104 Dow Jones Sector Industry Groups sorted by Relative Strength. Purpose is to track RS changes across the groups each week using stockcharts SCTR rating. Attached current top 50 sectors plus sectors with the strongest moves this week and YTD

Read More

Blog

25 April, 2021

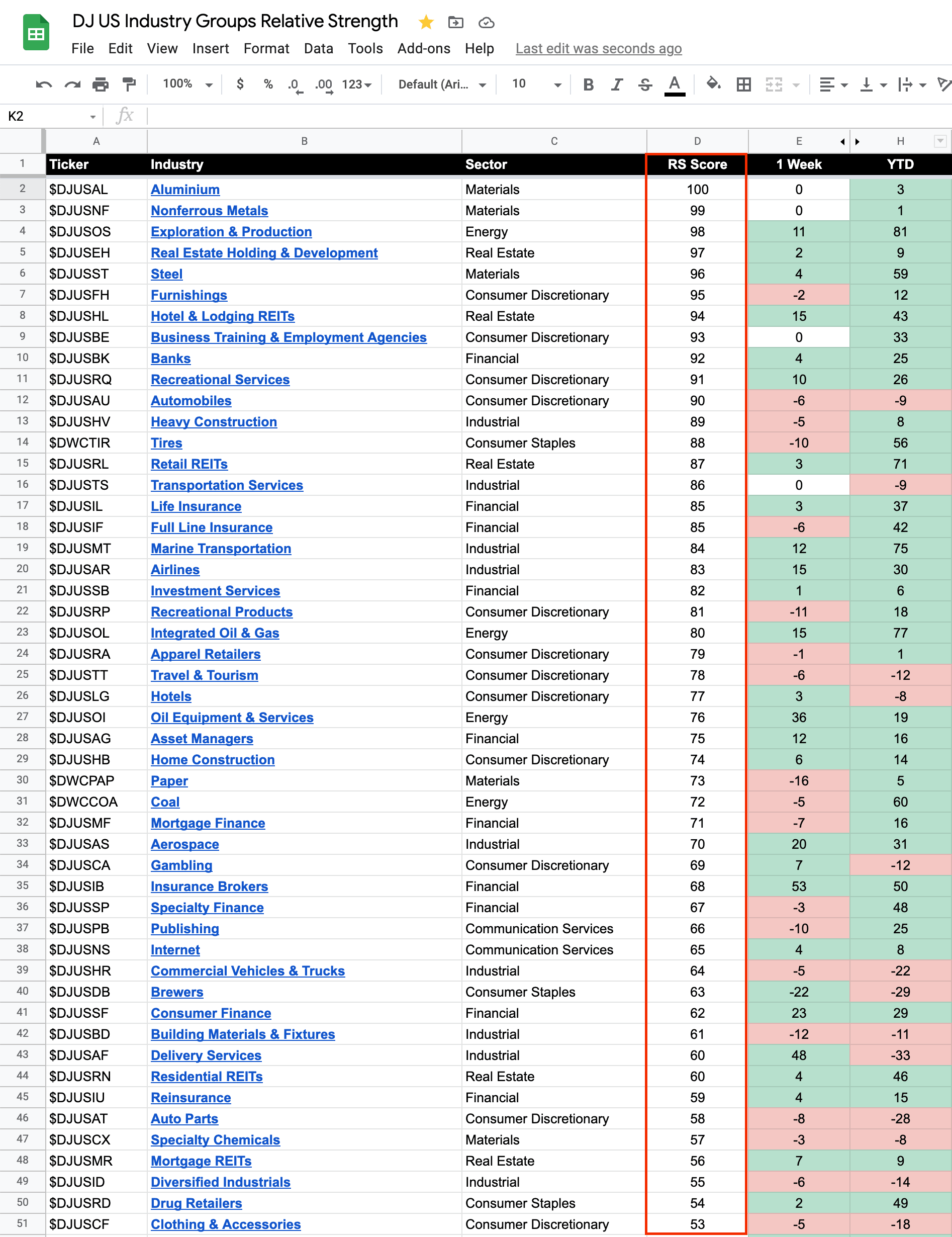

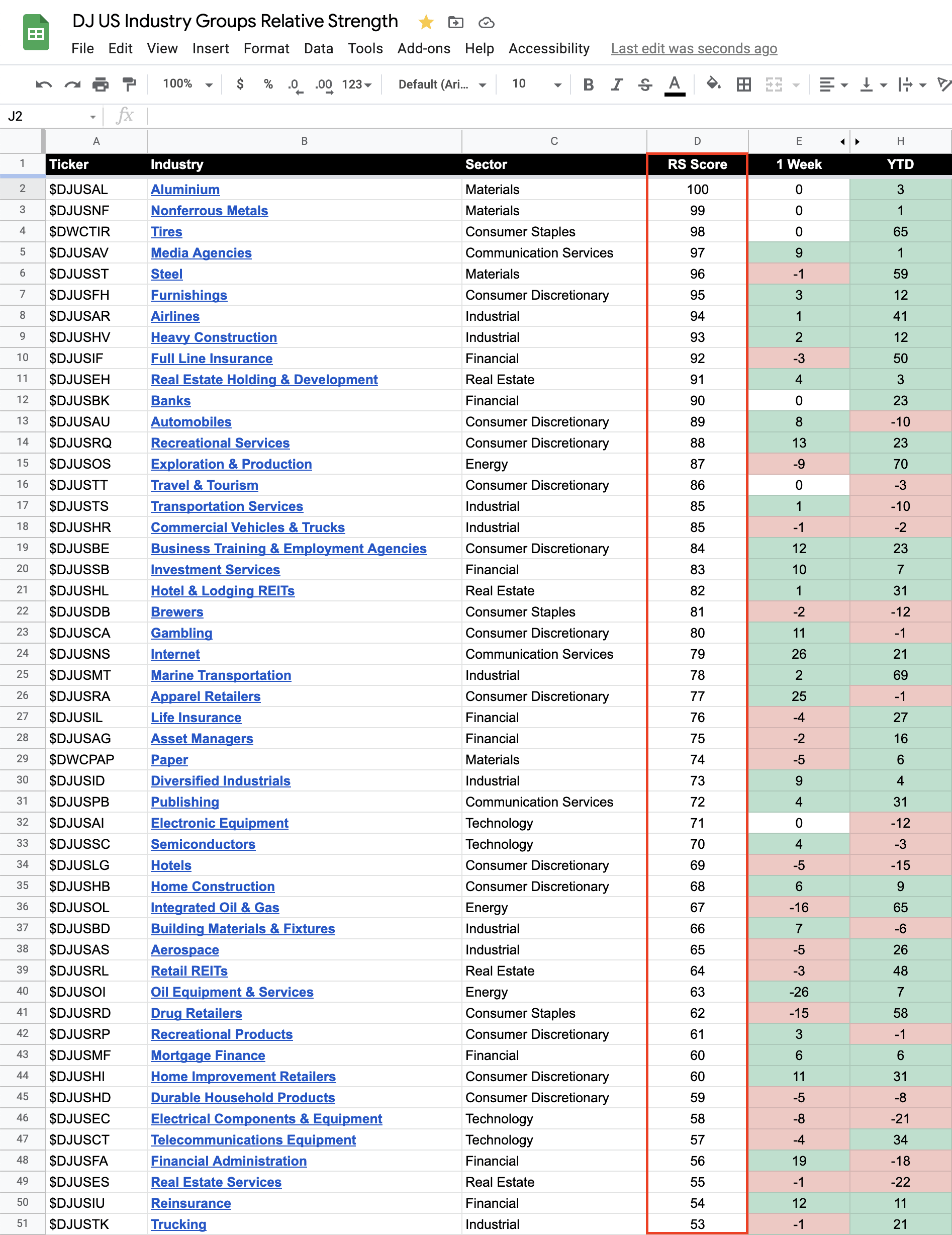

104 Dow Jones Sector Industry Groups sorted by Relative Strength

104 Dow Jones Sector Industry Groups sorted by Relative Strength. Purpose is to track RS changes across the groups each week using stockcharts SCTR rating. Attached current top 50 sectors plus sectors with the strongest moves this week and YTD

Read More

18 April, 2021

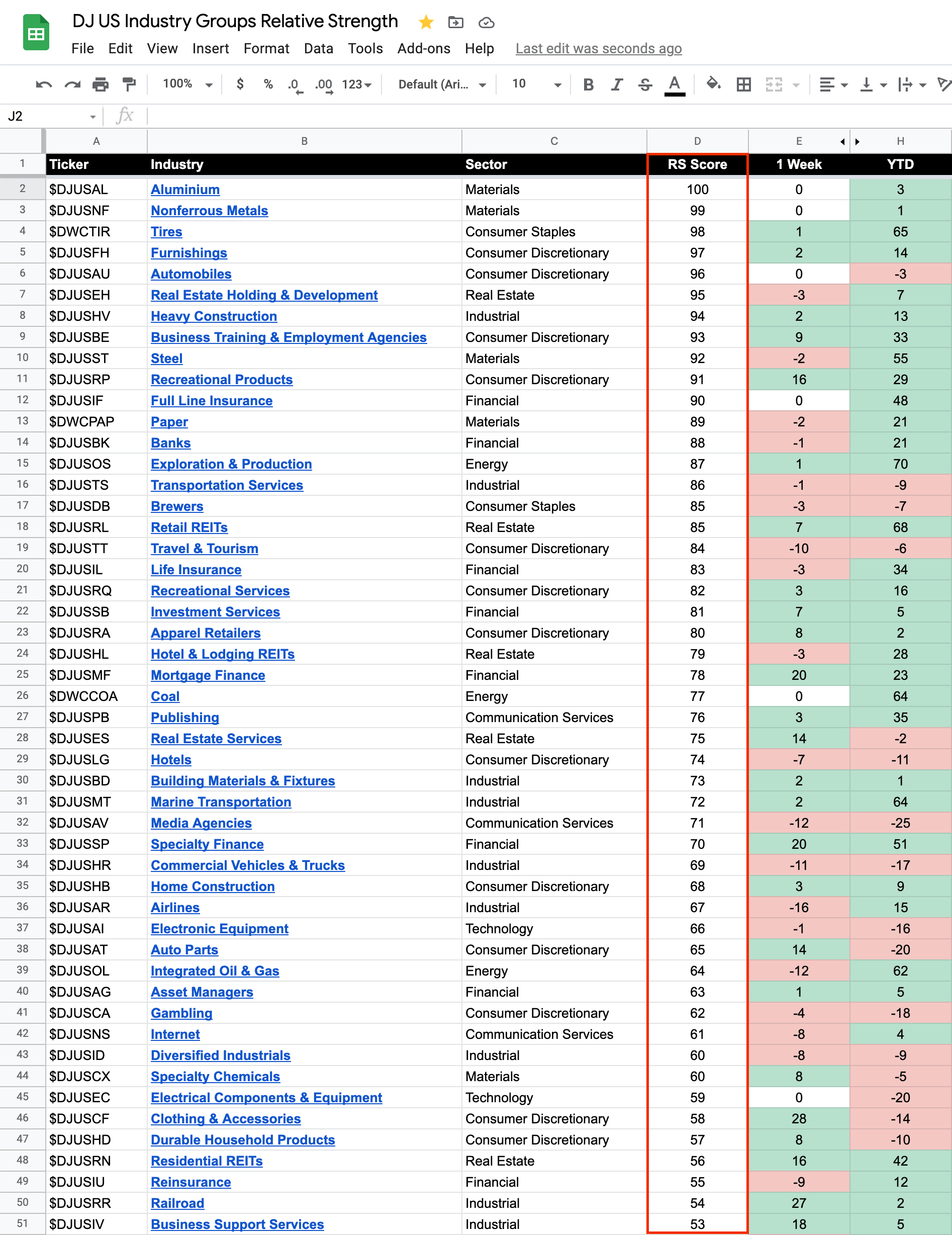

104 Dow Jones Sector Industry Groups sorted by Relative Strength

104 Dow Jones Sector Industry Groups sorted by Relative Strength. Purpose is to track RS changes across the groups each week using stockcharts SCTR rating. Attached current top 50 sectors plus sectors with the strongest moves this week and YTD

Read More

11 April, 2021

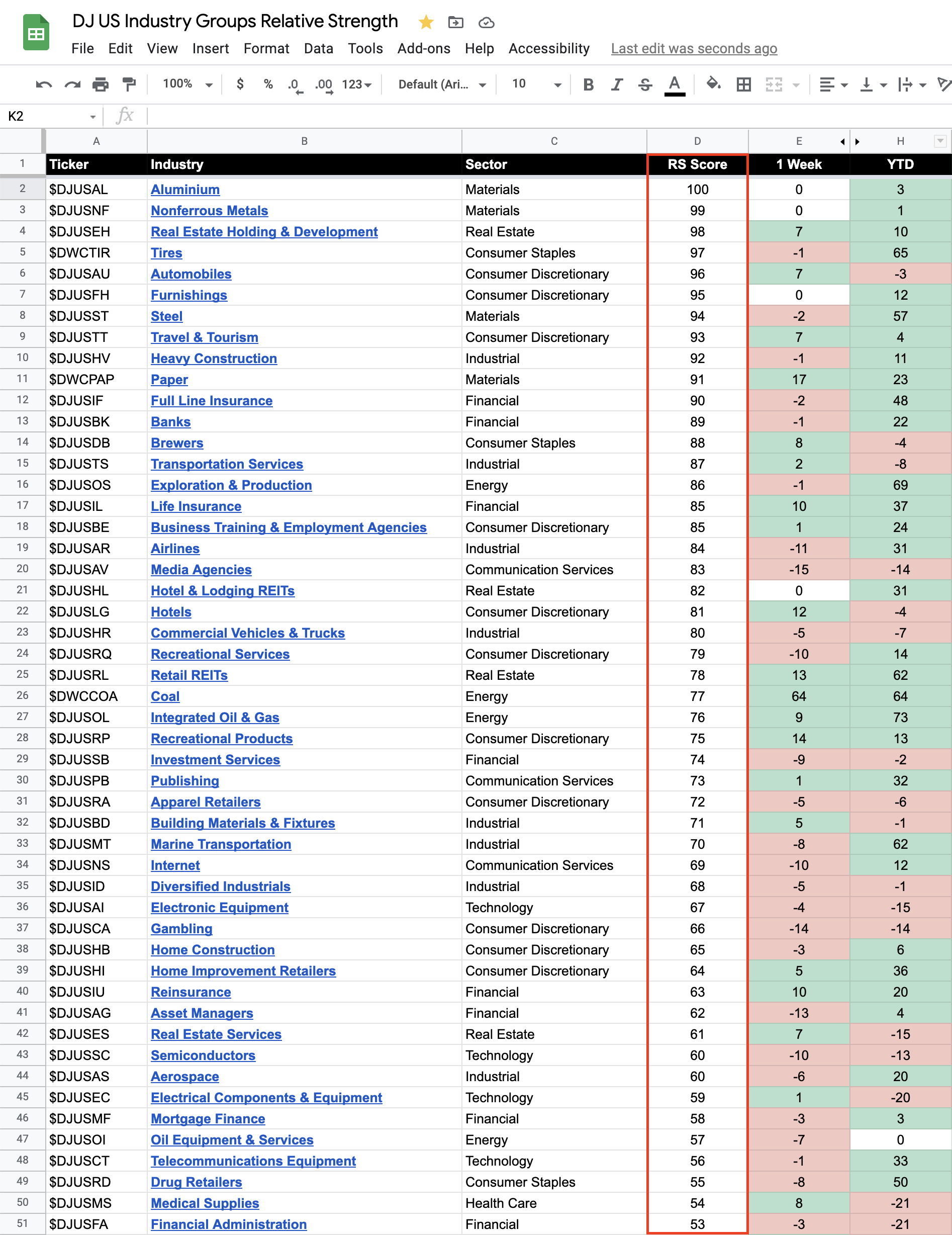

104 Dow Jones Sector Industry Groups sorted by Relative Strength

104 Dow Jones Sector Industry Groups sorted by Relative Strength. Purpose is to track RS changes across the groups each week using stockcharts SCTR rating. Attached current top 50 sectors plus sectors with the strongest moves this week and YTD

Read More

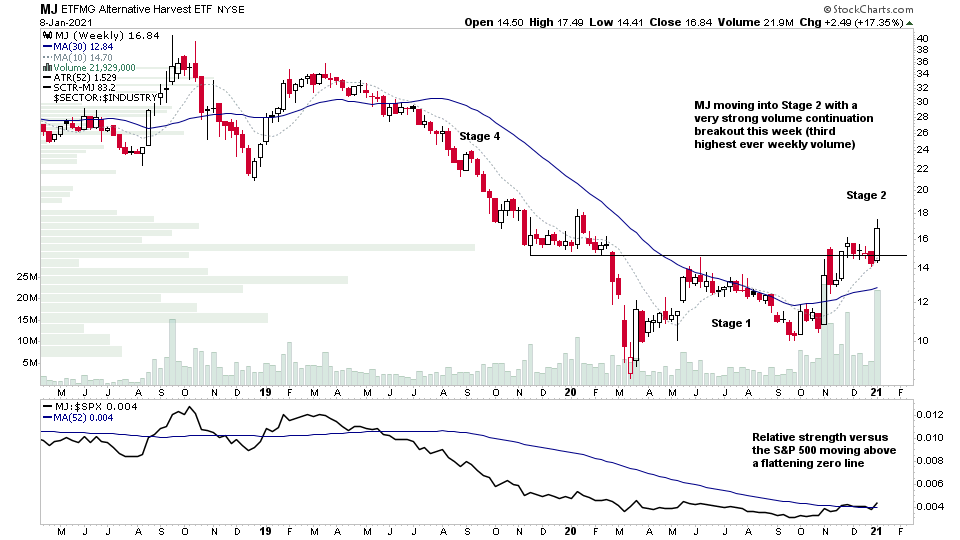

09 January, 2021

Cannabis Stocks Back in Stage 2. Big Industry Group Theme for 2021

At the start of each year I like to look at where the initial money is flowing once the institutional traders return from their end of year breaks, and this year I can see a strong group theme developing in the Cannabis stocks once more, with multiple early Stage 2A breakouts and continuation breakouts on strong volume recently from big Stage 1 bases, and multiple other stocks in the group setting up in the later part of Stage 1.

Read More

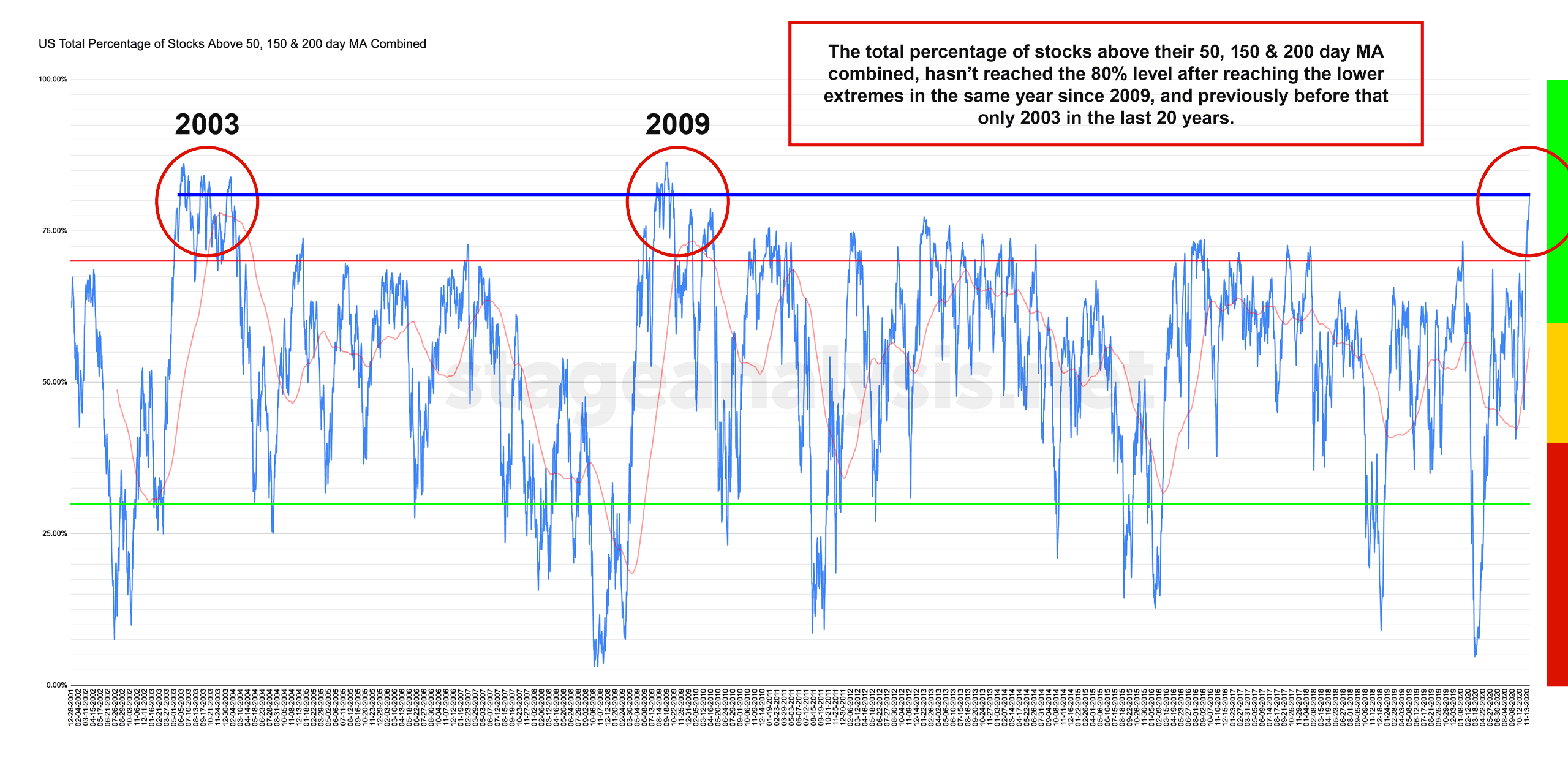

29 November, 2020

US Stock Market Breadth Update - 29th November 2020

Potential Major Market Breadth signal that the Bull market is still only just beginning. The 80%+ level has only been reached twice before in June 2003 & August 2009 as you can see attached. So although in the upper risk range. A major sign of strength.

Read More

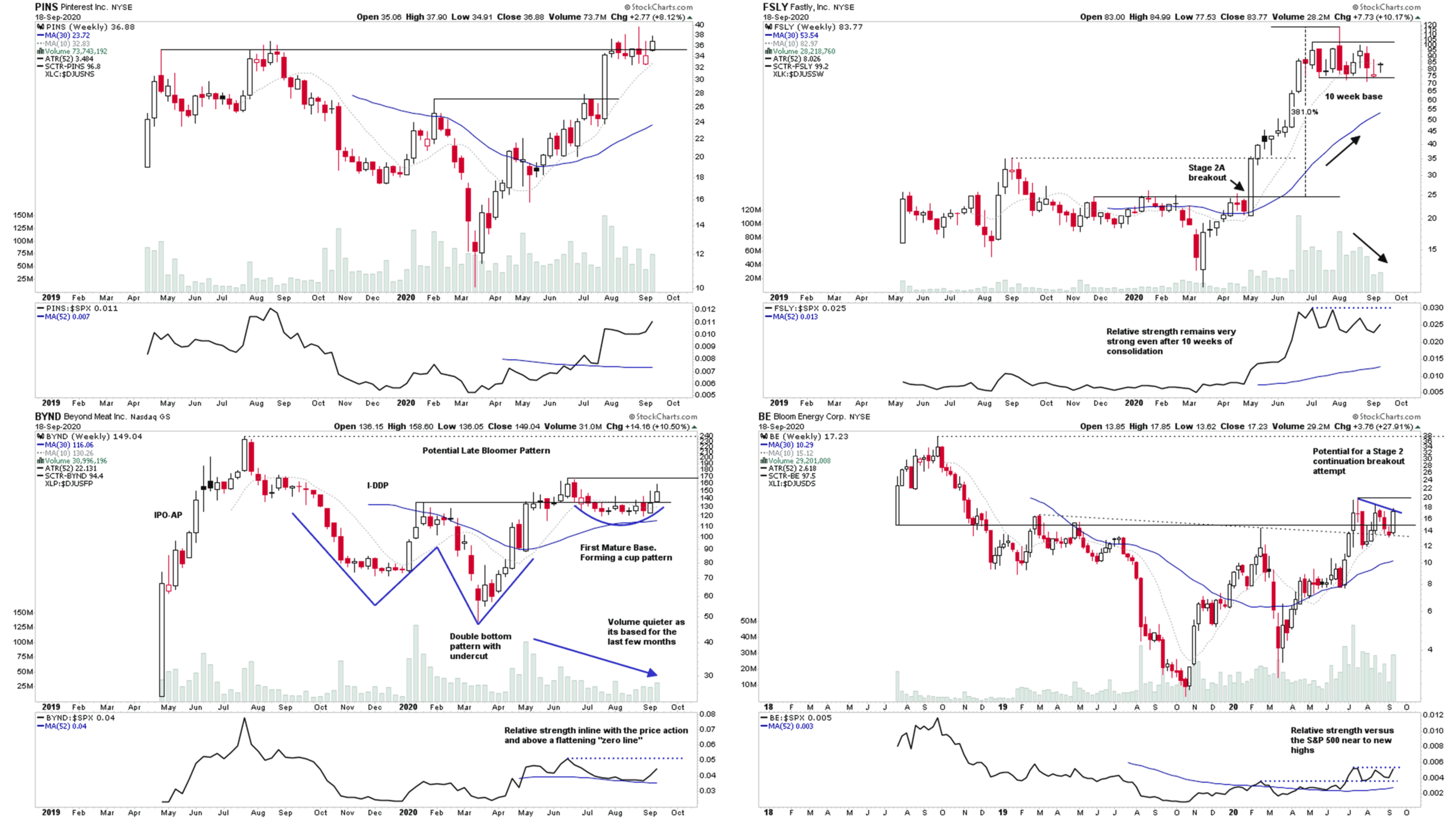

20 September, 2020

US Stock Market Update Plus Stocks Watchlist of Stocks Basing in Stage 2 With Breakout Potential

Update of the major US stock market indexes and the key market breadth indicators. Plus a multi-time frame analysis of my current watchlist stocks near positions for potential trades, if they breakout on strong volume from their current bases: $PINS, $FSLY, $BYND, $BE, $WRTC, $ARLO

Read More

19 July, 2020

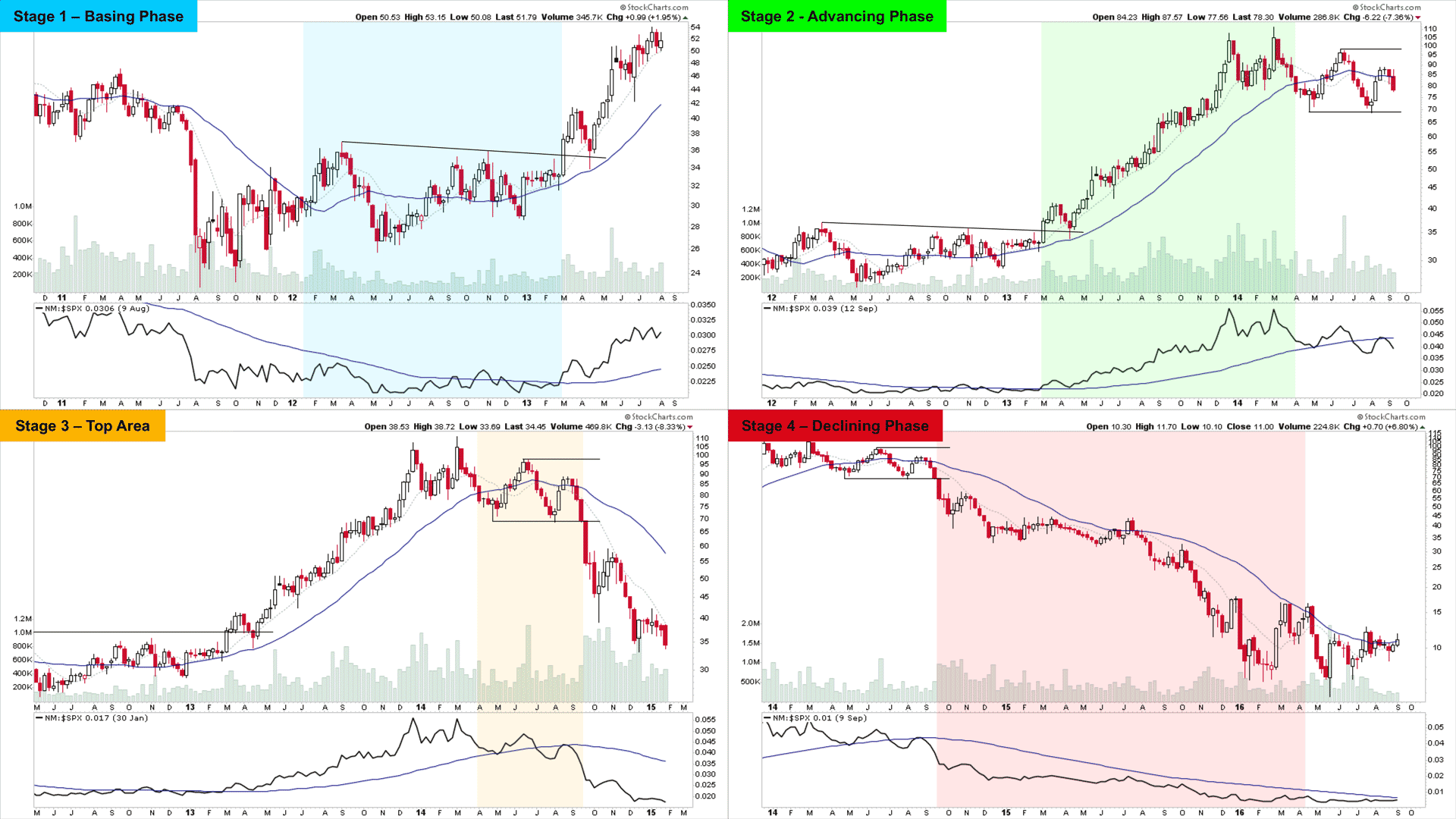

Is the S&P 500 About to Breakout Into the Stage 2 Advancing Phase? Stock Market Breadth Update

Regular update of the major US stock market indexes and indicators. A regular look beneath the surface of the US stock market, featuring the key market breadth charts for timing trading stocks and the stock market indexes, such as the NYSE Bullish Percent Index, the Advance Decline Line, the New Highs - New Lows etc and some custom breadth indicators of my own in order to determine what the "Weight of Evidence" is suggesting in terms of the US stock market direction and how to allocate your money.

Read More

14 June, 2020

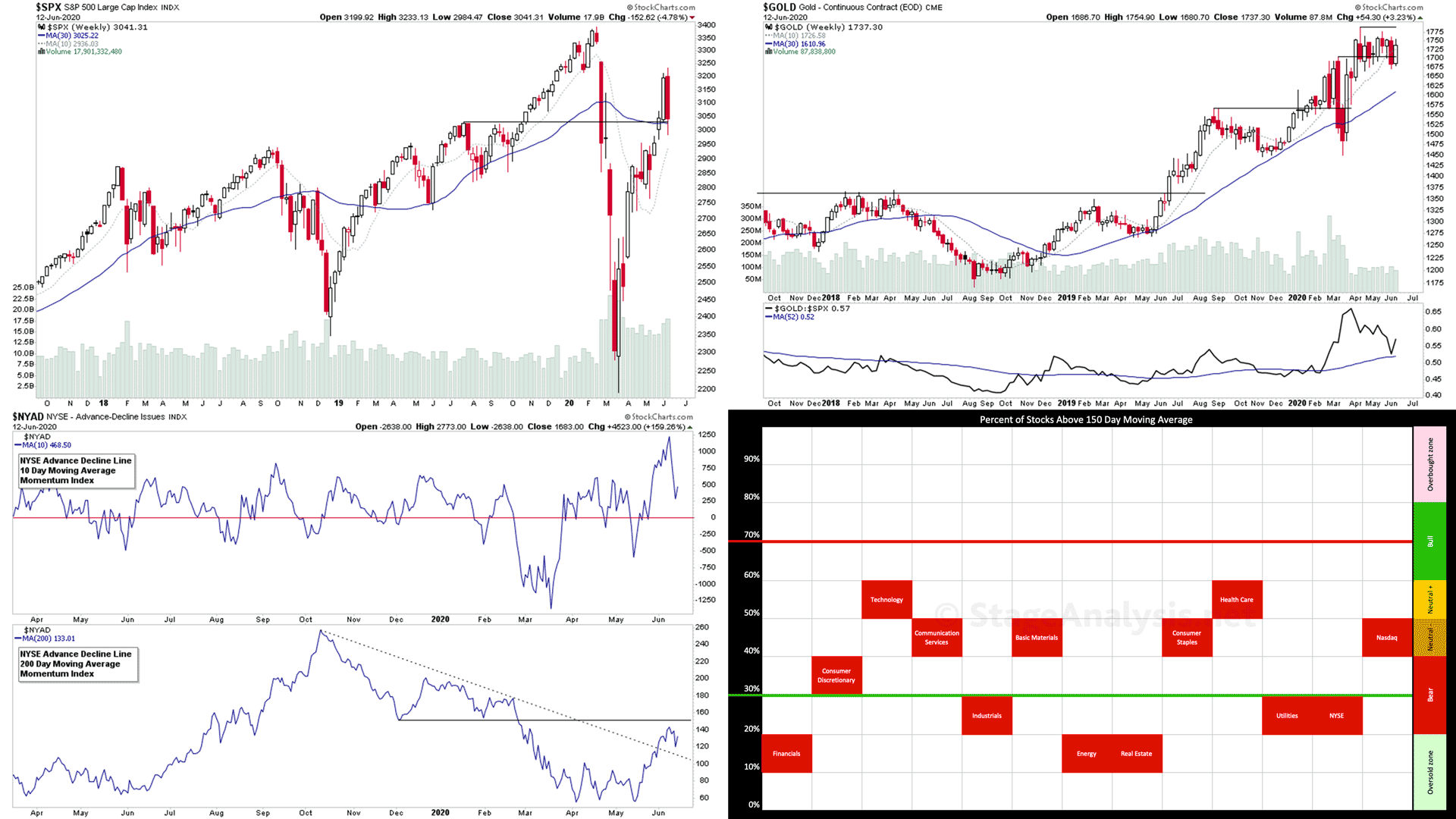

US Stock Market. Bullish Percent Index to Bear Alert Status. What does the Weight of Evidence Say?

Weekend update of the major US stock market indexes and indicators. A weekly look beneath the surface of the US stock market, featuring the key market breadth charts for timing trading stocks and the stock market indexes, such as the NYSE Bullish Percent Index, the Advance Decline Line, the New Highs - New Lows etc and some custom breadth indicators of my own in order to determine what the "Weight of Evidence" is suggesting in terms of the US stock market direction and how to allocate your money.

Read More

31 May, 2020

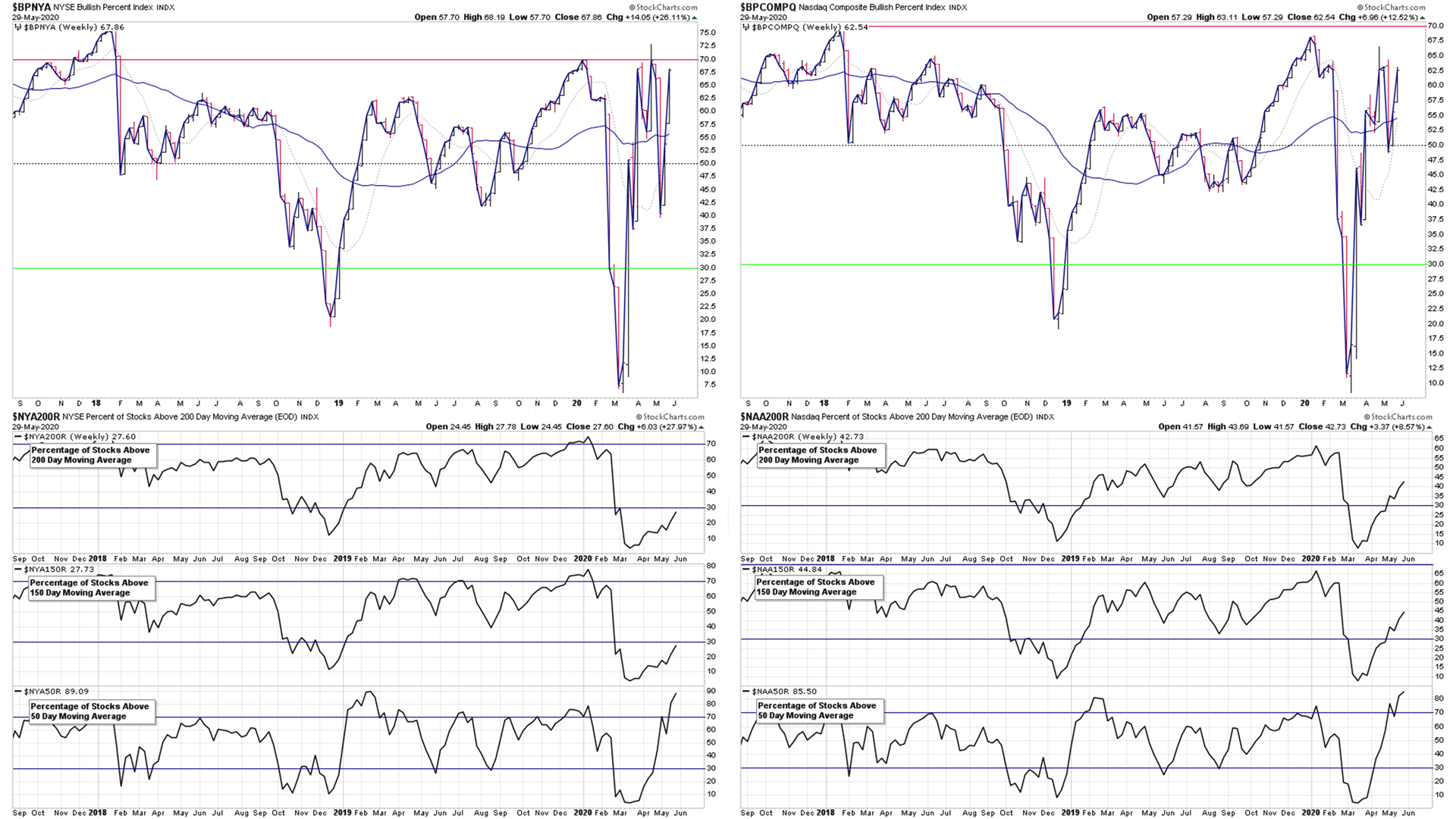

US Stock Market Breadth Update. Shakeout or Not? Improvements in a Number of Indicators

This week saw a huge shakeout in the leadership stocks with numerous tech and healthcare stocks dropping up to -20% in a just a few days from their highs. However, there is a chance that it was just a shakeout by the markets in order to let the larger players load up on the stronger stocks at a lower price. But this opinion now needs confirmation, as although some traders jumped back in immediately on the assumption of a shakeout. The price action of many stocks that got hit failed to recover with much strength, and still closed the week significantly lower than the previous week, even though they recovered half or more of the drop.

Read More