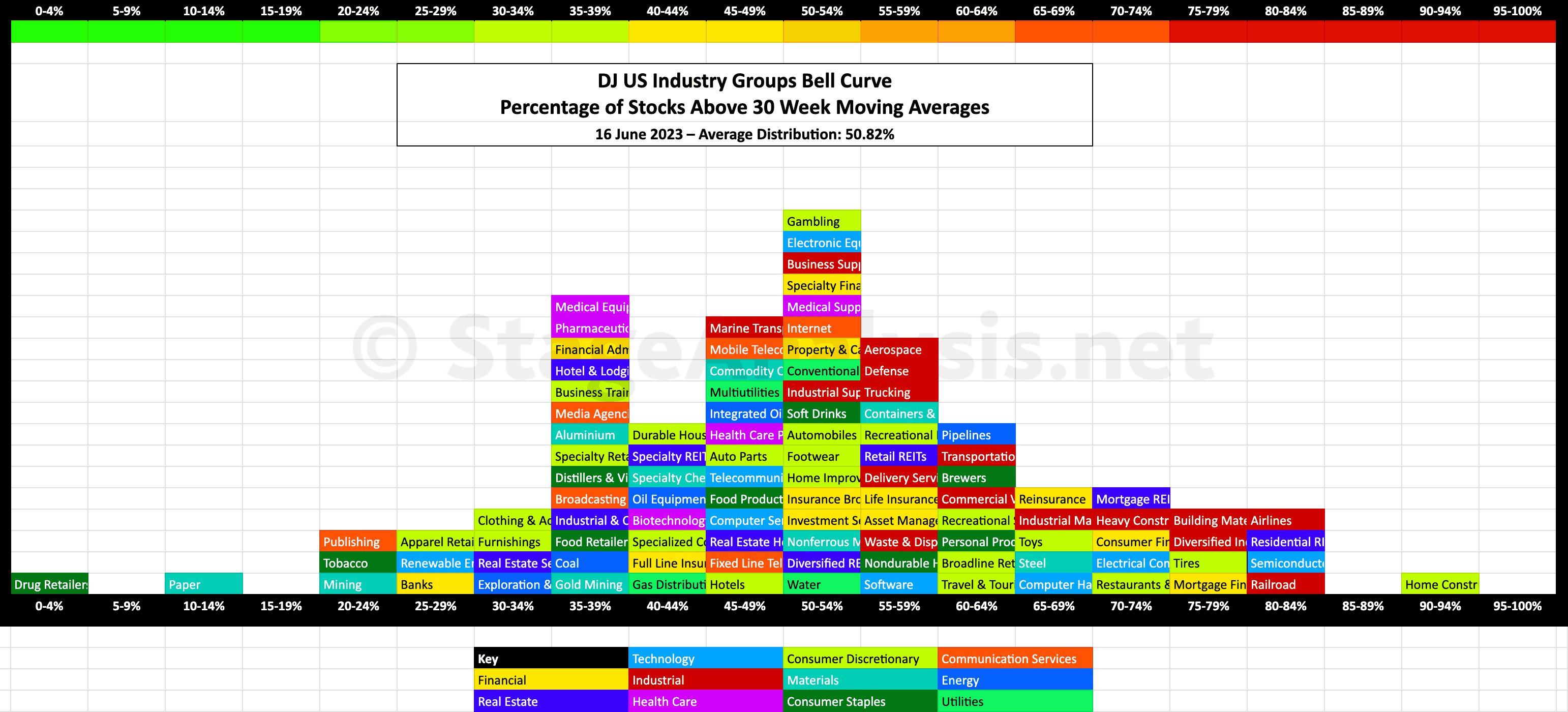

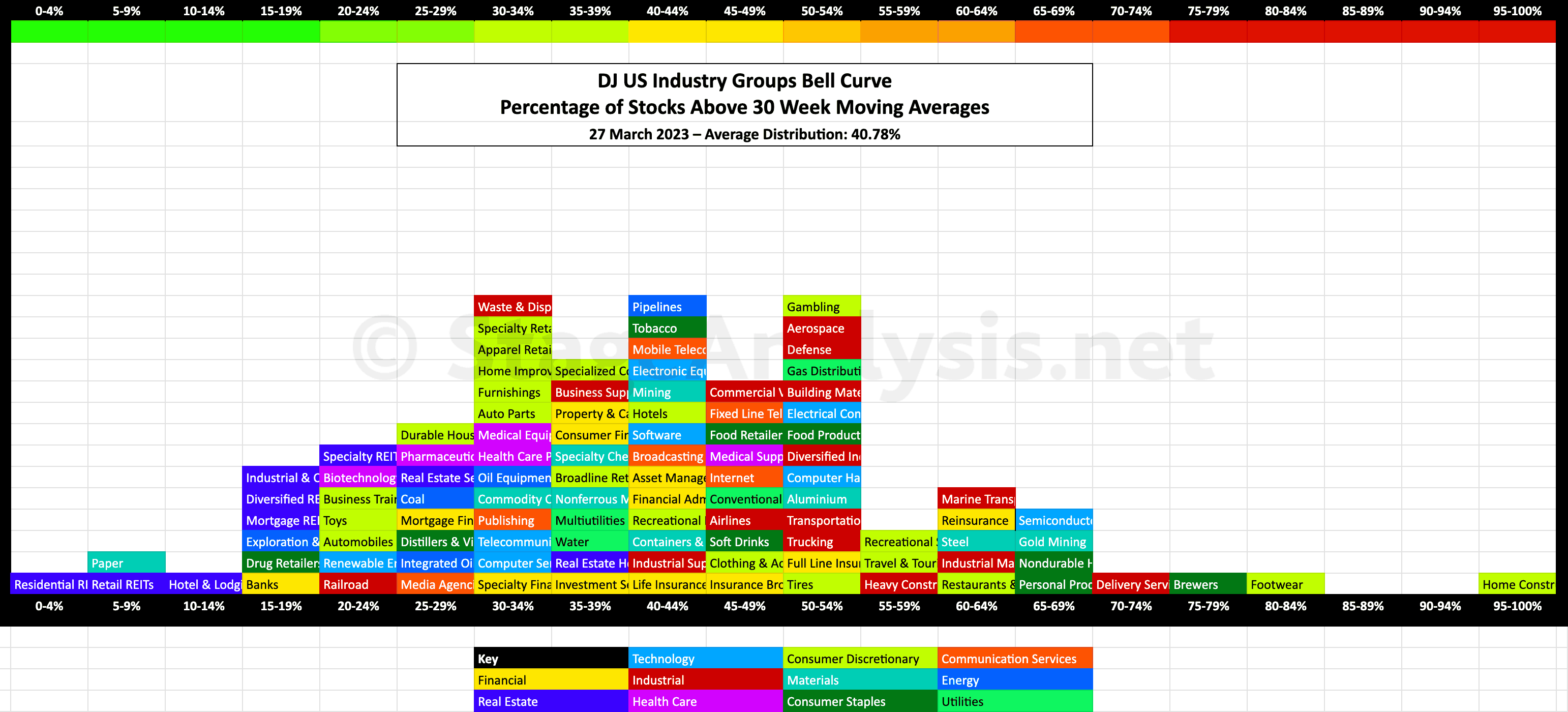

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More

Blog

14 June, 2023

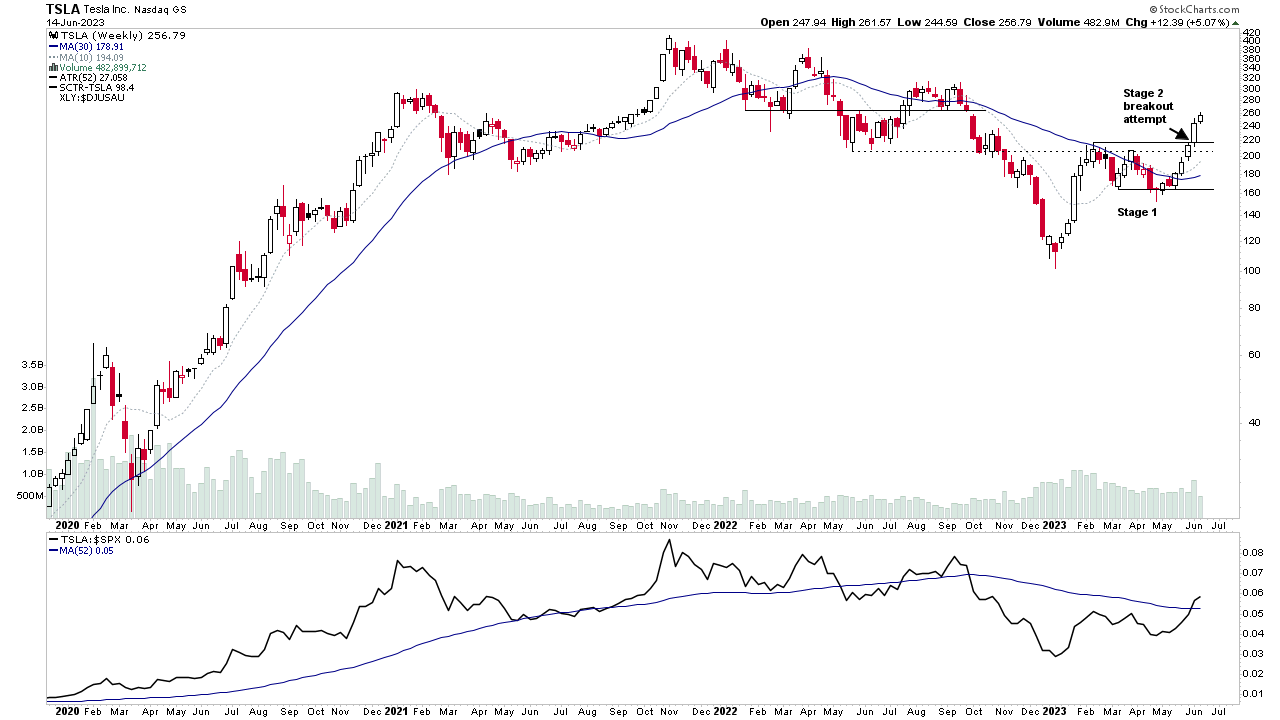

Group Focus Video: Automobiles Moving into Stage 2 – 14 June 2023 (1hr)

This weeks members midweek video is a special group focus on the Automobiles Group, which has moving strongly up the relative strength rankings over the last 3 months, and is currently in 2nd place overall, with multiple stocks in the group starting to breakout into early Stage 2...

Read More

12 June, 2023

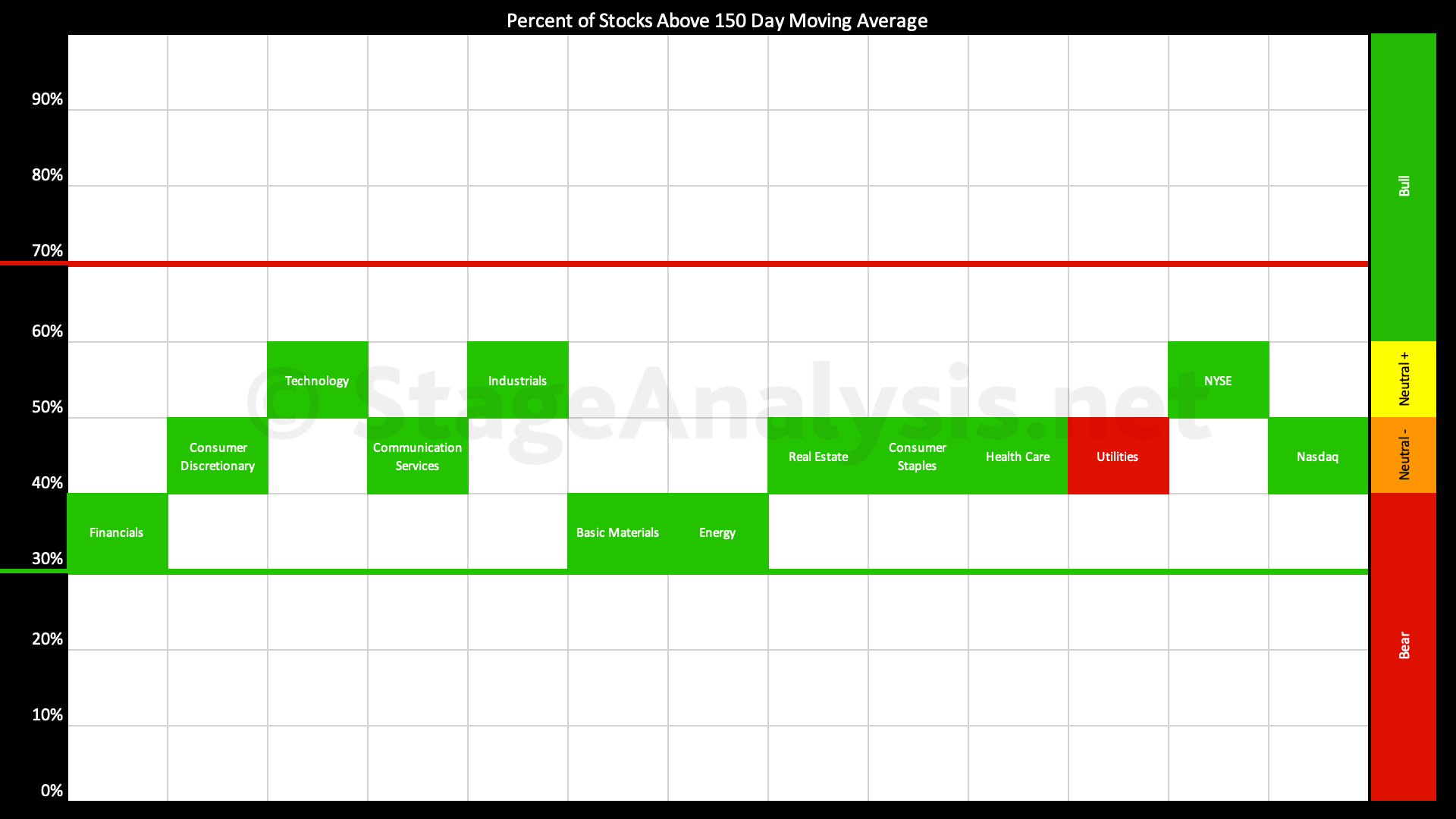

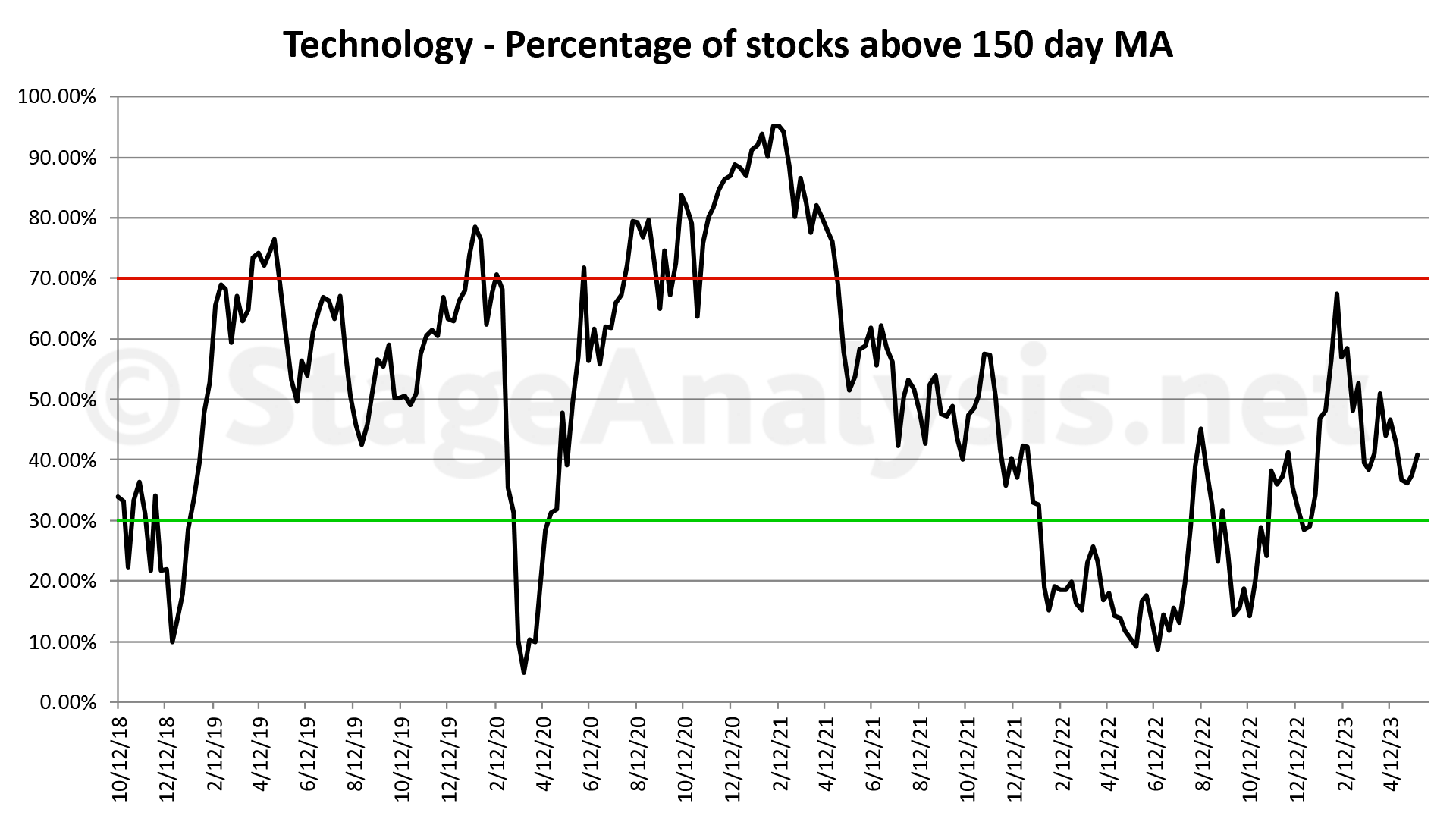

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

29 May, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

15 May, 2023

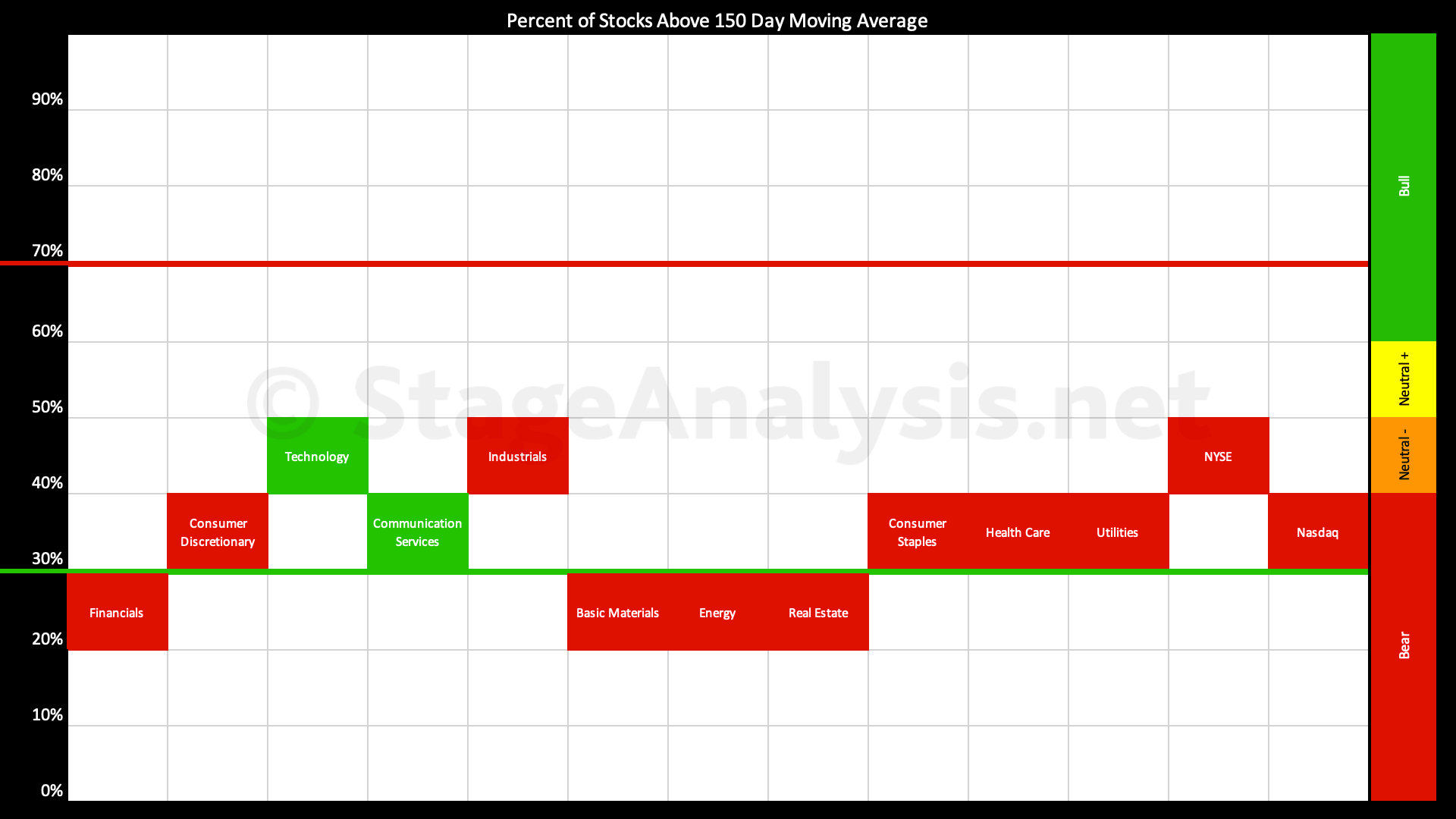

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

01 May, 2023

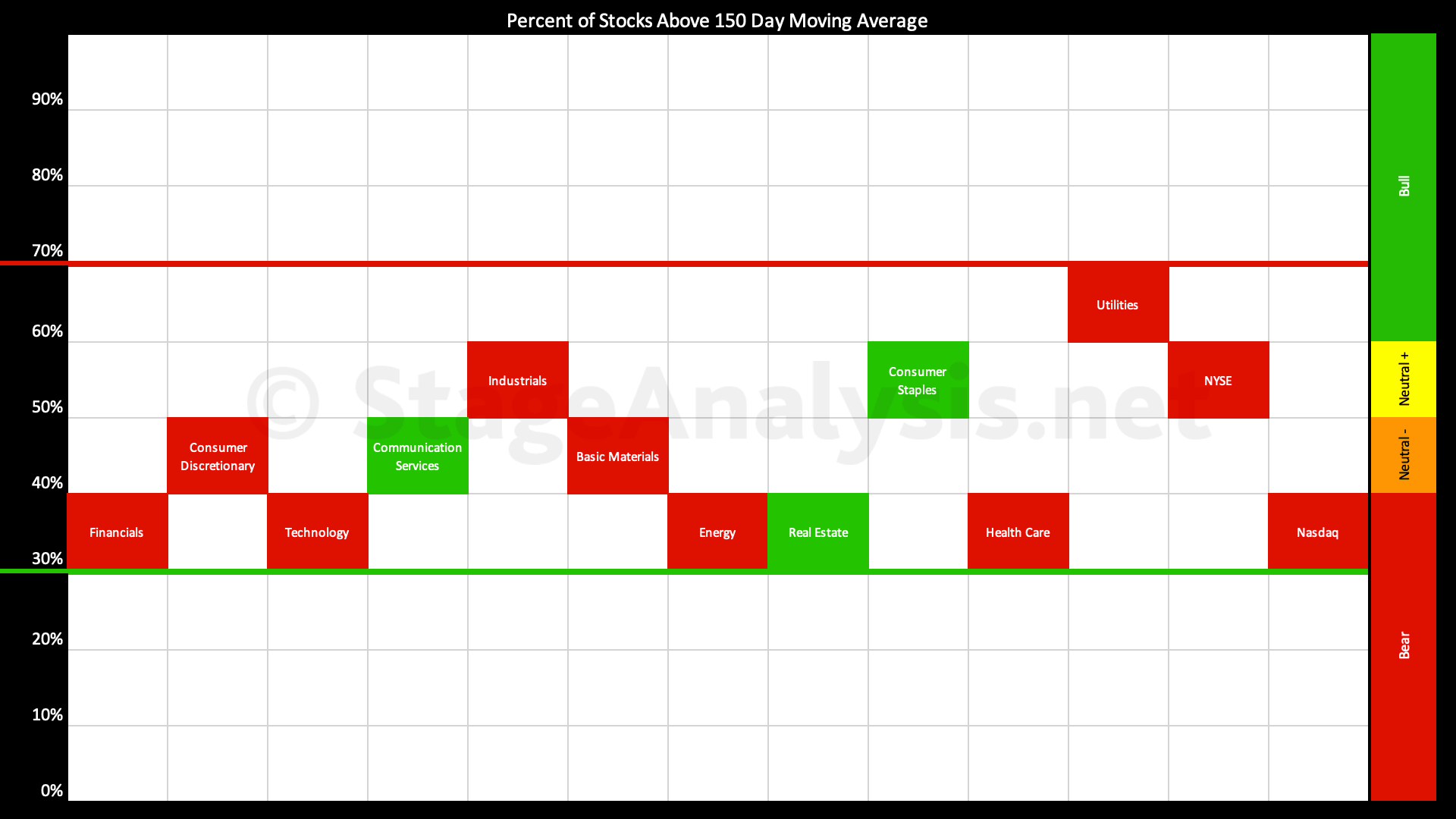

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors remains completely within the middle range. But with a weighting towards the lower end of the range. There has been a decline of -5.48%...

Read More

17 April, 2023

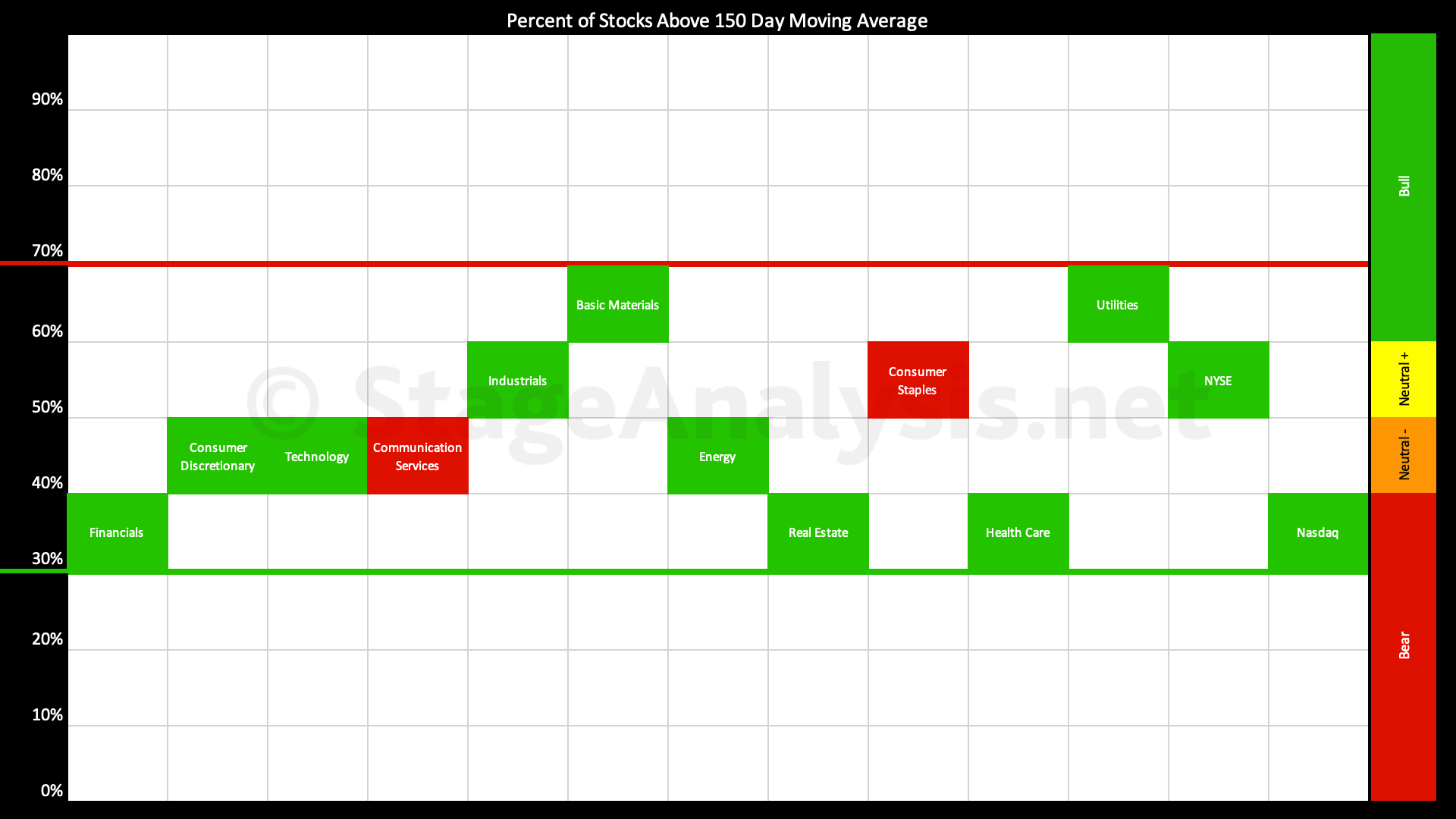

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors continues to edge to towards the middle of the range, with every sector clustered in the middle range, as can be see on the visual diagram...

Read More

03 April, 2023

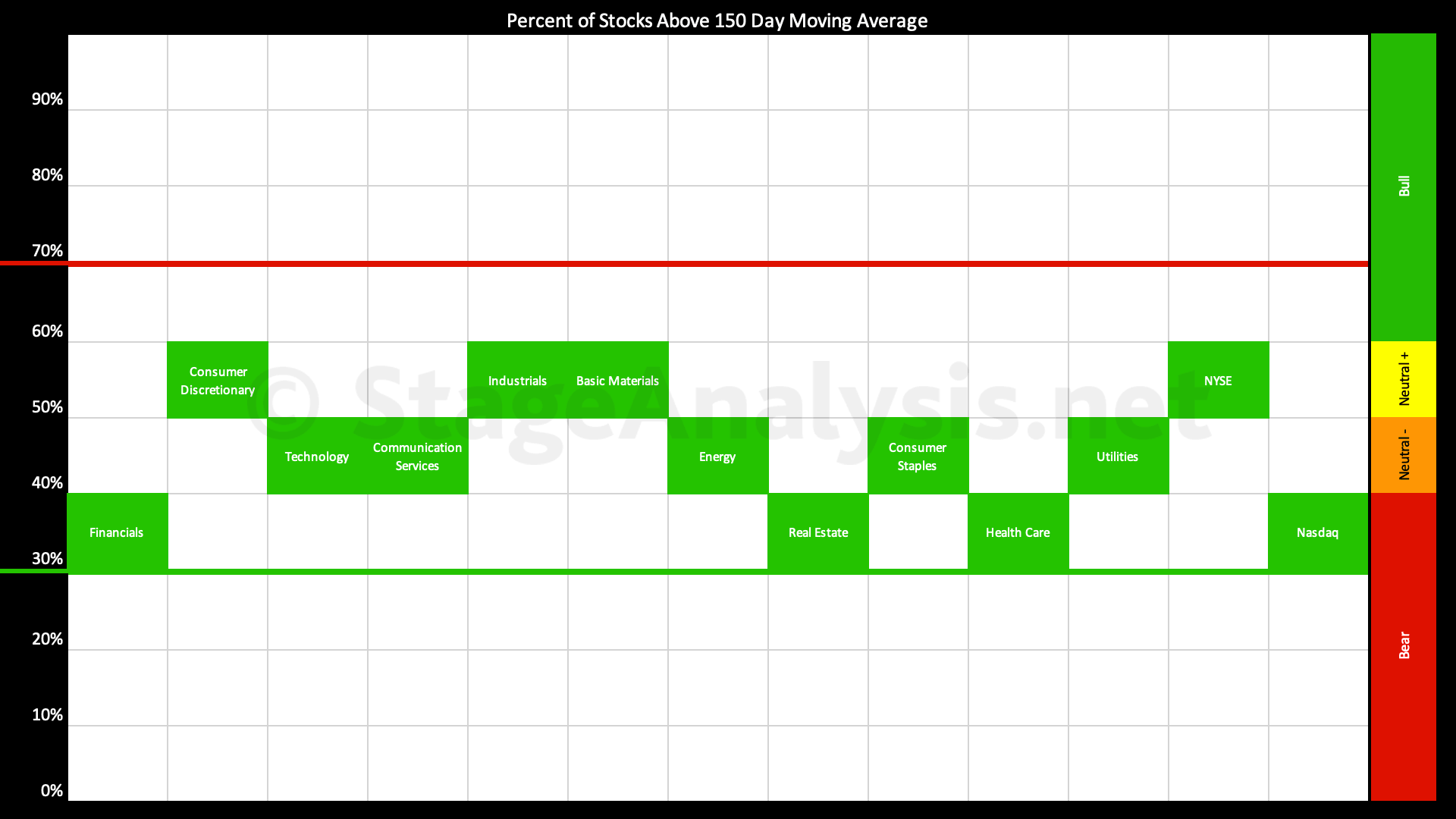

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has returned back to the middle range over the last two weeks since the previous post on the 20th March 2023, with the overall average increasing by +12.51% to 46.82%...

Read More

28 March, 2023

US Industry Groups Bell Curve – Exclusive to StageAnalysis.net

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More

26 March, 2023

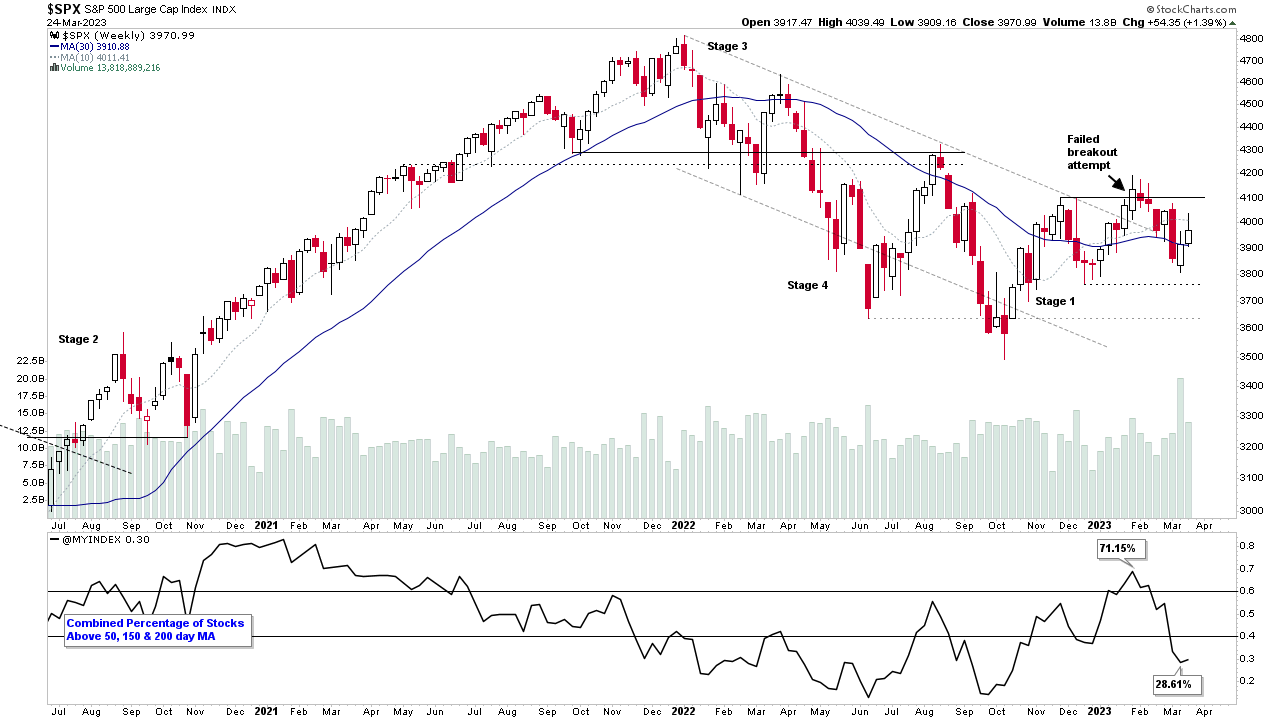

Stage Analysis Members Video – 26 March 2023 (1hr 20mins)

The Stage Analysis members weekend video with the Major Indexes Update, Futures, Sector Breadth, US Stocks Industry Groups RS Rankings, IBD Industry Groups Bell Curve – Bullish Percent, Market Breadth Update – Weight of Evidence and the US Watchlist Stocks in detail with live markups on multiple timeframes...

Read More