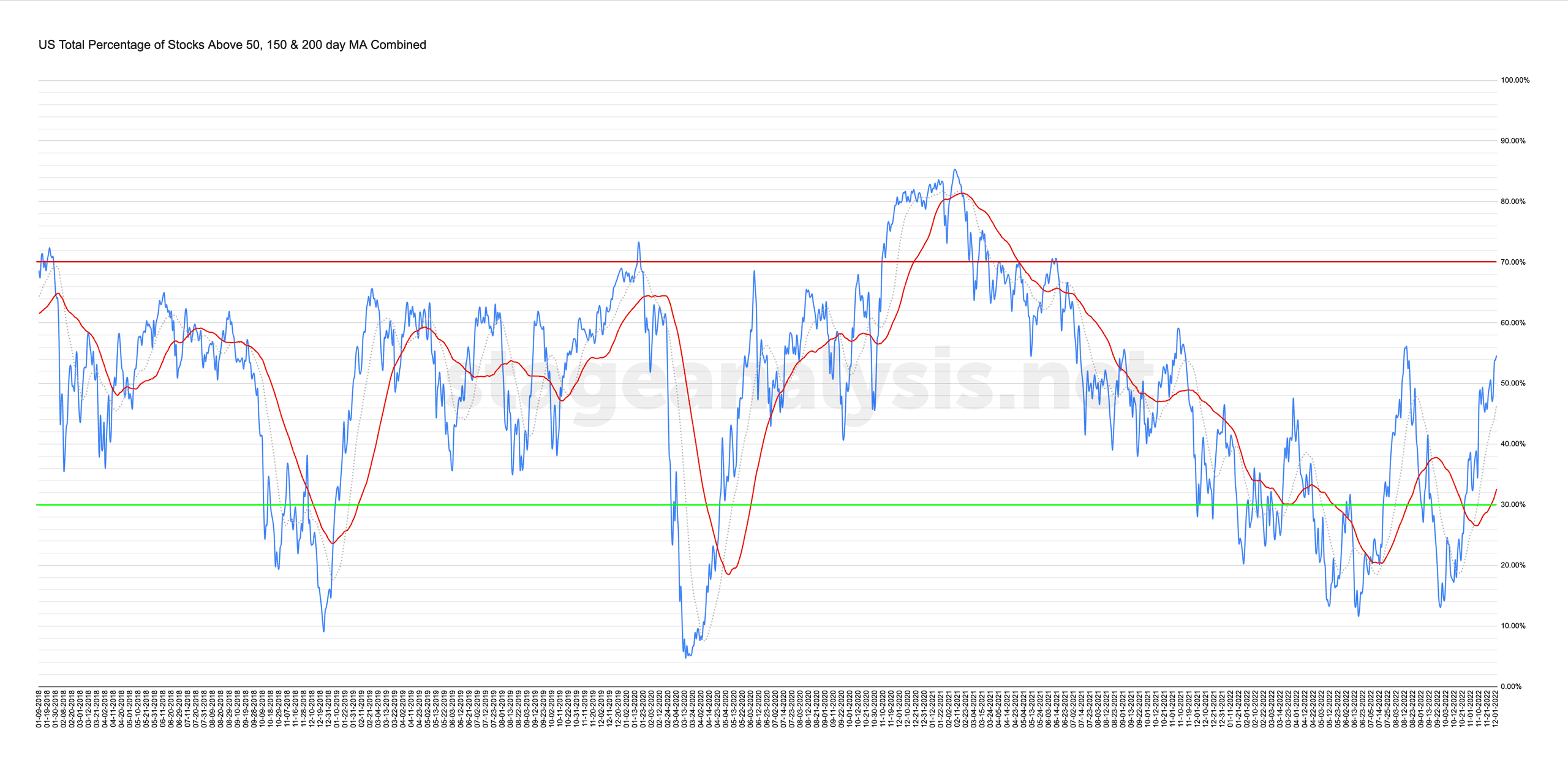

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

04 December, 2022

US Stocks Watchlist – 4 December 2022

For the watchlist from the weekend scans...

Read More

03 December, 2022

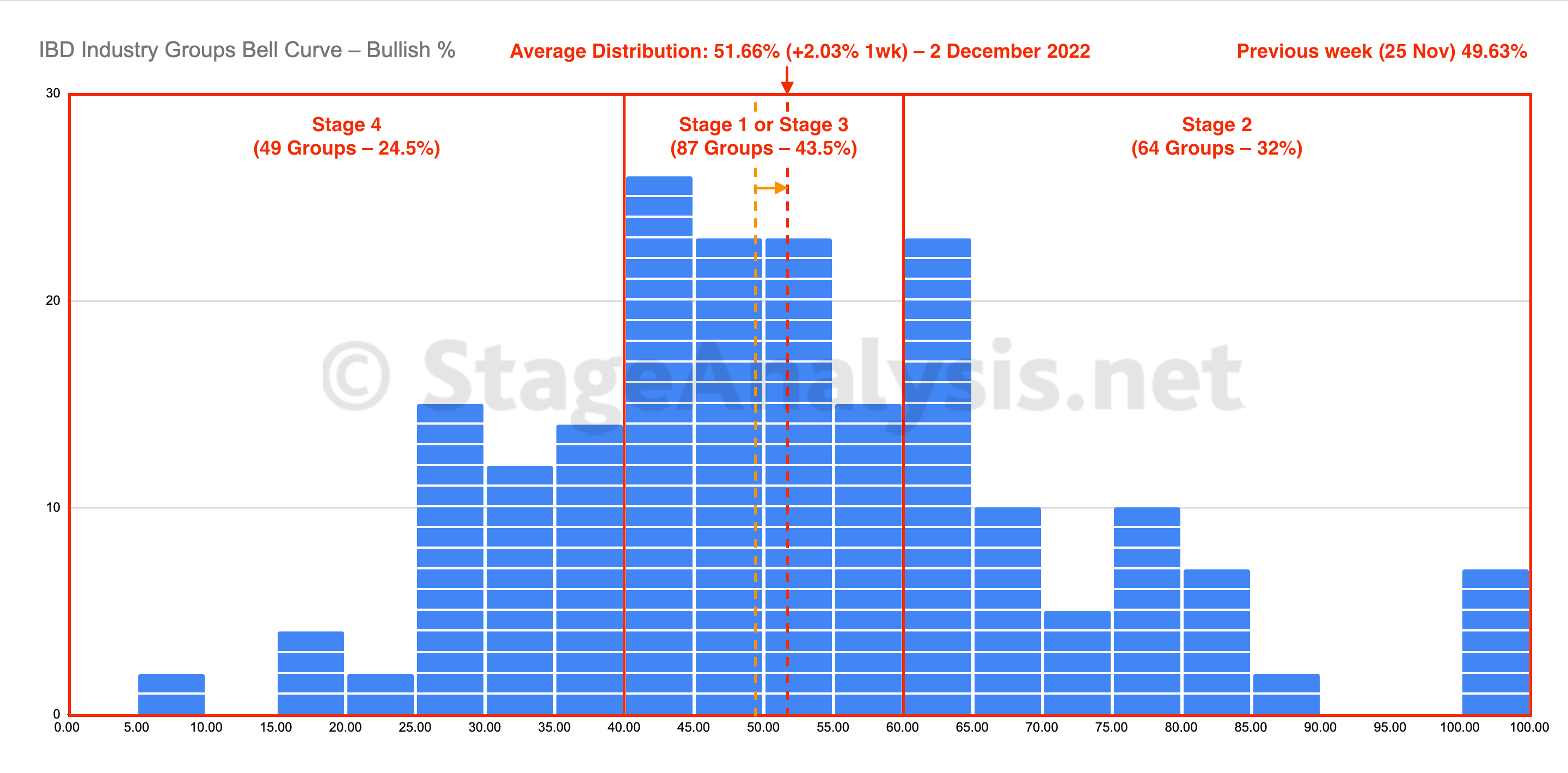

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve gained +2.03% this week, moving it back above the 50% level to close at 51.66%, which is firmly in the Stage 1 zone, with the bell curve fairly evenly distributed in the middle of the range.

Read More

03 December, 2022

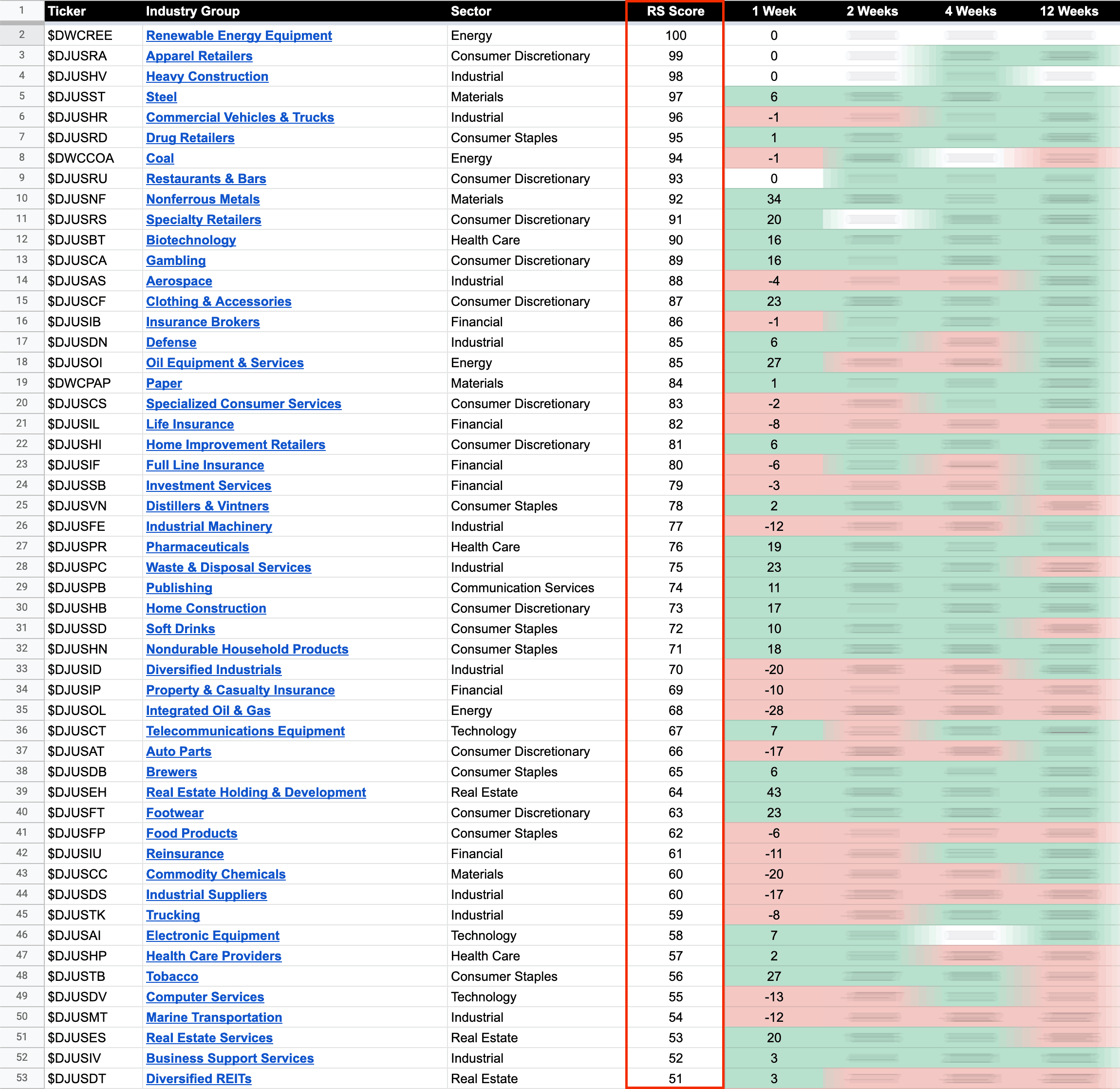

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

01 December, 2022

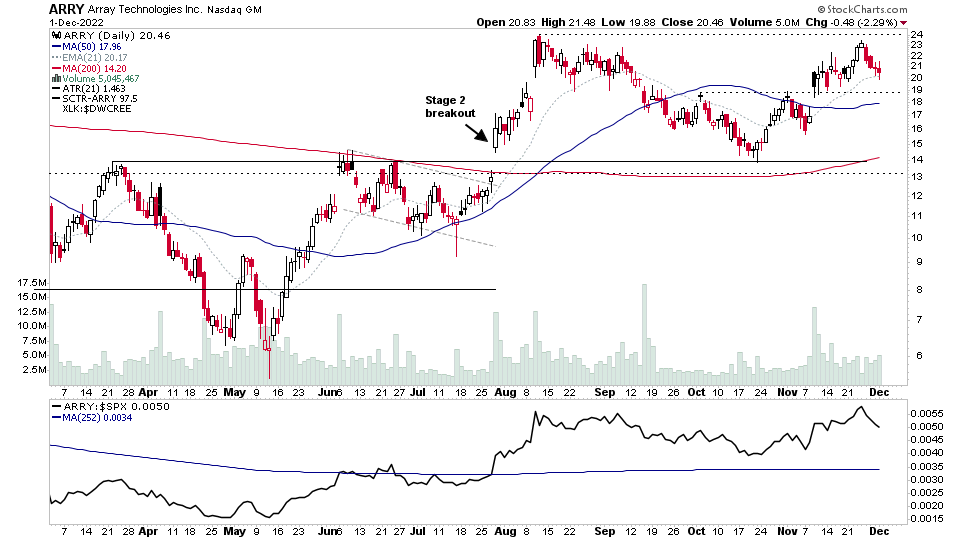

US Stocks Watchlist – 1 December 2022

There were 21 stocks highlighted from the US stocks watchlist scans today...

Read More

30 November, 2022

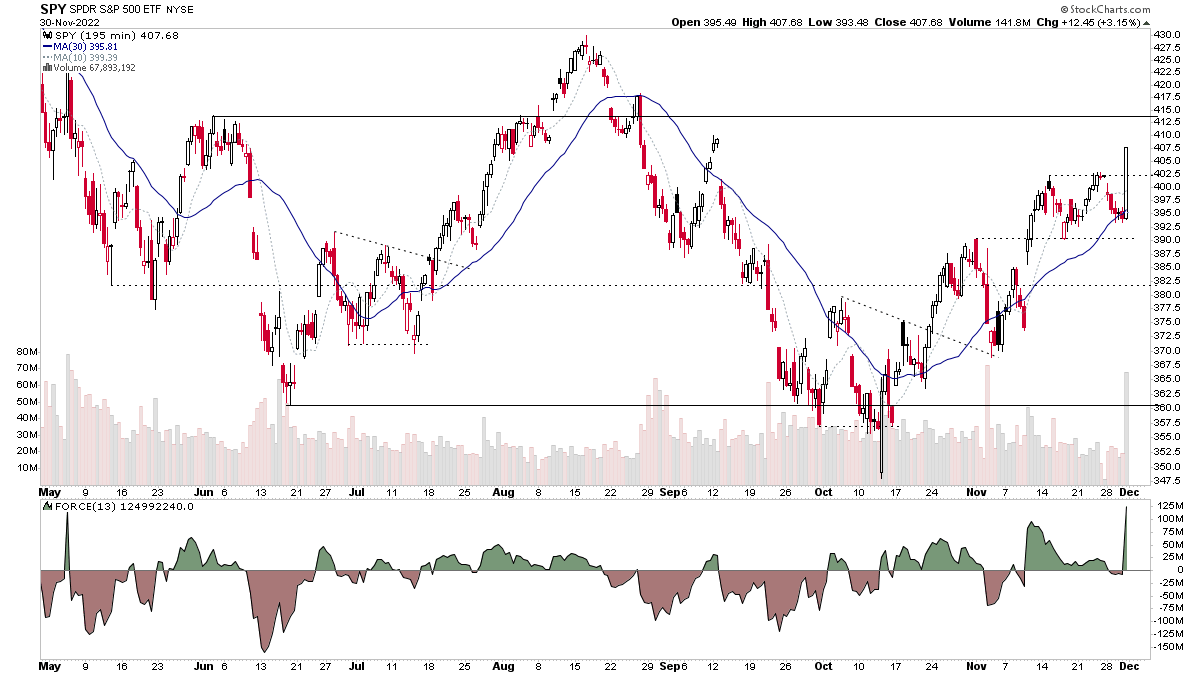

Stage Analysis Members Video – 30 November 2022 (56 mins)

The Stage Analysis members midweek video discussing the market indexes, sector breadth, short-term market breadth and the US watchlist stocks in more detail with live markups.

Read More

29 November, 2022

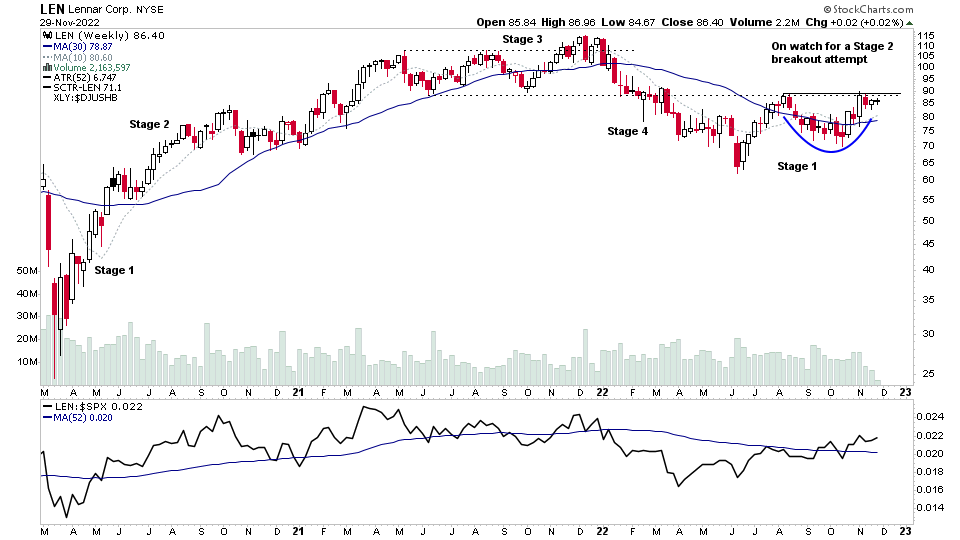

US Stocks Watchlist – 29 November 2022

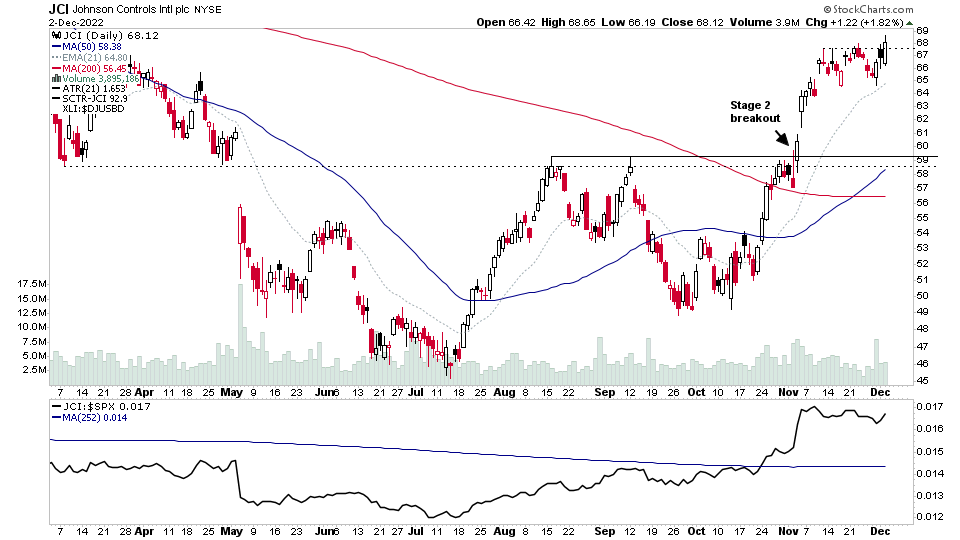

The pullback over the last few days and general consolidation range that's formed in the major indexes like the S&P 500 (shown above) since the secondary Follow Through Day (FTD) has put a number of stocks and groups in a more favourable position than they were at the FTD, with many stocks consolidating on low volume and tight spreads under potential Stage 2 breakout levels...

Read More

28 November, 2022

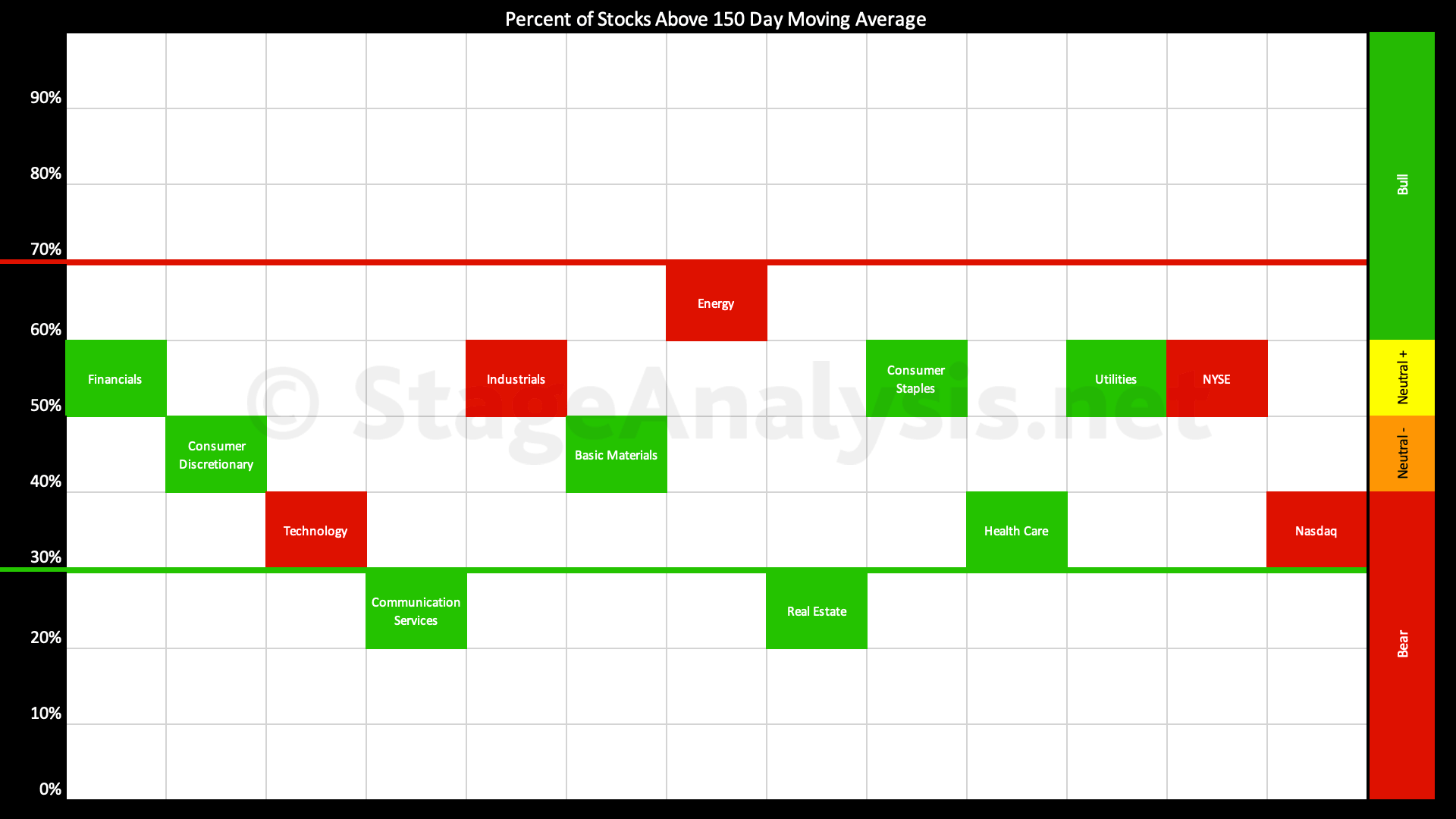

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has continued to improve since my previous post on the 9th November, which was the day before the secondary Follow Through Day (FTD) in multiple of the major US stock market indexes.

Read More

27 November, 2022

Stage Analysis Members Video – 27 November 2022 (1hr 24mins)

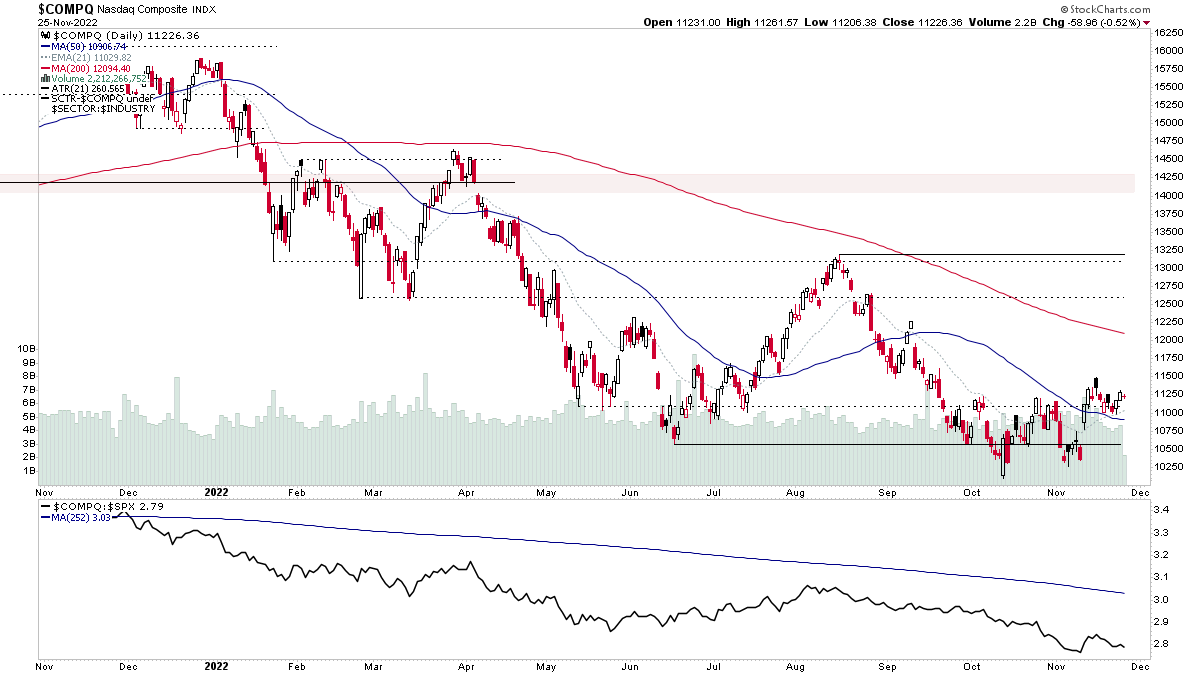

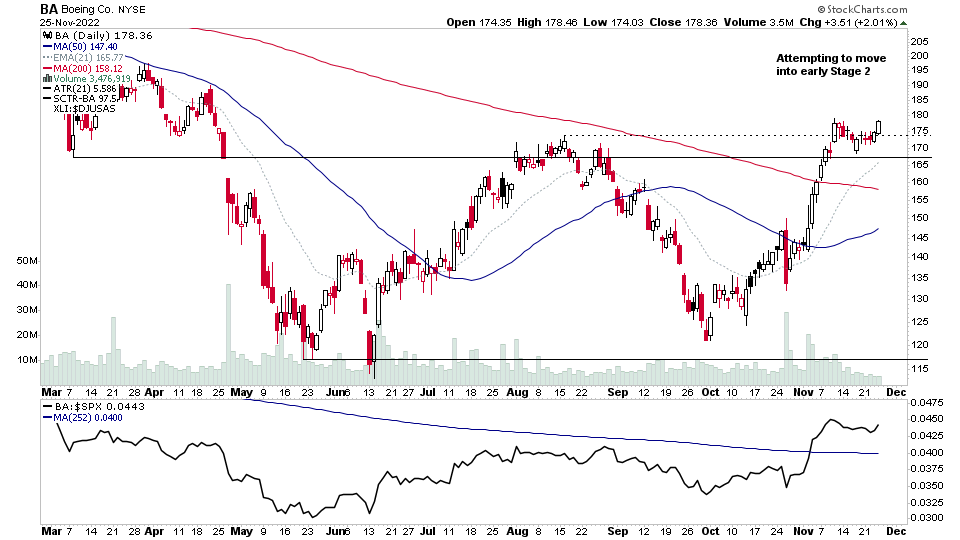

The Stage Analysis members weekend video discussing the market indexes, Dollar index, commodities, industry groups relative strength, IBD industry group bell curve – bullish percent, market breadth charts to determine the weight of evidence, this weeks Stage 2 breakout attempts and the US watchlist stocks in detail on multiple timeframes.

Read More

27 November, 2022

US Stocks Watchlist – 27 November 2022

There were 26 stocks highlighted from the US stocks watchlist scans today...

Read More