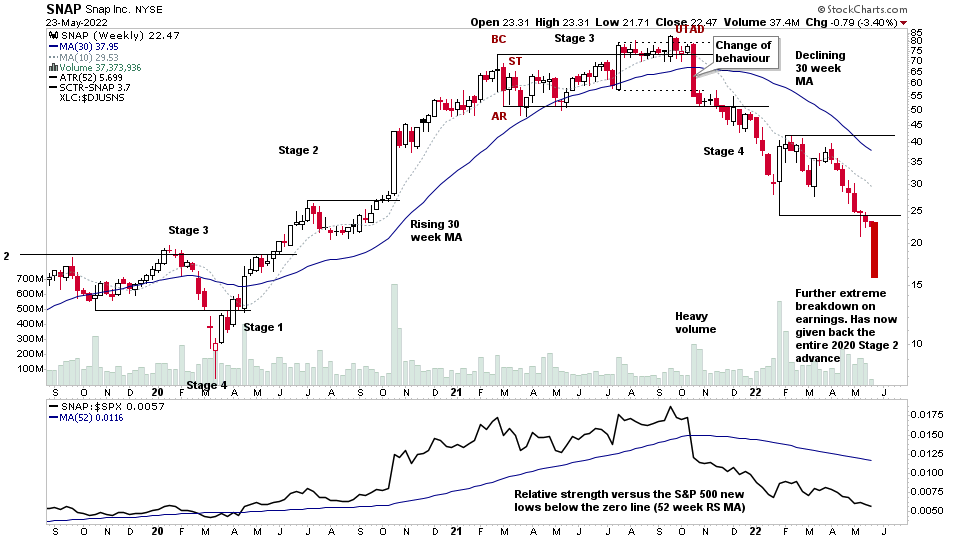

SNAP made another massive continuation breakdown on earnings in the after hours trade in its late Stage 4 decline, and has now given back the entire 2020 Stage 2 advance, and joins the likes of PTON, ROKU, PYPL, SQ, PINS and many more former 2020 leading stocks that have come full circle and given it all back again since breaking down into Stage 4 during various points over the course of the last year...

Read More

Blog

22 May, 2022

Stage Analysis Members Weekend Video – 22 May 2022 (1hr 18mins)

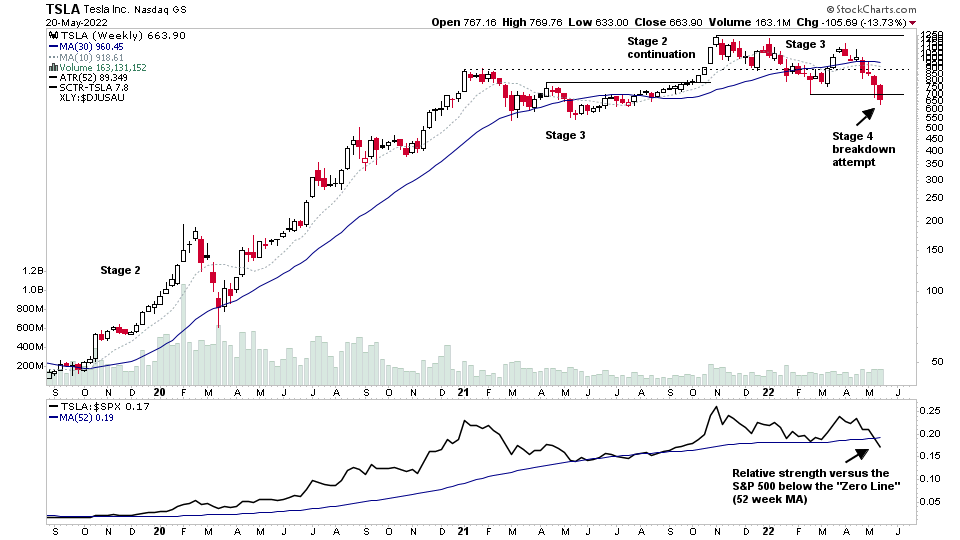

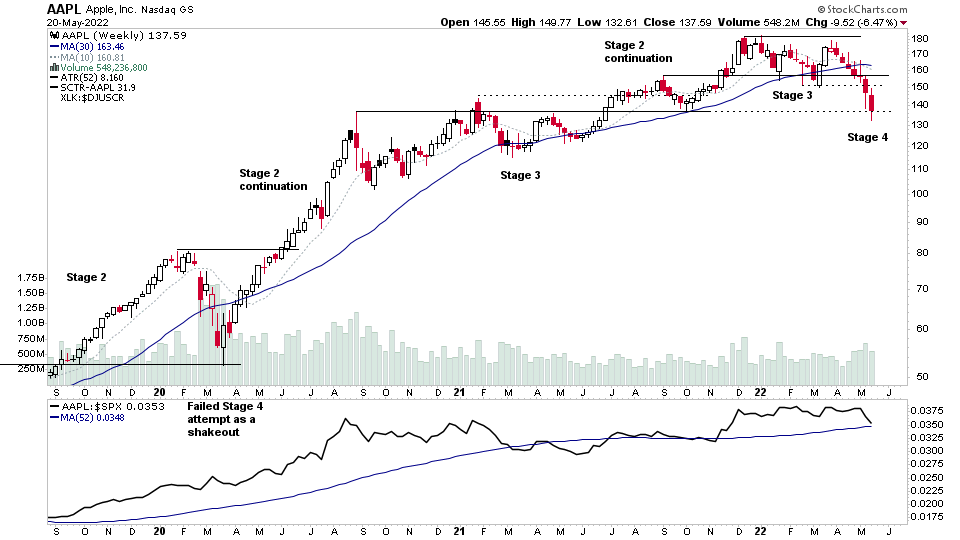

This weekends Stage Analysis Members Video features Stage Analysis of the mega caps $AAPL and $TLSA as they test major levels in early Stage 4, plus the Major Indexes Review. Then a look at the US Stocks Industry Groups Relative Strength tables and groups of interest. The Market Breadth Charts to determine The Weight of Evidence and the US Stocks Watchlist in Detail, with marked up charts of what I'm watching for on the long and short side.

Read More

22 May, 2022

Major Indexes Shakeout at the Lows in Stage 4 and the US Stocks Watchlist – 22 May 2022

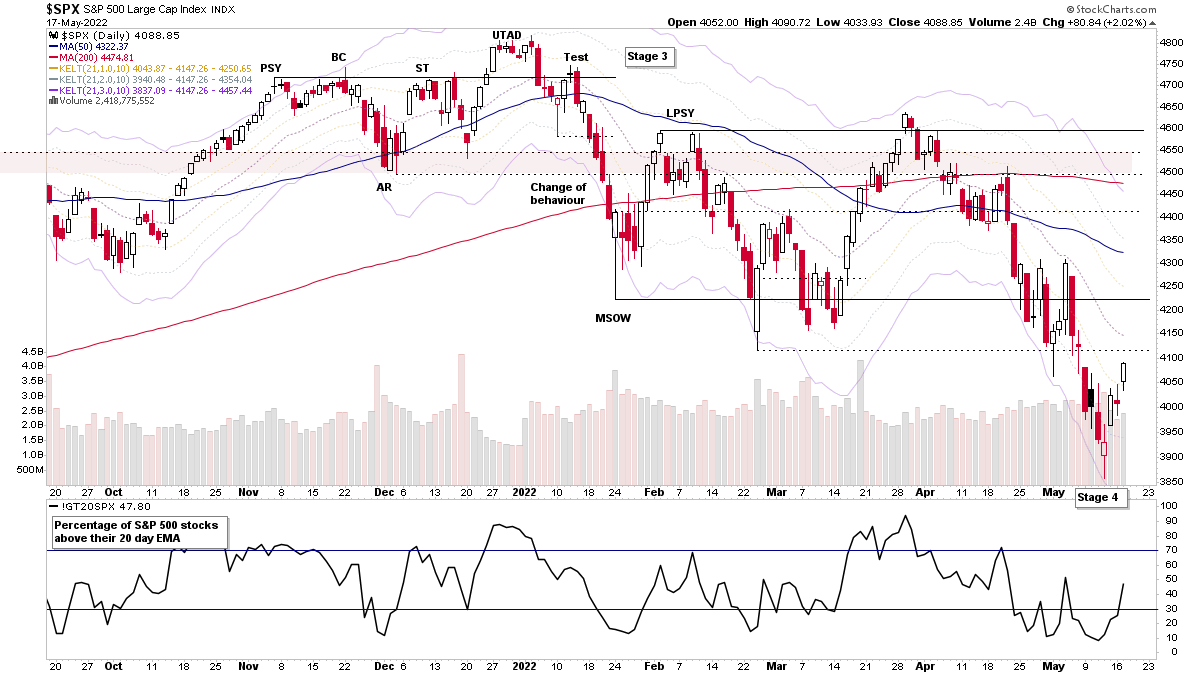

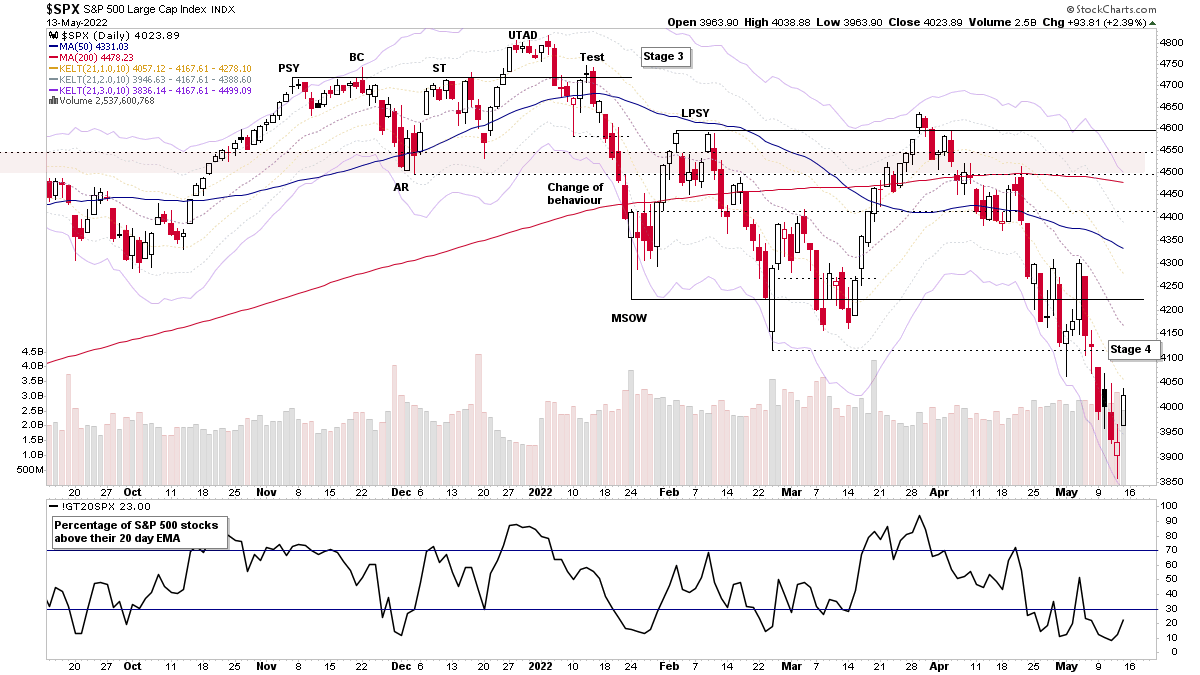

Friday produced a potential shakeout move in the major US stock markets (i.e. the S&P 500, Nasdaq Composite and Russell 2000) with a failed breakdown attempt and monthly options expiry potentially playing a role, with the price action closing between the maximum pain levels for both puts and calls...

Read More

21 May, 2022

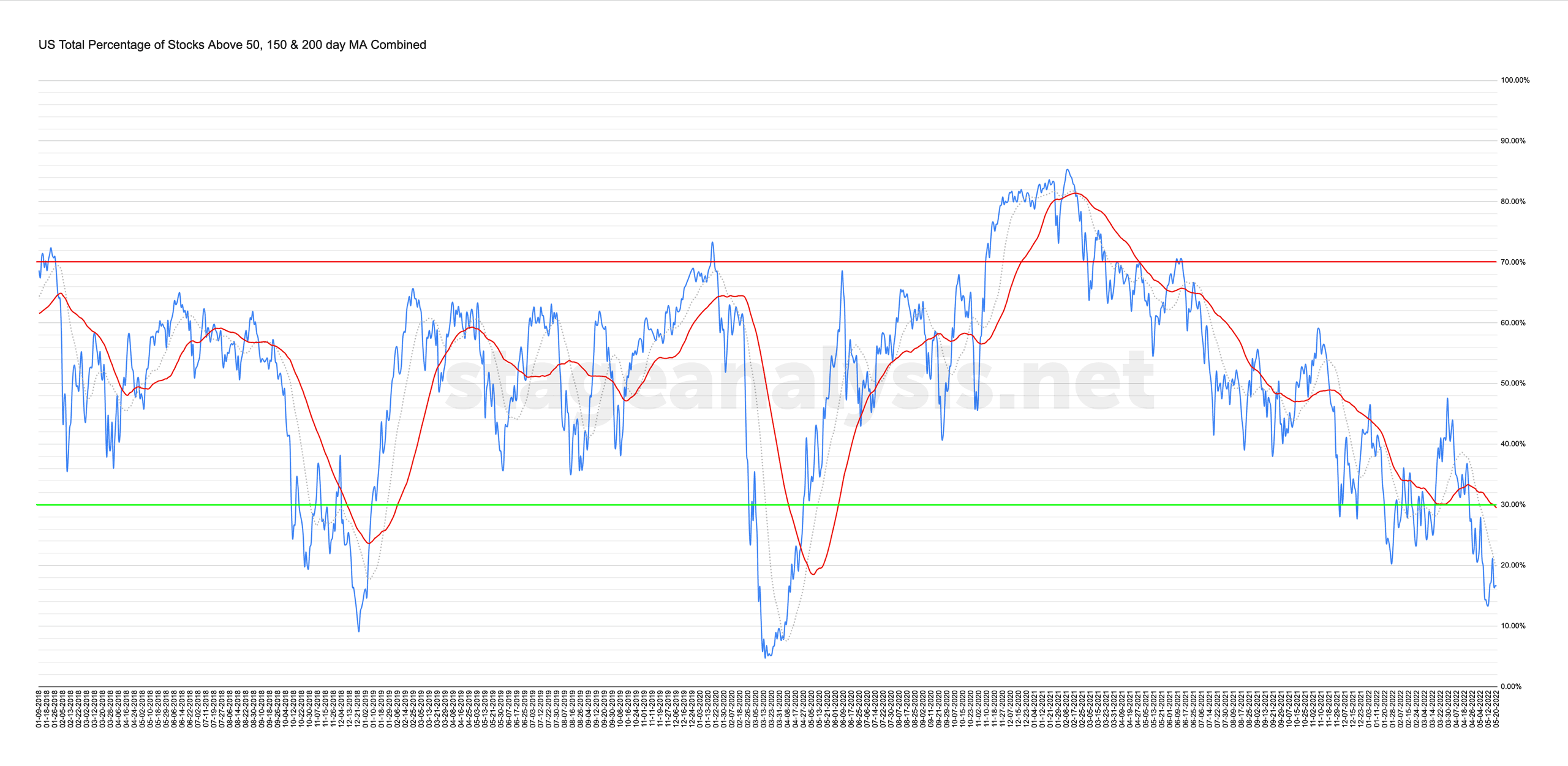

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

20 May, 2022

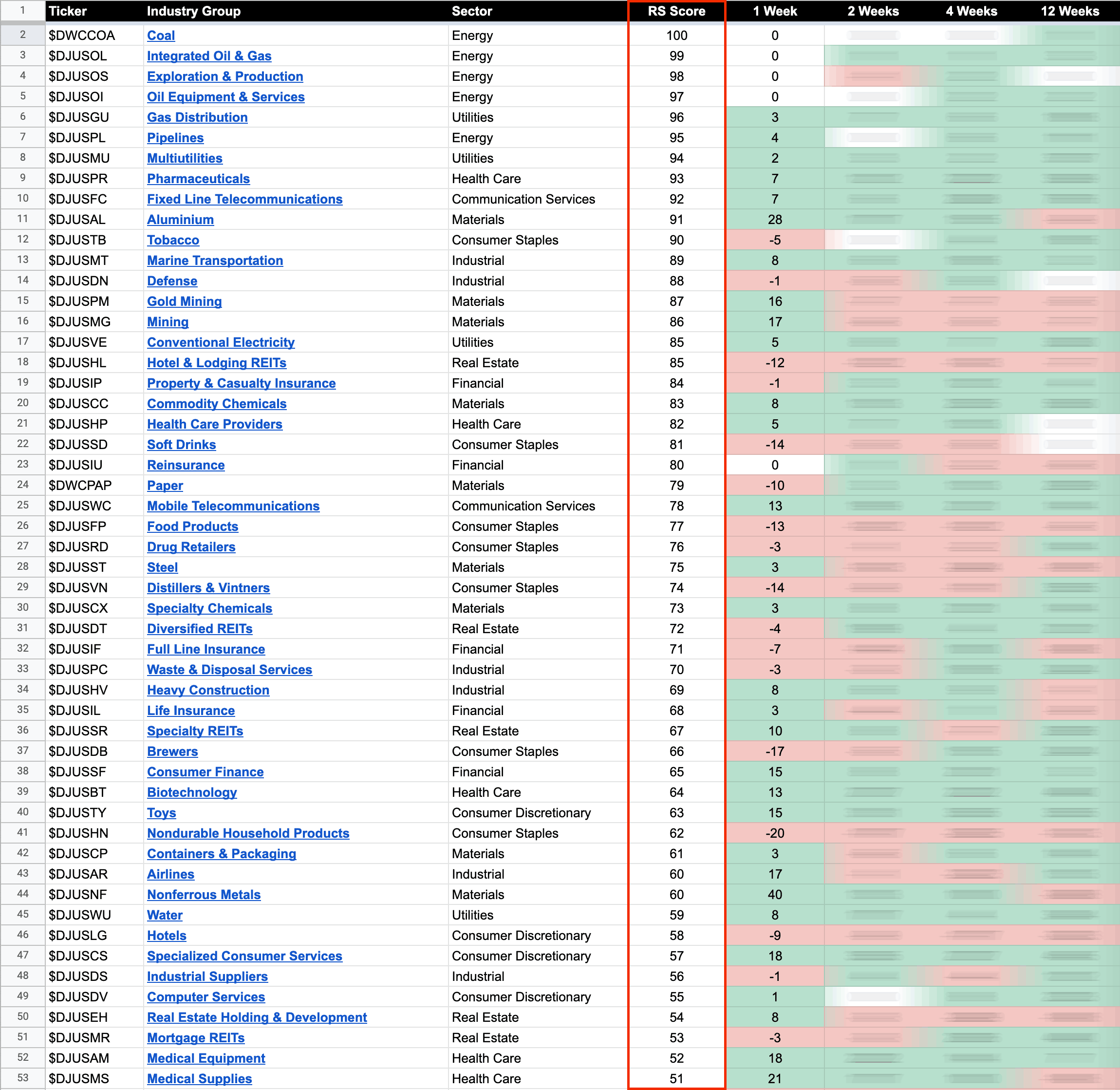

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

20 May, 2022

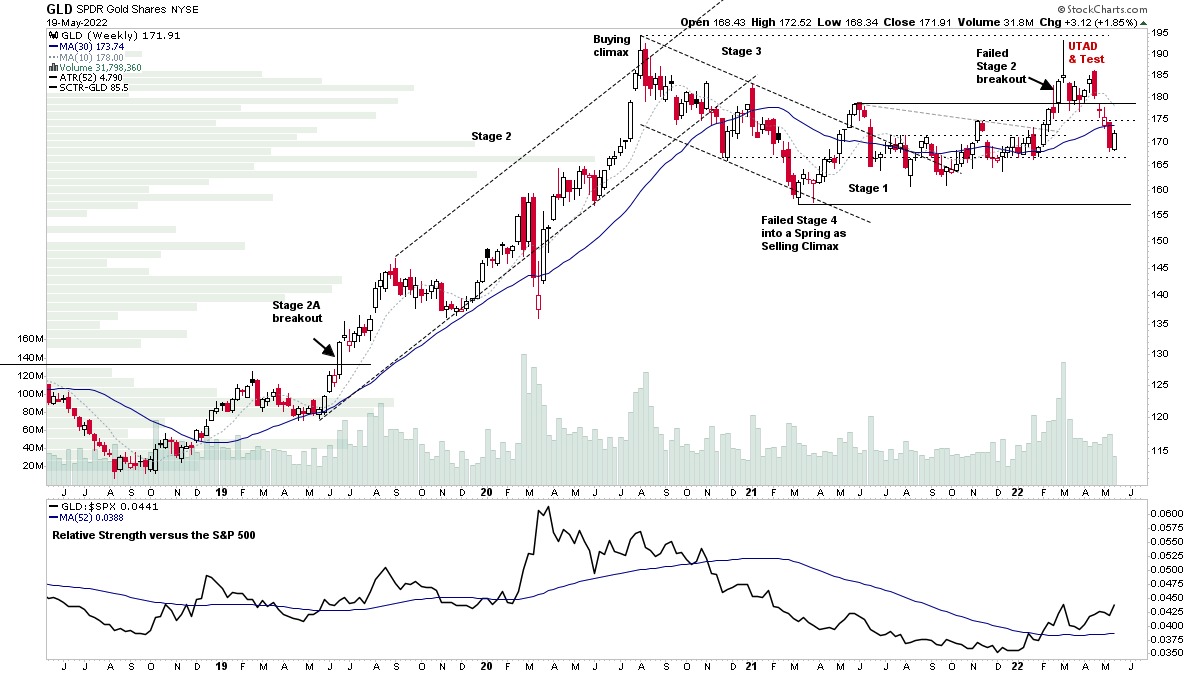

Gold Attempting To Move Back Above the 200 Day MA and the US Stocks Watchlist – 19 May 2022

Gold and Miners are coming back into focus today, with a move by the Gold continuous futures back through the 200 day MA on increased volume, and so a potential spring type event at the moving average – which has also been showing up in the individual gold miners and some of the silver miners too over the last week or so...

Read More

19 May, 2022

Stage Analysis Members Midweek Video – 18 May 2022 (1hr 17mins)

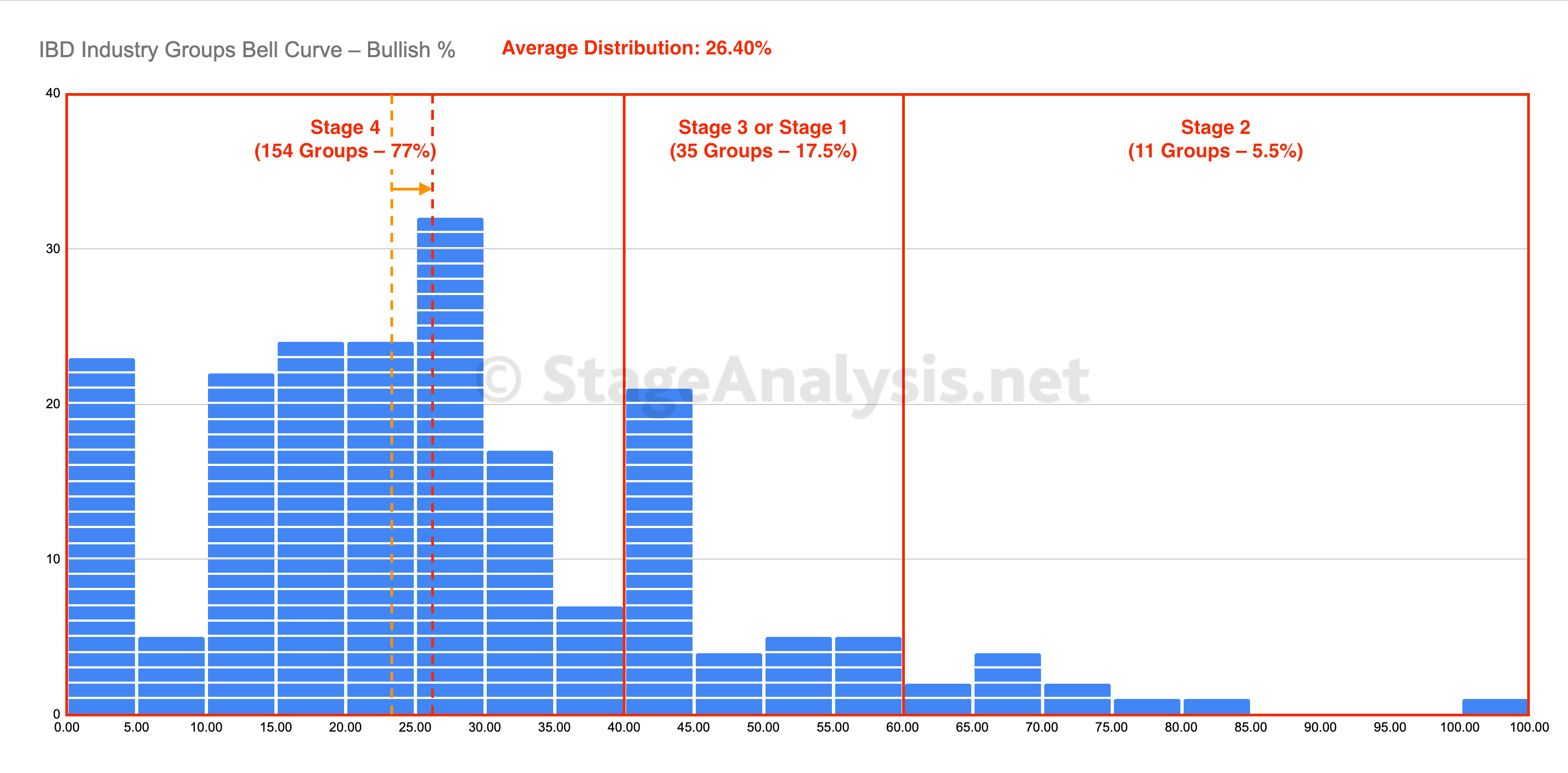

The Stage Analysis Members Midweek Video features Analysis of the Stages of the major US sectors, as well as a look at the sector breadth visual the custom IBD Industry Groups Bell Curve – Bullish % chart that I do for the members that shows the distribution of the 200 IBD Industry Groups as a bell curve chart...

Read More

18 May, 2022

NYSE Bullish Percent Status Change to Bull Alert and New CAN SLIM Follow Through Day Triggered

The major indexes managed to put in a Follow Through Day (FTD) which is defined in the excellent book about the CAN SLIM method called – How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition by William O'Neil. Which changes the Investors Business Daily (IBD) outlook to Confirmed Uptrend.

Read More

16 May, 2022

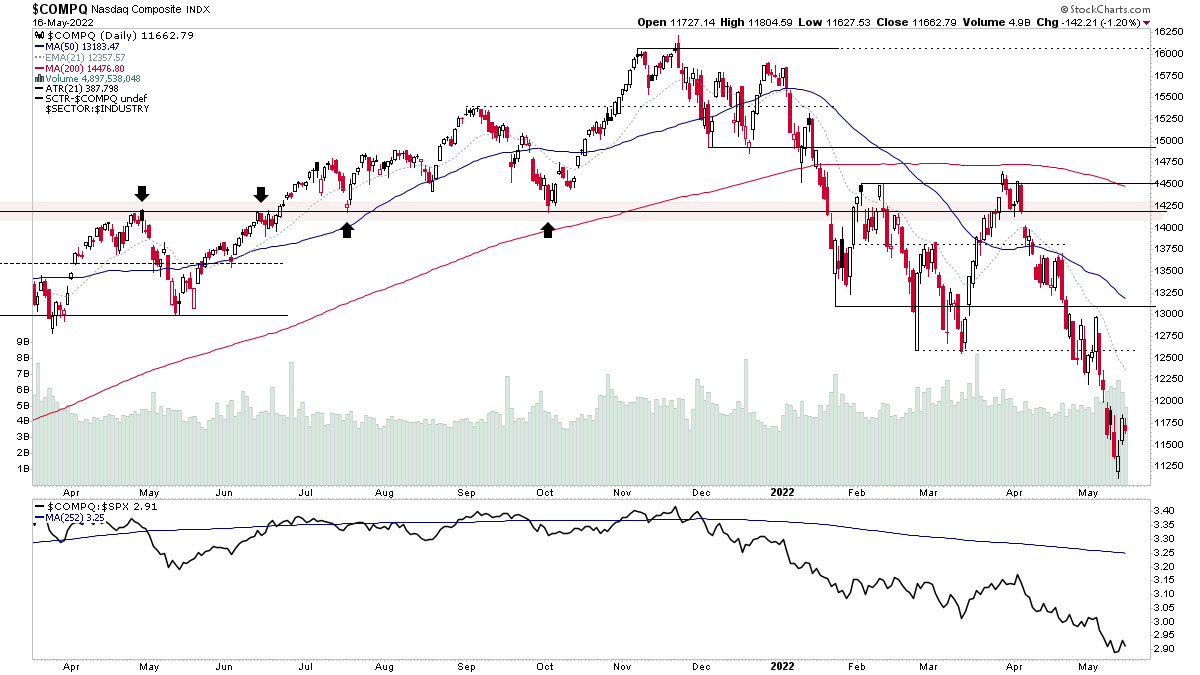

Inside Day on the Nasdaq Composite and the US Stocks Watchlist – 16 May 2022

There wasn't much in the way of follow through today except in the stronger RS areas of the market, with progress in all of the top ten groups, which is still dominated by the Energy groups. But in the broader market indexes such as the Nasdaq Composite (see above) there was mix of inside days and small stalling dojo candles...

Read More

15 May, 2022

Stage Analysis Members Weekend Video – 15 May 2022 (1hr 40mins)

This weekends Stage Analysis Members Video features the Major Indexes Review and analysis of the Sector Breadth charts. Plus the US Stocks Industry Groups Relative Strength tables and groups of interest. The Market Breadth Charts to determine The Weight of Evidence and the US Stocks Watchlist in Detail, with marked up charts of what I'm watching for on the long and short side.

Read More