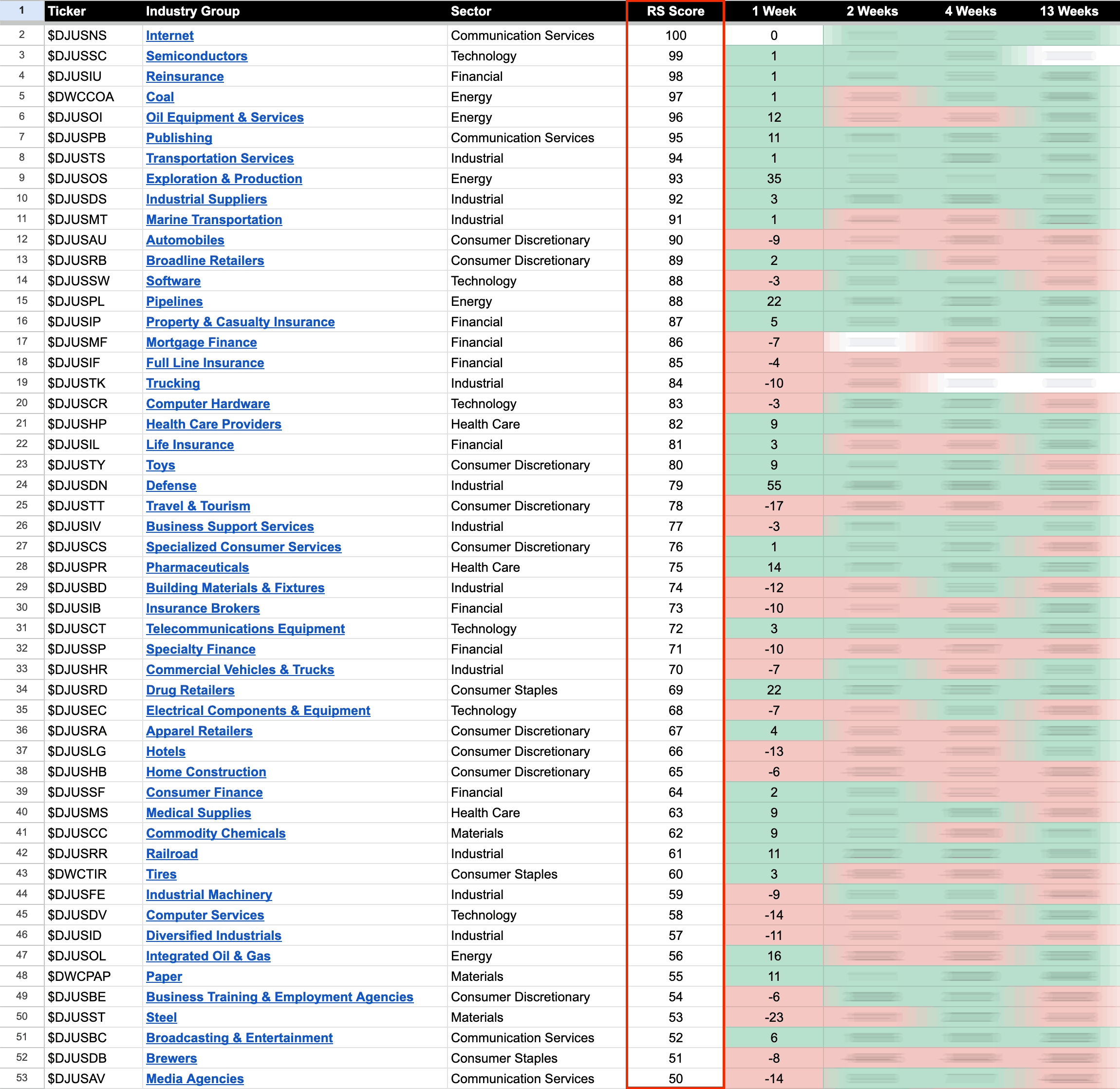

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

Blog

27 October, 2023

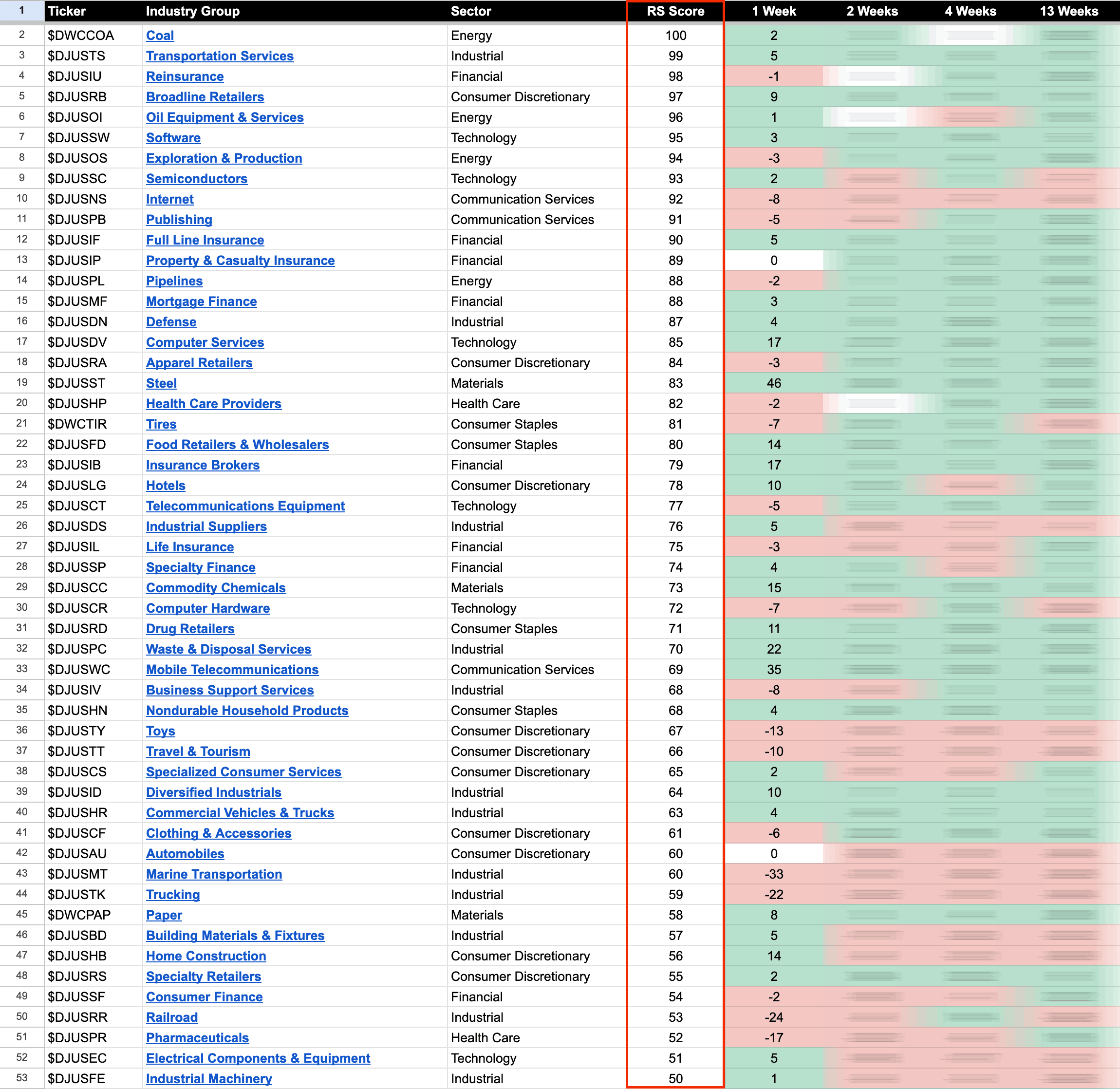

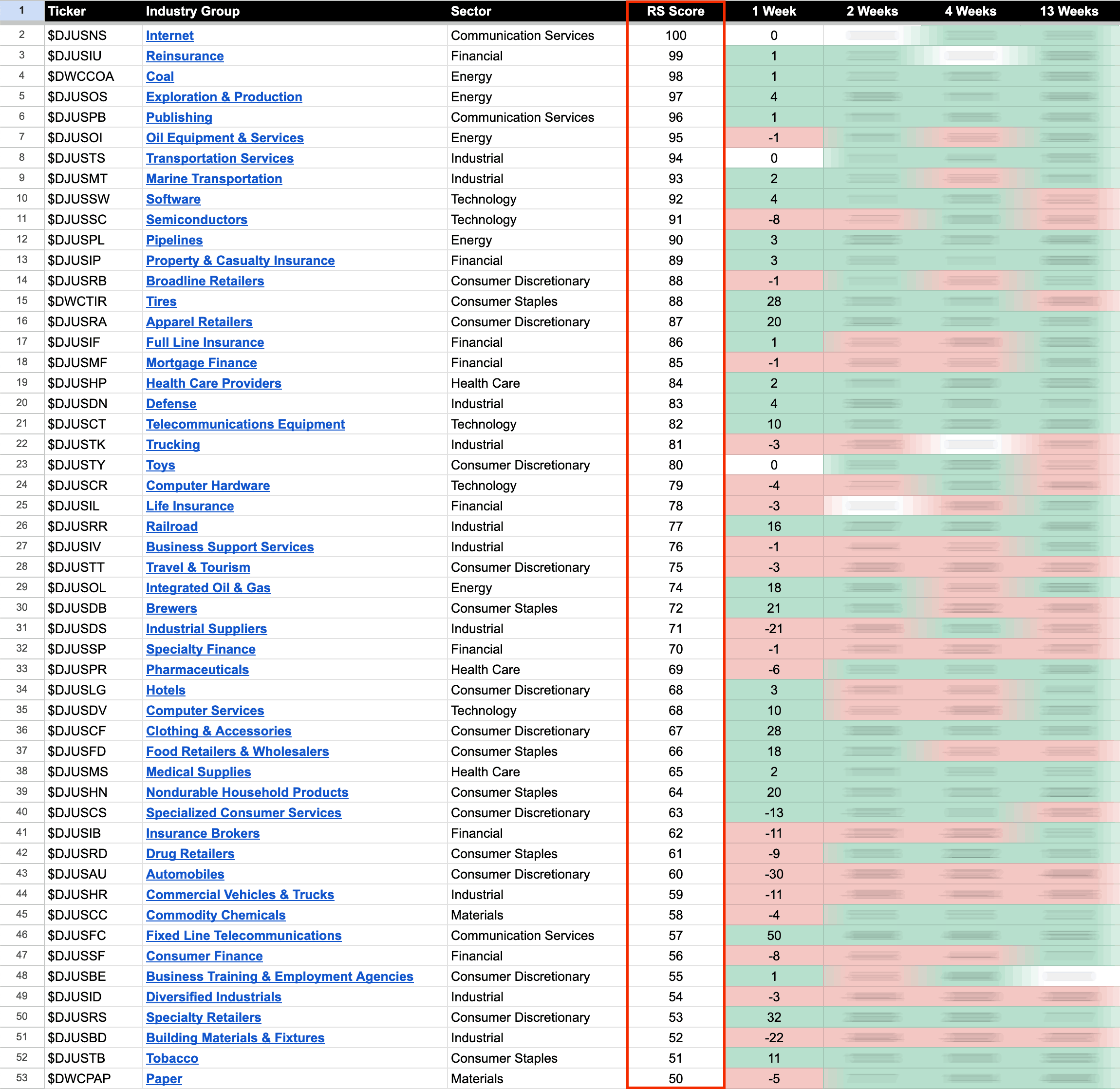

US Stocks Industry Groups Relative Strength Rankings

22 October, 2023

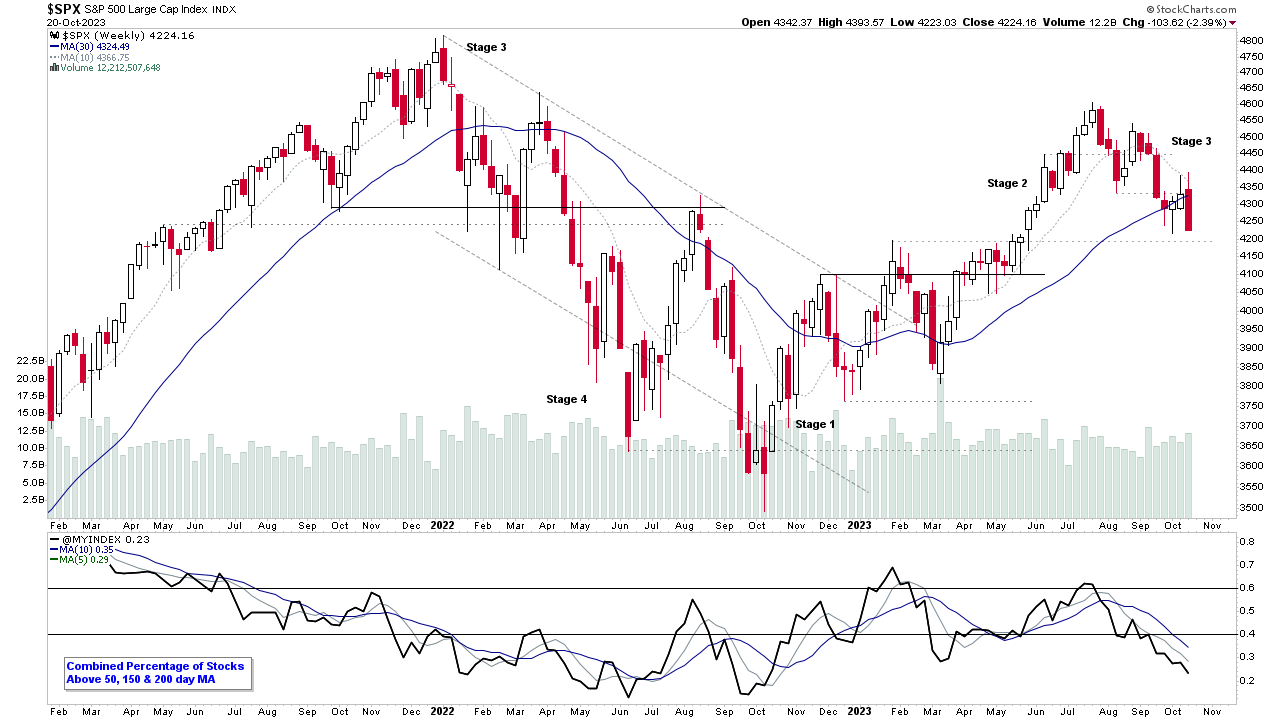

Stage Analysis Members Video – 22 October 2023 (1hr 10mins)

Stage Analysis members weekend video discussing the Major US Indexes, the Futures Charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, Market Breadth Update to determine the Weight of Evidence. Bitcoin and Ethereum analysis, and then finally a discussion of the weekends watchlist stocks in detail on multiple timeframes.

Read More

21 October, 2023

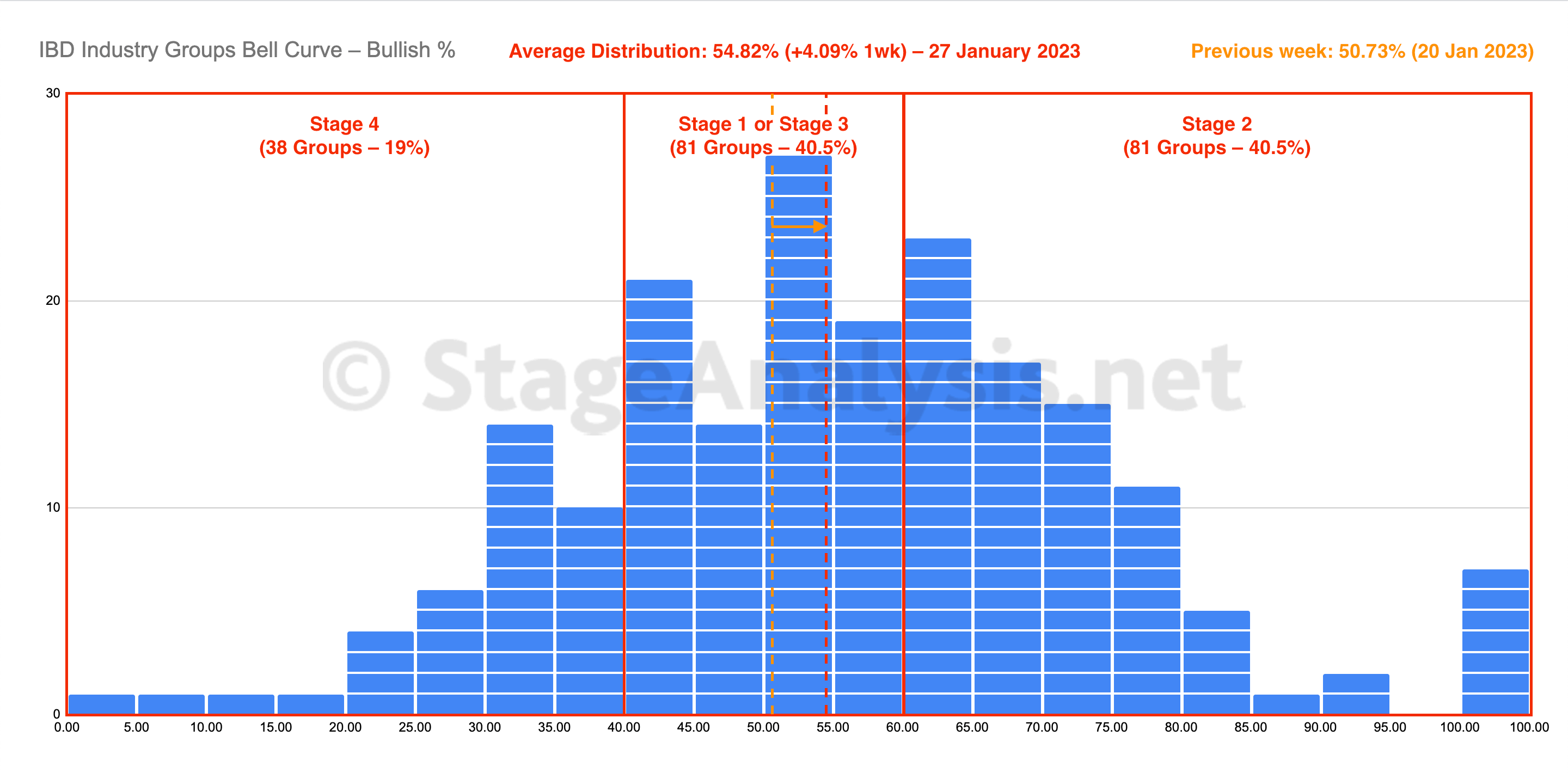

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent shows the few hundred industry groups plotted as a histogram chart and represents the percentage of stocks in each group that are on a point & figure (P&F) buy signal...

Read More

20 October, 2023

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

18 October, 2023

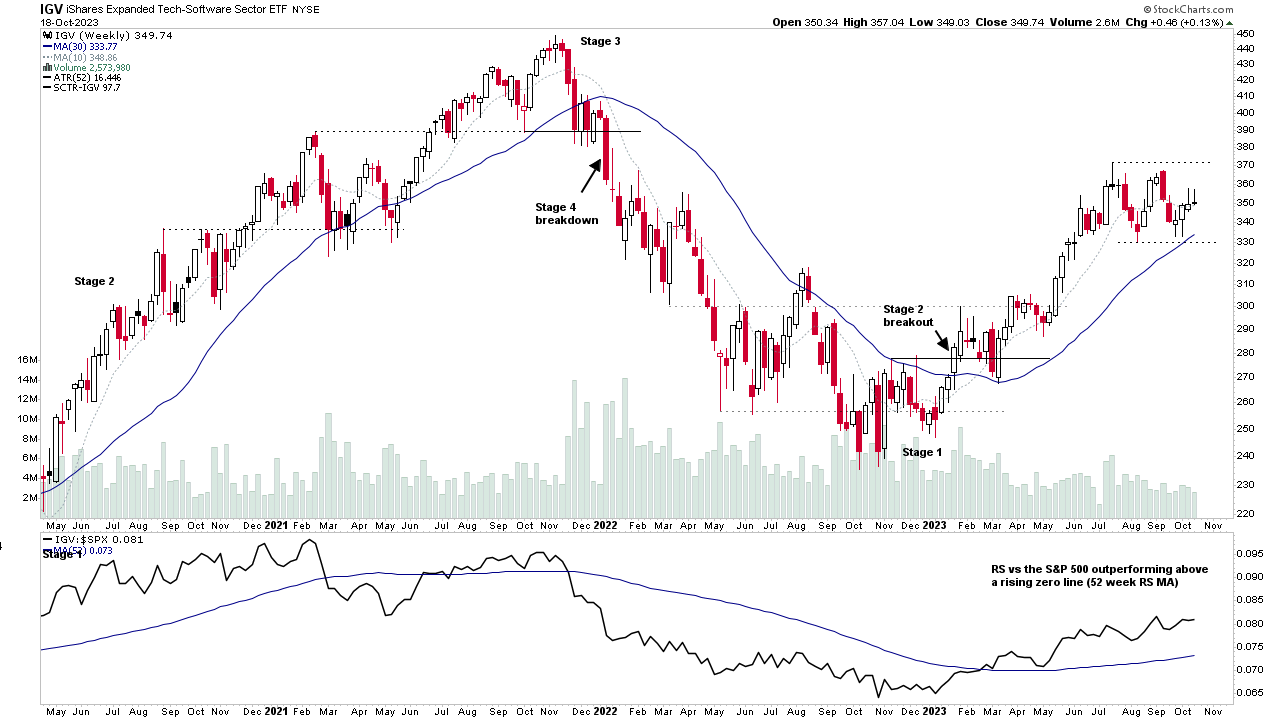

Software Group Focus Video – 18 October 2023 (55mins)

The Software group remains one of the leading industry groups year to date and has been consolidating / building a base structure in Stage 2 over the last quarter since the previous review as the broader market has also corrected. So with earnings approaching for the majority of the Software group in the coming weeks, it's an ideal time to do review the group again and how its current RS leaders are acting.

Read More

16 October, 2023

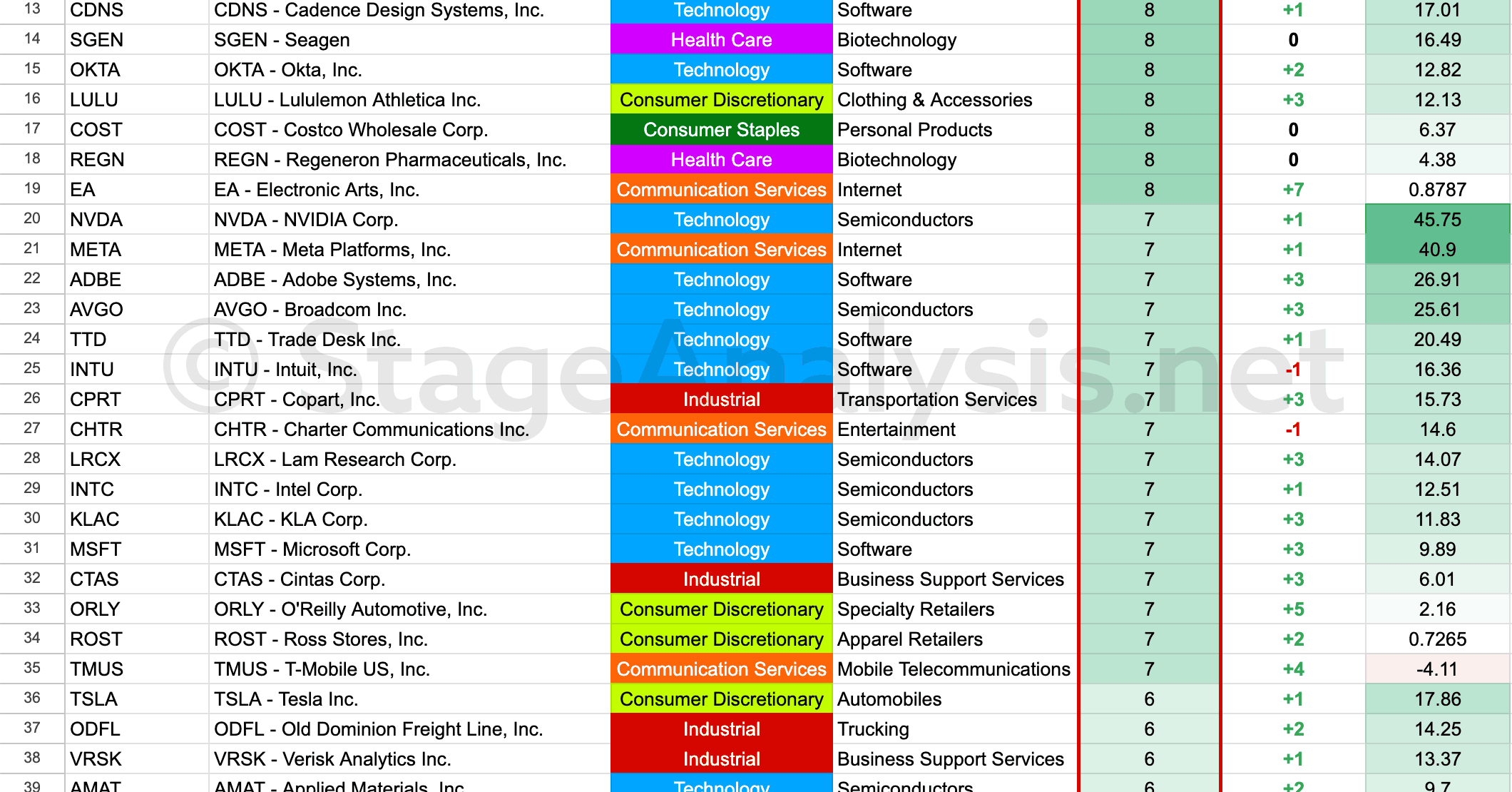

Stage Analysis Technical Attributes Scores – Nasdaq 100

The Stage Analysis Technical Attributes (SATA) score is our proprietary indicator that helps to identify the four stages from Stan Weinstein's Stage Analysis method, using a scoring system from 0 to 10 that rates ten of the key technical characteristics that we look for when analysing the weekly charts.

Read More

15 October, 2023

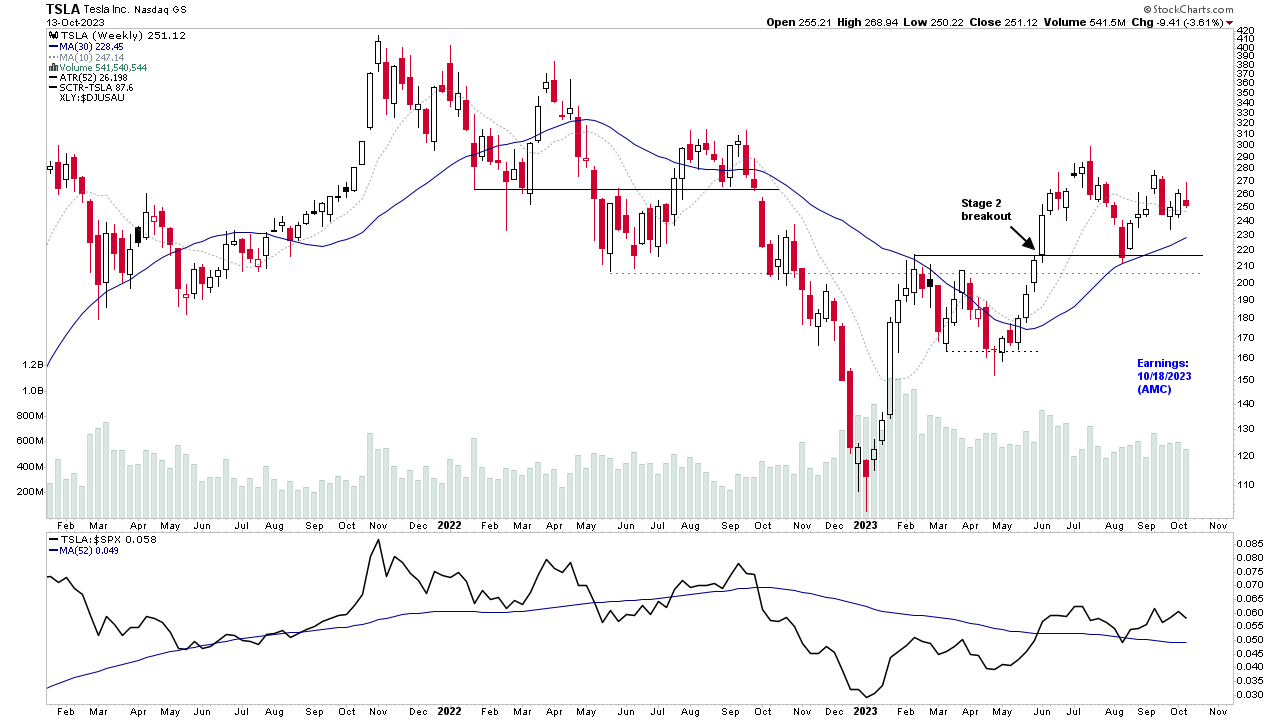

Stage Analysis Members Video – 15 October 2023 (1hr 11mins)

This weekends video begins with analysis of the TSLA and NFLX ahead of their earnings results this week, followed by the Major Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve – Bullish Percent, Market Breadth Update to determine the Weight of Evidence, Stage 2 breakouts, and finishing with analysis of the recent watchlist stocks in detail on multiple timeframes.

Read More

15 October, 2023

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent shows the few hundred industry groups plotted as a histogram chart and represents the percentage of stocks in each group that are on a point & figure (P&F) buy signal...

Read More

13 October, 2023

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

08 October, 2023

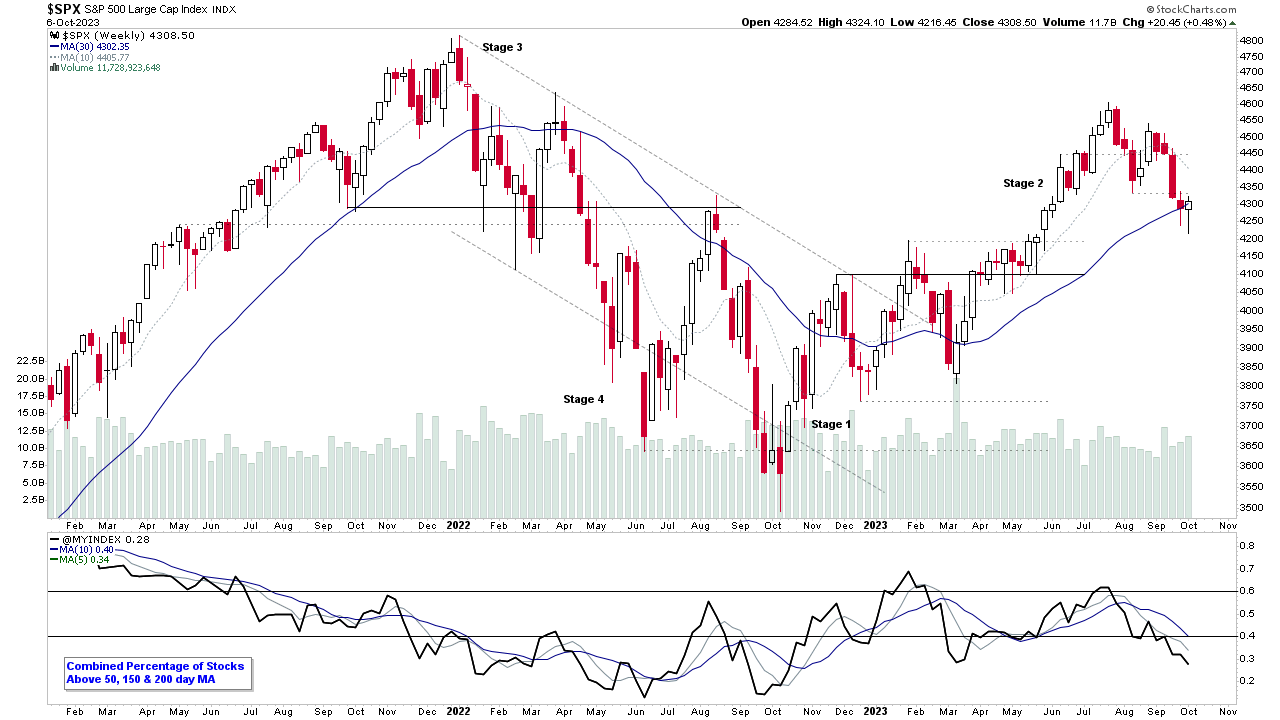

Stage Analysis Members Video – 8 October 2023 (1hr 15mins)

Stage Analysis members video discussing the Major Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve – Bullish Percent, Market Breadth Update to determine the Weight of Evidence, Strong Volume Stage 2 stocks and closing with analysis of the recent watchlist stocks in detail on multiple timeframes.

Read More