For the watchlist from Wednesdays scans. Software and Renewable Energy Equipment continue to be the main them this week...

Read More

Blog

14 September, 2022

US Stocks Watchlist – 14 September 2022

14 September, 2022

Stage Analysis Members Midweek Video – 14 September 2022 (52 mins)

Todays members video focuses on the US watchlist stocks from the last few days, as well discussing the leading Renewable Energy group and a few Stage 2 breakout attempts.

Read More

13 September, 2022

US Stocks Watchlist – 13 September 2022

There were 43 stocks for the US stocks watchlist today. Software and Renewable Energy Equipment were the major group themes today...

Read More

11 September, 2022

Stage Analysis Members Weekend Video – 11 September 2022 (1hr 34mins)

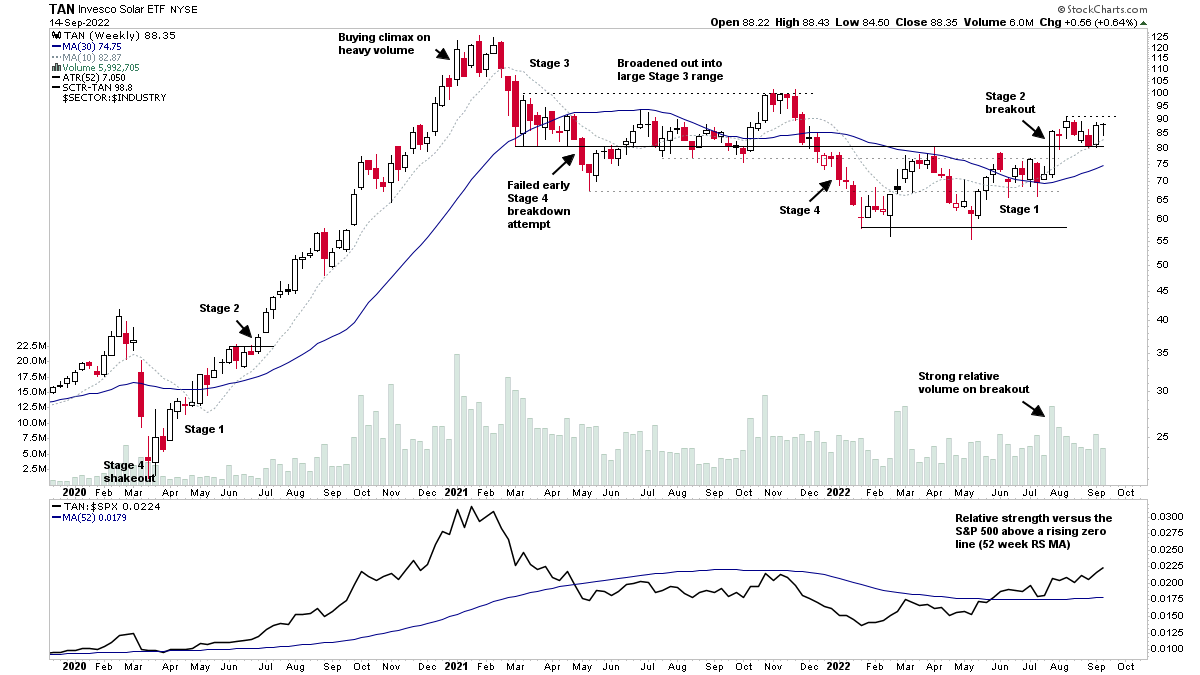

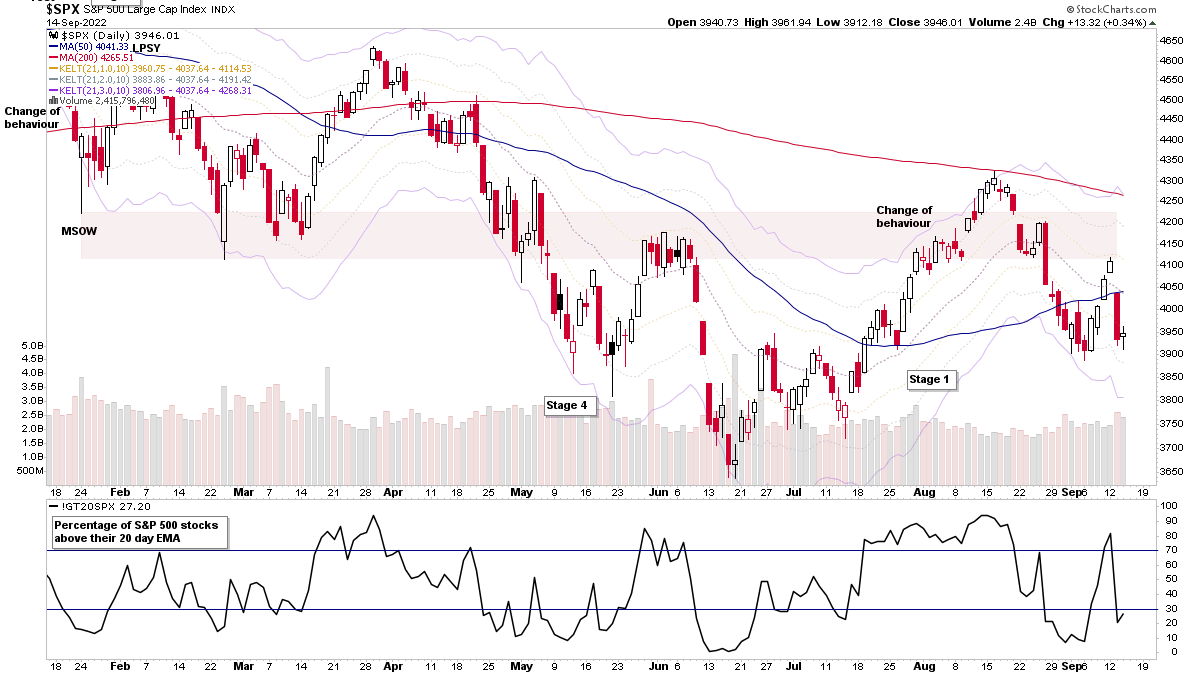

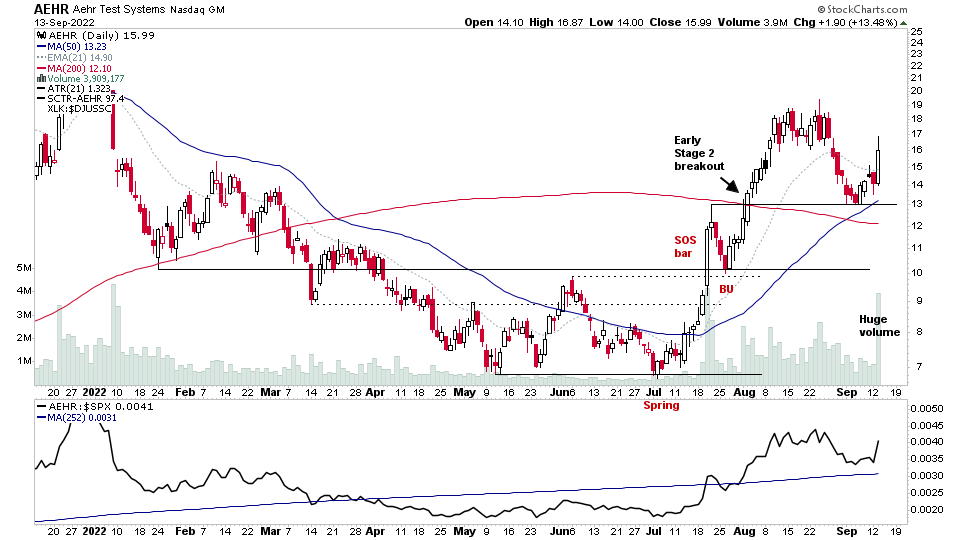

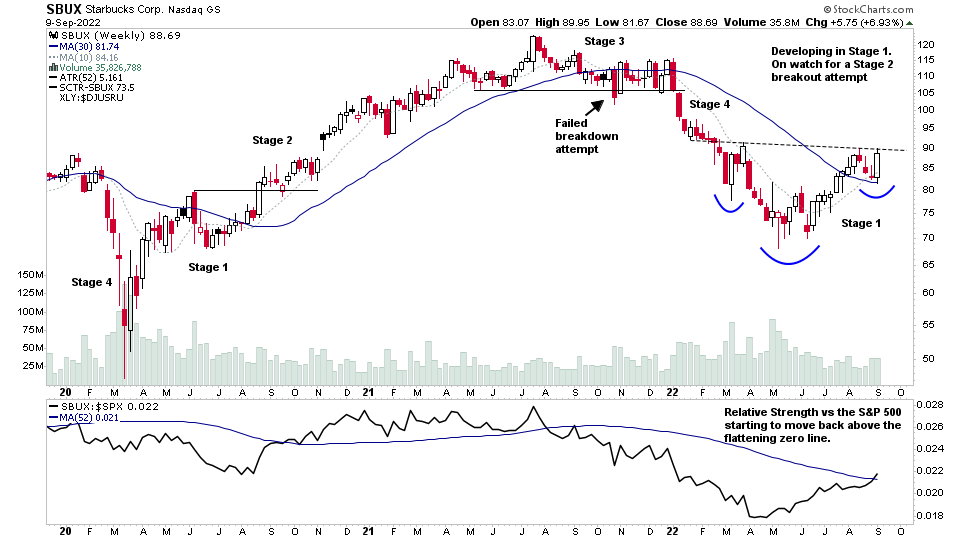

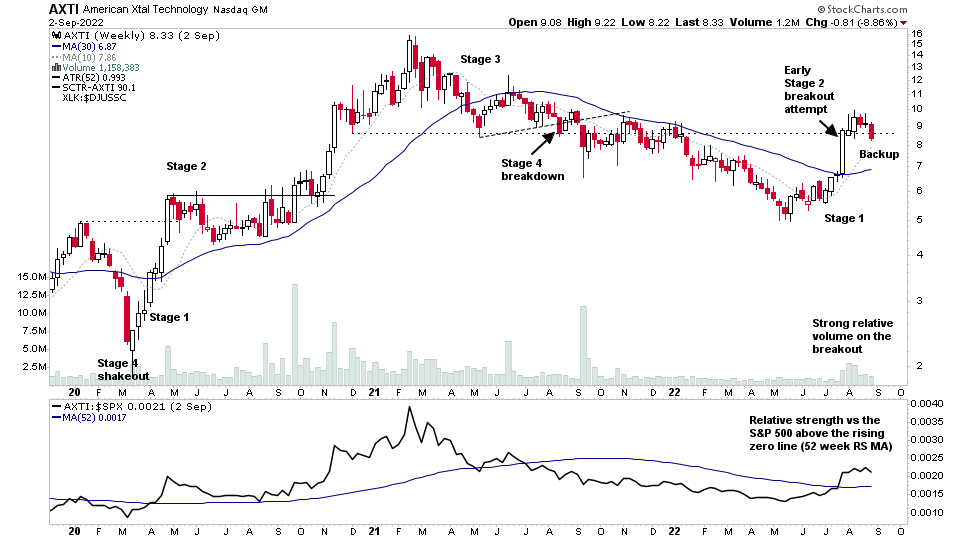

The weekend video begins with a detailed look at some of the weeks strong volume Stage 2 movers weekly charts and some interesting Stage 1 stocks too. Then an update on the major indexes developing Stage 1 base structures. What's moving in the US Industry Groups Relative Strength Rankings and the IBD Industry Groups Bell Curve – Bullish Percent...

Read More

11 September, 2022

Stage 1 Bases Continue To Develop in More Groups and the US Stocks Watchlist – 11 September 2022

There was a huge amount of scan results to go through again, which usually is suggestive of being extended in the short-term, although on the rarer occasions it will be a major breakout move. So the probabilities favour being extended. But there are lots of developing Stage 1 base structures as you might have noticed from the recent posts...

Read More

09 September, 2022

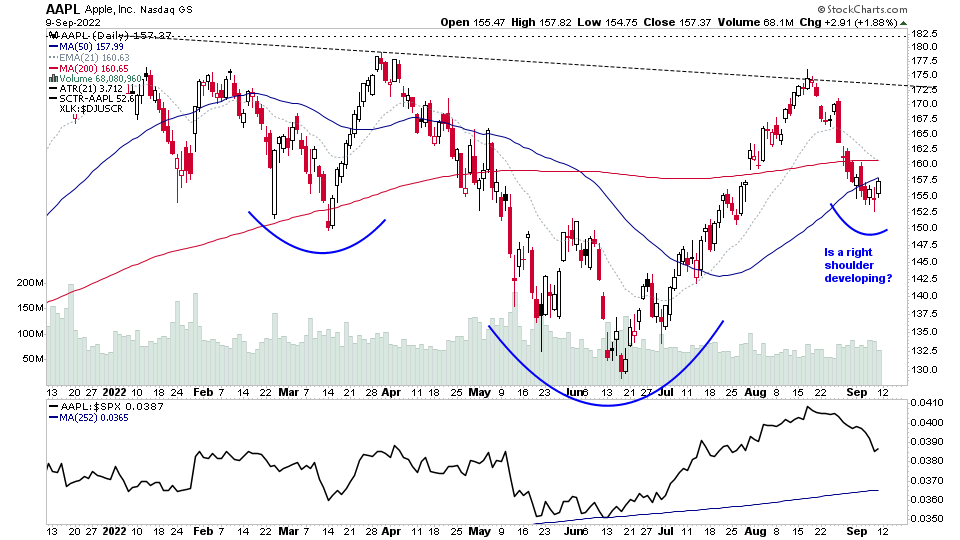

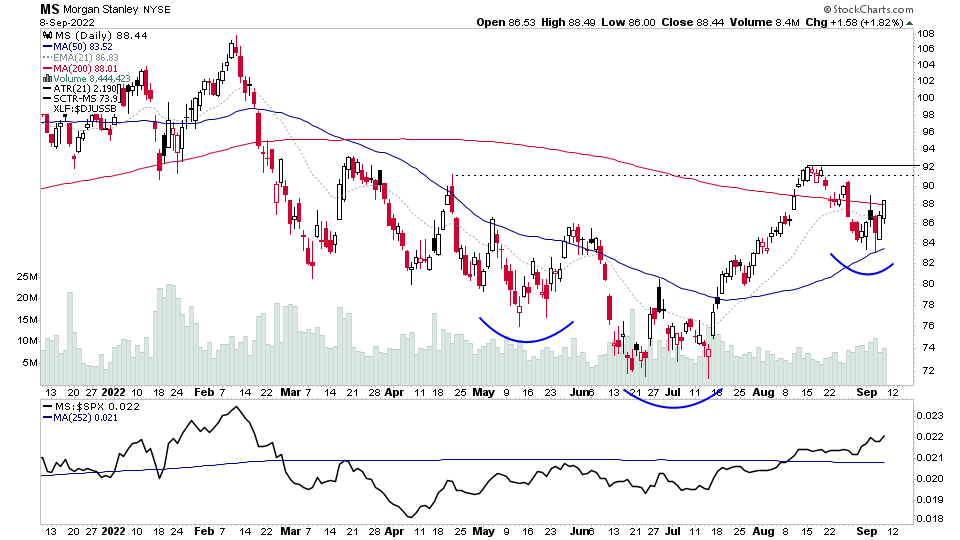

Stage 1 Bases in the Financials Sector Stocks Multiply and the US Stocks Watchlist – 8 September 2022

The Financials sector groups dominated the watchlist scans today, and as it's not a group that comes up very often in the watchlist, I've highlighted a number of them, as there's a similar inverse head and shoulders bottom pattern developing across the group...

Read More

07 September, 2022

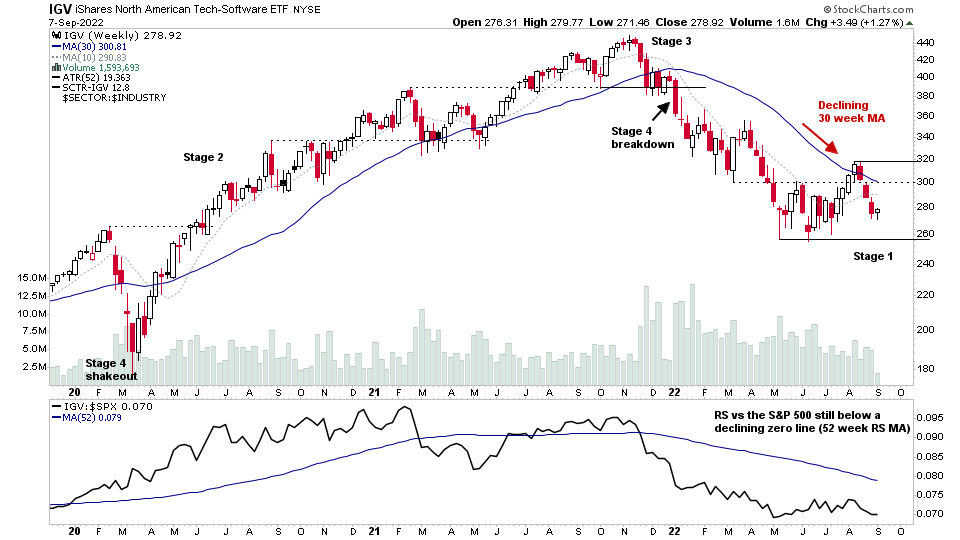

Video: Software Stocks Group Focus – Early Stage 2 Movers and Developing Stage 1 Bases – 7 September 2022 (1hr 8mins)

Today's video is a special feature following up on the Software group stocks progression over the last month since I last covered the group in early August: Video: Software Stocks Group Focus – Stage 1 Bases Proliferate – 10 August 2022, as at the time, numerous stocks within the group were showing signs of Stage 1 base structures developing.

Read More

06 September, 2022

US Stocks Watchlist – 6 September 2022

For the watchlist from Mondays scans...

Read More

05 September, 2022

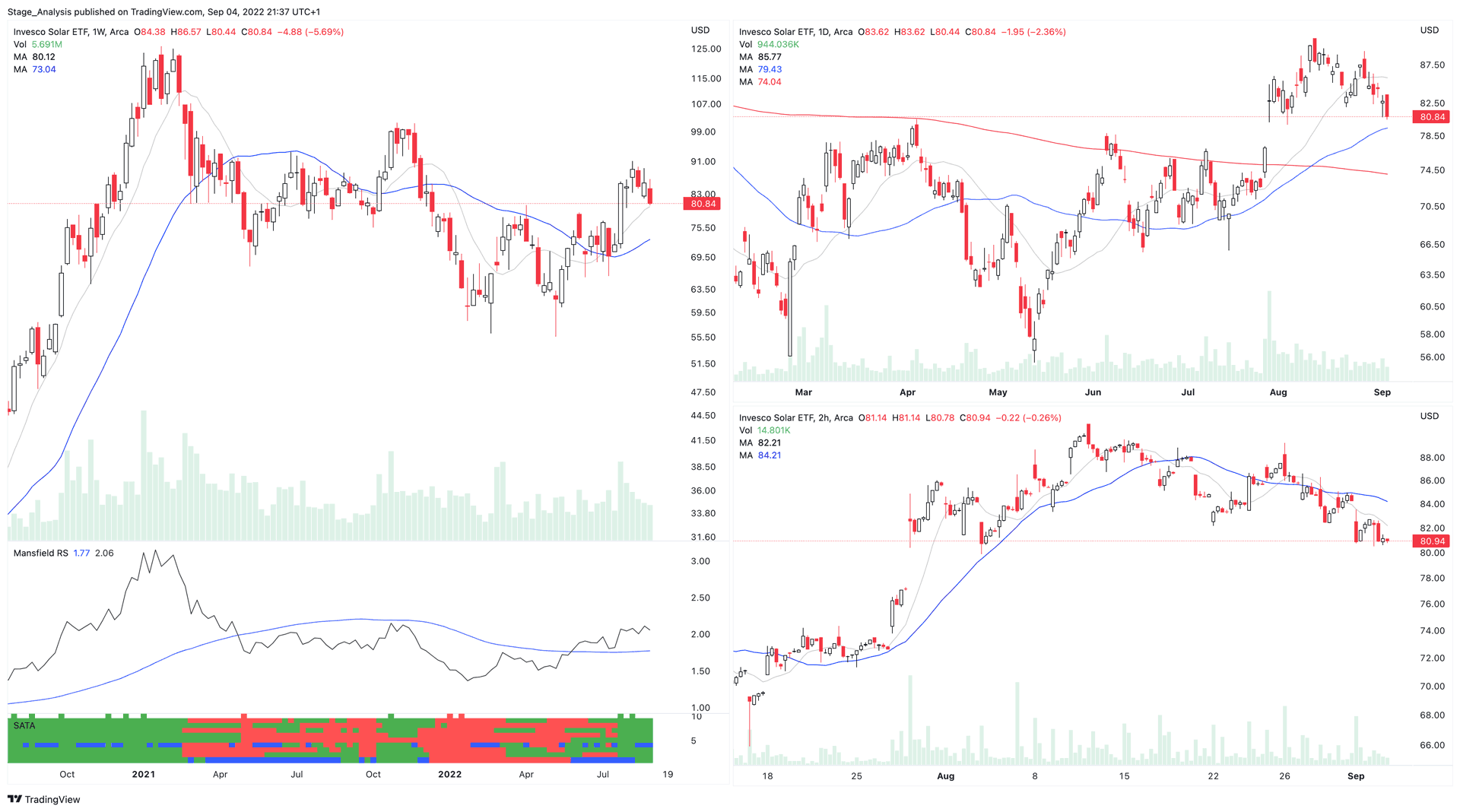

Part 2 – Stage Analysis Members Weekend Video – 5 September 2022 (49 mins)

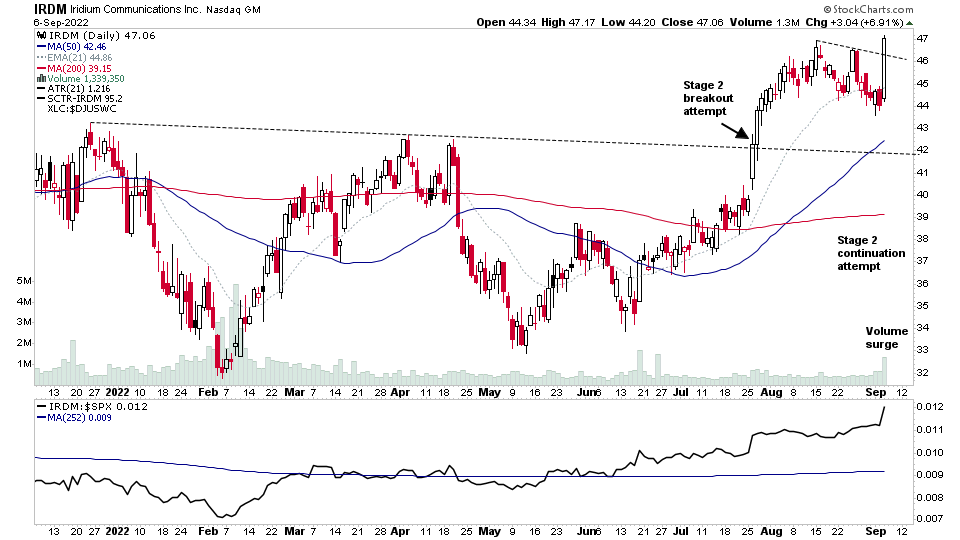

In Part 2 of the Stage Analysis Members weekend video I discuss the highlighted stocks from the weekend scans as well as Thursday's post. With live markups and discussion on multiple timeframes of why they were highlighted and what part of the Stage that they are in, and what I'm looking for in order for them to become actionable and the group themes appearing...

Read More

04 September, 2022

Part 1 – Stage Analysis Members Weekend Video – 4 September 2022 (1hr 3mins)

Part 1 of the weekend video begins with an explanation of how to use the new SATA - Stage Analysis Technical Attributes Indicator. Followed by a look at a few of this weeks high volume Stage 2 breakout attempts. Then a rundown of the price action in the major US indexes and Industry Groups RS Rankings...

Read More