Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

05 March, 2023

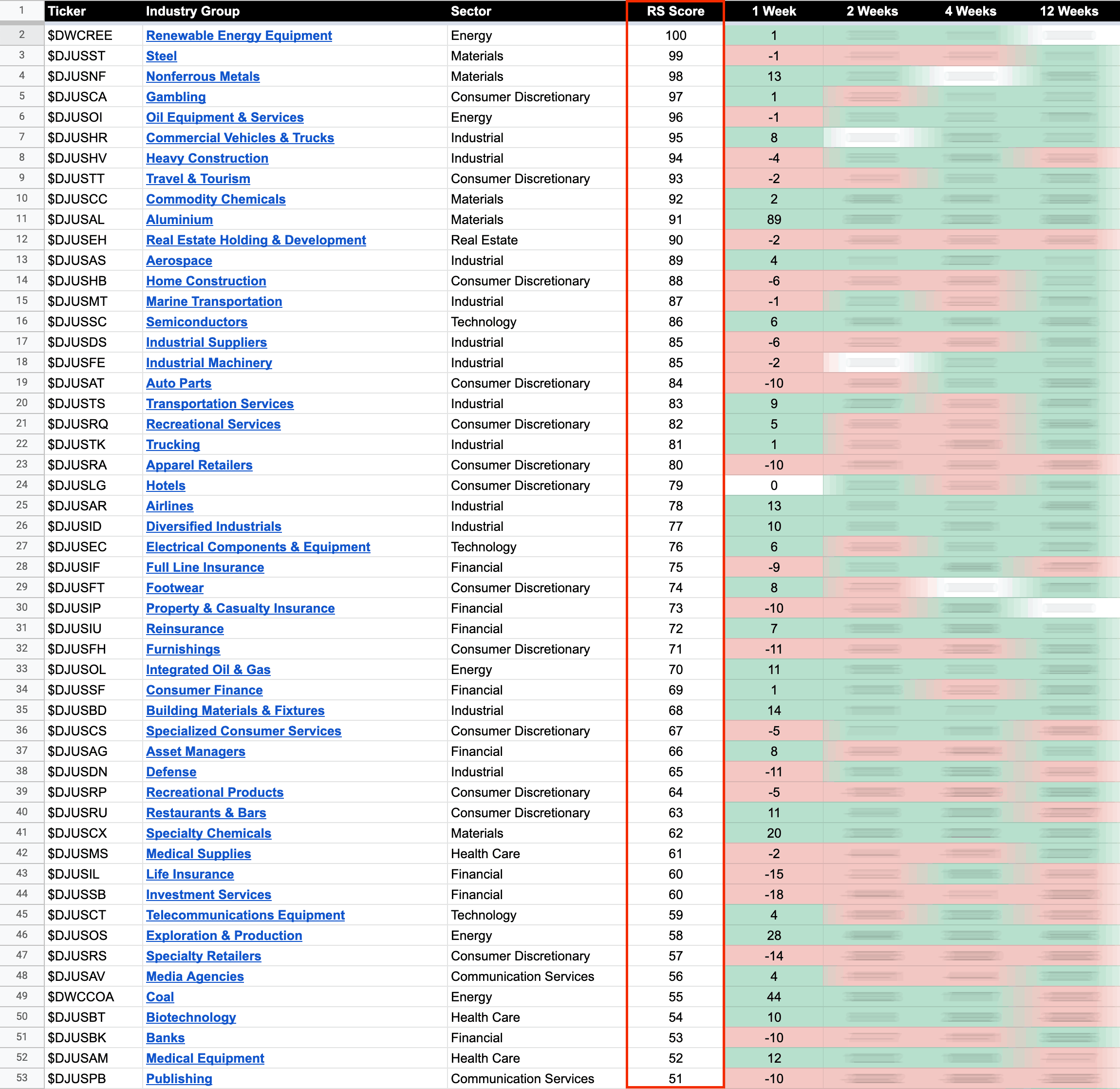

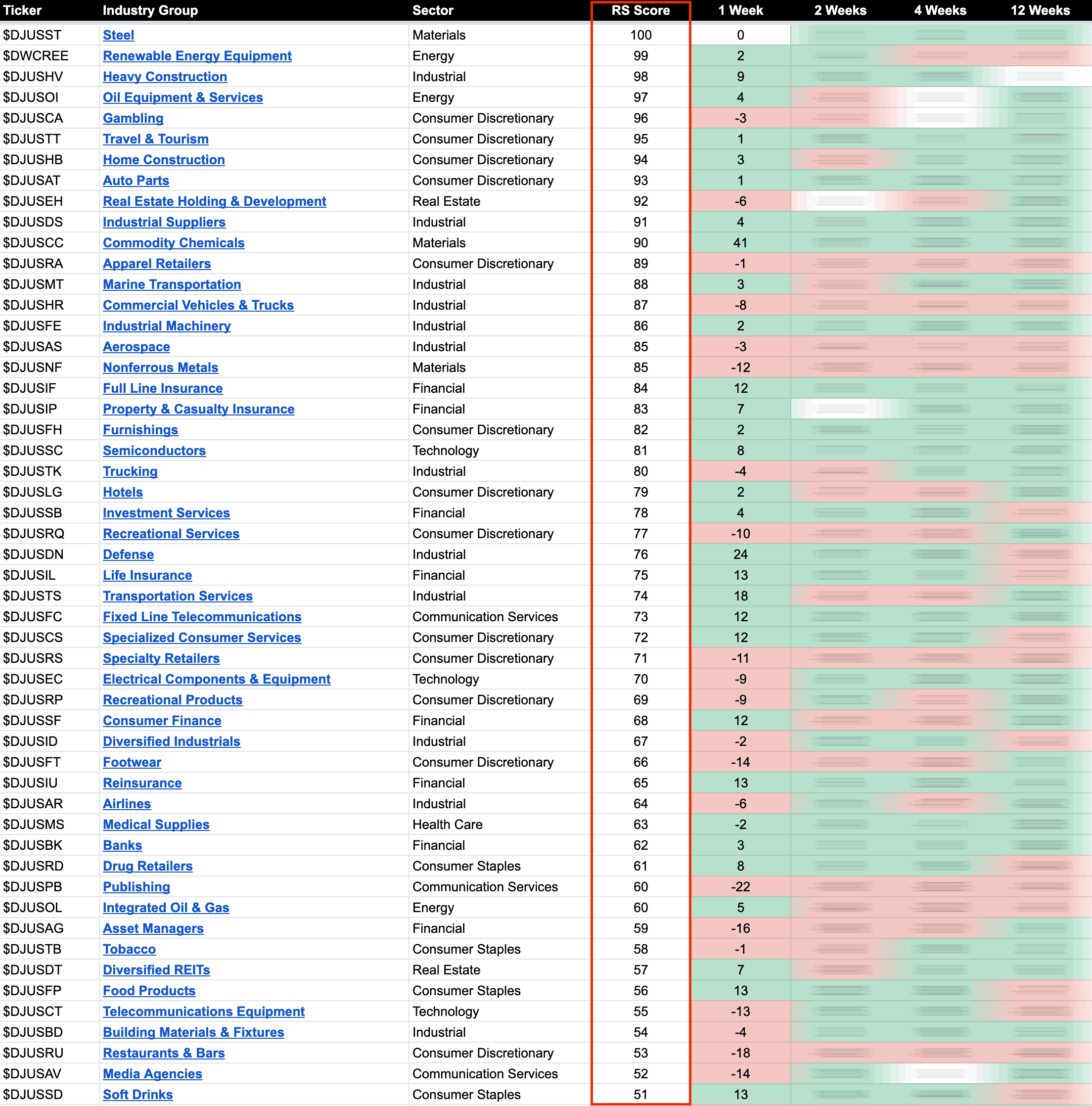

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

02 March, 2023

US Stocks Watchlist – 2 March 2023

For the watchlist from Thursday's scans...

Read More

28 February, 2023

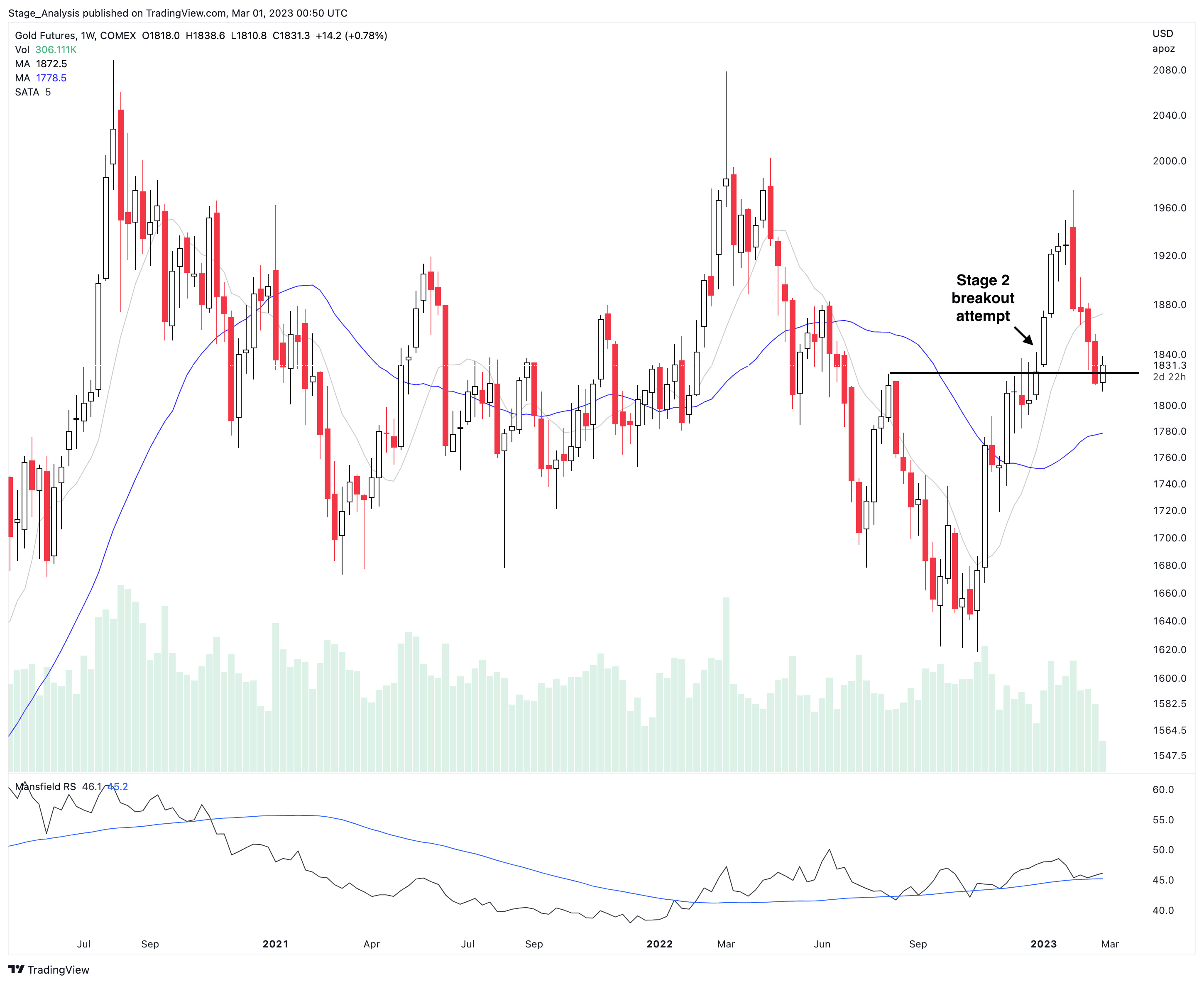

Gold Futures Testing Stage 2 Level and the US Stocks Watchlist – 28 February 2023

Gold is at an interesting point, as the Gold Futures (GC) has pulled back to its Stage 2 breakout level recently, while the US Dollar Index (DX) has also rebounded to its Stage 4 breakdown level, and hence both are now at potential pivotal points where support/resistance comes into play and hence potential for reversals...

Read More

27 February, 2023

US Stocks Watchlist – 27 February 2023

For the watchlist from Mondays scans...

Read More

26 February, 2023

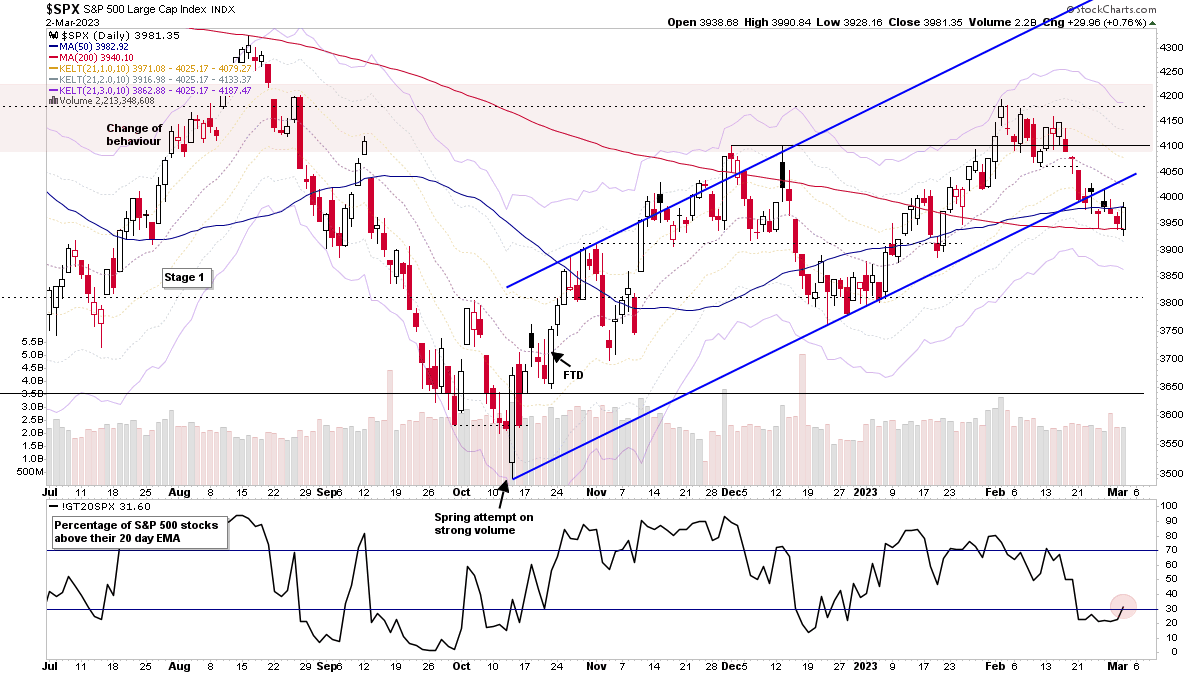

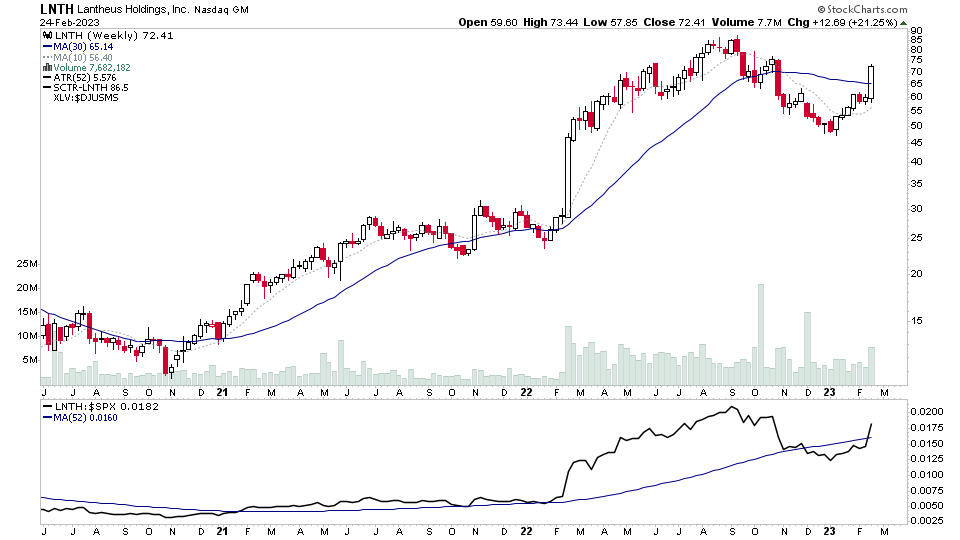

Stage Analysis Members Video – 26 February 2023 (1hr 22mins)

The Stage Analysis members weekend video featuring early Stage 2 and developing Stage 1 stocks, watchlist stocks in focus with upcoming earnings in the coming week. Plus the regular content with the major US Indexes, the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence.

Read More

25 February, 2023

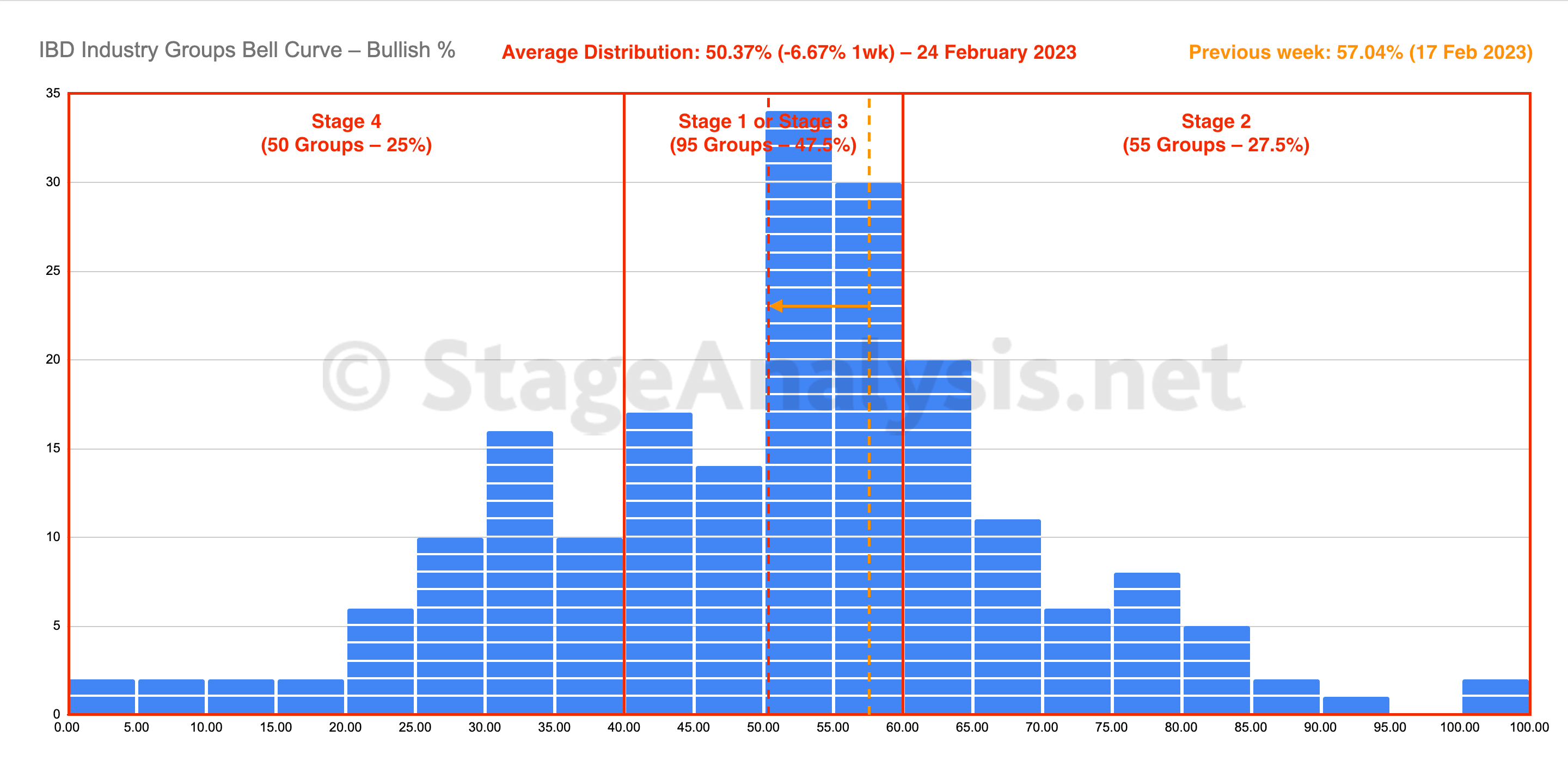

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve declined for a third week, losing -6.67% to finish at 50.37% overall. The amount of groups in Stage 4 was increased by 18 (+9%), and the amount of groups in Stage 2 decreased by -32 (-16%), while the amount groups in Stage 1 or Stage 3 increased by +14 (+7%).

Read More

25 February, 2023

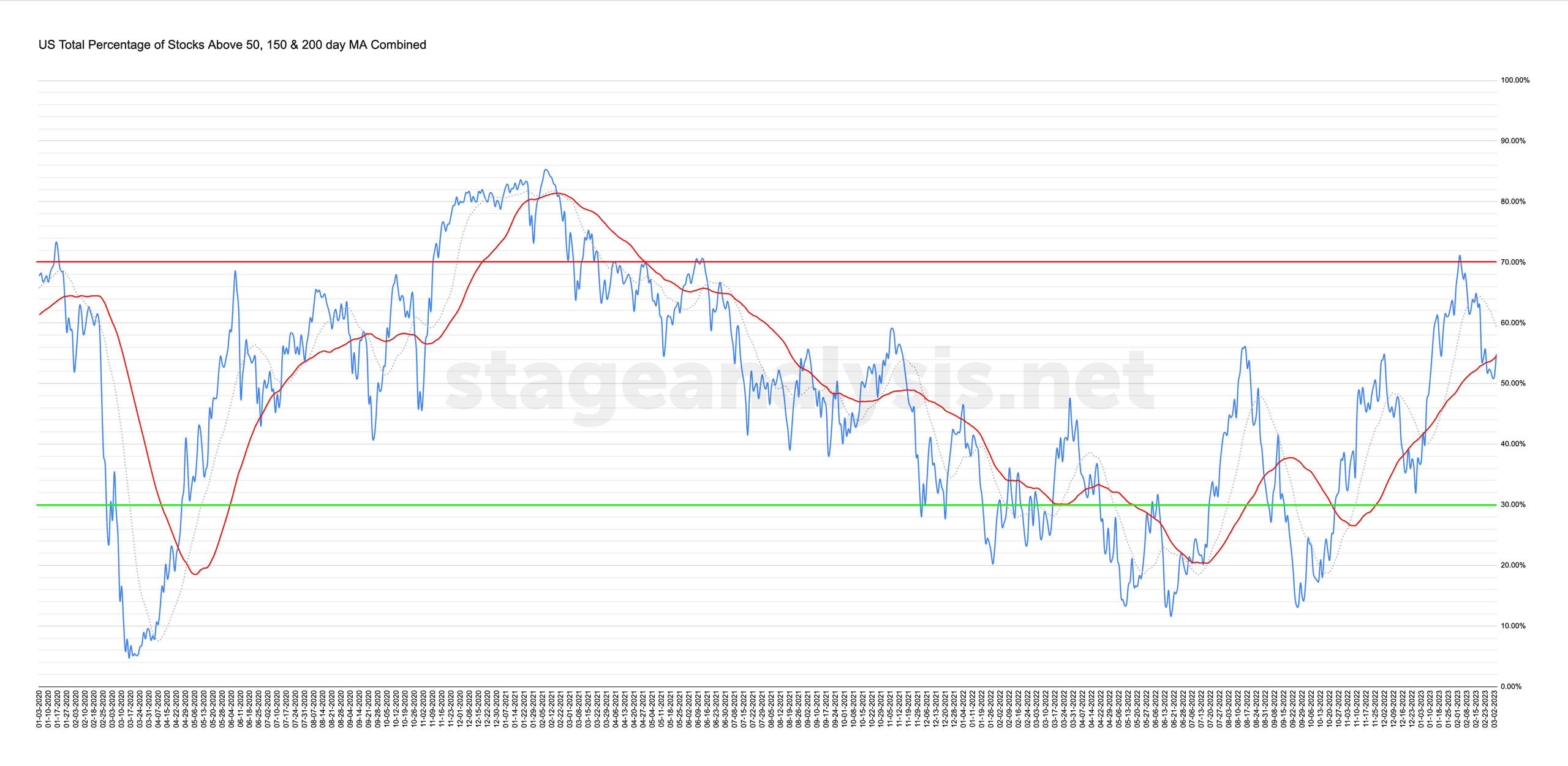

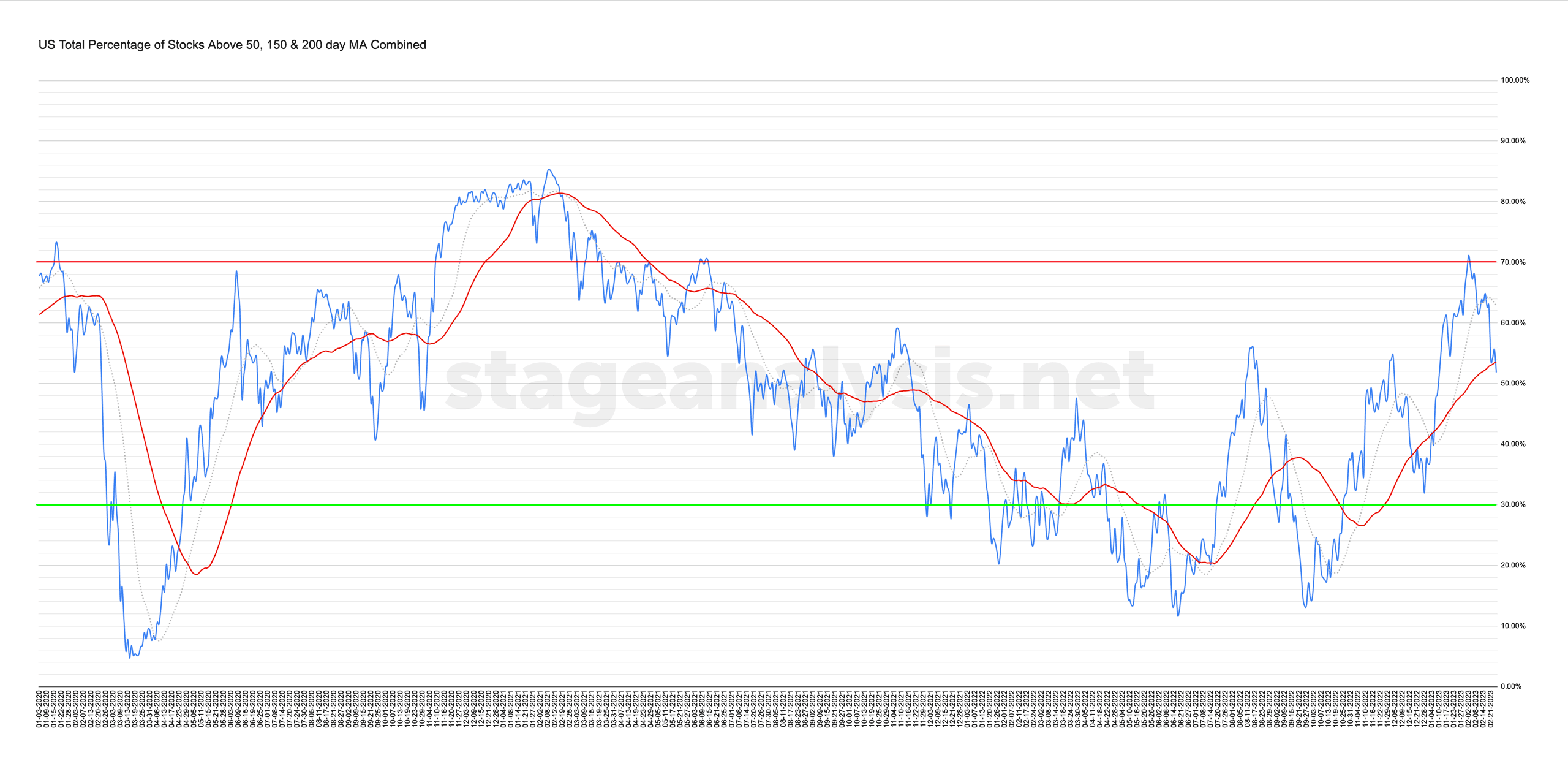

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

24 February, 2023

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

23 February, 2023

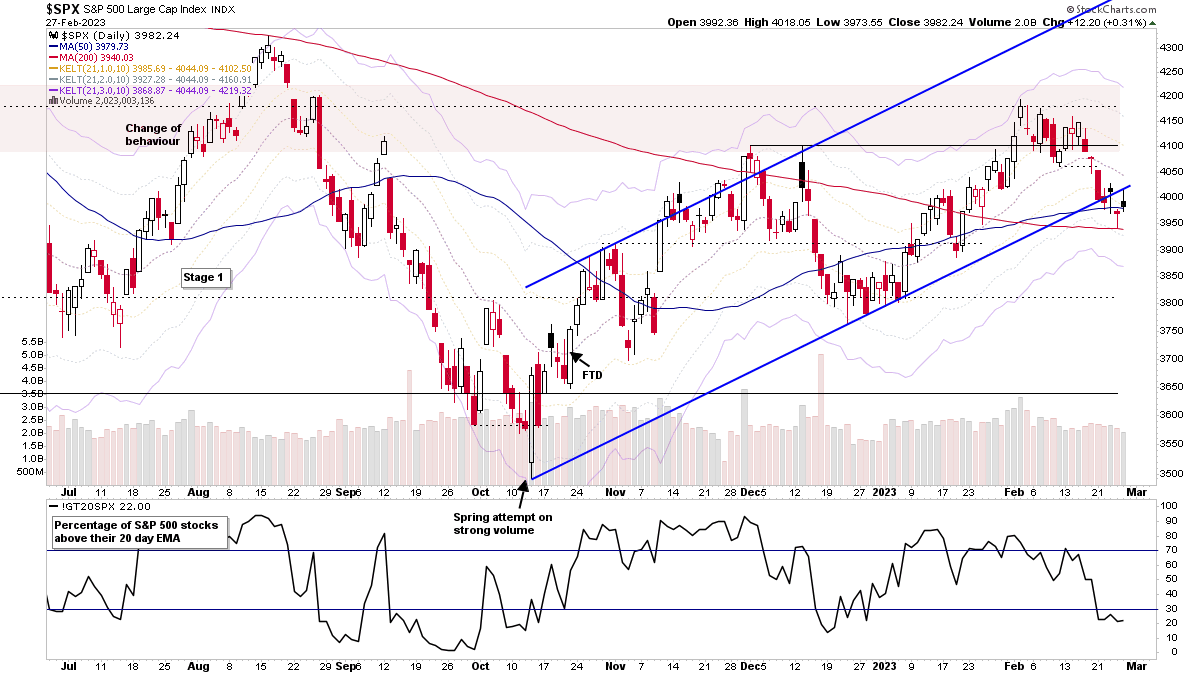

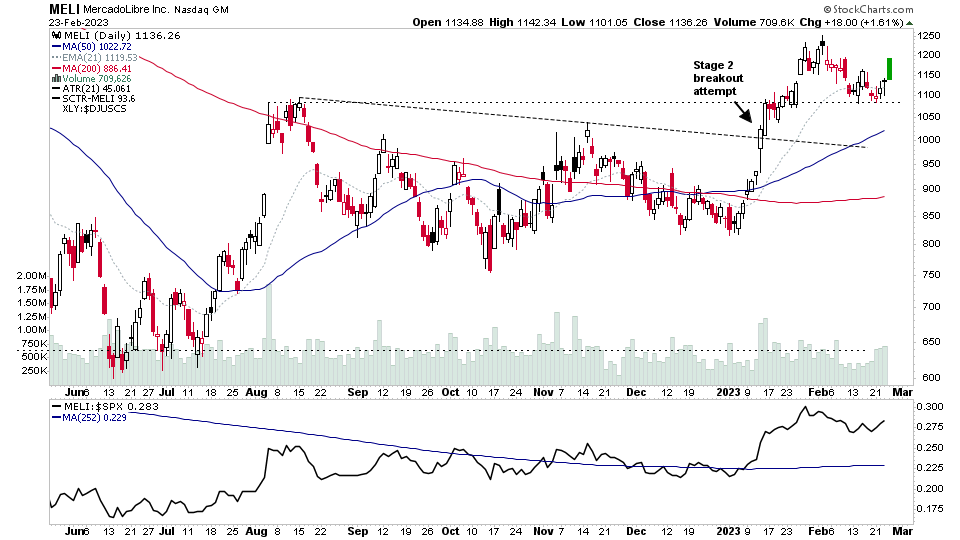

Stage Analysis Members Video – 23 February 2023 (51 mins)

The Stage Analysis members midweek video discussing the US Watchlist Stocks from today and yesterdays post in more detail with live markups on multiple timeframes, plus a brief look at the S&P 500 and short-term market breadth indicators too...

Read More