This weekends scans produced a fairly big list, with a few near actionable points. The bulk of the weekends watchlist picks look to be in the health care and biotechnology sectors though.

Read More

Blog

21 June, 2020

US Breakout Stocks Watchlist - 21 June 2020

18 June, 2020

US Breakout Stocks Watchlist - 18 June 2020

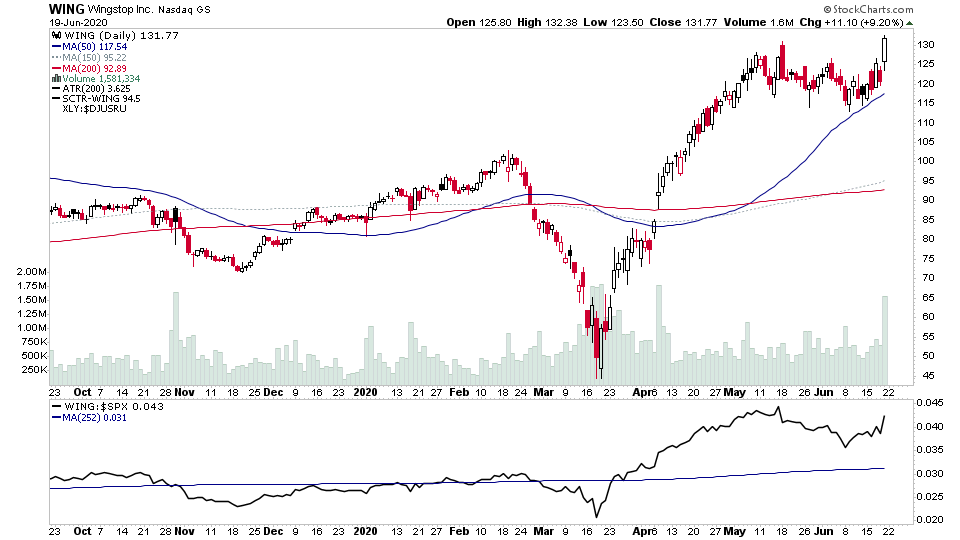

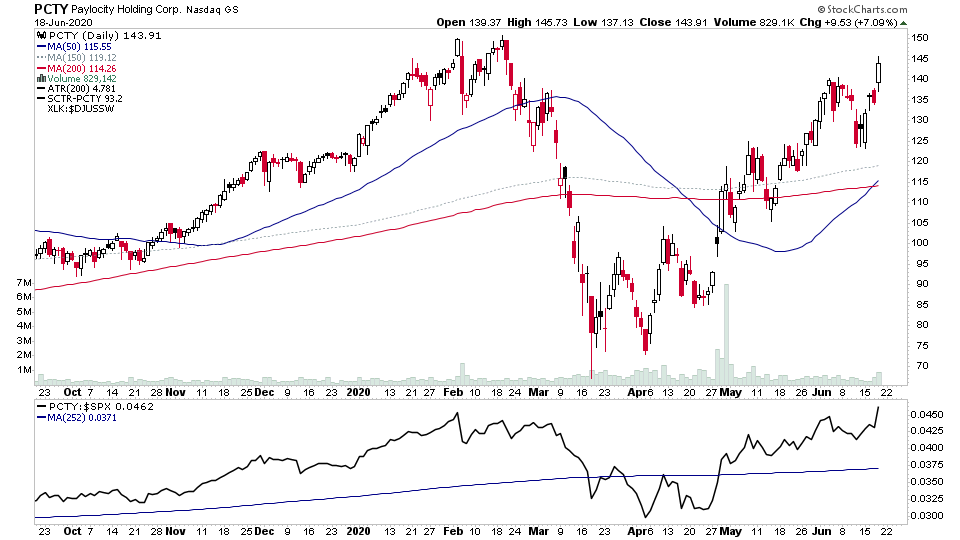

For the watchlist from Thursdays scans - ABM, AYX, EDIT, HEAR, MTCH, NBIX, NDAQ, PAYC, PCTY, PZZA, SEDG, TMUS

Read More

17 June, 2020

US Breakout Stocks Watchlist - 17 June 2020

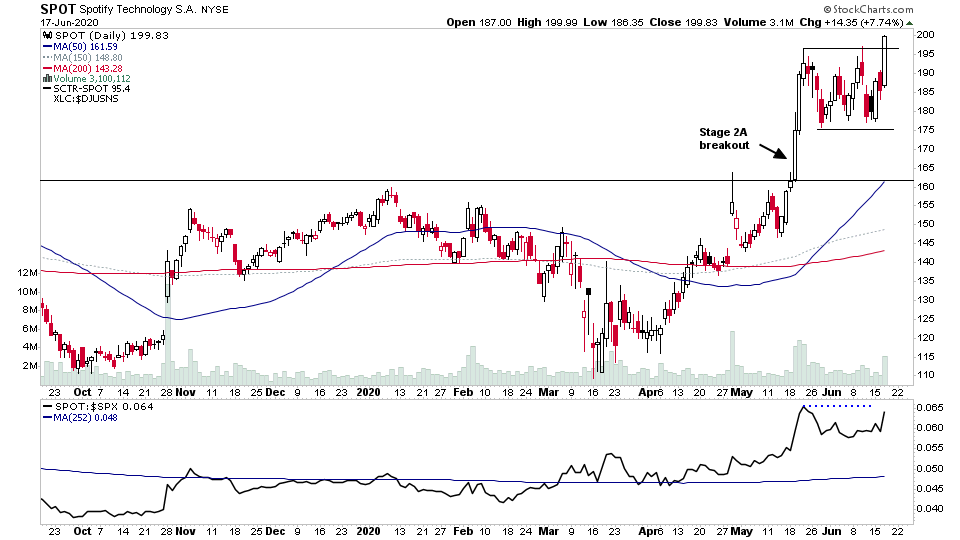

For the watchlist from Wednesdays scans - AJG, ATVI, DADA, NFLX, NVDA, SNE, SPOT

Read More

16 June, 2020

US Breakout Stocks Watchlist - 16 June 2020

Another one of those days where the market was gapped up on the open, and then spent the majority of the day going lower.

Read More

15 June, 2020

US Breakout Stocks Watchlist - 15 June 2020

There were a few charts of interest today which I posted on my twitter page: twitter.com/stageanalysis including the VIX and some more fun with google sheets, which I've been experiementing with recently, as you can get free stock data that automatically updates with a 20 min delay. So i've set up my entire trade spreadsheet on their now so that I can see the portfolio updates automatically, and have included volume, average volume etc, which is really useful info to have intraday in a spreadsheet.

Read More

14 June, 2020

US Breakout Stocks Watchlist - 14 June 2020

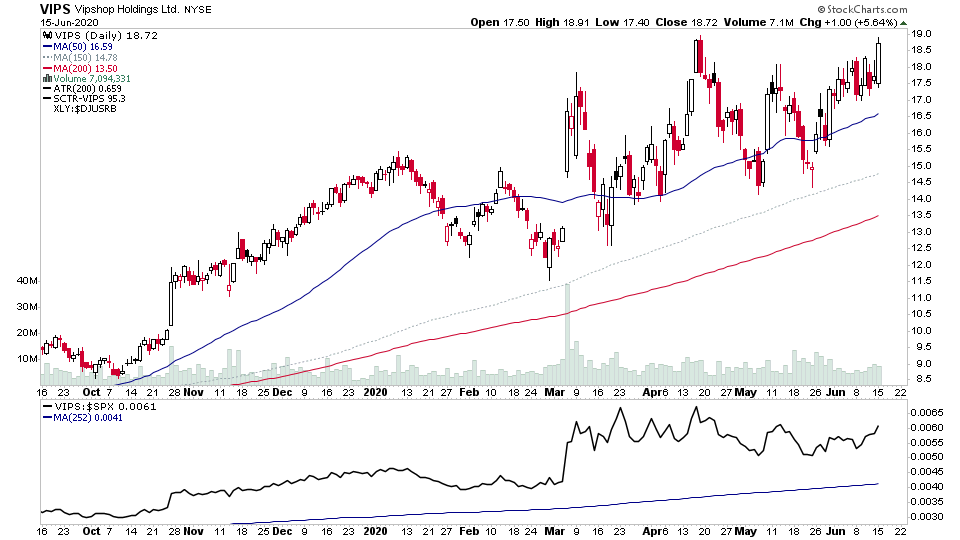

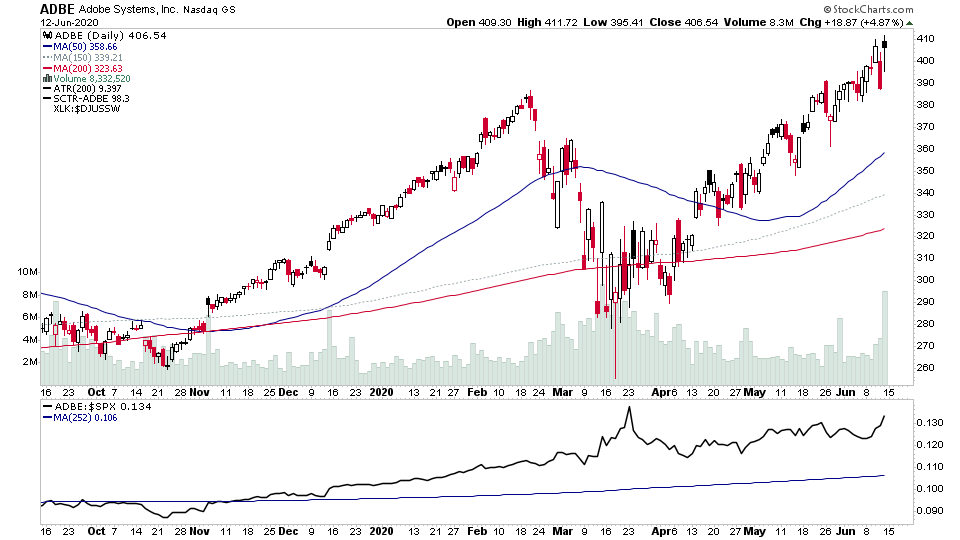

Only a couple for the watchlist from the weekend scans - ADBE, CCXI

Read More

14 June, 2020

US Stock Market. Bullish Percent Index to Bear Alert Status. What does the Weight of Evidence Say?

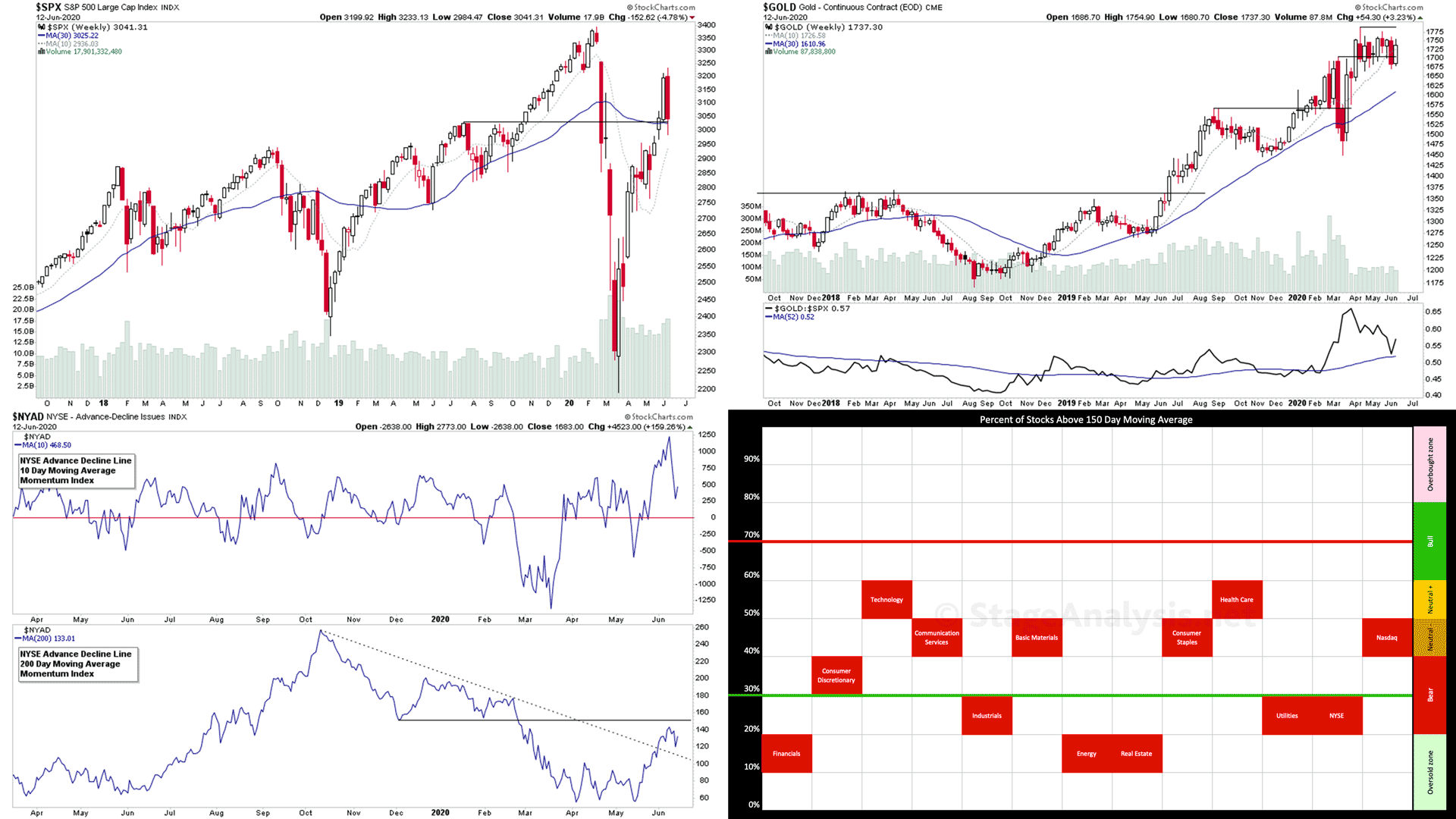

Weekend update of the major US stock market indexes and indicators. A weekly look beneath the surface of the US stock market, featuring the key market breadth charts for timing trading stocks and the stock market indexes, such as the NYSE Bullish Percent Index, the Advance Decline Line, the New Highs - New Lows etc and some custom breadth indicators of my own in order to determine what the "Weight of Evidence" is suggesting in terms of the US stock market direction and how to allocate your money.

Read More

11 June, 2020

US Breakout Stocks Watchlist - 11 June 2020

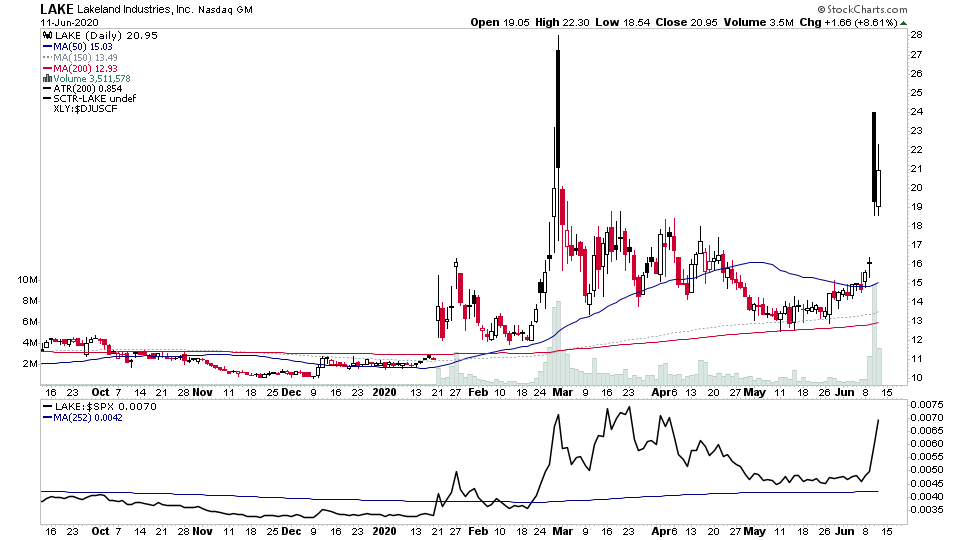

LAKE is the only addition to the watchlist tonight after a heavy down down across the board.

Read More

10 June, 2020

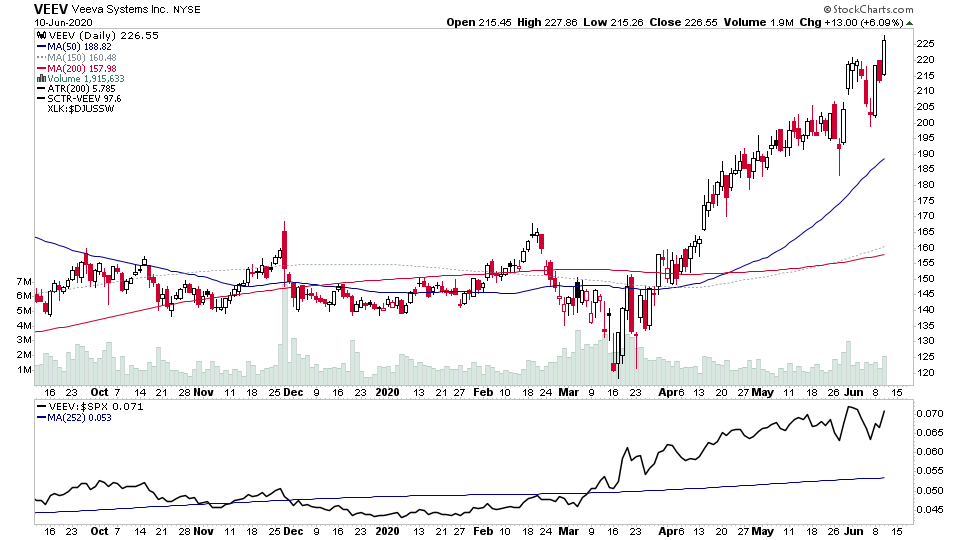

US Breakout Stocks Watchlist - 10 June 2020

A big list today, with a lot of potentials for continuation breakouts and numerous rebounds of gold mining stocks from support to back above their 50 day MA area.

Read More

09 June, 2020

US Breakout Stocks Watchlist - 9 June 2020

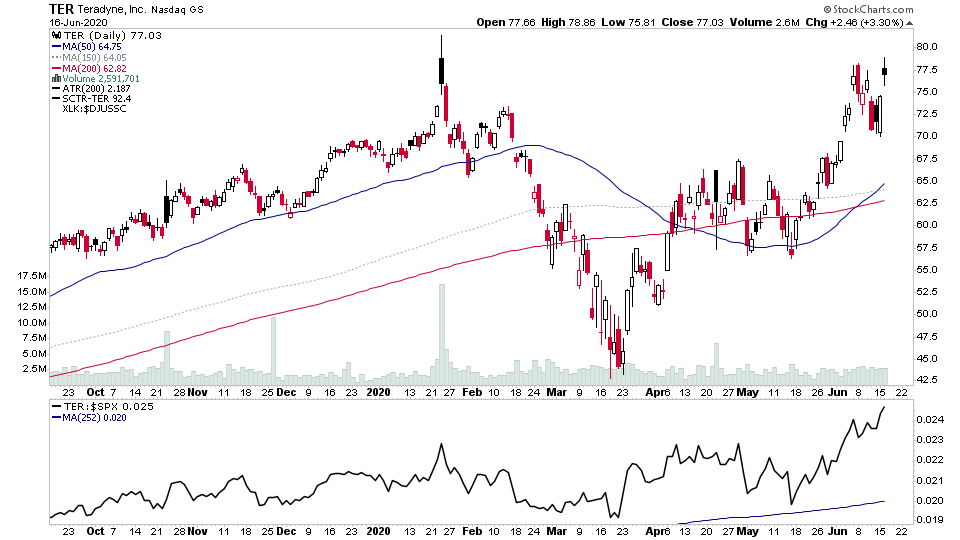

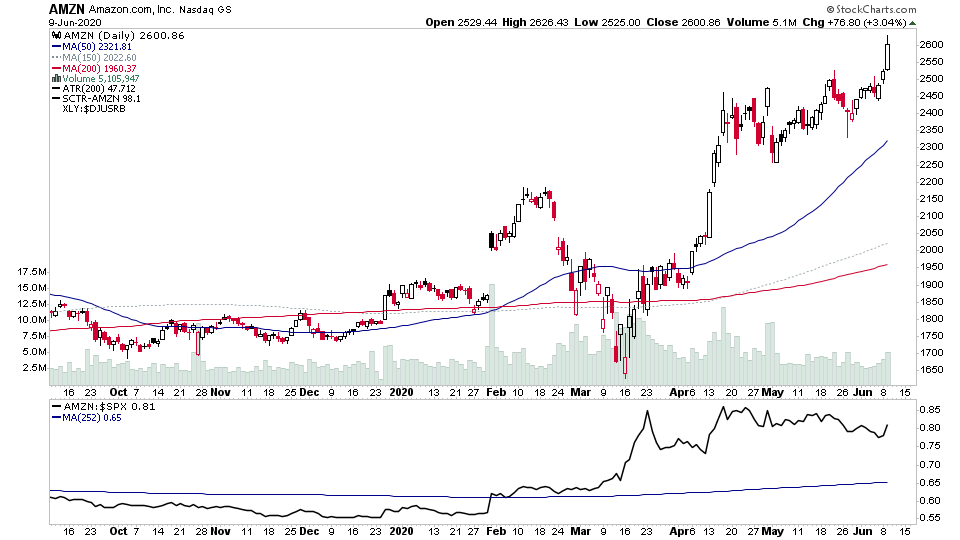

For the watchlist from Tuesdays scans - AMD, AMZN, ATVI, BF/B, FB, NFLX, NOW, PZZA, SWBI, TW

Read More