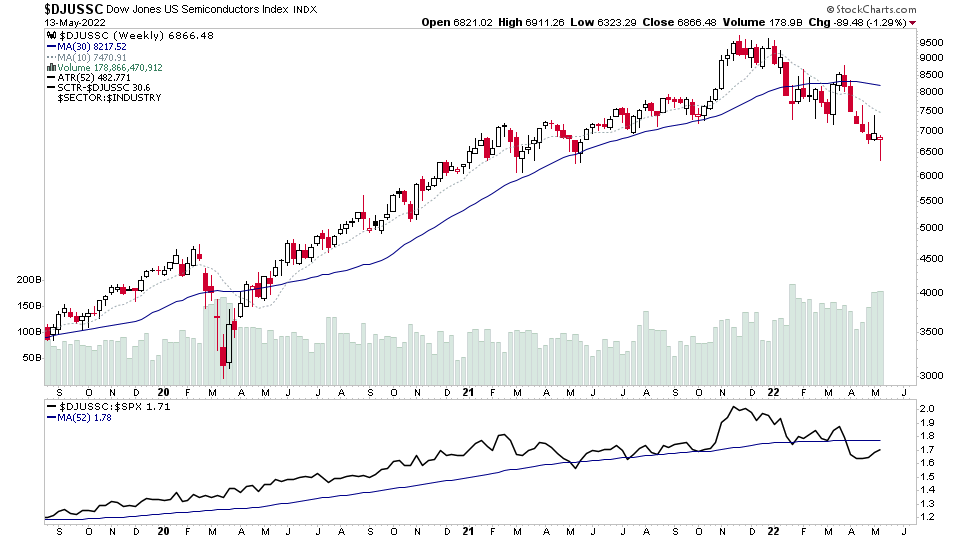

Friday saw a large amount of strong moves in the more beaten down areas of the market, with short covering type moves on volume in numerous stocks. Which reversed the Bullish Percent Index column to Xs in the majority of the Software IBD subgroups and Semiconductor groups in the lower zone, and hence changes their P&F status to Bull Alert...

Read More

12 May, 2022

US Stocks Watchlist – 12 May 2022

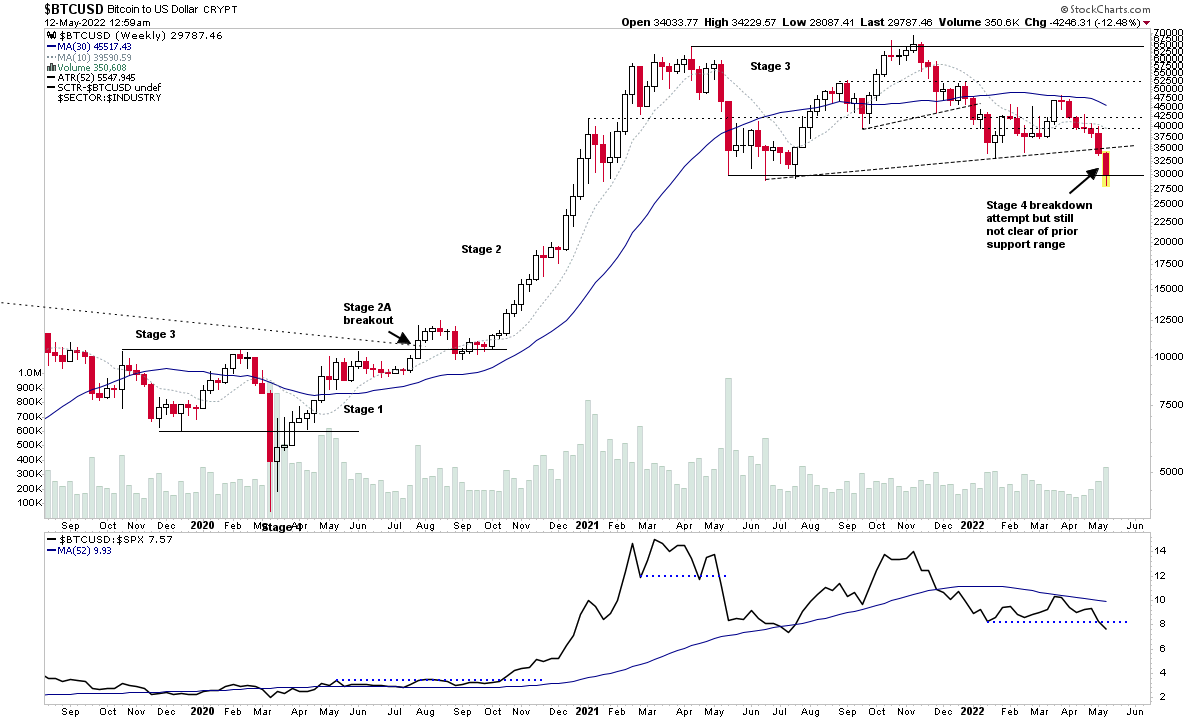

A very small list again today as the major Stage 4 decline in the market continues. There are a few group themes today with Specialty Chemicals and Electrical Components having multiple entries.

Read More

12 May, 2022

Stage Analysis Members Midweek Video – 11 May 2022 (1hr 14mins)

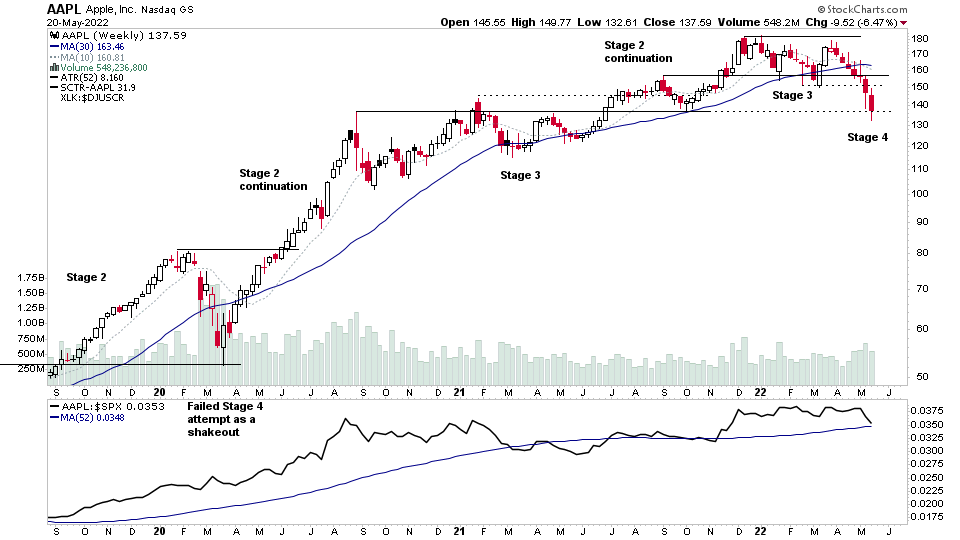

This weeks Stage Analysis Members Midweek Video features analysis of the major indexes Stage 4 declines and the VIX. Plus a detailed look at the mega caps stocks with AAPL (Apple) attempting to breakdown in Stage 4 today and join the other large cap stocks already in Stage 4...

Read More

10 May, 2022

Major Commodities and Market Breadth Update

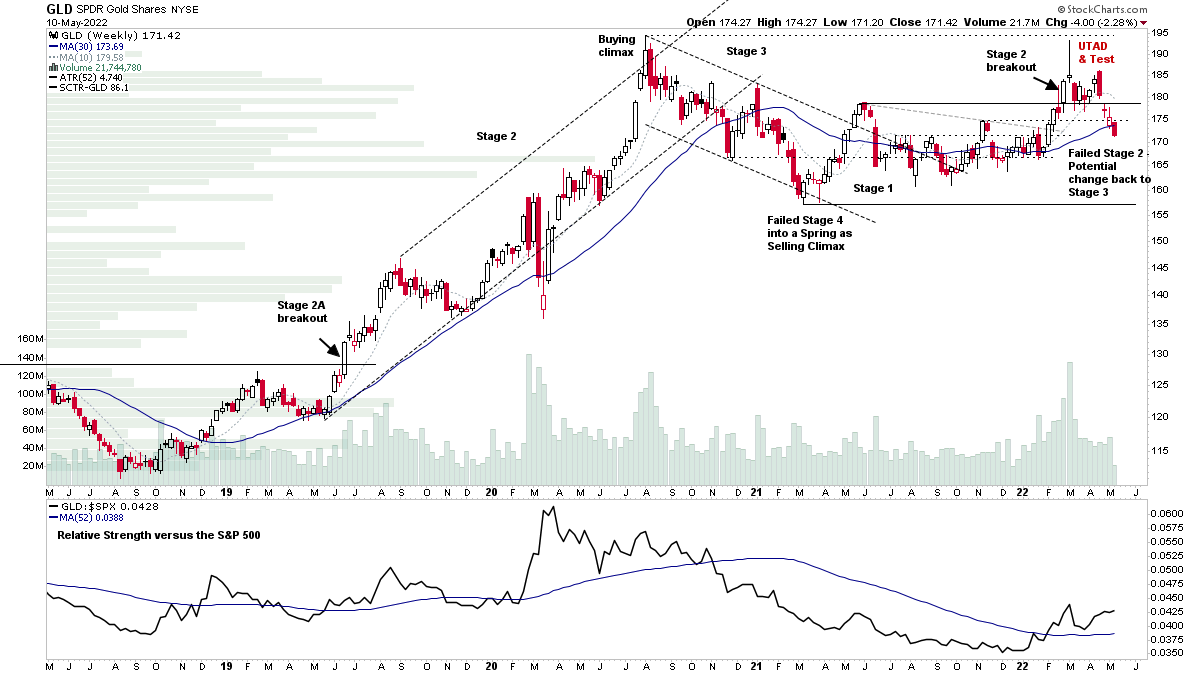

Golds brief move into Stage 2 in February and March looks to have failed with it moving strongly back into the previous Stage 1 base and through two support levels, and looks to have formed potential UTAD and Test events, which could shift the interpretation of the broader base structure from an Stage 1 accumulation structure to still being in a Stage 3 distributional structure...

Read More