For the watchlist from Thursdays scans...

Read More

Blog

07 July, 2022

US Stocks Watchlist – 7 July 2022

06 July, 2022

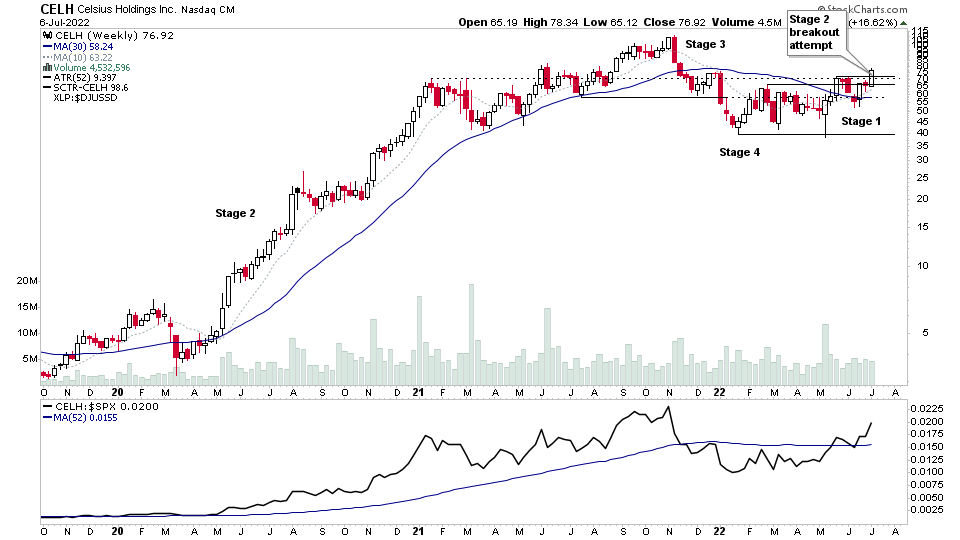

Stage Analysis Members Midweek Video – 6 July 2022 (1hr 21mins)

Midweek video covering the Stage 2 breakout attempt in CELH. Plus an In Focus segment on the Biotech (XBI) and Chinese (FXI) ETFs. Followed by the Major Indexes Update – S&P 500, Nasdaq Composite and Russell 2000, and short term Market Breadth charts, and then an in-depth run through of the recent US Watchlist Stocks...

Read More

05 July, 2022

Stock Market Update and US Stocks Watchlist – 5 July 2022

A mixed day in the stock market with the NYSE stocks down while the Nasdaq stocks were up. So rotation was the theme with money flowing out of the stronger RS areas, such as the Coal stocks, with the group chart now approaching its 200 day MA and moving into Stage 3...

Read More

03 July, 2022

Stage Analysis Members Weekend Video – 3 July 2022 (1hr 20mins)

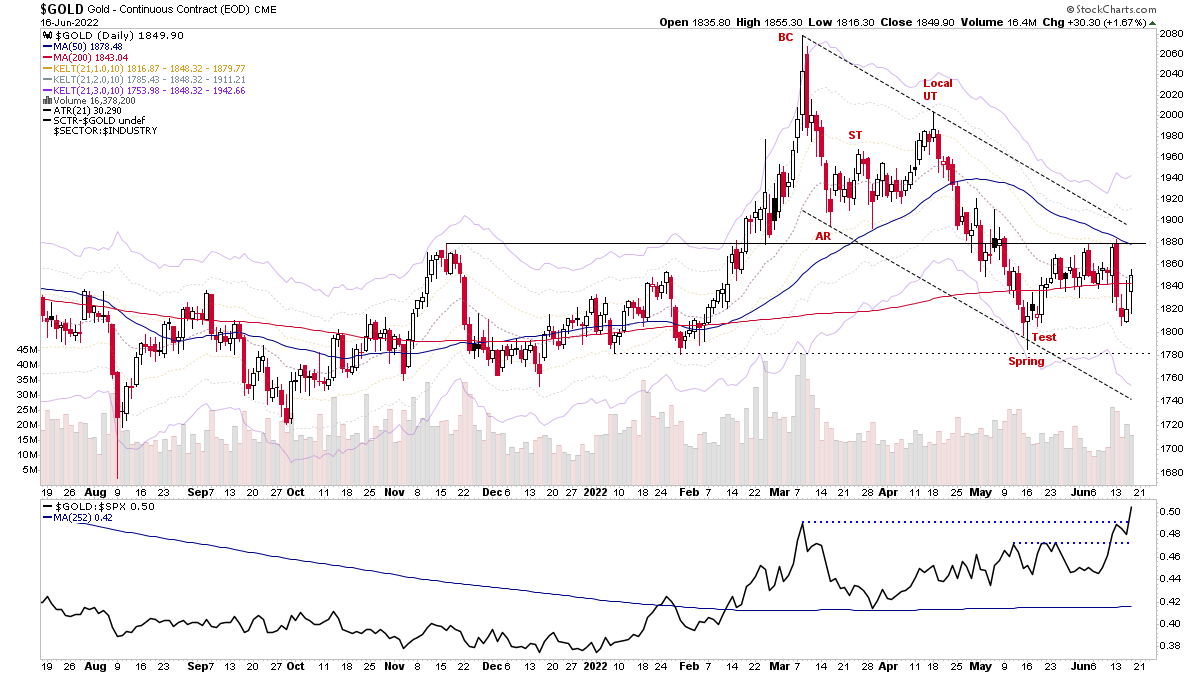

The Stage Analysis Members Weekend Video this week covers the Major Indexes with analysis of S&P 500, Nasdaq, Russell 2000, as well as Oil, Copper, US 7-10 Year Treasuries & Gold...

Read More

03 July, 2022

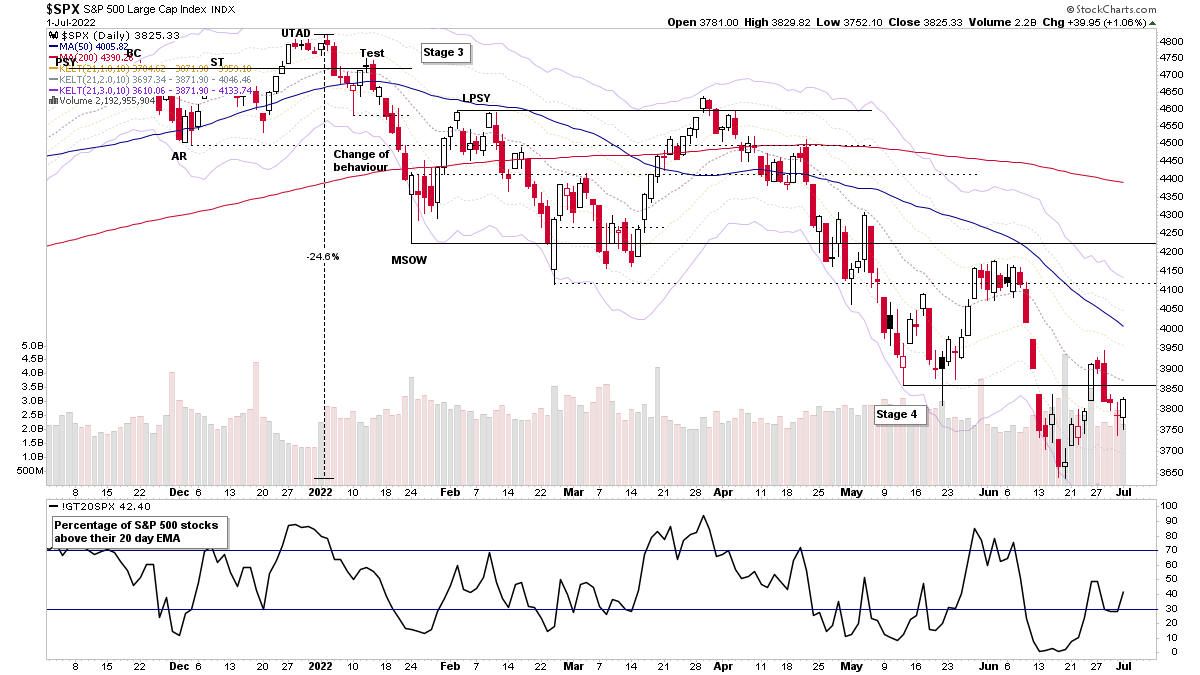

Stock Market Update and US Stocks Watchlist – 1 July 2022

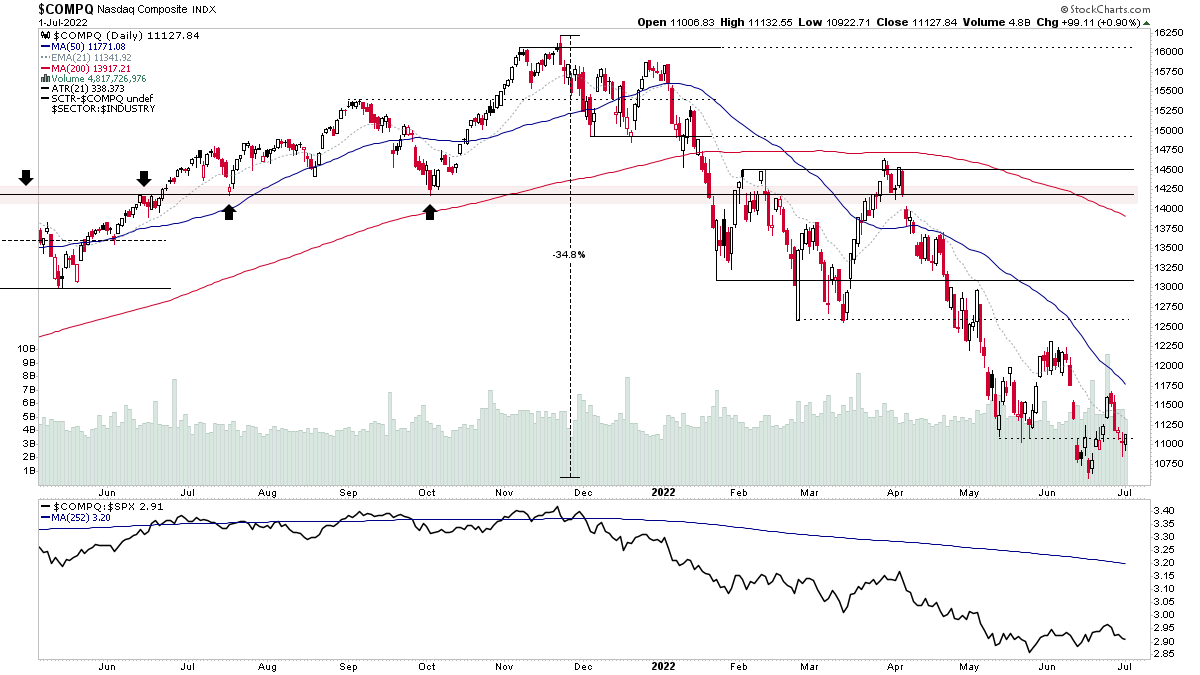

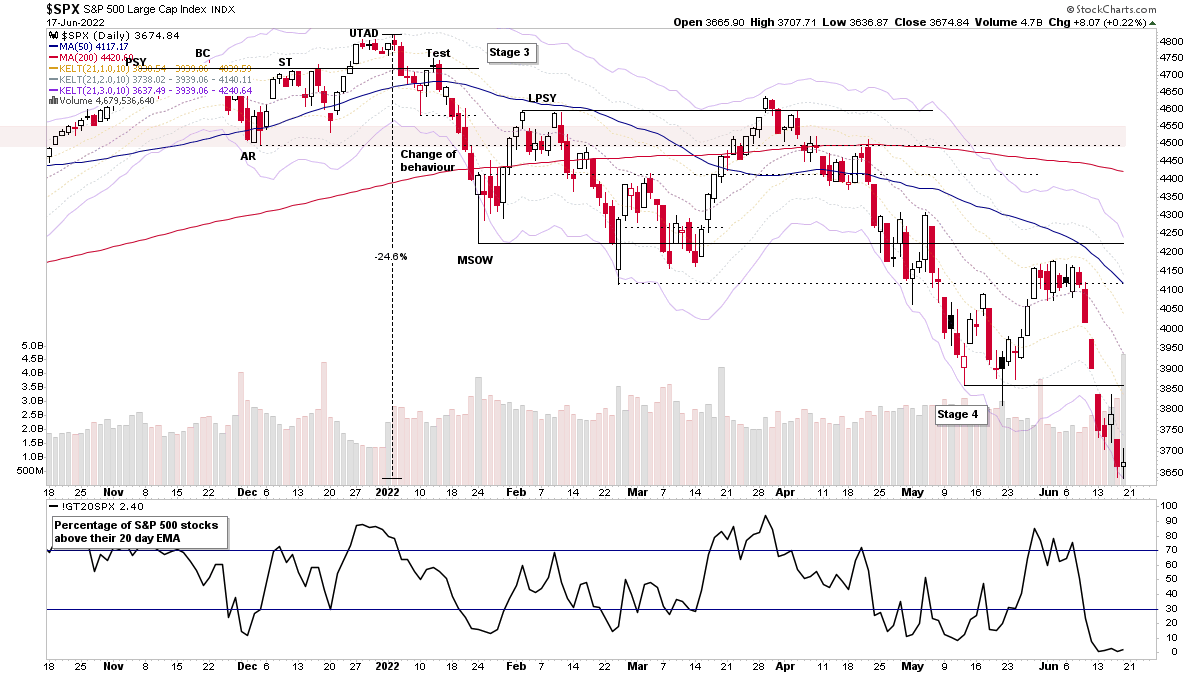

The S&P 500 percentage of stocks above their 20 day exponential moving averages closed the week at 42.40% with an attempt to make a high low after reaching the most extreme reading since March 2020 earlier in June...

Read More

26 June, 2022

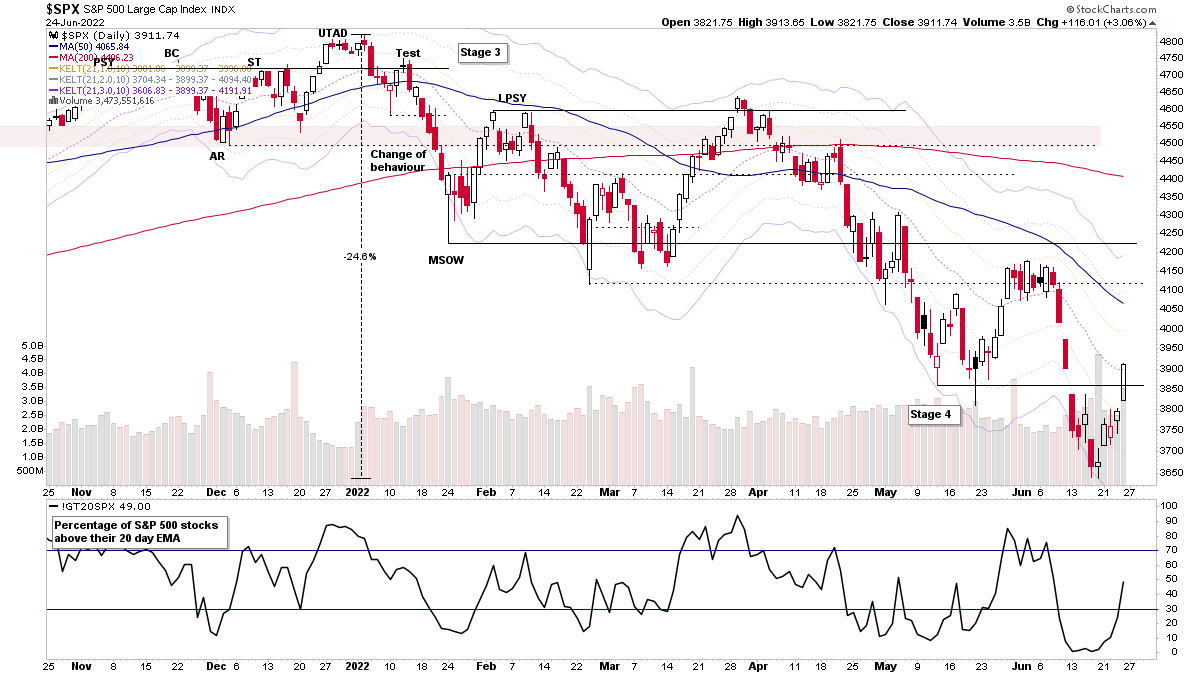

Stock Market Update and US Stocks Watchlist – 26 June 2022

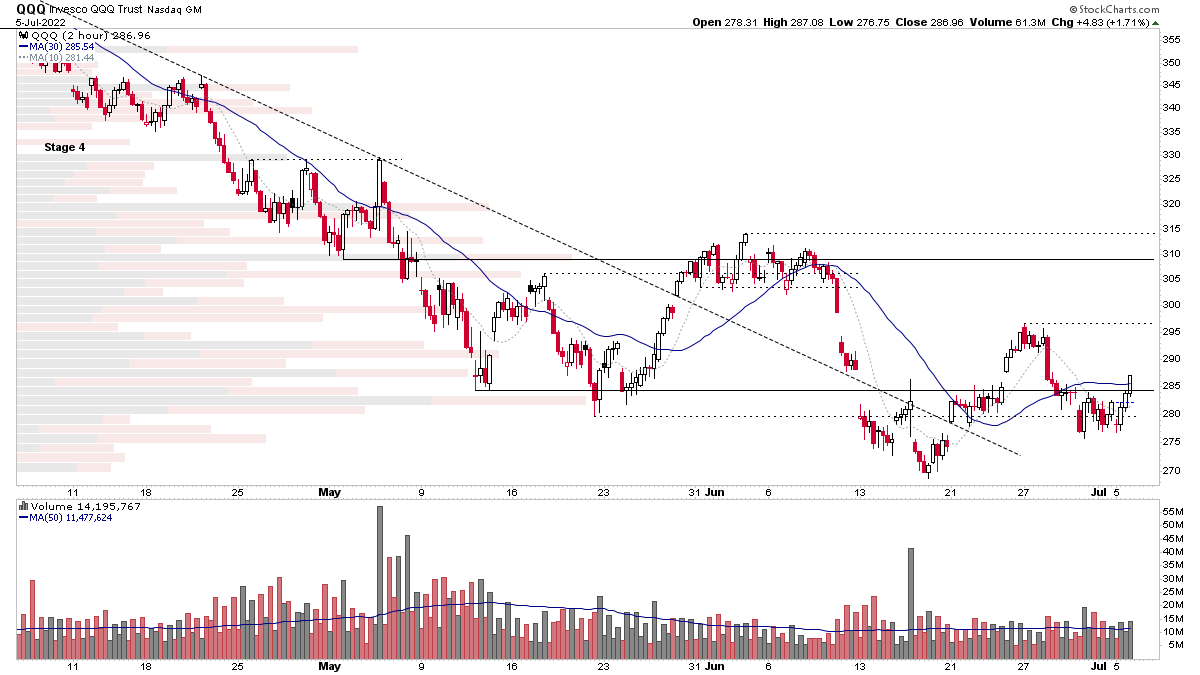

The stock market saw strong moves on Friday with the 5th attempt at a Follow Through Day (FTD) forming of this Stage 4 decline, which coincided with other short-term signals...

Read More

22 June, 2022

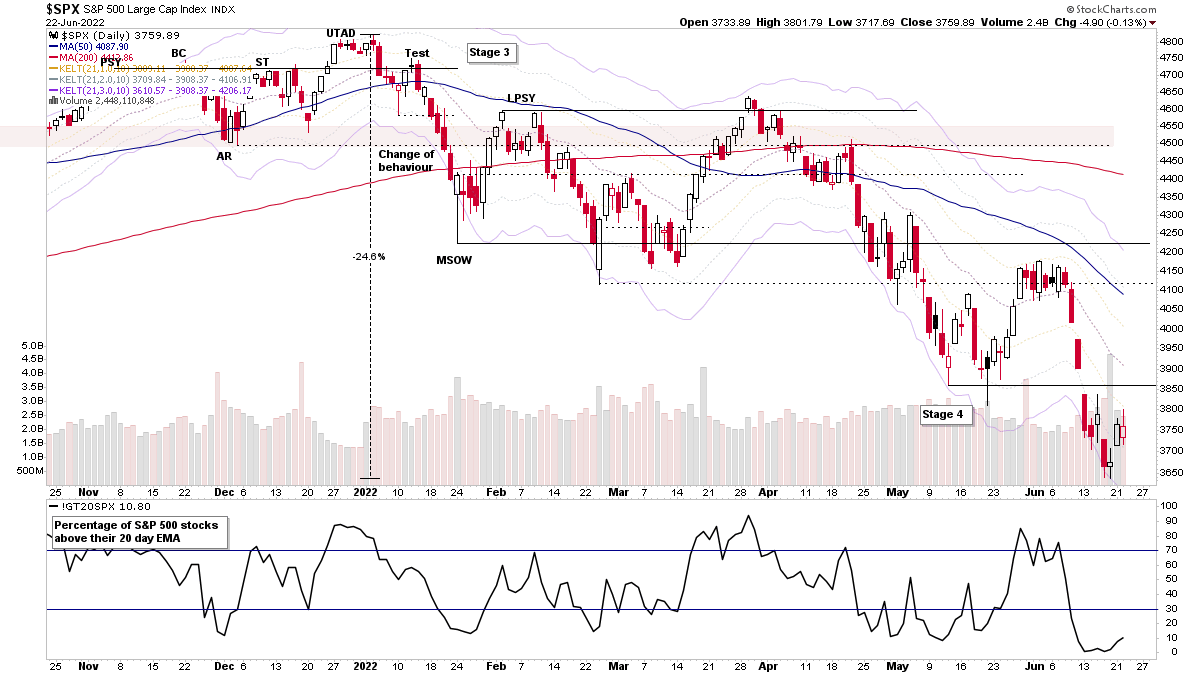

Stock Market Update and US Stocks Watchlist – 22 June 2022

The S&P 500 and the majority of other stock market indexes remain in weekly Stage 4 declines, but the stopping action at the end of last week has led to a three-day move higher...

Read More

19 June, 2022

Stage Analysis Members Weekend Video – 19 June 2022 (1hr 24mins)

The Stage Analysis Members Weekend Video this week covers the Major Indexes with analysis of S&P 500, Nasdaq, Russell 2000 and more. Plus a look at futures charts of Oil, Copper, Treasuries & Gold...

Read More

19 June, 2022

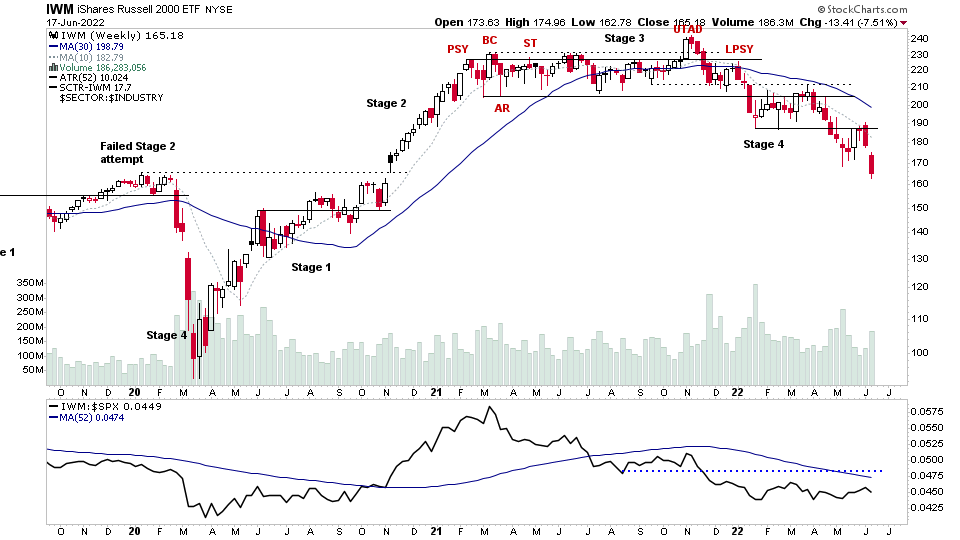

US Stocks Watchlist – 19 June 2022

Strong selling continued this week causing a further leg lower in the stock market Stage 4 decline with the major indexes (i.e. S&P 500, Nasdaq Composite and Russell 2000 etc) all closing below their recent base structures and are now at percentage levels off the highs that rival major bear markets of the past.

Read More

16 June, 2022

Gold and Silver and the Miners in Focus – 16 June 2022

Gold futures reversed back through the 200 day MA once more today and also closed above the short term 21 day EMA, and so is potentially forming a higher low, following the spring at the lower channel line in mid March...

Read More