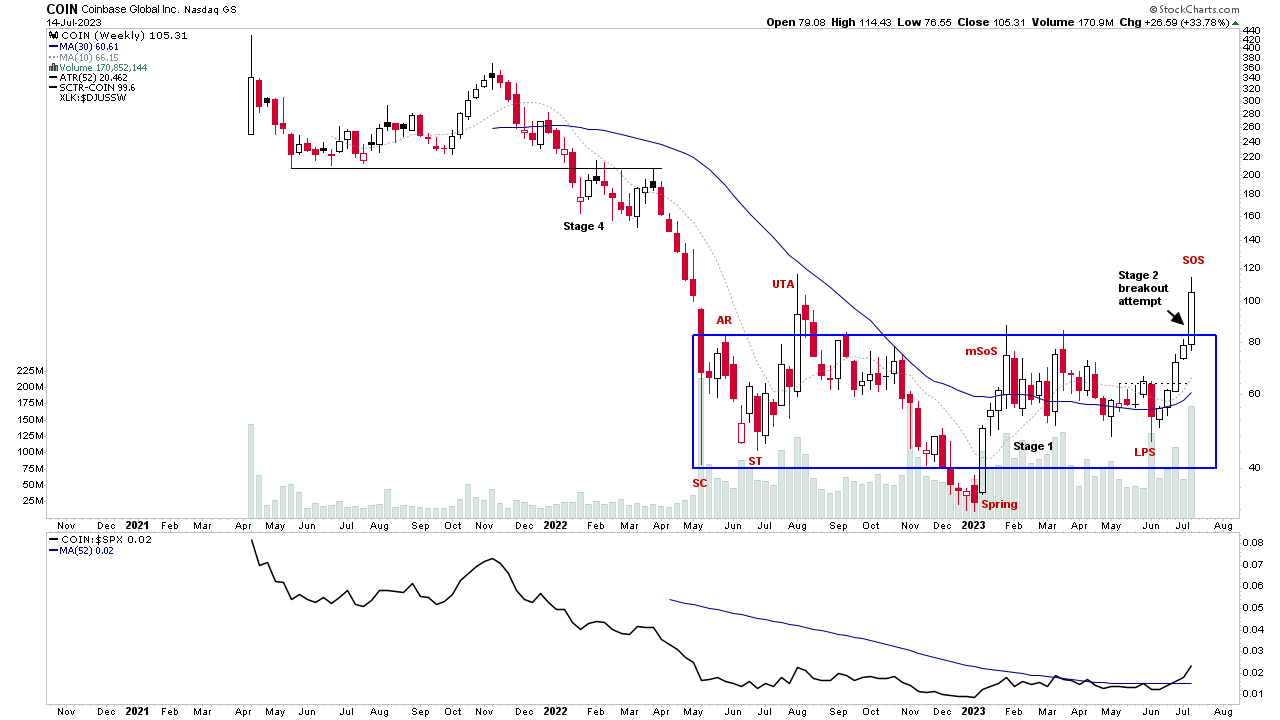

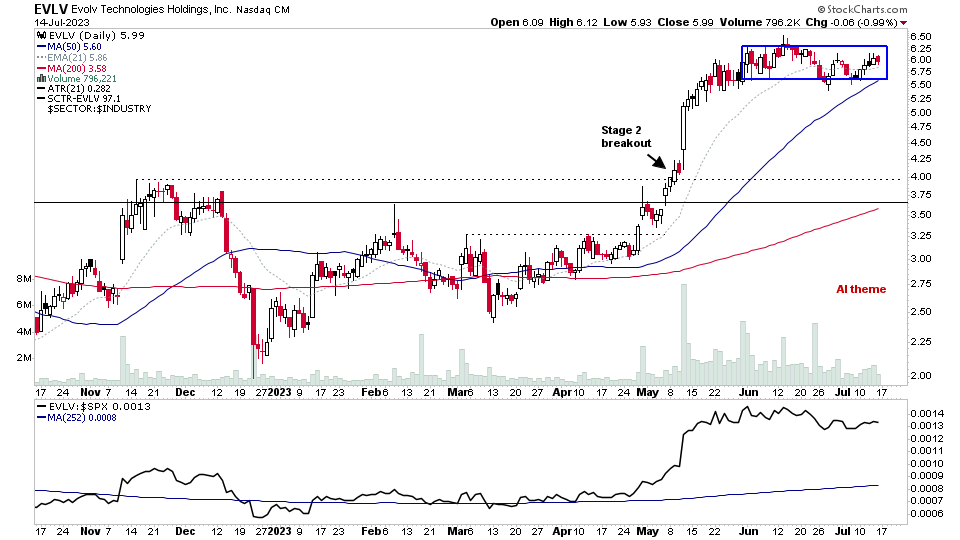

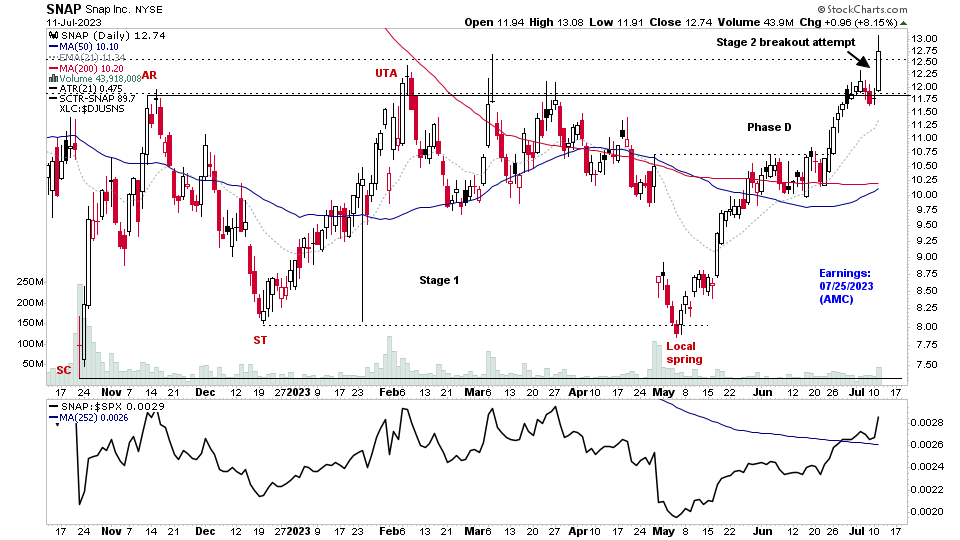

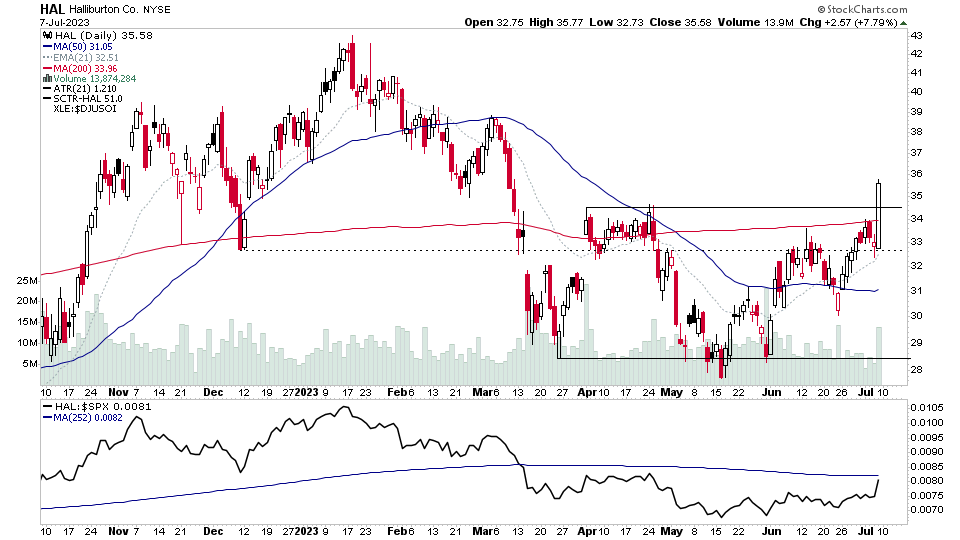

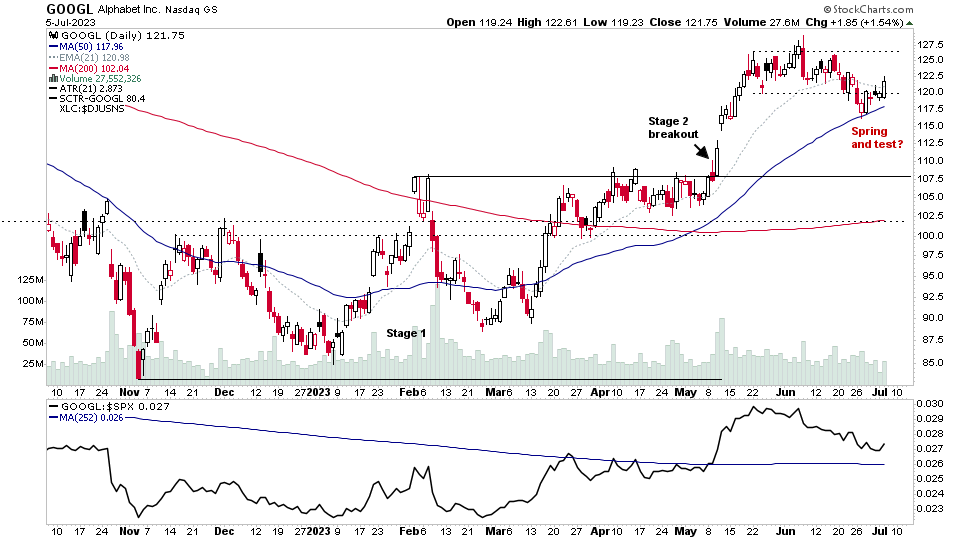

Stage Analysis members weekend video beginning with a discussion of some of the weeks strongest Stage 2 breakout attempts on volume, followed by the regular member content...

Read More

Blog

16 July, 2023

Stage Analysis Members Video – 16 July 2023 (1hr 25mins)

16 July, 2023

US Stocks Watchlist – 16 July 2023

There were 20 stocks highlighted from the US stocks watchlist scans today. I'll discuss the watchlist stocks and group themes in detail in the members weekend video...

Read More

13 July, 2023

US Stocks Watchlist – 13 July 2023

There were 26 stocks highlighted from the US stocks watchlist scans today...

Read More

12 July, 2023

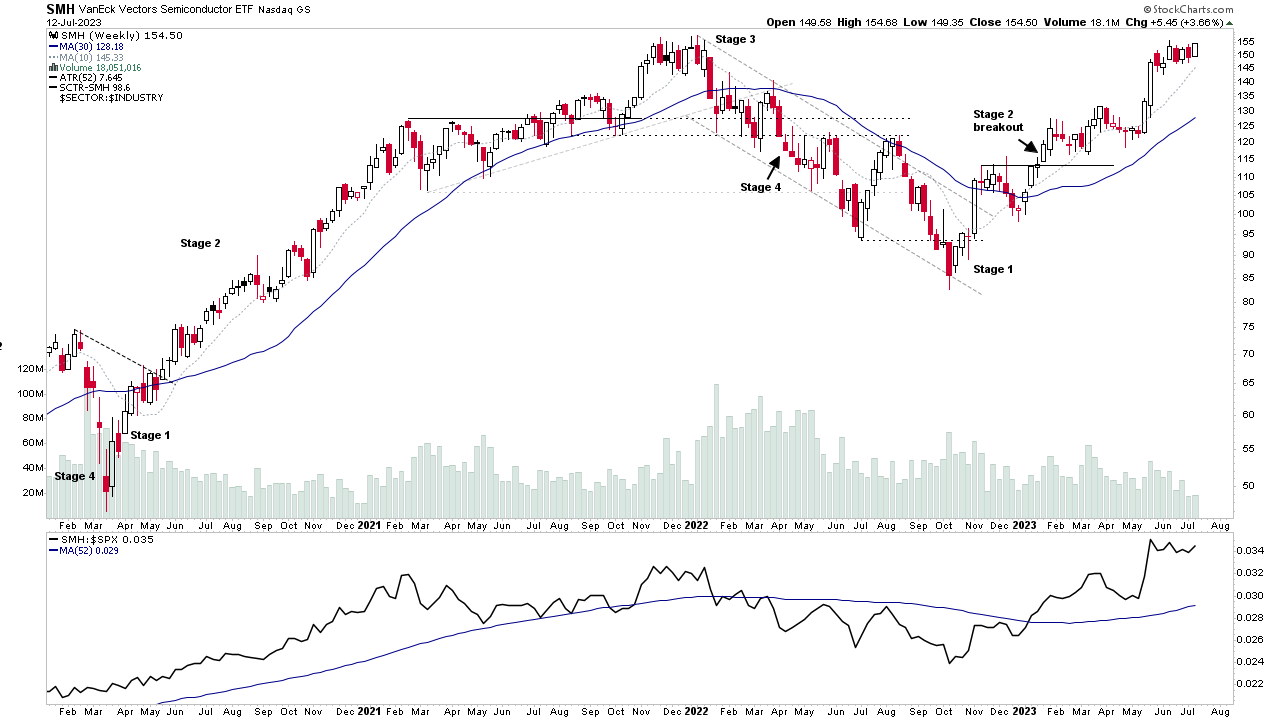

Group Focus: Semiconductors Review Before Earnings Results – 12 July 2023 (57mins)

This weeks midweek video is a special group focus, following up on the strong Semiconductors group. Which I discussed at length in multiple videos and posts at the beginning of the year as it moved into early Stage 2, and it has since gone on to be one of this years leading groups. With multiple periods at the top of the Relative Strength rankings as it has advanced higher in Stage 2 over the last six months...

Read More

11 July, 2023

US Stocks Watchlist – 11 July 2023

There were 36 stocks highlighted from the US stocks watchlist scans today...

Read More

09 July, 2023

Stage Analysis Members Video – 9 July 2023 (1hr 28mins)

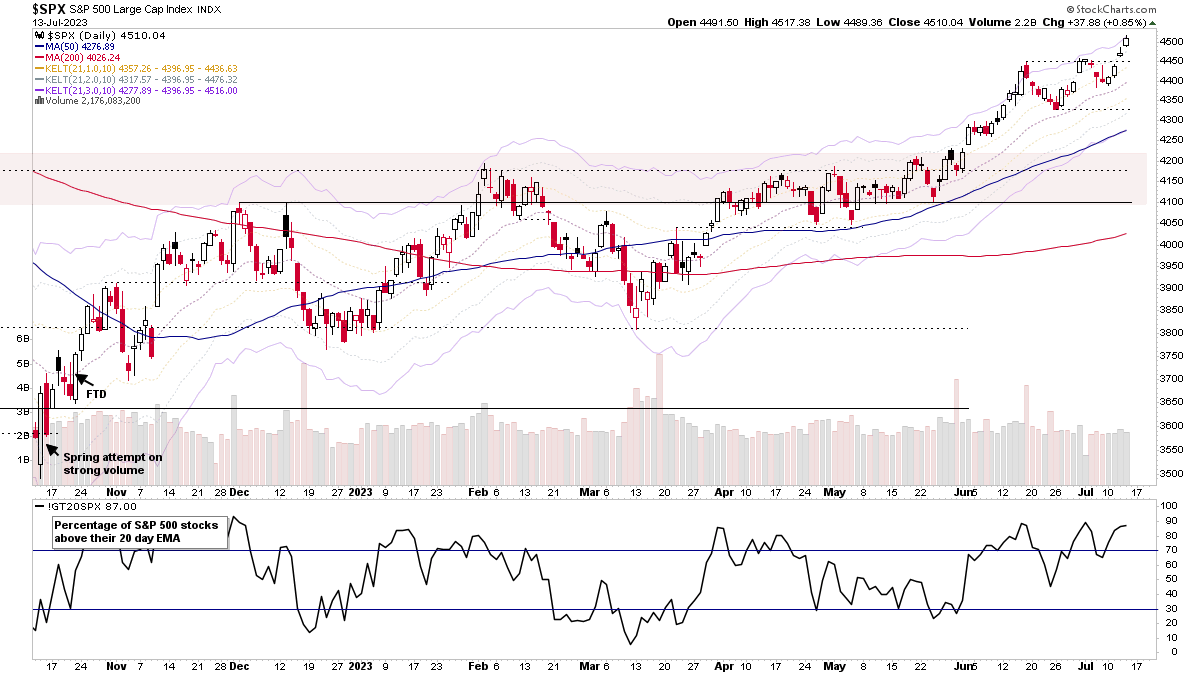

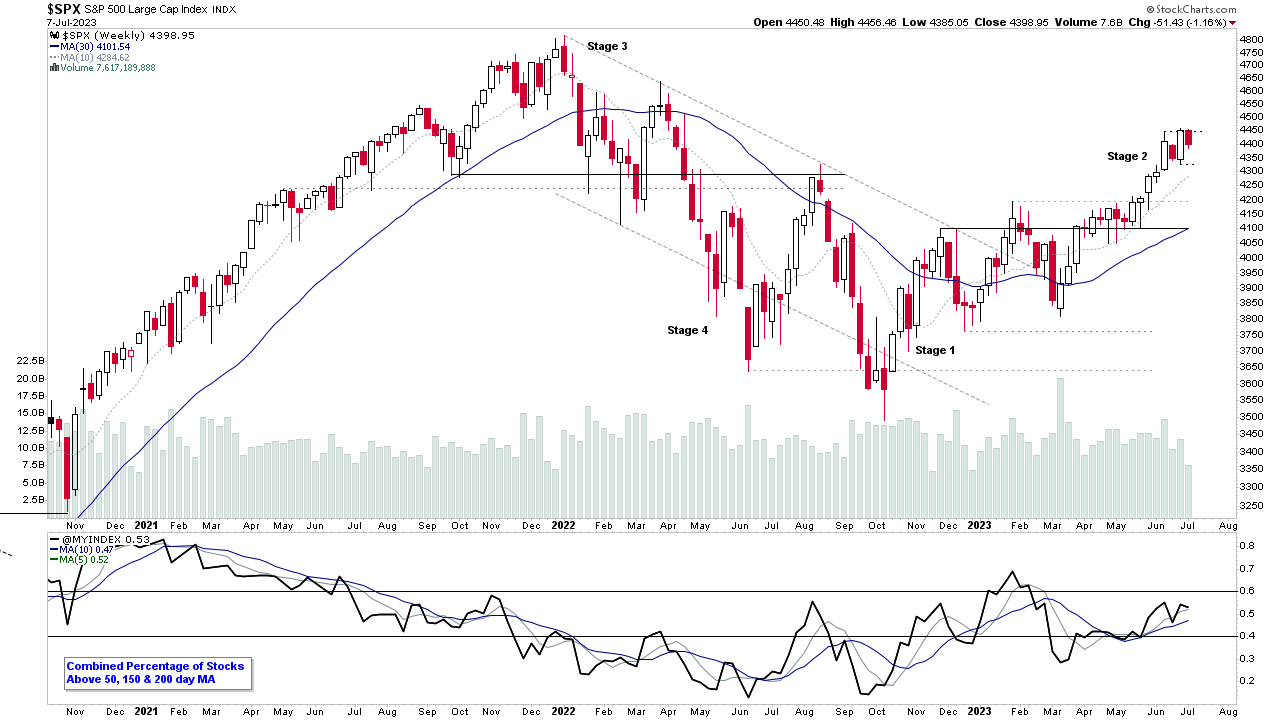

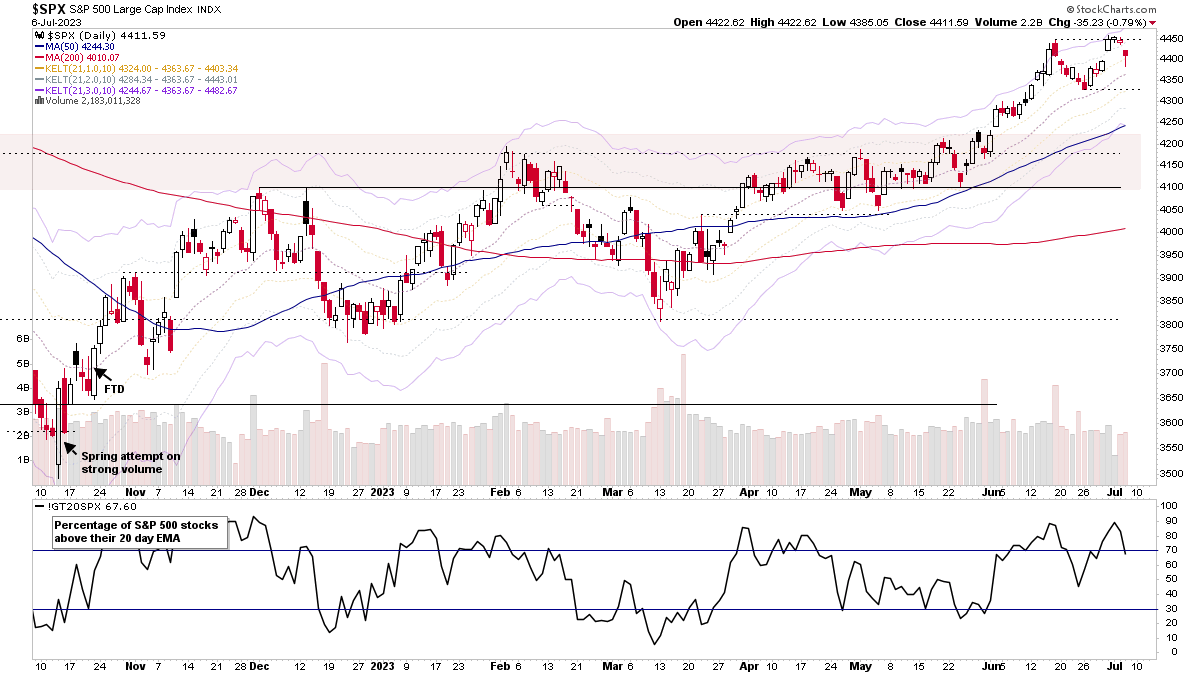

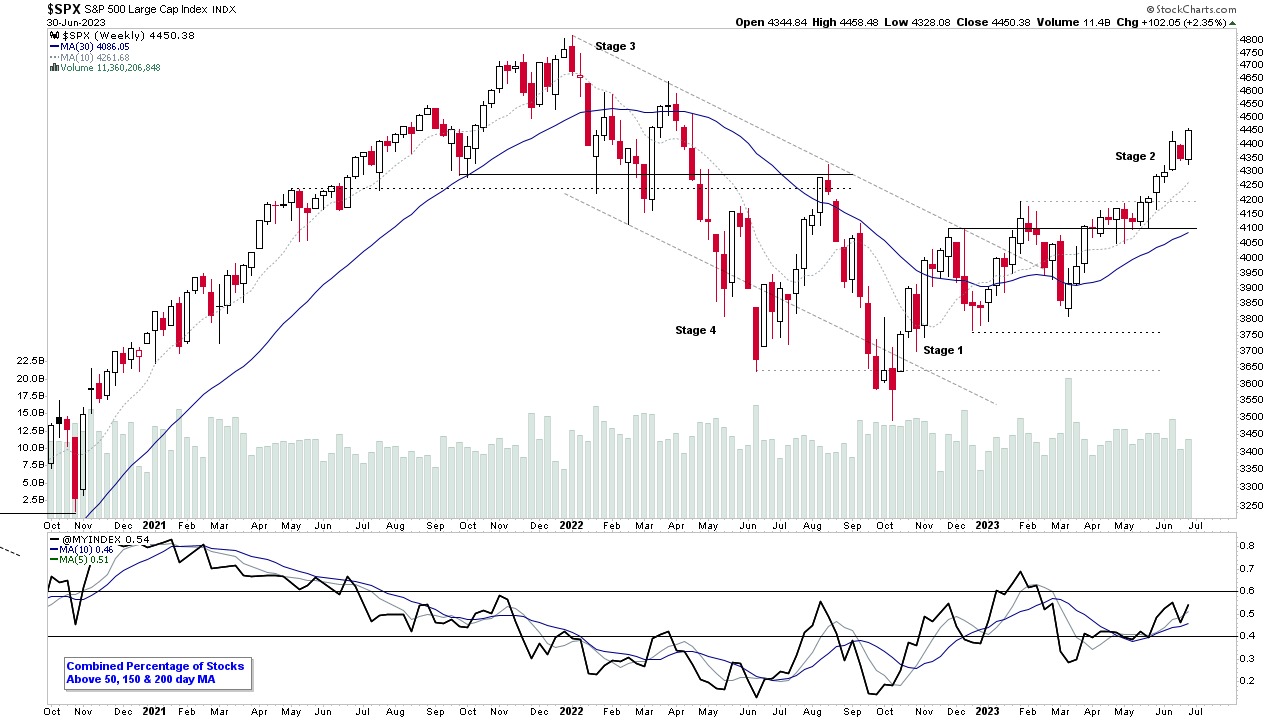

Stage Analysis members weekend video featuring the Major US Stock Market Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update to help to determine the weight of evidence, Stage 2 breakouts on volume, and finally the US Watchlist Stocks from the weekend scans in detail on multiple timeframes.

Read More

09 July, 2023

US Stocks Watchlist – 9 July 2023

There were 32 stocks highlighted from the US stocks watchlist scans today...

Read More

06 July, 2023

US Stocks Watchlist – 6 July 2023

There were 25 stocks highlighted from the US stocks watchlist scans today...

Read More

05 July, 2023

US Stocks Watchlist – 5 July 2023

There were 31 stocks highlighted from the US stocks watchlist scans today...

Read More

02 July, 2023

Stage Analysis Members Video – 2 July 2023 (1hr 35mins)

This weeks Stage Analysis members weekend video features discussion of the Major Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update to help to determine the weight of evidence, Stage 2 breakouts on volume, and finally the US Watchlist Stocks from the weekend scans in detail on multiple timeframes.

Read More