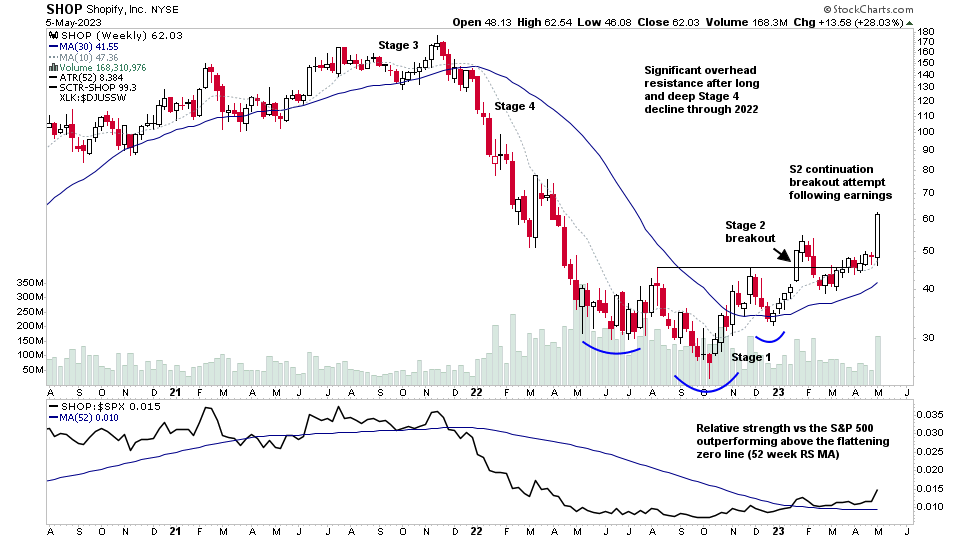

Stage Analysis weekend video begins this week with a detailed discussion of the charts of some of the weeks Stage 2 breakouts and continuation attempts...

Read More

Blog

30 April, 2023

Stage Analysis Members Video – 30 April 2023 (1hr 31mins)

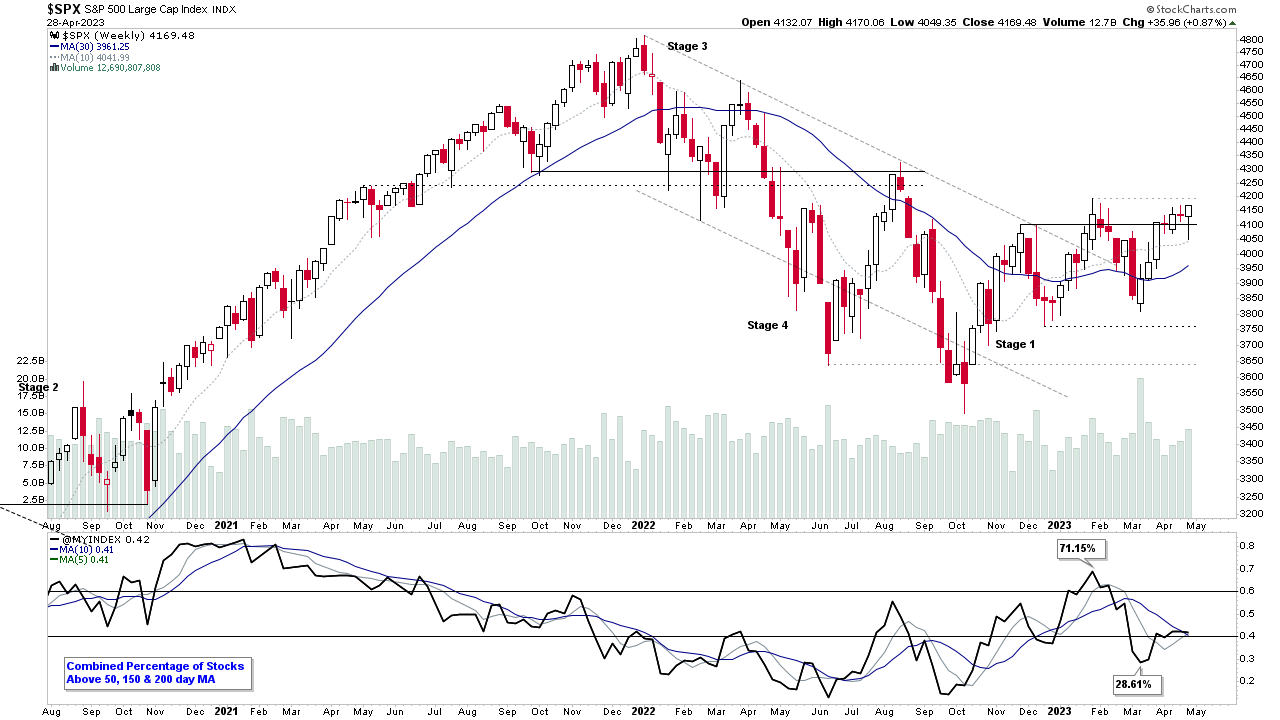

Stage Analysis members weekend video beginning by discussing this weeks Stage 2 stocks with strong volume moves. Followed by the Major Indexes Update, US Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update, and the US Watchlist Stocks in Detail...

Read More

23 April, 2023

Stage Analysis Members Video – 23 April 2023 (1hr 23mins)

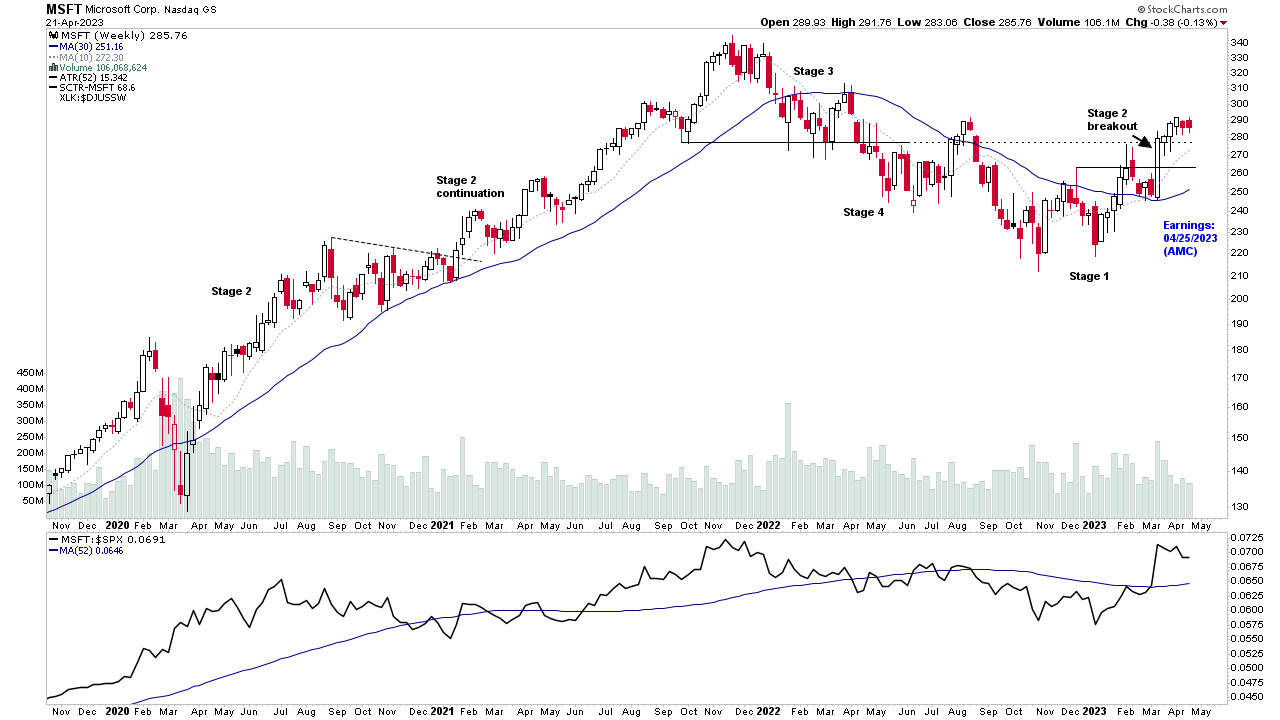

Stage Analysis members weekend video featuring Stage Analysis of the mega cap stocks reporting earnings in the coming week, plus the members only content covering the Major Indexes Update, Futures, Industry Group RS Rankings, IBD Industry Groups Bell Curve – Bullish Percent, Market Breadth, Stage 2 Continuation Breakouts and the US Watchlist Stocks detailed discussion...

Read More

16 April, 2023

Stage Analysis Members Video – 16 April 2023 (1hr 25mins)

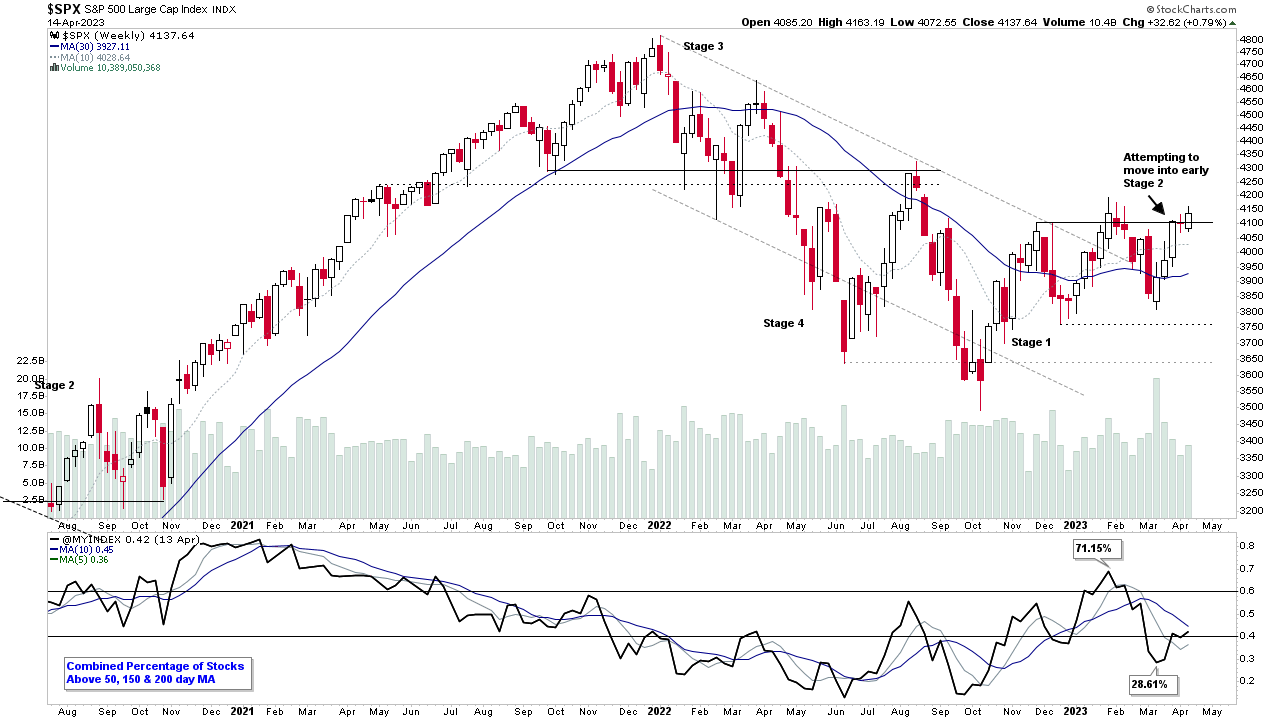

Stage Analysis Members Weekend Video featuring Stage Analysis of the major US indexes on multiple timeframes, Futures (SATA) Stage Analysis Technical Attributes Charts, Industry Group RS Rankings and changes, IBD Industry Groups Bell Curve – Bullish Percent data. The Market Breadth Update to help to determine the Weight of Evidence, which is so crucial to Stan Weinstein's Stage Analysis method....

Read More

12 April, 2023

Stage Analysis Members Video – 12 April 2023 (1hr)

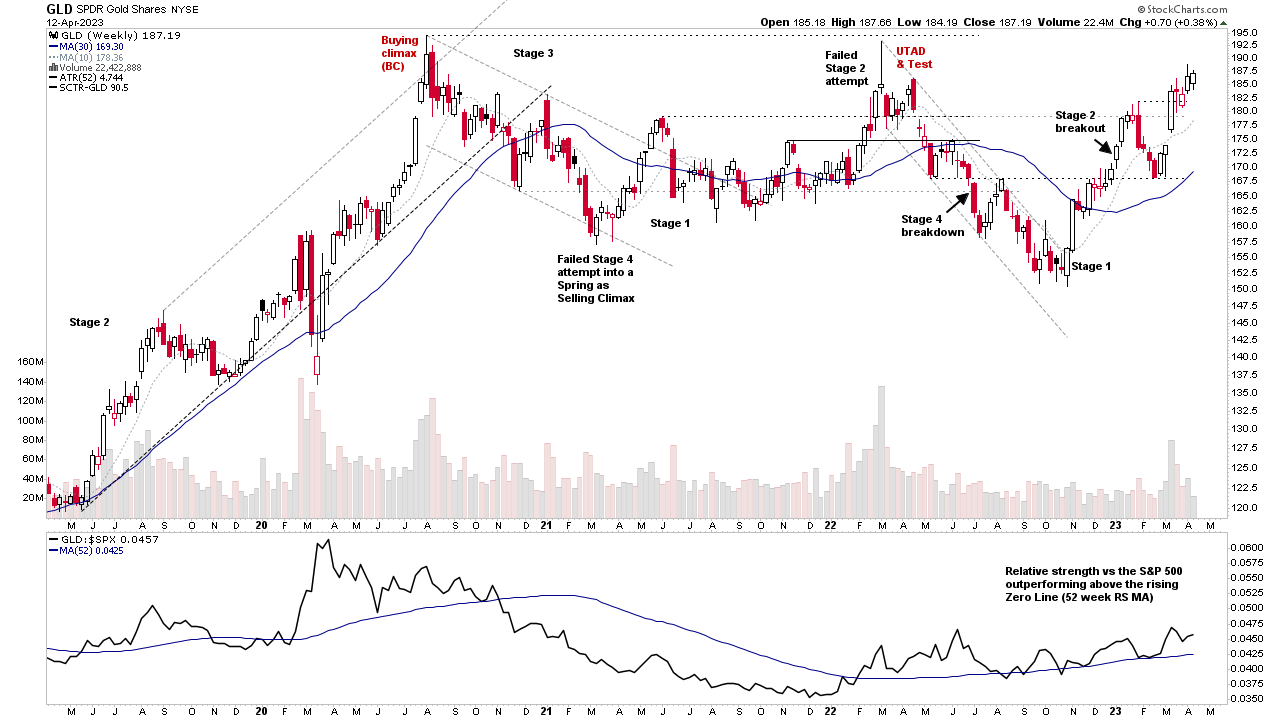

The Stage Analysis members midweek video begins today with Stage Analysis of Gold, Silver, Bitcoin and Ethereum. Followed by the Major Indexes Update, Short-term Market Breadth Indicators and a detailed discussion of the US Watchlist Stocks...

Read More

10 April, 2023

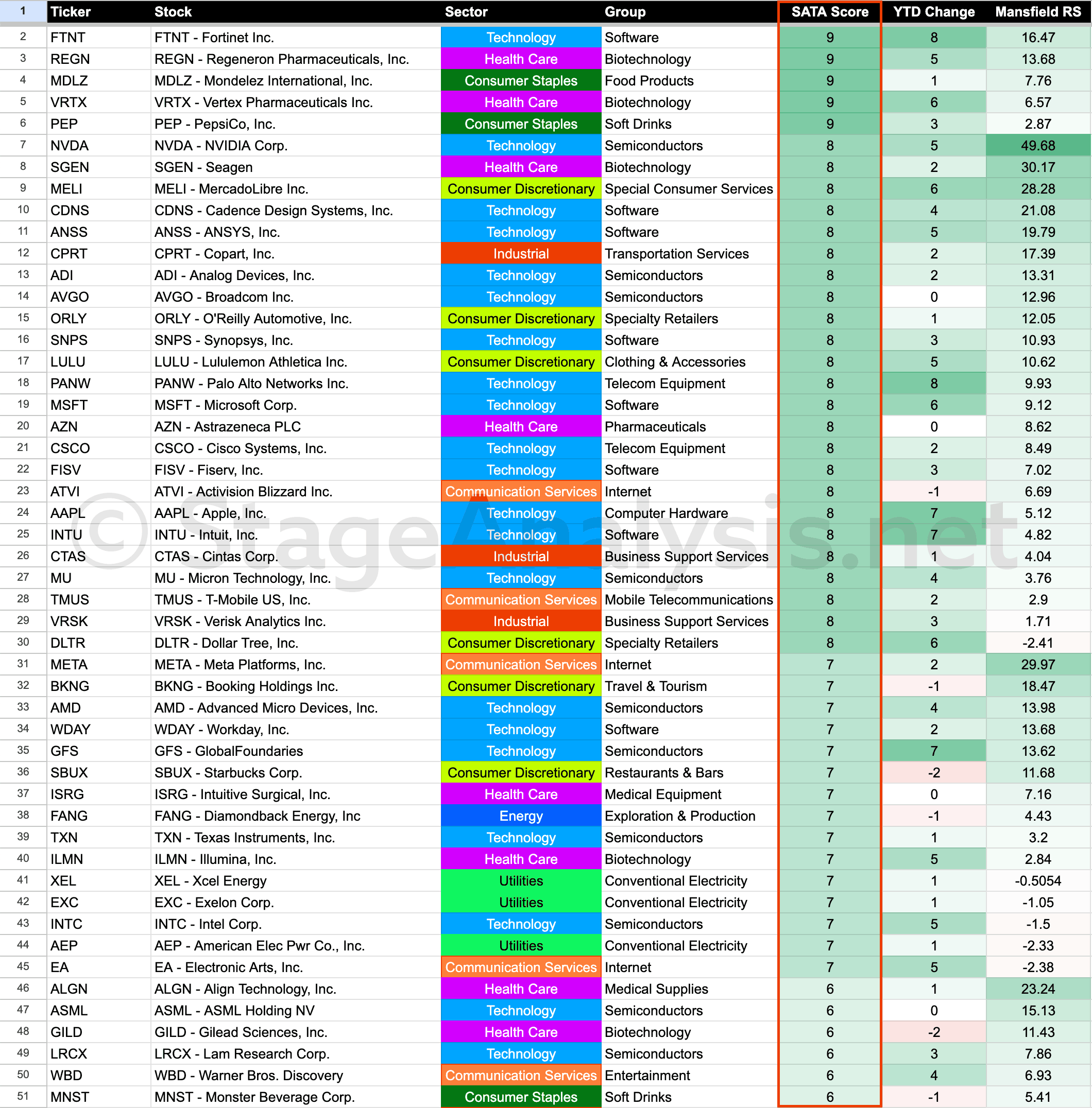

Stage Analysis Technical Attributes Scores – Nasdaq 100

The Stage Analysis Technical Attributes (SATA) score is our proprietary indicator that helps to identify the four stages from Stan Weinstein's Stage Analysis method, using a scoring system from 0 to 10 that rates ten of the key technical characteristics that we look for when analysing the weekly charts.

Read More

09 April, 2023

Stage Analysis Members Video – 9 April 2023 (1hr 21mins)

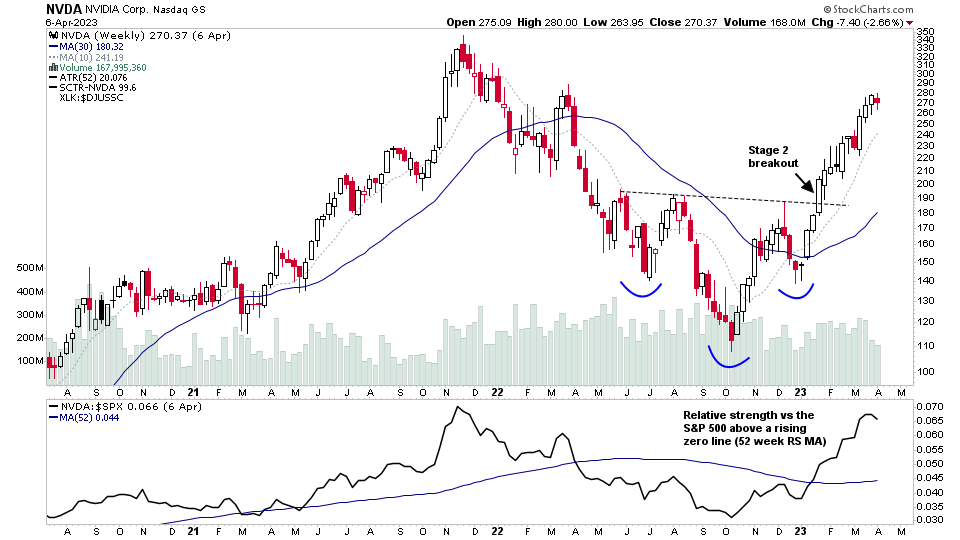

The Stage Analysis members weekend video this week begins with a feature on the mega cap stocks, as many are attempting to move into early Stage 2. Then the more regular member content covering the major US stock market indexes update, Futures stock charts, US Stocks Industry Groups Relative Strength (RS) Rankings...

Read More

02 April, 2023

Stage Analysis Members Video – 2 April 2023 (1hr 17mins)

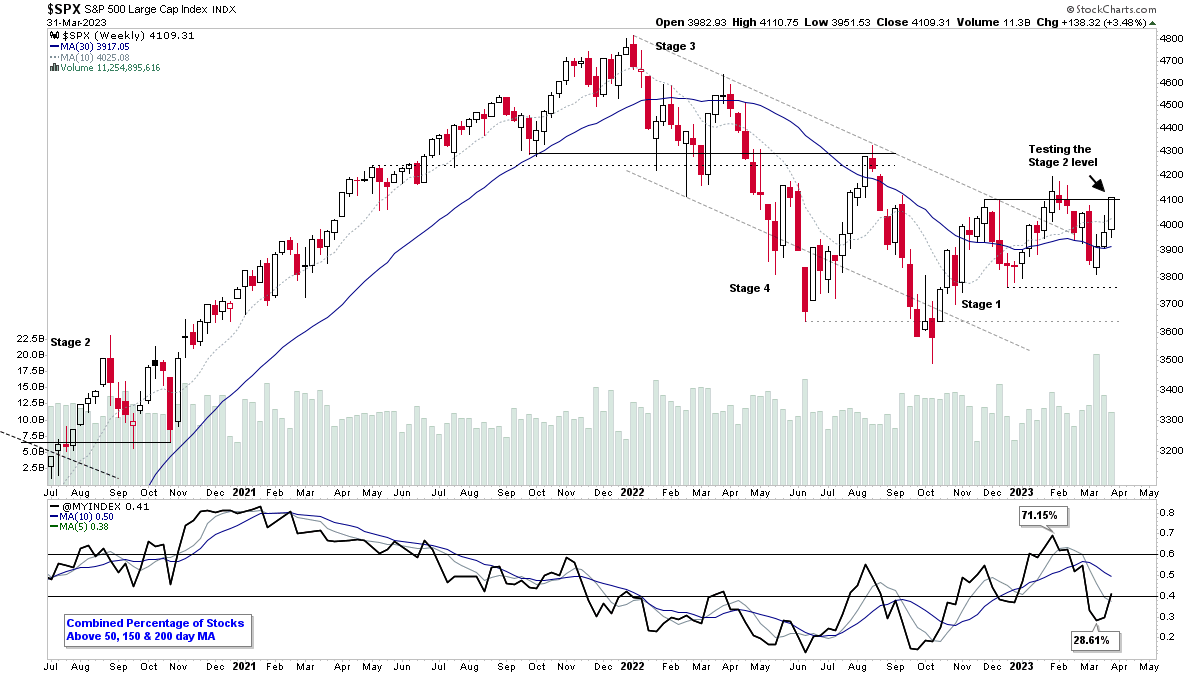

The Stage Analysis members weekend video this week features analysis of the Stage 2 breakout attempt in the Nasdaq 100, and test of the Stage 2 level by the S&P 500. Also discussion of the futures charts, US Stocks Industry Groups RS Rankings...

Read More

29 March, 2023

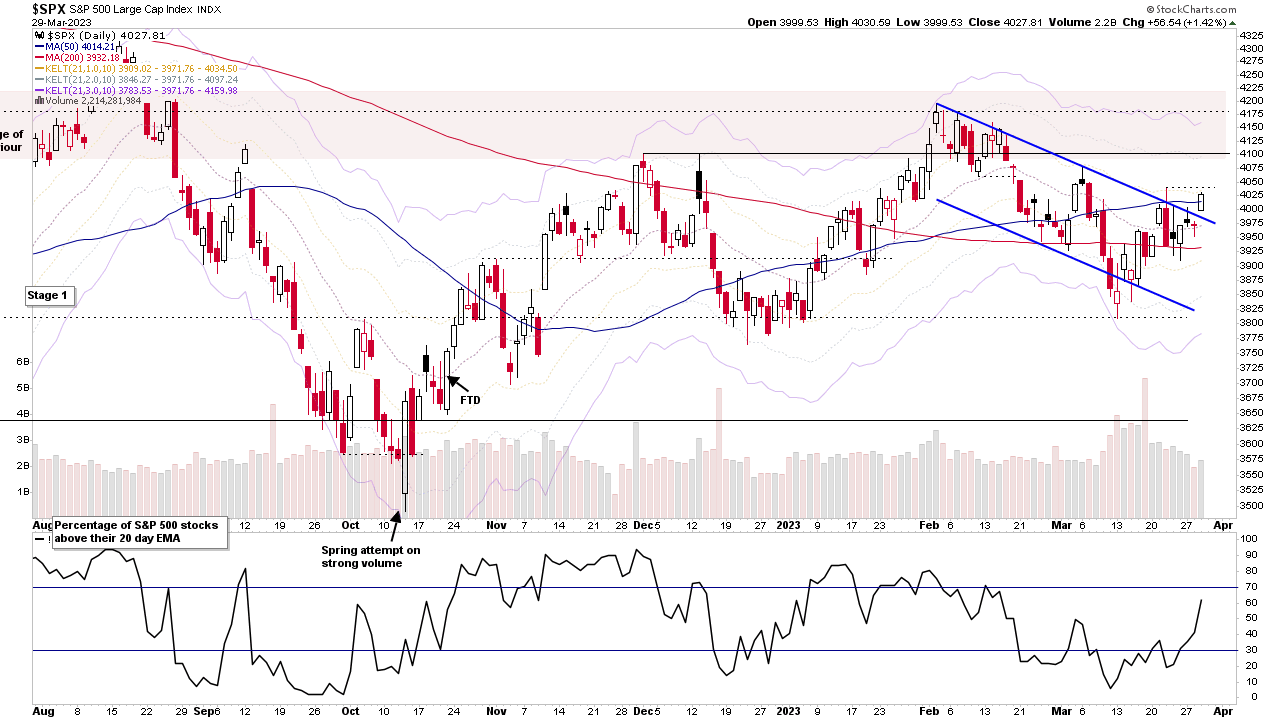

Stage Analysis Members Video – 29 March 2023 (1hr 4mins)

The Stage Analysis members midweek video discussing the improvements in the short-term market breadth indicators, the major market indexes. Stage Analysis of the mega cap stocks, and review of the banks position. Followed by discussion of the recent US watchlist stocks in more detail, and finishing off with a look at Bitcoin and Ethereum.

Read More

26 March, 2023

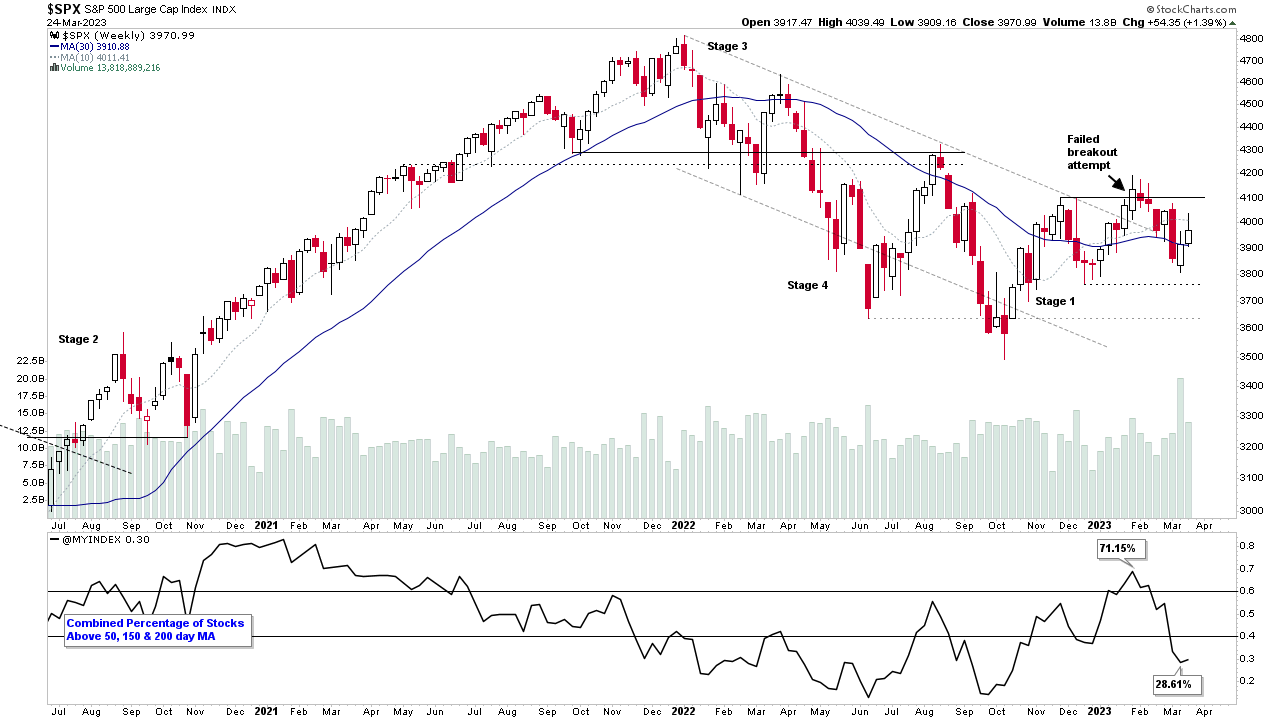

Stage Analysis Members Video – 26 March 2023 (1hr 20mins)

The Stage Analysis members weekend video with the Major Indexes Update, Futures, Sector Breadth, US Stocks Industry Groups RS Rankings, IBD Industry Groups Bell Curve – Bullish Percent, Market Breadth Update – Weight of Evidence and the US Watchlist Stocks in detail with live markups on multiple timeframes...

Read More