There were 26 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

12 March, 2024

US Stocks Watchlist – 12 March 2024

10 March, 2024

Stage Analysis Members Video – 10 March 2024 (1hr 3mins)

Stage Analysis members weekend video discussing the Significant Weekly Bars moving on volume, the US watchlist stocks in detail on multiple timeframes, the new Stage Analysis Technical Attributes (SATA) tool and how to use it, the Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, the Crypto Coins and the Major US Stock Market Indexes.

Read More

10 March, 2024

US Stocks Watchlist – 10 March 2024

There were 14 stocks highlighted from the US stocks watchlist scans today...

Read More

03 March, 2024

Stage Analysis Members Video – 3 March 2024 (1hr 13mins)

Stage Analysis members weekend video discussing the US watchlist stocks in detail on multiple timeframes, the new Stage Analysis Technical Attributes (SATA) tool added to the site, the Significant Weekly Bars moving on volume, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, and the Major US Stock Market Indexes.

Read More

03 March, 2024

US Stocks Watchlist – 3 March 2024

There were 22 stocks highlighted from the US stocks watchlist scans today...

Read More

29 February, 2024

US Stocks Watchlist – 29 February 2024

There were 30 stocks highlighted from the US stocks watchlist scans today...

Read More

29 February, 2024

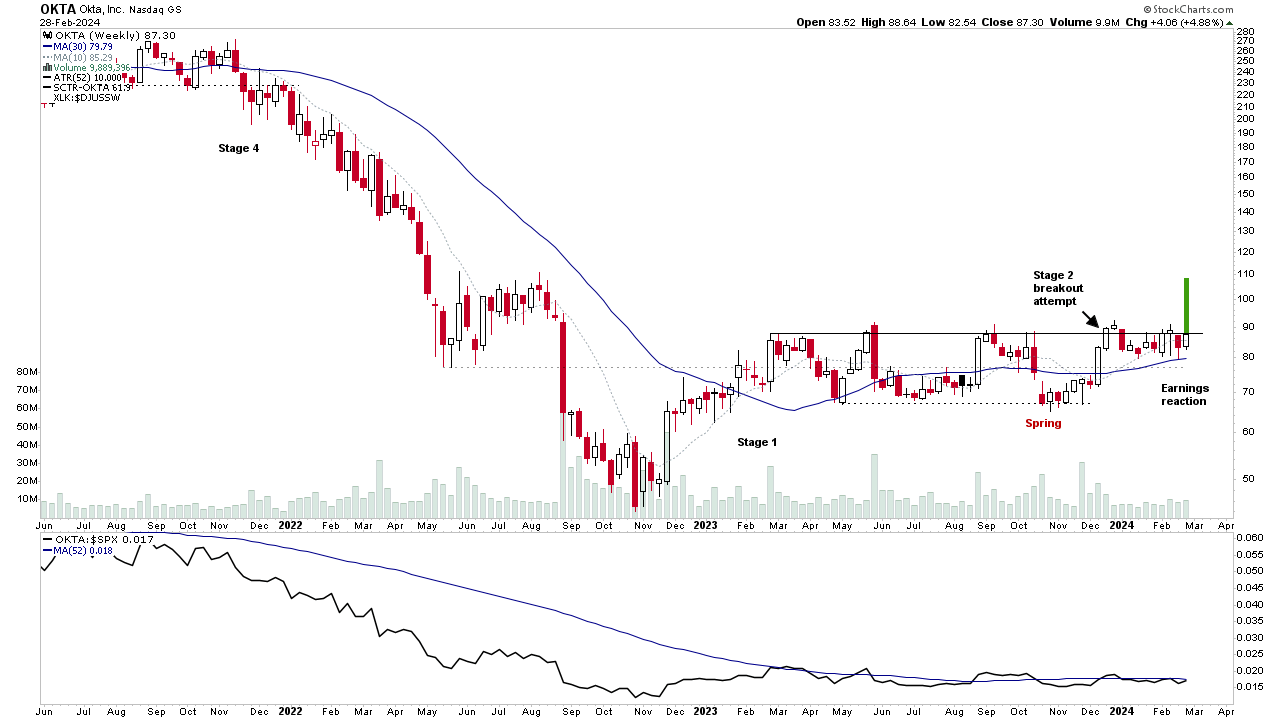

Video: Earnings Moves – OKTA, DUOL, AI and more – 28 February 2024

Midweek video discussing some of the weeks best earnings moves, and a preview of some of the upcoming new stocks pages and tools for the Stage Analysis website.

Read More

27 February, 2024

US Stocks Watchlist – 27 February 2024

There were 27 stocks highlighted from the US stocks watchlist scans today...

Read More

25 February, 2024

Stage Analysis Members Video – 25 February 2024 (1hr 5mins)

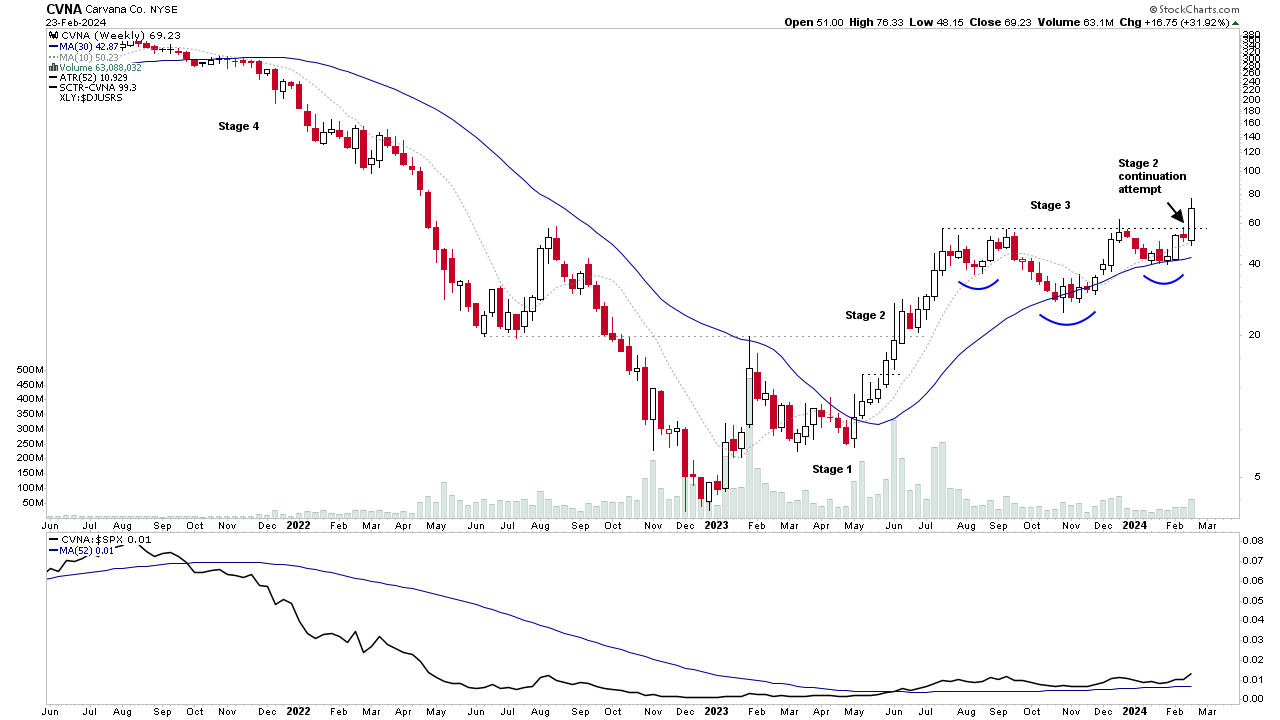

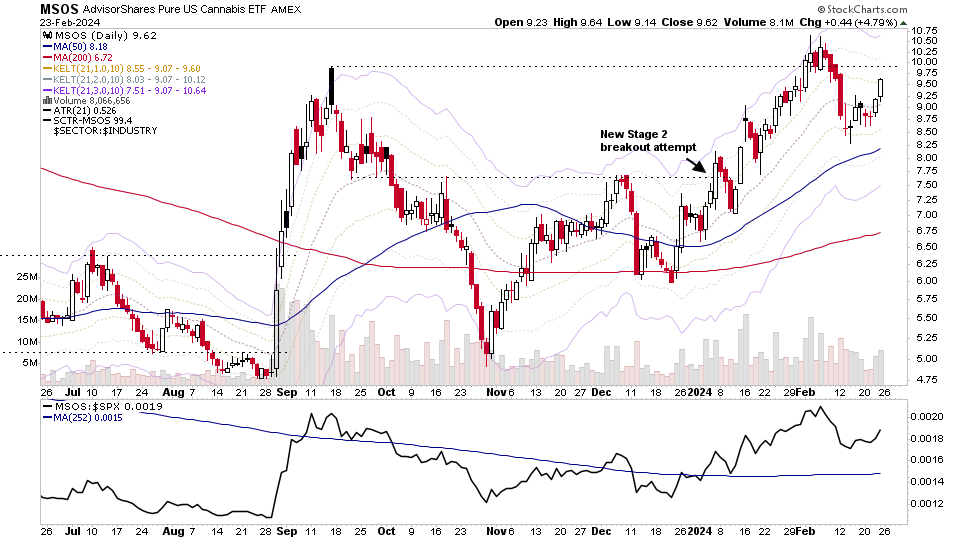

Stage Analysis members weekend video discussing the Significant Weekly Bars moving on volume, the US watchlist stocks in detail on multiple timeframes, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, and the Major US Stock Market Indexes...

Read More

25 February, 2024

US Stocks Watchlist – 25 February 2024

There were 25 stocks highlighted from the US stocks watchlist scans today...

Read More