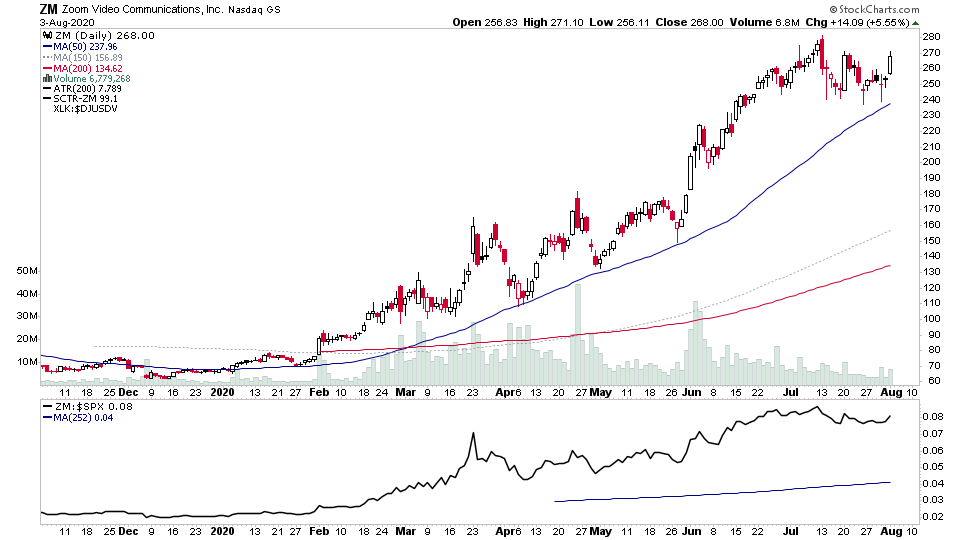

Base breakouts in leading stocks in Stage 2 continued today, with exceptional strength in numerous names...

Read More

Blog

03 August, 2020

US Breakout Stocks Watchlist - 3 August 2020

02 August, 2020

US Breakout Stocks Watchlist - 2 August 2020

A big watchlist this weekend with the strong close on Friday in the indexes, and numerous leading stocks at or near to buy points after consolidating for the last month...

Read More

30 July, 2020

US Breakout Stocks Watchlist - 30 July 2020

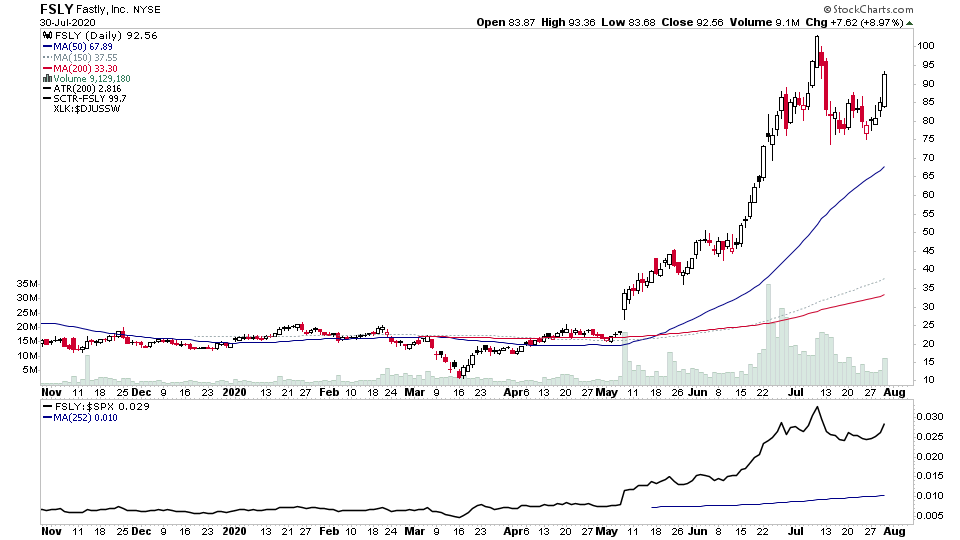

Numerous leading stocks appeared in tonights scans with Software dominating the screens, and lots of semiconductors too.

Read More

29 July, 2020

US Breakout Stocks Watchlist - 29 July 2020

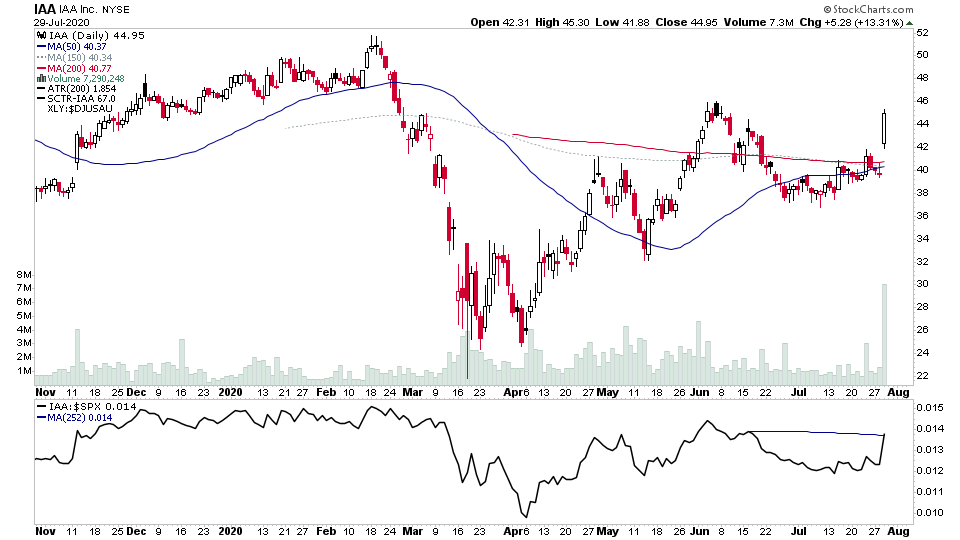

For the watchlist from Wednesdays scans - AAN, ADT, ATEN, BABA, CRWD, ETSY, FEYE, IAA, IIVI, LB, MIME, PENN, PING, PYPL, SQ, SVMK, TENB

Read More

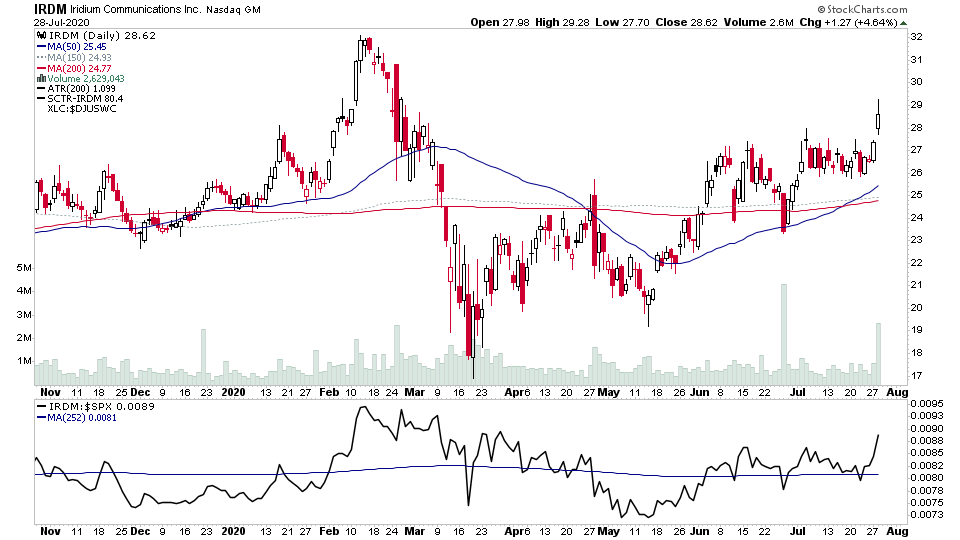

28 July, 2020

US Breakout Stocks Watchlist - 28 July 2020

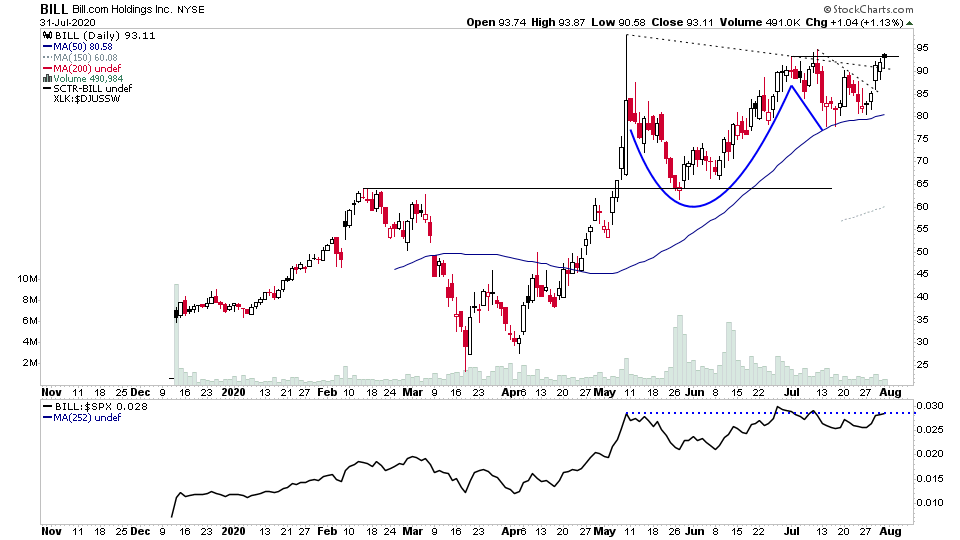

For the watchlist from Tuesdays scans - BILL, CLFD, INSG, IRDM, MTCH, PII, WKHS

Read More

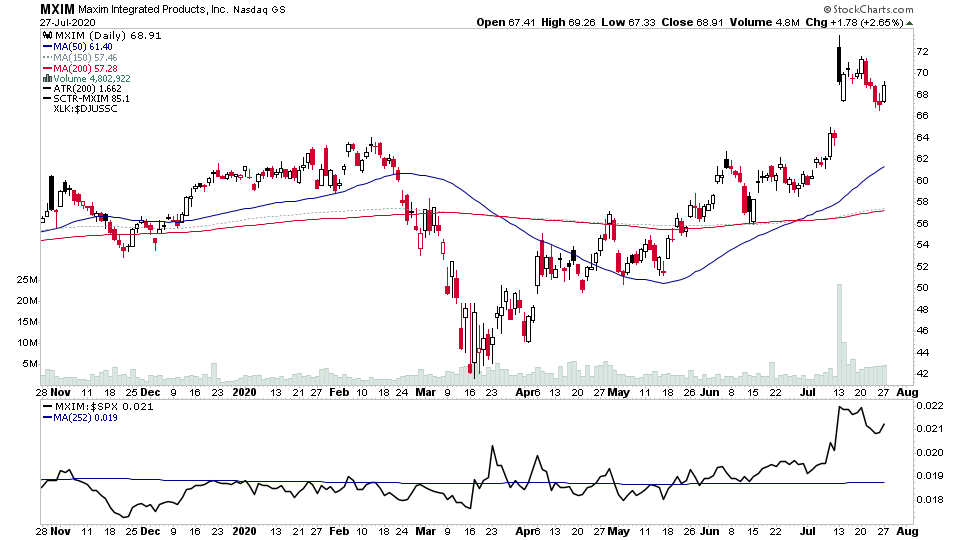

27 July, 2020

US Breakout Stocks Watchlist - 27 July 2020

For the watchlist from Mondays scans - ADSK, AKAM, AMKR, AVTR, AXNX, CSIQ, DLB, LULU, MXIM

Read More

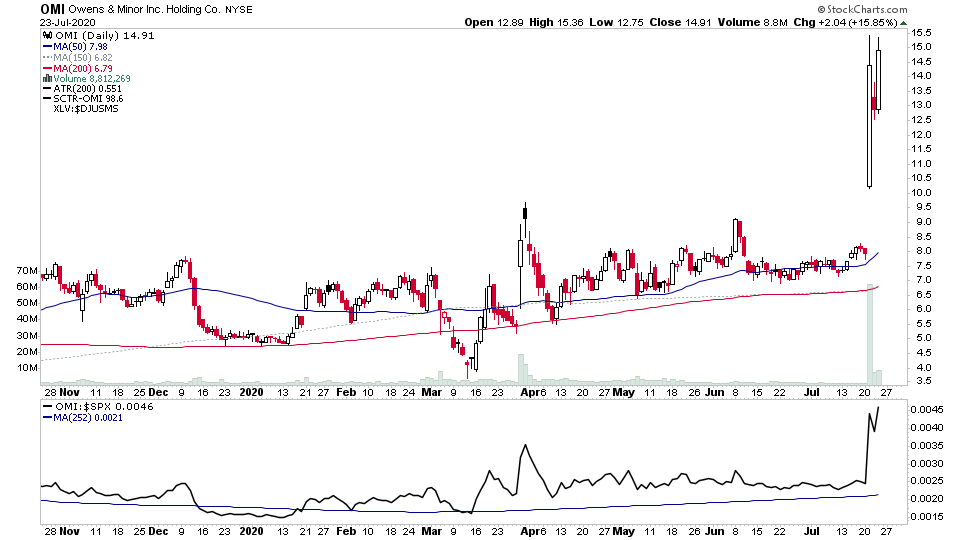

23 July, 2020

US Breakout Stocks Watchlist - 23 July 2020

For the watchlist from Thursdays scans - ENTG, EQT, OMI, STKL, WSO, XLRN

Read More

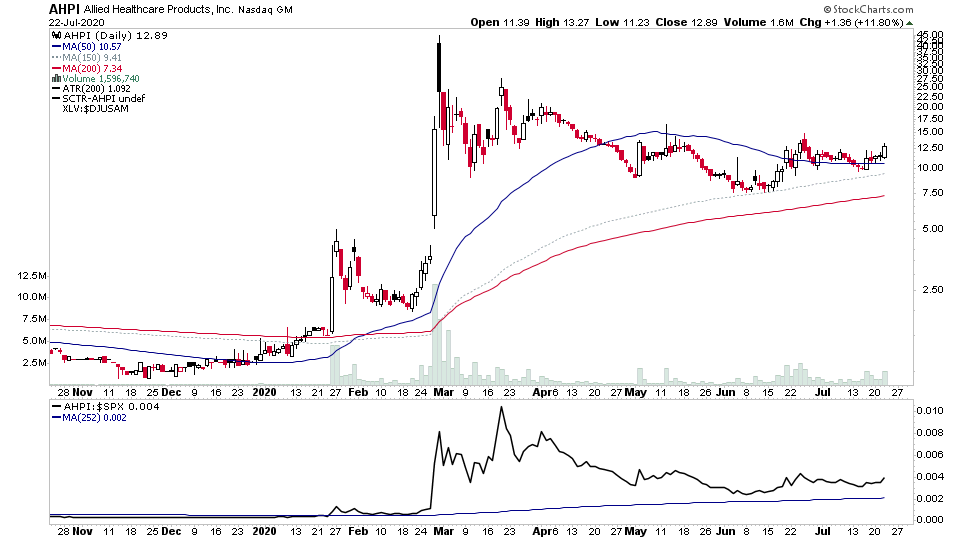

22 July, 2020

US Breakout Stocks Watchlist - 22 July 2020

For the watchlist from Wednesdays scans - AHPI, AMD, OLLI

Read More

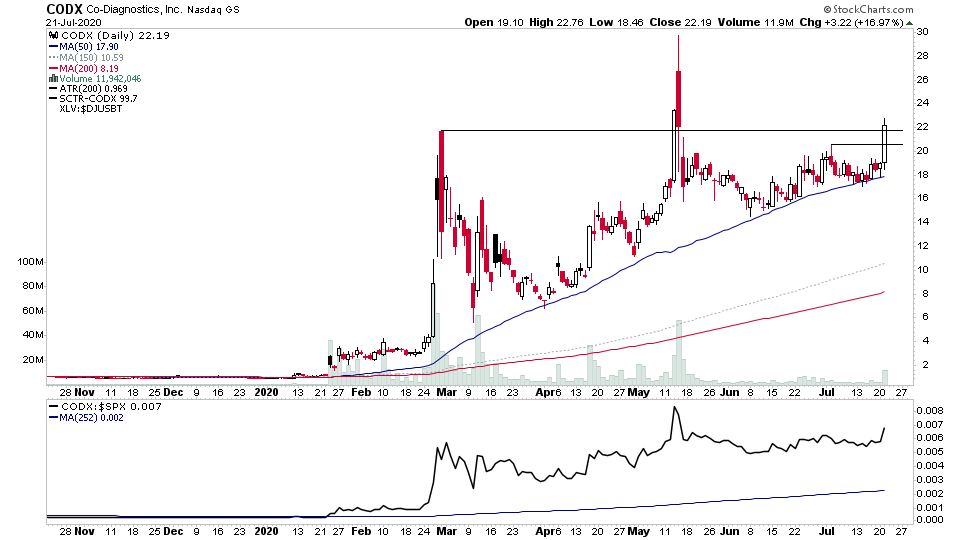

21 July, 2020

US Breakout Stocks Watchlist - 21 July 2020

With earnings season picking up steam its notable that there's a number of gap breakouts appearing in my scans today, of which a few have made it into the watchlist due to their volume on the gap, and as Mark Minervini said earlier today in a post – "That's not your Aunt Betty buying"

Read More

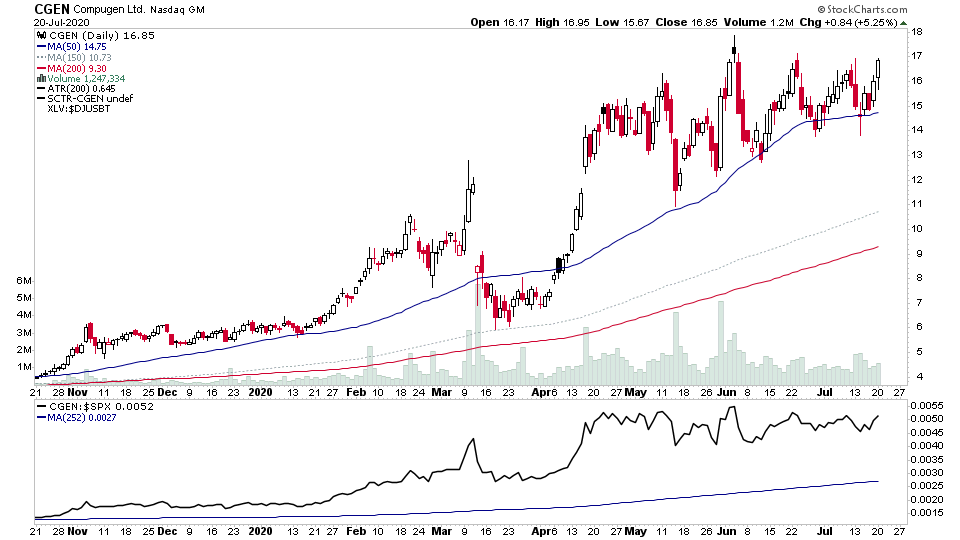

20 July, 2020

US Breakout Stocks Watchlist - 20 July 2020

Technology and Healthcare back dominating the watchlist again today as the leaders had a strong rebound after lagging over the last week...

Read More