There were 21 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

01 December, 2022

US Stocks Watchlist – 1 December 2022

30 November, 2022

Stage Analysis Members Video – 30 November 2022 (56 mins)

The Stage Analysis members midweek video discussing the market indexes, sector breadth, short-term market breadth and the US watchlist stocks in more detail with live markups.

Read More

29 November, 2022

US Stocks Watchlist – 29 November 2022

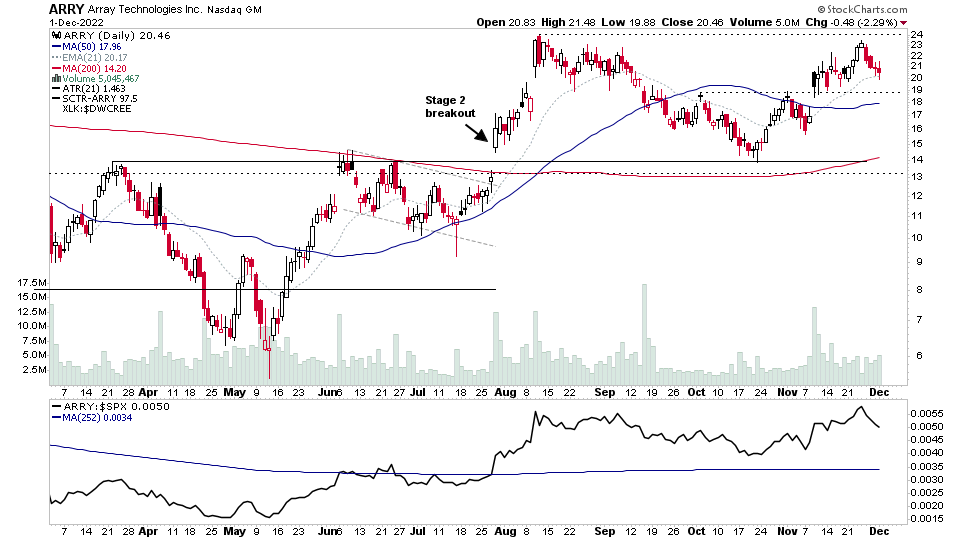

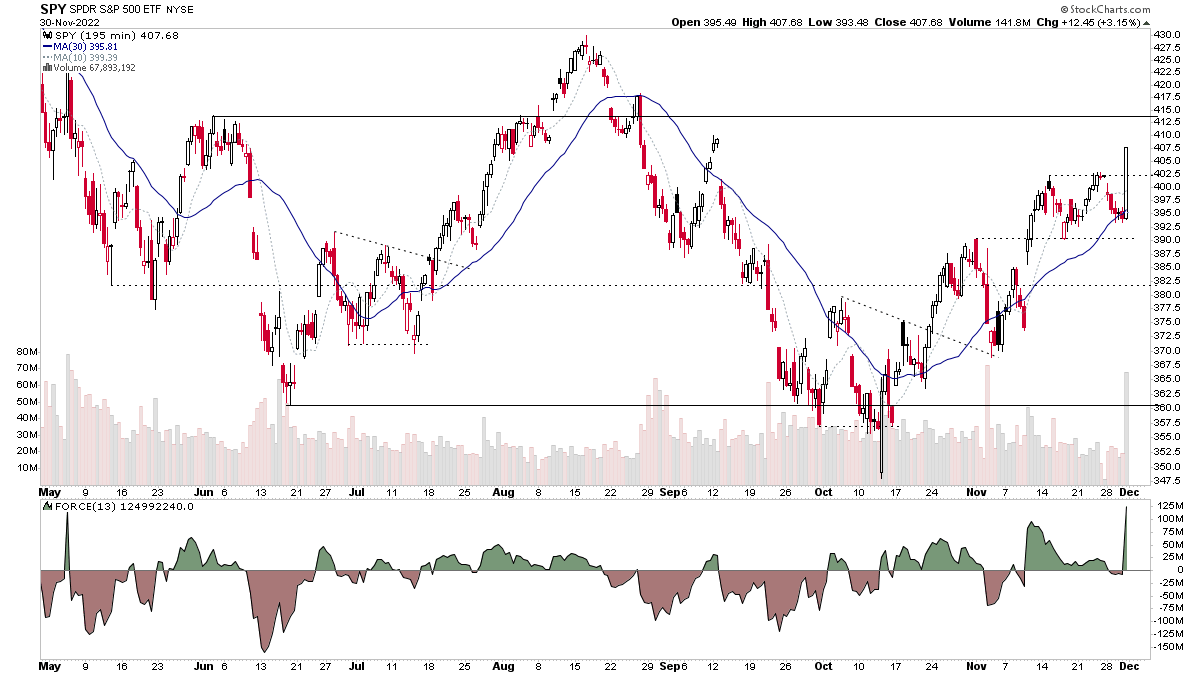

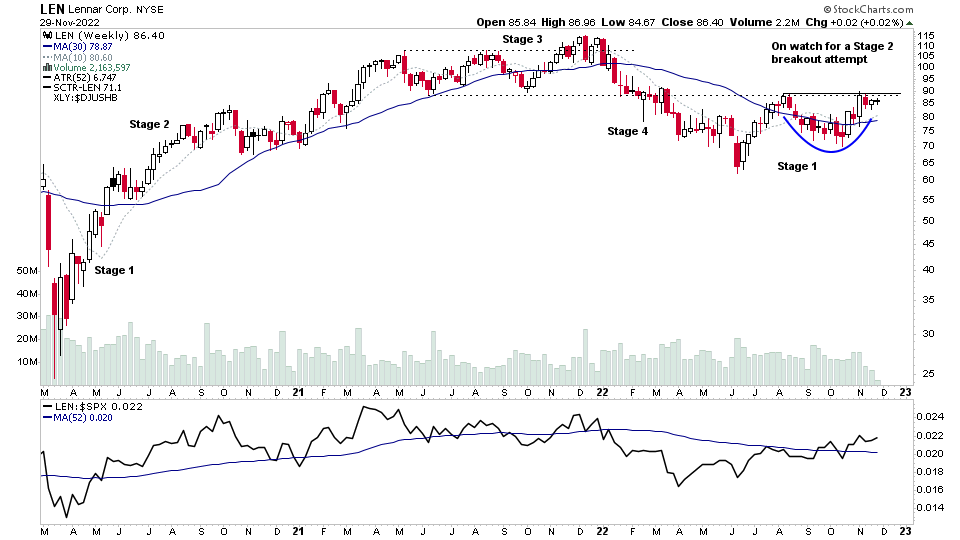

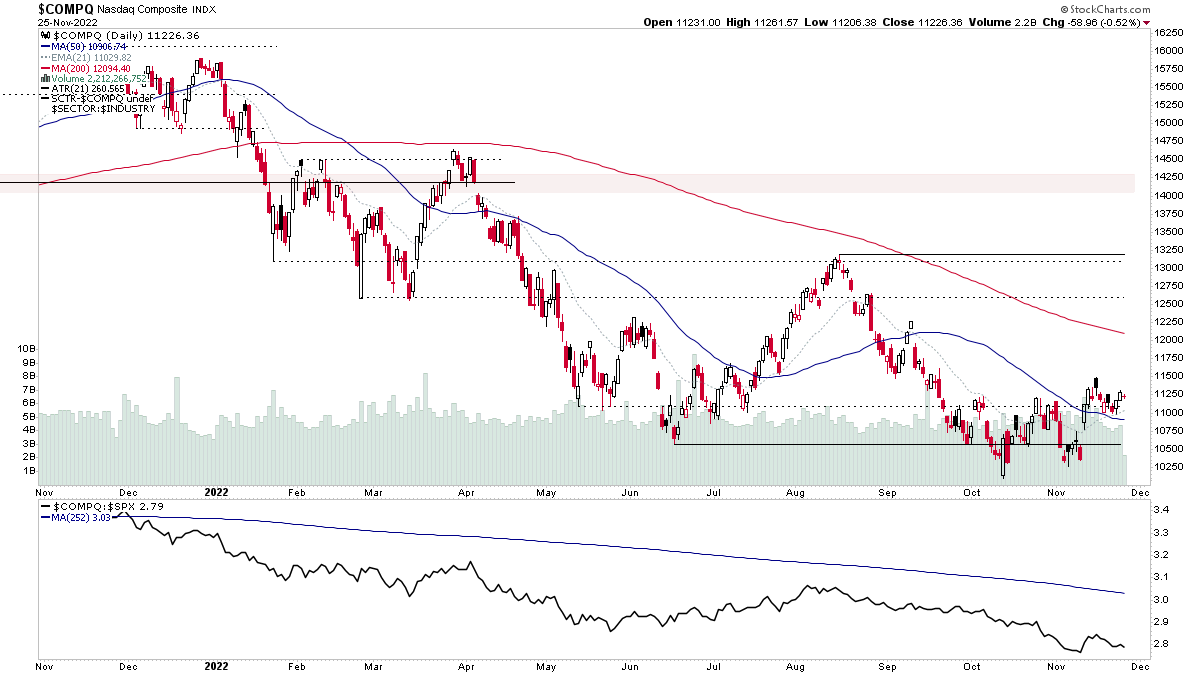

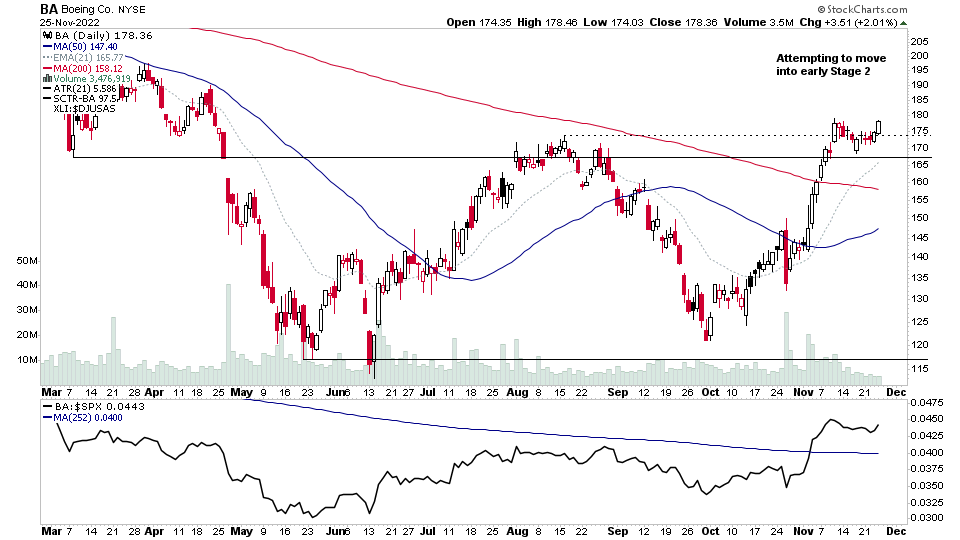

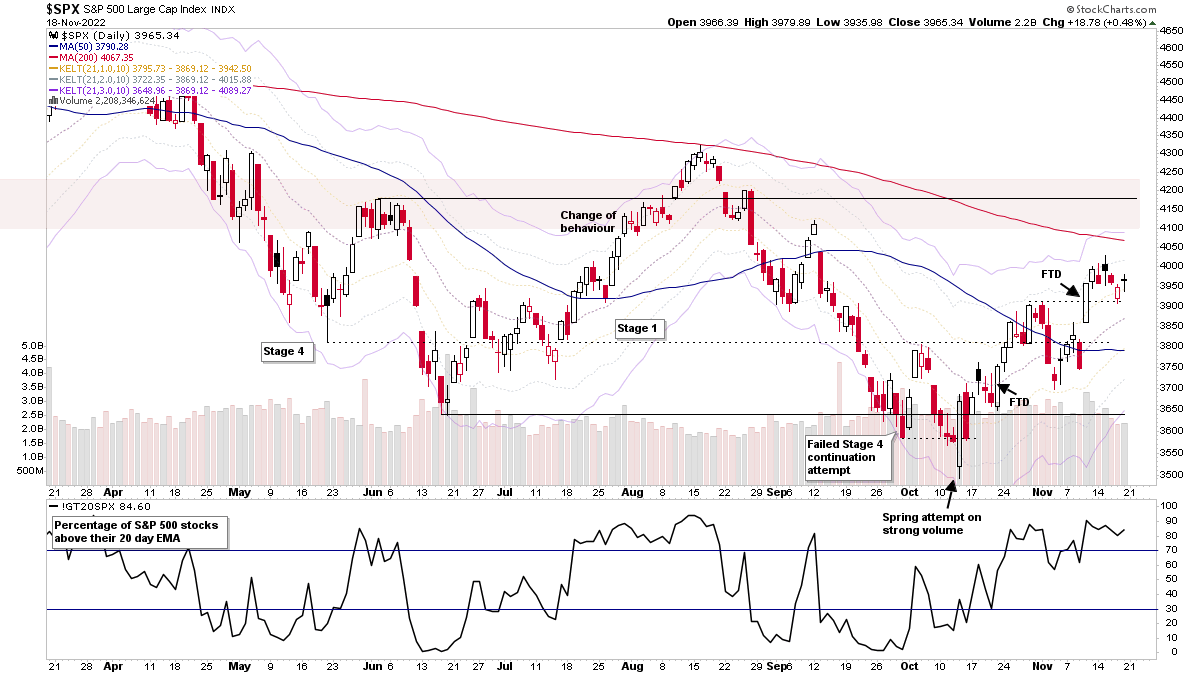

The pullback over the last few days and general consolidation range that's formed in the major indexes like the S&P 500 (shown above) since the secondary Follow Through Day (FTD) has put a number of stocks and groups in a more favourable position than they were at the FTD, with many stocks consolidating on low volume and tight spreads under potential Stage 2 breakout levels...

Read More

27 November, 2022

Stage Analysis Members Video – 27 November 2022 (1hr 24mins)

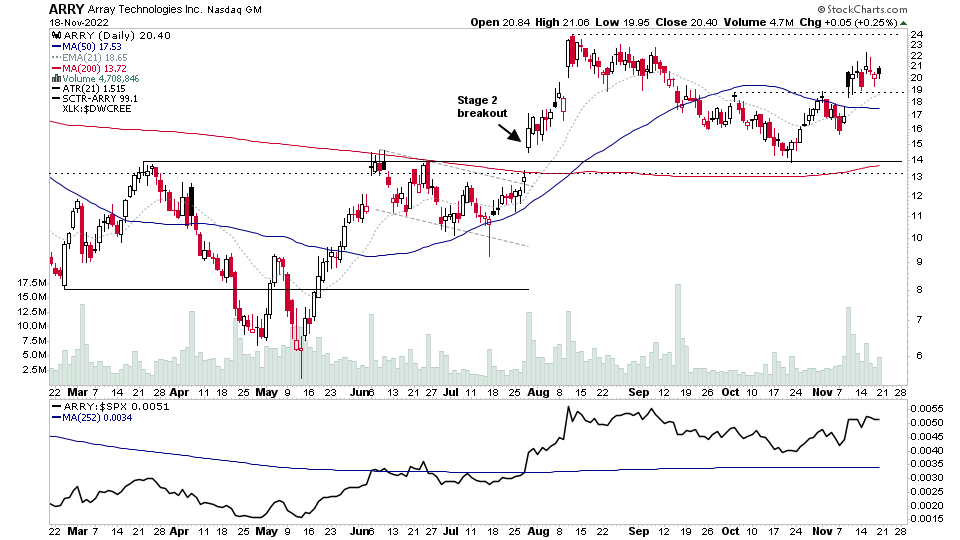

The Stage Analysis members weekend video discussing the market indexes, Dollar index, commodities, industry groups relative strength, IBD industry group bell curve – bullish percent, market breadth charts to determine the weight of evidence, this weeks Stage 2 breakout attempts and the US watchlist stocks in detail on multiple timeframes.

Read More

27 November, 2022

US Stocks Watchlist – 27 November 2022

There were 26 stocks highlighted from the US stocks watchlist scans today...

Read More

22 November, 2022

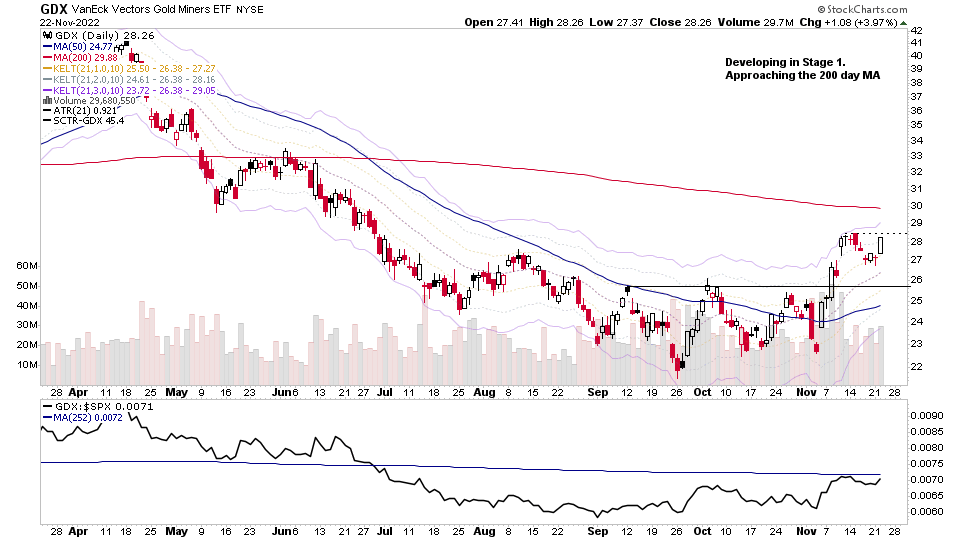

Gold & Silver Miners Developing in Stage 1 and the US Stocks Watchlist – 22 November 2022

The Gold and Silver Miners continue to improve in potential Stage 1 base structures as the US Dollar Index struggles to regain its 30 week MA, after the dramatic collapse into early Stage 3 three weeks ago, which boosted the precious metals, that the majority of the time move inversely to the Dollar Index...

Read More

20 November, 2022

Stage Analysis Members Video – 20 November 2022 (1hr 32mins)

The members weekend video discussing the market indexes, industry groups relative strength, IBD industry group bell curve – bullish percent, market breadth charts to determine the weight of evidence, Stage 2 breakout attempts in multiple stocks and the US watchlist stocks in more detail.

Read More

20 November, 2022

US Stocks Watchlist – 20 November 2022

For the watchlist from the weekend scans...

Read More

17 November, 2022

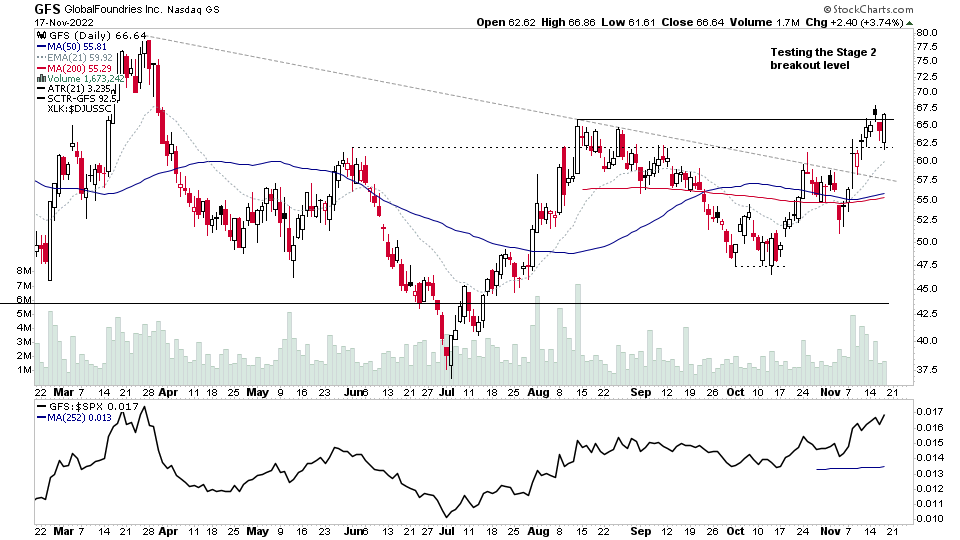

US Stocks Watchlist – 17 November 2022

There were 42 stocks highlighted in the US stocks watchlist scans today...

Read More

17 November, 2022

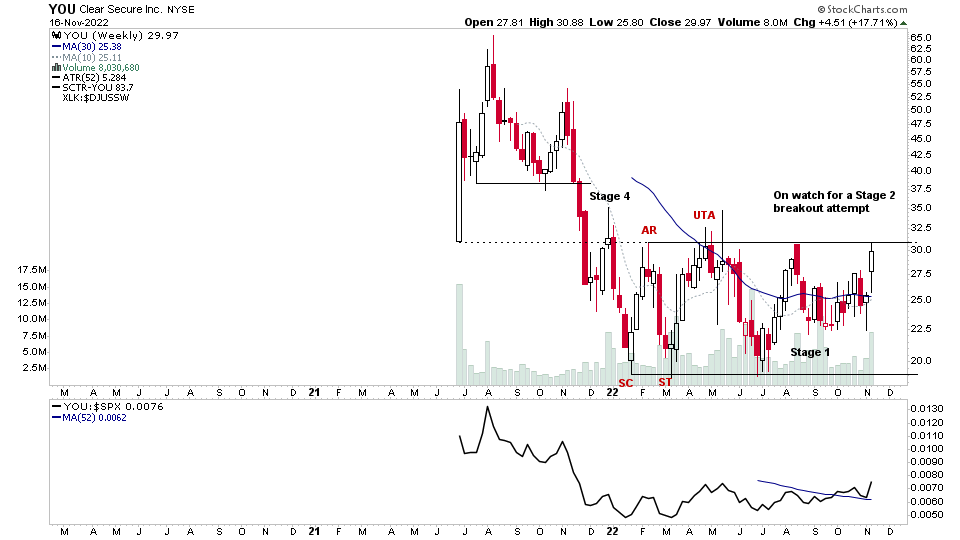

US Stocks Watchlist – 16 November 2022

For the watchlist from Wednesdays scans...

Read More