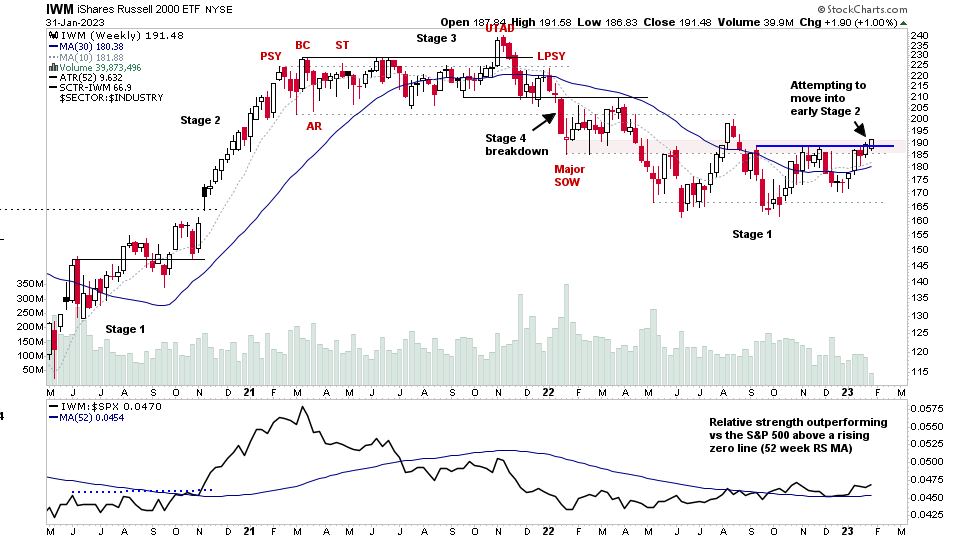

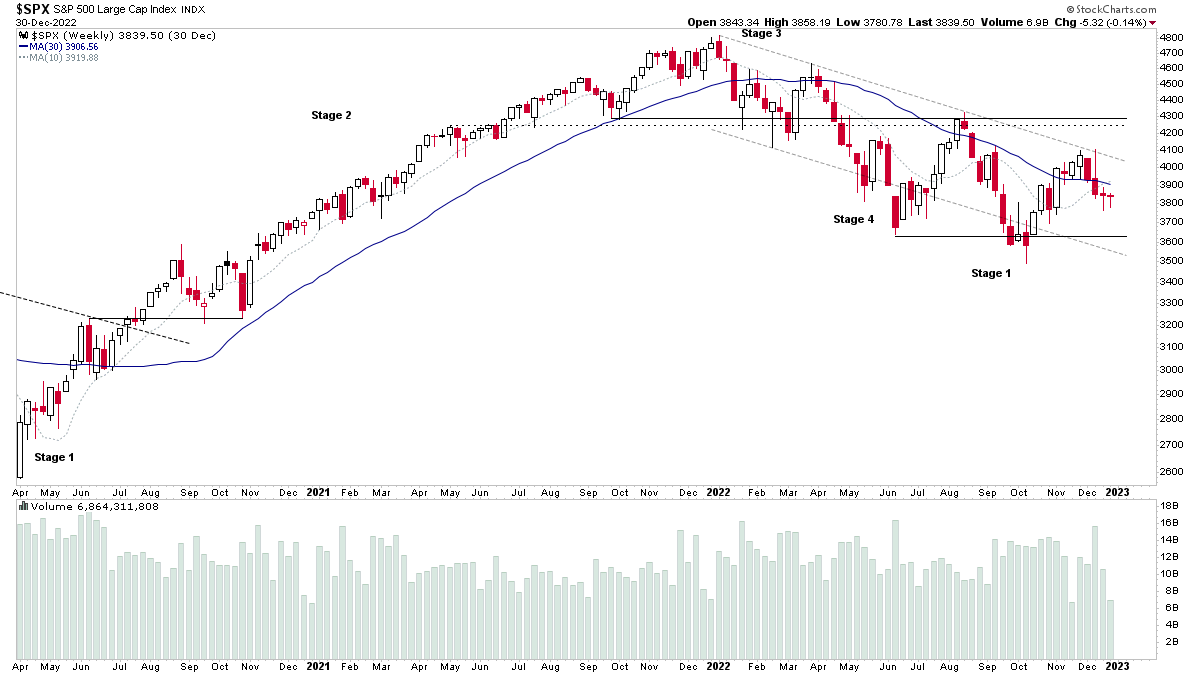

Todays post is a special feature looking at the Small Caps, as ahead of the FOMC on Wednesday, the Russell 2000 Small Caps ETF (IWM) is attempting to breakout into early Stage 2 (see above weekly and daily charts). Hence, with Stage Analysis its the perfect time to drill down into this area of the market, looking at the Small Cap sector Relative Strength, leading Small Cap stocks already in early Stage 2 or testing their Stage 2 level, and some of the market breadth stats from the group to get a broader picture of their internal health...

Read More

Blog

22 January, 2023

Stage Analysis Members Video – 22 January 2023 (1hr 12mins)

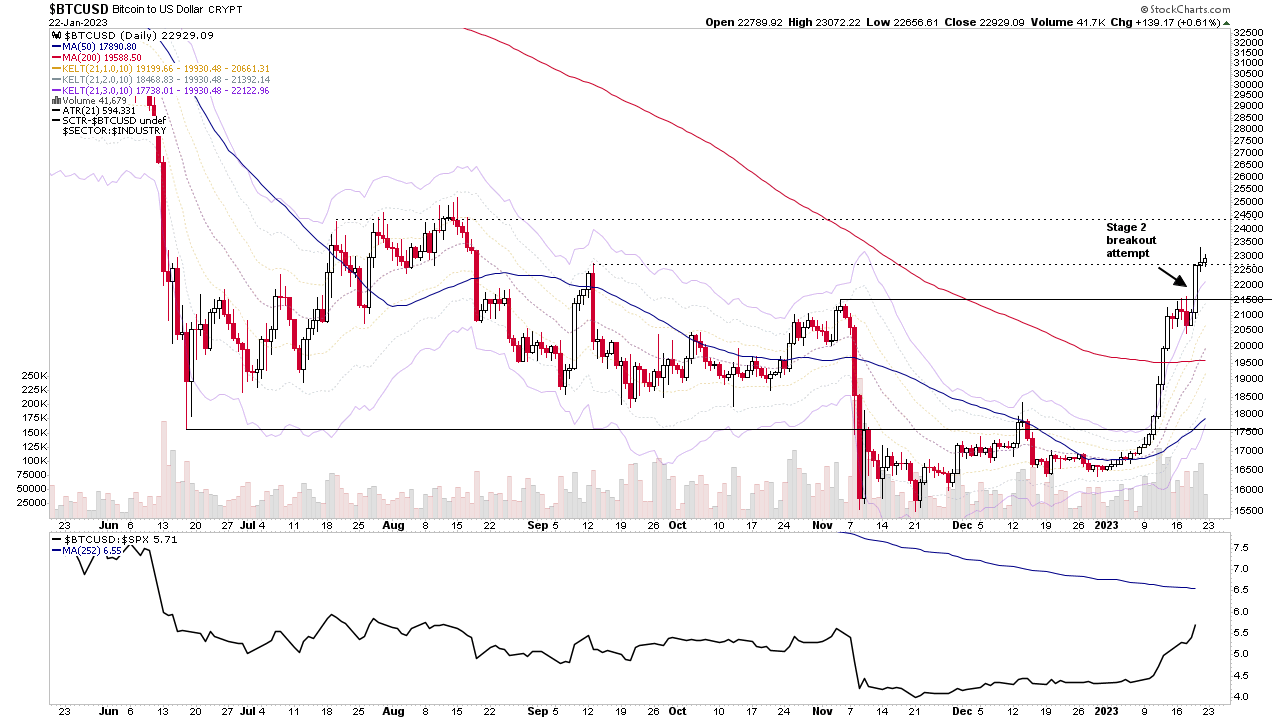

The Stage Analysis members weekend video featuring analysis of the early Stage breakout attempt in Bitcoin, and then the regular content with the major US Indexes, the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

15 January, 2023

Stage Analysis Members Video – 15 January 2023 (1hr 15mins)

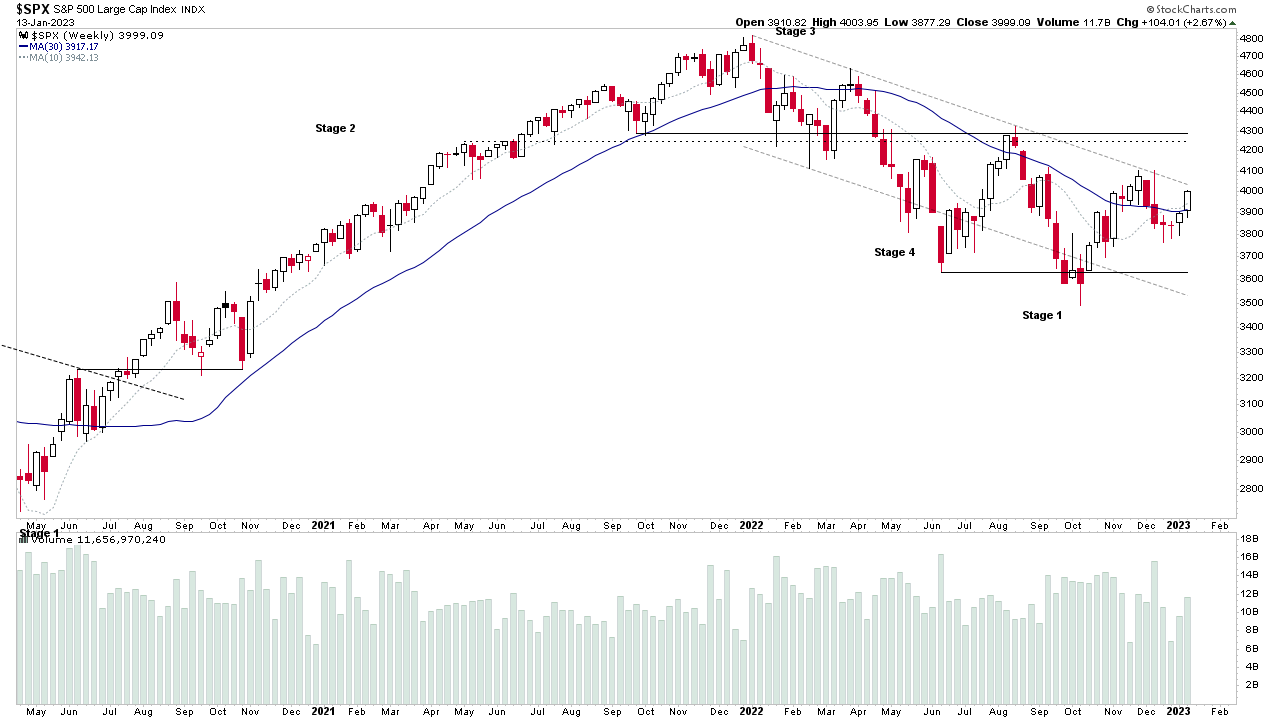

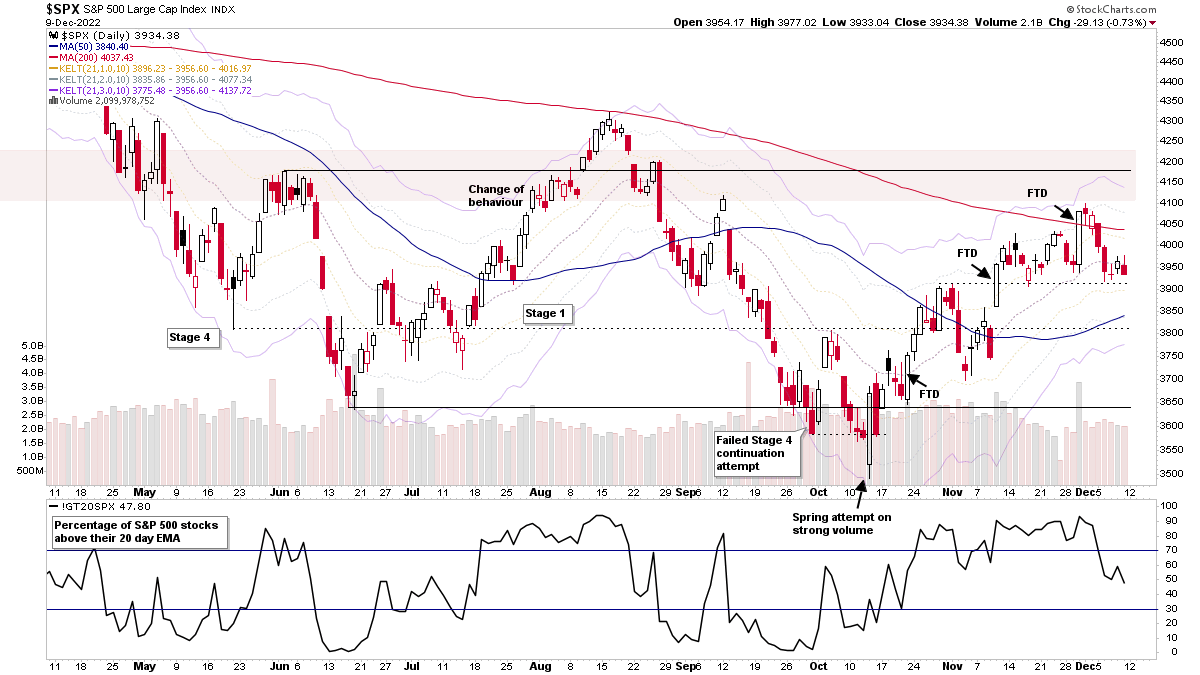

The Stage Analysis members weekend video featuring analysis of the major US Indexes as many approach their Stage 2 levels. Followed by a look at the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

08 January, 2023

Stage Analysis Members Video – 8 January 2023 (1hr 22mins)

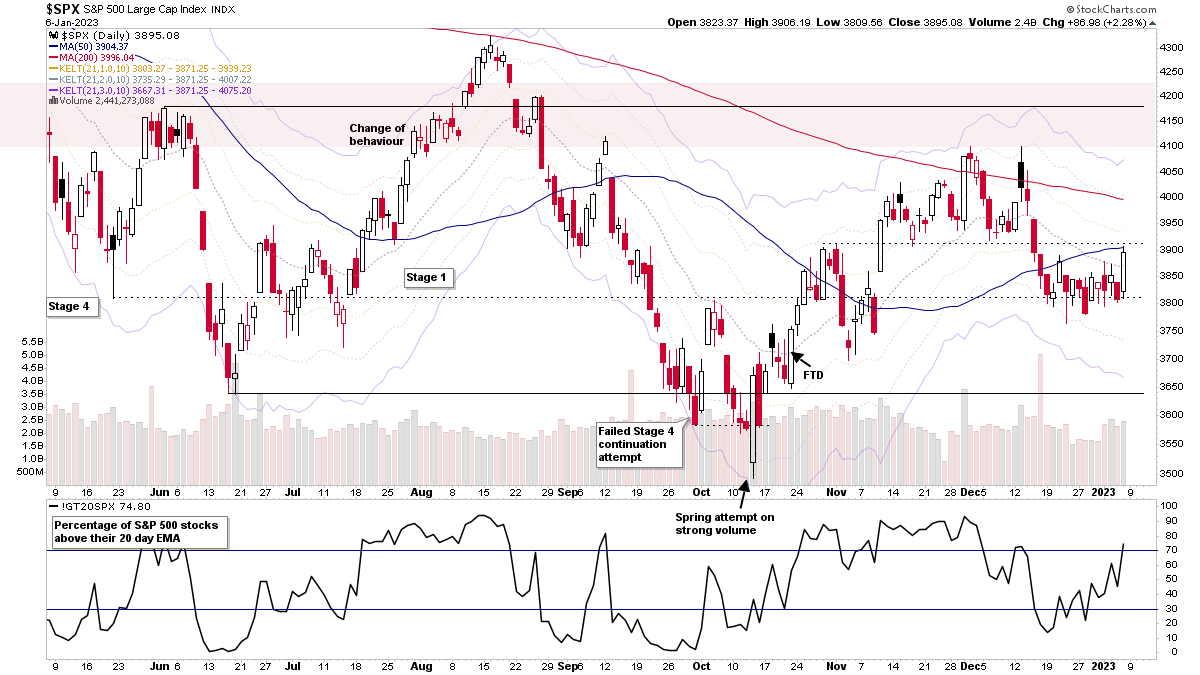

The Stage Analysis members weekend video featuring analysis of the US Sectors and major US Indexes. Followed by a look at the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, Nasdaq 100 SATA Scores, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

05 January, 2023

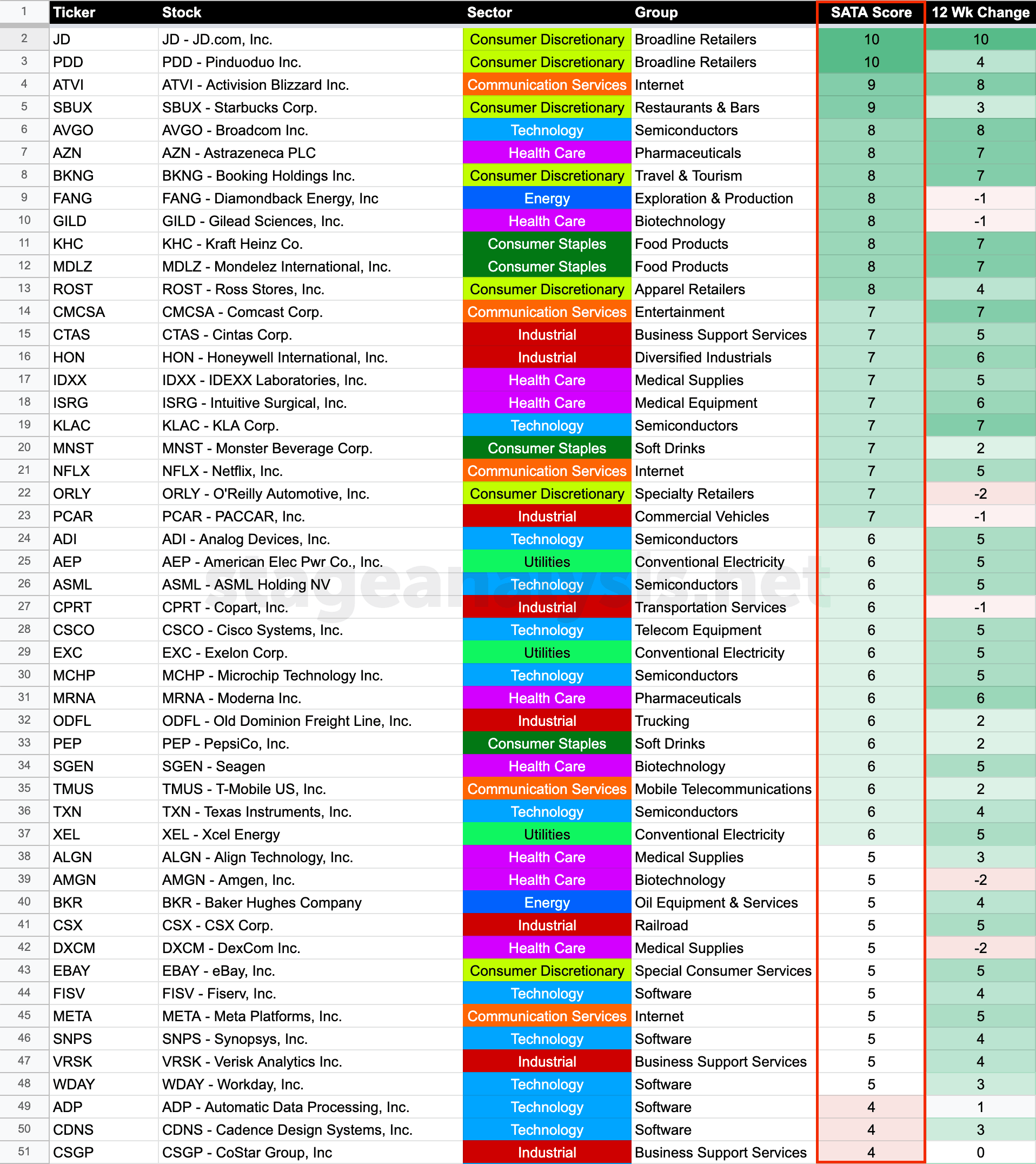

Stage Analysis Technical Attributes Scores – Nasdaq 100

We last covered the Stage Analysis Technical Attributes (SATA) weekly scores for the Nasdaq 100 back in mid November, which shows a rough guide of the Stages of the individual stocks within the Nasdaq 100. i.e. everything above a 7 would be considered in the Stage 2 zone (Positive), 4-6 in the Stage 1 or Stage 3 zone (Neutral), and 3 or below is the Stage 4 zone (Negative)...

Read More

02 January, 2023

Stage Analysis Members Video – 2 January 2023 (1hr 31mins)

The Stage Analysis members weekend video with an end of year review of the markets, and special features on the US Industry Groups Relative Strength 2022 strongest groups, and the IBD Top 5 stocks of 2022. Plus the IBD industry group bell curve, and the market breadth charts to determine the weight of evidence. Followed by the US watchlist stocks in detail on multiple timeframes.

Read More

28 December, 2022

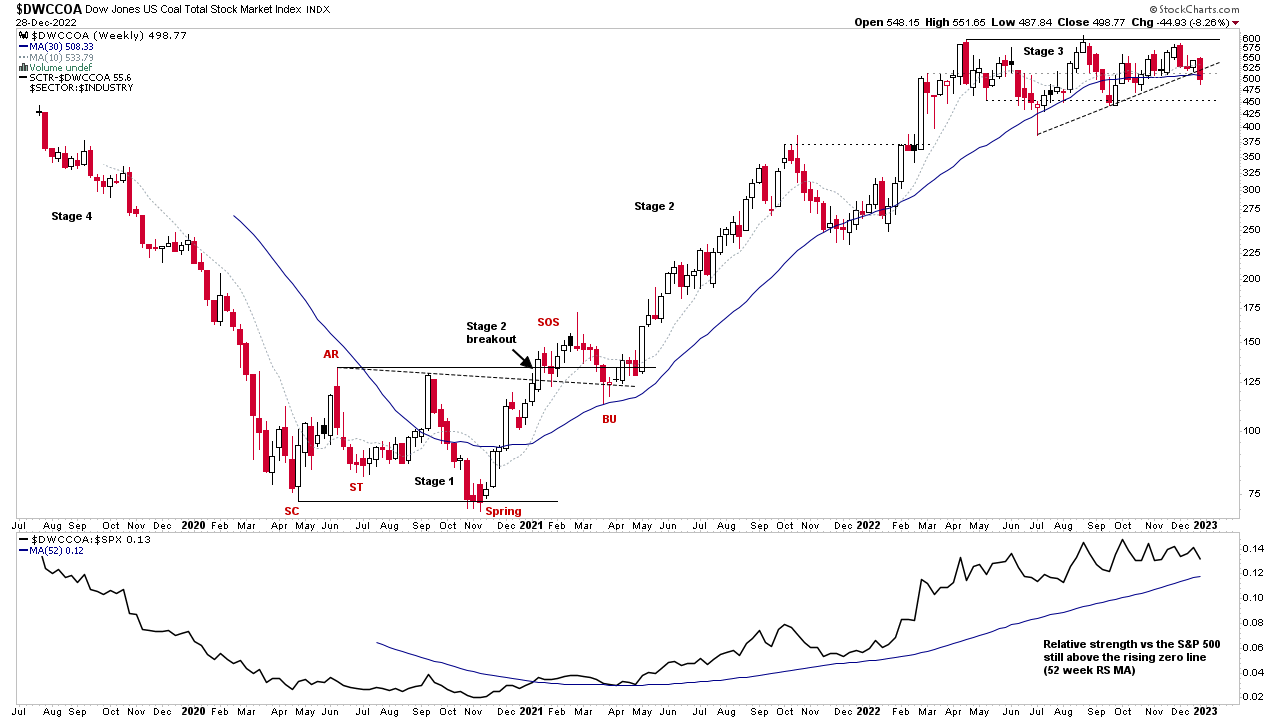

Group Focus: Coal Stocks in Late Stage 3 – 28 December 2022 (34mins)

The midweek video is a group focus on the Coal group and stocks, which led the market through the majority of 2021 and early 2022, and has multiple stocks closing the year above a +100% gain and three quarters of the stocks with more than a +20% gain year to date. However, the group and its stocks have weakened in late Stage 3 type structures over the last 8 months or so, and hence it is vulnerable to a potential Stage 4 breakdown attempt...

Read More

28 December, 2022

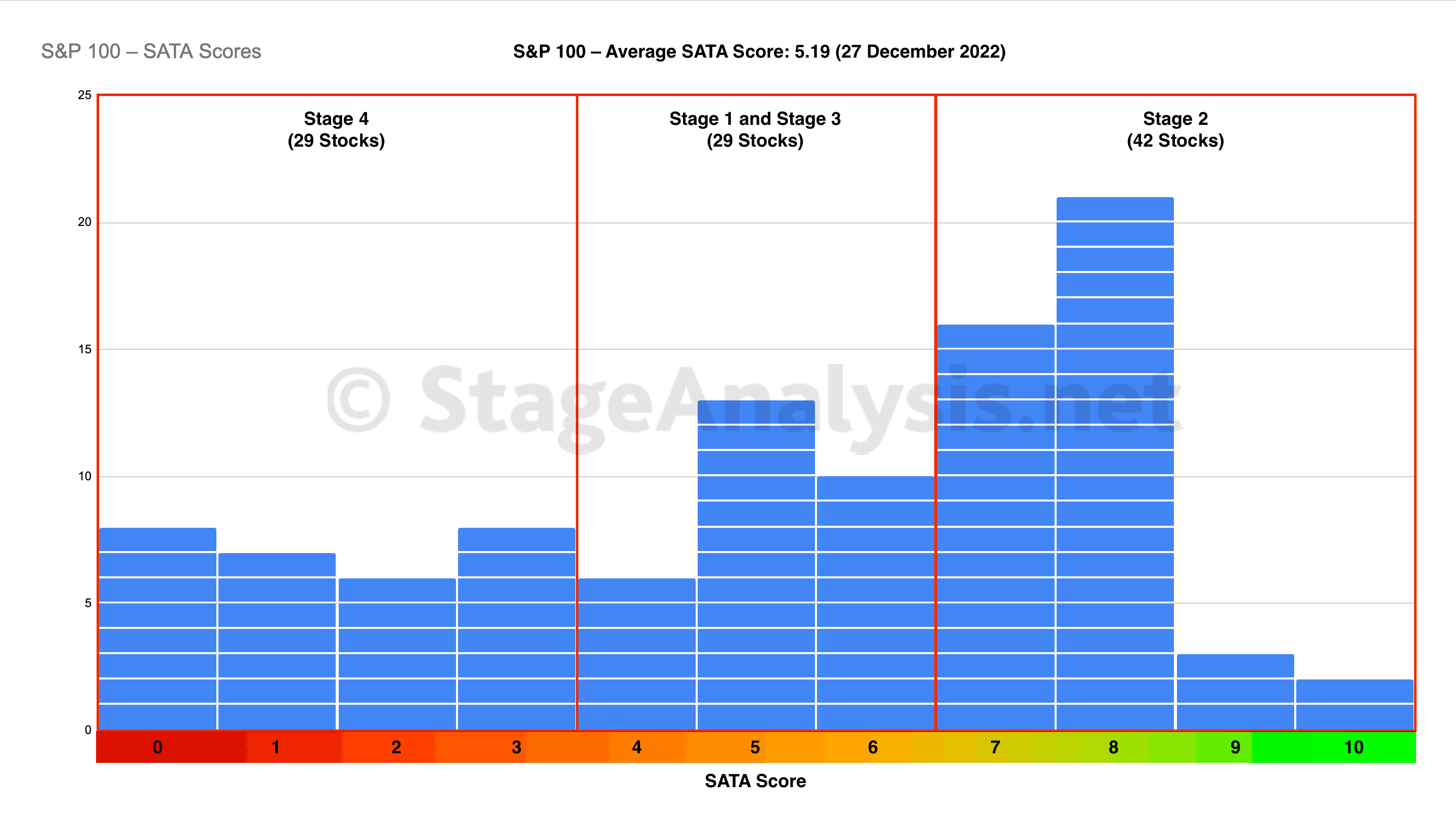

Stage Analysis Technical Attributes Scores – S&P 100 (OEX)

The S&P 100 comprises 100 major blue chip companies and is a sub-set of the popular S&P 500 index. So I thought it would be useful to look at the Stage Analysis Technical Attributes (SATA) weekly scores for all of the stocks in the S&P 100 as we come to the end of 2022, as it will give a picture of the current health of these 100 key stocks. for the US market...

Read More

18 December, 2022

Stage Analysis Members Video – 18 December 2022 (1hr 23mins)

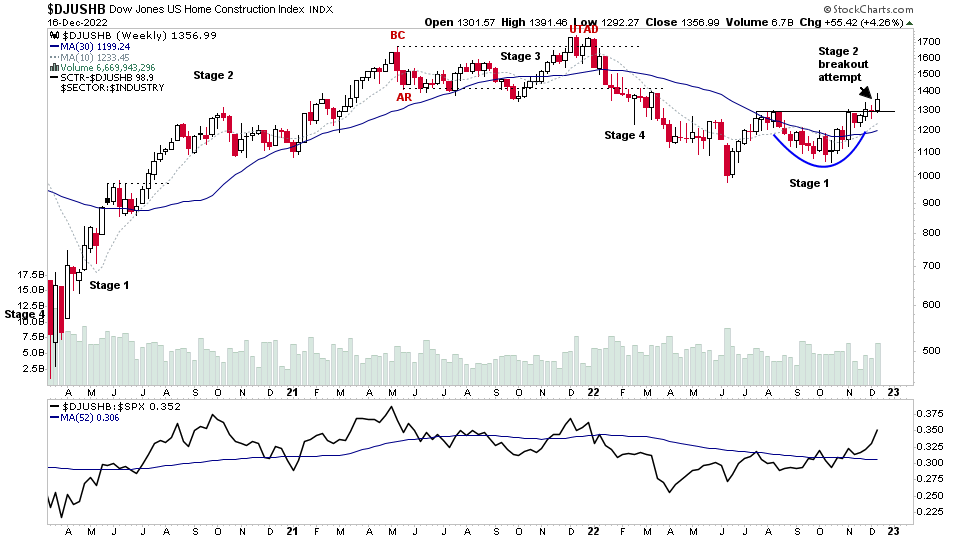

The Stage Analysis members weekend video begins this week with a special focus on the Home Construction Group stocks, of which multiple stocks within the group made a Stage 2 breakout attempt this week against the weak market action...

Read More

11 December, 2022

Stage Analysis Members Video – 11 December 2022 (1hr 5mins)

The Stage Analysis members weekend video discussing the market breadth charts to determine the weight of evidence, IBD industry group bell curve – percentage above 30 week MA and the bullish percent, industry groups relative strength, market indexes, and the US watchlist stocks in detail on multiple timeframes.

Read More