Broad based selling today with stocks accelerating to the downside in the afternoon session after initially attempting to hold up during the morning, and if you zoom into the intraday 2 hour chart...

Read More

Blog

09 June, 2022

Stage 4 Trend Reasserts Itself – 10 June 2022

08 June, 2022

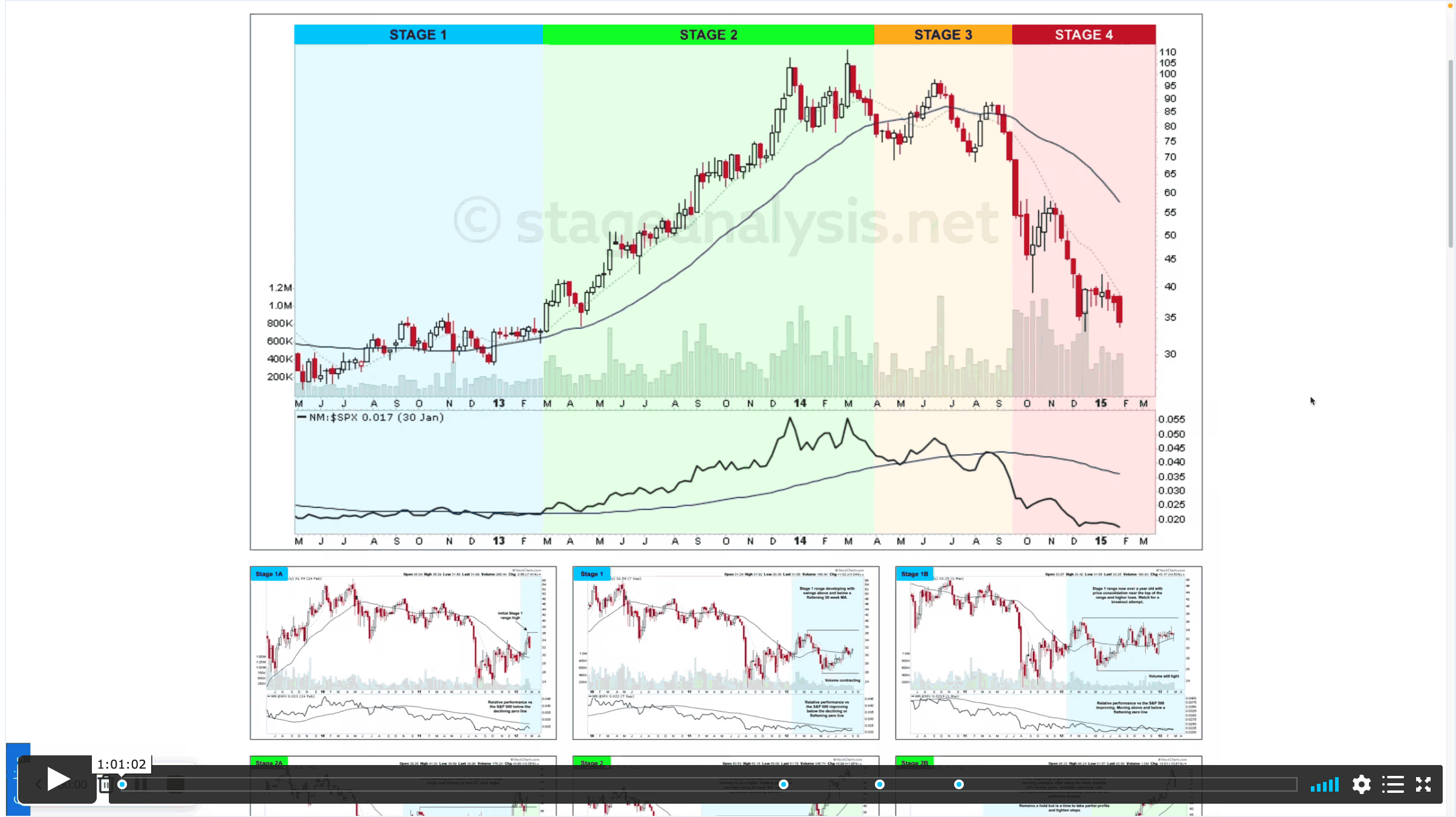

Stage Analysis Members Midweek Video – Searching for Stage 1 Bases in the Software Group – 8 June 2022 (1hr)

This weeks Stage Analysis Members midweek video features a special on the searching for Stage 1 Bases in the Software Group, as numerous software stocks have been appearing in the watchlist scans over the last month or so and exhibiting a change of behaviour...

Read More

07 June, 2022

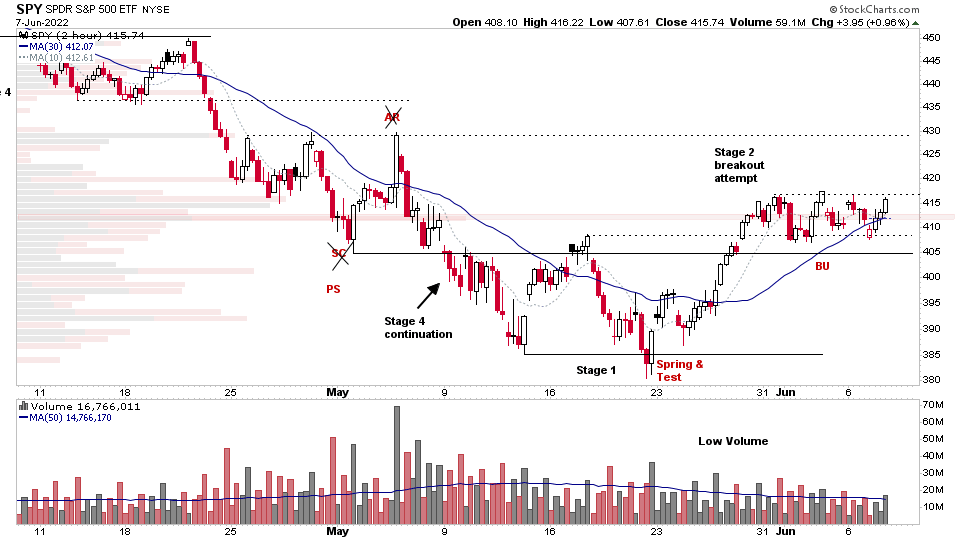

S&P 500 Rebounds from Short Term Moving Average Test and the US Stocks Watchlist – 7 June 2022

The S&P 500 gapped lower at the open, but rebounded from around its short term 21 day EMA early in the session and progressed steadily higher through the day to close near its highs at +0.95%...

Read More

07 June, 2022

US Stock Market Continues to Digest the Recent Stage 4 Counter Trend Rally – 6 June 2022

The S&P 500 continues to digest the recent run up from the lows in a tight consolidation pattern (flag) with a higher high and a higher low than yesterdays bar today, but with a close at the lower end of the range.

Read More

05 June, 2022

Stage Analysis Members Weekend Video – 5 June 2022 (1hr 36mins)

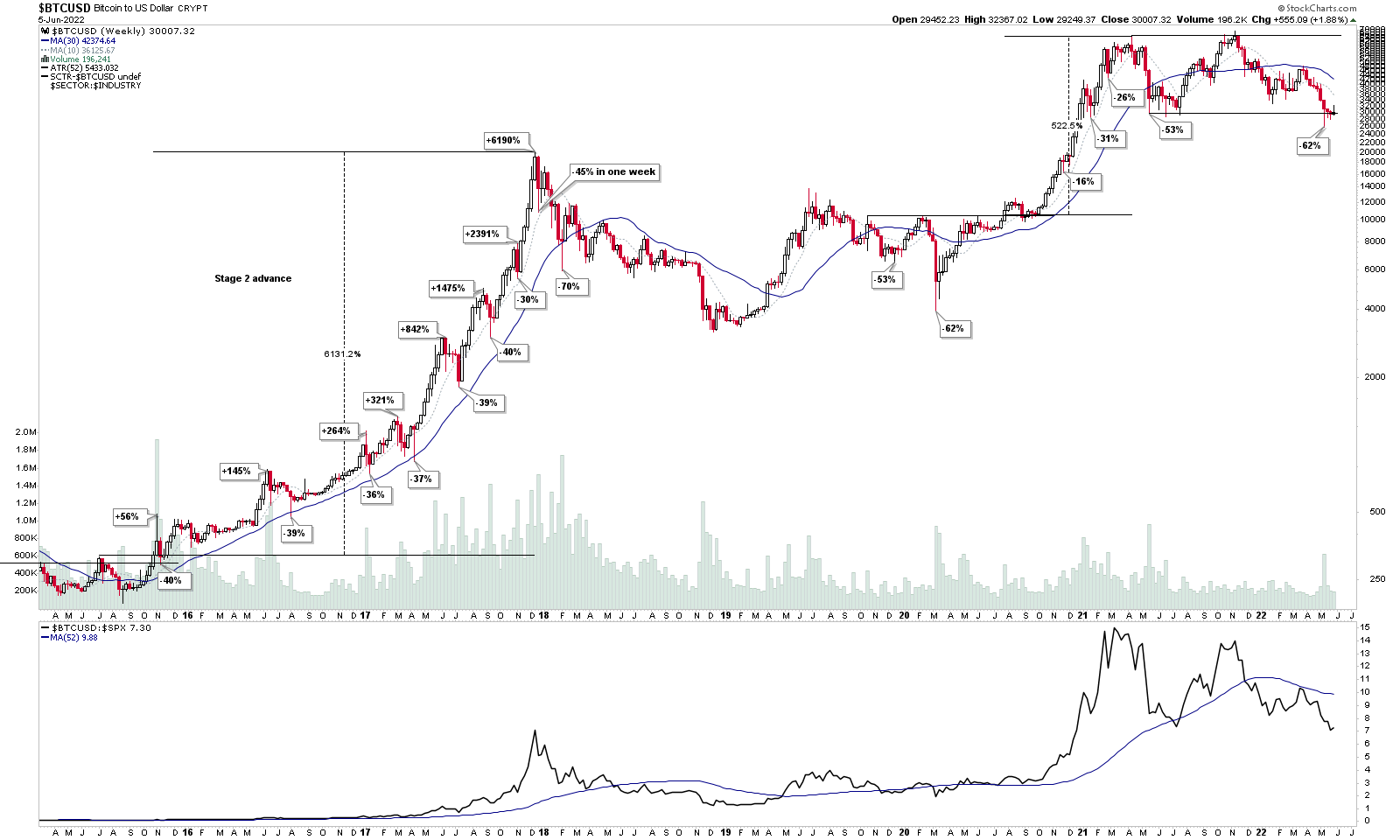

This weekends Stage Analysis Members Video features Stage Analysis of the major crypto coins – Bitcoin and Ethereum on multiple timeframes. And then in the members only portion of the video the usual Forest to the Trees approach...

Read More

05 June, 2022

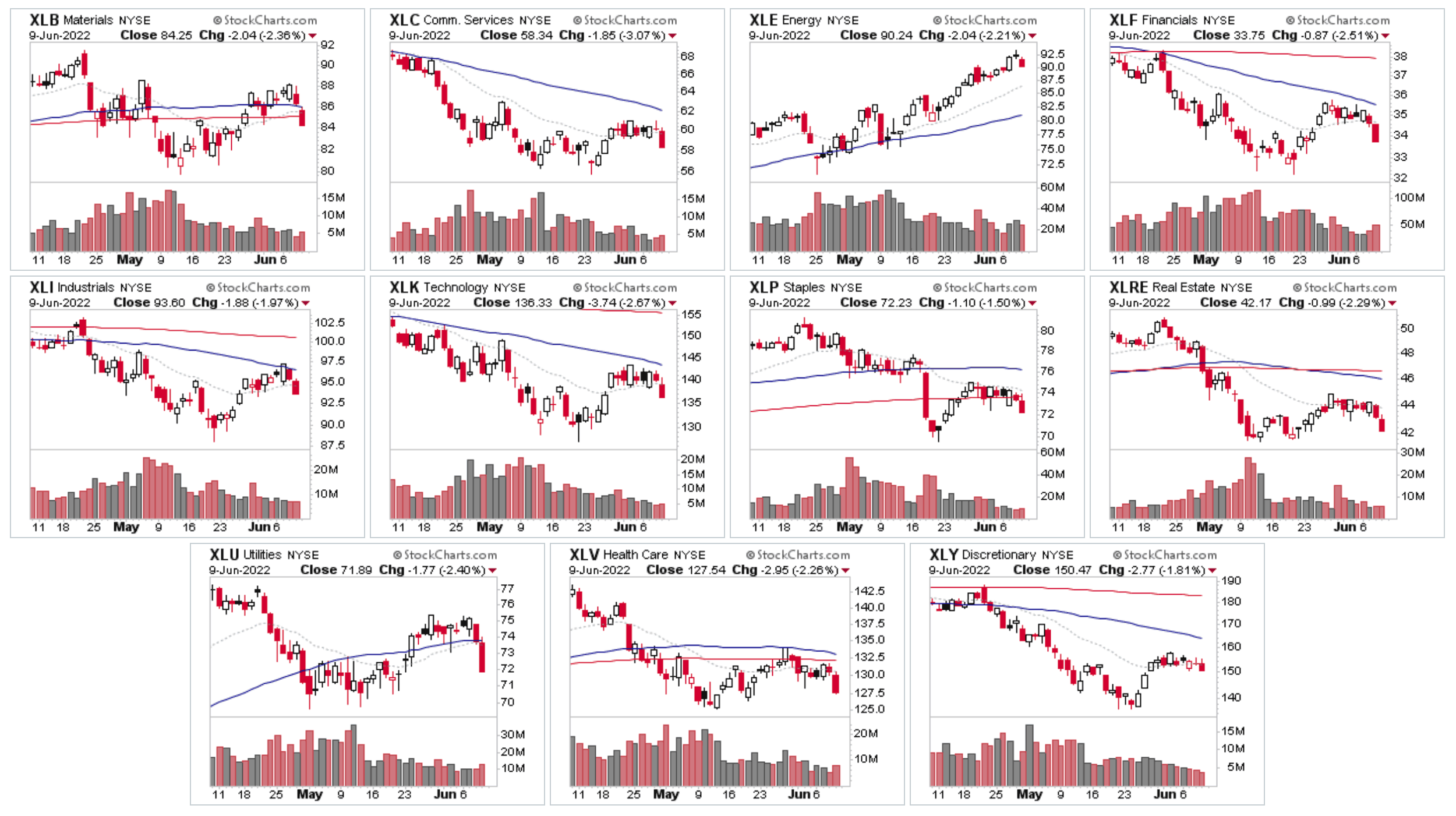

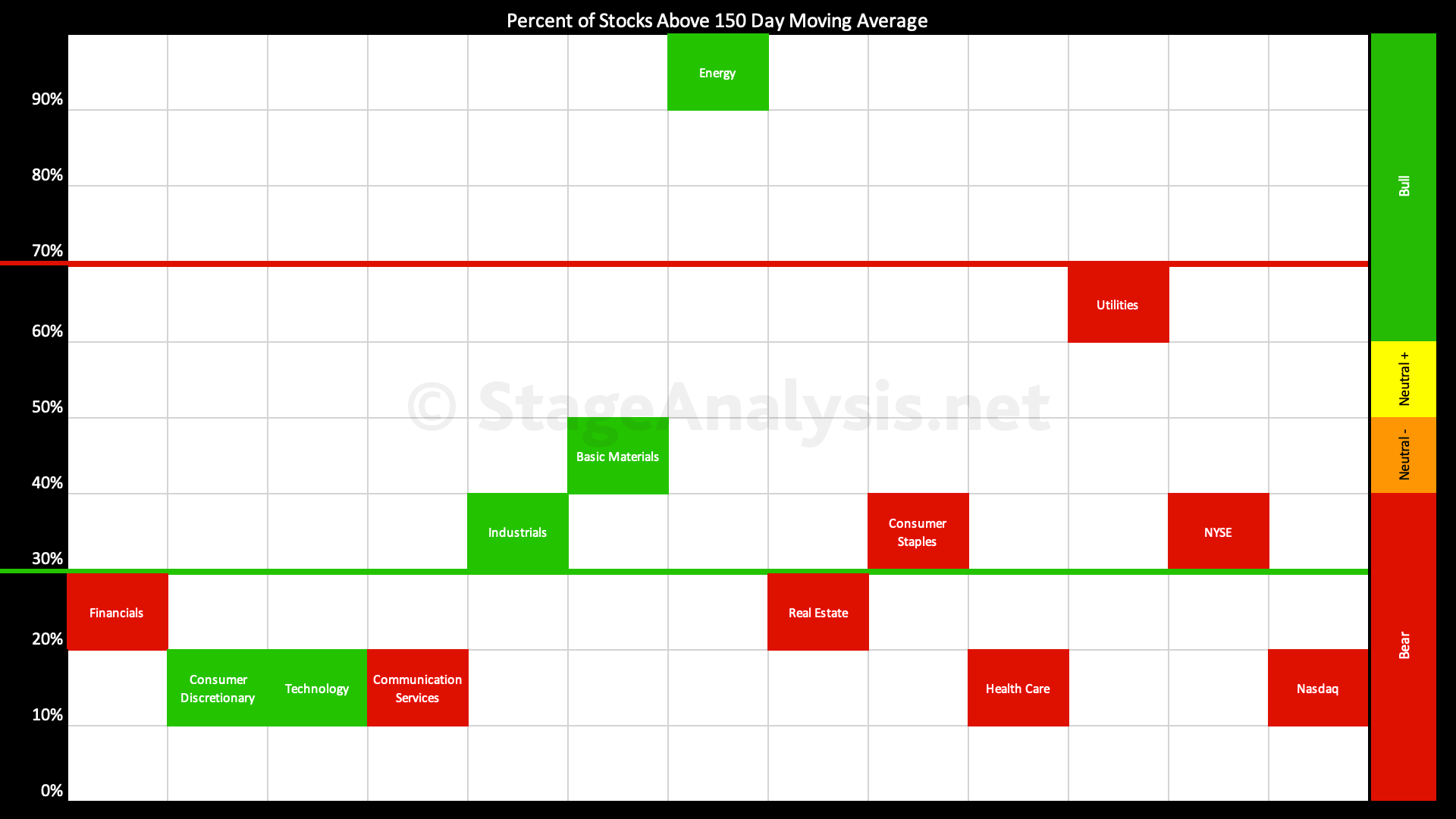

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

Energy remains the leading group in the Stage 2 zone, and has pushed back above the 90% level once more. I talked in the previous post about looking for new leadership in sectors that reverse strongly back out of the lower zone, of which Basic Materials and Industrials have been the first movers in the last few weeks.

Read More

05 June, 2022

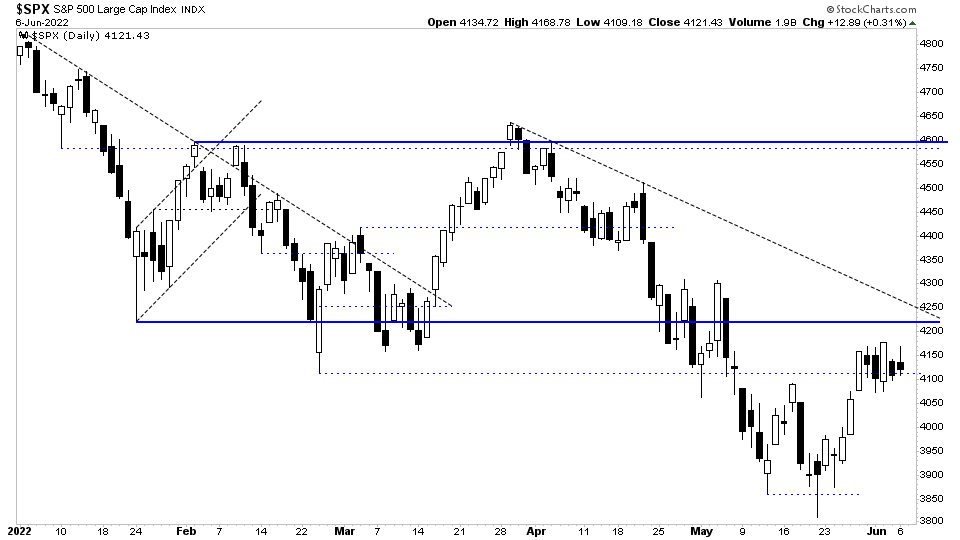

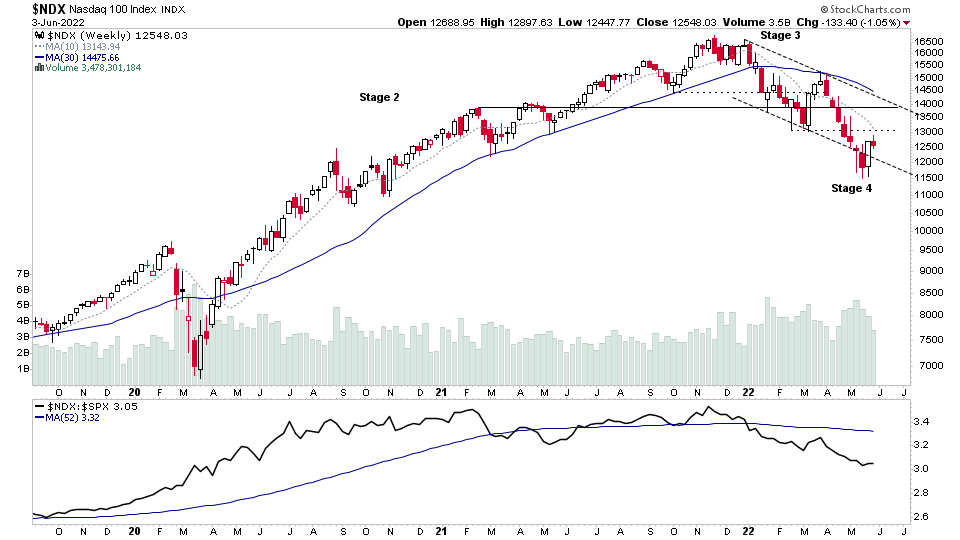

US Markets Consolidate at Resistance in Stage 4 and the US Stocks Watchlist – 5 June 2022

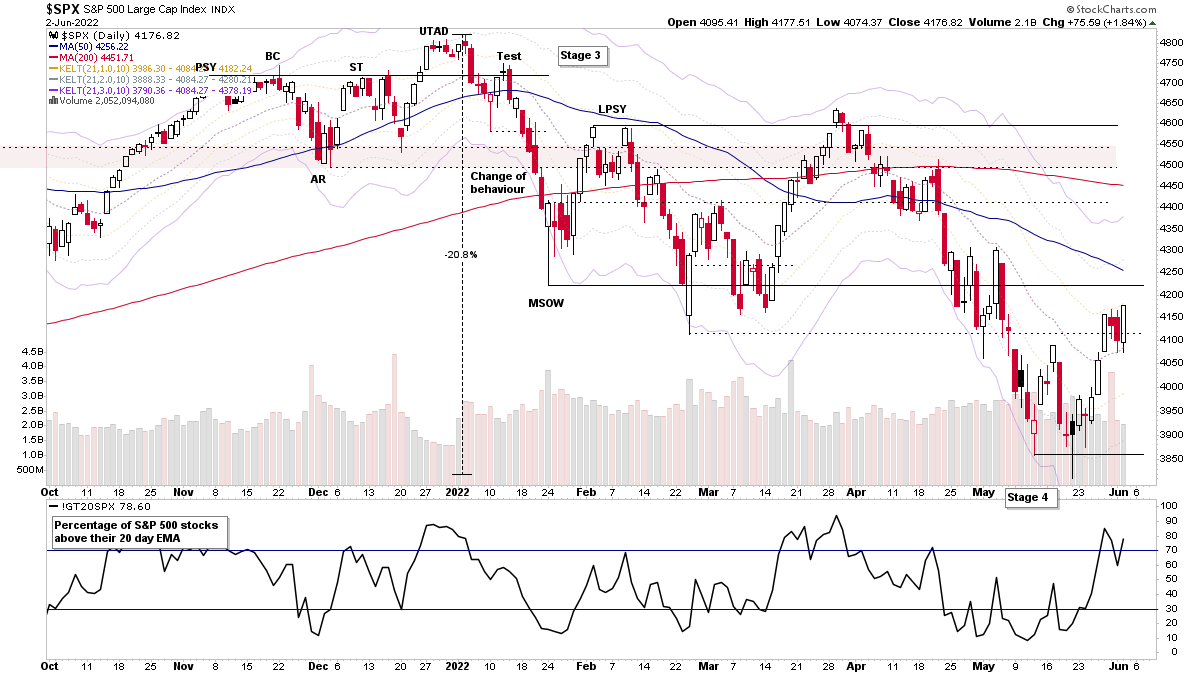

The majority of the major US market indexes all closed another week in Stage 4, except the AMEX, which continues to push towards new highs in Stage 2...

Read More

04 June, 2022

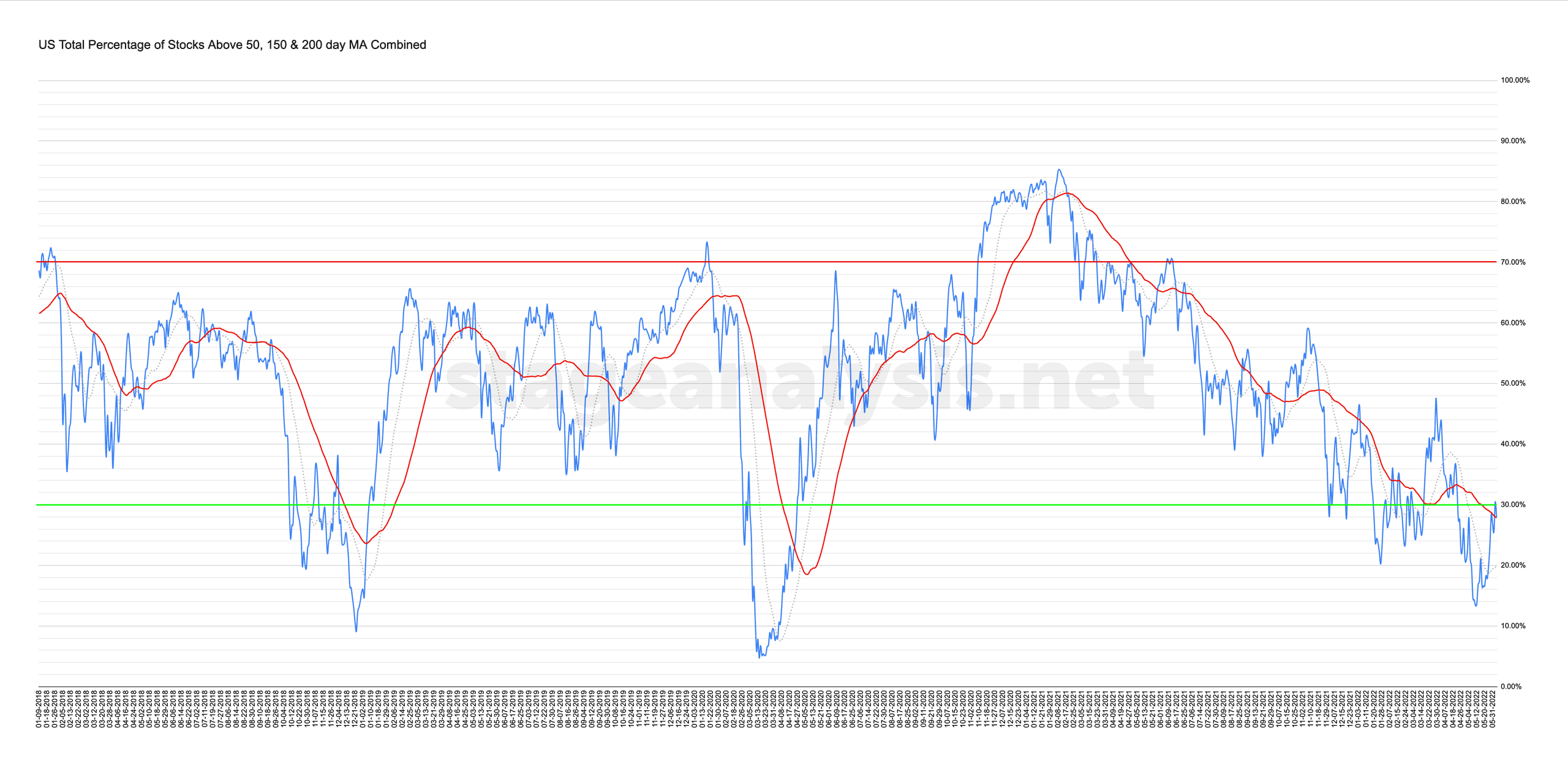

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

03 June, 2022

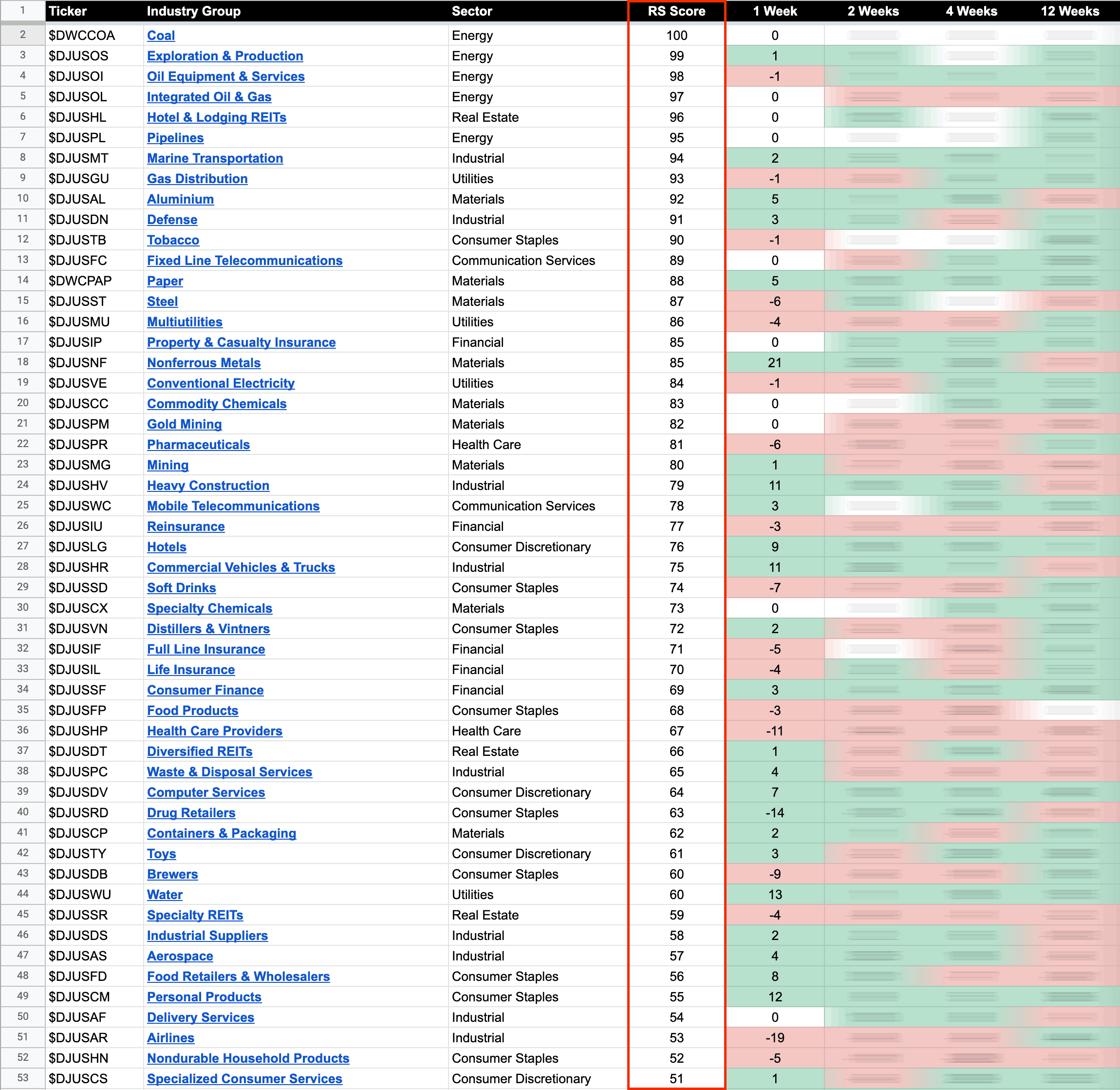

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

02 June, 2022

Stage 4 Rally Attempt Continues To Make Progress and the US Stocks Watchlist – 2 June 2022

It was a strong day for the bulls with price closing near the high of the day after opening slightly lower and initially moving lower to test yesterdays low and short term 21 day EMA, before rallying higher for the rest of the day, creating a bullish engulfing candle on the daily chart...

Read More